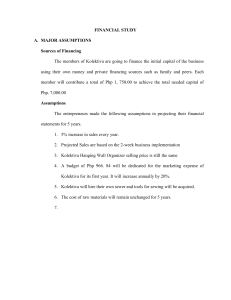

VALUCON REVIEWER MODULE 5 TRUE/FALSE 1. Value pertains to how much a particular object is worth to a particular set of eyes. TRUE 2. Value, in the point of view of corporate shareholders relates to the difference between cash inflows generated by an investment and the cost associated with the capital invested which captures both time value of money and risk premium. TRUE 3. Valuation techniques may differ across different assets, but all follows similar fundamental principles that drives the core of these principles that drives the core of these approaches. TRUE 4. Merger is the general term which describes the transaction wherein two companies are combined to form a wholly new entity. TRUE 5. Fair market value is the price expressed in terms of cash equivalents, at which property would change hands between hypothetically willing and able buyer and a hypothetically willing and able seller, acting at arm's length in an open and unrestricted market, when neither is under compulsion to buy or sell and when both have reasonable knowledge of the relevant facts. TRUE 6. Valuation includes the use of forecasts to come up with reasonable estimate of value of an entity's assets or its equity. TRUE 7. Intrinsic value refers to the value of any asset based on the assumption assuming there is a hypothetically complete understanding of its investment characteristics. TRUE 8. Businesses treat capital as a scarce resource that they should compete to obtain and efficiently manage. TRUE 9. Methods to value for real estate may be different on how to value an entire business. TRUE 10. Liquidation value is the net amount that would be realized if the business is terminated and the assets are sold piecemeal. TRUE 11. Fundamental analysts are persons who are interested in understanding and measuring the intrinsic value of a firm. TRUE 12. In the corporate setting, the fundamental equation value is grounded on the principle that Alfred Marshall popularized - a company creates value if and only if the return on capital invested exceeds the cost of acquiring capital. TRUE 13. Valuation is an estimation of an asset's value based on variables perceived to be related to future value investment returns, on comparisons with similar assets, or, when relevant, on estimates of immediate liquidation proceeds. TRUE 14. Valuation is also important to businesses because of legal and tax purposes. TRUE 15. According to the CFA Institute, valuation is the estimation of an asset's value based on variables perceived to be related to future investment returns, on comparisons with similar assets, or, when relevant, on estimates of immediate liquidation process. FALSE 16. Value is impacted by liquidity. TRUE 17. Definition of value may vary depending on the context. Different definitions of value include intrinsic value, going concern value, liquidation value and fair market value. TRUE 18. Going concern firm value is determined under the going concern assumption. The going concern assumption believes that the entity will continue to do its business activities into foreseeable future. TRUE 19. As valuation mostly deals with projections about future events, analysts should hone their ability to balance and evaluate different assumptions used in each phase of the valuation exercise, assess validity of available empirical evidence and come up with rational choices that aligns with the ultimate objective of the valuation activity. TRUE 20. An acquisition usually has two parties: the buying firm and the selling firm. The buying firm needs to determine the fair value of the target company prior to offering a bid price. TRUE 21. Spin-off is separating a segment or component business and transforming this into a separate legal entity whose ownership will be transferred to share holders. TRUE 22. Corporate finance mainly involves managing the firm's capital structure, including funding sources and strategies that the business should pursue to maximize firm value. TRUE 23. Information Traders are trades that react based on new information about firms that are revealed to the stock market. The underlying belief is that information traders are more adept in guessing or getting new information about firms and they can predict how the market will react based on this. TRUE 24. Divestiture is the sale of a major component or segment of a business (e.g. brand or product line) to another company. TRUE 25. Fundamentals refer to the characteristics of an entity related to its financial strength, profitability or risk appetite. TRUE 26. Top-down forecasting approach - forecasts starts from international or national macroeconomic projections with utmost consideration to industry specific forecasts. TRUE 27. Activity investors usually do "takeovers" - they use their equity holdings push old management out of the company and change the way company is being run. FALSE 28. Synergy can be attributable to more efficient operations, cost reductions, increased revenues, combined products/markets or cross-disciplinary talents of the combined organization. FALSE 29. Chartists relies on the concept that stock prices are significantly influenced by how investors think and act. Chartists rely on available trading KPIs such as price movements, trading volume, short sales - when making their investment decisions. TRUE 30. Leverage buyout is the acquisition of another