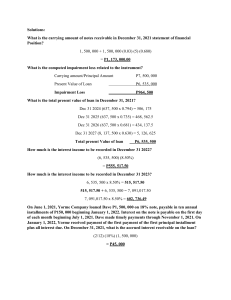

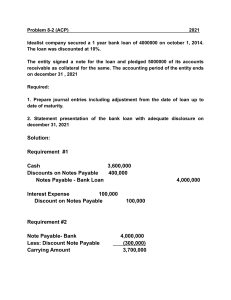

Notes Receivable Competency Appraisal • Notes receivable are claims supported by formal promises to pay, usually in the form of notes. A promissory note is a written contract in which the maker promises to pay the payee a definite sum of money on demand or at a definite future date. • The term "notes receivable" refers only to claims arising from the sale of merchandise or services in the ordinary course of business. Notes received from officers, employees, shareholders, and affiliates should be designated separately. • Dishonored notes are those that mature and are not paid. They should be removed from the notes receivable account and transferred to accounts receivable at an amount that includes any interest and charges. • Notes receivable should be initially measured at their present value, which is the sum of all future cash flows discounted using the prevailing market rate of interest for similar notes. Short-term notes receivable are measured at face value and are not discounted. The initial measurement of long-term notes depends on whether they are interest-bearing or noninterestbearing. • The approach of transferring dishonored notes to accounts receivable is defended on the grounds that the overdue note has lost part of its status as a negotiable instrument and represents only an ordinary claim against the maker. • Interest-bearing notes are measured at face value, which is the present value at the time of issuance, while noninterest-bearing notes are measured at present value, which is the discounted value of future cash flows using the effective interest rate. Although noninterestbearing notes do not have an explicit interest rate, they implicitly contain interest, which is included in the face value. • After initial recognition, long-term notes receivable are measured at amortized cost using the effective interest method, which calculates the present value of the note based on principal repayments, amortization of any remaining amount, and any reductions for impairment or uncollectible amounts. For noninterest-bearing notes, the amortized cost is the present value plus the amortization of the discount, or the face value. • These concepts apply to both interest-bearing and noninterest-bearing long-term notes. Interest income is only relevant for long-term notes receivable, and the effective interest rate method is used to measure and account for such notes. NOTES RECEIVABLE QUIZZER 1. Balentime Company has an 8% note receivable dated June 30, 2019, in the original amount of P600,000. Payments of P200,000 in principal plus accrued interest are due annually on July 1, 2020, 2021 and 2022. In its June 30, 2021 statement of financial position, what amount should Balentime Company report as a current asset for interest on the note receivable? a. None b. P16,000 c. P32,000 d. P48,000 2. On June 1, 2021, Erl Company loaned Peji Company P500,000 on 12% note, payable in five annual installments of P100,000 beginning January 2, 2022. In connection with this loan, Peji was required to deposit P5,000 in a non-interest bearing escrow account. The amount held in escrow is to be returned to Peji after all principal and interest payments have been made. Interest on the note is payable in the first day of each month beginning July 1, 2021. Peji made timely payments up to November 1, 2021. On January 2, 2022, Erl corporation received payment of the first principal installment plus all interest due. How much is Erl’s interest receivabe on the loan to Peji at December 31, 2021? A. None b. P5,000 c. P10,000 d. P15,000 3. On January 2, 2021, Kaya Go Company sold equipment with a carrying amount of P480,000 in exchange for a P600,000 non-interest bearing note due January 2, 2024. There was no established exchange prince for the equipment. The prevailing rate of interest for a note of this type at January 2, 2021 was 10%. The present value of 1 at 10% for three periods is 0.7513. Question 1: How much should Kaya Go Company report as interest income in its 2021 profit or loss statement? a. 45,078 b. 49,586 c. 54,544 d. 60,000 Question 2: How much should Kaya Go Company report as gain or loss on sale of equipment in its 2021 profit or loss statement? a. 29,220 loss b. 29,220 gain c. 120,000 gain d. 270,000 gain