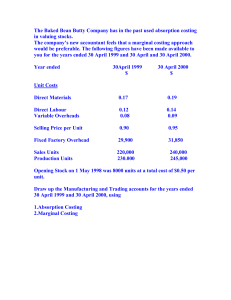

Management Accounting Variable and Absorption Costing Distinction between product costs and period costs ✓ Product Costs o The costs of goods manufactured or the cost of goods purchased for resale. o These costs are inventoried until the goods are sold. o When product costs are expensed, it will form part of the cost of goods sold. o Can be found in three types of inventories, raw materials, work-in process, and finished goods. ✓ Period Costs o All other non-product costs in an organization o Such costs are not inventoried but are expensed as time passes. o Examples • Selling expenses (Delivery Expense, Advertising Expense, Sales Commission) • General and Administrative (Accounting, Professional Fee, research and development) o When period costs are expensed, it will form part of the operating expenses. Inventory costs between variable costing and absorption costing Nature and treatment of fixed factory overhead costs – See #2 and #3 in Annex A Reconciliation of operating income under variable costing and absorption costing Beginning Inventory = Fixed cost that will be released that will make ↑Cost of Sales; ↓Net Income (AC – NI < VC – NI) Ending Inventory = Fixed cost that will be deferred that will make ↓Cost of Sales; ↑Net Income (AC – NI > VC – NI) Reconciling Item: Fixed Cost Component in the Inventories Summary: Absorption Costing Net Income xx Variable Costing Net Income xx Add: Fixed Cost Expensed last period (BI) xx Add: Fixed Cost Deferred (EI) xx Less: Fixed Cost Expensed this period (EI) xx Less: Fixed Cost Released (BI) xx Variable Costing Net Income xx Absorption Costing Net Income xx Shortcut in reconciliation: Δ Profit = Δ Inventory x unit FFOH Where: Δ Profit = AC Profit – VC Profit Δ Inventory = Production – Sales = Ending Inventory – Beginning Inventory Unit FFOH = Total FFOH ÷ Production See Annex B for rules on net income and explanation to the reconciliation 1|Page Management Accounting Additional Concepts and Discussions: Throughput Costing o Assigns only the unit-level spending for direct costs as the cost of products or services o A unit-level cost is incurred every time that a unit of product is manufactured Variable Costing o Definition • Product cost is comprised solely of variable manufacturing costs • Fixed manufacturing overhead is viewed as a cost of being ready to produce, not an actual production cost since it will remain constant no matter how many units are produced. Hence, expensed immediately. • Also Called as Direct or Marginal Costing • Direct Materials, Direct Labor, and Variable Overhead o Advantage • It can be used in constructing the contribution format approach income statement to highlight the cost behavior structure of the entity. • Fit nicely with Cost-Volume-Profit Analysis • Net income unaffected by changes in production levels • Net income closely tied to changes in sales level – not production levels which makes it easier to predict the level of operating income. • Fixed costs are not accounted for as an inventoriable cost – simplifying the record keeping – no need for allocation. • Companies can also break down each department or product line under variable costing, which provides a more thorough analysis of a company's business operation o Disadvantage • Does not conform to generally accepted accounting principles • Costs are required to be separated into fixed and variable – cost segregation • techniques can be subjective. • Expensing fixed production costs as a period expense lowers net income for each accounting period • Too much emphasis may be given to variable costs at the expense of disregarding fixed costs – fixed costs should still be recovered from operations. Absorption Costing o Definition: All costs related to the manufacture of a good are product costs. (Direct materials, Direct Labor, Variable and Fixed Overhead) o Advantages • Results in the preparation of a traditional income statement. • Is considered GAAP and is generally acceptable for tax reporting. • Considers all cost when setting the price (cost plus pricing method) o Disadvantage Does not consider excess capacity since fixed costs are already allocated to the different units Distort the results of decisions made to discontinue a business segment – fixed cost will remain whether the company will eliminate the segment or not. 2|Page Management Accounting Annex A: Summary of differences: 1. Other Names 2. Treatment of FFOH 3. Reason behind Treatment 4. Period Costs 5. Product Costs 6. Cost of Inventory 7. Matching Principle 8. Income Statement 9. Main Function 10. Common Applications ABSORPTION COSTING Full Costing, GAAP Costing Product Cost: Inventory, then Expense FFOH is necessary to produce units Selling & Administrative Expenses DM, DL, VFOH & FFOH Higher than Variable Costing’s Compliant Functional Presentation (“CGS” Format) External Financial Reporting Financial Statements, Reporting to BIR & SEC VARIABLE COSTING Direct Costing, Marginal Costing Period Cost: Full Amount as Expense FFOH is incurred with or without production FFOH, Selling & Administrative Expenses DM, DL & VFOH Lower than Absorption Costing’s Non-Compliant Behavioral Classification (“CM” Format) Management Decision Aid (Internal Use) CVP Analysis, Relevant Costing, Pricing Decision Annex B: Rules on Net Income 1 Situation Production = Sales Implication AC Profit = VC Profit 2 Production > Sales AC Profit > VC Profit 3 Production < Sales AC Profit < VC Profit Compiled by: Kent Adrian P. Mariano, CPA, CMA Sources: Roque, Rodelio S. Agamata, Franklin T. Abitago, Karim G. CPAR RESA CRC-ACE 3|Page Explanation Since Ending Inventory = Beginning Inventory, then FFOH expensed under AC is equal to FFOH expensed under VC Since Ending Inventory > Beginning Inventory, then FFOH expensed under AC is lower than FFOH expensed under VC Since Ending Inventory < Beginning Inventory, then FFOH expensed under AC is higher than FFOH expensed under VC