business by using significant debt which uses the acquired business as a collateral. TRUE MULTIPLE CHOICE 1. The relevance of valuation in _______________ largely depends on the investment objectives of the investors or financial managers managing the investment portfolio. PORTFOLIO MANAGEMENT 2. ___usually has two parties: the buying firm and the selling firm. The buying firm needs to determine the fair value of the target company prior to offering a bid price. On the other hand, the selling firm (or sometimes, the target company) should have a sense of its firm value as well as to gauge reasonableness of bid offers. Spin-off; Divestiture; Merger; ACQUISITION 3. ___refer to the characteristics of an entity elated to its financial strength, profitability, or risk appetite. Technical characteristics; Intrinsic value; FUNDAMENTALS; Financial value 4. This refers to the value of any asset based on the assumption that there is hypothetically complete understanding of its investment characteristics. Fair market value; INTRINSIC VALUE; Going concern value; Liquidation value. 5. This refers to the possible range of values where the real firm value lies. Risk of the unknown; UNCERTAINTY; Volatility; Solvency. 6. This pertains to how much a particular object is worth a particular set of eyes. VALUE; Cost; Price; Fundamentals 7. Valuation places great emphasis on the ___that are associated in the exercise. Due diligence; Human reasoning; Professional skepticism; PROFESSIONAL JUDGEMENT. 8. __ is particularly relevant for companies that are experiencing severe financial distress. Going concern value; Intrinsic value; LIQUIDATION VALUE; Fair market value. 9. Separating a segment or component business and transforming it into a separate legal entity whose ownership will be transferred to shareholders. Mergers; Acquisitions; SPIN-OFF; Divestiture 10. Which key principles in valuation refers to business value tending to change every day as transaction happens? The value of a business is defined only at a specific portion of time; Value varies based on the ability of the business to generate future cash flows; Market dictates the appropriate rate of return for investors; Firm value can be impacted by underlying net tangible assets. 11. __ tend to look for companies with good growth prospects that have poor management. ACTIVIST INVESTORS; Fundamental Analysts; Chartists; Information Traders 12. According to the CFA Institute, ____________ is the estimation of an asset's value based on variables perceived to be related to future investment returns, on comparisons with similar assets, or, when relevant, on estimates of immediate liquidation proceeds. VALUATION; appraisal; fundamentals; price estimation 13. They believe that these metrics imply investor psychology and will predict future movements in stock prices. Information Traders; Activist Investors; CHARTISTS; Fundamental Analysts 14. Value is determined under the going concern assumption. Liquidation value; Intrinsic value; GOING CONCERN VALUE; Fair market value 15. One of the major factors linked to the value of business that shows what are the business risks involved in running the business. EMBEDDED RISKS; Current Operations; Future Prospects; All of the above 16. The value of a business can be basically liked to three major factors, except: current operations; future prospects; embedded risks; NONE OF THE ABOVE. 17. The price expressed in terms of cash equivalents, at which property would change hands between a hypothetical willing and able buyer and a hypothetical willing and able seller, acting at arm's length in an open and unrestricted market, when neither is under compulsion to buy or sell and when both have reasonable knowledge of the relevant facts. FAIR MARKET VALUE; Going concern value; Intrinsic Value; Liquidation value 18. These are persons who are interested in understanding and measuring the intrinsic value of a firm. Chartists; FUNDAMENTAL ANALYSTS; Information Traders; Activist Investors 19. One major factor linked to the value of business that shows how is the operating performance of the firm in the recent year. CURRENT OPERATIONS; Future prospects; Embedded risks; All of the above. 20. One of the major factors linked to the value of business that reflects is the long-term and strategic decision of the company. Current operations; FUTURE PROSPECTS; All of the above; Embedded risks. 21. Sale of a major component or segment of a business (e.g. brand or product line) to another company is called: spin-off; DIVESTITURE; mergers; acquisitions. 22. Under portfolio management, the following activities can be performed through the use of valuation techniques, except: Stock Selection; Deducing Market Expectation; BOTH CAN BE PERFORMED; None of the above. 23. __ deals with prioritizing and distributing financial resources to activities that increases firm value by appropriate planning and implementation of resources, while balancing profitability and risk appetite. Financial Management; Portfolio Management; Risk Management; CORPORATE FINANCE 24. Which key principles in valuation refers to general concepts for most valuation techniques put emphasis on future cash flows except for some circumstances where value can be better derived from asset liquidation? The value of a business is defined only at a specific point in time; Market dictates the appropriate rate of return for investors; Firm value can be impacted by underlying net tangible assets; Value varies based on the ability of business to generate future cash flows. 