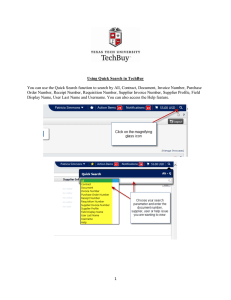

QUESTION & ANSWER 1.) When is the effectivity date of the IRR for Ease of Paying Taxes Act specially on the IRR for invoicing requirements? The IRR was posted on BIR website on April 12, 2024, IRR will take effect 15 days after the posting on the official gazette or BIR website whichever comes first. So, the effectivity date is April 27, 2024. 2.) I am a buyer, is it true that I cannot use our supplier’s Official Receipt to claim input tax? Yes, unless the supplier opted to convert their remaining unused official receipt as their principal invoice (see question 4), EOPT Act mandates a single document for both sales of goods and services. Hence, all references to Sales/Commercial Invoices or Official Receipts shall now be referred to as “INVOICE” - BIR RR 3 2024 – Section 2(B) Invoice as defined in RR 7 2024 – Section 2 is a written account evidencing the sale of goods and/or services issued to customers in the ordinary course of trade or business. This includes Sales Invoice, Commercial Invoice, Cash Invoice, Charge/Credit Invoice, Service Invoice, or Miscellaneous Invoice. It is also referred to as a “principal invoice.” Official Receipt, being now a supplementary document, is not valid proof to support the claim of input taxes by the buyers of goods and/or services. RR 7 2024 – Section 2.2 The buyer can claim input taxes using a valid VAT Invoice. 3.) What are the two categories of Invoice? a.) VAT Invoice – issued by a VAT supplier for sales of goods or services, whether cash or on account. It shall be the basis of the output tax liability of the seller and the input tax claim of the buyer or purchaser. b.) Non-VAT Invoice - issued by a non-VAT supplier for sales of goods or services, whether cash or on account. Sales are not subject to VAT. It shall be the basis of the Percentage Tax liability of the seller. 4.) What will happen to the remaining unused manual or loose-leaf Official Receipts of the supplier of services or lessor of properties? The seller has two options for the unused Official Receipts as provided in RR 7 2024 Section 8.2 VII TC 2024 Option 1 - Supplier may continue to use the remaining Official Receipts as supplementary document. – All unused Official Receipts may still be used ass supplementary document until fully consumed, provided that the phrase “THIS DOCUMENT IS NOT VALID FOR CLAIM OF INPUT TAX” is stamped on the face of the document upon the effectivity date of the regulations. The Official Receipt, along with other equivalent documents such as Collection Receipt, Acknowledgement Receipt and Payment Receipt are all the same, serve as proof of payment that cash has been received or that payment has been collected/made for goods and/or services. Option 2 - Supplier may convert and use the remaining Official Receipts as Invoice - For ease of doing business, supplier shall be allowed to strikethrough the word “Official Receipt” (e.g Official Receipt) on the face of the manual and loose leaf printed receipt and stamp “ Invoice”, “Cash Invoice”, “Charge Invoice”, “Credit Invoice", “Billing Invoice”, “Service Invoice", or any name describing the transaction, and be issued as primary invoice to its buyer/purchaser until December 31, 2024. This document shall be valid for claim of input tax by the buyer/purchaser until December 31, 2024 only. Official Receipt, whether stamped with “Invoice” or unstamped, issued after December 31, 2024, will be considered supplementary documents only and ineligible for input tax claims. 5.) What about for Cash Register machines (CRM) and Point-of-Sales (POS) Machines, Electronic Invoicing Software and Computerized Accounting System (CAS)? - Suppliers who uses CRM/POS/E-receipting/E-invoicing (e.g. machines used by the cashier the department store/ grocery store/malls/online store and the like) may change the word “Official Receipt (OR)” to “Invoice”, “Cash Invoice”, “Charge Invoice”, “Credit Invoice”, “Billing Invoice", “Service Invoice", or any name describing the transactions, without the need to notify the Revenue District Office(s) having jurisdiction over the place of business of such sales machines, since the reconfiguration shall be considered as minor system enhancement which shall not require the reaccreditation of the Permit to Use of the supplier. Documents issued by the CRM/POS/E-receipting/E-invoicing containing the word “Official Receipt” beginning the effectivity of RR 7 – 2024 (April 27, 2024) shall not be considered as valid for claim of input tax by the buyer/purchaser. - Suppliers who use a duly registered Computerized Accounting System (CAS) need to revisit their system to comply with the provision of the EOPT Act. Since the system reconfiguration will have a direct effect on the financial aspect, it shall be considered as major enhancement which will require taxpayer to update their system registration following the existing policies and procedures of filing a new application. The previously issued Acknowledgement Certificate (AC) or permit to Use shall be surrendered to the RDO where the concerned supplier is registered. In order to provide ample time in reconfiguring machines and systems, adjustments shall be undertaken on or before June VII TC 2024 30, 2024. Any extension due to enhancements of the system shall seek approval from the concerned Regional Director or Assistant Commissioner of Large Taxpayers Service which shall not be longer than six months from the effectivity of the regulations. Issuance of “Official Receipt” for the sale of goods or services after June 30, 2024 will not be considered as evidence of sales of goods or services and shall be tantamount to failure to issue or non-issuance of Invoice required under Section 6(A) hereof subject to penalty of not less than 1,000.00 pesos but not more than 50,000.00 pesos and suffer imprisonment of not less than 2 years but not more than 4 years pursuant to Section 264(a) of the Tax Code Reference: RR 7 2024 Section 8.3 6.) How to recognize a valid VAT Invoice that a buyer can use as proof for claiming input tax? RR 7 2024 SEC 3 - VAT registered persons are allowed to use the VAT as input tax credit if the lacking information do not pertain to: Amount of vatable sales Amount of VAT Name and TIN of both buyer and seller Description or Nature of Goods or Services Date of Transaction It is valid of course if the invoice is duly registered with the BIR, meaning, it has Authority to Print (ATP) for manual and loose-leaf invoice or Acknowledgement Certificate (AC) for Computerized Accounting System. SAMPLE ATP, AC/CAS PERMIT & PTU VII TC 2024 7.) What will you do if the supplier gave you an invalid document to support your claim for input taxes. VII TC 2024 VII TC 2024