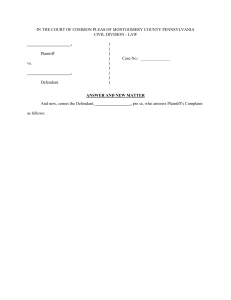

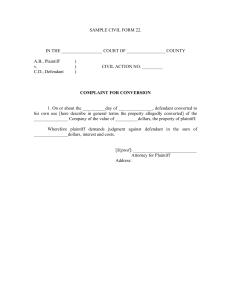

Chapter 3 Legal Processes and Institutions 3.1 Introduction 3.2–3.3 The Constitution and the Three Governing Arms 3.4–3.8 3.9–3.11 The Legislature The Parliamentary Law-making Process 3.12–3.15 The Executive 3.16 3.17–3.19 3.20–3.28 3.29 3.30–3.31 3.32 3.33–3.35 3.36 3.37–3.49 3.50 3.51–3.53 The Judiciary The Common Law Tradition The Doctrine of Judicial Precedent Common Law and Other Legal Concepts (1) Common law versus equity (2) Common law versus written law (3) Civil law tradition versus common law tradition (4) Civil law versus criminal law The Court Structure and Hierarchy in Singapore Technology and the Courts Interpretation of Written Law 3.54–3.61 The Legal Profession, Legal Education and Other Professional Bodies 3.62 Conclusion Principles of Singapore Business Law INTRODUCTION 3.1 Following a brief historical sketch of the Singapore legal system in Chapter 2, this chapter seeks to provide a contemporaneous and positivist account of the process of law-making, its implementation and adjudication by the various legal institutions and bodies in Singapore. Apart from exploring the structure, composition and functions of these legal institutions, we will also briefly examine in the last section legal education and the legal profession, as well as other related professional bodies in Singapore. As the alternative dispute resolution mechanisms have already been discussed in Chapter 2, they will not be pursued here. THE CONSTITUTION AND THE THREE GOVERNING ARMS 3.2 Let us begin with the most fundamental legal document within the Singapore legal system — the Constitution. The Constitution is the supreme law of Singapore. Article 4 of the Constitution provides that any law enacted by the Legislature after the commencement of the Constitution that is inconsistent with the Constitution shall, to the extent of the inconsistency, be void. Consistent with the hallmark of constitutional supremacy, it “breathes” life into the three main arms of the state, viz, the Legislature (the Parliament), the Executive (the Government) and the Judiciary, and at the same time, delineates their respective powers, roles and responsibilities within the legal system. According to the Constitution, the main role of the Legislature is to enact written laws, the Executive to implement and enforce the laws and the Judiciary to adjudicate disputes between the litigating parties based on its interpretation of the laws (see Figure 3.1). CONSTITUTION Executive Elected President (Head of State) + Prime Minister (Head of Government and Cabinet) Implements and enforces the enacted laws (and promulgates subsidiary legislation) Figure 3.1 Legislature Judiciary Executive Supreme Court + Members of Parliament + Subordinate Courts Law-making body: Makes written law = Parent legislation = Statute = Act of Parliament Adjudicates disputes between litigants. Judges decision = Case law The Constitution and the three governing arms of State 42 Chapter 3: Legal Processes and Institutions 3.3 Apart from imposing duties on the above legal institutions, the Constitution entrenches certain fundamental rights, such as the freedom of religion, freedom of speech and equal protection under the law. These individual rights are not absolute but qualified by public interest such as the maintenance of public order, morality and national security. In addition to the general protection of racial and religious minorities, the special position of Malays, as the indigenous people of Singapore, is constitutionally mandated. The provisions of the Constitution may be amended by the votes of two-thirds of the total number of elected Members of Parliament. As and when Article 5(2A) of the Constitution comes into force, the specific constitutional amendments seeking to amend the provisions on fundamental liberties will require, in addition, at least two-thirds of the total number of votes cast by the electorate in a national referendum. THE LEGISLATURE 3.4 The Legislature serves as the major law-making body in Singapore. It comprises the elected President and the Parliament. The law-making machinery operates via a unicameral (single-house) system. The Singapore Parliament, as the embodiment of representative democracy, consists of the Members of Parliament (“MPs”) and the parliamentary proceedings are presided over by the Speaker of Parliament. 3.5 The elected MPs are drawn from candidates who have won in the general elections held every four to five years. Following the recent general elections in 2011, the composition of the Parliament continues to be dominated by the ruling People’s Action Party (“PAP”) with a total of 81 seats whilst the opposition Workers’ Party holds six seats. The elected MPs are drawn from a combination of single-member constituencies as well as Group Representation Constituencies (“GRCs”). 3.6 According to the Constitution, each GRC consists of three to six members, at least one of whom must be of a minority race. One official aim of the GRC scheme was to entrench multi-racialism in Singapore politics. This GRC scheme is, in practice, tied to the establishment of Town Councils, whose role is to manage the housing estates under the Housing & Development Board at the local level. A Town Council is usually formed from a grouping of constituencies under the GRC scheme. Candidates who have won in the general elections via the GRC ticket have often banded 43 Principles of Singapore Business Law together to form a Town Council in order to achieve greater economies of scale. 3.7 In contrast to the elected MPs, the non-elected MPs do not enjoy voting rights on constitutional amendments, money bills and votes of noconfidence in the Government. They consist of two separate categories: the Non-Constituency Members of Parliament (“NCMPs”) and the Nominated Members of Parliament (“NMPs”). To offer an alternative political voice in Parliament, NCMPs are appointed from the candidates who have polled the highest percentage of votes amongst the “losers” in the general elections, up to a maximum of nine NCMPs. The actual number of NCMPs will be nine minus the total number of opposition MPs elected to Parliament (s 52(1) Parliamentary Elections Act (Cap 218, 2001 Rev Ed)). Following the 2011 general elections, three NCMPs (Yee Jenn Jong and Gerald Giam Yean Song from the Workers’ Party as well as Lina Loh Woon Lee from the Singapore Peoples’ Party) were appointed. The NMPs, on the other hand, are nonpoliticians who have distinguished themselves in public life and have been nominated to provide a greater variety of non-partisan views in Parliament. The Constitution stipulates that NMPs shall not exceed nine in number. The 12th Parliament comprises nine NMPs who took their oath of office on 14 February 2012. 3.8 For the purposes of providing a more in-depth discussion of specific public issues or Bills, the Select Committee, whose members are nominated by the MPs, scrutinises legislation and submits reports on its findings to the Parliament. One example of such a Select Committee hearing concerned the constitutional amendments on the establishment and roles of the Elected President (“EP”) in 1990. The Government Parliamentary Committees, formed at the initiative of the PAP and drawn exclusively from the PAP, focus on specific or specialised topics (such as education or transport) with a view to engendering greater debate in Parliament. The Parliamentary Law-making Process 3.9 The law-making process begins with a Bill, normally drafted by the Government legal officers. Private member’s Bills are rare in Singapore. One exception was the private member’s Bill initiated by NMP Walter Woon in 1994 which eventually led to the enactment of the Maintenance of Parents 44 Chapter 3: Legal Processes and Institutions Act (Cap 167B, 1996 Rev Ed). Subsequent amendments to the Maintenance of Parents Act were made in 2010 in order to emphasise conciliation and streamline the processes for claiming maintenance and enforcing maintenance orders pursuant to a Bill tabled by MP Seah Kian Peng and a group of ten MPs (at http://app1.mcys.gov.sg/MCYSNews/AmendmentstoMPAPassed. aspx). The Bill is initially introduced in Parliament at the First Reading. During the Second Reading, the Ministers usually outline the objectives of the Bill, defend the Bill and answer queries raised by the backbenchers. The Speaker of the Parliament is tasked to regulate the proceedings and enforce the Standing Orders of Parliament. The MPs may, in some cases, decide to refer the Bill to a Select Committee for scrutiny. If the report is favourable or the proposed amendments to the Bill are approved by the Parliament, the Bill is accepted by the Parliament at the Third Reading and is passed. 3.10 The Presidential Council for Minority Rights (“PCMR”), established under the Singapore Constitution and presently chaired by the Honourable Chief Justice, has been tasked, except for certain exempted Bills, to scrutinise Bills for any measures which may be disadvantageous to persons of any racial and religious communities without being equally disadvantageous to persons of other such communities, either by directly prejudicing persons of that community or indirectly by giving advantage to persons of another community. If the report of the PCMR is favourable or a two-thirds majority in Parliament has been obtained to override any adverse report of the PCMR, the Bill proceeds, as a matter of course, for the assent by the EP. 3.11 Upon the assent by the EP, the Bill is formally enacted as “written law”. The legislation does not, however, come into force until the date of its publication in the Government Gazette or the commencement date specified in the legislation or the Gazette notification (s 10 Interpretation Act (Cap 1, 2002 Rev Ed)). The enacted law is known as primary or parent legislation (or an Act of Parliament). An Act of Parliament may stipulate that a particular Ministry or agency has powers to promulgate subsidiary legislation to implement the statutory provisions, provided such subsidiary legislation is not inconsistent with the Act of Parliament. The subsidiary legislation is usually published in the Government Gazette. 45 Principles of Singapore Business Law THE EXECUTIVE 3.12 The Executive consists of the EP and the Cabinet in whom executive powers are vested. The head of the Executive is the EP, who is currently his Excellency President Tony Tan Keng Yam. He was appointed following the 2011 presidential elections. The qualifications for the presidential office are fairly stringent. Apart from integrity, good character and other requirements, the presidential candidate must have held one of the following positions for not less than three years: ° as a Minister, Chief Justice, Speaker of Parliament, Attorney-General, Chairman of Public Service Commission, Auditor-General, AccountantGeneral or Permanent Secretary; ° as chairman or chief executive officer of a statutory board; ° as chairman of the board of directors or chief executive officer of a company with a paid-up capital of at least S$100 million; or ° a “similar or comparable position of seniority and responsibility” in an organisation or department of equivalent size or complexity (whether in the public or private sector) which has given him or her the requisite experience and ability in managing financial affairs so as to handle the responsibilities of the job of the EP. The Presidential Elections Committee has been set up to ensure the requirements are adhered to. The EP is elected for a six-year term. He or she shall act in accordance with the advice of the Cabinet in discharging the EP’s constitutional functions except in specified areas. The areas in which the EP may act in his discretion are as follows: ° the veto against the government’s attempts to draw on past reserves (eg, in relation to a guarantee or loan given or raised by the government and the budgets of specified statutory boards and government companies that draw on past reserves); ° the appointment of the Prime Minister, specified constitutional appointees (eg, the Chief Justice and the Attorney-General) and other key civil service appointments (eg, Commissioner of Police); ° the concurrence with the Director of Corrupt Practices Investigation Bureau to make any inquiries or to carry out any investigations into any information received by the Director, notwithstanding the Prime Minister’s refusal to consent; 46 Chapter 3: Legal Processes and Institutions ° the withholding of concurrence to the detention of persons under the Internal Security Act (Cap 143, 1985 Rev Ed); ° the exercise of certain powers pertaining to restraining orders made under the Maintenance of Religious Harmony Act (Cap 167A, 2001 Rev Ed) where the Cabinet’s advice is contrary to that of the Presidential Council for Religious Harmony. There are also counter-checks on the presidential discretion (eg, Parliament overruling, via a two-thirds majority of the total number of elected MPs, the presidential decision in certain instances). In discharging certain specified constitutional functions, the President is required to consult the Council of Presidential Advisers, a body set up under the Singapore Constitution. In other cases, the Elected President may in his discretion consult the Council of Presidential Advisers. 3.13 The Cabinet, consisting of Ministers under the helm of the Prime Minister (currently Lee Hsien Loong), is collectively responsible to the Parliament under the Westminster system. The Prime Minister is someone appointed by the EP who, in the latter’s judgment, is likely to command the confidence of the majority of the MPs. There is no complete separation of powers between the Executive and Legislature in Singapore. In terms of composition, members of the Cabinet are typically drawn from the MPs. Parliamentary Secretaries are further appointed from amongst the MPs to assist the Ministers. Moreover, as mentioned above, the Ministers and the relevant Government agencies possess some “law-making” powers in the promulgation of subsidiary legislation in order to implement the parent legislation passed by the Parliament. 3.14 Each Minister is usually responsible for all government matters pertaining to one or more portfolios (such as education or trade and industry). In Parliament, the responsible Minister will have to justify the policies implemented by his or her Ministry, and is thus accountable to the Parliament. For the purposes of this chapter, one significant Ministry which should be mentioned is the Ministry of Law, which comprises the statutory boards of the Intellectual Property Office of Singapore and the Singapore Land Authority. Some important departments and bodies under the responsibility of the Ministry of Law include the Legal Aid Bureau, Insolvency and Public Trustee’s Office, Appeal’s Board (Land Acquisition) and the Copyright Tribunal. 47 Principles of Singapore Business Law 3.15 The Government is advised and represented by the Attorney-General and the Solicitor-General in both civil and criminal matters. The AttorneyGeneral possesses wide prosecutorial discretion, that is, to institute, conduct or discontinue any proceedings for any offence (Article 35(8) Constitution). The prosecutorial discretion is not absolute or unfettered but subject to constitutional provisions on fundamental rights of the individual (Law Society of Singapore v Tan Guat Neo Phyllis (2008)). However, the AttorneyGeneral is not obliged to disclose the reasons for his prosecutorial decision in a particular case (Ramalingam Ravinthran v The Attorney-General (2012)). The Attorney-General is appointed by the EP if the latter, acting in his or her discretion, concurs with the advice of the Prime Minister. The Honourable Attorney-General Steven Chong was appointed with effect from 25 June 2012. There are also special divisions within the Attorney-General’s Chambers (www.agc.gov.sg) dealing specifically with the drafting of legislation, law reforms, economic crimes and international affairs. The Attorney-General’s Chambers is staffed by State Counsel and Deputy Public Prosecutors who belong to the Singapore Legal Service. THE JUDICIARY 3.16 The primary role of the courts in Singapore is to adjudicate disputes between the litigating parties and serve as an independent check on the Legislature and the Executive within the adjudicative process. The Judiciary is empowered, for instance, to review the constitutionality of legislation as well as to review the decisions and actions of administrative authorities. As stated by the Court of Appeal (at [86]) in Chng Suan Tze v Minister of Home Affairs and others and other appeals (1988), “the notion of a subjective or unfettered discretion is contrary to the Rule of Law. All power has legal limits and the Rule of Law demands that the courts should be able to examine the exercise of discretionary power.” According to the Constitution, judicial power is vested in the judges of the Supreme Court and the Subordinate Courts. The judge is the sole arbiter of both facts and the law, the jury system having been entirely abolished in Singapore since 1970. In the course of adjudication, the judge would be required to interpret and apply various sources of law such as the Constitution, legislation and prior court decisions in order to distil the legal rule or principle to be applied to the particular facts of the case. 48 Chapter 3: Legal Processes and Institutions Box 3.1 Reflecting on the law What is your verdict on the jury system? Some of the common criticisms of the jury system are as follows: • • • • Juries tend to decide on legal liability or conviction based on prejudiced or stereotypical views and/or moral opinions. There is a danger that juries may be overly influenced by a lawyer’s glib tongue. The lack of availability of competent jurors. The costs in instituting and maintaining the jury system. On the other hand, supporters of the jury system and trials have raised the following arguments: • • • The right to jury trial should be regarded as a significant human liberty. Jury trials are important in directly involving the ordinary man in the administration of justice. The “strength in numbers” argument: for very serious offences such as capital offences, the legal system should be slow to convict an accused based on the decision of one single judge, as compared to the majority decision of the jury panel. Question: Do you think there should be a right to jury trial in the first place? If so, to what extent, if at all, should there be restrictions to the right to jury trial? The Common Law Tradition 3.17 Under the common law tradition, the judge is required to consider the relevance and effect of previous court decisions in order to decide the outcome of the case in accordance with the doctrine of judicial precedent. The common law tradition is one of the major legal traditions in the world, apart from the civil law, socialist and other religious legal traditions. Singapore has its roots in the English common law tradition and enjoys the concomitant advantages of stability, certainty and internationalisation of the British system. Whilst Singapore shares with countries such as India, Malaysia, Myanmar and Brunei the English common law roots, the actual application and workings of the traditions will vary in each country. 3.18 Historically, the English common law tradition arose out of a need for England to develop laws to be applied equally to litigants in similar disputes. As a result, assize and later, circuit judges, who were sent to various parts 49 Principles of Singapore Business Law of England to adjudicate disputes, applied the same laws to the resolution of the disputes before them. Further, these laws would be the same (or at least similar) regardless of the provinces or geographical areas in which the disputes took place. As a result, a “common” law developed throughout the whole of England. 3.19 The strong influence of the English common law on the development of Singapore law is generally more evident in certain traditional common law areas (such as contract, tort and restitution) compared to other statutebased areas (such as criminal law, company law and the law of evidence). With respect to the latter, other jurisdictions such as India and Australia have influenced the approach towards and interpretation of these statutes. However, the Singapore courts have, in recent times, significantly departed from the English common law in specific areas such as in the law of contract and torts. There is now a greater recognition of local jurisprudence in the development of the common law in Singapore. The Doctrine of Judicial Precedent 3.20 The doctrine of judicial precedent is integral to a common law jurisdiction such as Singapore. The doctrine of judicial precedent (also known as stare decisis, which means “standing decision”) requires judges to abide by the previous decisions made by the superior courts within the court hierarchy. 3.21 The doctrine promotes firstly uniformity and consistency of decisions within the court hierarchy as judges are not permitted to reach a decision in a dispute based merely on his or her whim or fancy, but on prior court decisions. Second, the resulting uniformity and consistency also lend a measure of certainty to the law for potential litigants. Third, the doctrine is consistent with the respect accorded to the hierarchy within the court system, which is usually based on the experience and seniority of the judges. 3.22 How is a judicial decision reached? A judicial decision is simply a conclusion that resolves a legal dispute; such a conclusion is invariably based on a legal principle applied to the particular facts of the dispute. For instance, the legal principle may be that “a man who commits a criminal act cannot profit from the criminal act”. The facts of the dispute are that X has committed a criminal act and seeks to recover the “rewards” obtained from the 50 Chapter 3: Legal Processes and Institutions commission of the criminal act. Hence, the judge may, applying the legal principle to the facts of the case, conclude that X shall not be entitled to recover the “rewards”. 3.23 Where it is apparent from the conclusion of the judge as to the legal principle(s) upon which the conclusion of the case is based, we refer to such a legal principle as the ratio decidendi (or “the reason for the decision”). Hence, in the above example, the legal principle that “a man who commits a criminal act cannot profit from the criminal act” is the ratio decidendi for the decision of the judge to disallow recovery by X. Obiter dictum, on the other hand, means a statement “made by the way” (or, if you like, a “peripheral” or an “incidental” statement). Obiter dictum refers to a legal principle or judicial statement that is not directly applied to arrive at the outcome in a case. 3.24 The determination of the ratio decidendi and the obiter dictum can be significant. If the particular legal principle or statement in a previous decision is regarded as ratio decidendi, then the judge has to abide by the ratio decidendi of the prior decision, assuming that the previous decision is made by a higher court within the court hierarchy. In legal parlance, we say that the ratio decidendi in the previous decision by a higher court is “binding” on a lower court. If, however, the legal principle in a previous decision is merely regarded as obiter dictum, the judge is not required to apply the obiter dictum in the present case, even if the previous decision is made by a higher court within the hierarchy. In legal parlance, we say that the obiter dictum is merely “persuasive”, and is not binding on the judge. 3.25 The doctrine of judicial precedent applies only to court decisions within the same court hierarchy. Hence, prior court decisions from England and foreign Commonwealth jurisdictions (such as Australia, Malaysia, India, Brunei and Canada) are not binding on Singapore courts. In practice, however, Singapore courts do treat relevant decisions from English and such Commonwealth courts as “persuasive”, though not “binding”. For instance, decisions from the UK Supreme Court (formerly the House of Lords in England) and the High Court of Australia respectively are generally “persuasive” precedents for Singapore judges adjudicating a similar dispute. 3.26 A situation may arise where the facts in the previous decision upon which the ratio decidendi is based may be materially different from those in the 51 Principles of Singapore Business Law present case. Hence, the judge may regard the facts in the prior decision as being so materially different that the ratio decidendi of that previous decision should not be followed or applied in the present case. In legal parlance, we say that the judge has “distinguished” the prior decision from the present case. 3.27 In summary, under the doctrine of stare decisis, the ratio decidendi contained in the previous decision by a higher court binds the judge in his or her adjudication of the present dispute. However, the doctrine does not apply to bind the judge where: ° the facts of the present dispute can be materially “distinguished” from the facts in the previous decision of the higher court so as to render the ratio decidendi of the previous decision inapplicable; or ° the legal principle embodied in the previous decision of the higher court and sought to be applied to the dispute at hand was merely obiter dictum, and hence not binding on the lower court. 3.28 The proper functioning of the doctrine of stare decisis depends on the publication of judicial precedents in a form accessible to the courts, lawyers and perhaps even laypersons. Hence, law reports containing prior court judgments are vital for the development of the common law in Singapore. Currently, the Singapore Law Reports is the main law reporter for Singapore. This was first published in 1992; prior to that, reports of local cases were published in the Malayan Law Journal since 1932. The judgments of the Singapore courts can also be accessed via LAWNET subscription at www.lawnet.com.sg. Recent judgments of the Supreme Court and the Subordinate courts can also be accessed free of charge at Singapore Law Watch (at http://www.singaporelawwatch.sg/slw/index. php). Common Law and Other Legal Concepts 3.29 To avoid confusion, we should note that the term “common law” may be used as a contrast to or comparison with other legal concepts such as equity, written law, the civil law tradition and criminal law. For completeness, we also discuss the differences between civil and criminal laws in para 3.36. 52 Chapter 3: Legal Processes and Institutions (1) Common law versus equity 3.30 Historically, in England, equity as a body of principles of fairness or justice was employed by the courts to ameliorate the defects or weaknesses inherent in the rigid common law system. In order for a claimant to bring a claim under the common law in England, he or she had to file a form known as a “writ” in the English courts according to rigid prescriptions. A case which could not fit into the inflexible categories under the writ was thus thrown out. This meant that the claimant had no remedy. Hence, the Lord Chancellor was tasked to provide new writs to cover claims which could not fit into the rigid categories under the then prevailing common law writs. Despite initial complaints about the perceived abuses of discretionary power conferred on the Lord Chancellor, the rules and practices of equity utilised by the Chancery Courts gradually became more formalised and institutionalised. 3.31 According to the Singapore Civil Law Act (Cap 43, 1999 Rev Ed), the Singapore courts are empowered to administer the common law as well as equity concurrently. The practical effect is that a claimant can seek both common law remedies (damages) and equitable remedies (injunctions and specific performance) (see Chapter 18) in the same proceedings before the same court. It should also be noted that equity has played a decisive role in the development of specific doctrines in the law of contract, including the doctrines of undue influence (see Chapter 14) and promissory estoppel (Chapter 8). (2) Common law versus written law 3.32 The concept of “common law” can also be contrasted with the notion of “written law”. In Singapore, “written law” refers to the Constitution, Acts and subsidiary legislation, whilst “common law”, in this context, refers to judge-made law or case law. The written laws of Singapore can be accessed either via the website of the Attorney-General’s Chambers (www.agc.gov.sg) or via LAWNET (http://www.lawnet.com.sg). The law-making process by the Legislature has been discussed in paras 3.9–3.11. (3) Civil law tradition versus common law tradition 3.33 The common law system in Singapore bears material differences from that in some Asian countries which have imbibed the civil law tradition (the 53 Principles of Singapore Business Law People’s Republic of China, Vietnam and Thailand) or those with a mixture of civil and common law traditions (the Philippines). 3.34 Firstly, the civil law systems generally place relatively less weight on prior judicial decisions and do not abide by the doctrine of stare decisis, unlike the common law system as described in paras 3.20–3.28. Second, the common law courts of Singapore generally adopt an adversarial approach in litigation between the disputing parties, whilst the civil law judges tend to take a more active role in the finding of evidence to decide the outcome of the case. Third, whilst numerous legal principles have been developed by common law judges, civil law judges are more reliant on general and comprehensive written codes governing a wide spectrum of areas. 3.35 Having said that, the divergence between the common law and civil law systems is now less marked than in the past. Common law jurisdictions have, for instance, embarked upon legislative programmes to fill the perceived gaps of the common law. In this regard, Singapore has enacted various statutes to govern many specific areas of law, such as the Contract (Rights of Third Parties) Act (Cap 53B, 2002 Rev Ed), Competition Act (Cap 50B, 2006 Rev Ed), Consumer Protection (Fair Trading) Act (Cap 52A, 2009 Rev Ed) and Workplace Safety and Health Act (Cap 354A, 2009 Rev Ed). (4) Civil law versus criminal law 3.36 A criminal case is prosecuted by the State against the accused person, whereas a civil lawsuit is initiated by one party (the plaintiff) against the other disputing party (the defendant). Second, the general purpose of civil law is to compensate the innocent party for the damages or losses which he or she has suffered or incurred arising from the alleged wrongdoing of the other party. However, in criminal law, the primary purpose is to “punish” or deter potential criminals from committing offences. Third, we speak in terms of “remedies” in civil law to compensate the innocent party. In criminal law, the offender may suffer the consequences of a jail term or a fine by the state or both; there is generally no direct compensation from the wrongdoer to the victim for the crime committed under the criminal law (but note that s 359 Criminal Procedure Code (No 15 of 2010) now requires the court to “consider” whether to make victim compensation orders upon conviction). Finally, in a criminal trial, the prosecution has to prove beyond reasonable doubt that the accused has committed the offence as charged (Teo Keng 54 Chapter 3: Legal Processes and Institutions Pong v Public Prosecutor (1996)). In a civil lawsuit, however, the plaintiff has to prove his or her case against the defendant merely on a balance of probabilities. The Court Structure and Hierarchy in Singapore 3.37 The Singapore Judiciary consists of the Supreme Court and the Subordinate Courts (see Figure 3.2). The great efficiency and strength of the Singapore Judiciary have won her several accolades and a strong international reputation as evidenced by the published rankings of the world’s legal systems by the Political and Economic Risk Consultancy (“PERC”) and the Institute for Management Development. Under the leadership of the former Chief Justice Yong Pung How and the former Registrar of the Supreme Court Chiam Boon Keng, strict case management and alternative dispute resolution (“ADR”) methods (see Chapter 2) have reduced drastically the problems associated with the backlog of cases in the early 1990s. Chan Sek Keong, Singapore’s third Chief Justice, who was appointed to head the Judiciary from 11 April 2006 to 5 November 2012, implemented various programmes with a view to enhancing access to justice and substantive jurisprudence in Singapore, including the establishment of community courts and the appointment of specialist judges to handle complex cases within the Subordinate Courts. The present Chief Justice, Sundaresh Menon, took over the helm on 6 November 2012. Court of Appeal Supreme Court Constitutional Tribunal High Court Subordinate Courts District Courts (including the Family Courts) Figure 3.2 Coroners Courts Magistrates Courts Juvenile Courts The judicial hierarchy in Singapore 55 Small Claims Tribunals Principles of Singapore Business Law 3.38 The Supreme Court comprises both the High Court and the Court of Appeal (Supreme Court of Judicature Act (Cap 322, 2007 Rev Ed)). As of 6 November 2012, there were 17 judges and judicial commissioners in the Supreme Court, including three female judges. Within the Supreme Court, a Constitutional Tribunal has also been set up to hear questions referred to the tribunal by the Elected President on the effect of provisions of the Constitution. The administration of justice in the Supreme Court is assisted by the Registrar and his or her team of deputy registrars, senior assistant registrars and assistant registrars. Since 1991, Justices’ Law Clerks have been appointed to provide research assistance to the Supreme Court judges. 3.39 Following the abolition of appeals to the Privy Council since 1994, the Singapore Court of Appeal is the highest court in the land. The Court of Appeal enjoys both appellate civil and criminal jurisdiction arising from the decisions of the High Court and the Subordinate Courts. The Court of Appeal comprises the Honourable Chief Justice and Judge(s) of Appeal. As of 6 November 2012, there were three Judges of Appeal: the Honourable Justices Chao Hick Tin, Andrew Phang, and V K Rajah. As the highest court of the land, the Court of Appeal is instrumental in maintaining and enhancing the administration of justice as well as the jurisprudential development of Singapore law. 3.40 The Practice Statement on Judicial Precedent issued by the Supreme Court on 11 July 1994 outlined the relevance of prior Privy Council and Court of Appeal decisions in Singapore. It stated that the Court of Appeal should not be bound by its own previous decisions and those of the Privy Council which, prior to 8 April 1994, were binding on it, “where adherence to such prior decisions would cause injustice in a particular case or constrain the development of law in conformity with the circumstances of Singapore”. Thus, the Court of Appeal will continue to treat such prior decisions as normally binding but will, whenever it appears right to do so, depart from such prior decisions. Bearing in mind the danger of retrospectively disturbing contractual, proprietary and other legal rights, this power to depart from prior Privy Council decisions will be exercised sparingly. 3.41 Apart from hearing cases at first instance, the High Court also hears civil appeals from the District and Magistrates’ Courts as well as other tribunals as prescribed by the written law. It also has appellate criminal jurisdiction over criminal appeals from the District and Magistrates’ courts and in 56 Chapter 3: Legal Processes and Institutions respect of points of law reserved by special cases submitted by the District and Magistrates’ courts. 3.42 Under the doctrine of judicial precedent, the Singapore High Court is bound by the prior decisions of the Court of Appeal, unless the High Court judge is able to show that either of the exceptions stated in para 3.27 apply. However, it is not bound by the previous decisions of the High Court. 3.43 The High Court judges enjoy security of tenure, whilst Judicial Commissioners are appointed on a short-term contract basis. Both, however, enjoy the same judicial powers and immunities. Their judicial powers comprise both original and appellate jurisdiction over both civil and criminal matters. In line with the enhanced complexity of commercial disputes, the Judiciary has since 2002 established three specialist courts: the Admiralty, Intellectual Property and Arbitration Courts which are presided by Judges and Judicial Commissioners with domain expertise in those areas. 3.44 The Subordinate Courts (consisting of the District, Magistrates’, Coroners’ and Juvenile Courts as well as the Small Claims Tribunals) have also been set up within the Singapore judicial hierarchy to administer justice amongst the people (Subordinate Courts Act (Cap 321, 2007 Rev Ed)). The administration of justice within the Subordinate Courts is aided by a team consisting of the Registrar and deputy registrars. 3.45 The District Courts and the Magistrates’ Courts share the same powers over specific matters such as contractual or tortious claims for a debt, demand or damage, and actions for the recovery of monies. However, the jurisdictional monetary limits in civil matters for the Magistrates’ Courts and District Courts are $60,000 and $250,000 respectively. The courts also differ in terms of criminal sentencing powers. Imprisonment terms imposed by the Magistrates’ Courts are limited to three years whilst the limit imposed on the District Courts is ten years (s 303 Criminal Procedure Code (No 15 of 2010)). 3.46 With the increased sophistication in business transactions and law, the Commercial Civil and Criminal District Courts have recently been established within the Subordinate Courts to deal with more complex cases. Law academics and practitioners with the relevant expertise have also been appointed as specialist judges on an ad hoc basis to deal with specific complex cases. 57 Principles of Singapore Business Law 3.47 We should also briefly mention the main roles and functions of the other Subordinate Courts. The Family Court, which is a District Court, deals with divorces, maintenance, custody, adoptions and applications for protection and exclusion orders in family violence cases. The Juvenile Court, presided over by a Magistrate, hears cases involving offences committed by young persons and children. The conduct of inquiries to determine whether the deceased person(s) died of unnatural causes is within the purview of the Coroners’ Court. The Small Claims Tribunals (“SCTs”) offer a speedy, cost-effective and informal process (without legal representation) for the disposition of small claims with a monetary limit of only $20,000, provided the disputing parties consent in writing. The SCTs hear claims in respect of contracts for the sale of goods and the provision of services, tort claims in respect of property damage (excluding those arising out of or in connection with the use of a motor vehicle) and disputes relating to leases of residential premises for a lease period of two years or less. 3.48 Other existing courts include the Subordinate Military Courts which hear cases at first instance involving military offences. Appeals against the decisions of the Subordinate Military Courts are heard by the Military Court of Appeal. The Industrial Arbitration Court has been established to conduct arbitration proceedings with respect to trade disputes involving trade unions and employers. The Syariah Court administers Muslim law in specific personal legal matters governing marriages, divorces, the nullity of marriages, judicial separations, disposition or division of property on divorce or nullity of marriage in respect of Muslims or parties married under Muslim law. The High Court, however, has concurrent jurisdiction with the Syariah Court on specific matters relating to maintenance, custody and division of property, subject to the parties obtaining leave of the Syariah Court prior to commencing proceedings in civil courts. 