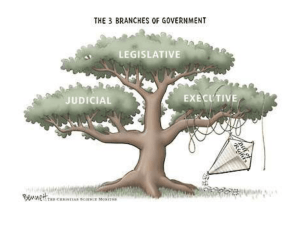

Federal Legislative Powers Commerce Clause Congress can regulate interstate commerce under the commerce clause, as well as the goods and instrumentalities of interstate commerce. Intrastate activities can also be regulated if in the aggregate they have a substantial effect on interstate commerce, and they are not too attenuated. Local, noneconomic activity cannot be regulated based on a weak connection to commerce. Regulating instrumentalities of interstate commerce focuses on railroads, ships and trucks. i. Regulating instrumentalities of interstate commerce (railroads, ships, trucks) (If not applicable, just say it) (Shreveport Rate Case; Gibbons) ii. Regulating what travels in interstate commerce (need not be economic or commercial) (Champion; McClung/Ollie’s BBQ; Darby) iii. Regulating activities that substantially affect interstate commerce (economic can be aggregated: Wickard; Heart of Atlanta; NLRB; Raich) (noneconomic cannot be aggregated–unless comprehensive regulatory scheme, which likely can be regulated) (Morrison; Lopez - behavioral, non-aggregate) (State how effective regulation would be)(Will the statute have to be extremely narrowing tailored, if so, then unlikely it would be effective) Taxing & Spending Congress has the power to tax if that tax raises revenue. As long as the tax rationally relates to raising revenue, then there will be no issue. Aside from raising revenue, a tax looks to create a disincentive for a certain type of behavior. (Taxing) (Kahriger) Sebelius Factors of a Tax (not a penalty): 1) raises revenue, it lacks the enforcement mechanism in law, 3) it does not apply to people who do not normally pay, 4) collected by the IRS (Sebelius) Why it is a penalty: 1) doesn’t collect revenue, 2) exceedingly heavy burden, 3) knowledge requirement (targeting a specific group, almost like criminal statute), 4) enforced by an agency responsible for punishing violations, not collecting revenue Step 1: Ask who would be taxed and on what basis In what amounts – fixed percent/flat tax (almost a penalty, effecting different people differently) or based on income Step 2: Is tax a penalty? (Child Labor Case) Heavy economic burden? Knowledge requirement (criminal statute) Enforced by agency responsible for punishing violation, not collecting revenue Step 3: If taxing nonperformance, how will the federal government find out about the activity in question? Is the IRS going to be able to reasonable keep track of tax? Furthermore, Congress has the power to spend money that was raised through taxes. For Congress to exercise spending power, it 1) must be for the general welfare (almost entirely within the broad discretion of Congress), 2) have conditions that are unambiguous and clearly stated, 3) be for a federal purpose, 4) not violate another constitutional provision, and 5) not be unduly coercive where states have no option but to accept it. (Spending) Step 1: Can Congress set up a new program? Note- Congress has been reluctant to create new spending programs for which imposing condition are easier Step 2: Can Congress add a restriction to an existing program saying that a state would lose X% of the funding under that program? Difficult to find an existing program that relates close enough to the issue (If I don't know of a program, say I don’t know if there is such a program, but here are the characteristics of the program that would best serve the issue Step 3: Amount of loss for state if it did not comply? Use Dole factors and level of scrutiny 5% of funds (1% of state budget) = not coercive - DOLE 100% of funds (10-20% of state budget) = coercive – ACA REMEMBER: spell out the details of how the program would work and then ask whether it would be enforceable and produce the desired result Necessary and Proper Clause The Necessary and Proper Clause states that Congress has the authority to “make all laws which shall be necessary and proper.” When Congress decides what is “necessary”, it is does need to decide that something is completely necessary. However, an implied power must be attached to an enumerated power in the Constitution, like McColloch. (5 considerations in Comstock) The Court has properly shown great deference to Congress in evaluating whether a particular measure is necessary under the Necessary and Proper Clause. Cases→ McCulloch; Comstock Rational basis test: o Attached to an enumerated power? o Modest addition to regulatory scheme? o Reasonable extension? o Accounting for state interests? o Not too attenuated? Congress decides what is NECESSARY; courts decide what is PROPER _____________________________________________________________________________ Limitations on State Powers Preemption An express preemption occurs when Congress expressly displaces states regulation of a particular subject. An implied preemption is when Congress doesn’t have to directly address preemption for Courts to find preemption. Here, there is preemption because…. Dormant Commerce Clause The Dormant Commerce Clause Doctrine states that even if Congress has not attempted to regulate a particular aspect of commerce, that they would be able to if they needed and states are subject to implied limits. The goal of the Dormant Commerce clause is to abolish local