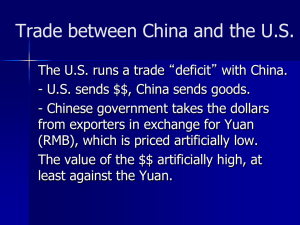

The importance of the Yuan becoming a major world currency is significant. It is impossible to overstate the significance of the Chinese yuan's rise to prominence as a major global currency. This development is pivotal for several reasons: International Monetary Influence and Stability: China continues to grow its economy rapidly, thereby boosting the status of the yuan as a global reserve currency and extending its influence worldwide. This higher standing enables Beijing to take part in more international financial organizations like IMF or World Bank Group where it has been given greater weight due to which they can push for policies that serve their economic interests – a move that guarantees stability not only within countries but across them as well. The decision made by International Monetary Fund (IMF) during 2016 regarding inclusion of Renminbi into Special Drawing Rights (SDR) basket also marked an important stage because this action recognized widely around the world how important such denomination is used globally. Diversification of Reserves: Expansion of Yuan’s worldwide status is likely to make it necessary for nations to diversify their foreign reserve portfolios that are presently dominated by US dollar and euro.. Diversifying currencies can achieve this, reducing global reliance on the dollar and stabilizing the world financial system against potential American economic shocks. In 2008, there was global economic instability because everybody relied too much on the dollar. If they introduce an assorted reserve regime with Yuan, it might help reduce these risks as well. Lower Transaction Costs: Chinese businesses and companies within China's borders benefit from using the Yuan because it eliminates the need for currency conversion, which in turn reduces transaction costs and protects against risks arising from fluctuations in exchange rates. This simplifies financial transactions, fosters operational efficiency, and reduces expenses related to increasing Chinese products' global competitiveness. Another thing is that trading with Yuan guarantees predictability, thereby making trade processes easier. Traders abroad can choose to import goods from China using yuan, which saves them from having to deal with volatile exchange rates whose unpredictability often leads to high charges or even loss of money through wrong calculations. By following this method, you can ensure that prices aren’t going to change so that financial planning can be done properly without any problems because of the sudden changes in prices caused by wrong guesses. This creates the best possible situation for doing business in different areas and provides profits for traders who want to grow their businesses in China. This is because such instabilities do not affect their calculations, resulting in frequent losses without any profit. Why venture into something risky if there are no returns? Generally, the use of yuan has achieved cheapness between China and other countries, thereby promoting both local and international economic activities. Promotion of Chinese Financial Markets: However, in the future, the yuan will be a global currency, and Chinese financial markets are becoming more interesting to foreign investors. Capital flow is going to contribute to financial infrastructure development, which means that China will turn into an up-to-date, enlarged, and financially advanced economy. On the other hand, global markets in the financial industry of China are prevented from reforming deeper by external forces. Another thing that the market is infused with globally is capital; such practices from all over the world are also used as they enhance the creation of efficient and clear markets. For this reason, Shanghai and Shenzhen have transformed into financial hubs that play larger roles by using foreign investments to modernize their sectors in line with international trends. Risks for China However, the journey toward making the yuan a major world currency is fraught with risks. Loss of Monetary Control: As the global community recognizes the Chinese currency, China might lose control over its monetary policies. To do this, they have to be more open about their financial practices and work towards making them look less random. However, should they succeed in that endeavor, it may hinder their ability to respond fast enough during domestic economic problems. For example, keeping a steady exchange rate as a way of reassuring foreign investors might come into conflict with other strategies meant to stimulate growth, or battling with China could either implement local policies aligned with international standards faster or maintain worldwide needs as it rapidly adjusts its internal politics, thus leading to a delayed response to economic concerns if any arise. The absence of these restrictions can impact various aspects of China's comprehensive economic policy objectives, including interest rate adjustments and capital controls, necessitating a more measured response in various scenarios. needed. The main difficulty lies in balancing worldwide demand for money against national needs for prosperity. Exposure to Global Market Volatility: China’s economy is becoming more vulnerable to world market volatility as the yuan gains international currency status. Fluctuations in global demand for the yuan could affect China’s export competitiveness and overall economic stability. A quick appreciation of the yuan would make Chinese exports expensive, thus unattractive to buyers worldwide. This could lead to the loss of jobs in industries that depend on exports since there would be less demand from abroad. The economy has become more open and vulnerable to external economic shocks than ever due to its higher volatility and wider integration into global financial markets, making sustainable development hard. It is a huge challenge for China as it seeks to balance gaining from the internationalization of the RMB while minimizing exposure to world market variations. Consequently, currency policy needs to be handled well with other economic measures designed to protect export sector health as well as the general national welfare of the country’s economy. Political and Economic Reforms: China must make drastic legal, political, and institutional changes if it wants to gain trust and credibility from global investors and businesses. These modifications have the potential to challenge both the