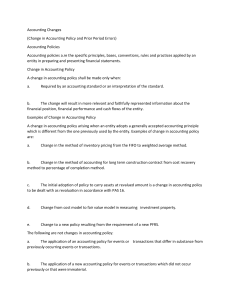

Chapter 22 The IASB has established a reporting framework for reporting the types of accounting changes: 1. Change in Accounting Policy: A change from one accepted accounting policy to another one. A change from an accounting policy that is not acceptable to an acceptable policy is considered a correction of an error. Changes in accounting policy are considered appropriate only when the alternative accepted accounting policy is preferable to the existing one. Examples Adopt new IFRS Change in inventory methods Change from capitalizing all research and development expenditures to expensing those not eligible for capitalization. Three Approaches for recording The Effect Of Changes in Accounting Policies 1. Report changes currently: The cumulative effect of the change is reported in the current year’s income statement as an irregular item. Advocates of this method argue that investor confidence is lost by a retroactive (backdated) adjustment of financial statements for prior periods. The cumulative effect = Prior years’ income old method – Prior year’s income new method The company does not change prior year financial statements. 2. Report changes retrospectively Prior years’ statements are restated as if the new policy had always been used. The cumulative effect of the change is an adjustment to beginning retained earnings of the earliest year presented. IASB requires the retrospective approach for reporting changes in accounting policies. a) The IASB believes that it provides financial statement users the most useful information. b) The prior statements are changed on a basis consistent with the newly adopted standard c) Any cumulative effect of the change for prior periods is recorded as an adjustment to the beginning balance of retained earnings of the earliest period reported. 3. Report changes prospectively. Previous periods’ statements are not adjusted to reflect the change in policy. Opening balances are not adjusted, and no attempt is made to compensate for prior events. Retrospective Changes: There is an assumption that once an accounting policy is selected, it should not change. 1. The IASB permits companies to change accounting policies if: -It is required by IFRS -The new policy will result in financial statements that report information that is more relevant and reliable. 2. A retrospective adjustment of the financial statements presented is made by modifying the statements of prior years on a basis consistent with the newly adopted policy. 3. Any part of the cumulative effect attributable to years prior to those presented is treated as an adjustment of beginning retained earnings (or other appropriate components of equity) for the earliest year presented. 4. When a company makes a change in accounting policy, the major disclosure requirements include: -Nature of the change in policy -Reasons why the new policy provides reliable and more relevant information -For the current and each prior period presented the amount of adjustment to each financial statement line item and EPS 5. A direct effect of a change in accounting policy should be retrospectively applied. -An example of a direct effect is the change in the inventory balance as a result of changing methods of inventory valuation. -Related changes, such as the deferred income tax effect, are also considered direct effects. How to Account for Impracticable Changes: 1. The retrospective approach should not be used, if any one of the following conditions exists: a) The company cannot determine the effects of the retrospective approach. b) Application of the retrospective approach requires assumptions about management’s intent in a prior period. c) The company cannot verify the necessary information needed to develop any estimates for a prior period under the retrospective approach. 2. Apply the prospective approach as of the earliest date practicable, if the retrospective approach is deemed impracticable. 3. Disclosures a) The effect of the change on the results of operations in the period of change. b) An explanation of the reasons for omitting the computations of the cumulative effect for prior years. c) Justification for the change in method. 2. Change in Accounting Estimate: A change that occurs as the result of new information or additional experience. Examples Change in the estimate of the useful lives of depreciable assets. Change in estimate of residual life Change in estimate of impairment The IASB requires that changes in estimates should be handled prospectively. Opening balances are not adjusted, and no attempt is made to “catch up” for prior periods. The effects of all changes in estimates are accounted for in a) The period of change if the change affects that period only or b) The period of change and future periods if the change affects both. When it is impossible to tell whether a change in policy or a change in estimate has occurred, the change is considered a change in estimate. Careful estimates that later prove to be incorrect should be considered changes in estimate, not errors. Disclosures: A company should disclose the nature and amount of a change in an accounting estimate that has an effect in the current period or is expected to have an effect in future periods (unless it is impracticable to estimate that effect). 3. Error correction: Correction of transaction recorded incorrectly of not recorded at all Errors result from: Examples: Failure to record adjusting entries. Recording assets as expense. Applying cash base instead of accrual base The IASB requires that corrections of errors be a) Treated as prior period adjustments b) Recorded in the year in which the error was discovered, c) Reported in the financial statements as an adjustment to the beginning balance of retained earnings. If comparative statements are presented, the prior statements affected should be restated to correct for the error. Types of errors include: 1. A change from an accounting policy that is not acceptable to an accounting policy that is acceptable. 2. Mathematical mistakes. 3. Changes in estimates that occur because a company did not prepare the estimates in good faith. 4. The incorrect classification of a cost as an expense instead of an asset, and vice versa. Error Analysis 1. Statement of Financial Position Errors. Only affect assets, liabilities, and/or equity. Example: A misclassification of an asset. 2. Income Statement Errors. It only affects revenues and/or expenses. Example: a misclassification of a revenue account Counterbalancing error: are errors that will be offset or corrected over two periods a. Failure to record accrued revenues or expenses. b. Failure to record prepaid revenues or expenses. c. Overstatement or understatement of purchases. d. Overstatement or understatement of ending inventory Non-counterbalancing errors: are errors that take longer than two periods to correct themselves a. Failure to record depreciation. b. Recording a depreciable asset as an expense c. Recording the purchase of land as an expense. d. Failure to adjust for bad debts.