protectionism, level the playing field of interstate commerce, avoid market distortions in favor of in state or out of state. Step 1: Ask - What is the statute doing? - Who is doing what to whom and why? (List winners and losers) - State’s rationale - Given what the state wants to do, is there a more-narrow to achieve this that is less discriminatory. Step 2: Is there facial discrimination? (is in the language of the law–who is it discriminating against and how & is in-state and out-of-state being treated the same.) Hughes; Taylor; City of Philadelphia; Pork Producers i. If facially discriminatory–unless it is for 1) a legitimate state purpose AND 2) there are no other alternatives→ unconstitutional i. Many laws invoke safety, sometimes as a cover for other goals, but even where there may be legitimate safety concerns, the dormant commerce clause will come into play if the burdens are excessive in light of the safety benefits. (Kassel) If not facially discriminatory, does the burden outweigh the benefit? (PIKE) o Pike Test → burden on commerce is excessive in comparison to benefits? Burden falls on out of state (South Pacific) Exceptions that defeat the rationale (Kassel)(not leg. local interest) Means do not fit the stated end (Dean Milk) o Burden: is a national uniform standard needed? (Cooley; Wabash) Is this having a discriminatory effect? o Benefit: legitimate local interest (health, safety, natural resources); NOT: competition, isolating from common problem in many states (protectionism)(Barnwell) If there is discrimination, could the state get out from under the law through the Market Participant Doctrine (South Central) or important government purpose? (United Haulers) o Market Participant: state can discriminate against interstate commerce if there a buyer (Alexandria), Seller (Reeves), Subcontractor (White) o *** is there a less discriminatory means to achieving the same goal Other: Discriminatory tax with affect on commerce (Camps Newfound; West Lynn) Privileges and Immunities Clause (Baldwin; Piper) The privileges and immunities clause states that “the citizens of each state shall be entitled to the privileges and immunities of citizens in several states.” For this clause, there must be discrimination against a state’s non-residents, and the discrimination must be about a fundamental right (Ex: medical services) Discrimination against non-residents could be allowed if there is a substantial reason to discriminate. This clause does not extend to non-US citizens or corporations. Separation of Powers and Justiciability Justiciability (Allen; Raines; Muskrat; Baker)(DO LAST!!) For there to be standing, there must first be an injury and fact, where the plaintiff must allege or prove that they been or will be injured (actual or imminent). Second, the injury must be fairly traceable. Third, there must be a likelihood that the injury will be redressed by favorable action. Article III, §2 states that federal courts may only hear cases and controversies. Advisory opinions will not be provided by the court is there is no case or controversy. Federal courts will not consider cases that are ripe or moot. Ripeness is when there are no controversies yet, where mootness refers to when parties no longer have meaningful stake in the case, or it is too late to consider a case. Political questions are not justiciable. The two main factors in deciding if a political question is present is when 1) an issue is wholly committed to another branch of Government (President or Congress), and 2) whether the court can resolve the issue. (Redressability) President’s Domestic Powers (START HERE) The President can only exercise power that is expressly or implicitly from Congress or the Constitution. Step 1: Identify which Youngstown Factor Youngstown Factors: (1) express or implied congressional authorization: when the President acts from express or implied authorization from Congress, the President’s power is at its strongest; (2) congressional silence: President relies upon independent executive powers, there is likely a ton of twilight where both Congress and President have concurring power (3) express or implied congressional prohibition: President’s powers are at their weakest because reliance upon independent powers minus Congress’s constitutional powers Step 2: Test in Nixon v. GSA & Morrison v. Olson Law is constitutional unless it significantly interferes with a constitutionally assigned function of the President. Executive privilege can be overcome if there is a legitimate legislative interest President’s Foreign Ability (might not use) In Curtiss-Wright, it was found that the President may have additional powers and a broader scope of discretion as opposed to national affairs. In Dames & Moore, it was found that unless Congress vehemently opposes of something that the President does in foreign affairs, then he will be able to carry it out. Cases: Curtiss-Wright; Dames & Moore; Goldwater Presidential Powers- Executive Privilege and Immunity a. Qualified Executive Privilege: exists to protect the President’s communications to ensure that the President gets candid advice from his advisors. (*can view in camera to maintain secrecy while weighing) Test: President’s claim for the privilege (military/diplomatic/national security