3.49 The Community Court was established in 2006 to deal with particular types of cases (youthful offenders, offenders with mental disabilities, neighbourhood disputes, attempted suicide cases, family violence, carnal connection offences by youthful offenders, abuse and cruelty to animals and cases impacting race relations). One important purpose of this court is to allow such offenders to reintegrate more successfully into the community via the use, in appropriate cases, of long-term community-based treatment rather than imprisonment. Subsequent legal reforms in 2009 have also enabled the Community Court to utilise more graduated sentencing 58 Chapter 3: Legal Processes and Institutions options (such as community service orders and day reporting orders) to deal with minor offences. Technology and the Courts 3.50 The Singapore Judiciary as a whole has taken big strides in imbibing information technology. Certain technologically enabled courtrooms (Technology Courts) were, for instance, set up to enable the sharing of information by lawyers and judges and the giving of evidence by witnesses via video conferencing. The Supreme Court’s Digital Transcription System allows for the digital audio recording of court hearings with near real-time transcription. Moreover, the Electronic Queue Management System provides a fair and orderly queue system in the Supreme Court for chamber hearings before the Registrars. It notifies lawyers, on a first-come-first-served basis, as to when their cases will be heard via display screens located within its premises. The Electronic Filing System (“EFS”), a joint project by the Judiciary, Singapore Network Services and the Singapore Academy of Law, has, in the past, enabled the filing, extraction and service of court documents as well as the tracking of case information by electronic means. Pursuant to an EFS review in 2003, the EFS has since been reconstituted as the Electronic Litigation Systems (“ELS”) in order to further integrate technology into the litigation process. Information technology innovations have also been utilised to facilitate and streamline various criminal processes (including the payment of traffic fines and information flow and exchange between the Subordinate Courts and Home Team agencies). New technologies (such as 3G mobile services) are being tested and employed to further enhance the delivery of court IT services, reflective of the incessant drive by the Judiciary to harness technological advancements. Interpretation of Written Law 3.51 The judge, during the course of adjudication, may be required to interpret the Acts of Parliament and subsidiary legislation as applicable to reach a decision in a particular case. A few general approaches to statutory interpretation have been used by judges for this purpose: ° literal rule: the words in the statutory provisions should be construed according to their plain and ordinary meaning; 59 Principles of Singapore Business Law ° golden rule: the literal rule should be followed unless it leads to an absurd result; ° mischief rule (also known as the rule in Heydon’s case (1584)): the words should be considered in the light of the mischief which the enactment of the legislation was attempting to remedy; and ° purposive rule: the purpose or object underlying the statute should be examined to ascertain the meaning of the words (see s 9A Interpretation Act (Cap 1, 2002 Rev Ed)). 3.52 Some of these approaches have been encapsulated in the Interpretation Act (Cap 1, 2002 Rev Ed). According to s 9A Interpretation Act, the judge can refer to, inter alia, the explanatory statement to the Bill, the speech made by the Minister in Parliament as well as the Parliamentary debates for the following purposes: ° to confirm the ordinary meaning of the provision of the written law, taking into account its context in the written law and the purpose or objective underlying the written law (ie, a combination of the literal rule and purposive rule); and ° to ascertain the meaning of the provision of the written law if: 3.53 – the provision is ambiguous or obscure; or – the ordinary meaning of the provision would lead to a result that is manifestly absurd or unreasonable (ie, the golden rule). There are also various specific technical rules which judges have used to interpret the written law, including: ° ejusdem generis rule: where general words follow specific words (eg, pens, pencils, erasers and “any object whatsoever”), the meaning of the general words will be confined to the class given by the preceding specific words; ° noscitur a sociis: this involves gathering the meaning of words from its context, that is, via association with its neighbouring words (eg, buses, “vehicles” and taxis); and ° expressio unius est exclusio alterius: words that are expressly mentioned in a statute suggest an intention to exclude those which have been omitted. 60 Chapter 3: Legal Processes and Institutions THE LEGAL PROFESSION, LEGAL EDUCATION AND OTHER PROFESSIONAL BODIES 3.54 The legal profession in Singapore is “fused”. This means the Singapore lawyer may act as both an advocate (to represent clients in the courts) as well as a solicitor (to assist clients in out-of-court work such as preparing and negotiating legal documentation). The Singapore lawyer is a versatile creature: he or she may serve as a legal or judicial officer in the Singapore legal service, an in-house counsel of a company or practise law in a local or international law firm. Within the local set-up, the lawyer may handle litigation, corporate work, conveyancing and intellectual property work. Outstanding litigators, practitioners and law academics have been appointed as Senior Counsel in recognition of their lofty professional standards. Leading Singapore lawyers have been consistently cited in Legal 500, Asia Pacific 500 and Chambers Global in one or more areas of expertise. The legal profession has, like the courts, undergone increased specialisation of functions in recent years as we find more lawyers involved in esoteric areas such as biotechnology and asset securitisations. 3.55 For the lawyer in private (legal) practice, one prominent feature of the legal landscape has been the proliferation of vehicles for the setting up of legal practices and the facilitation of tie-ups amongst the law practices. Apart from the sole proprietorships and partnerships, the legal profession has also seen the creation of the law corporation with the associated benefits of limited liability. The subsequent introduction of limited liability partnerships (“LLPs”) in Singapore has offered another vehicle for legal practice. There also exists the avenue of forming joint law ventures (“JLVs”) and formal law alliances (“FLAs”) between a Foreign Law Practice (“FLP”) and Singapore Law Practice (“SLP”) (subject to the approval of the Attorney-General) with the attendant advantages of marketing the venture or alliance as a single service provider and centralised billing for clients. FLPs licensed as Qualified Foreign Law Practices (“QFLPs”) are entitled to practise Singapore law in certain permitted areas via Singapore-qualified solicitors employed by them. In addition, the legislative amendments in 2012 will enable the foreign lawyers within the SLP to take an increased profit and equity share in the SLP up to a maximum of 33 per cent as well as encourage greater collaborations between the SLPs and the FLPs. For example, the recent reforms allow concurrent partnerships between SLPs and FLPs of a JLV and permit QFLPs to enter into FLAs and JLVs whilst still retaining their QFLP licences. 61 Principles of Singapore Business Law 3.56 A sound legal education is instrumental to the birth and subsequent development of the Singapore lawyer. The Singapore Institute of Legal Education (at http://www.sile.org.sg) was established in May 2011 to maintain and improve the standards of legal education in Singapore. To be admitted to the Singapore Bar, an aspirant has to first attain the status of a “qualified person” by obtaining a law degree from the National University of Singapore (“NUS”), the Singapore Management University (“SMU”) or one of the approved overseas universities of the United Kingdom, United States, Australia, Canada and New Zealand. In addition to the Bachelor of Laws (“LLB”) programme, SMU offers a Juris Doctor (“JD”) programme for graduates with a first degree from other disciplines as well as law graduates from civil law jurisdictions and non-gazetted universities in common law jurisdictions. Apart from a four-year LLB programme, NUS also offers a three-year graduate LLB programme for graduates with a first degree. 3.57 Law graduates from the approved foreign universities will be required to pass Part A of the Bar Examination (after an optional and shorter conversion course offered by NUS) in place of the former one-year Diploma of Singapore Law. Overseas graduates with Lower Second Class honours from approved universities are eligible to take the Bar Examination. Law graduates from NUS and SMU are not required to undertake Part A of the Bar Examination. The law graduates from both the local and approved foreign universities would have to undergo and pass the full-time Preparatory Course leading to Part B of the Singapore Bar Examinations. Finally, the law graduate may serve a practice training period with a Singapore law practice pursuant to a practice training contract or through work as a Legal Service officer or under the supervision of a qualifying legal officer. Upon fulfillment of the above requirements, he or she can be admitted to the Singapore Bar. 3.58 Foreign-qualified lawyers may apply for a Foreign Practitioner Certificate from the Attorney-General to practise in limited areas of Singapore law such as banking and finance, mergers and acquisitions, and intellectual property law subject to passing the Foreign Practitioner Examination (“FPE”). One prerequisite for taking the FPE is that the foreign lawyer must have at least three years of relevant legal practice or work in Singapore or overseas. Queen’s Counsel from the United Kingdom were previously admitted on an ad hoc basis for non-criminal cases provided the court was satisfied that the matter was of sufficient difficulty and complexity and the applicant had special qualifications or experience for purpose of the case (s15 Legal 62 Chapter 3: Legal Processes and Institutions Profession Act (Cap 161, 2009 Rev Ed); Re Millar Gavin James QC (2004)). In Re Joseph David QC (2012), admission was granted to a Queen’s Counsel for a commercial arbitration case. With a view to providing greater diversity in legal representation particularly for commercial disputes, the recent legislative reforms in 2012 have given the Chief Justice discretion in specifying the considerations as to whether to grant ad hoc admissions to foreign advocates. The impact of the recent overtures remains to be seen. 3.59 The Singapore Institute of Legal Education administers a mandatory Continuing Professional Development (“CPD”) scheme for lawyers, which commenced in April 2012. In its initial phase, the CPD scheme is targeted at young lawyers in legal practice (ie, those with less than five years’ experience) but it is expected that the scheme will, in the near future, also apply to the more experienced lawyers. 3.60 Apart from the law schools, the Singapore Institute of Legal Education, and local and foreign law practices, two other important professional bodies — the Law Society of Singapore and the Singapore Academy of Law — should be specifically mentioned. The Law Society (www.lawsociety.org.sg), comprising primarily lawyers in legal practice, continues to uphold and advance the interests of the practising lawyers as well as to promote access to justice. In respect of criminal matters, the Law Society of Singapore operates the Criminal Legal Aid Scheme (“CLAS”) for needy accused persons. The Pro Bono Services Office of the Law Society of Singapore, established in 2007, coordinates and administers pro bono initiatives including CLAS, Project Law Help for voluntary welfare organisations, Community Legal Clinics at the Community Development Councils as well as initiatives to raise public awareness of the law. Apart from the Law Society, the Singapore Legal Aid Bureau, a government department established under the Legal Aid and Advice Act (Cap 160, 1996 Rev Ed), provides civil legal aid to the needy based on “merits” and “means” tests. 3.61 The Singapore Academy of Law (“SAL”) (www.sal.org.sg), established by an Act of Parliament in 1988, seeks to advance the legal profession as a whole. Its members include practising lawyers, in-house counsel, government legal officers and law academics. The President of the SAL is the Honourable Chief Justice. Current and significant projects of the SAL include the promotion of Singapore law in the Asian region, the continuing legal education of its members, law reform initiatives, the promotion of alternative dispute 63 Principles of Singapore Business Law resolution (see Chapter 2) and the publication of law journals and case law in the Singapore Law Reports. Academy Publishing, set up under the auspices of the Singapore Academy of Law, has significantly contributed to the development of local jurisprudence with the publication of various Singapore law books including contract law, tort law and constitutional law. CONCLUSION 3.62 The maintenance and development of the legal institutions and their processes in Singapore are likely to be influenced by a combination of factors: economic pragmatism and efficiency, values of fairness and equity, local circumstances and evolving external conditions. In view of the relative youth of these legal institutions, the willingness to adapt and innovate, undergirded by fundamental principles such as the Rule of Law, will be important. Whilst the laws and practices of other jurisdictions remain a veritable source of knowledge in this age of globalisation, the Singapore legal institutions will inevitably have to, in at least some cases, develop and modify their own solutions and processes to tackle particular legal, socio-economic, political and cultural issues appropriate to their unique circumstances. 64 Chapter 6 Negligence 6.1–6.2 Introduction 6.3–6.4 The Legal Requirements 6.5 6.6–6.12 6.13–6.14 6.15–6.27 6.28–6.30 6.31–6.35 6.36–6.42 6.43–6.44 6.45–6.49 6.50–6.54 6.55 6.56–6.59 6.60–6.63 6.64–6.66 6.67–6.68 6.69 6.70–6.74 6.75–6.76 6.77–6.80 6.81–6.82 6.83–6.84 Duty of Care The Main Judicial Formulations for Duty of Care The Meaning of “Foreseeability”, “Proximity” and “Fair, Just and Reasonable” or Public Policy The Singapore Position Duty of Care: Various Scenarios (1) Negligent act or omission causing personal injury or physical damage (2) Negligent misstatements causing economic loss (3) Negligent misstatements causing physical damage (4) Negligent acts or omissions causing economic loss (5) Negligent acts or omissions causing nervous shock or psychiatric harm Breach of Duty of Care Factors to Determine the Standard of Care Standard of Care Relating to Professionals and Professional Standards and Practice Use of Expert Evidence in Determining the Standard of Care Res Ipsa Loquitur Causation of Damage Factual Causation (1) “But for” test (2) Material contribution to damage (3) Material contribution to risks of damage (4) Loss of chance Legal Causation Principles of Singapore Business Law 6.85–6.88 6.89–6.90 Remoteness of Damage General Principles Special Circumstances of the Plaintiff 6.91 Mitigation of Damage 6.92–6.93 Assessment of Damage 6.94–6.96 6.97–6.99 6.100 6.101–6.102 Defences Ex Turpi Causa Volenti Non Fit Injuria Exemption of Liability Contributory Negligence 6.103 6.104–6.106 6.107–6.108 6.109 6.110–6.112 Other Issues Vicarious Liability Director’s Liability for Company’s Negligence Concurrent Liability in the Tort of Negligence and in Contract Limitation Periods 6.113 Conclusion 132 Chapter 6: Negligence INTRODUCTION 6.1 In the previous chapter, we examined a category of torts known as business torts that dealt primarily with trade and economic interests arising from the intentional conduct of the defendants. In this chapter, we deal with the tort of negligence which is concerned with the legal liability and consequences arising from negligent conduct. The terms “negligent” or “negligence” connote, in layman’s language, conduct or acts performed carelessly or without proper care. However, not all forms or types of negligent conduct, acts or omissions will attract legal liability under the tort of negligence. There are legal rules that define the appropriate parameters relating to the range of potential defendants and the scope of liability. In this regard, they serve as control mechanisms or devices to delineate the circumstances in which a careless act or omission that causes harm may result in legal liability under the tort of negligence. 6.2 The situations in which the tort of negligence may feature in our lives and society are varied and, at times, complex. They include the typical car accident arising from the negligence of the driver, the negligent advice given by a professional such as an auditor or lawyer, the negligent construction or design of a structure, and the negligent acts and omissions of manufacturers and distributors of products. The list is by no means exhaustive and the categories of negligence are not closed. THE LEGAL REQUIREMENTS 6.3 The legal requirements necessary for the plaintiff to establish an action in the tort of negligence are as follows: ° the existence of a duty of care owed by the defendant to the plaintiff; ° the defendant must have breached his or her duty of care to the plaintiff; and ° the defendant’s breach must have caused the damage suffered by the plaintiff. In addition, the resulting damage cannot be too remote. With respect to the quantification of damages, we also need to ascertain if the plaintiff had failed to take reasonable steps to mitigate its losses, in which case the plaintiff cannot claim that portion of the damages to the extent that it was not duly mitigated. 133 Principles of Singapore Business Law 6.4 If the above legal requirements are met, the plaintiff would succeed in his action in negligence against the defendant unless the defendant can avail himself or herself of valid defences. The defences covered in this chapter are as follows: ° illegality (ex turpi causa); ° voluntary assumption of risk (volenti non fit injuria); ° exemption of liability; and ° contributory negligence. If either of the first two defences is proved, the defendant is not legally liable at all to the plaintiff under the tort of negligence. If the defence of contributory negligence is proved, the defendant will only be partially liable to the plaintiff. As for exemption of liability, it depends on whether the purported exemption entirely excludes or merely limits the extent of liability. DUTY OF CARE 6.5 The starting point for an action in the tort of negligence is the duty of care issue. Lawyers and judges have had to grapple with this thorny and complex concept since the landmark English decision of Donoghue v Stevenson (1932). This chapter will attempt to summarise, in chronological order, the development of what are generally regarded as the main judicial formulations or tests for establishing the duty of care in the tort of negligence. This is followed by an explanation of the legal jargon used in the judicial formulations, the tests involved and an analysis of the Singapore position. The Main Judicial Formulations for Duty of Care 6.6 We begin with Lord Atkin’s dictum in the abovementioned case of Donoghue v Stevenson (1932). In this case, the friend of a purchaser of a bottle of ginger beer that contained the decomposed remains of a snail had suffered gastro-enteritis upon consuming the contents. Obviously, there was no contractual relationship between the consumer and the manufacturer in this instance. Nonetheless, a claim for personal injury under the tort of negligence was brought by the ultimate consumer of the ginger beer against the manufacturer. With respect to duty of care, Lord Atkin raised the 134 Chapter 6: Negligence question “Who is my neighbour?” and proceeded to outline the “neighbour principle” as follows (at p 580): You must take reasonable care to avoid acts or omissions which you can reasonably foresee would be likely to injure your neighbour … persons who are so closely and directly affected by my act that I ought reasonably to have them in contemplation as being so affected when I am directing my mind to the acts and omissions which are called in question. [emphasis added] 6.7 About 45 years later, in Anns v Merton London Borough Council (1978), the lessee of a flat claimed against the council for the latter’s negligent failure to carry out inspections which resulted in inadequate foundations of the structure. The question which arose was whether a duty of care existed between the plaintiff (lessee) and the defendant (council). Lord Wilberforce (at pp 751–752) applied a general and broad two-stage test to establish a duty of care: (1) “whether, as between the alleged wrongdoer and the person who has suffered damage there is a sufficient relationship of proximity or neighbourhood such that, in the reasonable contemplation of the former, carelessness on his part may be likely to cause damage to the latter”? (2) If the answer to the above is “yes”, are there “any considerations which ought to negative, or to reduce or limit the scope of the duty or the class of persons to whom it is owed or the damages to which the breach of it may give rise”? [emphasis added] 6.8 In England, the Anns test was subsequently perceived by the courts as likely to result in overly expansive liability. There were doubts as to whether the scope of duty of care could be stated in the broad and general legal principle contained in the Anns two-stage test (Yuen Kun Yeu v Attorney-General of Hong Kong (1988); Governors of the Peabody Donation Fund v Sir Lindsay Parkinson & Co Ltd (1985)). The English courts interpreted the first limb of the Anns test above as based on reasonable foreseeability alone which was, according to the courts, easily satisfied in any particular case. This meant that the courts had to determine the existence of a duty of care based largely on the second limb by resorting to public policy grounds which are more uncertain. 135 Principles of Singapore Business Law 6.9 It should be noted that such an interpretation of Anns has not been universally accepted. Even so, the above criticisms prompted a “retreat” from Anns in England. A three-part test in the House of Lords decision of Caparo Industries plc v Dickman (1990) was subsequently formulated. In this case, the plaintiff, an existing shareholder of a company, bought additional shares in the company in reliance on the defendants’ audit report. It was alleged that the accounts of that company were negligently audited by the defendants (auditors). The plaintiff lost monies as a result of the purchase of shares and claimed that the defendants, who were engaged by the company, owed a duty to the plaintiff to take reasonable care in auditing the accounts of the company. With respect to duty of care, Lord Bridge in Caparo (at pp 617–618) stated: What emerges is that, in addition to the foreseeability of damage, necessary ingredients in any situation giving rise to a duty of care are that there should exist between the party owing the duty and the party to whom it is owed a relationship characterised by the law as one of “proximity” or “neighbourhood” and that the situation should be one in which the court considers it fair, just and reasonable that the law should impose a duty of a given scope upon the one party for the benefit of another. [emphasis added] The above test in Caparo for establishing a duty of care thus consists of the following three elements: ° foreseeability of damage; ° relationship of proximity or “neighbourhood” between the plaintiff and defendant; and ° whether it is fair, just and reasonable to impose a duty. Moreover, the House of Lords preferred an incremental (and cautious) approach to developing new categories of negligence via an analogy to the established categories instead of the general and broad formula of Lord Wilberforce in Anns. 6.10 For the sake of completeness, it should be mentioned that there are other contending tests for determining the existence of a duty of care. These include the test of “assumption of responsibility” as a standalone test without resorting to policy considerations (per Lord Goff in Henderson v Merrett Syndicates Ltd (1995)), the standalone incremental approach, the wholly 136 Chapter 6: Negligence policy-based test of Lord Denning MR in the Spartan Steel case (1973) as well as the multi-factorial approach in the Australian court decision in Perre v Apand (1999). 6.11 It is suggested that the above tests are not very persuasive. The standalone “assumption of responsibility” test may be criticised as being overly narrow in focus as it overlooks other relevant factors that impact on the duty of care equation. It is argued that, instead of treating “assumption of responsibility” as a standalone test for duty of care, the criterion of “assumption of responsibility” should serve merely as a relevant factor for determining “proximity” together with several other guiding factors such as reasonable reliance by the plaintiff, parties’ expectations and the precise relationship of the parties. Further, Lord Denning MR’s policy-based approach in Spartan Steel lends itself to excessive subjectivity and vagueness, which is unlikely to be conducive for a principled development of the tort of negligence. In the author’s view, the standalone incremental approach in itself also lacks any firm legal basis but appears largely to reflect the general “common law” approach of drawing analogy from prior precedents. Lastly, the multi-factorial approach of McHugh J in Perre v Apand (1999), which relies on a mix of factors to determine the existence of a duty of care (namely, reasonable foreseeability of loss, indeterminacy of liability, autonomy of the individual, vulnerability to risk and knowledge of the risk and magnitude), appears to focus more on the factual context of a case rather than the conceptual and legal foundations for determining duty of care in future cases. 6.12 One broad question remains: does the solution lie in a combination of tests as opposed to the selection of one appropriate test for any particular negligence case? Proponents of the former approach involving a combination of tests argue that each test will yield the same result and that each test may be used as a cross-check of the other tests (see the English Court of Appeal in Commissioners for Customs and Excise v Barclays Bank plc (2005)). The Singapore Court of Appeal in United Project Consultants Pte Ltd v Leong Kwok Onn (trading as Leong Kwok Onn & Co) (2005), however, does not appear to endorse such an eclectic approach. It stressed that the law must be “sufficiently clear and capable of guiding parties in the regulation of their affairs” and that “it would be undesirable for a court to refrain from coming down in favour of any particular test when faced with various alternative approaches” (at [33]). Even in the UK, the decision of the 137 Principles of Singapore Business Law House of Lords in Commissioners for Customs and Excise v Barclays Bank plc (2006), which overruled the decision of the English Court of Appeal, also appeared to cast doubt on the eclectic approach. As we shall see below, Singapore courts have adopted a single test for determining duty of care in negligence. The Meaning of “Foreseeability”, “Proximity” and “Fair, Just and Reasonable” or Public Policy 6.13 We should briefly analyse the elements mentioned in the above judicial formulations and tests. This is not, by any means, an easy task since the elements and the associated terms are not always used with precision or in the same fashion by all judges. ° Foreseeability: This refers to the foreseeability that one’s negligent act or omission is likely to result in the damage suffered by the plaintiff. The focus here is on the foreseeable harm and the class of persons who may be affected by the negligent act or omission. ° Proximity: The focus here is on the precise relationship between the plaintiff and the defendant. This element was used in both the two-stage Anns test and the three-part Caparo test. Lord Oliver in Caparo (at p 633) said that “proximity is no more than a label which embraces not a definable concept but merely a description of circumstances from which, pragmatically, the courts conclude that a duty of care exists”. In the Canadian Supreme Court decision in Cooper v Hobart (2001), the court took the view that the word “proximity” encompassed expectations, representation, reliance and property or other interests involved. As we shall examine below, the Singapore Court of Appeal has, unlike Caparo, sought to infuse meaning into the concept of proximity. ° Fair, just and reasonable or public policy: The terms “public policy” and “fair, just and reasonable” (in Caparo) are generally used interchangeably. Public policy considerations may apply differently from country to country. The public policy ground arose primarily from a concern for “indeterminate liability in an indeterminate amount for an indeterminate time to an indeterminate class” (Cardozo CJ in Ultramares Corporation v Touche (1931) at p 179). The above problem of indeterminacy, the need to preempt potentially defensive behaviour of defendants, public benefit and ensuring consistency between common law and statutory purposes 138 Chapter 6: Negligence are examples of policy considerations employed by judges in deciding negligence cases. 6.14 It should be noted that these elements of foreseeability; proximity; and fairness, justice and reasonableness/policy considerations overlap. In most cases, it is observed that the more foreseeable the harm, the more likely the courts will find there is “proximity”; in turn, it is more likely the courts will hold that policy considerations will result in, or that the notions of “fairness, justice and reasonableness” call for, the imposition of a duty of care. The Singapore Position 6.15 Bearing in mind the above English developments, it is now timely to analyse the Singapore approach to duty of care. In the past, the Singapore courts have applied both a two-stage process akin to Lord Wilberforce’s two-stage test in Anns as well as the Caparo three-part test. The current Singapore approach is now encapsulated in the Court of Appeal decision in Spandeck Engineering (S) Pte Ltd v Defence Science & Technology Agency (2007) (“Spandeck”). The case involved a claim by a contractor against a superintending officer for negligently undervaluing and under-certifying works carried out by the contractor. There was a building contract between the contractor and the employer, and the superintending officer was engaged by the employer to administer and supervise the building project. However, there was no contractual relationship between the contractor and the superintending officer. One issue was whether the superintending officer owed the contractor a duty of care in the absence of a contractual relationship. 6.16 The Court held (at [89]) that a single test was preferred to determine the scope of duty of care in negligence cases, regardless of the type of damages claimed. This single test is the two-stage test premised on proximity and policy considerations and the application of the test is to be preceded by a preliminary requirement of factual foreseeability. According to the Court (at [115]), the threshold requirement of “factual foreseeability” would likely be fulfilled in almost all cases. 6.17 With respect to the first stage of the test, the concept of “proximity” focuses on the relationship between the plaintiff and defendant, including physical, circumstantial as well as causal proximity and encompasses the twin criteria of 139 Principles of Singapore Business Law voluntary assumption of responsibility and reliance (at [78]). If the proximity requirement is satisfied, a prima facie duty of care arises (at [83]). At the second stage, the court will consider whether there are any considerations that ought to negative or limit the duty that has arisen under the first stage. These policy considerations involve the “weighing and balancing of competing moral claims and broad social welfare goals” (at [85]). 6.18 In addition, the Court stated (at [73]) that the single test should be applied “incrementally” (ie, when applying the test in each stage, judges ought to refer to decided cases in analogous situations). In a novel situation, the judge is not precluded from extending liability where it is “just and fair to do so”, taking into account the relevant policy considerations against indeterminate liability (at [73]). 6.19 The Court reiterated (at [69]) that there should not be a general exclusionary rule against recovery of all economic losses. Instead of focusing on the type of damages in order to determine duty of care, the court suggested (at [67]) that the circumstances in which the economic loss arises would be more important. The problem of indeterminate liability does not rear its ugly head in all pure economic cases such as in RSP Architects Planners & Engineers v Ocean Front Pte Ltd (1996) (“Ocean Front”) and RSP Architects Planners & Engineers v Management Corporation Strata Title Plan No 1075 (1999) (“Eastern Lagoon”) below). Thus, there should not be different tests for pure economic loss cases as distinct from physical damage. 6.20 The Court decided, on the facts, that the superintending officer did not owe any duty to the contractor. Although it was foreseeable that the negligent certification of the works would deprive the contractor of the moneys he was entitled to, the proximity requirement was not satisfied. This was because the building contract between the employer and contractor stated that in the event of a dispute or difference related to the contract or the works, either the employer or contractor may refer to an arbitrator for resolution. Due to the presence of the arbitration clause and the contractual matrix, no duty of care arose (see also Pacific Associates Inc v Baxter (1990) based on a similar arbitration provision). 6.21 Prior to Spandeck, the courts in two Singapore cases, Ocean Front and Eastern Lagoon (see the discussion of the above two cases in para 6.47) formulated 140 Chapter 6: Negligence a two-stage process (ie, proximity qualified by policy). This two-stage process is well-encapsulated in the following extract from Eastern Lagoon (at [31]): The court first examines and considers the facts and factors to determine whether there is a sufficient degree of proximity in the relationship between the party who has sustained the loss and the party who is said to have caused the loss which would give rise to a duty of care on the part of the latter to avoid the kind of loss sustained by the former … Next, having found such degree of proximity, the court next considers whether there is any material factor or policy which precludes such duty from arising. [emphasis added] 6.22 As can be seen, the two-stage process of proximity qualified by policy in Eastern Lagoon is substantially similar to Lord Wilberforce’s two-stage test in Anns (as observed by the Singapore High Court decision in Sunny Metal & Engineering Pte Ltd v Ng Khim Ming Eric (2007) at [87]) and the Spandeck test. 6.23 The tests in Ocean Front and Eastern Lagoon were examined in Man B&W Diesel SE Asia Pte Ltd and another v PT Bumi International Tankers and another appeal (2004). The respondent (“Bumi”) was the owner of a vessel. A contract was entered into between Bumi and the builder (“MSE”). The engines for the vessel were supplied by the appellant sub-contractor (“MBS”). There was no contract between MBS and Bumi for the supply of engines. The engines subsequently broke down and Bumi sued MBS for economic losses under the tort of negligence. The trial judge in PT Bumi International Tankers v Man B&W Diesel SE Asia Pte Ltd (2003) held that there was sufficient proximity between Bumi and MBS. As such, there was a duty of care subsisting between Bumi and MBS. In deciding so, the trial judge applied the principles enunciated in Ocean Front and Eastern Lagoon. However, the decision was overruled by the Court of Appeal. 6.24 The Court of Appeal held (at [33]–[34]) that the Bumi case should be distinguished from the Ocean Front case. It regarded the relationship between the developer and the management corporation in Ocean Front to be “as close to a contract as could reasonably be”. It was a “special case” which should, thus, be confined to the facts. The contract between Bumi and MSE essentially stated that MSE should be fully responsible for the work performed 141 Principles of Singapore Business Law by its sub-contractors and for their acts and omissions. In addition, the contract also provided that nothing in the contract shall create a contractual relationship between the sub-contractor and Bumi. On that basis, the Court of Appeal opined (at [48]) that Bumi, by directly contracting with MSE, had deliberately chosen to seek redress from MSE (instead of MBS) should the engines break down. In addition, extending a remedy to Bumi against MBS in tort would be in conflict with its express contractual relationship with MSE. 6.25 Apart from the two-stage process of proximity qualified by policy, the threepart test in Caparo was applied by the Singapore courts in several cases (such as Ikumene Singapore Pte Ltd v Leong Chee Leng (1993)). The application of the Caparo test must now be doubted in light of Spandeck. Nonetheless, prior cases, insofar as the treatment of the elements of foreseeability, proximity and policy considerations is concerned, remain relevant under the Spandeck “incremental” approach. In the well-publicised case of TV Media Pte Ltd v De Cruz Andrea Heidi and another appeal (2004), the Caparo test of foreseeability, proximity and fairness was applied to determine the duty of care owed by the sole distributor of a product (slimming pills) to the consumer in the promotion, endorsement and advertisement of the pills. The damage consisted of personal injury (liver damage) arising from the consumption of the pills. With respect to the proximity element, the Singapore Court of Appeal also referred to the seminal decision of Donoghue v Stevenson (1932) on negligence liability for physical damage due to the manufacturer’s defective products and stated (at [49]) that the principle should be extended to distributors and wholesalers as well. 6.26 In the same vein, the Caparo test was applied in the Singapore Court of Appeal decision in United Project Consultants Pte Ltd v Leong Kwok Onn (trading as Leong Kwok Onn & Co) (2005). The defendant, as the auditor and tax agent of the plaintiff company, attended to the filing of the plaintiff ’s tax returns. At the same time, the defendant was acting as the tax agent and handling the personal income tax returns of the plaintiff ’s managing director. The plaintiff failed to make proper tax returns to the Inland Revenue Authority (“IRAS”) in respect of certain declared fees payable to its directors and a penalty sum was imposed by IRAS. The plaintiff thus claimed damages for pure economic loss against the defendant for the latter’s alleged negligent failure to discharge his duties as auditor and tax agent. 