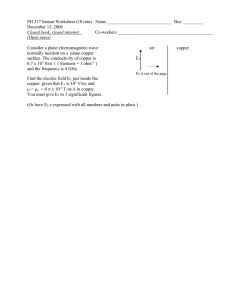

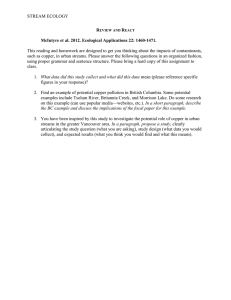

Copper Price Outlook Table of Contents Table of Contents Copper Market Update: Q1 2018 in Review ................................................................................. 2 Copper Price Update: Q2 2018 in Review ..................................................................................... 7 Copper Prices Could Rise as High as $10 During this Cycle ..................................................12 Best Copper Stocks of 2018 on the TSX ........................................................................................16 Best Junior Copper Stocks of 2018 on the TSXV .......................................................................19 © 2018 Copper Investing News 1 Copper Price Outlook Copper Market Update: Q1 2018 in Review Here’s an overview of the main factors that impacted the copper market in Q1 2018, and what's ahead for the rest of the year. Copper prices had a rocky start of the year, declining more than 6 percent in the first three months of 2018. Increasing geopolitical concerns, surging warehouse inventories and a weaker Chinese demand put pressure on prices. Despite this, some analysts remain cautiously optimistic about the future of the red metal and expect prices to pick up in the next few months. Read on for a more detailed overview of the main factors that impacted the copper market in the first quarter of 2018, plus a brief look at what investors should watch out for in the next few months. Copper price update: Q1 overview In the first quarter of the year, copper prices performed in a downtrend, declining more than 6 percent to end March at US$6,683 per tonne. As the chart below from Kitco shows, the copper price reached its quarterly peak at the beginning of January when it traded at US$7,202 a tonne, supported by a weaker US dollar and a strong demand outlook from China. © 2018 Copper Investing News 2 Copper Price Outlook Copper’s lowest price in Q1 came in March, when it fell to US$6,499 per tonne. Copper prices pulled back as the greenback rebounded and warehouse inventories surged. Copper price update: Supply dynamics Last year, all eyes were on copper mine disruptions. Supply stoppages at the top two copper mines, BHP Billiton’s (NYSE:BHP,LSE:BLT,ASX:BHP) Escondida and FreeportMcMoRan’s (NYSE:FCX) Grasberg, are estimated to have brought global 2017 copper output down by 5 to 7 percent. In 2018, there will be several labor negotiations as well but analysts believe mine supply will grow. “Having been more or less static last year, copper mine production is seen growing by 2.5-3 percent this year, which is expected to help facilitate an increase of similar magnitude in refined output,” Karen Norton, GFMS Thomson Reuters base metals analyst, said. According to the expert, the most notable new projects this year will be First Quantum's (TSX:FM) Cobre Panama project, which will now have a slightly larger capacity than previously planned at 350,000 tonnes per year, and Southern Copper's (NYSE:SCCO) Toquepala expansion in Peru. “More immediately, we have seen news of restarts of some capacity which had previously been idled in the downturn,” Norton said. © 2018 Copper Investing News 3 Copper Price Outlook Freeport’s El Abra mine in Chile is one of the most significant examples, she added. The mine has been operating at a reduced rate since the second half of 2015, but is expected to work at full capacity this year. “This is a year were most of the supply that is coming on is from mines that are restarting production or existing mines that are boosting their output,” ING commodities strategist Oliver Nugent said. Aside from Glencore’s (LSE:GLEN) Zambian production, Norlisk Nickel (MCX:GMKN) in Russia and output from some mines in Australia and Africa, he expects growth from Peru and a rebound in Chile’s production. “Although supply is expected to rise slightly on new projects and the resumption of operations in Zambia and the Democratic Republic of Congo, the market will likely remain in deficit,” FocusEconomics analysts said in their latest report. In contrast, analysts at GFMS Thomson Reuters forecast a surplus of 100,000 tonnes this year. “[However,] it is a busy year for labor contract negotiations and a repeat of last year’s lengthy strike at Escondida might throw a spanner in the works,” Norton said. According to Nugent, the risk of mine disruptions is always present in the copper market. “Every year we expect 5-7 percent of mine supply to be lost, and this year we expect the