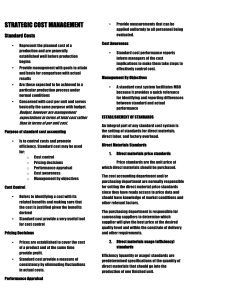

Cost of Production Report (CPR): Definition and Explanation of Cost of Production Report (CPR): A departmental cost of production report (CPR) shows all costs chargeable to a department. It is not only the source for summary journal entries at the end of the month but also a most convenient vehicle for presenting and disposing of costs accumulated during the month. A cost of production report shows: 1. Total unit costs transferred to it from a preceding department. 2. Materials, labor, and factory overhead added by the department. 3. Unit cost added by the department. 4. Total and unit costs accumulated to the end of operations in the department. 5. The cost of the beginning and ending work in process inventories. 6. Cost transferred to a succeeding department or to a finished goods storeroom. It is customary to divide the cost section of the report into two parts: one showing costs for which the department is accountable, including departmental and cumulative total and unit costs, the other showing the disposition of these costs. A quantity schedule showing the total number of units for which a department is accountable and the disposition made of these units is also part of each department's cost of production report. Information in this schedule, adjusted for equivalent production is used to determine the unit costs added by a department, the costing of the ending work in process inventory, and the cost to be transferred out of the department. A cost of production report determines periodic total and unit costs. However, a report that would merely summarize the total costs of materials, labor, and factory overhead and shows only the unit cost for the period would not be satisfactory for controlling costs. Total figures mean very little; cost control requires detailed data. Therefore, in most instances, the total cost is broken down by cost elements for each department head responsible for the costs incurred. Furthermore, detailed departmental figures are needed because of the various completion stages of the work in process inventories. Either in the cost of production report itself or in the supporting schedules, each item of material used by a department is listed; every labor operation is shown separately; factory overhead components are noted individually; and a unit cost is derived for each item. To condense the illustrated cost of production reports, only total materials, labor, and factory overhead charged to departments are considered; and unit costs are computed only for each cost element rather than for each item. Cost of Production Report - Blending Department (1st Department): Learning Objective: 1. Prepare a cost of production report of first department in a process costing system. 2. How equivalent units are calculated in a process costing system? 3. How the lost units are treated in the cost of production report of first department? The cost of production report of the Blending Department, the originating department of The Clonex Corporation, is shown below. It illustrates the detailed computations needed to complete a cost of production report. The Clonex Corporation Blending Department (1st Dept.) Cost of Production Report For the Month of January, 19 Quantity Schedule: Units started in process 50,000 ====== Units transferred to next department Units still in process (all materials - 1/2 labor and FOH) 45,000 4,000 Units lost in process 1,000 ------Total Cost 50,000 ====== unit Cost $24,500 29,140 28,200 ------$81,840 ====== $0.50 0.62 0.60 ----$1.72 ==== Cost Charged To the Department: Cost added by the department: Materials Labor Factory Overhead (FOH) Total cost to be accounted for Cost Accounted for as Follows: Transferred to next department (45,000 × $1.72) Work in process - ending inventory: Materials (4,000 × $0.50) Labor (4,000 × 1/2 × $0.60) Factory Overhead (4,000 × 1/2 × $0.60) Total cost accounted for $77,400 $2,000 1,240 1,200 ------ 4,440 -----$81,840 ===== Additional Computations Equivalent Production: Materials = 45,000 + 4,000 = 49,000 units Labor and factory overhead = 45,000 + 4,000 / 2 = 47,000 units Unit Costs: Materials = $24,500 / 49,000 = $0.50 per unit Labor = $29,140 / 47,000 = $0.62 per unit Factory overhead = $28,200 / 47,000 = 0.60 per unit Explanation: The quantity schedule of the cost report shows that Blending Department put 50,000 units in process, with units reported in terms of finished product. Finished units could be stated in pounds, feet, gallons, barrels, etc. If materials issued to a department are stated in pounds and finished product is reported in gallons, units in the quantity schedule will be in terms of the finished product, gallons. A product conversion table would be used to determine the number of units for which the department is accountable. The quantity schedule of the Blending Department's report shows that of the 50,000 units for which the department was responsible, 45,000 units were transferred to the next department (Testing Department - second department), 4,000 units are still in process, and 1,000 units were lost in processing. Equivalent Production: Costs charged to a department