142 Chapter 6: Negligence 6.27 The Court of Appeal held that the defendant owed a duty of care to the plaintiff. It was found (at [39]) that the defendant, who was handling the plaintiff ’s managing director’s personal tax returns, acquired actual knowledge that the plaintiff ’s directors were under-reporting their director’s fees to the IRAS. As such, the defendant ought to have foreseen the loss to the plaintiff. Moreover, the defendant, as a professional tax agent for the plaintiffs, had assumed responsibility in respect of the tax filing. The court ruled (at [41]) that the defendant was thus under a duty to warn of inaccuracies in the filing of tax returns and the tax consequences. In addition, the Court of Appeal was also satisfied that there were no policy reasons why such a duty ought not to be imposed. In this regard, the court stated (at [42]) that it was “common sense” that a tax agent who is a certified public accountant should warn his client of possible penalties imposed by IRAS in the event of incorrect submissions of tax returns. It bears repeating that the existence of a duty of care in negligence should now be determined pursuant to the Spandeck test instead of the Caparo test or any other tests. Duty of Care: Various Scenarios 6.28 Though the Spandeck test applies regardless of the type of damage, this does not necessarily mean that all types of damage arising from negligent conduct are equally recoverable. For example, physical damage and property damage arising from positive acts are generally recoverable as compared to pure economic losses. Notwithstanding the single test for duty of care in Spandeck, the law is generally more restrictive in imposing liability arising from pure economic loss (ie, financial loss not associated with any personal injury, physical or property damage) due to the fear of opening the floodgates and indeterminacy of liability. Further, claims in negligence for psychiatric harm are normally more restrictive than a similar claim for personal injuries arising from the defendant’s negligent acts. 6.29 “Physical damage” in this context refers to actual physical damage suffered, and does not include future or potential (physical) damage. Thus, mere defects in construction or functionality (eg, inadequate foundations of a house or an engine) are not generally treated as “physical damage”, but as economic loss. This is because such defects may or may not subsequently lead to actual physical damage. 143 Principles of Singapore Business Law 6.30 To illustrate the distinction between physical damage, economic loss consequent upon physical damage and pure economic loss, we should examine the case of Spartan Steel & Alloys Ltd v Martin & Co (Contractors) Ltd (1973). The defendants (building contractors) negligently cut electricity cables leading to the plaintiff ’s steelworks. The electricity was cut off for a few hours and the plaintiff ’s furnace stopped operating. As a result, the steel in the furnace was ruined. It was held by the court that the loss of profit for subsequent batches of steel which might have been produced if electricity had not been halted (pure economic loss) was not recoverable. However, damages for the materials used in processing the particular batch of steel at the time when the accident occurred (direct physical loss) and the loss of profit on that batch of steel (consequential economic loss) were held to be recoverable. (1) Negligent act or omission causing personal injury or physical damage 6.31 In cases where personal injury is caused by the positive act of the defendant, establishing a duty of care is generally unproblematic and uncontroversial. This is because the physical damage that arises from the defendant’s positive act is fairly direct and obvious. The requirement of “reasonable foreseeability” would normally be satisfied. In addition, there is unlikely to be a “floodgates” problem associated with indeterminate liability and indeterminate scope of potential defendants. Examples of such cases are the typical car accident where the plaintiff suffers personal injury (or damage to property) arising from negligent driving as well as personal injuries from the consumption of foods negligently manufactured by the defendant. 6.32 Not all cases pertaining to physical damage are straightforward and clear, as illustrated by the case of The Sunrise Crane (2004). The plaintiff ’s steel tanker, the Pristine, was destroyed due to the transfer of nitric acid contaminated by hydraulic oil from the defendant’s vessel, the Sunrise Crane. No one on board the Sunrise Crane provided information that the substance was contaminated nitric acid which had to be disposed of by alternative means. There was also no contractual relationship between the plaintiffs and defendants. The defendants had requested the vessel’s Protection & Indemnity (“P & I”) Club for assistance, and the Club appointed a surveyor. The surveyor then engaged a contractor (Pink Energy) for the disposal job who, in turn, engaged another sub-contractor (Pristine Maritime) to remove the contaminated cargo. Neither the sub-contractor (Pristine Maritime) that carried out the disposal nor the plaintiff was informed of the nature of the 144 Chapter 6: Negligence cargo. The Court of Appeal held by a majority (Prakash J dissenting) that the Sunrise Crane owed a duty of care in the tort of negligence to inform the Pristine of the nature of the cargo immediately prior to the transfer of the contaminated acid. The very dangerous nature of the cargo appeared to be a significant factor in the majority decision. The fact that the defendant had informed the contractor (Pink Energy) of the nature of the cargo was insufficient to fulfil the duty of care. 6.33 The decision in Bumi (2004) (see paras 6.23–6.24), which denied recovery for pure economic loss, was distinguished on the basis that direct property damage was caused. The court in The Sunrise Crane (2004) appeared (at [73]) to have applied the Caparo three-part test. With respect to the proximity element, it referred to the physical proximity of the two vessels which were moored alongside when the disposal operation was in progress (at [77]), and to the fact that the act of transferring the contaminated cargo “directly affected” the plaintiff (at [50]). There was also a statement in the judgment, albeit without elaboration, that it was not unfair or unjust to impose a duty of care in the instant case (at [41]). Box 6.1 Reflecting on the law Controversy in The Sunrise Crane The dissenting judgment in The Sunrise Crane is significant and should be briefly mentioned. Similar to the approach of the majority judges in The Sunrise Crane, Prakash J applied the Caparo test. However, Her Honour arrived at a different conclusion. The learned judge ruled that the defendant could not have foreseen that the tanker sent to collect the cargo (Pristine) would not have been told of its nature, after having provided the contractor (Pink Energy) the requisite information. In a fairly unusual stance, Her Honour conceded that, despite the absence of foreseeability, physical, circumstantial and causal proximity were present in the case. With respect to the fairness element, the learned judge was of the view that it is not fair or reasonable or just to impose on a party, who engages a qualified person to undertake a task, the duty to countercheck, before the task commences, that the person actually sent to complete the task is aware of the task at hand and the equipment required. Imposing a duty would, according to the learned judge, make the employer responsible for carrying out the duty of the contractor (Pink Energy) to inform the sub-contractor of the nature of the cargo and thus, open the floodgates to claims against a whole new class of parties. Do you agree with the majority judgment or the dissenting judgment in The Sunrise Crane? 145 Principles of Singapore Business Law 6.34 In contrast to positive acts, there is generally no duty of care arising from mere omissions. There is, for example, no legal duty placed on a passer-by to rescue a drowning man. One underlying reason for the current legal position against imposing a duty of care is that the law should not unduly interfere with a person’s liberty by requiring him to save another person with whom there is no prior relationship. The performance of altruistic (or heroic) acts may be laudable, but is generally not legally mandated. Further, there is the potential difficulty of ascertaining in (at least) some cases the particular defendant responsible where there are others who might have been able to effect the rescue. 6.35 The general principle of non-liability for the defendant’s omission to prevent the plaintiff from harming himself or to prevent a third party from harming the plaintiff is subject to certain exceptions. These exceptions include the following: where there is a special relationship between the plaintiff and defendant based on a voluntary assumption of responsibility by the defendant towards the plaintiff, or control by the defendant over the third party conduct; and where the defendant knew or ought to know that the third party has created a source of danger on the defendant’s premises and the defendant failed to take reasonable steps to prevent the danger from damaging the plaintiff ’s property (see Smith v Littlewoods Organisation Ltd (1987)). (2) Negligent misstatements causing economic loss 6.36 One notable case on negligent misstatements is Hedley Byrne & Co Ltd v Heller & Partners Ltd (1964). Here, the plaintiffs (advertising agents) wished to do some advertising work for a company called Easipower. The defendants (bankers for Easipower) negligently provided to the plaintiffs a reference on the creditworthiness of Easipower. The plaintiffs subsequently claimed for financial losses when Easipower went into liquidation. On the facts, there was a valid disclaimer clause that the bank’s statement was made “without responsibility on the part of the bank or its officials”. Thus, the defendant bank was not liable for the negligent misstatement. However, if not for the disclaimer clause, the House stated that a duty of care would have been owed by the defendant bank to the plaintiff to take reasonable care in making statements which others could reasonably rely upon. The judgments of the law lords indicated that the following factors should be considered when 146 Chapter 6: Negligence determining whether a duty of care had arisen between the plaintiff and the defendant bank: ° the skill and expertise of the maker of the statement; ° whether the maker of the statement knows or ought to know that the other person will rely on the statement; and ° whether the maker of the statement voluntarily undertakes or assumes responsibility for making the statement. Further, where the relationship between the maker of the statement and the recipient is akin to contract, a duty of care is likely to arise. 6.37 The rationale for the above additional requirements in respect of negligent misstatements (as compared to negligent acts causing physical damage discussed at para 6.31) is that words are more “volatile” than deeds, whilst damage by negligent acts to persons or property is more “visible and obvious” (see p 534). For example, statements made to a particular party may be conveyed or transmitted by the recipient to a third party or parties, whose identities may not be known to the maker of the statements, and the impact of those statements on the recipients may not have been contemplated by the maker. On the other hand, the effects of physical injury or property damage arising from one’s negligent acts (such as negligent driving) are normally more obvious and direct. 6.38 The following statements of Lord Devlin (at p 529) are instructive as to the relevance of payment or lack thereof for the advice: Payment for information or advice is very good evidence that [the advice] is being relied upon and that the informer or adviser knows that it is. Where there is no consideration, it will be necessary to exercise greater care in distinguishing between social and professional relationships and between those which are of a contractual character and those which are not. It may often be material to consider whether the adviser is acting purely out of good nature or whether he is getting his reward in some indirect form. [emphasis added] 6.39 Another important case on negligent misstatements, Caparo Industries plc v Dickman (1990), held that there was no duty of care owed by the defendant auditors to the plaintiff (purchaser of additional shares in a company) in 147 Principles of Singapore Business Law respect of the defendant’s negligent misstatement concerning the audited accounts of the company. The general principle is that no duty of care is owed by the auditors of a company to individual members of the public at large (including the plaintiff) who rely on the information to buy shares in the company (see p 627). It was held that the statutory accounts of the company were to be used at the general meeting for shareholders as a whole and were not intended for use by individual shareholders. This principle has been extended to preclude claims in negligence by lenders and guarantors (of credit facilities to audited companies) against auditors for negligently prepared audited statements (see also Standard Chartered Bank & another v Coopers & Lybrand (1993); Ikumene Singapore Pte Ltd v Leong Chee Leng (1993)). 6.40 In a similar vein as the decision in Hedley Byrne, the court in Caparo outlined (at p 638) some important requirements for establishing a duty of care: ° the purpose (general or specific) was made known to the adviser at the time of the advice; ° the adviser knows or ought to know that his or her advice will be communicated to the plaintiff (specifically or as a member of an ascertainable class) for the above purpose; ° the adviser knows or ought to know that his or her advice will be acted upon by the plaintiff without independent inquiry; and ° the advice was acted upon by the plaintiff to his or her detriment. 6.41 The House of Lords decision in Spring v Guardian Assurance plc (1994) provides an interesting factual twist. It concerned a written reference given by the defendants (Guardian Assurance) to Mr Spring’s prospective employer. Mr Spring failed to get the job with the prospective employer and sued Guardian Assurance for negligent misstatement in respect of the reference. The House held that a duty of care was owed by Guardian Assurance to Mr Spring, its ex-employee. Lord Goff in that case appeared to have applied Hedley. However, it is noted that Hedley concerned a claim in negligence by the recipient of the bank’s advice. In Spring, it was not the recipient of the reference (prospective employer) but the subject of the reference (the plaintiff employee) who had sued for damages. Thus, it is suggested that the decision in Spring might be construed as an extension of the Hedley principle. 148 Chapter 6: Negligence 6.42 The tort of negligence may be compared with the action based on negligent misrepresentation under the Misrepresentation Act (Cap 390, 1994 Rev Ed) (“MA”) (see Chapter 13). The MA typically applies to a scenario where a representee relies on a negligent representation made by the representor and enters into a contract with the representor (as opposed to a third party as in Hedley). According to s 2(1) MA, the representee would only need to show that the representation was false and the burden of proof would shift to the representor to show that he had reasonable ground to believe and did believe, up to the time the contract was made, that the facts represented were true. Hence, the burden of proof on a plaintiff in an action based on s 2(1) MA is considerably lighter than the plaintiff suing for negligent misstatement in tort. Further, based on the case of Royscot Trust Ltd v Rogerson (1991), the representee claiming pursuant to s 2(1) MA might be able to recover damages which are quantified based on the fraud measure, rather than the negligence measure in the tort of negligence. With respect to the fraud measure, damages are recoverable so long as causation is established, notwithstanding that the loss might be too remote, unlike in a typical negligence action. Thus, the representee in such a scenario would generally find it advantageous to sue pursuant to s 2(1) MA rather than the tort of negligence. (3) Negligent misstatements causing physical damage 6.43 Claims for physical damage arising from negligent misstatements are, as one can imagine, relatively uncommon. In Marc Rich & Co AG v Bishop Rock Marine Co Ltd (1996), the issue was whether a classification society (a nonprofit organisation) owed a duty of care to the owner of cargo on a vessel in respect of the society’s negligent certification of a vessel’s seaworthiness. It transpired that the ship sank and the cargo was physically damaged as a result. The House of Lords (Lord Lloyd dissenting) held that there was no duty of care. In disallowing recovery, the House appeared to have emphasised the policy requirements at the expense of the proximity requirement. Their Lordships outlined the following public policy reasons against recovery: the higher costs of insurance to the classification society which might be passed on to the ship owners; the fact that cargo owners already have contractual claims against the ship owners pursuant to the Hague-Visby Rules, which provide for the limitation of the ship owners’ liability to the cargo owners; the onerous duty of the classification society to promote the “collective 149 Principles of Singapore Business Law welfare”, namely to ensure the safety of ships and lives; if the classification society were to be held liable, it might, as a result, adopt a defensive position and useful resources may be diverted elsewhere; and the fact that the classification society had no protection at all via limitation provisions, unlike the ship owners. 6.44 In another case involving negligent certification resulting in physical harm, Perrett v Collins (1998), however, the English court held that an association that was approved by a civil aviation authority to issue the certification owed a duty of care to a passenger on an aircraft in respect of the personal injuries he suffered. The court noted that the defendant had voluntarily assumed responsibility for issuing the certification and the certification was for the protection of members of the public. (4) Negligent acts or omissions causing economic loss 6.45 Pure economic losses which arise as a result of a negligent act or omission in the context of building defects are generally not recoverable in England. This is illustrated by the English decision of Murphy v Brentwood (1991) in relation to liability for the construction or approvals of construction of houses or buildings. The purchaser of a flat claimed against the council, which approved the foundations, for the diminution in the value of his flat. The House of Lords held that no duty of care existed and consciously departed from the Anns two-stage test. The House in Murphy was concerned about extending the liability of potential defendants (eg, builders and manufacturers of chattels). 6.46 It should be noted that the UK Defective Premises Act 1972 already protects homeowners by imposing legal liability on architects, builders and others taking on work for or in connection with the provision of a dwelling-house if they fail to carry out work in a workmanlike or professional manner and the building is rendered unfit for habitation as a result. Hence, it might not be as necessary or crucial in England, in view of the statutory protection, to develop common law negligence liability in building construction cases. Singapore does not have a similar legislation. 6.47 As indicated earlier, Singapore has departed from the English position in Murphy v Brentwood (1991). In Ocean Front, a duty of care existed based 150 Chapter 6: Negligence on the proximity between the management corporation (the plaintiffs) and the developers (the defendants). Further, there were no public policy reasons against the existence of a duty of care. In that case, it was found that there was a determinate amount of recovery, a determinate class of persons and no transmissible warranty. Similarly, in Eastern Lagoon, a duty of care existed based on the proximity between the management corporation (the plaintiffs) and the architects (the defendants). It was found that there was sufficient reliance and assumption of responsibility to establish a duty of care. In addition, there were public policy reasons for supporting such a duty. These cases concern real property, which translates into greater financial investment and possesses permanence of structure as opposed to chattels, especially in the context of land-scarce Singapore. In fact, it should be noted that these factors were also applied in the Australian case of Bryan v Maloney (1995), a case involving a subsequent purchaser of a house (ie, not the first owner) claiming against the builder, though Bryan discussed the above policy factors in the context of the proximity element (see also the discussion on the Bumi case at paras 6.23–6.24). 6.48 In Animal Concerns Research & Education Society v Tan Boon Kwee (2011) (decided post-Spandeck), the criteria of voluntary assumption of responsibility and reliance were applied under the proximity requirement of the Spandeck test. A non-profit society engaged a company as contractor to construct a shelter for animals. The contractor appointed Tan, director of the company, as clerk of works for the building project. Under the contract, the contractor was obliged to level the site by using surplus earth (a process known as “backfilling”) but instead used materials which resulted in the pollution of the environment. As a result, the society had to excavate the contaminated portions of the site and thereby incurred economic losses. In the claim in negligence against Tan for the economic losses, the court held that the clerk of works owed a legal duty to the society to supervise the backfilling. 6.49 Applying the Spandeck test, the Court opined (at [35]) that it was reasonably foreseeable that the society would suffer some loss or damage if Tan did not take care in supervising the backfilling. On the proximity requirement, there was clearly physical proximity as the society was lessee of the site and the clerk of works was obliged to be physically present at the site to carry out 151 Principles of Singapore Business Law his duties. Tan, in procuring the contractor to appoint himself as clerk of works, was adjudged (at [63]) to have voluntarily assumed the responsibilities of a clerk of works and held himself out as having the qualifications and skills necessary to fulfil the role of a clerk of works. In addition, Tan, in declaring in a form submitted to the Building and Construction Authority that he was not linked to the contractor, knew or ought to have known that the society would rely on him to act in the society’s interests as the clerk of works (see [64]). (5) Negligent acts or omissions causing nervous shock or psychiatric harm 6.50 This applies only to recognised psychiatric illnesses, not mere mental distress, anxiety or disappointment not associated with any physical injury suffered by the plaintiff arising from a negligent act or omission of the defendant. 6.51 In the case of Page v Smith (1996), the House of Lords held that the plaintiff, who was a primary victim, can recover for psychiatric injury as long as some form of personal injury was foreseeable flowing from the negligent act. The plaintiff in this case was a “primary victim” of a car crash due to the negligence of the defendant. The plaintiff ’s car was damaged but the plaintiff did not suffer any physical injury. Instead, he suffered a condition known as chronic fatigue syndrome. The House of Lords (Lord Keith and Lord Jauncey dissenting) decided that as physical injury was foreseeable in such car accidents, it was not necessary for the plaintiff to show that the psychiatric injury was also foreseeable in order to recover for psychiatric injuries. 6.52 The above case of Page v Smith has been doubted by the Singapore Court of Appeal in Ngiam Kong Seng v Lim Chiew Hock (2008). According to the court in Ngiam Kong Seng (at [95]), there should not be any distinction between a primary victim as in Page and a secondary victim (eg, one who witnessed the car accident caused by the defendant’s negligence and suffered psychiatric illness as a result). Instead, there should be a single test applying to both primary and secondary victims. A duty of care would arise only if the plaintiff satisfies the three proximity requirements stated in Ngiam Kong Seng (at [101]–[103]). The proximity requirements are as follows: ° the closeness of the relationship between the plaintiff and the primary victim, such as parent–child and husband–wife relationships, though 152 Chapter 6: Negligence this does not necessarily exclude the other types of relationships (circumstantial proximity); ° proximity of the plaintiff to the accident in time and space (ie, through sight and sound of the event or its immediate aftermath) (physical proximity); and ° the means by which the shock is caused (causal proximity). 6.53 With respect to the first proximity requirement, Lord Wilberforce in McLoughlin v O’Brian (1983) had stated (at pp 421–422) that “[t]he closer the tie (not merely in any relationship, but in care) the greater the claim for consideration”. In McLoughlin, the plaintiff did not attend the scene of the car accident but saw her injured family members at the hospital soon after the accident. It is observed that when the plaintiff met them at the hospital, the family members were still in pain. Thus, the House allowed recovery. However, it is not clear how the first proximity requirement would apply to a case of a plaintiff who suffered psychiatric harm arising from a near collision with a negligent driver. In such a case, there does not seem to be any relational or circumstantial proximity to speak of, as opposed to the case of a plaintiff who witnessed his loved one colliding with the negligent driver. 6.54 Instead of negligent driving causing psychiatric harm, the Singapore decision of Pang Koi Fa v Lim Djoe Phing (1993) involved medical negligence that eventually culminated in the death of the plaintiff ’s daughter. Upon applying McLoughlin, the first proximity requirement was clearly satisfied on the basis of a mother–daughter relationship. With respect to the second and third proximity requirements, the court observed that there was no accident or aftermath witnessed by the plaintiff in Pang Koi Fa, unlike in McLoughlin. Nevertheless, the court held that the plaintiff in Pang Koi Fa was proximate in both time and space to the tortious event (ie, the death of her daughter) as the plaintiff had witnessed throughout the effects of the defendant doctor’s negligent diagnosis, negligent operation and negligent postoperative treatment. In addition, the learned judge regarded her (at [62]) as a “percipient witness in terms of the elements of immediacy, closeness of time and space, visual and aural perception”. His Honour added (at [76]) that the above legal analysis and outcome in the case should be confined to medical negligence cases. 153 Principles of Singapore Business Law Box 6.2 Reflecting on the law Wrongful birth and wrongful life claims Where a doctor negligently fails to discharge his or her duty of advising a pregnant woman the risks of bearing an abnormal child, and, as a result, the mother does not have the opportunity to terminate the pregnancy, can the parents sue the doctor in the tort of negligence in a claim for “wrongful birth”? In addition, can the child who is born with disabilities sue the doctor for damages in a claim commonly known as “wrongful life”? These are complex issues which have excited and troubled, not merely legal minds, but also those with philosophical, scientific and ethical inclinations. This is indeed a real medical negligence problem in the light of the advanced contraception or sterilisation methods and genetic tests available today. In fact, such actions are not necessarily limited to the negligent conduct of doctors, but may extend to genetic testing laboratories or manufacturers of contraceptives and sterilisation methods. Claims for damages for pain and suffering of the mother due to the pregnancy and childbirth based on “wrongful birth” by the parents of the abnormal child have generally been successful. In some cases, damages for the additional costs of raising the disabled child have been recovered by the parents (see Cattanach v Melchior (2003); Parkinson v St James and Seacroft University Hospital NHS Trust (2002)). In contrast, claims based on “wrongful life” for the damages suffered by the disabled child are generally not recoverable. In the Singapore case of JU v See Tho Kai Yin (2005), it was alleged that the defendant (obstetrician and gynaecologist) had negligently failed to advise a pregnant woman of the increased risks of having a baby with chromosomal abnormalities due to the woman’s age. As a consequence, the woman claimed that she was prevented from exercising her option to abort the baby. The child was born with Down’s Syndrome. With respect to the claim for “wrongful life” by the disabled child, the High Court ruled that such an action would be contrary to public policy as it violates the sanctity of human life. Thus, in Singapore, there is no cause of action for wrongful life. The learned judge also observed that this common law position has been adopted by the English (eg, McKay v Essex Area Health Authority (1982)), Canadian and Australian courts. The majority of the High Court of Australia adopted this common law position against recovery of claims based on wrongful life in Waller v James; Waller v Hoolahan (2006) and Harriton v Stephens (2006). BREACH OF DUTY OF CARE 6.55 In this section, we are concerned with the “standard of care” expected of the defendant in question. If the defendant’s conduct falls below that standard of care, we say that he has “breached” the duty of care. Generally, the standard of care is the objective standard of a reasonable person using ordinary care and skill. This will normally be the case even if the defendant is inexperienced in 154 Chapter 6: Negligence performing the activity or task in question (such as driving a car) (Nettleship v Weston (1971); Imbree v McNeilly (2008)). Factors to Determine the Standard of Care 6.56 The standard of care, based on the test of the objective reasonable man, is dependent on what was reasonably foreseeable as measured by the prevailing knowledge at the material time of the event in question, and not after (Roe v Minister of Health (1954); PlanAssure PAC v Gaelic Inns Pte Ltd (2007); JSI Shipping (S) Pte Ltd v Teofoongwonglcloong (2007)). Factors such as the likelihood of the injury, the severity of the injury as well as the costs of avoiding the injury are relevant in determining the standard of care. 6.57 Where the likelihood of injury to the plaintiff is extremely low or remote, a high standard of care is not required to prevent the injury. In Bolton v Stone (1951), the plaintiff was injured by a cricket ball hit from a cricket ground that was surrounded by a high fence. It was found that the chance of a cricket ball hitting a person such as the plaintiff outside the grounds was very low. In the circumstances, it was held that the defendant (the cricket club) did not breach its duty of care to the plaintiff to prevent the accident occurring. Conversely, where the likely injury is serious, a higher standard of care would be required. In Paris v Stepney Borough Council (1951), the House of Lords held that the defendant employer should have reasonably taken into account the risk of greater injury to the plaintiff employee (who was already injured in one eye) by providing goggles for his work as a garage hand. The disability of the plaintiff employee increased the risk of the injury becoming more serious (ie, blindness) as compared to a normal person. Thus, the defendant employer had breached its duty in not providing goggles to the plaintiff. 6.58 The costs of avoiding injury on the part of the defendant is also a relevant factor, and this is to be balanced against the risk of harm occurring. In Latimer v AEC Ltd (1953), the plaintiff tripped and fell on the floor of a factory owned by the defendant and sued for negligence. The House determined that the defendant did not breach its duty of care. Based on the facts, the risk of injury to the plaintiff resulting from the slippery floor due to flooding did not justify the closure of the factory. The defendant in this case had already taken reasonable steps to remove the effects of the flood and 155 Principles of Singapore Business Law it was unreasonable to expect them to close the factory. The Wagon Mound (No 2) (1967) case further illustrates this balancing exercise to determine the standard of care issue. It was stated that a reasonable man would only neglect a small risk provided he had some valid reason for doing so, for example, because it would involve considerable expense to eliminate the risk. He would weigh the risk against the difficulty of eliminating it. 6.59 Other factors determining the standard of care include the following: the presence of potential hazards or dangers posed to the plaintiff (eg, the contaminated nitric acid in The Sunrise Crane); the presence of industrial standards and regulations (eg, in the context of employer’s duties to employees: see Chandran a/l Subbiah v Dockers Marine Pte Ltd (2010)); the level of the plaintiff employee’s experience, training and skills (eg, Zheng Yu Shan v Lian Beng Construction (1988) Pte Ltd (2009)); and the level of knowledge and commercial sophistication of the plaintiff clients (in the context of investment advice given by banks: see Go Dante Yap v Bank Austria Creditanstalt AG (2011)). Standard of Care Relating to Professionals and Professional Standards and Practice 6.60 With regard to professionals, the standard of care is that which is reasonably expected of a reasonably competent professional with respect to a particular field. That is, a specialist must exercise the ordinary skills of his specialty (Maynard v West Midlands Regional Health Authority (1984); see also Yeo Peng Hock Henry v Pai Lily (2001) discussed below at para 6.71). In the English case of Bolam v Friern Hospital Management Committee (1957), the court stated that the test is based on the standard of the ordinary skilled man exercising and professing to have that special skill. A man need not possess the highest expert skill at the risk of being found negligent. It is sufficient if he exercises the ordinary skill of an ordinary competent man exercising that particular art. The level of experience of the professional is not relevant in determining the standard of care (Wilsher v Essex Area Health Authority (1988)). 6.61 What if the professional had acted consistent with the professional standards or practice of the professional body to which he or she belonged? It appears that the professional may still be found liable under the tort of 156 Chapter 6: Negligence negligence. The professional standards serve, at the most, as a guideline of what is expected of a reasonably competent professional. In the context of lawyer’s negligence, the courts have opined that the real issue is not the professional practice but the extent of the legal duty in a given situation which is a question of law (Edward Wong Finance Co, Ltd v Johnson, Stokes and Master (1984); Fong Maun Yee v Yoon Weng Ho Robert (1997); Yeo Yoke Mui v Ng Liang Poh (1999)). 6.62 In Fong Maun Yee, the plaintiffs wished to purchase a piece of property and had paid monies in reliance on the defendant’s negligent misrepresentation that the latter had authority to act for the purported vendor. The defendant lawyer had obtained from a property agent an option to purchase and a resolution purportedly passed by the vendor’s directors authorising the sale of the property. The defendant did not know the purported vendor or its directors personally. Yet, the defendant did not verify his instructions to act for the purported vendor, though the defendant carried out a company search and confirmed to the plaintiffs that the persons who had signed the resolution and option were directors at the material time. As it turned out, the signatures on the resolution and option were forgeries and the property agent absconded with the plaintiff ’s monies. 6.63 At the trial of the action in negligence, evidence was adduced from a conveyancing lawyer that it was not the practice in Singapore for lawyers to verify their instructions. Nonetheless, the Singapore Court of Appeal held that the defendant lawyer had breached his duty of care and skill to the plaintiffs. Applying the test in Edward Wong Finance Co Ltd, the Court of Appeal held that, in failing to verify his instructions, there was clearly a foreseeable risk that the defendant would be acting without authority. The court observed that the defendant could have avoided the risks by taking steps to confirm his authority to act or if he could not do so, to at least warn the plaintiffs of the risk that he could be acting without authority. Use of Expert Evidence in Determining the Standard of Care 6.64 The court would generally determine the standard of care expected of professionals based on the evidence of experts within the same or similar profession. With respect to the standard of care expected of medical doctors, 157 Principles of Singapore Business Law for instance, it was held that a doctor is not guilty of negligence if he has “acted in accordance with a practice accepted as proper by a responsible body of medical men skilled in that particular art … Putting it the other way around, a man is not negligent, if he is acting in accordance with such a practice, merely because there is a body of opinion that takes a contrary view” (Bolam v Friern Hospital Management Committee (1957) (at p 587).) [emphasis added] 6.65 The Bolam test was confirmed in the decision of Bolitho v City and Hackney Health Authority (1998) with some refinements. The judge hearing the medical negligence case had to be satisfied that the medical opinion had a logical basis which would involve weighing the risks against the benefits to reach a “defensible conclusion”. Lord Browne-Wilkinson in Bolitho stated thus (at p 243): In the vast majority of cases the fact that distinguished experts in the field are of a particular opinion will demonstrate the reasonableness of that opinion. In particular, where there are questions of assessment of the relative risks and benefits of adopting a particular medical practice, a reasonable view necessarily presupposes that the relative risks and benefits have been weighed by the experts in forming their opinions. But if, in a rare case, it can be demonstrated that the professional opinion is not capable of withstanding logical analysis, the judge is entitled to hold that the body of opinion is not reasonable or responsible. 