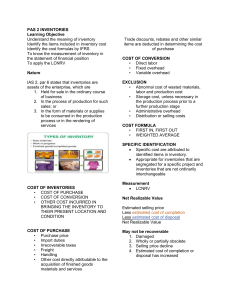

VEGA, NICOLE ANGELA O. CHAPTER 14 INVENTORIES CONCEPTUAL FRAMEWORK AND ACCOUNTING STANDARDS OBJECTIVE: To prescribe the accounting treatment for inventories, providing guidance on determination of cost and subsequent recognition as an expense, including any write-down to net realizable value (NRV). I. DEFINITION AND CLASSIFICATION INVENTORIES Inventories are assets which are held for sale in the ordinary course of business, in the process of production for such sale or in the form of materials or supplies to be consumed in the production in the rendering of services. PAS 2 applies to all inventories except: Work in progress under construction contracts. Financial instruments. Biological assets related to agricultural activity and agricultural produce at the point of harvest. Classes of inventories TRADING CONCERN MANUFACTURING CONCERN Trading concern is one that buys and sells goods in the same form purchased. The “term merchandising” is generally applied to goods held by a trading concern Manufacturing concern is one that buys goods which are altered or converted into another form before they are made available for sale. The term “finished goods”, “goods in process”, “raw materials”, and “factory or manufacturing supplies” refer to inventories of a manufacturing concern. II. COST OF INVENTORIES COST OF INVENTORIES COST OF INVENTORIES 1. Cost of purchase 2. Cost of conversion 3. Other cost incurred in bringing the inventories to their present location and condition indirect materials COST Inventories shall be measured at the lower of cost and NRV. Excluded from the cost of inventories: (ASAS) 1. Abnormal amounts of wasted materials, labor and other production costs. 2. Storage costs, unless necessary in the production process prior to a further production stage. Storage cost on goods in process are capitalized but storage costs on finished goods are expensed. 3. Administrative overheads 4. Selling costs or distribution Cost of purchase 1. Comprises the purchase price, import duties and irrecoverable taxes, freight handling and other costs directly attributable to the acquisition of finished goods, materials and services. 2. Trade discounts, rebates and other similar items are deducted in determining the cost of purchase. Cost of conversion 1. Includes cost directly related to the units of production such as direct labor. 2. It also includes a systematic allocation of fixed and variable production overhead that is incurred in converting materials into finished goods. Other Costs: Costs necessary to bring the inventories to their current location and condition. Fixed production overhead - is the indirect cost of production that remains relatively constant regardless of the volume of production. Variable production overhead - is the indirect cost of production that varies directly with the volume of production. Excluded from the cost of inventories: (ASAS) Excluded from the cost of inventories: (ASAS) III. INVENTORY VALUATION METHODS COST FORMULAS First in, first out (FIFO) - The FIFO method assumes that the oldest inventory items (the first ones purchased or produced) are sold first. This method is widely used in various industries and for different types of inventory. The inventory is thus expressed in terms of recent or new prices while the cost of goods sold is representative of earlier or old prices. FIFO METHOD Illustration Problem 1. Input given data and multiply the unit cost and units to identify COGAS 2. Identify COGS (total units of COGAS minus total units of ending inventory ) 3. Identify COGS (basis would start sa first/earlier product to accumulate the units sold then copy the rate and multiply the COGS units and rate for the COGS) 4. Identify Ending Inventory (basis would start sa naay remaining purchases to accumulate the units for ending inventory then copy the rate and multiply the units units and rate for the ending inventory) COST FORMULAS Weighted average - The cost of the beginning inventory plus the total cost of purchases during the period is divided by the total units purchased plus those in the beginning inventory to get a weighted average unit cost. Such weighted average unit cost is then multiplied by the units on hand to derive the inventory value. The average unit cost is computed by dividing the total cost of goods available for sale by the total number of units available for sale. WEIGHTED AVERAGE METHOD 1. Input beginning balance 2. Sales (input it sa issues column then copy the rate sa beg. balance then multiply qty issues and rate for the amount ) 3. Input Balance (sales minus beg. balance