come from an analysis of materials used, payroll distribution sheets, and department expense analysis sheets. The Blending Department's unit cost amounts to $1.72 ( $0.50 for materials, $0.62 for labor, and $0.60 for factory overhead). Calculations of individual unit costs requires an analysis of the ending work in process to determine its stage of completion. This analysis is usually made by a supervisor or is the result of using predetermined formula. Materials, labor, and factory overhead have been used on the 4,000 units in the process but not in an amount sufficient for completion. To assign costs equitably to in process inventory and transferred units, units still in process must be restated in terms of completed units, which is 4,000 units for materials cost but less than 4,000 for labor and overhead costs. The figure for partially completed units in process is added to units actually completed in order to arrive at the equivalent production figure for the period. This equivalent production figure represents the number of units for which sufficient materials, labor, and overhead were issued or used during a period. Materials, labor and overhead costs are divided by the appropriate equivalent production figure to compute unit costs by elements. Should a cost element be at a different stage of completion with respect to units in process, then a separate equivalent production figure must be computed. In many manufacturing processes, all materials are issued at the start of production. Unless stated otherwise, the illustrations in this discussion assume such a procedure. Therefore, the 4,000 units still in process have all the materials needed for their completion but not all labor and factory overhead (FOH). Only 50% of the labor and factory overhead needed to complete the units has been used. In terms of equivalent production, labor and factory overhead in process are sufficient to complete 2,000 units. Units Costs: Departmental cost of production reports indicate the cost of units as they leave department. These individual departmental units costs are accumulated into a completed unit cost for the period. The report for the Blending Department shows a materials cost of $24,500, labor cost of $29,140, and factory overhead of $28,200. The materials cost of $24,500 is sufficient tocomplete 49,000 units (the 45,000 units transferred out of the department as well as the work in process for which enough materials are in process to complete 4,000 units). The unit materialscost is, therefore, $0.50 ($24,500 / 49,000). A similar computation determines the number of units actually and potentially completed with the labor cost of $29,140 and the factory overhead of $28,200. The 2,000 equivalent units in process are added to the 45,000 units completed and transferred to obtain a total equivalent production figure of 47,000 units for both labor and factory overhead (FOH). When the equivalent production figure of 47,000 units is divided into the monthly labor cost of $29,140, a unit cost for labor of $0.62 ($29,140 / 47,000) is computed. The unit cost for factory overhead is $0.60 ($28,200 / 47,000). The unit cost added by the department is $1.72, which is the sum of the materials, labor, and overhead unit costs - $0.50, $0.62, and $0.60. This departmental unit cost figure cannot be determined by dividing the total departmental cost of $81,840 by a single equivalent production figure, because no such figure exists; units in process are at different stages of completion as to materials, labor and factory overhead. Disposition of Departmental Costs: In the departmental cost report, the section titled "Cost Charged to the Department" shows a total departmental cost of $81,840. The section titled "Cost Accounted for as Follows" show the disposition of this cost. The 45,000 units transferred to the next department have a cost of $77,000 (45,000 × $1.72). The balance of the cost to be accounted for, $4,440 ($81,840 - $77,400), is the cost of work in process. The inventory figure must be broken down into its component parts: materials, labor, and factory overhead. These individual costs are easily determined. The cost of materials in process is obtained by multiplying total units in process by the materials unit cost (4,000 × $0.50 = $2,000). The costs of labor and overhead in process is sufficient to complete only 50 percent or 2,000 of the units in process. Therefore, the cost of labor in process is $1,240 (2,000 × $0.62) and factory overhead in process is $1,200 (2,000 × $0.60). Lost Units: Continuous processing leads to the possibility of waste, seepage, shrinkage, and other factors which cause loss or spoilage of production units. Management is interested not only in the quantities reported as completed production, units in process, and lost units but also in a comparison of planned and actual results. In verifying reported figures, the accountant must reconcile quantities put into process with quantities reported as completed and lost. One method of making such reconciliation is to establish the process yield, i.e., the finished production that should result from processing various materials. This yield is