6.66 The above Bolitho test was endorsed in the Singapore case of Dr Khoo James v Gunapathy d/o Muniandy (2002). With respect to the meaning of “defensible conclusion”, the Singapore court took the view (at [65]) that the medical opinion must be internally consistent on its face. At the same time, it must not ignore or controvert known medical facts or advances in medical knowledge. Significantly, the court also observed (at [3]) that whilst judges are eminently equipped to deal with the practice and standards of the legal profession, the same cannot be applied to the intricacies of medical science. Subsequently, the Bolam and Bolitho tests have also been applied to assess the standard of care of auditors (PlanAssure PAC v Gaelic Inns Pte Ltd (2007); JSI Shipping (S) Pte Ltd v Teofoongwonglcloong (2007)). 158 Chapter 6: Negligence Res Ipsa Loquitur 6.67 The legal burden of proof is generally on the plaintiff to show on a balance of probabilities that the defendant had breached the duty of care. In some circumstances, however, the plaintiff may experience difficulties in adducing direct evidence of the negligent act or omission. In such an instance, the doctrine of res ipsa loquitur (“the thing speaks for itself ”) may be used in aid of the plaintiff. To establish the applicability of the doctrine, three criteria must be satisfied, namely: ° the defendant must have been in control of the situation or thing which resulted in the accident; ° the accident would not have happened, in the ordinary course of things, if proper care had been taken; and ° the cause of the accident must be unknown to the plaintiff. However, it should be noted that the defendant can displace the effect of the doctrine by giving evidence to show that he or she was not negligent. 6.68 A few illustrations shall suffice here. In Scott v London & St Katherine Docks Co (1865), sacks of sugar under the control of the defendant fell from a crane at the defendant’s warehouse. It was held that the doctrine of res ipsa loquitur applied as the accident could not, in the ordinary course of events, have occurred without the negligence of the defendant. The Singapore case of Teng Ah Kow and another v Ho Sek Chiu and others (1993) held that res ipsa loquitur is a rule of evidence. Thus, upon the fulfilment of the three criteria listed above, the effect of res ipsa loquitur results in the shift of the evidential burden of proof to the defendant to show that he or she was not negligent (see Ooi Han Sun v Bee Hua Meng (1991) and Awang bin Dollah v Shun Shing Construction & Engineering Co Ltd and other appeals (1997) in the context of occupier’s liability). However, the doctrine of res ipsa loquitur does not apply to a case where the accident could have happened via a number of permutations, some consistent with the plaintiff ’s negligence, the defendant’s negligence or a combination of the negligence of both parties (Cheong Ghim Fah v Murugian s/o Rangasamy (2004)). CAUSATION OF DAMAGE 6.69 The third legal requirement to establish an action in negligence is that the damage suffered by the plaintiff must have been caused by the defendant’s 159 Principles of Singapore Business Law breach. Causation is analysed by considering both factual and legal causation. Factual causation focuses on the causal link between the defendant’s negligent conduct and damage according to the laws of physics and natural science. There are two primary tests to determine the issue of factual causation of damage subject to certain exceptions (see paras 6.70–6.76). In addition to factual causation, the courts would have to consider the issue of legal causation (namely, to which cause should we ascribe legal responsibility). In this regard, the impact of a novus actus interveniens (or a “new intervening act”) of the plaintiff or a third party or even a natural event on the issue of causation will be assessed (see paras 6.83–6.84). Factual Causation (1) “But for” test 6.70 This test involves the question of whether the plaintiff would have suffered harm if the defendant had not been negligent. If it is found that the plaintiff would still have suffered harm notwithstanding that the defendant was not negligent, we can conclude, based on the “but for” test, that the defendant’s alleged negligence did not cause the harm suffered by the plaintiff. In Barnett v Chelsea & Kensington Hospital (1969), a patient who had suffered from persistent vomiting was taken to hospital. The doctor negligently refused to examine the patient and the latter died of arsenic poisoning. It was found, based on the evidence adduced, that even if the correct medical treatment had been given by the doctor at the relevant time, death to the patient would have taken place anyway. Thus, the court ruled that the doctor’s negligent omission in that case did not cause the death. 6.71 The “but for” test of causation may not be fulfilled due to the presence of certain variables which cannot be established by the plaintiff on a balance of probabilities. In Yeo Peng Hock Henry v Pai Lily (2001), the plaintiff (patient) consulted the defendant (general medical practitioner) and complained of fever, cough, cold as well as blurred vision and spots on her left eye. The defendant doctor suspected the plaintiff of having a detached retina and urinary tract infection but did not advise the plaintiff to consult an eye specialist or go to a hospital immediately. The plaintiff claimed damages for negligence on the grounds that as she was not advised to see an eye specialist or go to the hospital immediately, she had lost the chance of an earlier diagnosis by a specialist which would have prevented her from losing 160 Chapter 6: Negligence her sight. In this regard, the court held that the defendant had fallen short of the standard of care required of a competent general practitioner. 6.72 The more controversial issue in the case relates to causation, that is, whether, if the plaintiff had been properly advised by the defendant, the plaintiff would have immediately gone to the hospital and saved her sight. In this case, the plaintiff did not in fact suffer from a detached retina but a rare infection known as endogenous klebsiella endophthalmitis (“EKE”) which resulted in her loss of vision. The klebsiella bacteria grows at an exponential rate within 24 hours. It was clear that such a rare disease could not have been detected by a reasonably competent general practitioner. Based on the evidence of expert witnesses, the court observed that whether the plaintiff ’s eye could be saved was subject to three qualifications, namely (1) the correct diagnosis by the doctor at the hospital at the material time; (2) the appropriate treatment administered; and (3) the response of the eye to the treatment. The court concluded that the plaintiff had not proven, on a balance of probabilities, that had the defendant advised her to go to the hospital immediately and had she done so as advised, the plaintiff ’s eye would have been saved. 6.73 The requirement of the “but for” test to determine causation of damage does not appear to be applicable in the context of a medical practitioner’s failure to warn of risks of surgery to the patient. In Chester v Afshar (2005), the House of Lords decided, by a majority of 3:2, that the medical practitioner would be liable for a negligent omission to warn of risks to the plaintiff, notwithstanding that there is insufficient evidence to show that, even if duly warned, the plaintiff would not have undergone the surgery. In this instance, the “but for” test for causation of damage was not satisfied; yet the defendant doctor was held liable for the risks of surgery which eventuated. The majority judges (Lord Steyn, Lord Hope and Lord Walker) premised their decisions largely on the justice of the case, the doctrine of informed consent of the patient as well as the significance of the patient’s right of autonomy and dignity. The minority judges (Lord Hoffman and Lord Bingham) were, however, reluctant to depart from the traditional requirements of causation. We note that the majority position in Chester is consistent with that of the majority judges of the High Court of Australia in Chappel v Hart (1998) involving a doctor’s failure to advise the patient of the risks inherent in the treatment, which would deprive the patient of the right to choose a more experienced doctor. 161 Principles of Singapore Business Law 6.74 It is also noted that the application of the “but for” test may lead to incongruous results in certain multiple causation cases. For instance, assume that there are two fires which resulted in the damage to the plaintiff ’s property. Let us also assume that each fire, on its own, would have been sufficient to cause the property damage. What is the cause of the property damage here? If one applies the “but for” test, strictly speaking, fire #1 would not be regarded as the cause of the damage on the basis that but for fire #1, the property damage would still have occurred (ie, due to fire #2). Based on similar reasoning, fire #2 would not be regarded as the cause of the property damage. Such an outcome, that neither fire is the cause of the property damage, would clearly be absurd. In such a situation, it is submitted that the second test below, namely whether each of the fires #1 or #2 had materially contributed to the property damage, is the preferred approach. (2) Material contribution to damage 6.75 This test considers the question as to whether the breach materially contributed to the damage. To satisfy this test, it is not necessary for the breach to be the sole or dominant cause of the plaintiff ’s loss or damage. 6.76 In Bonnington Castings Ltd v Wardlaw (1956), the plaintiff suffered pneumoconiosis, alleging that the defendant employer failed to install a safety equipment to prevent exposure to silicone dust. He was exposed to silicone dust at the employer’s premises. Science could not demonstrate the precise proportions of the source of dust due to the employer’s negligence and another non-tortious source. But there is scientific evidence that severity of the illness was proportionate to the level of exposure to the dust. The court thus concluded that the defendant’s negligence had materially contributed to the plaintiff ’s pneumoconiosis. In a similar case, Holtby v Brigham & Cowan (Hull) Ltd (2000), where there were two or more employers, each employer was liable to the plaintiff employee for a portion of the damage proportionate to the relative time of exposure to the agent of harm (in that case, asbestos). (3) Material contribution to risks of damage 6.77 Where there are several potential causes of harm, some of which are tortious and some of which are natural, the basic rule is that the plaintiff can succeed only if he proves on a balance of probabilities that the damage in question is attributable to the tort (Wilsher v Essex Area Health Authority (1988)). 162 Chapter 6: Negligence 6.78 There is, however, an exception to the general rule in Wilsher. In the landmark decision of Fairchild v Glenhaven Funeral Services Ltd (2003), where several defendants consecutively expose the plaintiff to the same risk involving the same agent of harm, the defendants may be jointly and severally liable, even when it is impossible to determine scientifically which of them actually caused the plaintiff ’s damage. In this case, the worker had contracted mesothelioma after being exposed to asbestos dust at different times by more than one employer or occupier of the premises. According to the state of scientific knowledge in Fairchild, it was not possible for a plaintiff to prove on a balance of probabilities that the damage suffered was caused by the employer or occupier’s conduct, though each had materially increased the risk that the plaintiff would contract mesothelioma. It was clear that the plaintiff had contracted mesothelioma. The House of Lords held that, in the circumstances, the exception applied and hence, the defendant’s conduct had caused the damage. The decision to provide the plaintiff in the case with a remedy was based on grounds of fairness. 6.79 The prior decision in McGhee v National Coal Board (1973) was generally regarded as illustrative of the Fairchild exception. It was held in McGhee that in circumstances where a defendant has sole control over the agent of harm, he may be liable even if the plaintiff can establish only that the defendant negligently increased the risk of harm. The court found that the defendant’s (employer’s) failure to provide showers for the plaintiff (employee) to wash away the brick dust that the plaintiff was exposed to whilst working in a kiln had materially increased the risk of the plaintiff developing dermatitis. This was despite the fact that scientific knowledge could not establish that the dermatitis was caused by brick dust during the period of the defendant’s failure to provide the showers. Yet, the defendant was held to have caused the damage. 6.80 In Barker v Corus (UK) plc (2006), another asbestos-related mesothelioma case, the House had to decide on the scope of the Fairchild exception. The facts in Barker were slightly different from those in Fairchild. In Barker, the first two exposures were due to breaches of duty by employers, similar to Fairchild. However, the last exposure in Barker involved a failure by the plaintiff himself to take reasonable care for his own safety during the period of his self-employment. Would the Fairchild exception nevertheless be applicable here? Notwithstanding the different facts, the answer, according to the House of Lords in Barker, was “yes”. However, the House of Lords 163 Principles of Singapore Business Law (Lord Rodger dissenting) decided that, unlike in Fairchild, the defendants are not jointly and severally liable, but are liable only for an aliquot share, apportioned according to their respective contributions to the risks (but see subsequent UK Compensation Act 2006 which entitles the claimant to make a claim in full from a single defendant). The relevant factors for determining the appropriate apportionment may include the duration of exposure, the intensity of exposure and the type of asbestos involved. (4) Loss of Chance 6.81 It is fairly common for doctors as expert witnesses to assess the degree of likelihood of recovery or the extent of the illness developing in a particular case. In the case of Hotson v East Berkshire Health Authority (1987), the plaintiff fell and injured his knee. The doctor was negligent in his diagnosis. If the doctor had properly diagnosed the injury, there was only a 25 per cent chance that the injury would have healed and that the complications of avascular necrosis would not have developed. The court in Hotson held that causation was not, in this case, proved on a balance of probabilities and the defendants were not liable. 6.82 In Gregg v Scott (2005), there was a negligent delay by the defendant doctor in the diagnosis and treatment of the plaintiff suffering from cancer. This delay increased the latter’s chances of a premature death from 25 to 42 per cent. However, there was no evidence that the delay would, on a balance of probabilities, have caused premature death. The House of Lords (Lord Nicholls and Lord Hope dissenting) held, consistent with Hotson, that the plaintiff could not recover damages in respect of the alleged additional chance that he would suffer premature death caused by the delay. Legal Causation 6.83 In determining the issue of causation, one should also take note of the potential effect of a novus actus interveniens (“new intervening act”). This novus actus interveniens might be an act of the plaintiff or third party or even a natural event that takes place between the defendant’s alleged negligence and the damage that ensued. Where an act or omission is of such a nature as to constitute a wholly independent cause of the damage, the intervening conduct may be regarded as a novus actus interveniens (Muirhead v Industrial Tank Specialities Ltd (1986); TV Media Pte Ltd v De Cruz Andrea 164 Chapter 6: Negligence Heidi and another appeal (2004)). If there is a novus actus interveniens which is sufficient on the facts to break the chain of causation, the defendant’s breach would not be regarded as the cause of the plaintiff ’s damage. Cases in which the alleged novus actus interveniens was sufficient to break the chain of causation normally involve intervening acts that are unreasonable, deliberate, reckless or unforeseeable (McKew v Holland & Hannen Cubitts (Scotland) Ltd (1969); Wright v Lodge (1993); Poh Kim Ngoh v Yap Chwee Hoe (1968–1970)). 6.84 Another legal causation issue involves situations where one tort is followed by another tort or a natural event. In Baker v Willoughby (1970), the plaintiff injured his left leg in a road accident. He was later shot in the left leg by an armed robber. It was held that the defendant remained liable for the injury, even though the effects of his negligence had been wiped out by the second tort. However, where the second event is a natural cause which wipes out the physical effects of the first tort, the tortfeasor’s liability ceases at the point when the natural supervening condition manifests itself (Jobling v Associated Dairies (1982)). Otherwise, the defendant would be liable for damage which would have occurred naturally as part of the “vicissitudes of life”. The Singapore Court of Appeal decision in Salcon Ltd v United Cement Pte Ltd (2004) stated that the Baker approach should not be adopted for commercial disputes and appeared to prefer the Jobling approach. REMOTENESS OF DAMAGE General Principles 6.85 The test for remoteness of damage was originally embodied in the old case of Re Polemis and Furness Withy & Co (1921). In that case, the plaintiff ’s ship was destroyed by a plank falling into a hold. The hold contained some petrol vapour, which ignited due to a spark created by the falling plank. Though the presence of petrol vapour in the hold was not foreseeable, the fire caused was a direct consequence of the defendants’ breach of duty in allowing the plank to fall into the hold. 6.86 The test of “reasonable foreseeability” in the case of Overseas Tankship (UK) Ltd v Morts Dock & Engineering Co Ltd (or Wagon Mound (No 1)) (1961) later superseded the test of “direct consequence” in Re Polemis. According to Wagon Mound (No 1), the loss would not be too remote where the type 165 Principles of Singapore Business Law of loss which actually occurred was reasonably foreseeable, notwithstanding that the precise extent of the loss was not foreseeable. On the facts of Wagon Mound (No 1), the defendants (charterers of ship) breached their duty in spilling fuel oil which spread to the plaintiff ’s wharf, thereby causing damage to the wharf. The molten metal from the plaintiff ’s welding works on the wharf had set fire to the cotton waste floating on the oil. Though the fire damage was a direct consequence of the defendants’ breach, the plaintiff ’s claim in negligence failed. This was because the Privy Council determined that it was not foreseeable that the fuel oil would burn in water. 6.87 In the subsequent case of Wagon Mound (No 2) (1967), the facts were largely similar except that the plaintiffs in that case were the shipowners. The defendants were found liable in Wagon Mound (No 2) due primarily to the evidence of the ship’s chief engineer that there was a real risk that fire will result. The court decided that the defendants could not neglect the risk if it was easy in the circumstances to eliminate those risks (see para 6.58). 6.88 To further illustrate the concept of foreseeability as to the type of damage, let us examine the House of Lords decision in Jolley v Sutton London Borough Council (2000). The plaintiff, a schoolboy, suffered spinal injuries when an abandoned boat left on the grounds of a block of council flats owned by the defendant fell on the plaintiff. On the facts, the plaintiff and his friend were attempting to repair the boat that was propped up with a car jack by the boys. Unfortunately, the boat fell on the plaintiff, causing severe injuries. The Court of Appeal took the view that whilst it was foreseeable for the boys to be attracted to the abandoned boat and engage in “normal play”, it was not reasonably foreseeable that they would repair it and thereby sustain severe injuries due to its collapse. The House of Lords disagreed. Lord Steyn in Jolley stated that the boys’ activities were no different from normal play and can take the form of “mimicking adult behaviour”. His Lordship also cited the case of Hughes v Lord Advocate (1963) for the proposition that as long as the cause of the accident was a “known source of danger”, the defendant would be liable even if the accident was caused in a way which could not have been foreseen. Lord Hoffman in Jolley added that the actual injury was within the trial judge’s broad description of the risk that the children would “meddle with the boat”. Hence, the defendants were liable. 166 Chapter 6: Negligence Special Circumstances of the Plaintiff 6.89 The general rule is that the defendant has to take the plaintiff as he or she is, with existing predispositions (known as the “eggshell skull rule”). In Smith v Leech Brain & Co Ltd (1962), the plaintiff burnt his lip due to the defendant’s negligence. As the plaintiff had a pre-cancerous condition, the lip became cancerous due to the burn. The defendant was held to be liable for the entire damage. 6.90 However, will a defendant be liable for additional damage which the plaintiff suffers due to its impecuniosity? In the old English case of Liesbosch Dredger v SS Edison (1933), the plaintiff ’s ship sank due to the defendant’s negligence. As the plaintiff could not purchase another ship due to its poor financial condition, it had to hire a ship instead at a higher rate. It was in fact cheaper to purchase a ship than to hire one. The English court decided that the plaintiff could not later recover from the defendants the additional costs of the hire that were due to the plaintiff ’s impecuniosity. This decision appears to run counter to the doctrine of mitigation as the plaintiff would have been obliged to take reasonable steps, as he had done, to obtain a substitute ship in order to reduce his losses. It should also be noted that the Liesbosch Dredger principle is inconsistent with the eggshell skull rule described above. The position in Liesbosch Dredger has also been doubted in the case of Alcoa Minerals of Jamaica Inc v Broderick (2002) which allowed a claim for increased costs in repairing the plaintiff ’s roof notwithstanding that the repair could not be undertaken earlier due to the plaintiff ’s impecuniosity, and was subsequently overruled by the House of Lords in Lagden v O’Connor (2004). More importantly, the Singapore Court of Appeal has recently confirmed that the Liesbosch Dredger principle should not be applied in Singapore (Ho Soo Fong and another v Standard Chartered Bank (2007)). MITIGATION OF DAMAGE 6.91 It is the defendant’s burden to show that the plaintiff ought to have taken reasonable steps to prevent or reduce the plaintiff ’s loss. If the defendant is able to discharge its burden, the loss claimable by the plaintiff would be reduced accordingly. 167 Principles of Singapore Business Law ASSESSMENT OF DAMAGE 6.92 The main purpose of damages in the tort of negligence is to compensate for losses suffered (ie, to restore the plaintiff as far as possible to the position he or she would have been if not for the defendant’s negligence). 6.93 In personal injury cases, the plaintiff can claim for general damages such as pain and suffering, loss of amenities (eg, the loss of capacity due to the loss of a limb) and future loss of earnings. In addition, special damages such as loss of earnings (pre-trial) and medical expenses that have been reasonably incurred may, subject to proof, be recovered. In death cases, a claim for bereavement expenses may be made for the benefit of certain specified dependents (s 21 Civil Law Act (Cap 43, 1999 Rev Ed)). The quantum of damages for property damage is normally based on the costs of repair or diminution in value of the property. Assessment of damages in economic loss cases is intimately connected to the ascertainment of the precise scope of duty of care in a particular case (eg, whether the duty was merely to supply information or to advise on a purported transaction) which may result in quite different quantifications of damages. DEFENCES Ex Turpi Causa 6.94 The phrase ex turpi causa non oritur actio means that no action ought to be founded on a wicked act. As a defence, it has a limited application in the tort of negligence. The fact that the plaintiff is involved in some wrongdoing does not of itself provide a good defence to the defendant. For instance, a plaintiff who does not have a work permit to work in Singapore does not prevent him from claiming damages against the defendant who had negligently caused the plaintiff ’s injuries: Ooi Han Sun v Bee Hua Meng (1991). However, as stated by the court in Ooi Han Sun, public policy dictates that the plaintiff in such a case cannot be compensated on the basis of what he might have earned by working illegally in Singapore. 6.95 For the defence of ex turpi causa to arise, the plaintiff ’s wrongdoing must be sufficiently connected with the damage he suffered, and the damage caused by the defendant should be proportionate to the plaintiff ’s wrongdoing. The English courts have allowed the defence in fairly exceptional cases such 168 Chapter 6: Negligence as Ashton v Turner (1981) (where the plaintiff suffered the injury in the course of committing a crime together with the defendant) and Clunis v Camden and Islington Health Authority (1998) (in which the plaintiff claimed against the health care authority for the latter’s negligent omission to provide him with psychiatric care which, it was alleged, resulted in the plaintiff killing a person). In Stone & Rolls Ltd v Moore Stephens (2009), the liquidator of the plaintiff company claimed that the auditors were negligent in failing to detect the fraud committed by S, a director and shareholder of the company against certain banks. S was the sole directing mind and will of the company and thus the fraud was imputed to the company. The auditors were adjudged not liable due to the defence of ex turpi causa. 6.96 In the recent Singapore decision of United Project Consultants Pte Ltd v Leong Kwok Onn (trading as Leong Kwok Onn & Co) (2005) (see para 6.26 for the facts), the court opined that the defence of ex turpi causa could include, apart from criminal offences, other forms of reprehensible or grossly immoral conduct. On the facts of the case, the defence of ex turpi causa did not apply to defeat the action in negligence. The court found that the plaintiff had not connived to cheat the IRAS and thus did not engage in an act so culpable as to attract the defence. The plaintiff had merely committed the statutory offence under the Income Tax Act (Cap 134, 2008 Rev Ed) of making incorrect tax returns which was not criminal in nature, reprehensible or grossly immoral. This was sufficient to deny the defence of ex turpi causa but the Court of Appeal went a step further. It observed that the defendant was engaged by the plaintiffs precisely to avoid the economic loss (namely, the penalty imposed by the IRAS) suffered by the plaintiffs. Thus, the defendant should not be allowed to rely on a consequence (ie, the penalty imposed by the IRAS) that was directly caused by the defendant’s own failure in the first place, in order to absolve the defendant from liability. Volenti Non Fit Injuria 6.97 The issue is whether the plaintiff had acted freely and voluntarily with full knowledge of the nature and extent of the risks of the defendant’s negligence and consented, whether expressly or impliedly, to those risks that resulted in the tort. If this is the case, the defendant has a complete defence. 169 Principles of Singapore Business Law 6.98 The defence is generally applicable to absolve negligence liability for injuries suffered in the context of participation in sporting activities involving decisions and actions that have to be taken swiftly in the “agony of the moment”, though it is unlikely to cover intentional and reckless behaviour of the defendant (see Wooldridge v Sumner (1963)). The defence applied where the plaintiff was aware of the nature and extent of the risks and consented to those risks in the participation of inherently dangerous activities in deliberate breach of his employer’s orders and statutory regulations (ICI v Shatwell (1965)). The defence did not, however, apply where the plaintiff took conscious risks to effect rescue in emergency circumstances that had arisen from the defendant’s negligent conduct (Haynes v Harwood (1935)). The court may take into consideration the brave acts of the plaintiff in such rescue cases. 6.99 Section 2 Unfair Contract Terms Act (Cap 396, 1994 Rev Ed) (“UCTA”) provides that a person’s agreement to or awareness of a term or notice purporting to exclude or restrict liability does not necessarily constitute a voluntary acceptance of the risks. Full knowledge of the nature and extent of the risks and consent would have to be shown by the defendant in order to successfully raise the volenti defence. Exemption of Liability 6.100 In this section, we examine clauses or notices which seek to exempt the defendant from negligence liability. These exemption clauses or notices might either attempt to exclude liability entirely or to merely limit the liability of the defendant. For the defendant to rely on exemption clauses or notices to exempt liability, he would first have to show that these exemption clauses have been incorporated into the contract with the plaintiff or in a notice that the defendant had taken reasonable steps to bring to the attention of the plaintiff. Secondly, the defendant would have to show that the language of the clause or notice covers the situation in question. For instance, did the contract or notice sufficiently exclude liability for damages arising from the defendant’s negligence? Thirdly, the exemption clause or notice must not be rendered unenforceable by the UCTA. A defendant cannot exclude or restrict its liability for negligence which results in personal injury or death (s 2(1) UCTA). In respect of damage outside of personal injury or 170 Chapter 6: Negligence death (eg, property damage and financial losses), the effectiveness of the exclusion or limitation clause is subject to satisfying the requirements of reasonableness (s 2(2) UCTA) (see also Smith v Eric S Bush (1990)). Contributory Negligence 6.101 As indicated earlier, the doctrine of contributory negligence serves only as a partial defence. In this regard, s 3 Contributory Negligence and Personal Injuries Act (Cap 54, 2002 Rev Ed) reads: (1) Where any person suffers damage as the result partly of his own fault and partly of the fault of any other person or persons, a claim in respect of that damage shall not be defeated by reason of the fault of the person suffering the damage, but the damages recoverable in respect thereof shall be reduced to such extent as the court thinks just and equitable having regard to the claimant’s share in the responsibility for the damage: Provided that — (a) this subsection shall not operate to defeat any defence arising under a contract; (b) where any contract or written law providing for the limitation of liability is applicable to the claim the amount of damages recoverable by the claimant by virtue of this subsection shall not exceed the maximum limit so applicable. [emphasis added] 6.102 A plaintiff ’s negligence will result in a reduction of damages only where it is causally relevant to the damage which he or she has sustained. The apportionment of liability as between the plaintiff and the defendant depends on their respective causative potency and blameworthiness. Where the defendant’s liability in contract is concurrent with an identical tortious duty, the defendant could avail himself or herself of the defence of contributory negligence (Fong Maun Yee v Yoong Weng Ho Robert (1997); Forsikringsaktieselskapet Vesta v Butcher (1989); Jet Holding Ltd and others v Cooper Cameron (Singapore) Pte Ltd and another and other appeals (2006)). To reduce damages based on contributory negligence, there is no need for the defendant to show that the plaintiff had been in breach of a legal duty of care (Khoo Bee Keong v Ang Chun Hong and another (2005)). 171 Principles of Singapore Business Law OTHER ISSUES 6.103 We should examine the following issues related to the tort of negligence: vicarious liability, director’s liability for a company’s negligence, concurrent liability in tort and contract as well as the limitation periods for bringing an action in negligence. Vicarious Liability 6.104 Employers are vicariously liable for the torts committed by their employees in the course of their employment. This means that an employer is legally liable to the third party who suffers harm due to the employee’s negligence in the course of employment. Vicarious liability is based on various rationales: the employer has deeper pockets, exercises control over the employee and benefits from the employee’s work. 6.105 One criterion of vicarious liability is the existence of an employer–employeee relationship. Apart from any relevant terms of the contract between the parties, the precise relationship depends on the degree and extent of control by the employer over the employee’s method of work, whether the worker is sufficiently integrated into the organisation of the employer and whether the employee is acting on behalf of the employer or on his own account. The other important criterion (ie, “in the course of employment”) relies on the test of “close connection” between the nature of the employment and the tort committed as well as several policy considerations (eg, compensation for vulnerable victims of the tort and deterrence against employers)(see Skandinaviska Enskilda Banken AB (Publ), Singapore Branch v Asia Pacific Breweries (Singapore) Pte Ltd (2011)). 6.106 If the worker who committed the tort is not an employee of the defendant but merely an independent contractor, the defendant is not vicariously liable. It is nevertheless possible to claim against the defendant directly if the latter was negligent in engaging the independent contractor and that the negligence resulted in the plaintiff ’s loss. The employer may, in certain circumstances, be under a duty, where the working conditions are inherently dangerous, to exercise a significant degree of supervision and control over the independent contractors (see dicta in Mohd bin Sapri v Soil-Build (Pte) Ltd (1996)). 172 Chapter 6: Negligence Director’s Liability for Company’s Negligence 6.107 The director of a company is not generally liable for the company’s negligent conduct. The director is regarded in law as a separate entity from the company and hence the tortious acts or omissions of the company cannot normally be imputed to the directors. However, where the director in question is clearly the “controlling mind and spirit” of the company, the director may be personally liable for authorising, directing or procuring the company’s negligent acts, as was the case in TV Media Pte Ltd v De Cruz Andrea Heidi and another appeal (2004). In that case, the director was also a principal shareholder of the company. Based on the above, the corporate veil was lifted. The Singapore Court of Appeal in the TV Media case also stressed that a director would be found liable in negligence for the company’s negligent acts only in exceptional circumstances and, as such, the decision would not open the floodgates of litigation. 6.108 Apart from the above case, a director may be personally liable in negligence if he is shown to have voluntarily assumed personal responsibility to the plaintiff, and the assumption of responsibility was reasonably relied upon by the plaintiff. Whether such assumption arises in a particular case depends on the parties’ conduct, words and the surrounding circumstances objectively construed (Williams v Natural Life Health Foods Ltd (1998)). Concurrent Liability in the Tort of Negligence and in Contract 6.109 The oft-cited case on concurrent liability is Henderson v Merrett (1995). In that case, shorn of the detailed facts, the issue was whether the plaintiff, who had a contractual relationship with the defendants, could nevertheless sue the defendants in tort to avail himself of the more favourable limitation period for tort claims (as compared to contractual claims). The House of Lords gave an affirmative answer. The plaintiffs could select the tortious remedy which was more advantageous in the circumstances. The tort remedy would be applicable unless it is limited or excluded by the agreement of the parties concerned. Limitation Periods 6.110 According to s 6(a) Limitation Act (Cap 163, 1996 Rev Ed) (“LA”), an action founded on a tort shall not be brought after the expiration of six 173 Principles of Singapore Business Law years from the date on which the cause of action accrued. In the context of negligence, this date refers to the date that the damage occurred. This section is, however, subject to other provisions in the Act, namely, s 24A, which provides that, with respect to a negligence claim for damages for personal injuries, the action shall not be brought after the expiration of: (1) three years from the date on which the cause of action accrued; or (2) three years from the earliest date on which the plaintiff has the knowledge required for bringing an action for damages in respect of the relevant injury, if that period expires later than the period mentioned in paragraph (1). For other claims for damages in negligence (eg, property damage and financial loss), the relevant limitation periods are six years from the date of the accrual of action and three years from the date of acquisition of both the knowledge required for bringing an action in respect of the relevant damage and knowledge of a right to bring such an action (s 24A(3) LA). (Note that there is an overriding time period of 15 years from the “start date” for actions in damages for negligence, nuisance and breach of duty: see s 24B LA. This means that the action cannot be brought after the expiry of the overriding time period even if the cause of action had not yet accrued: see s 24B(3) LA). 