same,” he said. As a result, the analyst estimates the copper market will be fairly balanced this year. He also mentioned inventories levels as a factor to watch, as the market has seen a lot of stockpiles move from invisible to visible. This is a trend investors need to get used to, the analyst said. “We expect inventories to be drawn down going forward,” said Nugent, adding that it’s not unusual for stockpiles to be built in Q1. Copper price update: Demand forecast In terms of demand, all eyes are on China, the world’s top consumer, as the main factor driving copper prices. According to FocusEconomics, signs of softer activity have emerged in the Asian country. In fact, the Chinese manufacturing PMI fell to an over one-year low in February. © 2018 Copper Investing News 4 Copper Price Outlook “We expect Chinese copper demand growth to hold up reasonably well into the second quarter, but to slow somewhat in the second half, undermined primarily by the property sector,” Norton said. Even so, the overall picture is not especially disconcerting. That’s because “the picture elsewhere is improving such that overall consumption growth, though still unspectacular, will be slightly higher than in 2017,” Norton added. Aside from expected improvement in the United States, the world’s second biggest consumer, emerging nations such as Brazil and India will have a greater positive influence. “After five consecutive years of decline Brazilian demand is expected to pick up again, as the economy finally recovers,” Norton said. Meanwhile, demand in India is also expected to increase, despite being offset last year due to demonetization measures which affected construction activity. “Growth is expected to pick up pace again as the Smart Cities Mission continues, and despite criticism that progress so far has been slower than expected,” Norton added. Copper price update: What’s ahead? Looking at the next months of the year, there are several factors copper-focused investors should keep an eye on. “[Investors should pay attention to] trade war concerns that might spill over and curtail global economic growth,” Norton said. Other geopolitical factors, such as the escalation or otherwise of hostilities between Russia, the United States and other western nations could also impact the market. “There’s no doubt the risk of a global trade war derailing global growth is something we have to keep in the corner of our minds. We’ve got low probability on it but it has certainly been weighing on sentiment,” Nugent said. Other factors to watch are the US dollar and US politics, China’s credit and the reform of the financial sector in the Asian country, he added. “Looking beyond 2018, prices look set to trend upwards, on greater demand for infrastructure, electric vehicles and renewable energy,” FocusEconomics analysts said. Market watchers polled recently by the firm gave mixed copper price predictions for the second quarter of 2018. Looking ahead to the next few months, they estimate that the average copper price for Q2 2018 will be US$6,825 per tonne. © 2018 Copper Investing News 5 Copper Price Outlook The most bullish forecast for the quarter comes from Pezco, which is calling for a price of US$7,415; meanwhile, E2 Economia is the most bearish with a forecast of US$5,836. For her part, Norton said the copper price performance in the first quarter of the year was in line with her expectations, as it still rose by one-fifth year-on-year on an average basis and by 2 percent sequentially. “We are of the view that Q1 will prove to have been the strongest quarter for the market this year, with prices generally trending lower in the following six months, before picking up in the final quarter as supply growth starts to slow again on a more sustained basis,” she added. For his part, Nugent expects a rebound in the copper price, averaging U$7,000 in Q2 and Q3. Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article. © 2018 Copper Investing News 6 Copper Price Outlook Copper Price Update: Q2 2018 in Review Here’s an overview of the main factors that impacted the copper market in Q2 2018, and what's ahead for the rest of the year. Copper has had an interesting quarter—while looking at its start and end points for Q2, the red metal has failed to regain lost ground from the very start of 2018, but during the quarter copper reached four-year highs. Analysts are predicting that copper will fall in value through to the third quarter of the year, saying that "trade tension flareups" could make value increase while lower demand weighs on sentiment