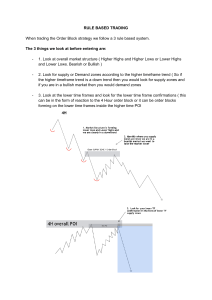

Market Structure For Precision Technicians ICT market structure refers to the way the market behaves and shifts based on various factors such as institutional order flow, imbalances, and key levels. It represented in a series of either higher lows and higher highs - bullish, or series of lower highs and lower lows - bearish. Market Structure Concept The actual turning points that include high and lows within it (Intermediate highs and lows). The market trades in a generic pattern or rhythm and it is easy to read if you are aware of the basic structure price tends to move in. 1. Generally, the market trades from short term low (STL) to short term high (STH) back to a new short-term low (STL). As these STL’s and STH’s form, they will develop a “market structure” of price action. 2. Any short term low (STL) that has higher short-term lows (STL) on both sides of it is considered an Intermediate term low (ITL). 3. Any short term high (STH) that has lower short-term highs (STH) on both sides of it is considered an Intermediate term high (ITH). 4. Any Intermediate term low (ITL) that has higher intermediate term lows (ITL) on both sides of it is considered long term low (LTL). 5. Any Intermediate term high (ITH) that has lower intermediate term highs (ITH) on both sides of it is considered long term high (LTH). Interbank Traders do not view Market Structure with Retail's method. Interbank Traders view Price in terms of Liquidity and Imbalances. 1) The highest time frame will act as a Long-term Perspective • This time frame will show you Higher Time Frame Levels which will offer Trade Setup Opportunities. • Trade Ideas will be built upon levels derived from the Higher Time Frame. 2) The mid-level timeframe will act as an Intermediate-Term Perspective • Following the Trade Setup Opportunity found on the HTF, Mid-level will give you more definition in terms of structure based on that HTF Level • Managing Trades will be done via a mid-level time frame. 3) The lowest time frame will act as a Short-term Perspective • Following the Trade Setup Opportunity found on the HTF and insights given with Mid-level, the short-term perspective will give you even more definition in terms of structure. • Timing trades with entries will be done via the lowest time frame. *Intermediate Term High/Low – Any short term low (STL) that has higher short-term lows (STL) on both sides of it is considered an Intermediate term low (ITL). Any short term high (STH) that has lower short-term highs (STH) on both sides of it is considered an Intermediate term high (ITH). If you see a Rebalanced ITH, that is telling you that the market is VERY weak. That is the market “tipping it’s hand” towards Interbank Traders. [Credit to Braveheart] To effectively recognize Market Structure in a manner akin to that of an Interbank Trader, it's imperative to first grasp the prevailing market narrative. The narrative guides us towards assessing liquidity conditions. Specifically, a liquidity draw serves as the foundation for establishing our daily bias. Key questions arise: - What is the current market narrative? - Is it going higher for Buy Side Liquidity or to Rebalance a SIBI? - Is it going lower for Sell Side Liquidity or to Rebalance a BISI? FAILURE TO UNDERSTAND MARKET STRUCTURE LIKE AN INTERBANK TRADER, WILL LEAD YOU TO FALL VICTIM TO FALSE MARKET STRUCTURE BREAKS. When you look at the charts, look each time to see if the market is retracing an imbalanced candle . Classify this as an intermediate high/low. Then make sure prices don't violate it. If you are bearish and your intermediate high is broken, then you need to step aside and not enter again. Wait for another setup. The daily chart is exactly what institutions and banks are using. That's where the money is. This is also where your preferences will be determined. Most of your time and study should be focused on determining where the daily chart will be for the next day, two, or week. Market Phases There are 3 phases in the market: • Accumulation phase: Accumulation is the process of opening a large position by a market maker without significant price movement against the direction of this position. • Manipulation phase: The release of negative news makes weak players panic. They become very predictable. Namely, if the market falls, these players begin to massively sell everything, which is responsible for a large increase in supply. The first manipulation leaves several questions: “What kind of demand can absorb the current volume?”, “Who is on the other side of the deal?”. Weak players tend to often miss bull market formation points. After which they are overcome by greed, they begin to get nervous, which brings with it the thought that the current trend is passing by. That is why the “crowd” begins to buy everything. Remember, market weakness manifests itself in moments of an uptrend, strength downtrend . • Distribution phase: Distribution is the reverse process of accumulation. ICT frames things based on a top down approach starting from the daily because that’s where banks and institutions trade off. Number one question is what the current market narrative is. Does the market have a reason to go up for BSL or to rebalance an imbalance (or FVG, Volume Imbalance)? Or is it likely to go lower to sweep Sellside liquidity or to rebalance an imbalance (or FVG, V.I.)