25. General term which describes the transaction of two companies combined to form a wholly new entity. Divestiture; Acquisitions; MERGERS; Spin-off 26. Acquisition of another business by using significant debt which uses the acquired business as a collateral. LEVERAGED BUY-OUT; Acquisitions; Divestiture. 27. __ assumes that the combined value of two firms will be greater than the sum of separate firms. ___ can be attributable to more efficient operations, cost reductions, increased revenues, combined products/markets or cross-disciplinary talents of the combined organization. SYNERGY; Volatility; Uncertainty; Control 28. The underlying belief is that ____________ are more adept in guessing or getting new information about firs and they can predict how the market will react based on this. Hence, ____________ correlate value and how information will affect this value. Chartists; Activist Investors; Fundamental Analysts; INFORMATION TRADERS 29. Generally, the valuation process considers these steps, except: understanding the business; forecasting financial performance; preparing valuation model based on forecasts; NONE OF THE ABOVE. 30. Which key principles in valuation refers to market forces are constantly changing and they normally provide guidance of what rate of return should investors expect from different investment vehicles in the market? Firm value can be impacted by underlying net tangible assets; Value varies based on the ability of business to generate future cash flows; The value of a business is defined only at a specific point in time; Market dictates the appropriate rate of return for investors. VALUCON REVIEWER MODULE 6 TRUE/FALSE 1. Equity has been defined by the industry as transactions that would yield future economic benefits as a result of past transactions. FALSE 2. The value of investment opportunities is highly dependent on the value that the asset will generate from now until the future. TRUE 3. In determining the value of equity, it is necessary to value the asset first. This method is known as asset-based valuation. TRUE 4. Brown field investment are those that started from scratch while green field investment are those opportunities that either partially or fully operational. FALSE 5. Discounted cash flows analysis is meticulous but more conservative method or approach that can be used to determine the asset value for it clearly demonstrate the movement of the transaction. TRUE 6. Theoretically, in valuation since it is more on the economic benefits valuation to determine the asset value, the pertinent and anticipated outflow must be included. TRUE 7. Valuation should be kept confidential to allow the company to negotiate a better position for them to acquire opportunity. TRUE 8. Methodologies on asset-based valuation are discounted cash flows or DCF analysis, comparable company analysis and economic value added. TRUE 9. Green field investments are those that are already in going concern state, as most business are in the optimistic perspective that they will grow in the future. FALSE 10. Going concern business opportunities are those business that has a long term into infinite operational period. TRUE MULTIPLE CHOICE THEORIES 1. This represents the amount of cash made available to the equity stockholders after deducting the net debt or the outstanding liabilities to the creditors less available cash balance of the company. Operating Cash Flows; NET CASH FLOWS TO EQUITY; Net Cash Flows to Creditors; Net Cash Flows to the Firm 2. This has been defined by the industry as transactions that would yield future economic benefits as a result of past transactions. Net Assets; Share of Stocks; Equity; ASSET 3. The beauty if GCBOs is that we already have a reference for their performance either on similar nature of business or from its historical performance. With this, the risk indicators can be identified easily and therefore can be quantified accordingly. The Committee of Sponsoring Organization of the Treadway Commission (COSO) suggest that risks management principles must be observed as well in doing business and determining its value. It was noted in their report that the benefits of having a sound Enterprise-wide Risk Management allows for the company as follows, except: DECREASE THE OPPORTUNITIES WITH RISK BEING MANAGED WELL. improve management and distribution of resources across the enterprise. facilitates the management and identification of the risk factors that affect the business. make the business more resilient to abrupt changes. 4. These are business opportunities which are those business that has a long-term into infinite operational period. GOING CONCERN BUSINESS OPPORTUNITIES; Strategic Business Opportunities; Perpetual Business Opportunities; Stable Business Opportunities 5. This represents the value of the company in perpetuity or in a going concern environment. Infinity value.; Perpetuity value; Salvage value; TERMINAL VALUE. 