computed as follows: Percent Yield = (Weight of finished product / weight of materials charged) × 100 The yield figure is useful to management for controlling materials consumption and ties in closely with a firm's quality control procedures. Various yields are established as normal. Yields below normal are measures of inefficiencies and are some times used to compute lost units. Frequentlyquality control data are used to compute production costs, since the use of incorrect quantities would result in incorrect unit costs. Units Lost in the First Department: Lost units reduce the number of units over which total cost can be spread, causing an increase in unit costs. The 1,000 units lost in the Blending Department increase the units costs of materials, labor, and factory overhead. Had these units not been lost, the equivalent production figure would be 50,000 units for materials and 48,000 for labor and factory overhead. The unit cost for materials would be $0.49 instead of $0.50; labor, $0.607 instead of 0.62; and factory overhead, $0.588 instead of $0.60. In the first department, the only effect of losing units is an increase in the unit cost of the remaining good units. In this situation, the loss is assumed to apply to all good units and to be within normal tolerance limits. Cost of Production Report Department (2nd Department): - Testing Learning Objective: 1. Prepare a cost of production report of second department in a process costing 2. system. How lost units are treated in process costing system when a cost of production report of subsequent to the first department is prepared? We recommend to see the cost of production report of the first department before you continue. Click here to see the cost of production report of the first department The Clonex Corporation Testing Department (2nd Dept.) Cost of Production Report For the Month of January, 19 Quantity Schedule: Units received from the preceding department 45,000 ====== Units transferred to next department Units still in process (1/2 labor and FOH) Units lost in process 40,000 3,000 2,000 Cost Charged To the Department: Total Cost 45,000 ====== unit Cost $77,400 $1.72 29,140 28,200 ------$81,840 0.91 0.80 ----$1.71 0.08* -----$3.51 ====== Cost from preceding department: Transferred in during the month Cost added by the department: Labor Factory Overhead (FOH) Total cost added Adjusted for lost units Total cost to be accounted for ------$147,510 ====== Cost Accounted for as Follows: Transferred to next department (40,000 × $3.51) Work in process - ending inventory: Adjusted cost from preceding department [3,000 × ($1.72 + $0.08)] $5,400 Labor (4,000 × 1/2 × $0.60) 910 Factory Overhead (4,000 × 1/2 × $0.60) 800 -----Total cost accounted for Additional Computations Equivalent Production: Labor and factory overhead = 40,000 + 3,000 / 3 = 41,000 units Unit Costs: Labor = $37,310 / 41,000 = $0.91 per unit Factory overhead = $32,800 / 41,000 = 0.80 per unit $140,400 7,110 -----$147,510 ====== *Adjustment for lost units: Method No.1: $77,400 / 43,000 = $1.80; $1.80 - $1.72 = $0.08 per unit Method No.2: 2,000 units × $1.72 = $3,440; $3,440 / 43,000 = $0.08 per unit Explanation: The Blending Department (first department) transferred 45,000 units to the Testing Department, where labor and factory overhead were added before the units were transferred to the Terminal Department (third or final department). Costs incurred in the testing department resulted in theadditional departmental as well as cumulative unit costs. The cost of production report of the testing department differ from that of the Blending Department (first department) in several respects. Several additional calculations are made, for which space has been provided on the report. The additional information deals with: 1. Cost received from the preceding department. 2. An adjustment of the preceding department's unit cost because of lost units. 3. Cost received from the preceding department to be included in the cost of ending work in process inventory. The quantity schedule of the Testing Department shows that the 45,000 units received from theBlending Department (first department) were accounted for as follows: 1. 40,000 units sent to terminal department. 2. 3,000 units still in process. 3. 2,000 units lost. An analysis of the work in process (WIP) indicates that units in process are but one third complete as to labor and factory overhead. Unit costs, $0.91 for labor and $0.80 for factory overhead, were calculated as follows: Equivalent production of the testing department is 41,000 units [40,000 + $1/3 × (3,000)], the labor unit cost is $0.91 ($37,310 / 41,000), and the factory overhead unit cost $0.80 ($32,800 / 41,000). There is no materials unit cost, since no materials were added by the department. The department unit cost is $1.71, the sum of the labor unit cost of $0.91 and the factory overhead unit cost of $0.80. The testing department is responsible for the labor and factory overhead used as well as for the cost of units received from the Blending Department (first department). This latter cost is inserted as a cost charged to the department under the title "cost from preceding