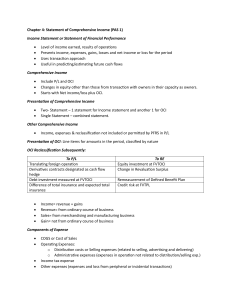

Investment Lecture Notes: Equity, Fair Value, Accounting

advertisement

Lecture Notes on Investment Equity security (Control) - Investment in Subsidiary (PFRS 3) Equity security (significant influence)- Investment in Associate - PAS 28 Equity security (without significant influence, with market value)- Fair Value- PFRS 9 Basis of Classification Classification/measurement Business Model: ‘Hold to Collect’ Cash Flow Characteristics: ‘SPPI’ (e.g. debt instrument) Amortized cost Business Model: ‘Hold to Collect and Sell’ Fair value- OCI (mandatory) Cash Flow Characteristics: ‘SPPI’ (e.g. debt instrument) “Solely Payments of Principal and Interest” Business Model: not defined Fair Value- PL Cash Flow Characteristics: not defined e.g. held for trading securities and equity instrument) Exceptions: 1. 2. Investment in Equity securities Fair value-OCI (irrevocable election) Eliminates or significantly reduces ‘accounting mismatch’ Fair value-PL (irrevocable designation) The irrevocable choices are available only on initial recognition. Once the choice is made, the classification is permanent until the financial asset is derecognized. Initial measurement Financial assets are initially measured at fair value plus transaction costs, except FVPL. FAFVPL are initially measured at fair value. The transaction costs are expensed immediately Subsequent measurement 1. Amortized cost 2. Fair value-OCI 3. Fair value-PL Classification Presentation gains and losses from changes in FV Presentation of other gains and losses - PL Amortized cost Not recognized From derecognition (sale), amortization, interest received and impairment - PL Fair Value-PL PL From derecognition (sale), interest /dividend received - PL Fair Value OCI – mandatory OCI From derecognition (sale), amortization, interest received and impairment - PL When the financial asset is derecognized, the cumulative gain or loss previously recognized as OCI in equity is reclassified to PL (with recycling). Fair value OCI – irrevocable election OCI From derecognition (sale), dividend received - PL When the financial asset is derecognized, the cumulative gain or loss previously recognized as OCI in equity is not reclassified to PL (without recycling). The entity may transfer the cumulative gain or loss within equity as a direct transfer to retained earnings. Financial Statement Presentation Investments are classified as either current or non-current assets depending on the period they are expected to be realized. Summary of Accounting for Investments Classification Composition Statement of Financial Position Initial Measurement Subsequent measurement Statement of Comprehensive Income Amortized cost Debt securities Current or non -current asset Fair value plus transaction cost Amortized cost ess impairment allowance Interest income computed using effective interest method – PL Impairment – PL FVPL Debt or equity securities Current asset Fair value Fair value Changes in FV are recognized in PL FV OCI Mandatory Debt securities Current or non -current asset Fair value plus transaction cost Fair value Changes in FV are recognized in OCI (with recycling) Interest income computed using effective interest method – PL mpairment – PL (with offset to OCI) FV OCI Equity securities (Election) Current or non -current asset Fair value plus transaction cost Fair value Changes in FV are recognized in OCI (without recycling) RECLASSIFICATION Reclassification Date Reclassification of financial assets is applied prospectively from the reclassification date. Reclassification date is “the first day of the first reporting period following the change in business model that results in an entity reclassifying financial assets.” From amortized cost to FVPL The fair value is determined at the reclassification date. The difference between the fair value and the carrying amount is recognized as gain or loss in the profit or loss statement. From Amortized cost to Fair Value – OCI Mandatory The fair value is determined on reclassification date. The difference between the fair value and the carrying amount is recognized as gain or loss in OCI. The effective rate is not adjusted. From Fair Value PL to amortized cost The fair value at the reclassification date becomes the new gross carrying amount. The difference between this amount and the face amount is subsequently amortized, as effective rate determined on reclassification date. From Fair Value PL to Fair Value OCI (mandatory) The financial asset continues to be measured at fair value. From Fair Value OCI (mandatory) to Fair Value PL The financial asset continues to be measured at fair value. However, the cumulative gain or loss previously recognized in OCI is reclassified from equity to PL as a reclassification adjustment at the reclassification date. From Fair Value OCI (mandatory) to amortized cost The financial asset is reclassified at its fair value at the reclassification date. However, the cumulative gain or loss previously recognized in OCI is removed from equity and adjusted against the fair value. PAS 28 prescribes the accounting for investment in associate and sets out the requirements for the application of equity method. PAS 28 shall be applied by all investors with significant influence over or joint control of an investee. Type of Investment Nature of Relationship with Investee Applicable Reporting Standard Investment measured at fair value Regular investor PFRS 9 Investment in Associate Significant Influence PAS 28 Investment in Subsidiary Control PFRS 3 and PFRS 10 Investment in Joint venture Joint Control PFRS 11 and PAS 28 · Significant influence is presumed to exist if the investor holds, directly or indirectly, 20% or more of the voting power of the investee, unless it can be clearly demonstrated that this is not the case. · Under equity method, the investment is initially recognized at cost and subsequently adjusted for the investor’s share in the changes in the equity of the investee. · When the associate has cumulative preference shares, the investor computes its share in profit or loss after deducting the one-year dividends on those shares whether declared or not. · The investor’s share in the depreciation of an undervalued asset is a deduction to both the investment income and the investment in associate accounts. AUDIT OBJECTIVES AND PROCEDURES ASSERTIONS Existence or Occurrence AUDIT OBJECTIVES To determine that investments in securities physically exist and in loans and advances exist.