Rare Earth Metals Market Focuses on Eco-Friendly Mining Practices

advertisement

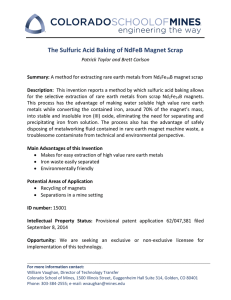

Overview Global Rare Earth Metals Market was valued at USD 12,753.8 Million, and is expected to reach USD 33,464.1 Million in 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 10.4. %. The global rare earth metals market refers to the industry that encompasses the mining, production, and distribution of rare earth elements (REEs). These elements, such as neodymium, praseodymium, dysprosium, and yttrium, are essential for producing high-tech electronics, renewable energy technologies, and various other advanced materials. The market's significance lies in the critical role these metals play in modern technology, including smartphones, electric vehicles, wind turbines, and military equipment. Due to their unique magnetic, luminescent, and electrochemical properties, rare earth metals are indispensable for achieving advancements in these sectors. Demand for rare earth metals is driven by the increasing need for clean energy solutions, advanced electronics, and defense applications. As countries strive for technological advancement and energy sustainability, the market for rare earth metals is expected to grow. However, this market faces challenges, such as limited supply, geopolitical tensions, and environmental concerns associated with mining practices. Major players in the market are focused on securing supply chains, investing in sustainable extraction methods, and developing recycling technologies to address these issues. Overall, the global rare earth metals market is a crucial component of the modern industrial landscape, influencing various high-tech industries and national security strategies. Key Market Segments Based on Type ● Cerium ● Lanthanum ● Neodymium ● Samarium ● Other Types Based on Application ● Magnet ● Metals Alloys ● Polishing ● Catalysts ● Glass & Ceramics ● Other Applications Download a sample report in MINUTES@https://market.us/report/rare-earth-metals-market/request-sample/ The market for rare earth metals is segmented by type into cerium, lanthanum, neodymium, samarium, and others. Neodymium is the most lucrative segment, holding a 26.2% market share in 2022, with an expected CAGR of 10.9% from 2023 to 2032. By application, the market is divided into magnets, metal alloys, polishing, catalysts, glass & ceramics, and others. The magnet application segment held the largest market share, accounting for 24.4% of total revenue in 2022. Market Key Players ● Iluka Resource Ltd. ● Neo Performance Materials Inc. ● Lynas Rare Earths Ltd. ● MP Materials ● Canada Rare Earth Corporation ● Australian Strategic Materials Ltd. ● Arafura Resources Ltd. ● Avalon Advanced Materials Inc. ● Energy Fuels ● Aclara Resources ● Ucore Rare Metals ● Other Key Players Driver: The increasing demand for clean energy and electric vehicles is significantly boosting the growth of the Rare Earth Metals market. As governments and industries prioritize reducing carbon emissions, the need for these metals in wind turbines, electric vehicle batteries, and solar panels is surging. Elements like neodymium, praseodymium, and dysprosium are essential for permanent magnet motors in electric vehicles, underscoring their critical role in advancing sustainable technologies. Restraint: The Rare Earth Metals market faces major challenges due to global supply chain vulnerabilities and environmental concerns. The heavy reliance on a few countries, particularly China, for rare earth production creates risks of supply shortages and price fluctuations. Additionally, the environmental impact of rare earth mining and processing, including toxic waste generation and ecosystem degradation, poses significant restraints on market growth. Opportunity: The escalating demand for innovative technologies in various industries, such as electronics, renewable energy, and telecommunications, presents a substantial opportunity for the Rare Earth Metals market. Their unique properties are crucial for the development of electric vehicles, wind turbines, and smartphones, driving the necessity for these metals and creating growth potential. Challenge: One of the main challenges is managing the high production costs and environmental impact associated with rare earth metal extraction and processing. The complex and resource-intensive nature of these processes can hinder competitiveness compared to alternative materials, emphasizing the need for more sustainable and cost-effective solutions in the industry.