overall. Read on for more on what copper did in Q2, with a look at big news in supply and demand and a glimpse at what the future could hold. Copper price update: Q2 overview Like in the first three months of the year, copper trended downward over Q2, but not as dramatically overall, with the metal falling only 1.63 percent. Copper started the quarter at US$6.755 per tonne and ended it at US$6,645— a rather bland looking journey, but a closer look reveals the metal touched a four-year high of US$7,261.5 on June 8. The quarterly high came amidst a week between June 6 and June 15, where the base metal stayed above US$7,000 a tonne—a situation that ended as quickly as it came about as you can see in the London Metal Exchange chart below, which shows copper’s lowest point was April 4, when it touched US$6,624. © 2018 Copper Investing News 7 Copper Price Outlook Chart via LME The high plateau began with news of strike fears at Escondida, the world's largest copper mine. Over the following days Ivanhoe Mines (TSX:IVN) and CITIC (HKEX:0267) became new best friends, Vedanta declared it wanted to double copper production in Africa and a number of mines in South America came closer to fruition. At the end of the quarter, Glencore (LSE:GLEN) blew US$3 billion on making Dan Gertler go away to give it some clear air to take on all its other problems. Since copper rapidly fell back below US$7,000, it continued a downward slide over the remainder of the quarter like its other base metals cousins, and overall for the whole of 2018 it’s lost 7.45 percent of its value after starting the year at US$7,180.5. Copper price update: Supply dynamics Fans of stability will be big fans of 2018. GFMS Thomson Reuters base metals analyst Karen Norton told the Investing News Network (INN) that few of the dramas of 2017 have carried into 2018. “In comparison with last year, supply news has been relatively uneventful,” said Norton. © 2018 Copper Investing News 8 Copper Price Outlook “Developments at the Escondida mine in Chile — operated by BHP (ASX:BHP, NYSE:BLT, LSE:BBL)— have been closely monitored, with latest reports from the two camps evidently quelling fears of a repeat of last year’s 44-day strike. “This has played some role in the retreat in copper prices from multi-year highs, although the up and down moves were largely CTA (Commodity Trading Advisor) driven against the backdrop of global trade war fears.” She said that there “are clear signs that the copper mine project pipeline, which had virtually ground to a halt, has gathered momentum in recent months, with the revival of mines that had been firmly on the backburner.” In this quarter, news from Anglo American (LSE:AAL) about its Quellaveco mine, and Southern Copper’s (NYSE:SCCO) Michiquillay, have brought welcome news on the supply front. Norton said that while supply growth will be slower in the short term, long term prospects are promising. “Our (GFMS Thomson Reuters) ten-year supply view indicates that there will be a period of slow supply growth between 2020 and 2022, but, even discounting low and medium probability projects, momentum (bearing in mind the economic cycle) is expected to pick up again with a return to long term, or close to long term, average growth rates in the ensuing years. “Given CITIC’s recent investment in Ivanhoe Mines we feel the large Kamoa project in the Democratic Republic of the Congo is even more likely to progress and in a timely fashion. China’s need for copper and the country’s relatively long-standing working relationship with the DRC should help the company to navigate changes to the latter country’s changes mining code.” Analysts at FocusEconomics hold similar views on supply. “Global supply levels should remain strong as production accelerates in the world’s top producers, especially Chile, conditional on the successful resolution of potential labor disputes,” they said in their June report. ScotiaBank also pointed to Escondida as a potential cause for turbulence unless negotiations went smoothly. “While last year’s disruption didn’t seem to contribute much of a boost to the already frothy copper market, physical balances are much tighter today and a similar disruption is likely to have a more pronounced effect on spot markets—copper prices briefly moved into backwardation from the protracted contango experienced by contracts since 2016, signaling just how tight spot markets are today,” ScotiaBank said in its Q3 commodities outlook report. © 2018 Copper Investing News 9 Copper Price Outlook “Despite recent concerns, we don’t believe that we