6.111 Under s 24A, an action may not be time-barred if it can be shown that the action was instituted within three years from the earliest date in which the plaintiff had acquired knowledge of his rights to bring a claim for the damage. In Chia Kok Leong and another v Prosperland (2005), as the action was instituted in May 2002, the plaintiff has the burden to show that it had acquired the relevant knowledge on or after May 1999. The onus on the defendants, on the other hand, is to show knowledge on the part of the plaintiff at an earlier date. 6.112 Knowledge of the factual essence of the complaint (as opposed to the details of the claim or whether the plaintiff had a legal claim in negligence) would suffice. It must be shown that the plaintiff possessed knowledge of material facts about the damage that would lead a reasonable person to consider it “sufficiently serious” to invoke legal proceedings (Lian Kok Hong v Ow Wah Foong (2008)). 174 Chapter 6: Negligence CONCLUSION 6.113 The tort of negligence has grown from its humble beginnings in Donoghue v Stevenson to be a very significant fault-based tort today. It is clearly instrumental in regulating business and other conduct and activities in Singapore. As we have seen, the courts have utilised legal mechanisms such as duty, breach, damage and defences to shape the contours of this expanding area of the common law whilst safeguarding the physical, mental, proprietary and economic interests of a person from the negligent conduct of another. In doing so, the courts should endeavour to strike a suitable balance between the application of concrete legal principles and the exercise of judicial discretion and policy to depart from those principles if and when such departure facilitates the proper development of tort law and where fairness and justice requires it. 175 Chapter 7 Offer and Acceptance 7.1–7.2 Introduction to the Law of Contract 7.3–7.5 7.6–7.7 Basic Terminology Offer and Acceptance 7.8–7.10 7.11–7.13 7.14–7.17 7.18–7.24 7.25–7.29 7.30–7.31 7.32–7.33 7.34 7.35–7.42 7.43–7.45 7.46–7.47 7.48–7.50 7.51 7.52–7.53 7.54–7.56 7.57–7.63 7.64–7.71 7.72–7.76 7.77–7.79 7.80 7.81–7.86 Offer Definition and Nature of Offer Offers to Public at Large Offer Distinguished from Invitation to Treat (1) Advertisements (2) Displays of goods for sale (3) Auction sales (4) Tenders Termination of Offer (1) Introduction (2) Revocation (3) Rejection and counter-offer (4) Lapse of time (5) Failure of a condition (6) Death Acceptance Definition and Nature of Acceptance General Principles (1) Acceptance must be final and unqualified (2) Acceptance must be communicated to offeror (a) General rule (b) Exception: The postal acceptance rule (c) Acceptance by silence? (d) Ignorance of offer (e) Cross-offers (f) Battle of forms Principles of Singapore Business Law 7.87–7.100 7.101–7.104 7.105 Some Issues Relating to Offer and Acceptance Certainty and Completeness Artificiality of Offer and Acceptance Rules Conclusion 180 Chapter 7: Offer and Acceptance INTRODUCTION TO THE LAW OF CONTRACT 7.1 In Part II we learnt about the two important branches of law, namely, criminal law and civil law. As regards the former, we dealt with the law relating to business crimes, and as regards the latter, we dealt with the law of torts. We now turn our attention to another important branch of civil law, the law of contract. In Part III we shall consider as to what is a contract, its formation, contents, termination and the remedies for breach of contract. 7.2 What is a contract? A contract is a legally binding agreement. For an agreement to be so binding, however, it must satisfy certain requirements of a valid contract. These are, first, there must be a meeting of the minds between the parties (consensus ad idem) as manifested through offer and acceptance (Chapter 7); second, there must be consideration and the intention to create legal relations (Chapter 8); third, parties must have the capacity to contract (Chapter 9); and fourth, the parties must freely consent to the agreement. The factors that may vitiate their free consent are mistake (Chapter 12), misrepresentation (Chapter 13), and duress and undue influence (Chapter 14). Further, a contract must not suffer from illegality (Chapter 15). BASIC TERMINOLOGY 7.3 Before we proceed, it is necessary to understand some of the terms that recur in the law of contract. In the paragraph above we referred to a “valid” contract as being an agreement that satisfies all the legal requirements. In this context there are other terms, namely, void, voidable and unenforceable contracts. A contract is said to be void when the law treats a contract as nullity, that is, as though it never existed at all, on account of some serious flaw, such as fundamental mistake. A contract is said to be voidable where the law treats the contract as valid when made but one of the parties to the contract has the right to avoid it, for example, on the ground of misrepresentation. In such a case, only the party who was induced to enter into a contract through misrepresentation can avoid it, but not the other party. The party entitled to avoid it can also opt to continue with the contract. Lastly, an unenforceable contract is one where there is a valid and legally binding contract but it cannot be enforced, for example, because of a provision of law. As an example, one cannot recover the debt after six years from the time when it was due because of the law of limitation. 181 Principles of Singapore Business Law 7.4 Then there are bilateral and unilateral contracts. All contracts are bilateral in the sense there must always be at least two parties to a contract. There must be mutual promises between the parties before an agreement between them can emerge. One party cannot impose his or her proposal on the other however persuasive or determined he or she may be, if the other party is unwilling to enter into an agreement with him or her. The main feature of a bilateral contract is that the offeror makes a promise in return for a promise on the part of the offeree. On the other hand, the term unilateral means one-sided. However, there is no such thing as a one-sided contract, as one party cannot enter into a contract with himself or herself. What it really means is that one party to a prospective contract has already done all that he or she is required to do under the contract, leaving only the other party to do his or her part. Thus, in a unilateral contract, the offeror makes a promise in return for an act to be performed by the offeree. Performance of this act by the offeree constitutes both the acceptance of the offer as well as consideration. Thus, where a person advertises a reward for finding a lost purse all that the other party has to do is to find the purse, and claim the reward. A contract arising from such an offer to the public at large is usually a unilateral contract but such offers may also be made to individuals. 7.5 Lastly, a word about the types of contracts. There are two categories of contracts, simple contracts and special contracts. Most contracts that are entered into for business and in everyday life are simple contracts. A reference to contract in this book is a reference to a simple contract, unless the context indicates otherwise. Simple contracts can be oral (also known as “parol contracts”) or in writing, or partly oral and partly in writing. Special contracts are formal contracts by deed or contracts under seal. Unlike simple contracts, they do not require consideration (see Chapter 8, para 8.44). They are used in a more formal setting such as a grant of a gift or purchase of land. Offer and Acceptance 7.6 We now turn to consider offer and acceptance. A contract is an agreement where the parties strike a bargain for themselves. It happens when one party makes an offer which the other party accepts. This may look simple in everyday contracts like boarding a bus or buying a loaf of bread but may be difficult to establish in more serious contracts involving long-drawn 182 Chapter 7: Offer and Acceptance negotiations. Yet for the contract to exist, it must be established that there was a meeting of minds (consensus ad idem) between the parties whereby they have thought about the same thing in the same manner before reaching an agreement. Since it is not possible to look into the minds of parties, it will be impossible to ascertain their subjective intentions. Indeed subjective intentions are irrelevant. The test of agreement is determined objectively, that is, by the external manifestation of their intentions through their actions as they may be reasonably understood by the other party. The Singapore High Court in Norwest Holdings Pte Ltd (in liquidation) v Newport Mining Ltd (2010) stated (at [34]) that the law is predominantly concerned with objective intentions of a party, and not his subjective or actual intentions. Specifically, the objective approach determines a party’s intentions by looking at all of his words and conduct directed towards his counterparty from the perspective of a reasonable man versed in business. Similarly, in Destiny 1 Ltd v Lloyds TSB Bank (2011) the English Court of Appeal noted (at [15]) that “communications, whether oral or written, are to be understood in the way that the reasonable person in the position of the recipient would have understood them”. 7.7 Consensus ad idem is established by applying the rules of offer and acceptance. Once the acceptance of a valid offer takes effect, a contract comes into existence provided other requirements are met. Both the parties will then be bound by their mutual promises. As to offer and acceptance in the context of electronic contracts, these are considered in Chapter 24. OFFER Definition and Nature of Offer 7.8 An offer has been defined as “an expression of willingness to contract on specified terms, made with the intention that it is to become binding as soon as it is accepted by the person to whom it is addressed” (see Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at p 8). It is “an intimation, by words and conduct, of a willingness to enter into a legally binding contract, and which in its terms expressly or impliedly indicates that it is to become binding on the offeror as soon as it has been accepted by an act, forebearance or return promise on part of the person to whom it is addressed” (see J Beatson, A Burrows and J Cartwright, Anson’s Law of Contract (29th ed, 2010) at p 33). Put in another way, “An offer, capable of being converted into 183 Principles of Singapore Business Law an agreement by acceptance, must consist of a definite promise to be bound provided that certain specified terms are accepted” (see M P Furmston, Cheshire, Fitfoot and Furmston’s Law of Contract (16th ed, 2012) at p 43). 7.9 Thus an offer is a proposal by one party indicating his willingness to be bound by certain terms provided they are unconditionally accepted by the other. The party making the offer is the “offeror” and the party to whom the offer is made is the “offeree”. The offer thus contains: (1) a proposal of the terms of the exchange; and (2) an expression of willingness to be bound as soon as the offeree manifests acceptance. An offer puts the offeror at risk: it confers a power on the offeree to bind the offeror at the precise moment of acceptance; thereafter the offeror loses his ability to withdraw from or further negotiate the arrangement (see Mindy Chen-Wishart, Contract Law (4th ed, 2012) at p 47). An offer may be made orally, in writing or by conduct. 7.10 The critical issue in this context is whether there is an intention to be bound. An objective approach is used in ascertaining whether there is an intention to be bound. As stated by the English High Court, an apparent intention to be bound may suffice where an alleged offeror by his words or conduct induces a reasonable person to believe that he intends to be bound, even though in fact he has no such intention (Maple Leaf Macro Volatility Master Fund v Rouvroy (2009)). This test embodies the principle of convenience because, as mentioned in para 7.6, it is not possible to read a person’s mind to ascertain his subjective intentions. Offers to Public at Large 7.11 In most cases an offer will be made to a particular person and only that person may accept the offer and no one else, for example, an offer of employment. However, an offer may also be made to a group or to the whole world. In such a case any member of that group or any member of the public, as the case may be, may accept the offer. An example of the latter is where the owner of a lost purse offers a reward to anyone who finds and returns it. 7.12 The principle that an offer can be made to the whole world was laid down by the English Court of Appeal in the famous decision in Carlill v Carbolic Smoke Ball Company (1893). The defendants were the manufacturers and vendors of the Carbolic Smoke Ball which they claimed could prevent influenza. They advertised in the newspapers stating that if anyone used 184 Chapter 7: Offer and Acceptance their smoke ball three times daily for two weeks and in accordance with the printed directions supplied with each ball and still caught influenza, they would pay that person £100. To prove that they were serious about their claim, they said they had deposited £1,000 with their bankers. Carlill bought the smoke ball and used it as directed and yet caught influenza. She, therefore, claimed the £100 but the defendants refused to pay. 7.13 The court had to settle a number of issues in coming to a decision. First was the argument that the advertisement was a mere puff and that there was no intention to create legal relations. The court rejected this argument on the ground that the advertisement itself stated that the defendants had deposited £1,000 with the bank which showed that they were serious about their promise. Second, whether the apparent promise by the defendants was indeed an offer since it was not made to any specific person or group of persons but to the world at large. The court held that an offer could indeed be made to the world at large. Third, whether the plaintiff should nevertheless fail in her claim on account of her failure to notify her acceptance to the defendants. The court rejected this argument also on the ground that no such notification was required since this was a unilateral contract. Lastly, the contract was supported by consideration. Offer Distinguished from Invitation to Treat 7.14 Sometimes one party, instead of making an offer, may invite others to make an offer. This is known as an invitation to treat. It is simply an expression of willingness to enter into negotiations with the other party. At this stage there is no intention to be bound. The distinction between the two is important in that if the proposal is an offer, a binding contract will come into existence without further negotiation upon its acceptance. Thereafter any attempt to escape from the contract would amount to a breach of contract. On the other hand, if it is an invitation to treat, and if the response of the other party amounts to an offer, the person inviting it may accept or reject the offer. 7.15 The wording is not conclusive — a statement may be an invitation to treat, although it contains the word “offer” (Spencer v Harding (1870)). Likewise in Datec Electronic Holdings Ltd v United Parcels Service Ltd (2007) an “offer” of carriage subject to certain restrictions was regarded as an invitation to treat. Had it been regarded as an offer in the strict sense, there would have been 185 Principles of Singapore Business Law no contract when the shipper tendered goods that did not comply with the restrictions. Hence it was held that the offer was made by the shipper which was accepted by conduct by the carrier. As stated in Maple Leaf above (see para 7.10), in deciding whether or not one party made an offer to another, the court will objectively determine the intention of the party making the proposal, that is, whether a reasonable person in the shoes of the recipient of the proposal, observing the words and conduct of the first party, could have concluded that an offer had been made. Singapore law tracks English law in this regard. 7.16 In Soon Kok Tiang and others v DBS Bank Ltd and another matter (2012), a plaintiff investor made an application for a declaration that the series of notes known as “DBS High Notes 5” (“HN5”) was void at the time of their issuance and an order that the defendant bank repay each of the plaintiffs the principal amounts they had invested in HN5. In refusing the application, the Singapore High Court could not be persuaded to hold that the launch of HN5 was an offer (at [19]). Although the launch of HN5 was termed an “offering” and the period for application called the “Offer Period”, the launch of HN5 was not an offer capable of being accepted to form a contract in law. The defendant bank retained the right to reject or accept any application without the need to give reasons. The launch of HN5 was thus an invitation to treat. It was the individual investor who, by submitting the application form, made an offer to the defendant to buy into HN5. The HN5 contract came into existence with the defendant’s acceptance of that offer. 7.17 There are situations in everyday life when what appears to be an offer is held by law to be an invitation to treat. In many such established situations, the courts have already decided whether there is an offer or an invitation to treat by treating certain situations as indicating the presence or absence of the intention to be bound. Some of these situations are dealt with below. (1) Advertisements 7.18 It is now common for businesses to advertise in the media including newspapers and magazines, TV, radio and the Internet. Also in the same category are catalogues, brochures and price lists. Generally, these advertisements are considered to be invitations to treat. 186 Chapter 7: Offer and Acceptance 7.19 The case often cited for this is Patridge v Crittenden (1968). Patridge advertised in a magazine, “Bramblefinch cocks and hens, 25s each”. He was charged with “offering for sale” a wild bird contrary to the provisions of the Protection of Birds Act 1954 and was convicted at the Magistrates’ Court. However, his conviction was quashed on appeal on the grounds that his advertisement was not an offer but an invitation to treat. According to Lord Parker, “when one is dealing with advertisements and circulars, unless they come from manufacturers, there is business sense in their being construed as invitations to treat and not as offers for sale”. Advertisements placed in newspapers and magazines are usually considered invitations to treat on the basis that people who read the advertisements may want to negotiate further. Further, the intending seller may have limited number of items to sell, with the result that he may not be in a position to sell to all who might respond to the advertisement. 7.20 Similar principles apply to electronic trading on the Internet or e-commerce. Advertisements posted on a website generally amount to invitations to treat (see s 14 Electronic Transactions Act (Cap 88, 2011 Rev Ed) discussed in Chapter 24, paras 24.15–24.16). Here the customer is said to be making the offer which the seller may accept or reject. So if a seller makes a mistake by quoting a ridiculously low price for the goods, he could refuse to sell the goods at the advertised price. It would be absurd if the seller were to honour all such “contracts”. It has long been established that a party cannot snap up an offer which he knows to be mistaken (Hartog v Colin & Shields (1939)). 7.21 This principle was applied in the Singapore case of Chwee Kin Keong and others v Digilandmall.com Pte Ltd (2004). The defendant advertised on its website laser printers for sale. On account of an employee error, the price quoted was $66 each, instead of the correct price of $3,854 each. The six plaintiffs spotted the bargain and quickly placed orders on the website for 1,606 printers in total at $66 each. Upon receiving the orders, the defendant’s automated response system sent emails to the plaintiffs confirming each purchase. When the defendant realised its error, it promptly removed the advertisement from the website. It informed all who had placed orders that the price was a mistake, and that it would therefore have to decline all orders. The plaintiffs sued, insisting that the confirmed orders were binding on the defendant. 187 Principles of Singapore Business Law 7.22 In the Singapore High Court, V K Rajah JC (as he then was) considered whether existing contract principles applied to Internet contracts and said they could. However, he cautioned against applying them the same way as they applied to traditional contracts. In his view, Internet merchants have to be cautious as to how they present an advertisement, since this determines whether the advertisement will be construed as an invitation to treat or a unilateral contract. Loose language may result in inadvertently establishing contractual liability to a much wider audience (purchasers) than resources permit. The case was eventually decided in favour of the defendant on appeal on the basis of unilateral mistake. However, the High Court’s views on Internet contracts mentioned above were not disputed and remain pertinent. 7.23 Hence, despite the general rule, the possibility cannot be ruled out where an advertisement on the Internet may constitute an offer itself rather than an invitation to treat. This is especially so where the buyer is guided on screen step by step by the seller until he clicks “I accept” and pays the purchase price online. The key element in such cases is the intention of the parties to be gathered from the circumstances of the particular case. 7.24 Nevertheless there are certain cases where an advertisement may amount to an offer rather than an invitation to treat. This was the case in Carlill v Carbolic Smoke Ball Co (see para 7.12). In that case, the court found an intention to be bound. Similarly in an American case, Lefkowitz v Great Minneapolis Surplus Store (1957), the advertisement stated: “Saturday, 9 am sharp; 3 brand new fur coats, worth $100, first come first served, $1 each”. The plaintiff was the first customer to present himself at the appointed time but the defendant refused to sell the coat to him. He successfully sued for breach of contract and the Supreme Court of Minnesota held that the advertisement amounted to an offer. Thus, in relation to advertisements, the question whether there is an offer or merely an invitation to treat turns on whether there is an intention to be bound. (2) Displays of goods for sale 7.25 Are the goods on display with price tickets on the supermarket shelves or in shop windows offers or invitations to treat? Holding it as the one or the other will result in a different outcome. If it is the former, the mere picking up of such goods might result in a binding contract. If it is the latter, there would be no contract since it is the customer who makes the offer. 188 Chapter 7: Offer and Acceptance 7.26 The general principle is that all such displays are regarded as invitations to treat rather than offers. This was affirmed in Fisher v Bell (1960), where the defendant had displayed flick knives in his shop window and was convicted of the criminal offence of offering such knives for sale. However, his conviction was quashed on appeal. The court held that the display of goods with a price ticket attached in a shop window is an invitation to treat and not an offer to sell. 7.27 The leading case in this regard is Pharmaceutical Society of Great Britain v Boots Cash Chemists (1953). The defendants were charged with the offence of selling drugs which could be sold only under the supervision of a qualified pharmacist. They operated a self-service shop where the goods for sale were displayed on shelves in packaging with the prices marked on them. Customers entering the shop picked up whatever goods they wished to buy and took them to a cashier near the exit. There was no pharmacist present near the shelves but a registered pharmacist was present near the cash desk and could prevent a customer from buying any listed drug. The Court of Appeal in this case had to identify the precise time when a contract was concluded. This required them to decide whether the display of goods on the open shelves in a self-service store amounted to an offer of goods for sale or an invitation to treat. The court held that the display of goods was an invitation to treat. The customer made the offer to buy at the cash desk and the sale was completed when the cashier accepted the offer. If it were otherwise, then the customer concerned would be unfairly bound once the article was placed in the basket and would not be able to change his mind to substitute it with another. The shopkeeper also would be in deep trouble if he ran out of stock. 7.28 Two practical consequences of this rule are that, first, the shop does not have to sell the goods at the marked price especially where it has misquoted the price, and second, the buyer cannot insist upon buying a particular item on display even if the shop has run out of stock. 7.29 The court’s reasoning, however, is not without criticism. Legal commentators have argued that a modern store or a supermarket is not a place for bargaining. There is also no reason to hold that the customer will be prejudiced by being automatically bound if he were to pick up priced goods, as that act in itself is too equivocal to constitute an act of acceptance. Lastly, the argument that the shopkeeper would be unfairly bound if he were 189 Principles of Singapore Business Law to run out of stock was not tenable. He could overcome this difficulty by holding that his “offer” was open only “while stocks last”. (3) Auction sales 7.30 At an auction sale, the call for bids by the auctioneer is an invitation to treat. The bids made by those present at the auction are offers. The auctioneer selects the highest bid and the contract is completed by the fall of the hammer. It follows from this that until the hammer fell, a bidder is free to withdraw his offer. This is now confirmed by s 57(2) Sale of Goods Act (Cap 393, 1999 Rev Ed). 7.31 It has been held that where an auction is advertised, that by itself does not constitute an offer. Therefore, a prospective bidder who travels to an auction to find that the advertised lot was subsequently withdrawn cannot recover damages for breach of contract (Harris v Nickerson (1873)). However, advertising that an auction will be “without reserve” amounts to an offer by the auctioneer that once the auction has commenced the lot will be sold to the highest bidder however low the bids may be (Warlow v Harrison (1859)). (4) Tenders 7.32 Large businesses and public authorities often award contracts by inviting interested parties to tender for the business. Such an invitation to tender is an invitation to treat and not an offer (Spencer v Harding (1870)). The offer is made by the person who submits the tender. The acceptance takes place when the person inviting the tender accepts one of them. However, the English Court of Appeal has held that an invitation to tender could give rise to a binding contractual obligation to consider tenders conforming to the conditions of the tender (Blackpool and Flyde Aero Club Ltd v Blackpool Borough Council (1990)). 7.33 There are circumstances where the courts have held that the invitation to tender was, in fact, an offer. In Harvela Investments Ltd v Royal Trust Co of Canada (1986), the House of Lords had to consider whether an invitation to tender for the purchase of shares which stated that the vendor would accept the highest “offer” was itself an offer to sell. The first defendants decided to dispose of shares in a company by sealed competitive tender. They invited the two parties most likely to be interested in the shares to submit tenders, 190 Chapter 7: Offer and Acceptance promising to accept the highest offer. The plaintiff ’s bid was higher but the second defendants’ lower bid was accompanied by a clause which stated “or $100,000 in excess of any other offer”. The first defendants accepted the second defendants’ bid to be the higher of the two. The House of Lords held that given the expressed intention of the vendor to sell to the highest bidder, the invitation to tender was a contractual offer. It held that the second defendants’ “referential bid” was invalid. The purpose of competitive tendering was to secure a sale at the best possible price. If both parties had submitted a referential bid it would have been impossible to conclude the contract. Termination of Offer (1) Introduction 7.34 Where an offer has been accepted, a binding contract comes into existence and the offer ceases to exist. Thereafter, any attempt to disclaim the obligations therein will amount to a breach of contract. However, if an offer is terminated prior to its acceptance no contract can come into existence. There are five ways in which an offer may be terminated. (2) Revocation 7.35 The offeror can revoke his offer at any time before it is accepted by the offeree. Once revoked, the offer ceases to exist and it is no longer possible for the offeree to accept it. In order to be effective, however, revocation must be communicated to the offeree. In Byrne v Van Tienhoven (1880), the defendants, a Cardiff company, mailed a letter on 1 October to New York offering to sell to the plaintiffs 1,000 boxes of tinplates. The plaintiffs received the letter on 11 October and immediately accepted by telegram and confirmed by a letter posted on 15 October. (Acceptances by telegram are effective as soon as they are sent; see the postal rule at paras 7.64–7.71). Meanwhile, on 8 October, the defendants had sent a letter revoking the offer which reached the plaintiff on 20 October. The court held that there was a binding contract. The revocation was not effective since the contract had come into existence nine days before the letter of revocation reached the plaintiff. 7.36 However, it appears from case law that the revocation of an offer does not have to be communicated by the offeror himself; communication may be 191 Principles of Singapore Business Law made by some other reliable source. Dickinson v Dodds (1876) appears to suggest that an implied revocation is possible. If the offeree comes to know of the revocation of the offer by the offeror through a third party, that would be sufficient to terminate the offer. In this case, the defendant offered to sell a house to the plaintiff, the offer “to be left open until Friday, June 12, 9 am”. But on 11 June he sold the house to someone else. The plaintiff heard about the sale from his property agent the same day. Nevertheless he purported to accept the defendant’s offer by forwarding a written acceptance before 9 am on 12 June. The English Court of Appeal held that the defendant had validly withdrawn his offer and that the withdrawal was validly communicated to the plaintiff through a third party. 7.37 In a Singapore case, Overseas Union Insurance Ltd v Turegum Insurance Co (2001), the plaintiff company had entered into reinsurance contracts with the defendants. Owing to certain claims relating to the reinsurance contracts, the plaintiff decided to negotiate with the defendants on the reduction of the plaintiff ’s liability under these contracts. In March 1999, the defendant offered to accept a sum of US$220,000 from the plaintiff to reduce its outstanding liability. On 21 October 1999, the plaintiff purported to accept this offer. However, the defendant claimed that the offer had since been withdrawn by the defendant’s letter of demand for payment by the plaintiff of its full liability made on 5 October so that it was no longer capable of acceptance. The plaintiff insisted that the parties had entered into a binding agreement on 21 October. The Singapore High Court agreed with the defendant that the offer had been revoked. The court held that the maker of an offer is free to withdraw it at any time before it is accepted. Notice of withdrawal must be given and must actually reach the offeree to be effective. It is not necessary, however, that the notice of withdrawal be explicit. It was enough if the offeree is given information which would show that the offeror has changed his mind and no longer wants to proceed with the offer. This information need not even come directly from the offeror. 7.38 Although it is clear that the revocation must be brought to the attention of the offeree, there is uncertainty about the exact point at which it comes to his attention. For example, if revocation is made by post, revocation could be effective when the letter reaches his business or when he actually reads it. There is no clear authority on this point, but in The Brimnes (1975) the English Court of Appeal held that, in the case of a notice of withdrawal of a vessel sent by telex during ordinary business hours, the withdrawal was 192 Chapter 7: Offer and Acceptance effective when it was received on the telex machine. There was no requirement that it actually be read by any particular person within the organisation. 7.39 There is no legal obligation on the part of the offeror to keep the offer open for a specified period even if he had promised to do so. In Routledge v Grant (1828), the defendant offered to buy the claimant’s house, giving the claimant six weeks to consider the proposal. The court held that he could withdraw the offer at any time before acceptance, even though the deadline had not yet expired. The claimant could not accept the offer after it had been withdrawn. This is on the basis that an offeree cannot enforce an offeror’s promise to keep his offer open unless there is a separate contract supported by consideration. Such contracts are called “options”. A legally binding option will be created if the offeree provides some consideration in return for the offeror’s promise to keep the offer open. Thus in Mountford v Scott (1975), the purchaser of a house paid the seller £1 for an option to buy, exercisable within six months. The Court of Appeal held that the seller could not withdraw the offer before the option expired. 7.40 An offer may be revoked when it is replaced by a subsequent offer. The second offer must stipulate that it supersedes the earlier offer, so that it can no longer be accepted (Pickfords Ltd v Celestica Ltd (2003)). 7.41 The rule that revocation is effective only when it is communicated to the offeree causes some difficulty in unilateral contracts. In such cases acceptance is by performance of an act. The offeror is not aware if anyone has accepted or has started to accept the offer by looking for the lost item or by performing the act as required by the offeror. Under the usual rules of offer and acceptance, the offeror can always revoke the offer at any time before the offer is accepted. With regard to unilateral contracts, two issues need to be considered: first, the means by which revocation is to be validly effected, and second, whether a unilateral offer can be revoked once performance has begun. As to the first, it seems to be enough for the offeror to take reasonable steps to bring the withdrawal to the attention of such persons. Thus if the offer of a reward for finding a lost item was made through a newspaper advertisement, it would suffice to place another similar advertisement withdrawing the offer, although there is no guarantee that everyone concerned will see it. The second question poses some difficulty. One possible approach may be to proceed on the basis of there being two offers — a main offer and an implied offer not to revoke the main offer. 193 Principles of Singapore Business Law Box 7.1 Reflecting on the law Is it possible to revoke a unilateral offer once performance has started? Despite the traditional rule that an offeror can withdraw his offer any time before it is accepted, in the case of unilateral contracts, there is potential unfairness to people who may have spent considerable time and effort in response to an advertisement offering a reward for the recovery of a lost pet and in performing the conditions required in the advertisement. An alternative approach is that, if an offeree begins to perform his obligations within a reasonable time from the making of the offer, the offeror cannot revoke the offer. This is known as the “two-offer” approach. Here the offeror impliedly undertakes not to revoke the main offer once the offeree has commenced performance within a reasonable time. Yet another suggested approach is to allow the offeror to withdraw his offer at any time before full performance of the required act subject to compensation being paid to the offeree who has commenced performance by way of a suitable sum for his trouble in quantum meruit. The law in Singapore is not settled and the pros and cons of each approach need to be considered in deciding on the appropriate default approach to take on this matter. 7.42 The “two-offer” approach was endorsed by the English Court of Appeal in Daulia Ltd v Four Millbank Nominees Ltd (1978). Goff LJ said as obiter dicta, that the offeror is entitled to require full performance of the condition which he has imposed, and short of that, he is not bound. This is, however, subject to one important qualification which stems from the fact there must be an implied obligation being satisfied on the part of the offeror not to prevent the condition being satisfied, an obligation that arises as soon as the offeree starts to perform within a reasonable time. Until then the offeror can revoke the whole thing, but once the offeree has embarked on the performance, it is too late for the offeror to revoke his offer. In Singapore, Chan Sek Keong JC (as he then was) approved of this approach obiter in Dickson Trading (S) Pte Ltd v Transmarco Ltd (1989). (3) Rejection and counter-offer 7.43 An offer is terminated when the offeree rejects it. This may be done either expressly as when the offeree states that he has no interest in the offer, or impliedly, where he purports to accept the offer with conditions attached or makes a counter-offer. A counter-offer has two distinct effects. As the facts of Hyde v Wrench (1840) illustrate, first, it acts as a rejection of the original offer and accordingly, the original offer lapses; and second, it stands as a new offer 194 Chapter 7: Offer and Acceptance capable of being accepted by the offeror. In this case, the defendant offered to sell his farm to the plaintiff for £1,000. The plaintiff made a counter-offer of £950 which the defendant refused. The plaintiff then purported to accept the original offer to buy for £1,000. It was held that there was no contract. The counter-offer had the effect of rejecting the defendant’s original offer causing it to lapse. 7.44 However, sometimes it may be difficult to decide whether the offeree is making a counter-offer or is merely asking for additional information on the offer. In the latter case, there is no rejection of the offer. In Stevenson v McLean (1880), the defendant offered to sell a quantity of iron to the claimants for cash. The claimants asked whether they could have credit terms. When there was no reply to their enquiry, they accepted the terms of the original offer. However, the defendant sold the iron to someone else. It was held that the enquiry was a request for more information and not a rejection of the offer. Hence the defendant was liable for breach of contract. 