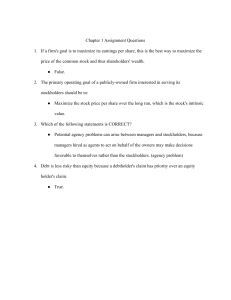

Solutions Manual For Financial & Managerial Accounting, 15th Edition By Carl Warren, James Reeve, Jonathan Duchac

advertisement