will see another significant work stoppage at Escondida this year and we anticipate that the union and management will come to an agreement through the summer.” Norton did point to another big story this quarter, this one in India. “The closure, supposedly permanent of Vedanta’s Sterlite smelter in India has been significant, not so much to the bottom line of copper supply as excess concentrate will be shipped to China, but more to an uptick in smelter processing charges. However, the ongoing expansion of smelter capacity in China is expected to reverse that trend later this year.” Copper price update: What’s ahead? Looking ahead, analysts across the board are predicting copper to average below US$7,000 for the remainder of 2018 before picking up into 2019. Analysts recently polled by FocusEconomics project that copper prices will average US$6,842 per metric ton in Q4 2018 and US$7,069 per metric ton in Q4 2019. The minimum forecast for Q3 comes from Emirates NBD, which is expecting an average price of US$6,250 per tonne, while the maximum forecast comes from DZ Bank, which is projecting prices to average US$7,500. Norton took a similar approach. “We were already looking for prices to fall in the third quarter and so recent developments fit in with that picture. In the absence of a major supply disruption, this seasonally quieter period for demand is likely to weigh on sentiment, with trade tension flare-ups exacerbating the situation periodically. “We are still looking for a market in surplus this year, and even though we would expect prices to recover somewhat in the final quarter, we are still forecasting an average for the year of $6,700 per tonne.” And ScotiaBank too. “Copper prices are expected to average US$3.10 per pound (US$6,834.26 per tonne) in 2018 before rising to US$3.25 per pound (US$7,164.95 per tonne) in 2019 on gradually widening supply-side deficits.” Securities Disclosure: I, Scott Tibballs, hold no direct investment interest in any company mentioned in this article. Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions © 2018 Copper Investing News 10 Copper Price Outlook of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence. © 2018 Copper Investing News 11 Copper Price Outlook Copper Prices Could Rise as High as $10 During this Cycle The copper story is "incredibly bullish," says Leigh Goehring in this interview. As weak supply and strong demand collide, prices could climb as high as $7 to $10 per pound. Copper is currently just over $3 per pound, but Leigh Goehring of research firm Goehring & Rozencwajg believes prices could rise as high as $10 during this cycle. In an interview at the recent Mines and Money conference in New York, Goehring explained that this bullish forecast stems from price action that has taken place in previous bull markets. "We basically went from a bottom of about $0.60 reached in 2000 to a top of about $4.10 reached in the beginning part of 2006. So in a five-year period you basically went up four or five and a half times the price," he explained to the Investing News Network (INN). Goehring added, "I wouldn’t be surprised if something along that magnitude happens in this bull market. We started to hit the bottom a little below $2 back in the first quarter of 2016, so ... a target price would be anywhere between $7 to $10 in this cycle." Watch the interview above for more insight on copper from Goehring, plus additional commentary from his partner Adam Rozencwajg. You can also read the transcript below. INN: It's our first time speaking, so I thought you could begin by telling me a little bit about yourselves and about the firm. LG: Goehring & Rozencwajg is a firm that was established about two and a half years ago. I'm Lee Goehring, and I established the firm with my long-term colleague Adam Rozencwajg. It is a firm that's dedicated to researching and investing in global commodity markets. INN: We're here at Mines and Money in New York. Earlier today, Leigh, you gave a talk on copper. For those who might not be aware, how have we seen copper © 2018 Copper Investing News 12 Copper Price Outlook perform so far this year? And has its price movement been in line with your expectations? LG: Copper had a very strong year in 2017. And in the very beginning part of January, it hit a price of about $3.25 a pound. It has pulled back and actually has been one of the weaker metal stocks this year. However, I should point out that the weakness that we're seeing now is — we believe is nothing more than a pullback in a very large, multi-stage bull market that is going