current political system of China and its economic control methods, thereby resulting in domestic unrest. Efforts aimed at increasing openness as well as reducing intervention by the state in the economy may face opposition among powerful figures within government and state-owned enterprises in China too. Such resistance can stem from an unwillingness to relinquish power or a fear of losing control over monetary decisions. The call for more transparency through reforms may also come into conflict with the self-interests of those benefiting from the present arrangements, thus leading to internal fights. China will find it hard to balance credibility requirements with the maintenance of internal peace. Effective handling of this tactic requires meticulous planning and a strong political will to overcome deeply entrenched rivalries. This is important because failure would mean that such reforms are implemented inefficiently, thereby further destabilizing the broader socio-economic foundations within which they operate. Foreign banks and electronic platforms play a crucial role. Facilitating Offshore Trading HSBC, Citi, and Standard Chartered are among the foreign banks that are central to the trading of Chinese currency (yuan, or renminbi). These banks operate in key global financial centers like Singapore, London, and Hong Kong, which are instrumental for the internationalization of the yuan. They do this by offering services denominated in the yuan as well as facilitating cross-border transactions. They have established a robust trading network in strategic locations around these cities, which enhances its liquidity and accessibility outside China, thereby boosting its appeal as a global currency and promoting its use for international trade and investment. They also contribute to the development of additional Yuan-related products and services, facilitating their They play a stabilizing role in promoting Yuan's stability, enhancing its reliability, and accelerating its global acceptance and use. acceptance rate and use globally. Offshore Market Dynamics: Hong Kong has a significant offshore market for the yuan, which is critical to its liquidity. Consequently, China’s capital controls do not apply here because they do not limit the exchange rates of yuan in the market, which enables it to be more versatile and active. Through this arrangement, China is able to have a platform on which to test the waters as far as the yuan is concerned as a global currency; hence, it can observe and influence how trading affects the rest of the world without destabilizing its economy internally. The Hong Kong Offshore RMB Centre carries out millions of RMB transactions every day, thereby affording it a significant boost in recognition worldwide. Foreign Bank Operations: International banks such as HSBC provide a variety of fiscal products and services in the Chinese currency. Some of Businesses and investors willing to trade with China need yuan sovereign savings accounts, treasury bonds, and trade finance solutions, among others. ding such services, foreign banks make Yuan more accessible and attractive to global businesses, thereby promoting its use in international transactions and investments. HSBC, for example, played a key role in Hong Kong's introduction of dim sum bonds (yuan-denominated bonds), which provide global investors with an avenue to invest in yuan-denominated assets. Enhancing Transparency and Accessibility Thomson Reuters and ICAP are very useful when it comes to making yuan trading more transparent and efficient. These give real-time information, provide room for trading, and encompass a broad range of financial information that is helpful for global market participants. This would be an important step towards increasing trust among international traders, which would in turn promote further acceptance of the Yuan as a reserve currency globally. They also give access to up-to-date market data and enable efficient trade execution, enabling traders to make informed choices and thus reducing the risks related to forex transactions. Moreover, these platforms facilitate transaction processing, thereby enhancing its ease and reliability, leading to higher liquidity and stability within this Chinese currency’s local market. Therefore, Thomson Reuters and ICAP have emerged as significant players because they combine state-of-the-art solutions with robust data resources indispensable for the yuan’s internationalization, turning it into an attractive global investment or trade currency. Real-time Data and Analytics: Thomson Reuters and ICAP operate platforms that provide traders and investors who monitor the yuan’s exchange rates, trading volumes, and market trends. This helps them make well-thought-out decisions based on the information of the moment that is precise enough for accurate price discovery. For instance, in addition to being a great way to follow the market closely and execute trades quickly, Thomson Reuters Eikon extensively covers tools related to yuan financial markets. Thus, these systems facilitate currency trading by making it transparent because they offer all relevant financial data and means of trade. This is crucial, as it will help establish trustworthiness and support wider acceptance of Yuan in global markets. Consequently, access to real-time data and analysis of market trends greatly enhances decisionmaking, thereby reducing risks while improving liquidity and stability within the Yuan trading environment. Trading Platforms: This can be done by linking buyers and sellers worldwide to trade yuan on electronic platforms such as Thomson Reuters and ICAP. Some functions that they offer are automated trading systems, which make the yuan market more fabulous. This is made possible by websites like ICAP, an electronic broking provider with a daily turnover of billions of Yuan tokens, making it more liquid than ever before. These markets are contemporary in nature and are operated through these platforms so as to achieve efficient, transparent, and real-time transaction information. The effect is an increase in investors’ confidence all over the world; therefore, they may also think about using those safe environments for the purpose of investment or trading. The use of advanced technology and the provision of accurate data remain vital aspects played by Thomson Reuters and ICAP to facilitate worldwide money placement, leading to an opportunity to use the Yuan as one of the world’s