6. This represents the cash flows which was described in the preceding paragraph. This is the amount made available to both debt and equity claims against the company. Net Cash Flows to Equity; Net Cash Flows to Creditors; Operating Cash Flows; NET CASH FLOWS TO THE FIRM 7. These are investments which are already in the going concern state, as most business are in the optimistic perspective that they will grow in the future. Blue Field Investment; Green Field Investment; BROWN FIELD INVESTMENT; Black Field Investment 8. There are two levels of net cash flows, these are: NET CASH FLOWS TO THE FIRM AND NET CASH FLOWS TO EQUITY. net cash flows to the firm and net cash flows to creditors. net cash flows to the creditors and net cash flows to equity. none of the above, since there are three levels of net cash flows. 9. DCF Analysis is most applicable to use when the following are available, except: validated operational and financial information. CASH FLOW PRICING MULTIPLES. new quantifiable information. reasonable appropriated cost of capital or required rate of return. 10. These are the amounts of cash available for distribution to both debt and equity claim from the business or asset. Financing Cash Flows; Investing Cash Flows; Operating Cash Flows; NET CASH FLOWS. MULTIPLE CHOICE PROBLEMS 1. Singapore Ltd., has reported PHP 125,000 revenue where their EBITDA Margin is 45%. If the taxes are 30% of the EBITDA and the capital expenditure was purchased at PHP 1,500, how much is the Net Cash Flows? PHP 56,250 PHP 37,875 PHP 46,625 PHP 39,375 2. Cornerstone Inc., reported revenue for the period amounting to PHP 75,200 and EBITDA Margin of 60%. How much is the operating expenses excluding depreciation? PHP 0 PHP 75,200 PHP 30,080 PHP 45,120 3. Green Tea Corp. reported the following information: Revenue - PHP 32,500; Operating Expenses - PHP 16,250. Included in the operating expense are salaries and wages of PHP 1,450, depreciation of PHP 500, and rentals of PHP 275. The interest expense incurred is PHP 200. How much is the EBITDA for the period? PHP 16,550 PHP 16,750 PHP 16,250 PHP 14,025 4. If Jupiter Inc.'s market value per share is PHP 275 Million, and the EPS it generated is PHP 12.50, what is the P/E Ratio? PHP 32.80 PHP 27.50 PHP 12.50 PHP 20.00 (PHP 22.00) 5. Pluto Corp., a listed company, sells its share in the stock market at PHP 13.50 per share with EPS of PHP 2.50. Based on the foregoing, how much is the P/E Ratio? 5.00 3.50 5.40 2.50 6. Uranus Co. Ltd reported net income of PHP 2,750 while 8 years ago, net income was PHP 2,000 only. How much is the compounded annualized growth rate? 4.56% ; 5.25% ; 5.65% ; 4.65% 7. Sunflower Inc., provided the following information: EPS is PHP 25 while P/E Multiple is 2.0. How much is market value per share? PHP 50.00 PHP 55.00 PHP 50.75 PHP 48.00 8. Malaysia Inc. purchased a capital expenditure amounting to PHP 1,500 and reported revenue of PHP 125,000 and operating expenses is PHP 50,000. The company incurred PHP 500 for interest. If the depreciation is PHP 5,000, how much is the net cash flows? PHP 75,000 PHP 56,150 PHP 57,650 PHP 52,150 9. Leone Inc., a listed corporation, reported on its Statement of Financial Position total assets of PHP 85 Million. The company maintain its debt ratio of 70% and have outstanding capital stocks of PHP 1 Million. Given their performance and financial stability, their stocks were traded at PHP 30 per share. Based on the foregoing, the book to market ratio of Leone Inc., is: 0.95 ; 0.90 ; 1.00 ; 0.85 10. The management accountant of Yza Belle Inc., has calculated their book value per share at PHP 6.25. If Yza Belle's shares will be sold using the average book to market ratio for the industry similar to the company of 0.68, the price per share would be at least: PHP 4.25 PHP 9.90 (PHP 9.19) PHP 6.25 PHP 10.00 VALUCON REVIEWER MODULE 7 TRUE/FALSE 1. Valuation is a sensitive and meticulous task for every analyst and investors. TRUE 2. Most of the companies hire financial modelers to assist the in determining the value of GCBOs or any opportunities. TRUE 3. Historical information may be generated from, but not limited to the following: audited financial statements, corporate disclosures, contracts, and peer information. TRUE 4. Civil engineers are good candidate for financial modeler role given their ability to understand operational models and design long-term financial strategies. FALSE 5. Historical information must be made available before the financial model is to be constructed. TRUE 6. Financial Modelling is a sophisticated and confidential activity in a company or for an analyst. TRUE 7. Financial modelers normally are economists, financial managers, and accountants. TRUE 8. Information can also be considered as competitive advantage of a company or a person. TRUE 9. Financial Models are mathematical models designed to aid in coming up with a recommended decision and at the same time can be used to validate the assumptions made. TRUE 10. Value of the asset is an important representation f the value of the firm. TRUE 11. Statement of Changes in Stockholder's Equity provides the information on how much is the claim and dividend background of the company. TRUE 12. The components of the audited financial statements enable the analyst or the financial modeler to assess the future of the company based on its past performance. TRUE 13. Statement of Financial Position is used to determine the market value of the assets and the disclosed stakes of the debt and equity financiers. FALSE 14. Peer information provides more context and even supports the risk identified or will be assumed in the valuation process. TRUE 15. Statement of Cash Flows illustrate how the company historically financing