Yellow terminal auction redrawing US LTL map as pricing surge subsides Journal of Commerce

advertisement

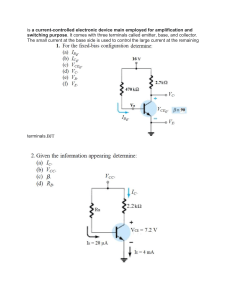

4/6/24, 4:48 PM Yellow terminal auction redrawing US LTL map as pricing surge subsides | Journal of Commerce Yellow terminal auction redrawing US LTL map as pricing surge subsides LTL carriers have been strategic — and picky — when it comes to buying terminals from bankrupt Yellow, analysts say. Photo credit: Yellow. William B. Cassidy, Senior Editor | Jan 3, 2024, 4:57 PM EST Bankrupt trucking company Yellow continues to sell off its assets piecemeal, but it hasn’t sold many terminals since two rounds of bids and sales brought in $1.9 billion in December. How Yellow’s remaining terminals are sold will redraw the US less-than-truckload (LTL) map for shippers in 2024. That map is still being reworked in the wake of Yellow’s demise and the reallocation of its freight and assets. And the LTL market, which surged in the fall, is slowing post-holiday, trucking analysts say. https://www.joc.com/article/yellow-terminal-auction-redrawing-us-ltl-map-pricing-surge-subsides_20240103.html 1/4 4/6/24, 4:48 PM Yellow terminal auction redrawing US LTL map as pricing surge subsides | Journal of Commerce Yellow on Tuesday closed several deals announced in late December, finalizing the sale of terminals to FedEx Freight, ArcBest Property Management and Saia Motor Freight Line. But Yellow still has 118 leased properties and 46 company-owned facilities on the auction block after selling 151 of its properties, documents filed by Yellow with the Delaware Bankruptcy Court show. Yellow’s court filings show those remaining facilities have 9,495 dock doors among them — a substantial amount of LTL capacity. However, it’s not clear whether the remaining properties will stay in the LTL fold. A sale to developers could put that capacity beyond the reach of shippers. US BLS long-haul less-than-truckload producer price index (PPI) Producer price indices based on selling prices for trucking services 240 220 200 180 160 140 2020 2021 2022 2023 LTL PPI Source: US Bureau of Labor Statistics data, JOC analysis © 2024 S&P Global Related data for this chart Click here to explore related data on Gateway And that could bring renewed pressure to LTL pricing. All-inclusive LTL prices rose 5.9% from July to October before dropping 1.4% in November, according to the LTL producer price index (PPI) from the US Bureau of Labor Statistics (BLS). That drop in November was a sign the market was settling post-Yellow. https://www.joc.com/article/yellow-terminal-auction-redrawing-us-ltl-map-pricing-surge-subsides_20240103.html 2/4 4/6/24, 4:48 PM Yellow terminal auction redrawing US LTL map as pricing surge subsides | Journal of Commerce And that settling will continue in the absence of new industrial demand, said Satish Jindel, president of SJ Consulting Group. LTL carriers “are not getting big rate increases” in new contract agreements, Jindel told the Journal of Commerce Wednesday. “Some rates are flat, some are rising by low single digits.” Even with the loss of Yellow and its terminals, “there is still adequate capacity in the LTL market” to meet current demand, he said. “Some of these carriers even say they have excess capacity.” Opportunities, obstacles Certainly, the large carriers that purchased the lion’s share of terminals in the first round of bidding will have plenty of capacity, once they can bring those terminals online. In fact, the appetites of the LTL carriers that bid on terminals or their leases in the first two rounds of the auction may be sated. Altogether, Estes Express Lines acquired 29 terminals, while XPO and Saia Motor Freight each bought 28 — more than half the total number of properties that have been sold. Several other large and regional LTL providers brought smaller numbers of terminals. The fact that LTL carriers have yet to bid on many remaining properties indicates they may not need them. Larger LTL carriers don’t want a slew of terminals re-entering their market, loosening capacity further and potentially putting downward pressure on pricing. The remaining terminals aren’t all small, end-of-the-line rural facilities. Some are major breakbulk hubs with hundreds of doors. There are 29 leased or owned terminals still up for grabs with more than 100 dock doors, according to Yellow’s court filings. The challenge for Yellow when it comes to selling some properties is likely the classic real estate conundrum: location. “The carriers that made winning bids on terminals were very strategic in picking where they wanted to go,” said Jindel, noting those carriers wanted terminals that extended their reach in certain states or gave them greater freight density on key lanes. Still, they don’t want 100 doors in every location. Some of the terminals are so large, “they’re monsters,” he said, including a 304-door, 177,600-square-foot terminal in Maybrook, NY, and a 426-door, 283,000-square-foot terminal in Chicago. Those facilities are “white elephants,” said one LTL executive whose company won bids on other terminals, claiming the hub or breakbulk facilities are too large for any https://www.joc.com/article/yellow-terminal-auction-redrawing-us-ltl-map-pricing-surge-subsides_20240103.html 3/4 4/6/24, 4:48 PM Yellow terminal auction redrawing US LTL map as pricing surge subsides | Journal of Commerce but the biggest of carriers to integrate into their networks successfully. And some of the remaining terminals may be less attractive because of their age or design. Facilities with more acreage for truck and trailer parking or warehousing next to a cross-dock are likely to sell faster than smaller facilities designed and built decades ago. There’s a chance some of the remaining terminals may be purchased by Next Century Logistics, an affiliate of Jack Cooper Transport that wants to relaunch a leaner version of Yellow. Sources told the Journal of Commerce that Next Century is pursuing the purchase of a portion of the remaining terminals. An earlier bid for all the terminals and Yellow’s equipment was rejected by Yellow. And other LTL providers aren’t looking to buy older facilities. Southeastern Freight Lines, one of the US’ largest regional LTL carriers, on Wednesday opened an expanded 230-door terminal in Charlotte, NC. Contact William B. Cassidy at bill.cassidy@spglobal.com. © 2024 S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited. You are permitted to print or download extracts from this material for your personal use only. None of this material may be used for any commercial or public use. For more information on reprints/eprints, please visit https://subscribe.joc.com/mediasolutions/. https://www.joc.com/article/yellow-terminal-auction-redrawing-us-ltl-map-pricing-surge-subsides_20240103.html 4/4