? Imbalance, rebalance and liquidity, that’s all they’re doing. The daily is where your bias is going to be determined. That’s what makes or breaks your trend continuation. So the majority of your time should be where that daily chart is going. If you’re trading against what the daily chart is likely to do, you are absolutely asking for failure. That’s not to say that you can’t go long when the daily will go lower, but why would you? Why would you swim against the tide? If you line up with the daily, you will avoid a lot of mistakes. From Narrative to Market Structure: How Market Structure is built: Market profiles will assist in market structure analysis concepts. Are we trending, in a reversal pattern or in a consolidation preparing for a breakout scenario? It helps you determine if we are bullish or bearish. Below you see two examples of how market structure is built. To the left you see a market rally into a key (Higher Time Frame) resistance level followed by a Smart Money Reversal (SMR) and then a decline (which can be a retracement or a reversal dependent on if we’ve taken HTF external or internal liquidity) and to the right the opposite. Here the decline reaches into a key (HTF) support level. These support and resistance levels are your so called “PD arrays” (ICT Core Content month 4) and you have to use the highest timeframe to identify those levels. Without key support and resistance levels you’re not going to get a directional bias regardless of what trading model you’re using. Swings consist of consolidation and expansions until we reach a key support/resistance level where the smart money reversal (SMR) takes place. The SMR takes place at the top by either a turtle soup or a failure swing (CC month 5 ep. 5). Same goes for the support level. You can anticipate an entry at the SMR after we hit the key support/resistance level. The consolidations are the building blocks that we work with. During a consolidation you look for dynamic support/resistance levels to trade off until we reach the key support/resistance level (HTF). Those levels are very clear. So as price declines, you want to see these swing lows being formed and every swing low that forms there will be a discernible OTE at the retracement. Which timeframes to use to break down market structure depends on the type of trade(r)? There are lots of different timeframes, and that can be overwhelming. Your primary objective is to know the timeframe that you’re trading. That depends on what type of trader you want to be, as disposed in the image above. You see 3 timeframes per type of trade(r): - HTF: trade idea based on this, directional bias and manage trade. - Middle timeframe: manage your trade. - LTF: short term, for timing your entry and looking for early reversal signs, so you know it’s time to take profits. [Blue dots: are ITH/ITL, Orange arrows: those ITH/ITL are LTH/LTL. Green = STH/STL] If Price is Bearish, we want to see price spend little time above highs, create shallow runs on highs, reject, and/or Respect Premium Arrays. We also want to see DISPLACEMENT LOWER. Violating discount arrays and/or LT,IT,ST LOWS. Below you see 2 charts. The daily timeframe and the price action between the red lines from a 1h perspective. The daily is the parent of the 1h price structure so minor price swings are subordinate to it. [On this daily you see the dealing range and a retrace into premium (just above EQ to rebalance that FVG)] [1h TF] As you see you will have 2 possible entry points, an aggressive entry and a low risk high confirmation entry as displayed below. *Once a ITH/ITL is broken, you have a significant break in market structure(BMS/MSB). Once we break down and take out the STL and ITL or just a ITL/ITH, then we have a significant break in market structure. This is more significant than just simply going into a chart and saying okay well it took out a short term low there it is. Your entry should be based on the lowest of the 3 timeframes. Now let’s assume we are a swing trader; market structure is bullish and we’ve traded off of a higher timeframe support level and we had a market shift to the upside on the highest timeframe chart. Our midlevel timeframe has allowed us to find a key support/resistance level that converges with the HTF s/r level. Our confluence: pattern overlaps with that s/r level. We now have a bias and that’s bullish. Keep in mind that not every day a setup will be delivered and every day the bias is both directions. You have to decide what it is that you’re trading and you want the bias that you are holding to line up with price action, you can’t force price action to do what you want it to do, you want to get in sync. During the Killzone (time!) you wait for the key support level to be hit (as in the example below) and you look for a market shift there (based on the highest of the 3 timeframes) in the form of either a stop run or a failure swing (cc month 5 episode 5) and after that market shift happened you look for an entry on the lowest timeframe. After MSS and you’ve found your entry, you can use standard deviations for target projections. Once we break that ITL, we can use the fib standard deviations to determine price targets from this consolidation. [You see the yellow price swing on the left. As soon as the low is taken out, you can use the swing projection for targets] Above, as you can see, I drew the FIB from the ITH at the top to the LTL at the bottom of the range. Why anchor the FIB like this? This is not random of course. Because that’s the up move, so the swing, from where the decline starts. It’s the retracement swing up that fails that starts to decline. The projection is -2.0 STDV. Once you are in trade, use institutional order flow to know if the move is still good. When you’re bearish, all of your up close candles should keep price from going higher than that. So they are your resistance. For bullish price action, down close candles should support price.