7.45 The difference between the two situations discussed above is that a counteroffer seeks to introduce a new term, while a request for information merely seeks to clarify what the offer is. (4) Lapse of time 7.46 Where the offeror has specified a time limit by which the offer must be accepted, the offer will lapse if not accepted within that time. This is subject to the offeror’s right to revoke it earlier unless he has agreed to keep the offer open (see paras 7.35–7.37). However, if it is clear from the offeror’s conduct and other evidence that the terms of the supposedly lapsed offer continue to govern the relationship after the specified period, then the offer is still valid and capable of acceptance after the deadline (Panwell Pte Ltd & Anor v Indian Bank (No 2) (2002)). 7.47 Where the offeror has not specified a time limit, the offer will lapse after a reasonable period of time. What is a reasonable period of time would depend on the circumstances of each case. Thus in dealing with commodities whose prices fluctuate daily, the period will be shorter. In Ramsgate Victoria Hotel v Montefiore (1866), the defendant applied for shares in the plaintiff company in June and paid a deposit into their bank. Having heard nothing from the 195 Principles of Singapore Business Law company for five months, he was then informed in November that shares had been allotted to him, and asked for the balance due on them. He refused to pay. The court upheld his argument that five months was not a reasonable time for acceptance of an offer to buy shares, as the price of shares fluctuates rapidly. (5) Failure of a condition 7.48 An offer may be made subject to conditions which may be stated expressly by the offeror or implied by courts from the circumstances of the case. If such conditions are not satisfied, the offer is not capable of being accepted. For example, when a person offers to buy goods, it is implied that the offer is conditional on the goods remaining in the same condition as when the offer was made until acceptance. If goods are damaged before acceptance, then the offer will cease to exist. 7.49 In Financings Ltd v Stimson (1962), the defendant saw a car at the premises of a dealer on 16 March which he decided to buy. He signed a hire-purchase form provided by the plaintiff which stated that the agreement would be binding only when signed by the finance company. The defendant took possession of the car and paid the first instalment on 18 March. On 20 March, he returned the car because he was not satisfied with it. On 24 March, the car was stolen from the car dealership, but was later recovered badly damaged. On 25 March the finance company signed the hire-purchase agreement, unaware of what had happened. The defendant argued that he was not bound by the contract and refused to pay the instalments and was sued for the breach of the hire-purchase agreement. The English Court of Appeal held that the hire-purchase agreement was not binding because the defendant’s offer to obtain the car on hire-purchase was subject to an implied condition that the car would remain in substantially the same state until acceptance. Since the implied condition had not been fulfilled at the time the finance company purported to accept, no contract had come into existence. 7.50 In Dysart Timbers Ltd v Roderick William Nielsen (2009) the New Zealand Supreme Court held that as a rule of law an offer can lapse if there has been a fundamental change in the basis of the offer. The court held that an offer to settle a case had not lapsed when the offeror’s leave to appeal was 196 Chapter 7: Offer and Acceptance granted just before the offer was accepted. The change of circumstances was not sufficiently fundamental. (6) Death 7.51 Death of the offeror or the offeree may in some cases terminate the offer. However, the law is not entirely clear in this regard. It appears that the offer will terminate if the offeree knows that the offeror has died; it will not if the offeree has no notice of it (Bradbury v Morgan (1862)). His acceptance may be valid if made in ignorance of the death of the offeror, depending on the nature of the contract. If the offer involved personal services of the offeror (eg, to paint a portrait), it cannot be accepted. Other offers may survive and be accepted and binding on the personal representatives of the deceased. If the offeree dies before accepting the offer, the offer made to him is no longer capable of acceptance. This is especially so if the offer is made only to the offeree and is not capable of acceptance by the deceased offeree’s estate or his personal representatives. ACCEPTANCE Definition and Nature of Acceptance 7.52 An acceptance is a final and unqualified expression of assent to the terms of an offer (see Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at p 17). It is an unconditional agreement to all the terms of the offer which bring a contract into existence, making both parties legally bound. Thereafter neither party can get out of the contract nor vary its contents. Acceptance can be signified orally, in writing or by conduct. An acceptance must be made when the offer is still open and it must be absolute and unqualified. Acceptance in a contractual setting must be ascertained objectively. When there is a history of negotiations and discussions, the court will look at the whole continuum of facts to decide whether a contract exists (VK Rajah JC, as he then was) in Midlink Development Pte Ltd v The Stansfield Group Pte Ltd (2004) at [48]). 7.53 The mode of acceptance depends on the type of contract. As mentioned above (see para 7.4), in the case of an unilateral contract, the acceptance is through the offeree’s performance of an act in return for a promise, while in 197 Principles of Singapore Business Law the case of a bilateral contract it is through the offeree’s promise in return for a promise. General Principles (1) Acceptance must be final and unqualified 7.54 The offeree must agree to all the terms contained in the offer. Any attempt on his part to introduce new terms would result in a counter-offer. As noted above (see paras 7.43–7.44), a counter-offer destroys the original offer and simultaneously constitutes a new offer on his part. 7.55 Sometimes when parties carry on lengthy negotiations it may be hard to say exactly when an offer has been made and accepted. In such cases the court must look at the whole correspondence and decide whether, on its true construction, the parties have agreed to the same terms. In Allianz Insurance Co (Egypt) v Aigaion Insurance Co SA (2008) the parties in an insurance contract had previously agreed upon a warranty, but an insurance slip was emailed by the reinsured without a reference to the warranty. The appearance of “finality” in the reinsurer’s emailed reply took effect as an acceptance and there was a contract which omitted the warranty. 7.56 The requirement that the acceptance must be unqualified does not, however, mean that there must be precise correspondence between offer and acceptance so long as there are no new terms. The question is whether what has been introduced would have been regarded by a reasonable offeror as introducing a new term into the bargain rather than acceptance of the offer (Midgulf International Ltd v Group Chimique Tunisien (2010)). (2) Acceptance must be communicated to offeror (a) General rule 7.57 The general rule is that before a binding contract can come into existence, the acceptance must be communicated to the offeror. The acceptance is generally said to be validly communicated when it is actually brought to the notice of the offeror. A mere mental assent is insufficient. Where an offeror has prescribed that the offer can only be accepted in a specified way, he would not, in general, be bound unless the acceptance is made in that way. An offeror can waive any requirement as to the form of acceptance if the stipulation as to form is solely for his benefit. But if the stipulation is for 198 Chapter 7: Offer and Acceptance the benefit of both parties it must be clear that both parties have waived the stipulation (MSM Consulting Ltd v Tanzania (2009)). 7.58 Apart from the direct oral or written communication, acceptance can take place through conduct. In Brogden v Metropolitan Railway (1877), Brogden had supplied the railway company with coal for many years without any formal agreement. The parties then decided to formalise their relationship and the railway company sent Brogden a draft agreement. Brogden filled some blanks, including the name of an arbitrator, marked it “approved” and returned it to the company. The company’s employee put the draft in his desk drawer where it remained for the next two years without anything being done about it. Meanwhile, Brogden continued to supply coal under the terms of the “agreement” and the railway company paid for it. Eventually, a dispute arose between the parties and Brodgen refused to supply coal to the company holding that there was no binding contract between them. The House of Lords held that a contract had been concluded between them. Brogden’s amendments to the draft agreement amounted to an offer which was accepted by the company either when the first order was placed under the terms of the agreement or at the latest when the coal was supplied. The parties had indicated their approval of the agreement by their conduct. 7.59 The general rule set out above applies to all modes of instantaneous communications including face-to-face negotiations and communications by telephone, telex and fax. It is likely that email and text messaging will be categorised as instantaneous forms of communication. In Olivaylle Pty Ltd v Flottweg AG (No 4) (2010), a decision of the Federal Court of Australia, Logan J noted (at [25]) that experience suggests that email is often, but not invariably, a form of near instantaneous communication. In cases of instantaneous communications the rule is that the communication must actually be received by the offeror. This important principle was established in Entores Ltd v Miles Far East Corporation (1955). The plaintiffs in London telexed an offer to buy copper cathodes from the defendants in Amsterdam. The defendants telexed acceptance back to London. Later, when sued for breach of contract in England, the defendants argued that the English courts had no jurisdiction because the contract was concluded in Holland when they typed the acceptance on their telex machine. The plaintiffs, on the other hand, argued that the acceptance was not effective until it was printed out in London. The court held that the English courts had jurisdiction because 199 Principles of Singapore Business Law where a contract is made by instantaneous communication the contract is complete only when the acceptance is received by the offeror. 7.60 As explained by Lord Denning in the above case, suppose the offeror shouts an offer to the offeree who is across the river and just as the offeree shouts back an acceptance a noisy aircraft flies over preventing the offeror from hearing the offeree’s reply; no contract has been made. The same would apply if the contract was made by telephone and the offeror failed to hear what the offeree said because of the interference on the line; there is no contract until the offeror knows that the offeree is accepting the offer. The main reason for this rule is that in the alternative people might be bound by a contract without knowing that their offers have been accepted, which would lead to future difficulties. It should, however, be noted that the general rule will not apply strictly if the offeror is at fault, for example, where he failed to maintain his equipment in a proper condition. To hold it otherwise would not be fair to the offeree (see also dicta of Lord Wilberforce in Brinkibon’s case reproduced in para 7.63). 7.61 The decision in Entores was approved by the House of Lords in Brinkibon Ltd v Stahag Stahl und Stahlwarenhandels GmbH (1983). The facts were similar except for the location. In Brinkibon, the offer was made by telex from Vienna to London, and accepted by a telex from London to Vienna. The House of Lords held that the contract was therefore made in Vienna. In both cases, the telex machines were in the offices of the parties, and the messages were received during the normal working hours. However, the House of Lords in Brinkibon said that a telex message sent outside working hours would not be considered instantaneous in the circumstances described in para 7.63 below. In these circumstances, the time at which acceptance of an offer is considered received should be decided by reference to the factors laid down by Lord Wilberforce in his dicta reproduced in para 7.63. 7.62 Do the rules relating to instantaneous communication apply to email? Though it may appear to be a mode of instantaneous communications as mentioned above (see para 7.59), there are doubts that in fact it may not be so since it is conveyed in “packets” (see Chapter 24, para 24.20, and Table 24.2). It is also said to be no different from the normal post. The position with regard to it thus is not fully conclusive. 200 Chapter 7: Offer and Acceptance 7.63 Lord Wilberforce in Brinkibon observed that though the general rule as to instantaneous communications may be sound, it is not necessarily a universal rule. He canvassed the possible exceptions to the general rule, even in the context of instantaneous communications, when he observed as follows (at p 42): Since 1955 the use of telex communication has been greatly expanded, and there are many variants of it. The senders and recipients may not be the principals to the contemplated contract. They may be servants or agents with limited authority. The message may not reach, or be intended to reach, the designated recipient immediately: messages may be sent out of office hours, or at night, with the intention, or on the assumption, that they will be read at a later time. There may be some error or default at the recipient’s end which prevents receipt at the time contemplated and believed in by the sender. The message may have been sent and/or received through machines operated by third persons. And many other variations may occur. No universal rule can cover all such cases; they must be resolved by reference to the intentions of the parties, by sound business practice and in some cases by a judgment where the risks should lie … This position was accepted in Singapore in Transniko Pte Ltd v Communication Technology Sdn Bhd (1996). (b) Exception: The postal acceptance rule 7.64 The postal rule of acceptance is an exception to the general rule that acceptance must be communicated to the offeror. Instead, acceptance takes place at the time when the letter of acceptance is posted and it is complete regardless as to when the letter reaches the offeror or whether it reaches him at all. This exception applies equally to telegrams although this mode of communication is now hardly in use. 7.65 The postal rule was laid down in Adams v Lindsell (1818). On 2 September 1818, the defendants wrote to the plaintiffs offering to sell wool and requiring an answer by return of post. In the normal course the letter would have reached the plaintiffs on 3 September but since the defendants did not address the letter correctly, it was delivered to them on 5 September. The plaintiffs posted their acceptance the same evening and it reached the defendants on 9 September. If the defendants had not misdirected the letter, 201 Principles of Singapore Business Law then the reply by return of post would have come by 7 September. Since they did not hear from the plaintiffs by this date, they sold the wool to a third party on 8 September. The court held that the contract was concluded on 5 September when the letter of acceptance was posted. 7.66 It makes no difference to the rule even if the letter of acceptance is lost in the post. In Household Fire and Carriage Accident Insurance Co v Grant (1879), the defendant by his letter agreed to buy 100 shares in a company. He paid 5 per cent of the price of £100. A letter accepting his offer was posted but he never received it. The company subsequently went into liquidation and a demand was made for payment of the balance of £95. The English Court of Appeal held that a contract was formed when the letter was posted and therefore he was obliged to pay the balance. However, where a letter of acceptance is lost or delayed because it bears a wrong, or incomplete, address such misdirection will be due to the carelessness of the offeree and the postal rule should not apply to such cases (LJ Korbetis v Transgrain Shipping BV (2005)). 7.67 The rationale for the postal acceptance rule is historical as it dates back to 19th century England when the communication through post was slower and less reliable than it is today. It was then, as it is now, easier to prove that the letter has been posted than to prove that it has been received. The rule continues to apply in England and has been applied in Singapore (Lee Seng Heng v Guardian Assurance Co Ltd (1932)). 7.68 The postal rule of acceptance will apply subject to two conditions. First, it will apply only where it is reasonable to do so. An offer made by post may generally be accepted by post, but in some circumstances it may be reasonable to accept through post offers made in other ways. The offeror is at liberty to prescribe the mode of acceptance and it is open to him to expressly exclude the application of the postal rule. Second, the letter of acceptance must be properly stamped and addressed as noted above in para 7.66. 7.69 Can a postal acceptance be recalled or revoked before it reaches the offeror? There are two sides to this issue. As we have seen before, a valid acceptance of an offer results in a contract. Thus, if the postal rule applies, a contract comes into existence immediately upon the posting of the letter of acceptance. In such a case, the offeree has no acceptance to revoke. Besides, it would not be fair to the offeror if the offeree were allowed to have the best of both 202 Chapter 7: Offer and Acceptance worlds — to avail of the postal acceptance rule if it suited him, or to revoke his acceptance if it did not. On the other hand, it is possible to argue that there is no prejudice to the offeror if he is unaware of the acceptance, and the letter of acceptance can be intercepted by faster means. In any case, the offeror had the choice of the medium. If he chooses the postal medium, he must bear the consequences. 7.70 Should the postal rule of acceptance apply in Singapore? As mentioned above, the reasons for the origin of the postal rule of acceptance in England are historical under the prevailing conditions of the 19th century. Given Singapore’s small size and its efficient communications infrastructure it is worth considering whether this rule is relevant in the context of the local conditions. 7.71 Does the postal acceptance rule apply to communications via email? It depends on whether email is considered a mode of instantaneous communication or not (see para 7.62). If it is the former, then the general rule would apply. If it is the latter, the postal acceptance rule would apply. Email resembles the post in some respects but is more often than not, an instantaneous mode of communication. Consequently, the position remains inconclusive. (c) Acceptance by silence? 7.72 Since acceptance is complete only when communicated to the offeror, it follows that acceptance must take some form of objective manifestation of his intention through positive action. Mere mental assent on the part of the offeree is insufficient. Thus, it follows that silence cannot normally be a mode of acceptance. In Felthouse v Bindley (1862), the plaintiff who wanted to buy his nephew’s horse wrote to him: “If I hear no more about him, I shall consider the horse mine at £30 15s.” The nephew wanted to sell to the uncle at this price but did not reply to this letter. However, he did ask the auctioneer, whom he had engaged to sell his farming stock, not to sell the horse as he had sold it to his uncle. The auctioneer sold the horse to a third party by mistake and the uncle sued him for the tort of conversion for selling his property. For this purpose it was necessary to establish whether there was a concluded contract between the uncle and the nephew. The court held that there was no contract and therefore the ownership of the horse had not passed to the uncle. Although the nephew had mentally accepted the offer, some form of positive action was required for a valid acceptance. 203 Principles of Singapore Business Law 7.73 The issue of acceptance by silence was only raised in this case indirectly in the context of a tortious action. The policy behind the decision seems to be that no one should be able to force a contract upon an unwilling party. However, the facts in this case make it amply clear that the nephew indeed wanted to sell the horse to his uncle. It may well be asked as to whether his silence amounted to his acceptance through conduct. However, the justification for the rule in this case appears to be that there are many situations in which it would be undesirable and confusing for silence to amount to acceptance. 7.74 At the same time, it would not be prudent to totally preclude the use of silence as a mode of acceptance. This is particularly so where there are special circumstances. The final determination thus must depend on the special facts of the particular case. 7.75 A strong case for inferring that the offeree wants his silence to be regarded as acceptance is where he says so. In Re Selectmove Ltd (1995) the English Court of Appeal found that it was in fact the offeree who had undertaken that he would communicate with the offeror if he did not desire to conclude the contract. The difference between this decision and the one in Felthouse v Bindley discussed above is that in this case, it was the offeree who was seeking the possibility of acceptance by his silence while in the latter, it was the offeror who was seeking to impose on the offeree the term of acceptance by his silence. However, the present case was inconclusive on this issue for other reasons. 7.76 In Singapore, the proposition that silence can in certain exceptional circumstances be construed as acceptance was recognised in Southern Ocean Shipbuilding Co Pte Ltd v Deutsche Bank AG (1993) (at [46]–[47]) and in Midlink Development Pte Ltd v The Stansfield Group Pte Ltd (2004) (at [50]–[52]). (d) Ignorance of offer 7.77 The general rule is that a person cannot accept an offer of which he has no knowledge. In such a case it is not possible to reach an agreement resulting in a binding contract. A case which appears to be contrary to this principle is Gibbons v Proctor (1891). In this case, a reward had been advertised for information leading to the arrest or conviction of a criminal. The plaintiff 204 Chapter 7: Offer and Acceptance attempted to claim the reward, even though he had not originally known of the offer. He was allowed to receive the money. However, the case does not shed much light on the problem as although he did not originally know of the offer of reward, he did know of it by the time the information was given on his behalf. 7.78 The Australian High Court decision of R v Clarke (1927) is a leading case in support of the general principle. In this case, a reward had been offered by the Australian Government for information leading to the conviction of the murders of two policemen. There was also a promise of free pardon to an accomplice giving such information. Clark, who was an accomplice, gave the required information to obtain pardon without any thought of the reward at that time. He subsequently claimed the reward. The court held that he could not claim the reward as he was ignorant of it at that crucial time. 7.79 However, it appears that the motive of the person claiming the reward is irrelevant so long as he has knowledge of the reward. In the American case of Williams v Cawardine (1833), a reward had been offered for information leading to the discovery of the murderer. The plaintiff knew about the reward, but when she gave the information it was not in order to receive the money. She did it to ease her conscience. The court held that she was entitled to the reward. The general principle was affirmed in another US case, Fitch v Snedaker (1868), where it was held that a person who gives information without knowledge of the offer of a reward cannot claim the reward. (e) Cross-offers 7.80 The general principle is that there is no contract in the case of cross-offers (Tinn v Hoffmann & Co (1873)). Cross-offers happen when two parties send offers to each other in identical terms and at about the same time, and their letters cross each other in transit. For example, A offers to purchase B’s antique clock for $5,000 and B offers to sell to A his antique clock for $5,000 and both offers are put into the post at the same time. The obvious reason would be that there is no meeting of the minds between them. Under the rules applicable to offer and acceptance, there can be no valid acceptance since the offeree has no knowledge of the offer at the relevant time. However, there is an alternative view. It has been pointed out that in such a situation, each party does in truth contemplate legal relations upon an identical basis, and each is prepared to offer his own promise as consideration for the 205 Principles of Singapore Business Law promise of the other. There is not only a coincidence of acts, but if this is thought to be relevant, a unanimity of minds. (see M P Furmston, Cheshire, Fiftoot and Furmston’s Law of Contract (16th edition, 2012) at p 74). (f) Battle of forms 7.81 Instead of negotiating terms each time a contract is made, businesses often enter into agreements using their standard forms of contract. This is convenient as it saves effort, time and money. Understandably, both parties would like to conclude the contract upon their own terms. Since the terms and conditions on these standard forms can be incompatible with each other, this will sometimes lead to offers and counter-offers. If counteroffers are constantly being made in a particular transaction, no concluded contract can ensue as each counter-offer destroys the original offer and itself constitutes a new offer. This could lead to an endless exchange resulting in no contract. This situation is popularly known as the “battle of forms” where the contract is ultimately formed on the terms of the party who fires the last shot. 7.82 The leading decision in this respect is that of the English Court of Appeal in Butler Machine Tool Co v Ex-Cell-O Corporation (England) Ltd (1979). On 23 May 1969, the plaintiffs offered to sell to the defendant buyers a machine, delivery to be made in ten months. The offer was made on the plaintiff ’s terms and conditions which included a price variation clause and stated that these terms and conditions were to prevail over any terms and conditions in the buyer’s order. On 27 May the defendants ordered the machine on their order form that excluded the price variation clause. At the foot of the order form was a tear-off slip which stated, “We accept your order on the Terms and Conditions stated thereon.” On 5 June the plaintiffs signed the slip and sent it back to the defendants with a covering letter that stated that the order “is being entered in accordance with our revised quotation of 23rd May”. The machine was delivered. There was, in fact, a subsequent rise in costs, and the plaintiffs invoked the price variation clause but the defendants resisted such a claim. The court held that the contract was concluded on defendants’ terms. Their letter of 27 May was a counter-offer which had been accepted by the plaintiffs on 5 June. Though the plaintiff ’s covering letter did refer to the offer of 23 May the court held that it was only intended to identify the price and the identity of the machine. The majority of the judges in this case adopted the traditional offer, 206 Chapter 7: Offer and Acceptance counter-offer and acceptance approach. Here, the acceptance is complete only when a particular party finally concedes by way of unqualified acceptance as opposed to a mere counter-offer. 7.83 The English Court of Appeal reaffirmed this rule in Tekdata Interconnections Ltd v Amphenol (2009). The parties to this dispute were in a long-term business relationship and were part of a chain of suppliers to Rolls Royce as ultimate purchasers. Rolls Royce bought engine control systems for installation in their aero engines from a company called Goodrich who themselves bought the components from Tekdata Interconnections Ltd (“Tekdata”), who in turn bought them from Amphenol Ltd (“Amphenol”). The dispute arose between Tekdata and Amphenol in which Tekdata claimed that certain connectors were delivered late and were not fit for the purpose or of merchantable quality. They claimed that the contract of purchase was on the terms of their purchase orders. Amphenol, on the other hand, claimed that the contracts were on the terms of their (Amphenol’s) acknowledgment of the purchase orders and that those terms excluded or limited their liability for any breaches of contract. The Court of Appeal acknowledged (at [21]) that it is possible, particularly in the context of long-term and multiple-party relationship, that the traditional offer and acceptance rules could be displaced where the parties clearly intended to do so. However, the Court held that such an intention was not proved in this case and accordingly Amphenol’s terms applied. 7.84 In a situation where both sides insist on having the last word, a contract will not come into existence as agreement will never be reached. In such a situation, it is possible for the court to conclude that there is a contract but on neither party’s terms. In GHSP Inc v AB Electronic Ltd (2010) the claimant’s terms imposed unlimited liability on the seller while the defendant’s terms effectively excluded such liability. The issue was as to whose terms applied. The court noted that there was a deadlock but nevertheless it was clear that a contract existed and had been performed. The court filled the gap by implying the term contained in s 14(2) of the Sale of Goods Act 1979 concerning the quality of the goods supplied. 7.85 Lord Denning MR, in Butler Machine Tool Co, while endorsing the traditional approach, advocated a relatively more radical alternative approach which requires looking at all the documents passing between the parties and glean 207 Principles of Singapore Business Law from them and from the conduct of parties on whether they had reached agreement on all material points despite the differences between the terms and conditions printed on the back of them. Lord Denning’s approach was endorsed by the Singapore Court of Appeal in Projection Pte Ltd v The Tai Ping Insurance Co Ltd (2001), which in turn was cited with approval by the Singapore High Court in Overseas Union Insurance Ltd v Turegum Insurance Co (2001) on this specific issue. 7.86 However, though Lord Denning’s approach might give the judges flexibility, it has generally not found favour with the English courts, probably because it is too vague and may result in uncertainty. Thus the law in this area continues to be along the traditional lines as discussed above. SOME ISSUES RELATING TO OFFER AND ACCEPTANCE Certainty and Completeness 7.87 A contract will come into existence as a result of offer and acceptance only if the terms of that agreement are both certain and complete. It should be possible to determine with certainty what exactly has been agreed upon between the parties. The court will not make a contract for the parties but rather decide through objective criteria as to whether the agreement is reasonably certain. Despite negotiations between the parties there may be no enforceable contract if the agreement is conditional, incomplete or vague. We will briefly consider these situations below. 7.88 Sometimes parties may enter into agreements “subject to contract” or “subject to a formal contract being drawn up by our solicitors”. These words postpone liability until such a document has been drafted and signed. On account of this, the general view is that no binding contract has been concluded (Winn v Bull (1877); Thomson Plaza (Pte) Ltd v Liquidators of Yaohan Department Store Singapore Pte Ltd (2001); Norwest Holdings Pte Ltd (in liquidation) v Newport Mining Ltd and another appeal (2011)). In Norwest, the Singapore Court of Appeal noted (at [24]–[28]) that the question whether there was a binding contract between parties should be determined by considering all the circumstances, including what was communicated between the parties by words or conduct, not just the inclusion of the stock phrase “subject to contract”. In the instant case, the documentary evidence of the communication between the parties contained several indications to an 208 Chapter 7: Offer and Acceptance objective observer that they had not intended to be contractually bound until a formal Sale and Purchase Agreement was negotiated and executed. The objective indications were that the parties had intended to negotiate the terms and conditions of a Sale and Purchase Agreement. Even if the essential terms of a contract had been agreed upon and thus needed no further negotiation regarding those terms, parties who entered into an agreement expressly “subject to contract” might be taken to have intended for legal relations to be deferred until the execution of a formal contract, unless there was strong and exceptional evidence to the contrary. Hence there was no binding contract between the parties. 7.89 Sometimes the parties themselves may stipulate in their agreement that “terms and conditions will be agreed upon later”. It is clear that in such cases there is no contract. However, the particular facts as well as the language utilised are crucial. The presumption of unenforceability attached to such expressions is rebuttable by clear evidence to the contrary. If, in other words, the actual facts and/or language merit it, the court will hold that a valid and binding contract has been concluded. In the English decision of RTS Flexible Systems Ltd v Molkerei Alois Muller GMBH (2010) the parties entered into a contract through a “letter of intent” while they were negotiating for a full formal contract. A draft of the final contract was produced, which stipulated that it would be effective only when executed, but was never executed. Meanwhile the plaintiff carried out substantial work at the defendant’s factory after the expiry of the letter of intent and claimed for the work done. The Supreme Court (previously known as the House of Lords) found clear evidence of the existence of a contract because, among other things, it made no commercial sense to say that the parties agreed to the work without any relevant contract terms. The principle laid down in this case that the parties can by their conduct waive reliance on the “subject to contract” term was cited with approval by the Singapore Court of Appeal in Norwest (at [24]). See also the English case of Benourad v Compass Group plc (2010) for further guidelines in this regard. 7.90 It is not necessarily decisive to establish that the parties had orally agreed to the terms of an intended agreement since written agreements are typically preceded by oral agreements on the terms between the parties. Ultimately that issue must be determined by reference to the objective evidence before the court. Where it had been agreed that there would be a “Supplemental 209 Principles of Singapore Business Law Agreement to be executed to effect necessary changes” but the bank failed to do so before the expiry of the time limit, the Singapore High Court in OCBC Capital Investment Asia Ltd v Wong Hua Choon (2012) held that there was no contract. The evidence showed that the objective intention of the parties, including the bank, was not to be bound prior to the formal execution of the written agreement (at [2]). 7.91 As regards completeness, though the courts will avoid making contracts for the parties, they are willing to uphold contracts where possible by filling the gaps. For this purpose, the court may avail of a definite formula if there is one (Brown v Gould (1972)). The other factors that the court may take into consideration include a previous course of dealing between the parties or a trade practice. In Sudbrook Trading Estate v Eggleton (1983), a lease gave the tenant an option to buy the land absolutely, “at such price, not being less than £12,000, as may be agreed upon by two valuers one to be nominated by the lessor and the other by the lessee and in default of such agreement by an umpire appointed by the … valuers …”. The tenant exercised the option to purchase but the landlord refused to appoint a valuer. The House of Lords held that even if one of the parties refused to appoint a valuer as provided for under the terms of the contract, the court could nevertheless treat the agreement as if it were one to pay a reasonable price which was to be reached by applying objective standards. If the machinery set up by the parties for that purpose failed, the court would substitute its own machinery to find a fair and reasonable price. The Singapore High Court followed this decision in Tan Yeow Khoon v Tan Yeow Tat (No 1) (2000). 7.92 In Cooperatieve Centrale Raiffeisen-Boerenleenbank BA (trading as Rabobank International), Singapore Branch v Motorola Electronics Pte Ltd (2011), the Singapore Court of Appeal affirmed (at [46]) that contracts might in certain cases be implied from a course of conduct or dealings between the parties or from correspondence or all relevant circumstances. Where it was alleged that an implied agreement existed, the court ought to scrutinise the evidence before it carefully to determine whether the existence of a contract, compliant with all the requirements for contract formation, had been proven on a balance of probabilities (at [47]). Indeed, all the requirements for the formation of a contract, viz, offer and acceptance, consideration, intention to create legal relations, and certainty of terms had to be satisfied before the court would imply the existence of a contract (at [50]). 210 Chapter 7: Offer and Acceptance 7.93 Once an agreement has started to be performed, the courts are much more likely to hold that there is a contract. In such cases, where necessary, the court may imply terms to give effect to the contract. The topic of implied terms will be considered in Chapter 10. However, even where this is not possible, the party who has received valuable benefit under the agreement could be ordered to pay on the basis of quantum meruit. 7.94 Vagueness sometimes overlaps with incompleteness since the agreement may be so vague on a particular matter as to be incomplete. In Scammell and Nephew Ltd v Ouston (1941), Ouston wanted to acquire a new van on hirepurchase. The agreement stated that “this order is given on the understanding that the balance of the purchase price can be had on hire-purchase terms over a period of two years”. After some disagreements, Scammells refused to supply the van. They argued that the agreement was not certain enough to amount to a contract. The House of Lords held that there was no contract between the parties because the agreement on hire-purchase terms was so vague that it could not be given a definite meaning. For instance, it left open such questions as whether payments would be made on a weekly, monthly or yearly basis; whether there would be an initial deposit; and what the interest rate would be. Hence the parties would need to reach further agreement before there could be a completed contract. 