department" which is immediately above the section of the report dealing with cost added by the department. The cost transferred in was $77,400, previously shown in the cost report of the Blending Department (first department) as cost transferred out of that department by this journal entry: Work in process - Testing department Work in process - Blending department 77,400 77,400 The work in process account of the testing department is charged with cost received from the preceding department and with $70,110 of departmental labor and factory overhead (FOH), a total cost of $147,510 to be accounted for by the department. Units Lost in the Department Subsequent to the First: The Blending Department (first department) unit cost was $1.72 when 45,000 units were transferred to the Testing Department. However, because 2,000 of these 45,000 units were lost during processing in the Testing Department, the $1.72 unit cost figure no longer applies and must be adjusted. The total cost of the units transferred remains at $77,400, but 43,000 units must now absorb this total cost, causing an increase of $0.08 in the cost per unit due to the loss of 2,000 units in the testing department. The lost units cost can be computed by one of two methods. Method No.1: Determines a new unit cost work done in the preceding department and subtracts the preceding departments old unit costs figure from the adjusted unit cost figure. The difference between the tow figures is the additional cost due to the lsot units. $1.80 new adjusted unit cost for work done in the preceding department is obtained by dividing the remaining good units, 43,000 (45,000 - 2,000), into the cost transferred in, $77,400. The old unit cost figure of $1.72 is subtracted from the revised unit cost to arrive at the adjustment of $0.08. Method No. 2: Determines the lost units share of total cost and allocates this cost to the remaining good units. total cost previously absorbed by the units lost is $3,440, which is the result of multiplying the 2,000 lost units by their unit cost of $1.72. The $3,440 cost must now be absorbed by the remaining good units. The additional cost to be picked up by each remaining good unit is $0.08 (3,440 / 43,000 units). The lost unit cost adjustment must be entered in the cost of production report. The$0.08 is entered on the "Adjustment for lost units" line. The departmental unit cost of $1.71 does not have to be adjusted for units lost. In the testing department, the cost of any work done on lost units has automatically been absorbed in the departmental unit cost by using the equivalent production figure of 41,000 instead of 43,000. The $1.72 unadjusted units cost for work done in the preceding department, the $1.71 departmental unit cost, and the $0.08 adjustment for lost units are totaled in order to obtain the $3.51 cumulative unit cost for work done up to the end of operations in the testing department. Timing of Lost Units: Lost units may occur at the beginning, during, or at the end of a manufacturing process. For purposes of practicality and simplicity, it is ordinarily assumed that units lost at the beginning or during the process were never put in process. The cost of units lost is spread over the units completed and units still in process. When units are lost or are identified as lost at the end of a process, the cost of the lost units is charged to completed units only. No part of the loss is charged to units still in process. Assume that the 2,000 units lost by the testing department were the result of spoilage found at final inspection by the quality control department; their cost would be charged only the 40,000 finished units, as illustrated below: The Clonex Corporation Testing Department (2nd Dept.) Cost of Production Report For the Month of January, 19 Quantity Schedule: Units received from the preceding department 45,000 ====== Units transferred to next department Units still in process (1/2 labor and FOH) Units lost in process 40,000 3,000 2,000 Cost Charged To the Department: Total Cost 45,000 ====== unit Cost $77,400 -------- $1.72 ------- 37,310 32,800 ------$70,110 ------$147,510 ====== 0.87 0.76 ----$1.63 -----$3.35 ====== Cost from preceding department: Transferred in during the month Cost added by the department: Labor Factory Overhead (FOH) Total cost added Total cost to be accounted for Cost Accounted for as Follows: Transferred to next department [(40,000 × $3.51+$0.167)]* Work in process - ending inventory: From preceding department (3,000 × $1.72) Labor (3,000 × 1/3 × $0.87) Factory Overhead (3,000 × 1/2 × $0.76) $140,720 $5,160 870 760 ------ Total cost accounted for 6,790 -----$147,510 ====== Additional Computations: Equivalent Production: Labor and factory overhead = 40,000 + 3,000 / 3 + 2,000 lost units = 41,000 units Unit Costs: Labor = $37,310 / 43,000 = $0.87 per unit Factory overhead = $32,800 / 43,000 = $0.76 per unit Lost unit cost = $3.35 × 2,000 units = $6,700 + 40,000 units $0.1675 per unit to be added to $3.35 to make the transfer cost $3.5175. *40,000 units $3.5175 = $140,700. To avoid a decimal discrepancy, the cost transferred is computed: $147,510 $6,790 = $140,720. A comparison