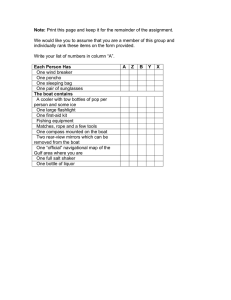

Table of Contents Project Title 3 Problem Statement 4 Mathematical Formulation 5 Problem Solution 6 Discussion of Findings 10 Conclusion 11 Bibliography 12 2|Page Project Title An investigation to determine whether an investment in a boat tour business is feasible with a payback period of 3 years. 3|Page Problem Statement King Kong Tours located in Kingston, Jamaica is interested in adding a boat ride tour of the Kingston Harbour to their offerings. The executive board will only invest the required 𝐽𝑀𝐷$100 𝑚𝑖𝑙𝑙𝑖𝑜𝑛 in the new venture if the payback period is less than 3 years. Based on the available market data available, the monthly demand for boat ride tickets can be estimated by the demand schedule: Figure 1: Monthly Demand Schedule for Boat Rides Price ($ 000) Number of Passengers 1 65 16 60 46 50 91 35 166 10 181 5 Additionally, the tour company incurs a fixed cost of 𝐽𝑀𝐷$14,000 per month to cover boat maintenance and pays a fee of 𝐽𝑀𝐷$4,000 per passenger in insurance, taxes and other related fees. This project aims to determine the whether the investment is feasible with an expected payback period of less than 3 years. This will be achieved through the following objectives: 1. 2. 3. 4. 5. Develop a model for the demand of boat rides offered by the company Develop a model for the revenue generated from the boat rides offered by the company Develop a model for the profit generated from the boat rides offered by the company Determine the maximum possible profit from the boat rides. Determine the expected payback period from the investment in the venture 4|Page Mathematical Formulation The problem at hand will be solved through the following steps: Step 1: Develop a linear model for the monthly demand of boat tours. Step 2: Develop a model for the monthly revenue from boat tours using 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 = 𝑃𝑟𝑖𝑐𝑒 × 𝑄𝑢𝑎𝑛𝑡𝑖𝑡𝑦 Step 3: Develop a model for the monthly cost for offering boat tours using 𝐶𝑜𝑠𝑡 = 𝐹𝑖𝑥𝑒𝑑 𝐶𝑜𝑠𝑡 + 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝐶𝑜𝑠𝑡 Step 4: Step 5: Develop a model for the monthly profit for the monthly profit from the offering of boat rides using 𝑃𝑟𝑜𝑓𝑖𝑡 = 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 − 𝐶𝑜𝑠𝑡 Step 6: Use the second derivative to confirm that the stationary point found is indeed a maximum point Step 7: Calculate the payback period for the investment using 𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 𝑃𝑎𝑦𝑏𝑎𝑐𝑘 𝑃𝑒𝑟𝑖𝑜𝑑 = 𝐴𝑛𝑛𝑢𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡 5|Page Determine the maximum profit by finding the stationary point of the profit function Problem Solution Demand Model Firstly, to develop the demand model, we must assume that the demand schedule is constant over time. This assumption is necessary as the demand for leisure activities, such as boat rides, varies with the period of the year. Therefore, it becomes necessary to assume a constant demand model for all months of the year. Graphically, the demand model can be represented with a scatter plot as shown below in Figure 2. Figure 2: Scatter Plot of Price vs. Number of Tickets Sol 200 180 160 Price/ $000 140 120 100 80 60 40 20 0 0 10 20 30 40 50 60 70 Number of Tickets Based on the scatter plot, we can observe that the demand schedule shows a strong negative correlation between the price and number of tickets. This observation is in line with the law of demand which states that all things being equal, as the price of a good increases, the quantity demanded of that good will decrease. Since our points along the scatter form an apparent straight line, we can proceed with finding the demand model in the form 𝑦 = 𝑚𝑥 + 𝑐. In doing so, the gradient can be calculated using the points (60,16) and (10,166). Using the formula: We get: 6|Page 𝑚= 𝑦 −𝑦 𝑥 −𝑥 𝑚= 166 − 16 150 = = −3 10 − 60 −50 Using the point (35, 91) from our schedule, the demand model can be estimated using: 𝑝(𝑥) − 𝑦 = 𝑚(𝑥 − 𝑥 ) Where 𝑝(𝑥) is the price of the boat rides in thousands of dollars and 𝑥 is the number of passengers. Fitting this model, we get: 𝑝(𝑥) − 91 = −3(𝑥 − 35) 𝑝(𝑥) = −3𝑥 + 105 + 91 That is: 𝑝(𝑥) = 196 − 3𝑥 , 𝑥 ≥ 0 Revenue Model With this information, the revenue model can be estimated using 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 = 𝑃𝑟𝑖𝑐𝑒 × 𝑄𝑢𝑎𝑛𝑡𝑖𝑡𝑦 Where the price comes from the demand function. Thus, we get: 𝑅(𝑥) = 𝑥 × 𝑝(𝑥) 𝑅(𝑥) = 𝑥(196 − 3𝑥) That is: 𝑅(𝑥) = 196𝑥 − 3𝑥 Cost Model The general cost model is defined as 𝑇𝑜𝑡𝑎𝑙 𝐶𝑜𝑠𝑡 = 𝐹𝑖𝑥𝑒𝑑 𝐶𝑜𝑠𝑡 + [𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝐶𝑜𝑠𝑡 𝑝𝑒𝑟 𝑈𝑛𝑖𝑡 × 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑈𝑛𝑖𝑡𝑠] Based on the information provided, the fixed cost is $14,000 and the variable cost per passenger is $4,000. Thus, the cost function is 𝐶(𝑥) = 14 + 4𝑥, 𝑥 ≥ 0 where 𝐶(𝑥) is the cost associated with providing the service to 𝑥 passengers per month. 