7.95 In such situations, as mentioned above, courts have tended to uphold a contract by taking a practical approach by filling the gaps. Thus in Hillas v Arcos (1932) where the buyer had an option to buy additional softwood goods, the seller sought to escape the option by alleging that no enforceable meaning could be deduced from what was agreed. The court held that the option was binding. The court resolved the uncertainty by reference to the parties’ previous dealings, the custom of the timber trade and the standard of reasonableness. 7.96 In Foley v Classique Coaches (1934), the court upheld the contract on the basis of fairness between the parties. In this case, Foley sold a piece of land to a bus company on the understanding that they would enter into a second agreement to buy petrol from him. The bus company agreed to buy petrol “at a price to be agreed by the parties in writing and from time to time”. The court enforced the agreement as a binding contract to buy petrol at a reasonable price. It took into consideration the fact that the bus company had bought petrol from Foley for three years before denying the agreement. 211 Principles of Singapore Business Law The refusal to enforce the contract would be substantially unfair to him as by entering into the contract he had suffered detriment with regard to the selling price of his land. As stated in RTS Flexible Systems (see para 7.89), an agreement is not incomplete merely because it calls for some further agreement to be arrived at between the parties. Even if certain terms of economic or other significance to the parties have not been finalised, the objective appraisal of their words and conduct may lead to the conclusion that they did not intend agreement of such terms to be a pre-condition to a concluded and legally binding agreement. 7.97 As to vagueness, the courts will as far as possible try to give effect to the contract particularly where the parties have acted on the agreement and will do their best to avoid striking it down on the ground that it is too vague. To declare it void for uncertainty is a last resort conclusion (Shaw v Lighthousexpress Ltd (2010)). 7.98 Another relevant issue in this context is the status of an agreement to negotiate between the parties on a particular matter with a view to reaching agreement (“lock-in” agreement), or an agreement not to negotiate with third parties with regard to it (“lock-out” agreement). Both these aspects figured in the leading House of Lords decision in Walford v Miles (1992). In this case, the plaintiffs entered into negotiations (subject to contract) to purchase the defendants’ company and its premises. Since there was another interested buyer, the plaintiffs obtained an oral undertaking from one of the defendants. The parties agreed that if the plaintiffs provided a comfort letter from their bank confirming their financial resources to pay the defendants’ asking price, the latter would not deal with any third party and would deal exclusively with the plaintiffs. The plaintiffs complied with the agreement but the defendants continued to negotiate with the third party and later withdrew from negotiations with the plaintiff and ultimately sold their interest to the rival third party. The plaintiffs then brought legal action. Since there was no concluded contract, the plaintiffs relied on a collateral contract, which they claimed had been formed. 7.99 The House ruled in favour of the defendants. They held that agreement to negotiate (“lock-in” agreement) was unenforceable for uncertainty. There was in this case no duty to negotiate in good faith. The agreement not to negotiate with third parties (“lock-out” agreement) also failed for uncertainty as it did not specify for how long it was to last. A “lock-out” 212 Chapter 7: Offer and Acceptance agreement may be enforceable if there is a time limit on its duration. An instance where a “lock-out” agreement might exist, for instance, is where a specific “try-out” time for negotiations is agreed upon. The subsequent English Court of Appeal decision of Pitt v PHH Asset Management Ltd (1993) in fact held that the “lock-out” agreement in that particular case was valid. 7.100 The Singapore High Court in Climax Manufacturing Co Ltd v Colles Paragon Converters (S) Pte Ltd (2000) took note of the decision in Walford v Miles (at [32]) and followed it in Grossner Jens v Raffles Holdings Ltd (2004) (at [43]) and Sundercan Ltd v Salzman Anthony David (2010) (at [25]). Artificiality of Offer and Acceptance Rules 7.101 As we have seen above, a contract comes into existence through consensus between the parties as manifested through offer and acceptance. Yet this theoretical framework may not neatly fit all contract situations. Strict adherence to this framework may result in artificiality. 7.102 Lord Wilberforce in New Zealand Shipping Co Ltd v AM Satterthwaite & Co Ltd (The Eurymedon) (1975) gave some examples of these situations, such as sales at auctions, supermarket purchases, boarding a bus, buying a train ticket, tenders for supply of goods, offers of rewards, acceptances by post, warranties of authority by agents, manufacturers’ guarantees, gratuitous bailments and bankers’ commercial credits. He went on to say, “These are all examples which show that English law, having committed itself to rather technical and schematic doctrine of contract, in application takes a practical approach, often at the cost of forcing the facts to fit uneasily into marked slots of offer, acceptance and consideration.” 7.103 Although the courts will ordinarily apply the settled legal rules to given situations, at times they have resorted to “backwards” reasoning to achieve justice between the parties. In such a situation the court may have a desirable solution in mind and will reason back to “find” the presence or absence of the labels of offer and acceptance in order to justify that solution. In this context see the two cases on exception clauses discussed in Chapter 11, Chapelton v Barry Urban District Council (1940) and Thornton v Shoe Lane Parking Ltd (1971). In these cases the respective courts held that the exception clauses 213 Principles of Singapore Business Law were not part of the contract as they were introduced after the contract had been concluded. 7.104 Difficulties with the offer and acceptance model sometimes arise because of the courts’ attempt in achieving multiple objectives at the same time. These include the court’s wish to give effect to the intention of the parties, their desire to achieve a just result on the facts of the case and the need to establish a clear rule which can be applied to all cases in future. The courts’ utilisation of the concepts of offer and acceptance, despite occasional artificiality, has in general, aided in achieving a just result. CONCLUSION 7.105 We started this chapter by defining a contract as a legally binding agreement and introduced various terms that are used in the context of the law of contract. We then considered the requirements of a valid contract, and noted that the first and foremost of these is the consensus ad idem, that is, the meeting of the minds. This is ascertained objectively through the requirements of offer and acceptance. We noted how each of these have their particular rules that may be easy to state in theory but may sometimes be difficult to ascertain in practice. We rounded off the chapter with a consideration of the courts’ approach to such practical difficulties in determining the existence of the offer and acceptance especially where the agreement appears to be conditional, incomplete or vague. 214 Chapter 8 Consideration and Intention to Create Legal Relations 8.1–8.2 Introduction 8.3–8.9 Consideration 8.10 Consideration Must be Requested for by the Promisor 8.11–8.17 Consideration Must Not be Past 8.18–8.19 Consideration Must Move from the Promisee 8.20–8.22 8.23–8.24 8.25–8.26 8.27–8.28 8.29 8.30–8.39 8.40–8.43 8.44 8.45 8.46 8.47–8.48 8.49–8.60 8.61–8.62 8.63–8.64 8.65–8.68 Consideration Must be Sufficient Concept of “Sufficiency” Intangibles and Moral Obligations Forbearance and Compromise Existing Public or Legal Duty Existing Contractual Duty (1) Owed to third party (2) Owed to the promisor (a) In return for a promise for more (b) In return for a promise for less When Consideration is Not Required: The Exceptions Contract by Deed Promissory Estoppel (1) Meaning and origin (2) Elements of promissory estoppel (a) Clear and unequivocal promise (b) Reliance (c) Inequitable to go back on promise (d) Shield, not sword (3) Effect of promissory estoppel: Suspensive or extinctive? Principles of Singapore Business Law 8.69–8.70 Intention to Create Legal Relations 8.71–8.74 Social and Domestic Agreements 8.75–8.79 Business and Commercial Agreements 8.80–8.82 Conclusion 216 Chapter 8: Consideration and Intention to Create Legal Relations INTRODUCTION 8.1 In Chapter 7, we considered the circumstances in which the law would recognise that parties have come to an agreement. However, the law does not enforce all agreements. Generally, ideas of fairness, the concern to give effect to the intention of parties to the agreement (thus facilitating “free market” economy) and general public policy concerns are relevant in deciding which agreements to enforce. 8.2 Hence, two other elements (in addition to the presence of an agreement) are required for the formation of a contract: consideration and intention to create legal relations. In this chapter, we shall consider the following questions for each of these legal requirements: ° What are these legal requirements and the rationale or justification for them? ° When, if at all, are these requirements not necessary for the enforcement of an agreement (“the exceptions”) and what are the justifications for allowing such exceptions? ° Is the law on these legal requirements and exceptions coherent and satisfactory? CONSIDERATION 8.3 The general rule is that a promise is only enforceable if it is supported by consideration, that is, where the promise is given in exchange for something of value. Such reciprocity is said to be the reason and justification for the enforcement of the promise. However, the reader should note that exceptions to the general rule exist and will be discussed in detail later (see paras 8.44–8.68). 8.4 So what exactly is consideration? Consideration is defined as something that has value in the eyes of the law and given in exchange for a promise. Traditionally, the “benefit–detriment analysis” is used to explain consideration (Currie v Misa (1875) at p 162): A valuable consideration, in the sense of the law, may consist either in some right, interest, profit, or benefit accruing to the one party, or 217 Principles of Singapore Business Law some forbearance, detriment, loss, or responsibility given, suffered, or undertaken by the other. 8.5 Take the example where A agrees to purchase B’s car at the price of $50,000 (see Figure 8.1). As is typical of most agreements, there are two promises. There is A’s promise to purchase B’s car at $50,000 and B’s promise to transfer ownership and possession of his car to A. For each promise to be enforceable, the recipient of the promise must provide consideration in exchange. The law refers to the maker of a promise as the “promisor” and the recipient of a promise as the “promisee”. To determine if each promise is supported by consideration and therefore enforceable, the benefit–detriment analysis is used as follows: ° In return for A’s promise: B provides consideration in the form of either a benefit conferred upon A (ie, A obtains the right to ownership and possession of the car) or a detriment suffered by B (ie, B having to part with the car). ° In return for B’s promise: A provides consideration either by conferring upon B a benefit (ie, the promise to pay B the purchase price), or by suffering a detriment (ie, A having to part with his money). Several observations can be made from the above example: ° In return for a promise, a promisee may often have conferred a benefit as well as suffered a detriment. However, the law only requires either a benefit or detriment to satisfy the requirement of consideration (see para 8.29 for an example where only a benefit exists to support a promise without a detriment being suffered by the promisee). ° In any one agreement, a party may be both a promisor and a promisee depending on the promise under discussion. Thus, it is important to specify the promise that is sought to be enforced when we are trying to decide if consideration exists to support that promise. [Promisor] A [Promisee] [Promisee] A PROMISES to purchase and pay $50,000 for Bs car B Promises to sell and deliver his car to A Figure 8.1 Two sets of promises in an agreement 218 B [Promisor] Chapter 8: Consideration and Intention to Create Legal Relations 8.6 Consideration may also be defined as the price for purchasing a promise. In the example above, A can be said to have bought B’s promise of sale and delivery of the latter’s car at the price or consideration of $50,000. Conversely, B can be said to have bought A’s promise of payment at a price or consideration equivalent to the car. 8.7 Consideration must be distinguished from a condition to which a promise is subject. If A says to B “I will buy you a car when you attain the age of 21”, the question is whether A is promising a gift subject to the fulfilment of a condition or making a contractual promise to be accepted by a reciprocal promise by B. In the example above where the fulfilment of the condition is not within the control of the promisee, the promise is likely to be a mere conditional gift. However, where the fulfilment of the condition involves the performance of some act by the promisee, it is not as clear. 8.8 The difficulty is illustrated by the differing views between the majority and minority judges in Chappell & Co Ltd v Nestlé Co Ltd (1960). The defendant company, Nestlé, offered to sell records of the tune “Rockin’ Shoes” for a nominal cash price and three wrappers of their chocolate bars. The court had to decide whether the chocolate wrappers formed part of the consideration for the purchase of the records. The majority of the House of Lords thought so as Nestlé had (indirectly) benefited from the receipt of the chocolate wrappers since its chocolate sales might have increased in connection with the promotion. Alternatively, the purchaser had suffered a detriment having been put to the trouble of purchasing the chocolate bars in order to purchase the record. The minority judges, however, disagreed as they felt that the requirement for the wrappers was merely a condition which a purchaser had to fulfil before he could purchase the records. 8.9 The definition of consideration is also significant in other ways (see Figure 8.2). First, consideration is defined as something given in exchange for a promise. The idea of exchange or reciprocity is said to indicate that the law will only enforce bargains as opposed to gifts. Thus gratuitous promises, that is, promises to confer some thing or service for nothing in return, are generally not enforceable (see exception in para 8.44). It also underlies other rules concerning consideration: ° a benefit or detriment must have been requested by the promisor in order to constitute a valid consideration; 219 Principles of Singapore Business Law ° past consideration is no consideration; and ° consideration must move from the promisee. Second, consideration is defined as something that has value in the eyes of the law. What the layman may consider factually to be a benefit or detriment may not be accepted by the law as consideration. The law only recognises consideration which it deems to be sufficient (and it does not concern itself with the adequacy of the consideration). Thus whether consideration (and the related concepts of benefit and detriment) exists is a legal inquiry rather than a factual one. The reader is cautioned that the notion of consideration is far from simple and commentators have suggested that consideration is actually about the policy reasons that justify the enforcement of a promise (see R Halson, Contract Law (2001) at p 160). CONSIDERATION DEFINED: Something of value in the eyes of the law given in exchange for a promise BenefitDetriment Price of promise Consideration must be requested by promisor Figure 8.2 Exchange Consideration must not be past Consideration must move from promisee Value in eyes of law Consideration must be sufficient; need not be adequate Significance of the definition of consideration CONSIDERATION MUST BE REQUESTED FOR BY THE PROMISOR 8.10 The idea of exchange requires that the benefit conferred or detriment suffered by the promisee must be requested by the promisor. Thus, in Combe v Combe (1951), the plaintiff was unsuccessful when she sued her ex-husband for breach of a promise to pay her an annual maintenance of £100 after their divorce. Although she had, in reliance on her ex-husband’s promise, refrained from applying to the court for maintenance (and thus arguably conferred a benefit on her husband), the court held that the defendant ex-husband’s promise was not supported by any consideration as he had not requested her to so refrain. 220 Chapter 8: Consideration and Intention to Create Legal Relations CONSIDERATION MUST NOT BE PAST 8.11 An act done prior to and independently of a promise cannot be regarded as valid consideration for the promise since it is not done in exchange for the promise. Hence, if A voluntarily washes B’s car and thereafter, B, impressed by A’s kindness, promises to pay $50 to A, the promise is not enforceable as the “consideration” provided by A occurred prior to B’s promise. Such past acts are conveniently referred to as “past consideration”. 8.12 Past consideration must be distinguished from executed consideration. To appreciate this distinction, we must understand the concepts of executory and executed consideration. For example, B promises to sell his car to A and deliver it in a month’s time in return for A’s promise to make payment on delivery. At the time the contract is formed, both A and B’s promises have yet to be performed. They are executory in nature but are still valid consideration for each other’s promise. If, at the time of agreement, A hands the purchase price to B, who delivers his car to A simultaneously, both parties have furnished executed consideration; the consideration is performed at the time the contract is formed. 8.13 Typically, executed consideration is also the acceptance of an offer in a unilateral contract. In Carlill v Carbolic Smoke Ball Co (1893) (see Chapter 7, para 7.12), the plaintiff was held to have accepted the defendant’s unilateral offer by taking the smoke ball thrice daily for two weeks. This act of acceptance is also consideration for the defendants’ promise as the defendants benefited from the sale of the smoke ball while the plaintiff suffered a detriment by using the smoke ball as instructed. Thus the consideration provided by the plaintiff was executed at the time the contract was formed. 8.14 Executed consideration is therefore an act or forbearance undertaken in return for the promisor’s offer unlike past consideration, which involves an act or forbearance undertaken without any reference to the promisor’s offer. 8.15 Are all acts or forbearance occurring before the promise invalid consideration for the promise? This may not be so. In Pao On v Lau Yiu Long (1980), the plaintiffs had agreed, at the defendants’ request, not to sell the shares of a company for a period of one year. Subsequently, the defendants agreed to indemnify the plaintiffs for any loss which they might suffer as a result of their earlier promise not to sell the shares. Eventually, the plaintiffs did suffer 221 Principles of Singapore Business Law losses and sued the defendants on the indemnity. In defence, the defendants argued that their promise to indemnify the plaintiffs was not enforceable as it was not supported by consideration; the plaintiff ’s promise not to sell the shares was given before the indemnity and was therefore past consideration. 8.16 The Privy Council rejected the defendants’ argument and held that the indemnity was enforceable. Even though the plaintiffs’ promise to hold the shares was given before the defendants’ promise to indemnify, it was nonetheless good consideration as it satisfied all the conditions below: ° the act was done at the promisor’s request; ° there was an understanding between the parties, at the time the request was made, that the act would be compensated by payment or some other benefit conferred; and ° such compensation would be enforceable if it had been promised in advance. This decision is often regarded as an exception to the rule that past consideration is no consideration and has been endorsed in Singapore (Sim Tony v Lim Ah Ghee (1995); Rainforest Trading Ltd and another v State Bank of India Singapore (2012)). 8.17 The first and second conditions are easy enough to understand. The third condition is best explained as a safeguard against enforcing a promise that would not have been enforceable for any reason under contract law (eg, due to the lack of an intention to create legal relations or the presence of vitiating factors, etc) even if the problem of past consideration is overcome by virtue of the first and second conditions being satisfied. Box 8.1 Reflecting on the law Pao On’s decision — a true exception? If payment was contemplated by both parties at the time the act was requested, it would be more accurate to say that the promisee’s act was executed for a payment to be fixed in the future (ie, the promisee’s act is executed and not past consideration for the promised payment). Indeed, a strictly chronological view of the events should not be taken in deciding if an act is in fact past consideration. Rather, the more important question is whether the preceding act and the subsequent promise are in substance part and parcel of one and the same transaction. 222 Chapter 8: Consideration and Intention to Create Legal Relations CONSIDERATION MUST MOVE FROM THE PROMISEE 8.18 A person can only enforce a promise if the consideration for the promise is furnished by him. Hence, in Tweddle v Atkinson (1861), A and B, the respective fathers of a married couple, entered into a contract where each undertook to pay a sum of money to C (the husband). When C tried to enforce the contract against the estate of B after B’s death, he failed as the consideration for the promise was furnished by A and not by him. This decision can also be explained on a different ground; that C was unable to enforce the contract because he was not a party or not privy to the contract (on privity of contract, see Chapter 9, para 9.50 onwards). 8.19 While consideration must move from the promisee, it does not have to move to the promisor. Hence, if A promises to pay B $50 if B washes C’s car, the consideration provided by B is valid even though it does not confer a direct benefit on A, the promisor (see Figure 8.3). [Promisor] A A promises to pay $50 to B if C [Promisee] B B washes Cs car [Third party] Figure 8.3 Consideration moving from promisee to third party CONSIDERATION MUST BE SUFFICIENT Concept of “Sufficiency” 8.20 As mentioned, consideration must be sufficient but need not be adequate. The term “sufficient” refers to “legal validity”, that is, something having value in the eyes of the law. Once an act or forbearance is deemed sufficient consideration at law, it is not necessary to show that it is also adequate — that it has a value comparable to the value of the promise. The rationale is that contracting parties are taken to be perfectly able to assess the merits 223 Principles of Singapore Business Law of their own bargains and the court’s role is to ascertain whether a bargain has been made, not whether it is a good bargain. This is consistent with the free market philosophy of minimal state interference into bargains that are freely and voluntarily made by its citizens. Hence, if A agrees to sell his car to B for $20,000 although it has a market value of $50,000, B’s payment of $20,000 is sufficient consideration even if it may not be a fair price for A’s car. A more extreme example can be found in Chappell & Co Ltd v Nestlé Co Ltd (1960) (see para 8.8), where it was held that even used chocolate wrappers which were discarded on receipt could constitute sufficient consideration for the sale of records. Thus a nominal consideration can be sufficient consideration as long as parties freely consented to it. 8.21 Sometimes, a grossly inadequate consideration may indicate that the promisor did not freely and willingly consent to a bargain but was in fact coerced or improperly influenced into such agreement. In such situations, the contract may be set aside on the ground of duress or undue influence. The relevant legal principles will be considered in Chapter 14. 8.22 How then do we identify “value in the eyes of the law”? Clearly, where the consideration is given in monetary terms or is readily measured in economic terms, such consideration is sufficient in the eyes of the law. This is so in most commercial contracts, where consideration is furnished in the form of monetary payment or the provision of goods or services (with ascertainable market prices). Where such price tags cannot be readily ascertained, identifying such “value” becomes a much more difficult task. Table 8.1 provides a list of what may be considered sufficient or insufficient consideration and the underlying rationale. Intangibles and Moral Obligations 8.23 Would natural love and affection, as well as other motives of a purely sentimental nature be sufficient consideration in return for a promise? The answer is generally not. The rationale is that such motives lack certainty for purposes of enforcement. Also there is the policy concern that love and affection should not be held at ransom in return for a promise. 8.24 Would the promisee’s promise of an act which he is already under a moral obligation to perform be sufficient consideration in support of a promisor’s 224 Chapter 8: Consideration and Intention to Create Legal Relations promise? In White v Bluett (1853), a father who was wearied by his son’s frequent complaints that he had distributed his assets unfairly among his children, agreed to release his son from his debt obligation under a promissory note if he would cease complaining. It was held that the father was not bound by his promise — it was his right to distribute the property as he wished and the son had no right to complain. In ceasing his complaints, the son was only doing what he was morally obliged to do and that was no consideration for his father’s promise. As a matter of policy, the law would not allow moral obligations or good behaviour to be used to extort a favourable promise from the other party. Forbearance and Compromise 8.25 Where a party has a claim against another, he may agree to refrain from enforcing the claim for a promise given by the latter and such an agreement is described as a forbearance. Similarly, the parties to a dispute may consider it more beneficial to enter into a compromise whereby one party agrees to surrender his claim in consideration for the other’s payment or other promises, as costly and time-consuming litigation to enforce the claim can be avoided. In both instances, the promisor’s agreement not to pursue a claim is good consideration for the promises given in exchange. 8.26 Where a person promises not to enforce an invalid claim and it is shown that he knew such claim to be invalid at the time of his promise, such forbearance is no consideration (see Wade v Simeon (1846)). The rationale is that the surrender of a groundless claim is neither a benefit to the other party nor a detriment to the one purporting to give up the claim. However, it is not necessary for the person surrendering his claim to show that he has given up a valid claim. It is sufficient if he could establish, first, that he has reasonable grounds for his claim; and secondly, that he honestly believes that he has a fair chance of success; and finally, that he has not concealed from the other party any fact which he knows may affect the validity of the claim (see Callisher v Bischoffsheim (1870)). This means that the consideration furnished lies not in giving up a valid claim, but rather, in giving up a right to claim. This makes practical sense as most compromises and settlements relate to doubtful claims, the validity of which could not be ascertained without a complete trial. 225 Principles of Singapore Business Law Existing Public or Legal Duty 8.27 In general, where A makes a promise to B in consideration for B’s promise to do something which B is already legally obliged to do, B’s promise is not good consideration. The rationale appears to be that an act obliged by law is neither a benefit to A nor a detriment to B. Also, such a rule is said to be necessary to prevent public officers from extorting money for services which they were legally bound to render. 8.28 Where the act or conduct in question exceeds the requirements of the legal duty, it may constitute good consideration. In Glasbrook Bros v Glamorgan County Council (1925), the appellant mining company agreed to pay the respondent police authority to maintain a stationary troop at its mine to protect workers returning to work during a strike. Later, the appellant refused to make the promised payment and argued that the police authority had provided no consideration for the promise as they were merely discharging their legal duty to protect life and property. The House of Lords rejected this argument; holding that the police were only legally obliged to provide a mobile force in the circumstances, and by providing a stationary force, had gone beyond their legal duty. Existing Contractual Duty (1) Owed to third party 8.29 The performance of, or the promise to perform, an existing contractual duty owed to a third party is sufficient consideration for a promise given in exchange. In Scotson v Pegg (1861), A contracted with X to deliver goods to X or his nominee and X nominated B to accept the goods. B later contracted with A that if A would deliver the same goods to B, B would unload them from the ship at a fixed rate. B did not honour his promise and A sued for breach of contract. B contended that A had provided no consideration because in delivering the goods, A was merely performing his existing contractual duty to X. The court disagreed. When A promised B to perform an existing contractual duty which A owed to X, such a promise benefits B by conferring on B the personal right to enforce that promise. Note that A would not have suffered a detriment in performing the act as A is already contractually obliged to X to so perform. However, it should be recalled that the law only requires either a benefit conferred or a detriment suffered to constitute consideration. 226 Chapter 8: Consideration and Intention to Create Legal Relations (2) Owed to the promisor (a) In return for a promise for more 8.30 What if the alleged consideration lies in the performance, or a promise to perform, an existing contractual duty owed to the promisor? The traditional view is that such a promise is generally not regarded as sufficient consideration — the promisor derives no benefit from a performance to which he is already entitled and the promisee suffers no detriment for doing what he is already bound to do. In Stilk v Myrick (1809), the captain of a ship, unable to replace two crewmen who had deserted in the course of a voyage, promised to divide the wages of the deserters equally among the rest of the crew if they would work the ship safely back to London. One of the seamen sued to enforce this promise after the completion of the voyage. The court rejected the claim, holding that the seamen were already bound under the terms of their existing contracts to complete the voyage and hence a subsequent promise to do the same was no consideration for the captain’s promise. 8.31 It has been suggested that the rationale behind Stilk v Myrick’s decision is to discourage seamen from holding their employer to ransom by threatening to breach their contracts and aggravating the perils of seafaring. A party should not be encouraged to extort further concessions from the other party after having already concluded a contract. 8.32 However, any performance which is over and above the promisee’s existing contractual duty is sufficient consideration for a promise given in exchange. In Hartley v Ponsonby (1857), the remaining crewmen were also promised additional wages to continue on a voyage which had become too hazardous after the desertion of 17 (out of 36) sailors. The promise was held to be binding because in such circumstances, the remaining crew members were no longer bound to complete the voyage and in agreeing to do so, they have done more than what was required under their original contractual undertakings. 8.33 Stilk v Myrick should be contrasted with the controversial case of Williams v Roffey Bros & Nicholls (Contractors) Ltd (1991). The defendants (Roffey Bros) were building contractors who were awarded a contract to refurbish 27 flats. For that purpose, they engaged the plaintiff (Williams) as sub-contractor to 227 Principles of Singapore Business Law carry out the carpentry work for £20,000. Shortly after commencing work, the plaintiff got into financial difficulty; the agreed price of £20,000 was too low to enable him to carry out the work satisfactorily and this was aggravated by the slow progress of the work due to his own inadequate supervision. The defendants, being aware of the plaintiff ’s problems, were concerned that if the plaintiff did not complete the carpentry work on time, the defendants would incur a delay penalty under the main contract. After some negotiation, the defendants agreed to pay the plaintiff an additional sum of £10,300 at the rate of £575 for each flat completed. Thereafter, the plaintiff resumed work and substantially completed the work on eight more units but received only one further payment of £1,500 from the defendants. The plaintiff then ceased works and brought an action to enforce the defendants’ promise of additional payment. 8.34 Relying on Stilk v Myrick, the defendants resisted the plaintiff ’s claim on the ground that no consideration was furnished for the defendants’ promise of additional payments — the plaintiff was already bound to complete the carpentry work under the original sub-contract. However, the English Court of Appeal disagreed. Clearly, the defendants had agreed to the additional payment because they considered it advantageous to do so. They stood to enjoy practical or factual benefits from the plaintiff ’s promise to complete the work on time such as avoiding the need to engage another subcontractor and, more importantly, the avoidance of liability for delay to the owners under the main contract. Such practical or factual benefits were held to be sufficient consideration for the defendants’ promise. The result of this decision is that the promise to perform an existing contractual duty owed to the promisor may constitute sufficient consideration if the promisor derived “practical benefits” from the performance. As summarised by Glidewell LJ (at pp 15–16): (1) if A has entered into a contract with B to do work for, or to supply goods or services to, B in return for payment by B; and (2) at some stage before A has completely performed his obligations under the contract, B has reason to doubt whether A will, or will be able to, complete his side of the bargain; and (3) B thereupon promises A an additional payment in return for A’s promise to perform his contractual obligations on time; and 228 Chapter 8: Consideration and Intention to Create Legal Relations (4) as a result of giving his promise, B obtains in practice a benefit, or obviates a disbenefit; and (5) B’s promise is not given as a result of economic duress or fraud on the part of A; then (6) the benefit to B is capable of being consideration for B’s promise, so that the promise will be legally binding. 8.35 Clearly, Williams v Roffey marks a significant departure from the traditional position represented by Stilk v Myrick. The defendant in Stilk v Myrick had also benefited from the crew’s promise to sail the vessel back to the destined port, yet such benefit was not held to be sufficient consideration. These two decisions are (despite denials of the judges in Williams v Roffey to the contrary) clearly inconsistent with each other. At present, the inconsistency remains unresolved. 8.36 Williams v Roffey has been endorsed in two local decisions with, unfortunately, dissimilar suggestions as to its ambit. In Sea-Land Service Inc v Cheong Fook Chee Vincent (1994), the defendant employer issued a 30-day termination notice to the plaintiff employee stating that his severance benefit included an enhanced severance payment of $14,340 (which was not an existing contractual entitlement). Subsequently, after serving out the notice period, the defendants refused to pay the enhanced severance payment but offered an ex gratia allowance of $4,780 instead. The plaintiff sued to enforce the enhanced severance payment, arguing that the defendants had in fact benefited from his services during the last month of his employment which constituted consideration for the promised payment. 8.37 The Court of Appeal disagreed. It regarded Williams v Roffey as a “limited exception” (see [11]–[14]) and held that in this case, the defendants derived no benefit from the plaintiff ’s work in the last month because a company would only retrench employees who were no longer essential to its operations and hence the value of such employee’s work in the final month was at best minimal. This reasoning suggests that the concept of “practical benefits” ought to be understood narrowly such that only a real and significant benefit (and not just any benefit) would constitute sufficient consideration under the principle established in Williams v Roffey (see J Carter, A Phang and J Poole, “Reactions to Williams v Roffey” (1995) 8 Journal of Contract Law 248). 229 Principles of Singapore Business Law 8.38 In Sharon Global Solutions Pte Ltd v LG International (Singapore) Pte Ltd (2001) (see Chapter 14, paras 14.21–14.22) however, the concept appears to be interpreted more broadly. In this case, the defendant agreed to make additional payments to the plaintiff in exchange for the latter’s promise to deliver goods, which it was already bound to do under its existing contract with the defendant. The Singapore High Court applied Williams v Roffey to enforce the defendant’s promise. It found that the defendant had benefited from the timely delivery of the goods and avoided “negative commercial consequences” such as the damage to its reputation arising from its failure to meet its customers’ orders. However, no attempt was made to reconcile Williams v Roffey’s approach with that in Stilk v Myrick nor was the previous Court of Appeal decision of Sea Land Services referred to. The law in Singapore thus remains equally unsettled. 