to take place in the next five years. INN: Yes. In your talk, you gave quite a long-term perspective on the copper price. Can you briefly go over what has led us to this point? LG: Of all the metals we follow, copper, we believe, has the most interesting and best supply/demand profile of any metal market out there today. What's going to happen in global copper markets is that incredibly strong demand ... will be driven by two forces. One will be the desire to invest in renewables, because remember, renewables require a lot more copper intensity in their investment than standard hydrocarbon fuel plants. I'm talking about wind and solar farms here. That demand will be layered on top of traditional very, very strong demand that's going to come from basically the emerging markets — not only China, but India, Malaysia, Indonesia, the Philippines, Vietnam. Each of which is entering their period of very rapid and intense copper consumption. So you have very strong demand, and on the supply side we are running into long-term structural [supply concerns]. We have a depletion issue in the copper business ... we basically use, we calculate, about 500,000 tonnes of copper supply a year to depletion. And the ... very large, what I call mega-projects, coming online in the next five to seven years are few and far between. So we believe that you will have very, very strong demand that's going to basically collide with very, very weak supply. It's an incredibly bullish story. INN: Further to the supply side — so we've got supply actually dropping, what about grades? What are we looking at in terms of grades right now? LG: One of the interesting things is that ... when I mention depletion, one of the easiest ways to measure that is the drop of the head grade. That is the amount of copper that's contained in the ore that's actually mined and then put through the mill. What we're seeing is, we're seeing about a 2-percent drop in head grades per year over the last five to seven years. That's accelerated from about a 1-percent drop that we saw from 2005 all the way to 2012. And literally back in 2012 we were mining on a global basis, we calculate, copper with about a 0.9-percent head grade. Today we calculate you're down to about 0.67 [percent] or something like that. It's been a significant drop and that head grade drop is dropping by 2 percent per year. INN: Looking a little more closely at demand, at this conference, copper has been designated an "old-school battery metal." To what extent can investors expect © 2018 Copper Investing News 13 Copper Price Outlook battery demand to drive copper prices in the years to come? You talked a little bit about that, but let's hear some more. AR: Sure. This is Adam Rozencwajg speaking now. The big demand push for copper as it relates to batteries won't necessarily come from the batteries themselves as opposed to cobalt or lithium, which will actually go right into the batteries. But rather, it'll be the ... larger push of electric vehicles and renewable power. An electric vehicle is three times more copper intensive than an internal combustion engine. And as Leigh was mentioning earlier, renewable power sources could be 30 to 40 times as copper intensive as a traditional gas or coal plant. So as we begin to make a push — and we clearly have a strong government and societal desire to move towards a certain amount of EV penetration backed by renewables — that's really going to drive the impact on copper. LG: Charlotte, there's an irony in here that they say it's an "old" battery metal, but it's really probably the greenest of all metals that there is. INN: So we've got all of these supply and demand factors adding up — what is your prediction for prices? Where are we going to see prices go? Do you have a specific outlook? LG: Pricing is always difficult, but if we're in a real bull market — if you sat through my presentation, I talked about how we really turned bullish on copper markets back in 2000. At the time, the copper was probably $0.75, and what happened in that bull market cycle? We basically went from a bottom of about $0.60 reached in 2000 to a top of about $4.10 reached in the beginning part of 2006. So in a five-year period you basically went up four or five and a half times the price. I wouldn't be surprised if something along that magnitude happens in this bull market. We started to hit the bottom a little below $2 back in the first quarter of 2016, so I wouldn't be surprised — a target price would be anywhere between $7 to $10 in this cycle. INN: It sounds like there definitely