Business Accounting 2 Textbook by Frank Wood & Alan Sangster

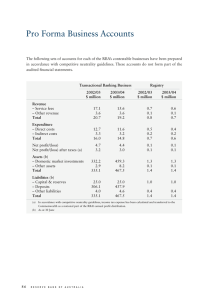

advertisement