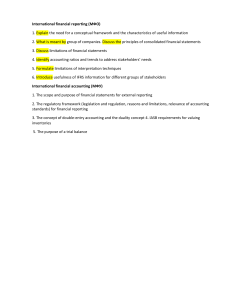

Compare and contrast the IASB’s accounting conceptual UK’s financial reporting regulatory framework. framework (2018) and the Established conceptual and regulatory frameworks exist to guarantee uniformity and dependability in financial reporting. The conceptual framework of the IASB and the regulatory framework of the UK serve separate yet interconnected purposes. The regulatory framework in the UK defines principles and norms for financial reporting, ensuring consistency and compliance with local laws (Reid et al.,2019). Conversely, the IASB's conceptual framework provides a foundation for the creation of international accounting standards (IFRS), with the aim of achieving global consistency in financial reporting practises (Mondal, 2021). This essay will discuss each framework’s key concepts, roles, relationships during the discussion and presents a comparison and contrast between both. Numerous elements comprise the UK's regulatory framework, which regulates how firms disclose their financial information. These components include Accounting Regulations are the set of accounting rules is called Financial Reporting Standards (FRSs). The Financial Reporting Council (FRC) is the organization that issues these guidelines, which guide how companies should prepare their financial statements. For UK financial reporting methods to be consistent and comparable, FRSs are required (Solomons, 2021). Legislation: The Companies Act of 2006 is a critical piece of legislation that creates the legal framework for financial reporting in the United Kingdom. It has financial statement provisions that specify things like giving an accurate and fair representation of a company's financial situation (La Torre et al., 2018). This law ensures companies declare their financial information following specific rules and regulations. Stock Exchange Requirements: Businesses listed on UK stock exchanges must comply with extra reporting regulations. These regulations frequently call for additional disclosures and publications to improve openness and investor access to information (Solomons, 2021). For listed firms, noncompliance with stock exchange regulations can have dire repercussions. International Financial Reporting Standards IFRS are developed using the 2018 IASB's accounting conceptual framework as a basis. It provides a thorough framework for developing dependable and uniform financial reporting standards across the globe (Nearshoreme, 2020). The eight primary chapters that comprise the 2018 framework each focus on essential facets of financial reporting: Objective of General-Purpose Financial Statements: This element defines financial statements' main goal of delivering meaningful information to investors, creditors, and lenders. Management and governing boards are accountable for efficiently allocating an entity's resources; hence stewardship is emphasised (Cbarckow, 2018). Qualitative Characteristics of Useful Financial Information: This section examines qualitative factors that enhance financial data. Relevance, reliability, comparability, and verifiability are stressed. The 2018 framework emphasises financial reporting neutrality and faithful portrayal with new provisions. (IFRS - Conceptual Framework for Financial Reporting, 2018). Financial statements and Reporting Entity: This element identifies the body responsible for creating financial reports that include assets, liabilities, equity, expenses, and income. It recognises that reporting entities can be single entities, numerous entities, or sections of entities. The reporting entity's boundaries should match key users' information demands (Cbarckow, 2018). The Elements of Financial Statements: The components of financial statements are divided into five basic categories by this element: assets, liabilities, equity, income, and spending. The 2018 framework addresses control and the identification of assets and obligations, and it adds new subheadings to improve clarity, such as the idea of having a "right" to assets (IFRS - Conceptual Framework for Financial Reporting, 2018). Recognition and Derecognition: The element define recognition as the process of incorporating a financial statement element into either the statement of financial position or the statement of financial performance. The analysis considers the uncertainty in measurement, the low probability of economic gains flowing in or out, and the uncertainty of existence. Derecognition refers to the process of eliminating a recognised asset or liability, either in part or in its entirety, from an entity's financial statement or financial position (Mondal, 2021). Measurement: The present value and historical cost are the two main bases used to measure assets and liabilities, and they are discussed in the measurement aspect. It offers a comprehensive examination of the different measuring bases and the elements to take into account when choosing one (Nearshoreme, 2020). Presentation and Disclosure: This element centers on the objectives of financial statement reporting. It covers classification, offsetting of assets and liabilities, and aggregation. The presentation