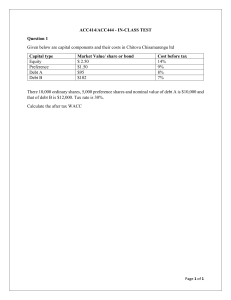

Weighted Average cost of Capital WACC/Overall/Total cost of capital • WACC: Total cost of all sources of finance for a company. WACC = wErE + wprp + wDrD (1 – tc) wE = proportion of equity rE = cost of equity wp = proportion of preference rp = cost of preference wD = proportion of debt rD = pre-tax cost of debt tc = corporate tax rate What is cost of capital (COC)? • It is the rate of return which a firm must earn on its invested capital to keep its investors satisfied. • A few points about cost of capital: • If a firm’s returns are lesser than its expected COC, then its access to the capital market is curtailed. • It varies with prevalent macroeconomic conditions. • Different projects of a single firm may have different COC. • Type of funding source (Debt vs. Preference vs. Equity) • Start-up vs. established players • Risky vs. Safer Industries • Note: A company’s ROI > Cost of capital The cost of capital of any investment (project, business, or company) is the rate of return the suppliers of capital would expect to receive if the capital were invested elsewhere in an investment (project, business, or company) of comparable risk • The cost of capital reflects expected return • The cost of capital represents an opportunity cost Assumptions for further slides • Only three types of capital (equity; nonconvertible, preference; and nonconvertible, debt) are considered. • Debt includes long-term debt as well as short-term debt. • Non-interest bearing liabilities, such as trade creditors, are not included in the calculation of WACC. • The company cost of capital is the rate of return expected by the existing capital providers. • The project cost of capital is the rate of return expected by capital providers for a new project the company proposes to undertake • The company cost of capital (WACC) is the right discount rate for an investment which is a carbon copy of the existing firm. Why do we need cost of capital? • Access the project viability • Firm Valuation • Capital Structure • Performance Measurement of managers Cost for the following Sources: Risk and cost relationship • WACC calculation: refer excel sheet • Cost of Debt • Why pre and after tax cost of debt: • Debentures and Long term loan are tax deductible instruments • Refer next slide for explaination • Note: Formula for cost of loan will be same as for cost of debt • Question: refer excel sheet Which of the two i.e., Kd post-tax and Kd pre-tax should a firm consider for its decision making? Problem 2 Consider two firms A and B. The two firms are identical except for their capital structure as is given below. All figs are in Lacs of Rs: Firm A Firm B Equity 100 50 Debt(@10%) 0 50 Total Capital 100 100 EBIT 20 20 Assume that the Face Value of a single Equity share in both the companies is Rs100. Assume Corporate Tax Rate is 50%. Do the apportionment of EBIT of each firm across their debt providers (in form of interest), Government (in form of Corporate Taxes) and Equity Shareholders (in form of EAT/EPS)? Continued (all fig. are in Lacs of INR) Firm A EBIT 20 Interest EBT 20 Tax(50%) 10 -----EAT 10 Number of Shareholders 1 EPS 10 Firm B 20 5 15 7.5 ----7.5 0.5 15 Cost of Irredeemable/perpetual Preference Capital • Preference shares have some of the characteristics of debt and some of the characteristics of equity. If preference shares are perpetual, then their cost can be calculated as follows: Kp Preference dividend Market price of preference share (1- floatation cost) • Note: When floatation cost is in percentage; else deducted from per share value when FC per share is given. • This approach assumes that the dividend is constant in INR terms forever and that the preference shares have no special features. • Floatation or issue costs consist of items like underwriting costs, brokerage expenses, fees of merchant bankers, underpricing cost, and so on. Are preference shares more or less risky to investors than debt? • More risky. A firm can skip preference dividend without being sued if it is not in a position to do so. • However, firm has to pay preference dividends if it is profitable. Otherwise, it (a) cannot pay equity dividend, (b) will find difficulty in raising additional funds in future, and (c) preference dividends are cumulative. Cost of Equity Capital • Various models are used to estimate the cost of equity. Yet, at best calculated cost of equity capital through these models can be considered as a rough estimate of firm’s actual COE. • Models for Cost of Equity Capital: • Dividend Discount Model • CAPM (Capital Asset Pricing Model) • Other Models (APT (Arbitrage Pricing Theory),Three Factor Model) What are alternate ways firms can source their Equity Capital? • By issue of new equity shares to investors via public offerings or private placement; and • By reinvestment (plough back) of their earnings (retained earnings). • Irrespective of whether a firm raises equity finance by retaining earnings or issuing additional equity shares, the cost of equity is the same. The only difference is in floatation cost. • Is there a cost for reinvested earnings? • Earnings can be reinvested or paid out as dividends to investors. • Investors can buy other securities and earn a return. • Thus, there is an opportunity cost if earnings are reinvested. • The opportunity cost of retained earnings is the rate of return, which the ordinary shareholders would have earned on these funds if they had been distributed as dividends to them. Dividend Discount Model (DDM) • When the dividends are expected to grow at a rate of g perpetually, the value of the share is given by the following formula: Po = D1 / (1+Ke) + D2 / (1+Ke)2 +…..+ Dn /(1+Ke)n ….. (1) • The cost of equity, Ke, in Equation (1) is the rate of return. • D1 = D0 (1+g), is projected dividend in the first year, which perpetually grows at a constant growth rate g. • Simplifying Equation (1), we have Po = D0 (1+g) / (Ke – g ) = D1 / (ke – g ) ……..(2) Or, Ke = D1 / P0 + g ……….(3) The cost of equity is, thus, the dividend yield plus the growth rate. More on DDM • If a firm is not growing (Zero growth firms) The cost of equity of a share on which a constant amount of dividend is expected perpetually is given as follows: Ke = D1 / P0 …….(4) • In equity shares, floatation cost are usually material in nature. If the company pays f fraction of the share price as floatation costs, the cost of new issue of common share will be Ke = D1 / P0 (1-f) + g ….(5) How do we get growth rate? Analysts’ forecasts of growth rate. • Average annual growth rate in the preceding 5 - 10 years. • (Retention rate) (Return on equity)