then copy rate sa issues and multiply qty balance and rate for the amount) 4. Purchase (input it sa receipts column then copy the rate sa given data then multiply qty receipts and rate for the amount ) 5. Input Balance (receipts plus current balance then to get the rate sa balance is add the prev balance amt and receipts amt divided by total current balance and then multiply the rate and current balance for the amount) 6. Sales (input it sa issues column then copy the rate sa current nceance then multiply qty issues and rate for the amount ) 7. Input Balance (sales minus current balance then copy rate sa issues and multiply qty balance and rate for the amount) 8. Purchase (input it sa receipts column then copy the rate sa given data then multiply qty receipts and rate for the amount ) 9. Input Balance (receipts plus current balance then to get the rate sa balance is add the prev balance amt and receipts amt divided by total current balance and then multiply the rate and current balance for the amount) 10. Sales (input it sa issues column then copy the rate sa current nceance then multiply qty issues and rate for the amount ) 11. Input Balance (sales minus current balance then copy rate sa issues and multiply qty balance and rate for the amount) IV. MEASUREMENT OF INVENTORIES Lower of Cost and Net Realizable Value (LCNRV) NRV - Estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. NRV provides a conservative valuation approach to avoid overstating the value of inventory. Ensures that inventory is not carried at a value higher than what can be realized from its sale. Aligns with the principle of prudence, where assets should not be overstated and liabilities should not be understated. Components of NRV Calculation: 1. Estimated Selling Price: Price expected from selling inventory. 2. Costs of Completion: Costs needed to bring inventory to a saleable condition. 3. Costs Necessary to Make the Sale: Costs directly associated with selling the inventory. LCNRV CALCULATION: if NRV is given 1. For each item, compare the unit cost to the NRV and take the lower value 2. Multiply the lower value (either cost or NRV)sa number of units for each item to determine the inventory value LCNRV CALCULATION: if NRV is not given NRV=Estimated Sales Price−Cost of Disposal Step 1: Calculate Net Realizable Value (NRV) The NRV is calculated as: NRV=Estimated Sales Price−Cost of Disposal Step 2: Compare Cost and NRV For each item, compare the unit cost to the NRV and take the lower value Step 3: Multiply the lower value (either cost or NRV) by the number of units for each item to determine the inventory value What to do if NRV is lower than its cost? If the NRV of inventory is lower than its cost, you must write down the inventory to its NRV. This writedown is recognized as an expense in the period it occurs, ensuring that inventory is not overstated on the balance sheet. Write-Down Amount = Cost − NRV = 150 − 140 =10 per unit Total Write-Down Amount = 1,200 units × 10= 12,000 Accounting for inventory writedown If the cost is lower than the net realizable value, there is no accounting problem because the inventory is stated at cost and the increase in value is not recognized. If the net realizable value is lower than the cost, the inventory is measured at net realizable value. The writedown of inventory to net realizable value is accounted for using the allowance method. Journal Entry for Write-Down Journal Entry: Debit: Inventory Write-Down Expense (or Cost of Goods Sold) for $12,000 Credit: Inventory for $12,000 This entry reflects the reduction in the value of the inventory on the balance sheet and the recognition of the expense on the income statement. Allowance method The inventory is recorded at cost and any loss on inventory writedown is accounted for separately. Also known for loss method If the required allowance increases, an additional loss is recognized. If the required allowance decreases, a gain on reversal of inventory writedown is recorded. The gain is limited only to the extent of the allowance balance DISCLOSURES The accounting inventories. policies adopted for measuring The total carrying amount of inventories and the carrying amount in classifications appropriate to the entity. The amount of inventories recognized as an expense during the period. The amount of any write-down of inventories recognized as an expense and the amount of any reversal of any write-down recognized as a reduction in the amount of inventories recognized as an expense. The carrying amount of inventories pledged as security for liabilities. Nicole Angela O. Vega THANK YOU PAS 2 Valix