and disclosure element underscores the role of financial statements as communication tools and highlights their function in providing valuable information to users (Cbarckow, 2018). Concepts of Capital and Capital Maintenance: The final element delves into the concepts of capital and capital maintenance, distinguishing between physical and financial definitions of capital (Nearshoreme, 2020). It clarifies how revaluations and restatements related to capital maintenance adjustments are addressed. Ensuring high quality financial reporting is the shared goal of the IASB’s conceptual framework and the UK regulatory framework (Reid et al., 2019). The establishment of trust and confidence among stakeholders necessitates the provision of financial statements that accurately and impartially depict a company's financial position, a task facilitated by this framework (Pelger, 2020). The IASB's conceptual framework serves as the theoretical basis for the development of IFRS. The standard-setting process is guided by this entity, which establishes financial reporting objectives, the qualitative characteristics of useful financial information, and the criteria for recognising and measuring components of financial statements (Mondal, 2021). These frameworks are interconnected as they mutually enhance each other, yet there are still some differences between them. The regulatory structure governing financial reporting in the UK is predominantly legal and prescriptive, depending on certain laws and regulations. On the other hand, the theoretical conceptual framework of IASB provides the basis for creating accounting standards (Mondal, 2021). Since nationwide employ the IASB’s standards, its conceptual framework has an international reach. The financial reporting requirements for businesses that operate in the UK are governed by a regulatory structure unique to that nation (Pelger, 2020). The 2018 IASB framework emphasizes stewardship since it acknowledges the need for conscientious resource management (Mondal, 2021). Awareness of stewardship aligns financial reporting with more comprehensive societal expectations in an era of sustainability and corporate social responsibility. The regulatory structure in the UK might not specifically address this issue (Mondal, 2021). More freedom in reporting entity definition is offered by the IASB’s conceptual framework, which provides recommendations based on primary users’ information needs (Reid et al., 2019). The regulatory framework in the UK could include more stringent guidelines for identifying the reporting entity. The UK regulatory framework may adopt the IASB’s IFRS, enabling UK businesses to disclose their financial information following international accounting standards (Reid et al, 2019). This alignment promoted international commerce and investment and improves the comparability of the financial accounts across the borders. The conceptual framework of the International Accounting Standards Board (IASB) and the legislative framework of the United Kingdom are fundamental pillars of financial reporting. When both frameworks are united, they contribute to the harmonisation of financial reporting methods. The 2018 IASB framework governs the development of global accounting standards and emphasises stewardship, recognising management's accountability in resource management. In contrast, the UK's framework prioritises local norms and adherence to regulatory requirements. Enhancing the simplicity and harmonisation of these standards will enhance global comparability and lessen the compliance burden for multinational corporations. The establishment of consistent and reliable financial reporting procedures in the current globalised context relies on the collaboration between national and international frameworks. References Cbarckow. (2018, March 29). IAS Plus: Summary of main aspects of the Conceptual Framework. IASB publishes revised Conceptual Framework. https://www.iasplus.com/en/news/2018/03/cf IFRS - Conceptual Framework for Financial Reporting (2018). https://www.ifrs.org/supportingimplementation/supporting-materials-by-ifrs-standards/conceptual-framework-for-financialreporting/. La Torre, M., Sabelfeld, S., Blomkvist, M., Tarquinio, L., & Dumay, J. (2018). Harmonising nonfinancial reporting regulation in Europe: Practical forces and projections for future research. Meditari Accountancy Research, 26(4), 598-621. Mondal, U. (2021). Conceptual framework for financial reporting 2018: a critical review. International Journal of Critical Accounting, 12(5), 429-443. Nearshoreme. (2020). IASB Conceptual Framework https://nearshoreme.com/ifrs-hub/f/iasb-conceptual-framework---2018 - 2018. nearshoreme. Pelger, C. (2020). The return of stewardship, reliability and prudence–a commentary on the IASB's new conceptual framework. Accounting in Europe, 17(1), 33-51. Reid, L. C., Carcello, J. V., Li, C., Neal, T. L., & Francis, J. R. (2019). Impact of auditor report changes on financial reporting quality and audit costs: Evidence from the United Kingdom. Contemporary Accounting Research, 36(3), 1501-1539. Solomons, D. (2021). Guidelines for financial reporting standards. Routledge.