Question 3: What is the carrying value of the note receivable as of December 31, 2021 statement of financial position? a. 450,780 b. 495,858 c. 545,444 d. 600,000 4. Sky Co. sold to Mavis Co. a P200,000, 8%, 5 year note that required five equal annual year end payments. This note was discounted to yield a 9% rate to Mavis. The present value factors of an ordinary of P1 for five periods are as follows: 8% 3.992 9% 3.890 What should be the total interest revenue earned by Mavis on this note? a. P50,500 b. P55,610 c. P80,000 d. P90,000 5. On March 1, 2021, Aki Company sold goods to Snow Company. Snow signed a non-interest bearing note requiring payment of P60,000 annually for seven years. The first payment was made on March 31, 2021. The prevailing interest for this type of note at the date of issuance was 10%. Information on present value factors is as follows: Periods PV of 1 at 10% PV of Ordinary Annuity of 1 at 10% 6 .56 4.36 7 .51 4.87 How much should Aki Company report as sales revenue in March 2021? a. 214,200 b. 261,600 c. 292,200 d. 321,600 6. On December 31, 2021, Primo Corporation sold for P50,000 an old machine having an original cost of P70,000 and a book value of P20,000, the term of the sale were as follows: 10,000 downpayment Balance of 20,000 payable equally for the next two years every December 31 The agreement of sale made no mention of interest, however, 9% would be a fair rate for this type of transaction. What should be the amount of the notes receivable, net of the unamortized discount and gain on sale, respectively, on December 31, 2021? a. 35,182 and 25,182 b. 40,000 and 20,000 c. 45,182 and 25,182 d. 70,364 and 30,000 7. Sky Company purchased from Mavis Corporation a P400,000, 8%, five year note that requires five annual year-end installments of P100,180. The note was discounted to yield a 9% rate to Sky. At the date of purchase, Sky recorded the note at its present value of P389,700. What is the total unearned interest revenue that will be realized over the term of the financial instrument? a. 100,900 b. 111,200 c. 160,000 d. 180,000 Loans Receivable Pointers •A loan receivable is a financial asset resulting from a loan granted by a bank or financial institution to a borrower/client. •The repayment period of the loan may be shortterm, but in most cases, it covers several years. •At initial recognition, the loan receivable is measured at fair value plus directly attributable transaction costs. •The fair value of the loan receivable at initial recognition is typically the transaction price or the loan amount. Pointers • Transaction costs that are directly attributable to the loan receivable include direct origination costs. • Direct origination costs are included in the initial measurement of the loan receivable. • Indirect origination costs are treated as an outright expense and are not added to the fair value of the loan receivable. • PFRS 9, paragraph 4.1.2, states that if a financial asset's business model is to collect contractual cash flows on specified dates and the contractual cash flows are solely payments of principal and interest, the asset should be measured at amortized cost. Pointers • A loan receivable is measured at amortized cost using the effective interest method. • Amortized cost is calculated by subtracting principal repayments and adding or subtracting the cumulative amortization of any difference between the initial amount recognized and the principal maturity amount, minus reduction for impairment or uncollectibility. • If the initial amount recognized is lower than the principal amount, the difference's amortization is added to the carrying amount, and if it's higher, the difference's amortization is deducted from the carrying amount. Pointers • Origination fees are charged by banks to borrowers for loan creation, including activities like evaluating financial conditions, collateral and security, negotiating terms, preparing documents, and closing the loan transaction. • Origination fees received from borrowers are recognized as unearned interest income and amortized over the loan term. Pointers • Direct origination costs are the fees that are not chargeable against the borrower. • Direct origination costs are deferred and also amortized over the loan term. • Direct origination costs are preferably offset against any unearned origination