is an investment opportunity here. Should investors be considering stocks? And if so, which ones? What's the best way to invest in copper? LG: There is a copper stock ETF out there that I believe that you can invest in. I think that would be one of the easiest ways to do it, you wouldn't have to be involved with all the individual research that's required for all these names, which have all sorts of geological and national risk associated with them. So that's what I would recommend. I do definitely like the copper equities, I think that they will be the best performers. But I think the copper stock ETF would be the best way for an individual investor to play it. INN: And now is the time? LG: I think now is the time. © 2018 Copper Investing News 14 Copper Price Outlook INN: You came here to talk about copper, but I know you've got extensive knowledge about the resource space as a whole. What other commodities do you believe have potential in 2018? LG: I think that the most interesting market for the rest of 2018 is going to be global oil markets. Back in January of 2017, we published a big piece outlining our view that we're going to hit $100 oil in 2018 at some point. We were called crazy, a lot of people ridiculed us. We had a lot people say we didn't know what we're talking about. But it's interesting that Brent right now is closing in on $80 already. The oil market is a market that's classically out of balance. Demand is running about 600,000 to 700,000 barrels a day greater than supply. OPEC seems determined to keep their production cuts, but that's becoming a non-issue as they're falling so far behind now that even if they were to reinstitute all the cuts made in 2016, the oil market would still stay in deficit. So we believe that given the supply/demand fundamentals, the fact that we keep drawing down inventories, which we'll do through at least the next six months, a $100 oil price is still within our realm of possibility, and we think that oilrelated equities offer tremendous opportunity here. INN: Are there any other final points that you would leave investors with for this year? LG: I think we made a classic cycle bottom in all commodities back in the first quarter of 2016. And the pricing of commodities vs. financial assets has reached extremes that you've only seen a couple of times in the last hundred years — back in the late 1960s, early 1970s and again back in 1990 to 2001. Both were ... excellent times to be an investor in the commodity space, and we believe that investors are being given that opportunity right now, today. Securities Disclosure: I, Charlotte McLeod hold no direct investment interest in any company mentioned in this article. The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in contributed article. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence. © 2018 Copper Investing News 15 Copper Price Outlook Best Copper Stocks of 2018 on the TSX What are the best copper stocks on the TSX so far this year? These five companies have seen the biggest gains year-to-date. After such a promising jump in value at the start of June, copper is still well on its way downwards as of the close of the second quarter and into the start of July in 2018. The red metal broke through the floor and set a new low today (July 5), falling to US$6,458 per tonne—below the previous low of US$6,499 hit at the end of March. Much of the blame is going towards general jitters in the markets and fears over the emerging trade war between the US and its partners, which is forcing all base metals down. In its most recent report, Scotiabank analysts directed blame for the fall in value away from supply concerns for copper, saying that rumblings at Escondida in Chile were not the culprit. “[We] don’t believe that we will see another significant work stoppage at Escondida this year and we anticipate that the union and management will come to an agreement through the summer,” they said. Escondida’s claim to 5 percent of global copper production means it can move the market by itself. On the TSX, copper miners have been making gains through the year despite an overall fall in value. Here’s a look at what the 5 best copper stocks of 2018 are up to so far. The list below was generated using the Globe and Mail’s market data filter, and it shows the TSXlisted copper companies with the biggest share price gains from January 1 to July 5. Only companies with market caps above $50 million are included. 