GDP and Unemployment: Measuring Economic Activity

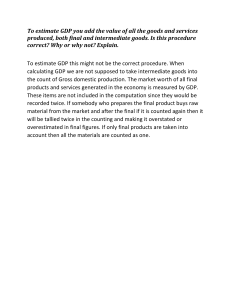

advertisement