7|Page Profit Model The general profit model is given by 𝑃𝑟𝑜𝑓𝑖𝑡 = 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 − 𝐶𝑜𝑠𝑡 Since we have obtained model for both revenue and cost, we can fit our model as: 𝑃(𝑥) = 196𝑥 − 3𝑥 − (14 + 4𝑥) That is: 𝑃(𝑥) = 196𝑥 − 3𝑥 − 14 − 4𝑥 𝑃(𝑥) = −3𝑥 + 192𝑥 − 14, 𝑥 ≥ 0 Figure 3: Graph of Profit Function To determine the maximum possible profit, we will proceed with analyzing the marginal profit function. The marginal profit function is: 𝑃 (𝑥) = −6𝑥 + 1 92 8|Page The point where maximum profit is achieved is a stationary point of the profit function. Therefore, the maximum profit occur when 𝑃 (𝑥) = 0 That is: −6𝑥 + 192 = 0 6𝑥 = 192 𝑥 = 32 Therefore, the maximum profit occurs when 32 ride tickers are sold per month. The maximum profit can then be calculated as: 𝑃 = 𝑃(32) = −3(32) + 192(32) − 14 𝑃 = 3058 Therefore, the maximum profit from the monthly sales of ride tickets is $3,058,000. Which implies that the maximum profit for the year is 12 × $3,058,000 = $36,696,000. To prove that this is indeed the maximum possible profit, we will analyze the sign of the second derivative at the point 𝑥 = 32. 𝑃 (𝑥) = −6 < 0 Since the second derivative is less than zero, this confirms that our calculations have produced the maximum possible profit for the boat ride venture under the given marker conditions. Application of Solution The payback period for an investment is defined by the formula 𝑃𝑎𝑦𝑏𝑎𝑐𝑘 𝑃𝑒𝑟𝑖𝑜𝑑 = 𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 𝐴𝑛𝑛𝑢𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡 Assuming the company can sell 32 ride tickets monthly to achieve maximum profit, the payback period can be calculated as: 𝑃𝑎𝑦𝑏𝑎𝑐𝑘 𝑃𝑒𝑟𝑖𝑜𝑑 = 100,000,000 = 2.72 𝑦𝑒𝑎𝑟𝑠 (3 𝑠𝑓) 36,696,000 Since the payback period is less than the required of three years, the company should invest in the venture as they would be able to recoup their investment from the profits generated before the required three years. 9|Page Discussion of Findings Based on the findings of this research, investing in a boat tour business with a 3-year payback period is feasible for King Kong Tours. The analysis considered several key models: the demand model (𝑝(𝑥) = 196 − 3𝑥), revenue model (𝑅(𝑥) = 196𝑥 − 3𝑥 ), cost model (𝐶(𝑥) = 14 + 4𝑥), and profit model (𝑃(𝑥) = −3𝑥 + 192𝑥 − 14). The demand model indicates that as ticket prices increase, the number of tickets sold decreases. The revenue model shows that revenue initially increases, reaches a maximum point, and then decreases, considering the relationship between price and demand. The cost model reveals a linear increase in costs as the number of tickets sold rises. The profit model combines the revenue and cost models to determine profitability. It demonstrates that profit increases, reaches a maximum point, and then decreases. It was found that the maximum profit occurs when 32 boat ride tickets are sold per month, resulting in a monthly profit of $3,058,000 and an annual profit of $36,696,000. The second derivative test confirms that the maximum profit is indeed a maximum point, adding credibility to the findings. The payback period, assuming maximum profit, is calculated to be 2.72 years. This means the initial investment can be recouped within this timeframe. This highlights the feasibility and financial viability of the venture. 10 | P a g e Conclusion Since the payback period is less than the required 3 years, it is recommended that the company should invest in the boat tour business. 11 | P a g e Bibliography Bostock, L. and Chandler, S. Mathematics. The Core Course for A-Level, United Kingdom: Stanley Thornes (Publishers) Limited, 1997. Campbell, E. Pure Mathematics for CAPE, Vol. 1, Jamaica: LMH Publishing Limited, 2007. Hosein, R., and Gookool, R. Cape Economics Study Guide Unit 1, Caribbean Examinations Council, 2007 Martin, A., Brown, K., Rigby, P. and Ridley, S. Pure Mathematics, Cheltenham, United Kingdom: Stanley Thornes (Publishers) Limited, 2000. 12 | P a g e