Open Economy Macroeconomics: Savings, Trade, and Capital Flows

advertisement

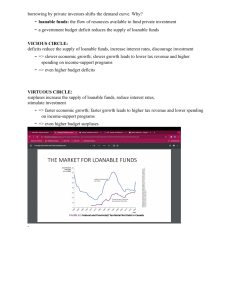

open economy National Savings trade surplus identity changes depending on if the country is in a Investment or deficit I outflows Flows $ transfers from : one country to another done to expand a company worldwide or mak factories where there is cheaper labour or production costs think BMO made goes national e sets up another office is France or HEM by kids in their new factory in China. Capital inflows (Inflow of funds) : gets their clothes foreigners buy domestic assets (finance investments in our country Capital outflows: we use domestic savings to buy toreign assets (foreign investment Coutflow of funds) Net or foreign investment national flow outflows = of funds= (NF1) = Net exports NX a count Trade Deficit Trade Surplus negative positive NFL NFI outflows inflows $ from national savings is repaid to with interest to someone donistically $ from foreign capital inflow outflows > inflows O NX more IM than X more NX inflows X- IM = another - > foreigner to fund you) must be repaid wh interest to a foreigner O X (you get a than Im * $ of investment spending financed by foreign capital inflow comes of a which is the interest that must be paid to a ↑ national cost foreigner Unexpected inflation expansionsa sudden contractions can make flows dangerous , closed econ Closed econ . + savings-investment identity Savings-investment identity y - : C - y = G = Snational C + 1 + (X 1 = = national savings Open encon can use its 1) Accumulate physical capital 1 + G + - + (X - 1M) (M) NF Investments - Net foreign Investment savings 2 ways 2) Buy foreign assets (investing abroad) (investing domestically) So, the funds used to finance domestic investment can come from , capital inflows 2) Foreign Funds 1) Domestic funds Snational : Domestic Investments (1) Money "Borrowed" = not truee borrowing Snational ? trade deficit NFI Investment spending A : (f) NF domestic market for loanable funds = investment spending Savings always closed econ Savings National savings Open econ Savings National Savings : = : = + capital inflow Loanable Funds Market < Assumptions Only 1 type of loan : (i) = nominal interest R8 only 1 interest R8 in the econ The loanable funds market is a hypothetical maket that brings the savers (those who want to lend) & borrowers (those who have profitable investment opportunities) together The nominal interest R8 is determined in the market for loanable funds Domestic Demand for loanable funds (D) Theory Graph Comes from ppI who want to borrow $ for investments Downward sloping blc & higher interest R8 there are ↑ - L It relation w/ Slopes downward interest R8 - negative net present values Investment spending payin upfront expecting it to generateI profit in the future BUT, $now is worth ↑ than it will be in the future especially wh ↑ interestrf : So , investment is only worth it if it generates a future return ↑ than the price of the investment today . ↓ Net Present Value : amount of $ needed today in order to recieve x export of a future given the interest r8 Interest R8 measure the Opp Cost of investment spending vs putting that $ in the bank earninga The higher the interest R8 the more attractive earning interest from the bank is higher the int r8 higher the OC lower the # of investments date . , . , , interest R8 Represents OC · . . Return on investment must be only given investments wh positive net present value will receive loans Net Present Value : compares present value of of future payoff wh the project's current cost important b/c money pres value of future payoff fluctuates interest ROX So , total invest. FV = PV = PV(1 + + " so more : profitable investment projects get funded spending (ID) have a negative relationship wh int.rf r("how much money will I have I year from now if I how FV (1 Present value : > current cost Is much do I have to invest r)n a year (1 i)2 (current value) year value today for invest x x 2 va le NPV : + value = + ooo cost + Revenue usually, current value is C blc you pay money I get $ back imediatly Net = Present value of return on investment present value NPV = O : project will be undertaken present value of invest cost . Compression Example 1) Let’s say a year from now you want to go on a trip that will cost $1000. In order to have $1000 a year from now, how much do you need today? More than $1000 because of interest rate! X = amount you need in today & i = inflation rate If you put X into the bank today and earn interest on it, then 1 year from now the bank will pay you X x (1 + i) If what the bank will give you a year from now is $1000, then the amount of money you need today is X x (1+i) = $1000 X = $1000/1+i i is always > then 0 so X is always < than $1000. If i = 5% then X = $952.38 In other words, $952.38 today is equivalent to having $1000 a year from now. That is that $952.38 is the present value of $1000 today given an interest rate of 5%. Present value of X: amount of money needed today to receive X in the future given the interest rate. Comprehension Example 2) Think about a first that have 2 potential investments in mind, each of which will yield $1000 a year from now. However each project has a different initial cost: Project 1: $900 Project 2: $950 Which, if any, is worth borrowing money to finance and undertake (aka lending money to? Answer depends on i which determines the present value from now a $909 loan requires a repayment of $1000 a year from now. X = $1000/(1+10) X = 909 So, a loan of less than $909 requires a repayment of more than $1000 and a loan of more than $909 requires a repayment of less than $1000. This being said, only project 1 which has an initial cost of less than $909 is profitable because its return a year from now is more than the amount of the loan repayment. With an interest rate of 10%, the return on any project costing more than $909 is less than the amount the firm has to repay on its lean and is therefore unprofitable. A firm will borrow more and engage in more investment spending when the interest rate is lower. Since, similar calculations will happen with other firms. So at a lower interest rate there will be higher investment spending in the economy as a whole. Hence the downward D slope. domestic supply of loanable funds DomesticSupply (t) relation T Graph I Comes from savers just outright lenders Upward sloping heory Upward sloping blo savers have an OC when they lend to a business which is the $ on something else. A saver will become a lender - 7 w/ interest L R8 they could spend depending on the int . RO received in return ppl area willing to forgo current consumption I make a loan to a borrower when int r8 ↑ . b/c current consumption ↑ $ $ equilib int RO . Supply Where a : + total but, quantity of lending market for loanable funds Demand a N profitable projects e equilib interest R8 or higher that get approved b : c : . r8 t than lenders willing equilib . . : lenders demanding will be rejected - && E to accept int r8 & or t equilib will have their offers to lend accept d d s & Rejected projects that will only be profitable wi int returns ↑ int . 8 I than equilib . - · a d ~ quantity c supply "Demand & of funds . d graph shifts DEMAND SUPPLY 7) Changes in percieved business opp AKA . change on beliefs abt payoffs , preference blu 1) Change in Sprivate behavior current a future weath D - Covid threatened a recession a ppI started 3) Changes in Spublic/Gov budget 2) Changes ingou policies that · Surplus : (t) Spublic credit (subsidy the form of t taxes Tax for makes ~ Deficit : (-) = & 1990s internet invention caused tech hype companies investing in computers 2007 fauireatmanyonlinps e as affect invest in targeted invest types) E inv . E spending ↓ + more . = gov is a lender Spublic-gou is a borrower cheaper M attractive Right shift more investments more fundsI interest RS tends to ↓ overall : , economy's investment spending Crowding : out Expected future inflation Shifts S & D upwards , ↑ equilib int R8 but . = quantity