reserve currencies, thus furthering its attractiveness in global trade or investment practices once again. Promoting financial integration For the promotion of financial integration, foreign banks and electronic platforms are important players in facilitating the trading and clearing of yuan-denominated financial products. This is important because it will enhance the adoption of the yuan as a global currency. The supports help in having good processes that are efficient and transparent and can make the yuan an acceptable international trade currency for financing transactions. For doing these things, there are many things that Chinese institutions do, like, e.g., Thomson Reuters, HSBC Bank, Standard Chartered Bank, and ICAP Brokerage Company Limited, and some other firms do not use virtual money at all while dealing with real money. All this helps in creating a seamless transaction path for Yuans so that they can be guaranteed by global investors and traders who have confidence in them; hence, this makes Yuan suited more towards international business as well as attracting investment that aids it on its way into the world economy. It is from this notion that we understand how China has managed to build an enormous Financial Markets Infrastructure (FMI) to support its currency by having also huge amounts of open market operations (OMOs) for their sovereign bond markets by looking at offshore RMB market size today compared to what happened twenty years ago. Yuan-denominated Financial Instruments: Overseas banks and electronic platforms make it possible to generate and trade all sorts of financial products in Yuan, such as equities, derivatives, securities, etc. By doing this, they give foreign investors the chance to diversify their investments and offer them a share of the Chinese economy. It is worth mentioning that these products are widely used in world markets and therefore support Renminbi’s international role. The London Stock Exchange, for instance, offers bonds denominated in yuan, and this has attracted investors who want to take advantage of China’s economic growth. Clearing and Settlement Services: Smooth international transactions necessitate efficient clearing and settlement services. These services are provided by foreign banks and electronic platforms that ensure the timely and accurate settlement of trades involving the yuan. Such trustworthiness enhances the credibility of the yuan as a solid global currency. For example, the clearing system for the yuan in Hong Kong, run by the Hong Kong Monetary Authority (HKMA), processes billions of dollars worth of deals on a daily basis, which helps cross-border trade and investments to be established. By offering robust clearance systems, these institutions increase transactional efficacy, thus minimizing risks relating to currency conversion or transfer delays. Moreover, reliable settlement services boost confidence; hence, more companies and investors tend to use this kind of money, so it is more integrated into global finance. Hence, it makes its role in terms of global financial matters stronger, thus supporting its development as one of the leading currencies for world trade (yuanbank.com). This smooth integration is necessary for the ongoing internationalization process of Yuan and its stability within worldwide markets. Regulatory Support and Infrastructure: The development of infrastructure and regulatory support is crucial to the internationalization of the yuan. In order to establish a legal framework for foreign banks and electronic platforms, they cooperate closely with regulatory authorities. With this cooperation, it becomes possible for the conditions necessary for using yuan in global markets to exist. An example is CIPS (China International Payment System), which was developed with inputs from various stakeholders, including foreign banks. Yuan cross-border transactions are eased with CIPS, thereby improving their efficiency and reliability. Infrastructure supporting Yuan transactions gets bettered in this joint effort, creating an enabling environment for its worldwide usage. These collaborations help to strengthen trust in the stability and dependability of the yuan by ensuring that international standards and regulations are adhered to. The integration of the yuan into the global financial system necessitates regulatory and infrastructural support that enables its acceptance in world trade and finance. This strengthens its status as one of the largest currencies globally. Will the dollar or euro be succeeded by the yuan? Thus, given its growing role in global finance, it is unlikely that China will replace US dollars and euros anytime soon as the world’s primary reserve currency. The two currencies have become dominant because of America’s economic size, stability, and openness on the one hand and Europe’s transparency requirements for joining their union on the other. If replacement is desired by China with regard to these funds, then there should be extensive economic reforms, together with political ones, that would foster similar levels of confidence among international investors and governments. Legalized standards, such as those underpinning contracts, enforcement rights protection mechanisms, etc., make strong legal systems necessary for any economy basing its currency on either the US dollar or Euro. Hence, Yuan cannot gain this trust without significant changes in laws and institutions, which may take time before completion happens. The United States (US) has a market-oriented economy that is transparent and reliable , while Europe is also transparent and market-driven . However much progress China may have made towards liberalizing her economy, some critical sectors are still under state control, thereby compromising its attractiveness to foreign investors seeking stable business environments based on markets. Nevertheless, these developments have occurred against a backdrop where deep-seated financial markets exist alongside high transaction volumes that facilitate the universal use of American dollars as well as euros. Although there has been an increase in global transactions using yuan over recent years, it remains comparatively less used than other major currencies; for instance, worldwide deals denominated in the United States’ notes constitute about eighty-eight percent, while Chinese money accounts for only approximately four percent, thus signifying that much work needs to be done before it attains parity.