1. Atalaya Mining (TSX:AYM) Current price: C$4.21; year-to-date gain: 58.87 percent. Copper miner Atalaya has the Proyecto Riotinto as its primary asset, a 9.5 million tonne per year open-pit mine in Andalucia in southern Spain. According to the company, the © 2018 Copper Investing News 16 Copper Price Outlook mine’s measured and indicated mineral resources total 193 million tonnes at 0.43 percent copper, at a cut-off grade of 0.20 percent copper. It also has Proyecto Touro, also in Spain, which is another copper mine, where the company has been conducting exploration and snapping up concessions surrounding the project as of early June. Atalaya’s first quarter results released in May detailed positive progress at Proyecto Riotinto, where copper production increased 7.2 percent compared to Q1 2017. The company also released details about Proyecto Touro and its recently concluded pre feasibility study, showing a future mine would need 2 years of development for 12 years of production, yielding 30,000 tonnes of copper per year. 2. Nevsun Resources (TSX:NSU) Current price: C$4.35; year-to-date gain: 38.87 percent. Nevsun Resources has spent plenty of time in the spotlight this year, gaining a decent 38.87 percent on the Toronto Stock Exchange thanks to attempted woo-ing by fellow Canadian miners Lundin Mining (TSX:LUN) and Euro Sun Mining (TSX:ESM)—the two companies that have been attempting to buy Nevsun since May. Nevsun is guarding its two major assets however, which are the producing Bisha mine in Eritrea and the Timok project in Serbia. In June, the company released the initial resource estimate for the Timok lower zone, showing 1.7 billion inferred tonnes grading 0.86 percent copper and 0.18 grams per tonne gold, containing 31.5 billion pounds of copper and 9.6 million ounces of gold. The company is yet to show any interest in the offer from Lundin Mining and Euro Sun Mining, which would see Lundin take Timok, and Euro Sun acquire Bisha. 3. Sierra Metals (TSX:SMT) Current price: C$3.51; year-to-date gain: 17.39 percent. Sierra Metals has three operating mines throughout Latin America, including the copper-producing Yauricocha mine in Peru and the Bolivar mine in Mexico. According to Sierra, Yauricocha saw a 33.9 percent increase in copper production in Q1 2018 over Q1 2017, with output reaching 3,727,000 pounds. The Bolivar mine in Mexico was down 3.2 percent however, but still produced 4,363,000 pounds of copper. In late June, Sierra released positive results from a preliminary economic assessment looking into increasing output at Yauricocha to 5,500 tonnes per day—a 66 percent increase. © 2018 Copper Investing News 17 Copper Price Outlook 4. Ero Copper (TSX:ERO) Current price: C$9.16; year-to-date gain: 9.71 percent Base metals miner Ero Copper has mining and development operations in Brazil, in the states of Bahia and Pará. Its primary focus is its MCSA mining complex in Bahia, which includes the Vale Do Curaçá properties, where it has underground and open pit mining as well as processing facilities. In May, the company released its Q1 results for 2018, detailing an increase in total ore mined as well as copper grade compared with the previous quarter. The company also detailed progress on its Vermelhos mine development, where the company has continued to provide updates throughout the year. 5. PolyMet Mining (TSX:POM) Current price: C$1.22; year-to-date gain: 6.09 percent Polymet Mining controls the NorthMet project in Minnesota, which includes a major copper-nickel-cobalt deposit and a steel processing facility, which the company says it will repurpose as part of its development of the asset. According to PolyMet, Northmet will be developed in two stages, the first of which will see the deposit turned into an operating mine capable of producing 32,000 tonnes of ore per day, and the rehabilitation of the facilities on site. PolyMet says that at peak production, the project will produce 69.4 million pounds of copper, 9.6 million pounds of nickel and 352,000 pounds of cobalt every year. Permitting applications are still underway, but the company says it has broad support from the local community. Securities Disclosure: I, Scott Tibballs, hold no direct investment interest in any company mentioned in this article. © 2018 Copper Investing News 18 Copper Price Outlook Best Junior Copper Stocks of 2018 on the TSXV Which junior copper stocks have gained the most on the TSXV so far this year? Evrim Resources is in the lead with a rise of over 266 percent. Copper has had a bit of a wild ride in the past few months — the vital red metal reached its 2018 high less than a month ago, and is now sliding towards a new low for