fees received. Pointers • If origination fees received exceed direct origination costs, the difference is unearned interest income, and the amortization will increase interest income. • If direct origination costs exceed origination fees received, the difference is charged to direct origination costs, and the amortization will decrease interest income. • The origination fees received and the direct origination costs are included in the measurement of the loan receivable. Review Questions 1. Piggy Bank granted a loan to a borrower on January 1, 2023. The interest rate on the loan is 10% payable annually starting December 31, 2023. The loan matures in 5 years on December 31, 2027. The data related to the loan are: • Principal amount P4,000,000 • Direct origination cost 61,500 • Origination fee received 350,000 The effective rate on the loan after considering the direct origination cost and origination fee received is 12%. Question 1: what is the carrying amount of the loan receivable on January 1, 2023? a. 4,000,000 b. 4,650,000 c. 4,411,500 d. 3,711,500 Question 2: what is the interest income for 2023? a. 400,000 b. 558,000 c. 529,380 d. 445,380 2. Zylin granted an 8%, 3 year P6,000,000 loan to Amanda Company on January 1, 2020. The interest on the loan is payable every December 31. Zylin incurred P520,600 of direct origination cost but an origination fee of P200,000 was charged against Amanda Company. The effective rate on the loan as a result of the origination fee and cost is now 6%. Question 1: what is the carrying value of the loan on January 1, 2020 in Zylin’s accounting books? a. 5,800,000 b. 6,000,000 c. 6,320,600 d. 6,520,600 Question 2: What is the carrying value of the loan on December 31, 2021 in Zylin’s accounting books? a. 6,000,000 b. 6,113,026 c. 6,219,836 d. 6,320,600 3. Mam P G Bank loaned Earl Krus P5,000,000 on January 1, 2021. The terms of the loan require principal payments of P1,000,000 each year for 5 years plus 8% interest. The first principal and interest payment is due on January 1, 2022. Earl made the required payments during 2022 and 2023. However, during 2023, Earl began to experience financial difficulties, requiring PG Bank to reassess the collectability of the loan. On December 31, 2023, PG Bank has determined that the remaining principal payment will be collected but the collection of interest is unlikely. PG bank did not accrue the interest on December 31, 2023. The present value of 1 at 8% is as follows: For one period 0.926 For two periods 0.857 For three periods -.794 Question 1: what is the loan impairment loss on December 31, 2023? a. 423,000 b. 217,000 c. 222,000 d. 0 3. Mam P G Bank loaned Earl Krus P5,000,000 on January 1, 2021. The terms of the loan require principal payments of P1,000,000 each year for 5 years plus 8% interest. The first principal and interest payment is due on January 1, 2022. Earl made the required payments during 2022 and 2023. However, during 2023, Earl began to experience financial difficulties, requiring PG Bank to reassess the collectability of the loan. On December 31, 2023, PG Bank has determined that the remaining principal payment will be collected but the collection of interest is unlikely. PG bank did not accrue the interest on December 31, 2023. The present value of 1 at 8% is as follows: For one period 0.926 For two periods 0.857 For three periods -.794 Question 2: what is the interest income to be reported in 2024? a. 126,160 b. 142,640 c. 240,000 d. 0 3. Mam P G Bank loaned Earl Krus P5,000,000 on January 1, 2021. The terms of the loan require principal payments of P1,000,000 each year for 5 years plus 8% interest. The first principal and interest payment is due on January 1, 2022. Earl made the required payments during 2022 and 2023. However, during 2023, Earl began to experience financial difficulties, requiring PG Bank to reassess the collectability of the loan. On December 31, 2023, PG Bank has determined that the remaining principal payment will be collected but the collection of interest is unlikely. PG bank did not accrue the interest on December 31, 2023. The present value of 1 at 8% is as follows: For one period 0.926 For two periods 0.857 For three periods -.794 Question 3: what is the carrying amount of the loan receivable on December 31, 2024? a. 2,000,000 b. 1,925,640 c. 1,640,360 d. 1,783,000