of the differences between the two cost of production reports for the testing departments as to amounts for costs of units transferred and work in process inventory is shown below the production report. Not the offsetting increases and decreases. In this illustration, the assumption has been made that the lost units, identified at the end of the process, were complete as to all costs. In sum companies, members of the quality control or inspection departments make production checks prior to the end of the process. Such a procedure uncovers lost units that are not complete when the loss is incurred or the spoilage discovered and yet the loss may pertain only to units completed and not to units still in process. In such a case the lost units should be adjusted for their equivalent stage of completion. For example, 2,000 units lost at the 90% stage of conversion would appear as 1,800 equivalent units with regard to labor and factory overhead costs. Normal Vs Abnormal Loss of units: Units are lost through evaporation, shrinkage, substandard yields, spoiled work, poor work man ship, or inefficient equipment. In many instances the nature of operations makes certain losses normal or unavoidable, because they are considered with in normal tolerance limits for human and machine errors. The cost of these normally lost units does not appear as a separate item of cost but is spread over the remaining good units. A different situation is created by abnormal or avoidable spoilage or losses that are not expected to arise under normal, efficient operating conditions. The cost of such abnormal spoilage or losses is charged either to factory overhead as shown below, thereby appearing as an additional unfavorable able factory overhead variance, or directly to a current period expense account and reported as a separate item in the cost of goods sold statement. Factory Overhead Control Work in process - Testing Department (lost units) 6,700 6,700 The cost of production report would show the abnormal spoilage or loss as follows: Transferred to next department (40,000 units × $3.35) ..............$134,020* Transferred to factory overhead [40,000 units × $0.1675) or (2,000 lost units × $3.35)].......................................................6,700 *40,000 units × $3.35 = $134,000. To avoid decimal discrepancy, the cost transferred is computed: $147,510 - $6,790 ending inventory - $6,700 = $134,020 If the lost units were only partially complete, equivalent production calculations should consider their stage of completion when lost or spoiled, and the costing of the abnormal loss should be weighted accordingly. If one part of the loss is normal and another abnormal, each portion must be treated in accordance with the above discussion. The critical factor in distinguishing between normal and abnormal spoilage or loss is the degree of controllability. Normal or unavoidable spoilage or loss is produced by the process under efficient operating conditions, referred to as uncontrollable. Abnormal or avoidable spoilage or loss is considered unnecessary, because the conditions resulting in the loss are controllable. For this reason, within the limits set by the state of the art of production, the difference is a short-run condition; in the long run, management should adjust and control all factors of production and eliminate all abnormal conditions. The cost of production report at the beginning of this page shows a total cost of $147,510 to be accounted for by the Testing department. The department completed and transferred 40,000 units to the Terminal Department (third or final department) at a cost of $140,000 (40,000 ×$3.51). The remaining cost is assigned to the work in process inventory. This balance is broken down by the various costs in process. When computing the cost of the ending work in process inventory of any department subsequent to the first, costs received from the preceding departments must be included. The 3,000 units still in process, completed by the Blending Department (first department) at a unit cost of $1.72, were later adjusted by $0.08 (to $1.80) because of the loss of some of the units transferred. Therefore, the Blending Department's (first department) cost of the 3,000 units still in process is $5,400 figure is not broken down further , since such information is not pertinent to the Testing Department's operations. However, the amount is listed separately in the cost of production report, because it is part of the Testing Department's ending work in process inventory. Materials (if any), labor, and factory overhead (FOH) added by a department are costed separately in order to arrive at total work in process (WIP). In the testing department, no materials were added to the units received; thus, the ending inventory shows no materials in the process. However, labor and factory overhead costs were incurred. The work in process analysis stated that labor and factory overhead used on the units in process were sufficient to complete 1,000 units. The cost of labor in process is $910 (1,000 × $0.91) and factory overhead is process is $800 (1,000 × $0.80). The total cost of the 3,000 units in process is $7,110 ($5,400 + $910 + $800). This cost, added to that transferred to the Terminal Department (third or final department), $140,400, accounts for the total cost of $147,510 charged to the Testing Department. Cost of Production Report - Terminal Department (3rd - Final Department): We recommend to see the cost of production report of the first and second department before you continue. 