its operations and investments. TRUE 16. Peer information and other public information are also essential inputs to the financial model. TRUE 17. Statement of income are used to determine the historical financial performance. TRUE 18. Audited financial statements are the most ideal reference for the future performance of the company. FALSE 19. One of the most important components of the financial statements are the Cover Pages to the Financial Statements. It provides the summary of important disclosures that should be considered in the valuation. FALSE 20. Contracts are formal agreements between parties. In valuing the GCBOs, it is important for the modeler to also know the existing contracts and the covenants. TRUE MULTIPLE CHOICE THEORIES 1. This component of audited financial statements is used to determine the historical financial performance. Statement of Financial Position STATEMENT OF COMPREHENSIVE INCOME Notes to the Financial Statements Statement of Changes in Stockholders' Equity 2. In order to develop financial models, the following steps are needed to be observed. Which one is incorrect? Step 3: Determine the Reasonable Cost of Capital Step 2: Establish Drivers for Growth and Assumptions STEP 4: MAKE SCENARIOS AND SENSITIVITY ANALYSIS BASED ON THE RESULTS Step 1: Gather Historical Information and References 3. Which of the following is a correct related to financial modelling? Operations managers are good candidates for this role given their ability to understand operational models and design long-term financial strategies. Most financial modelers do not have extensive financial acumen and vast knowledge and experience. MOST OF THE COMPANIES HIRE FINANCIAL MODELERS TO ASSIST THEM IN DETERMINING THE VALUE OF GCBOS OR ANY OPPORTUNITIES. Financial modelling is a sophisticated and non-confidential activity in a company or for an analyst. 4. These is the most ideal reference for the historical performance of the company. AUDITED FINANCIAL STATEMENTS Notes to Financial Statements Statement of Income Statement of Financial Position 5. In gathering historical information and references, which statement is not correct? Historical must be made available before the financial model is to be constructed. Historical information may be generated from, but not limited to the following: audited financial statements, corporate disclosures, contracts, industry and market prospects and peer information. Statement of income are used to determine the historical financial performance. Audited financial statements are the most ideal reference for the historical performance of the company. 6. This component of audited financial statements is used to illustrate the company historically financing its operations and investments. Statement of Financial Position Statement of Changes in Stockholders' Equity STATEMENT OF CASH FLOWS Statement of Comprehensive Income 7.____ provide more context for the future plans and strategies of the company. This will enable the analysts or the financial modelers to identify the risk about the GCBO and quantify them accordingly. Peer information. CORPORATE DISCLOSURES. Market prospects. Notes to the financial statements. 8. This component of audited financial statements is used to determine the book value of the assets and the disclosed stakes of debt and equity financiers. Statement of Changes in Stockholders' Equity Statement of Comprehensive Income STATEMENT OF FINANCIAL POSITION Notes to the Financial Statements 9. This component of audited financial statements provides the information on how much claim an dividend background of the company. Statement of Cash Flows Statement of Financial Position STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY Statement of Comprehensive Income 10. One of the most important components of the financial statements is the ___________________. It provides summary of important disclosure that should be considered in the valuation. Statement of Changes in Stockholders' Equity Statement of Financial Position Statement of Comprehensive Income NOTES TO THE FINANCIAL STATEMENTS 11. _____ growth rate is factored in to serve as a growth driver for the demand of the product, particularly for the merchandising or manufacturing business. Consumer Price Index Inflation POPULATION Gross National Product 12. ____ provides more context and even supports the risks identified or will be assumed in the valuation process. This may be the other analysts, industry experts and other consultants. PEER INFORMATION. Corporate disclosures. Notes to the financial statements. Market prospects. 13. Drivers for growth used in financial modelling are suggested to be those validated and is represented by authorities like government experts. Which government agency is not a source of these information? Philippine Statistics Authority BUREAU OF INTERNAL REVENUE Bangko Sentral ng Pilipinas National Economic and Development Authority 14. Collectively, the financial model must be able to filter the information that would be necessary for the valuation. What are the two characteristics of information that are considered very important in financial modelling? * Timeliness and Reliability Timeliness and Availability. RELIABILITY AND RELEVANCE Availability and Relevance 15. The usual growth indicators used in financial modelling are as follows, except: Gross National Product CONSUMER PRICE INDEX Inflation Population