the year. Currently trading at US$6,594.5 per tonne on the London Metals Exchange, copper hit a peak of US$7,261.5 in early June, well above its starting point for the year at US$7,180.5. The increase was reversed as quickly as it came about though, with this month's slump representing a slide back towards the year-to-date low of US$6,499 it touched on in late March, meaning it’s now back to being down 8 percent on the year. In its most recent report, FocusEconomics analysts predicted demand would remain stable through the year, with copper averaging US$6,842 in the fourth quarter of 2018 — meaning it now has ground to make up. On the TSXV copper-focused companies are making plenty of gains. The list below was generated using The Globe and Mail’s market data filter, and shows the TSXV-listed copper companies with the biggest share price gains from January 1 to July 3. Only companies with market caps above $10 million are included. 1. Evrim Resources (TSXV:EVM) Current price: C$1.1; year-to-date gain: 266 percent Evrim Resources is enjoying quite the year, with its share so far trading at over 266 percent above its starting value at the beginning of the year. The lion’s share of those gains happened in April, when the price went from C$0.49 on April 4 to C$1.50 on May 23, before settling down to where it sits today. The gains appear to be the result of positive news around the company’s gold-silver projects, but © 2018 Copper Investing News 19 Copper Price Outlook Evrim maintains a number of copper-focused properties in British Columbia and Mexico that will benefit from increased investment. 2. Oroco Resource (TSXV:OCO) Current price: C$0.2; year-to-date gain: 150 percent Oroco Resource is currently trading 150 percent higher than where it started, at C$0.2, up from C$0.08 in January. The company was trading much higher in May, with its value topping out the year to date at C$0.3, or 275 percent higher. Oroco has two major projects on the go (both in Mexico), including the Santo Tomas copper porphyry property in Sinaloa state. Efforts to increase ownership of properties in the area around Santo Tomas are helping along the company’s share price this year. 3. Newport Exploration (TSXV:NWX) Current price: C$0.32; year-to-date gain: 35.42 percent Newport Exploration has seen a 35.42 percent increase in its share price, going from C$0.24 at the start of the year to C$0.32 today. The company enjoys royalty interests in producing oil and gas permits in Australia, and has a copper project in British Columbia in the Chu Chua copper-gold deposit near Kamloops. The mineral resource estimate for Chu Chua pegs the company as sitting on an inferred resource of 2.5 million tonnes grading 2 percent copper and 9.4 grams per tonne (g/t) silver. 4. NorthIsle Copper and Gold (TSXV:NCX) Current price: C$0.12; year-to-date gain: 25 percent Vancouver-Island focused Northisle Copper and Gold enjoyed huge gains at the start of this year. In the first quarter, the company’s share price was almost 80 percent above its starting point of C$0.1. As of today (July 3), it now sits at C$0.125 — a still respectable 25 percent increase over the course of 2018. © 2018 Copper Investing News 20 Copper Price Outlook The Canadian junior controls the North Island project on Vancouver Island, a 38,000 hectare block of mineral titles containing one confirmed mineral deposit and a collection of historic and prospective deposits. The company announced a JV with Freeport-McMoRan (NYSE:FCX) in February, which later developed into an exploration program for the Pemberton Hills property that’s part of the broader project. 5. Pan Global Resources (TSXV:PGZ) Current price: C$0.23; year-to-date gain: 24.32 percent Spanish-focused base and precious metals explorer Pan Global Resources has also enjoyed modest gains over the year, with the Canadian company rising 24.32 percent from a low base of C$0.18 to C$0.23. The company currently holds two projects in Andalucia, including the Águilas project, which Pan Global describes as having copper mineralization similar to the Olympic Dam and Cloncurry districts in Australia. In May, the company reported that exploration works on Águilas had returned assay values as high as 1.57 percent copper. Securities Disclosure: I, Scott Tibballs, hold no direct investment interest in any company mentioned in this article. Editorial Disclosure: NorthIsle Copper and Gold is a client of the Investing News Network. This article is not paid-for content. © 2018 Copper Investing News 21 Copper Price Outlook © 2018 Copper Investing News 22