1. Click here to see the cost of production report of the first department 2. Click here to see the cost of production report of Second Department The cost of production report of 3rd and final department is illustrated below: The Clonex Corporation Terminal Department (3rd Dept.) Cost of Production Report For the Month of January, 19 Quantity Schedule: Units received from the preceding department 40,000 ====== Units transferred to finished goods storeroom Units still in process (1/4 labor and FOH) Units lost in process 35,000 4,000 1,000 Cost Charged To the Department: Total Cost 40,000 ====== unit Cost $140,400 $3.51 32,400 19,800 ------$52,500 0.90 0.55 ----$1.45 0.09* -----$5.05 ====== Cost from preceding department: Transferred in during the month Cost added by the department: Labor Factory Overhead (FOH) Total cost added Adjusted for lost units Total cost to be accounted for ------$192,600 ====== Cost Accounted for as Follows: Transferred to finished goods storeroom (35,000 × $5.05) Work in process - ending inventory: Adjusted cost from preceding department [4,000 × ($3.51 + $0.09)] $14,400 Labor (4,000 × 1/4 × $0.90) 900 Factory Overhead (4,000 × 1/4 × $0.55) 550 -----Total cost accounted for Additional Computations: Equivalent Production: Labor and factory overhead = 35,000 + 4,000 / 4 = 36,000 units Unit Costs: Labor = $32,400 / 36,000 = $0.90 per unit Factory overhead = $19,800 / 36,000 = 0.55 per unit *Adjustment for lost units: Method No.1: $140,400 / 39,000 = $3.60; $3.60 - $3.51 = $0.09 per unit $176,750 15,850 -----$192,600 ====== Method No.2: 1,000 units × $3.51 = $3,510; $3,510 / 39,000 = $0.09 per unit Explanation: Total and unit cost figures were derived by using procedures discussed for the cost of production report of the Testing Department. The work completed is transferred to the finished goods storeroom; thus, the title "Transferred to finished goods storeroom" is used in place of the title "Transferred to next department." Cost charged to the Terminal Department come from the payroll distribution and the department's expense analysis sheet. The journal entry transferring costs from the Testing Department follows: Work in process - Terminal Department Work in process - Testing Department 140,000 140,000 The entry to transfer finished units to the finished goods storeroom is presented below: Finished Goods Work in process - Terminal Department 176,750 176,750 Combined Cost of Production Report (CPR) - Process Costing: The three cost of production reports for the Clonex Corpora have been discussed and computed separately. Click here to see the cost of production report of Blending Department (first department) Click here to see the cost of production report of Testing Department (second department) Click here to see the cost of production report of Terminal Department (third or final department) These reports would most likely be consolidated in a single report summarizing manufacturing operations of the firm for a specific period. Such a report, as illustrated below, should be reviewed in order to observe the interrelationship of the various department reports. The Clonex Corporation Cost of Production Report All Producing Departments For the Month of January, 19 Quantity Schedule: Units started in process Units received from the preceding department Units transferred to next department Blending 1stDepartment 50,000 ====== 45,000 Testing 2ndDepartment Terminal 3rdDepartment 45,000 ====== 40,000 40,000 ====== Units transferred to finished goods storeroom 35,000 Units still in process 4,000 3,000 4,000 Units lost in process 1,000 ------50,000 ====== Total unit cost Cost 2,000 ------45,000 ====== Total unit cost Cost 1,000 ------40,000 ====== Total cost unit Cost Cost Charged To the Department: Cost from preceding department: Transferred in during the month $77,400 $1.72 $140,400 $3.51 -------- ----- -------- ----- Cost added by the department: Materials $24,500 $.50 Labor 29,140 .62 $37,310 $.91 $32,400 $.90 Factory Overhead (FOH) 28,200 ------$81,840 .60 ---$1.72 32,800 ----$70,110 .80 ---$1.71 $.08 19,800 ------$52,200 .55 ---$1.45 $.09 ------$81,840 ---$1.72 ------$147,510 ----$3.51 -------$192,600 ---$5.05 ====== === ====== === ====== === Total cost added Adjusted for lost units Total cost to be accounted for Cost Accounted for as Follows: Transferred to next department $77,400 $140,400 Transferred to finished goods storeroom (35,000 × $5.05) Work in process - ending inventory: $176,750 Adjusted cost from preceding department [4,000 × ($3.51 + $0.09)] $5,400 $14,400 Materials $2,000 Labor (4,000 × 1/4 × $0.90) 1,240 910 900 1,200 -----4,440 -------$81,840 ====== 800 -----7,110 -----$147,510 ====== 550 -----15,850 -------$192,600 ====== Factory Overhead (4,000 × 1/4 × $0.55) Total cost accounted for