will weigh more heavily than just general) vs. purpose for the information sought (criminal trial will weigh more heavily than civil) Law is constitutional unless it significantly interferes with a constitutionally assigned function of the President. Executive privilege can be overcome if there is a legitimate legislative interest (GSA) b. Presidential Immunity – covers actions relating to the official duties of the President, including those in the “outer perimeter” (scope) of those duties. Absolute immunity from civil damages arising from actions during presidency (injunction may be different like in Youngstown) No immunity for things that occurred before presidency unless extreme circumstance Cases: o o Privilege: US v. Nixon; Nixon v. GSA (no interference) Immunity: Nixon v. Fitzgerald; Clinton v. Jones Congressional Powers–Subpoenas for Records of the President (may not use) a. Four considerations that need to take place for the House to subpoena the President’s records: (1) whether the asserted legislative purpose warrants the significant step of involving the President and his papers; (2) whether the subpoenas are no broader than reasonably necessary to support Congress’ legislative objective; (3) what kind of evidence Congress has offered to establish that the subpoenas advance a valid legislative purpose; and (4) how great are the burdens imposed on the President by the subpoenas b. Cases→ Trump v. Mazars (interference) Congressional Powers- Congress and the Legislative Process The non-delegation doctrine states that Congress cannot delegate legislative authority to the executive branch. However, despite this doctrine, Congress has broad power to delegate legislative authority to the executive branch as long as it provides an “intelligible principle” to guide the exercise of that authority. (Whitman) A legislative action requires bicameralism and presentment. A one-house legislative veto is unconstitutional, and if Congress wants to undo an agency action, both houses must pass the bill and present it to the President for a potential veto. (Chadha) Step 1: Ask- Does the law violate bicameralism or presentment? o Is Congress changing a fundamental decision-making process (Look at legislative veto) o Is Congress retaining the power to change part of the law without going through bicameralism and presentment? Ask- After Congress has properly enacted a statute, does it then give itself any role in implementing the statute v. does it not have a role implementing it? (Congress only can enact laws, however, they cannot implement them. It is the executive branch’s role to implement laws) Cases: Whitman; Chadha (Congress aggrandizing power); Clinton v. New York (unconstitutional delegation of powers; Line-Item Veto) Congressional Powers- Congressional Control over the Executive Branch The appointment clause states that the President nominates principal officers with advice and consent of the Senate. Congress vests the power of appointment in the President to appoint inferior officers. Furthermore, the President has the power to remove the heads of agencies, however, Congress can limit this removal power. While Congress can limit this removal power, Congress is not able to inject themselves into the actual removal process. Appointments & Removal Step 1: ASK #1: Has congress reserved for itself in the implementation of the removal? Does Congress have any role beyond enacting the statutes? o IF YES, more likely there is a problem Chadha, Meyers, Bowsher (aggrandizement) o IF NO, much better chance it is ok Humphreys (no interference), GSA(no interference), Seila, Ziv o BUT, still ask #2: does the law significantly interfere with the president's ability to carry out constitutional duties? Principal officers: selected by President with advice and consent of Senate → congress may NOT limit Inferior Officers: congress can appoint by President alone, heads of departments or by the Judiciary o How to find if someone is an inferior officer: Subject to removal by higher officer Duties, jurisdiction, tenure is limited Do removal restrictions impede the President’s ability to perform? o Meyers- president has absolute discretion to remove executive branch officer at will → power to remove is inherent in power to appoint o Bowsher- Congress may not remove a federal executive officer on its own, except by impeachment Is this person part of the executive branch? Figure out by: (1) how he is appointed and (2) how he can be removed o Seila- President can remove when one department head of agency even when it performs all 3 government functions Meyers shows that there is a broad power and Humphrey’s is the exception Congress MAY limit the President’s removal power for (1) independent administrative agencies or (2) inferior officers o Morrison - A law vesting the judiciary with the power to appoint an inferior executive officer (an independent counsel) and prohibiting the Attorney General from removing the officer without good cause does not violate separation-of-powers principles. o Inferior officers with limited duties and no policymaking or administrative authority Humphrey- President cannot remove FTC (quasi functions) at will, congress can have good cause standard Multimember expert agencies that do not wield substantial power