8.39 The Sea Land Services decision has been subsequently referred to by the Singapore High Court in Teo Seng Kee Bob v Arianecorp Ltd (2008) and the principle in Williams v Roffey applied; again without any discussion as to its scope of application. Despite remaining ambiguities, the Williams v Roffey exception is part of Singapore law. Indeed, the Singapore Court of Appeal in Gay Choon Ing v Loh Sze Ti Terence Peter and another appeal (2009) affirmed as much (at [118]), in observing that a diluted doctrine of consideration represents the current state of Singapore law. The traditional role played by the doctrine of consideration in guarding against extortionate behaviour is diluted if practical or factual, as opposed to legal, benefit is accepted as sufficient consideration in return for a promise for more (see “Implications of Williams v Roffey” in Box 8.2). Box 8.2 Reflecting on the law Implications of Williams v Roffey (1) Doctrine of Consideration Theoretically, the captain in Stilk v Myrick could sue the sailors for breach if they decided to discontinue the voyage, but the practical value of such action is minimal compared to the loss, expense and inconvenience which could result from a delayed or abandoned voyage. Thus the sailors’ promise to sail the ship to the destined 230 Chapter 8: Consideration and Intention to Create Legal Relations Box 8.2 (Continued ) port was undoubtedly a factual benefit. But the court appears to have construed consideration as a legal rather than a factual concept. By accepting “practical benefits” as sufficient consideration, the court in Williams v Roffey has shifted the focus of enquiry from “Has the promisee provided something that has value in the eyes of the law?” to “Did the promisor in fact benefit from the promisee’s promise?” This is a broader and more flexible understanding of the concept of consideration which arguably accords with commercial reality — parties do often agree to pay more for the same goods or services (or render more services for the same price) where it is beneficial to do so. Yet, if the slightest benefit could constitute consideration, almost all modifications of (especially commercial) contracts will be upheld as the promisor would almost always benefit more from the promisee’s continued performance than a breach of his contractual duty. In practice, this will mean that the requirement for consideration will cease to have a meaningful role in defining the kinds of agreements which are enforceable at law. (2) Contract Modification and Economic Duress The inconsistency between these two cases is also reflective of the tension between two legitimate concerns when deciding whether a contract modification is valid and enforceable. On the one hand, there is concern that such modification might have resulted from one party’s exploitation of the other’s weaker bargaining position. In Stilk v Myrick, the court dealt with such risks by insisting on the presence of consideration, the assumption being that where fresh consideration has been furnished, the variation is less likely the result of duress or coercion. However, a counter argument is that a freely agreed modification should be upheld even in the absence of consideration. If one party encounters problems in the performance of his contractual obligations, should he not seek a solution by negotiating with the other party for a modification of the contract terms? Such self-help methods are likely to be more time and cost effective than formal dispute resolution processes such as litigation. Indeed, some commentators have argued that the concept of consideration is no longer necessary to curb such risks, as this function is more aptly performed by the doctrine of economic duress (see Chapter 14, Box 14.1). See R Halson, “Sailors, Sub-Contractors and Consideration” (1990) 106 Law Quarterly Review 183; A Phang, “Whither Economic Duress? Reflections on Two Recent Cases” (1990) 53 Modern Law Review 107; and A Phang, “Consideration at the Crossroads” (1991) 107 Law Quarterly Review 21. They argue that instead of depending on the presence or absence of consideration, such modification is valid as long as it can be shown that both parties intended to be bound by the modification and that no improper pressure has been applied on the promisor in the bargaining process. This reasoning is persuasive in that, if accepted, it will bring the law closer to commercial reality. 231 Principles of Singapore Business Law Table 8.1 Promises/Acts proffered as consideration in return for a promise Of nominal value Sufficiency of Consideration Proferred and Rationale Is it sufficient? Intangibles Moral obligation Existing public duty Going beyond existing public duty Existing contractual duty owed to third party Existing contractual duty owed to promisor ? Rationale The law does not interfere with bargains freely entered into by private citizens in a free market economy. Too uncertain for purposes of enforcement. Policy not to encourage extortionate behaviour (eg, holding of love and affection at ransom). Policy not to encourage extortionate behaviour (ie, holding moral/good behaviour at ransom). Policy not to encourage extortionate behaviour by public officials. No benefit to promisor nor detriment to promisee. No risk of extortionate behaviour by public officials. Benefit to promisor and detriment to promisee exist. No risk of extortionate behaviour by promisee. Benefit conferred to promisor although promisee suffers no detriment. Insufficient: Stilk v Myrick (traditional view) Policy not to encourage extortionate behaviour by contracting parties once a contract is concluded. No benefit to promisor nor detriment to promisee. Sufficient: Williams v Roffey (practical benefits enjoyed by promisor) Gives effect to commercial reality. Problem: Threatens to derail the traditional role of the doctrine of consideration. Going beyond existing contractual duty No risk of extortionate behaviour by contracting parties. Benefit to promisor and detriment to promisee exist. 232 Chapter 8: Consideration and Intention to Create Legal Relations (b) In return for a promise for less 8.40 A owes B $1,000. A pays $700 to B, which B accepts as complete discharge of A’s debt. Can B later sue A for the unpaid balance of $300? In other words, can A hold B to his promise to accept $700 as complete discharge of A’s debt? In this situation, A does not rely on B’s promise to seek additional payment (unlike the case in Stilk v Myrick) but to avoid part of his liability. 8.41 The general rule laid down in Pinnel’s case (1602) is that the payment of a lesser sum is not a complete satisfaction of the debt. The rationale is that a promisor is not bound by his promise to forego the unpaid portion of the debt as the promisee has not furnished any consideration for the promise — in making part payment, the promisee has done no more, and in fact, less than what he is contractually bound to do. Thus, such contract modifications are not enforceable in the absence of consideration, and in the example above, B may insist on the full repayment of A’s debt despite his promise to the contrary. The rule in Pinnel’s case has been affirmed and applied by the House of Lords in Foakes v Beer (1884). 8.42 The rule in Pinnel’s case does not apply where the debtor has provided something different to the creditor, at the creditor’s request. Thus if A owed B $1,000 and B agreed to treat the debt as discharged in full if A washes B’s car, or make partial payment of $500 and washes B’s car, the rule in Pinnel’s case would not apply since A would have furnished consideration for B’s promise to forgive the debt or forgo the balance. Alternatively, partial repayment of a debt at a different place or on an earlier date would suffice as fresh consideration for the creditor’s promise. 8.43 The rule in Pinnel’s case has been criticised on the ground that it runs counter to the ordinary expectations of the business community. As Lord Blackburn observed in Foakes v Beer (at p 622): All men of business, whether merchants or tradesmen, do every day recognise and act on the ground that prompt payment of a part of their demand may be more beneficial to them than to insist on their rights and enforce payment of the whole. Even where the debtor is perfectly solvent, and sure to pay at last, this often is so. Where the credit of the debtor is doubtful it must be more so. 233 Principles of Singapore Business Law Thus, it is reasonable to ask whether the principle in Williams v Roffey should apply to contract variations resulting in a promise to accept less. In other words, why should the practical benefit of receiving a partial payment not be accepted as good consideration for the promise to forgive the whole debt? In Re Selectmove Ltd (1995), the English Court of Appeal acknowledged the force of this argument but did not extend the principle in Williams v Roffey to situations involving partial payment of debts as that would in effect be overruling the House of Lords decision in Foakes v Beer, which the Court of Appeal had no power to do. The court thus correctly adhered to the doctrine of precedent but unfortunately left the inconsistency between Williams v Roffey and Foakes v Beer unresolved. In principle, it is difficult to see why the law should differentiate between these two situations as the practical benefits which a promisor may derive from the receipt of part payment is no less real than the benefits of receiving a promised performance (see J Carter, A Phang and J Poole, “Reactions to Williams v Roffey” (1995) 8 Journal of Contract Law 248). The law in Singapore on this point also remains unresolved. WHEN CONSIDERATION IS NOT REQUIRED: THE EXCEPTIONS Contract by Deed 8.44 An exception to the legal requirement of consideration are contracts by deed, that is, formal documents in writing which have been signed by the parties before a witness or witnesses, sealed and delivered. A gratuitous promise made by deed may be enforced (see, eg, Development Bank of Singapore Ltd v Yeap Teik Leong (1988); Hong Leong Finance Ltd v Tay Keow Neo (1991)). The rationale for exempting such contracts from the requirement of consideration is that having gone through such elaborate steps, the party making the gift would be well aware of what he is doing and would seriously intend to be legally bound to make the gift. Promissory Estoppel (1) Meaning and origin 8.45 An important exception to the rule in Pinnel’s case, the equitable doctrine of promissory estoppel prevents a person from going back on his promise even though the promise is not supported by consideration. The origin of this doctrine is often traced to Denning J’s (as he then was) obiter remarks 234 Chapter 8: Consideration and Intention to Create Legal Relations in Central London Property Trust Ltd v High Trees House Ltd (1947). In that case, a 99-year lease was granted by the plaintiffs to the defendants in 1937 for a block of flats at a rent of £2,500 per year. In January 1940, the plaintiffs agreed to halve the rent as the defendants were encountering difficulty securing sub-tenants for the flats owing to the war conditions then prevailing. The defendants thereafter paid the reduced rent. However, the flats were again fully let by early 1945 and the plaintiffs sought to restore the rent to £2,500 from mid-1945. Denning J held that the plaintiffs were entitled to do so as the reduced rent was intended to apply only while the adverse conditions persisted. More importantly, Denning J observed that if the plaintiffs had claimed for the full rent for the period prior to 1945, they would have been estopped from doing so as they could not go back on a promise that was intended to be binding and which was in fact relied upon by the defendants as it would have been inequitable for them do so under the circumstances. (2) Elements of promissory estoppel 8.46 To successfully invoke the doctrine, all of the following elements must be present: ° a clear and unequivocal promise by the promisor not to insist upon his original contractual rights; ° reliance by the promisee; ° such that it is inequitable for the promisor to go back on his promise; and ° the doctrine is invoked as a shield, not a sword. Each of these elements, as well as the effects of promissory estoppel, will be considered. (a) Clear and unequivocal promise 8.47 The promisor must have made a clear and unequivocal promise which is intended to affect the future conduct of the parties’ relationship. Obviously, the clearer the promise, the more likely it is that the promisee will act in reliance on it and render it inequitable for the promisor to retract his promise. Whether a promise is sufficiently clear and certain is judged objectively, that is, it is sufficient if a promisee could reasonably have been so induced in the circumstances. 235 Principles of Singapore Business Law 8.48 Silence or mere inaction would not generally constitute a clear promise as it lacks certainty. Thus, a mere failure to enforce a contractual obligation does not amount to a promise to abandon such a right of enforcement. However, a promise does not have to be express but can be implied by words or conduct. In Hughes v Metropolitan Railway Company (1877), a landlord gave his tenant six months’ notice to repair the premises but thereafter, the parties commenced negotiations for the sale of the lease to the landlord. The tenant had indicated that he would not effect the repairs whilst negotiations continued. And in fact, in the course of negotiations, the landlord raised the state of disrepair of the premises as a reason for objecting to the tenant’s asking price for the lease. Soon after, the negotiations broke down and the landlord sought to forfeit the lease as the tenant had not carried out the repairs on the expiry of the original six months’ notice. It was held that he could not do so as it could reasonably be inferred from his conduct in entering into negotiations with the tenant that the notice period would not run while the negotiations continued and would only continue to run after the negotiations ended. (b) Reliance 8.49 The second requirement is that the promisee must have acted in reliance on the promise. Generally, such reliance is evidenced by the promisee’s change of position on the faith of the promise, that is, by doing or omitting to do something which he would otherwise not have done or omitted to do. 8.50 Is it sufficient for the promisee to merely alter his course of action in reliance on the promise made, or must he also have suffered some detriment or disadvantage as a result? Some cases suggest that detrimental reliance is necessary. The rationale is that only where the promisee has suffered such detriment would it be inequitable for the promisor to go back on his word (see paras 8.61–62). 8.51 The English position does not require detrimental reliance. In W J Alan & Co Ltd v El Nasr Export and Import Co (1972), Lord Denning rejected the suggestion that a promisee must adduce evidence of detriment in order to invoke promissory estoppel; all he needed to demonstrate was that he had, in reliance on the promise, acted differently from what he otherwise would have done. Similar observations were made in Société Italo-Belge pour le 236 Chapter 8: Consideration and Intention to Create Legal Relations Commerce et l’Industrie SA v Palm and Vegetable Oils (Malaysia) Sdn Bhd, The Post Chaser (1982) by Goff J (as he then was) (at p 27): To establish such inequity, it is not necessary to show detriment; indeed, the representee may have benefited from the representation, and yet it may be inequitable, at least without reasonable notice, for the representor to enforce his legal rights. Take the facts of [the High Trees case] … the representation was by a lessor to the effect that he would be content to accept a reduced rent. In such a case, although the lessee has benefited from the reduction in rent, it may well be inequitable for the lessor to insist on his legal right to the unpaid rent, because the lessee has conducted his affairs on the basis that he would only have to pay rent at the lower rate. 8.52 The English position was endorsed by the Singapore High Court in Abdul Jalil bin Ahmad bin Talib v A Formation Construction Pte Ltd (2006). In that case, Judith Prakash J commented (at [44]) that “the better view is that detriment of the kind required for the purpose of estoppel by representation is not an essential requirement and all that is necessary is that the promisee should have acted in reliance on the promise in such a way as to make it inequitable to allow the promisor to act inconsistently with it”. Under this approach, the question whether the promisee has suffered any detriment would only be a factor to be taken into account when considering the last element of the doctrine, that is, whether it is in fact inequitable for the promisor to retract his promise in all the circumstances (see para 8.61). When the case went up on appeal, this point was not challenged and the Court of Appeal (at [48]) chose not to rule on the correctness of Judith Prakash J’s approach without the benefit of arguments (see Abdul Jalil bin Ahmad bin Talib and others v A Formation Construction Pte Ltd (2007)). 8.53 The issue of detrimental reliance was finally clarified in Lam Chi Kin David v Deutsche Bank AG (2010) by the Singapore High Court whose position appears to have been implicitly endorsed by the Court of Appeal (see Lam Chi Kin David v Deutsche Bank AG (2011)). Of further interest is the novel approach introduced by the Court of Appeal in Lam Chi Kin to establish promissory estoppel in the absence of “detrimental reliance”. This will be explained in para 8.59 but first, the issue of detrimental reliance is elucidated. 237 Principles of Singapore Business Law 8.54 In Lam Chi Kin, the Singapore High Court, upon a short survey of the law, noted (at [55]–[56]) that conflicting views on the requirement of detriment arose because some courts used the word “detriment” in a narrow sense while others used it in a broad sense. The narrow sense was used in situations where the promisee was put to some trouble in acting (or relying) upon the promisor’s promise and thus already suffered a detriment prior to any indication that the promisor wished to resile from his promise. For example, the promisee had to incur expenditure of money (see, eg, Yokogawa Engineering Asia Pte Ltd v Transtel Engineering Pte Ltd (2009)) or time, or was placed in a position of disadvantage such as incurring legal obligations (see, eg, Fenner v Blake (1900)). The broad sense was used in situations where the promisee did not suffer any immediate trouble or disadvantage in acting (or relying) on the promisor’s promise; instead, the promisee might have enjoyed a benefit from doing so. “Detriment” or disadvantage to the promisee would only arise if the promisor was permitted to go back on his promise (see, eg, Hughes v Metropolitan Railway Company (1877) and WJ Alan Co Ltd v El Nasr Export and Import Co (1972)). 8.55 The facts of Hughes v Metropolitan Railway Company (see para 8.48) may be used to illustrate the difference. Relying on the landlord’s implied promise not to insist on repairs to the leased premises during the period of negotiations for the sale of the lease, the tenant did not effect the repairs within the notice period. Was there detrimental reliance? There was no “detriment” in the narrow sense of the word — the promisee-tenant did not suffer any detriment in relying on the promise. Instead, the tenant enjoyed the benefit of not being put to the trouble and expense of effecting repairs, which might be rendered unnecessary (and wasted) had the negotiations resulted in a successful sale of the lease. Nevertheless, “detriment” in the broad sense existed — the tenant’s reliance on the implied promise to suspend the notice period for repairs had resulted in a change of the tenant’s position; the tenant-promisee would suffer detriment, that is, the prospect of eviction for failing to effect repairs within the original notice period, if the landlord was permitted to go back on his word. 8.56 Steven Chong JC (as he then was) rejected a technical approach of dwelling on the narrow or broad sense of detriment in establishing promissory estoppel. Instead, the learned judge distilled (at [57]) an overarching principle that ran 238 Chapter 8: Consideration and Intention to Create Legal Relations through the decided cases in which the doctrine of promissory estoppel had been applied: The overarching principle … is that the doctrine has consistently been held to apply in circumstances when it was inequitable either in the narrow or broader sense of “detriment” for the promisor to resile from his promise and to enforce his strict legal rights. Applying the principle to the facts of Lam Chi Kin, the learned judge concluded that it was not inequitable to allow the promisor to go back on the promise — no detriment was suffered by the promisee in reliance on the promise to justify preventing the promisor from insisting on their strict legal rights. 8.57 On appeal, while the Court of Appeal disagreed with the High Court’s conclusion, they appear to have implicitly approved of the identified principle (see, however, A Phang (general ed), The Law of Contract in Singapore (2012) at para 04–082 where doubt is expressed on whether the Court of Appeal has embraced the “overarching principle”). What is clear is that the Court of Appeal’s focus of inquiry into the existence of detriment was on establishing the last element, that is, that it will be inequitable to allow the promisor to go back on his promise (see [38]). Detriment suffered by the promisee is therefore relevant towards justifying the inequity of allowing the promisor to resile from his promise. 8.58 As mentioned, the Singapore Court of Appeal reached a conclusion opposite to that of the High Court on the facts of Lam Chi Kin. The brief facts are: Deutsche Bank promised to extend a “48-hour grace period” to Lam Chi Kin (“Lam”), their private banking client, to respond to a “margin call” in the course of complex foreign exchange trades. The “grace period”, a more generous time allowance than that permitted under the original contract term governing the parties, was valuable given the volatility of foreign exchange rates and the financial impact they would have on Lam’s investments. The Court of Appeal found (at [38]) that various actions taken by Lam resulted in a change of his position: Lam provided additional business to the bank by obtaining from them a credit line of USD200 million to carry on foreign exchange trades, placed large cash deposits with the bank as collateral for the credit line and entered into risky leveraged foreign exchange trades to the tune of multiple millions of several currencies, something Lam would not have done if not for the promised grace period. On this basis, the Court 239 Principles of Singapore Business Law of Appeal concluded that Lam relied on the bank’s promise and thereby suffered sufficient detriment to make it inequitable to permit the bank to resile from their promise. 8.59 In an interesting turn, the Court of Appeal went on to introduce a novel approach to establish promissory estoppel. The Court held that in the absence of detrimental reliance, Lam could rely on an alternative principle (a “broader principle”) to establish promissory estoppel. Chan Sek Keong CJ (delivering the judgment of the court) said, at [40]: Furthermore, in our view, even if it is arguable that there was no detrimental reliance on the facts of this case, we would hold that the appellant is entitled to succeed in this appeal on the broader principle set out at V.5.17 of Bower ([33] supra), where it is stated: However, even adopting such a broad definition of detriment, an exception may be suggested to the rule that detriment is required. It is strongly arguable that a representor may be stopped from denying a representation because it is inequitable for the representor to resile from it, although the representee has suffered no detriment, where the representor has obtained an advantage by the reliance of the representee on the representation, as had been held in relation to constructive trusts, by reasoning equally applicable to the doctrine of estoppels. [emphasis in the original] Emphasising the particular relevance of the “broader principle” to the facts of Lam Chi Kin, Chan CJ stated, at [40]: We are of the view that this principle is particularly relevant in the context of private banking where if banks and financial intermediaries engaged in the business of wealth management cannot be trusted with their words, they should not allowed to be in this business. The courts should not allow a bank to claim that “my word is not my bond”, and should be sufficiently astute to find inequity, and where it is possible to do so within legal limits, to hold the promisor to his word in a case, such as the present, where the respondent has obtained an advantage from his promise at the expense of the promisee. Applied to the facts, the court found that the bank’s promise of a grace period enabled them to attract and induce Lam to use their wealth management services. Since the bank had benefitted considerably as a result of Lam’s 240 Chapter 8: Consideration and Intention to Create Legal Relations reliance on their promise, the court concluded that it was inequitable for the bank to resile from their promise. 8.60 Various observations on the “novel approach” are pertinent. First, the status of the “broader principle” is unclear — the Court had already decided the case on the “detriment” analysis and the novel approach would likely be obiter. However, the language used by the Court (in [40] reproduced above and the summary of findings in [48]) seems to suggest that it could be an alternative ratio decidendi. This remains to be clarified by the Court of Appeal. Second, the focus of the broader principle is on the attainment of an advantage (or benefit) by the promisor as a result of the promisee’s reliance on the promise — and whether this circumstance makes it inequitable for the promisor to resile from his promise. This is in stark contrast to the traditional focus on whether the promisee had suffered a detriment as a result of his reliance on the promise. Traditionally, promissory estoppel is used to protect the promisee from disadvantage in relying on the promisor’s promise and not to prevent the promisor’s advantage as a result of such reliance. Third, the “broader approach” raises a number of interesting questions: What sort of “advantage” will trigger the operation of promissory estoppel? Will it result in greater availability of the doctrine constrained only by the need to link the promisor’s enjoyment of advantage to the resulting inequity if the promisor is to go back on his promise? It may be fair to say that a promisor would enjoy an advantage or benefit in not insisting on his original contractual rights in most, if not all, voluntary contract modification scenarios. Indeed, academics have commented, inter alia, that the Court of Appeal’s novel approach is likely to further dilute the role played by the doctrine of consideration (see, eg, Yeo Tiong Min, “The Future of Promissory Estoppel in Singapore Law” Fifth Yong Pung How Professorship of Law Lecture, Singapore Management University, 16 May 2012). (c) Inequitable to go back on promise 8.61 Consistent with promissory estoppel being an equitable doctrine, an essential element is that it must be inequitable for the promisor to go back on his word. Inequity or injustice is a broad concept and overlaps substantially with the concept of “detrimental reliance” (see para 8.50 onwards above). Where a promisor makes a promise upon which the promisee relies and suffers detriment as a result, these facts would render it inequitable to allow the 241 Principles of Singapore Business Law promisor to recede on his word. Notably, in The Post Chaser (see para 8.51) although the court held that detriment was not necessary, it nonetheless held that it was not inequitable for the promisor to recede on his promise because the lapse of two days between the time of the promisee’s reliance and the time at which the promisor retracted his promise was too short to have caused any prejudice to the promisee. Thus, even if one accepts as correct the English position that detriment is unnecessary, detriment remains an important factor in the general assessment of whether it is just and equitable to permit the promisor to go back on his word, a point implicitly acknowledged by the Singapore High Court in Lam Chi Kin. Additionally, the Court of Appeal in Lam Chi Kin signalled that it is pertinent, in the absence of detriment, to examine if the promisor has obtained an advantage or benefit as a result of the promisee’s reliance to decide if such inequity is made out. 8.62 Ultimately, the issue of inequity must be determined by taking into account all the relevant circumstances. Any factor that could tip the balance one way or the other must be considered. D&C Builders v Rees (1966) is a useful illustration. The defendant owed the plaintiffs £482 but offered, through his wife, to pay £300 in full settlement of the account, stating in effect that the plaintiffs would get nothing if they did not accept the lesser sum. The plaintiffs were then on the verge of bankruptcy and the defendant’s wife was well aware of that fact. For lack of a real option, the plaintiffs accepted the payment but subsequently brought an action to recover the balance of the debt. Lord Denning held that it was not inequitable for the plaintiffs to resile from their promise as the defendant had improperly procured the plaintiffs’ agreement by taking advantage of their weak financial position. (d) Shield, not sword 8.63 The principle of promissory estoppel is often metaphorically described as one which acts only as a shield but not as a sword. This means that the principle may only be invoked to defend or resist a claim, but it cannot be used to create a new cause of action where none existed before. In Combe v Combe (1951) (see para 8.10), the plaintiff could not enforce her ex-husband’s promise as she had not furnished consideration for the promise and thus no contract existed between them in the first place. The court also rejected her further argument that the defendant was estopped from breaking his promise since 242 Chapter 8: Consideration and Intention to Create Legal Relations to do otherwise would amount to creating a contractual relation between them when none existed before. 8.64 One may question why the doctrine of promissory estoppel is limited to operate only as a shield but not as a sword. If the rationale is to protect reasonable reliance placed on a promise, why should such protection be allowed only by way of a defence but not as a cause of action? Some other jurisdictions such as Australia have allowed the doctrine to be used as a sword. Neither Singapore nor English courts have thus far adopted this bold approach. (3) Effect of promissory estoppel: Suspensive or extinctive? 8.65 A number of cases suggest that promissory estoppel merely suspends the enforcement of an obligation such that it may be revived by the promisor upon giving due notice to the promisee. This is observed in the High Trees case (see para 8.45), where the court held that it was possible to restore payment of the full rent for the future and in the Hughes case (see para 8.48), where the tenant’s obligation to repair is not lost but is resurrected upon the giving of notice and more time. What constitutes sufficient notice in each case would depend on its particular facts. An express notice is not necessary and precise time need not be specified for it to take effect. Generally, it would suffice if the promisor has by his conduct made clear his intention to withdraw his concession and the promisee is given a reasonable time to make the necessary adjustments thereafter. 8.66 It should be noted, however, that in the High Trees case, the court was prepared only to allow a restoration of the landlord’s rights to future rental at the full rate. Lord Denning was of the view that the landlords would not have been able to recover the full rent for the war years. This indicates that the payment obligations falling within the duration of the suspension were actually extinguished. This is inconsistent with the view that promissory estoppel is suspensory in nature. 8.67 Perhaps a better view is to determine the effects of the doctrine by reference to the nature, intent and circumstances of the promise made. In exceptional circumstances, an obligation may be extinguished because the reliance placed on the promisor’s assurance makes it impossible for the promisee to 243 Principles of Singapore Business Law perform his original obligation or highly inequitable for him to do so (see GH Treitel, “Contract: In General”, in A Burrows (ed), English Private Law (Oxford: OUP, 2nd ed, 2007, at [8.54]). 8.68 In cases such as High Trees, which involved periodic payments, a distinction may have to be drawn between the payments which accrued before the notice and those accruing thereafter. Where it is not possible to recover the former payments, the right to these payments is therefore extinguished; but the general right to future payments is merely suspended and may be revived upon reasonable notice. The suspensory effect is justifiable by the fact that the promises were given in response to acute and temporary circumstances and thus it is likely that the said promises were only intended to be binding while the extenuating circumstances lasted. In the case of one-off payments, where a creditor accepts a lesser sum in satisfaction of a larger debt, the effect of promissory estoppel should ultimately depend on whether the creditor’s intention (objectively determined) is to forgive the entire debt or merely to allow the debtor more time to pay. INTENTION TO CREATE LEGAL RELATIONS 8.69 Even where an agreement is supported by consideration, it is not necessarily enforceable unless the parties intended the agreement to be legally binding. Whether the parties to an agreement did intend to create legally binding relations is a question to be determined by the facts of the case on an objective basis. The parties are said to have the intention to create legal relations if an objective view of the relevant facts suggests that such an intention exists, even if one of the parties should assert the contrary. In Norwest Holdings Pte Ltd (in liquidation) v Newport Mining Ltd (2010), the Singapore High Court reiterated this principle, stating the rationale and highlighting an implication of (or exception to) the objective approach. Belinda Ang J observed (at [34]) thus: … in finding an intention to enter into legal relations, ... the law is predominantly concerned with the objective intentions of a party, and not his subjective or actual intention. … Specifically, the objective approach determines a party’s intentions by looking at all of his words and conduct directed towards his counterparty from the perspective of a reasonable person versed in business. The obvious rationale for the objective approach is to enable parties to deal in reliance with each 244 Chapter 8: Consideration and Intention to Create Legal Relations others’ manifest intentions. It follows from this rationale that there is an exception to the objective approach where a party’s actual intention differs from his apparent intention, and this is actually known to his counterparty. 8.70 Generally, the agreements are analysed under two broad categories: agreements made in social and domestic contexts and agreements arising in business and commercial contexts. SOCIAL AND DOMESTIC AGREEMENTS 8.71 For social or domestic arrangement, there is a presumption that the parties do not intend the agreement to be legally binding. In Balfour v Balfour (1919), the defendant husband who was leaving for an overseas assignment promised to pay his wife, the plaintiff, a monthly sum of £30 until she joined him overseas. The defendant later failed to honour his promise and the plaintiff sued for breach of contract. The court held that the agreement was motivated mainly by the parties’ natural love and affection for each other and not the intention to create legal obligations and thus the plaintiff ’s claim failed. Atkin LJ was also of the view that the courts should not interfere with domestic agreements because the parties do not usually intend such agreements to have legal consequences and that to do so would unduly overload the judicial system. 8.72 In Jones v Padavatton (1969), a mother’s agreement to maintain her adult daughter on the condition that the latter studied to become an advocate was also held not to be enforceable as it was merely an informal family arrangement where each party depended on the other’s good faith for the performance of the promises. 8.73 However, the presumption against contractual intent can be rebutted by clear evidence of the parties’ intention to create legal obligations. In Merritt v Merritt (1970), a husband who had deserted his wife agreed to pay her a monthly maintenance of £40 and to transfer the house to her when she had fully repaid the outstanding mortgage as well as other expenses related to the house. At the wife’s insistence, the husband wrote the agreement on a piece of paper and signed against it. The court held that in these circumstances, the presumption against creating legal relations did not apply and the agreement 245 Principles of Singapore Business Law was binding. Unlike the facts of Balfour v Balfour, where the couple were living in amity at the time of the agreement, the couple in Merritt v Merritt was estranged when the agreement was made. As such, they were clearly making a serious bargain and not merely relying on the other’s affection and good faith for the fulfilment of the promises. 8.74 As the issue of contractual intent is a question of fact, all the surrounding facts of a case are relevant in considering whether the presumption against contractual intent has been displaced. It is not possible to list all the relevant factors but cases have shown that two factors are of particular significance. The first is the certainty of the terms of the agreement. The more certain the terms, the more likely that the parties would have carefully considered the content and effects of the agreement. Conversely, vague and imprecise terms are likely to be construed as evidence of lack of contractual intent. The second factor is the actual reliance placed on the agreement; evidence of such reliance will tend to suggest that the parties intended the agreement to be binding. Both factors were present in Merritt v Merritt; the court found that the agreement was written with sufficient certainty and that the wife had acted in reliance on the husband’s promises in settling the mortgage loan and other related expenses. BUSINESS AND COMMERCIAL AGREEMENTS 8.75 Where business and commercial agreements are concerned, the presumption is that the parties intend to create legally enforceable obligations. The burden of rebutting the presumption is a heavy one and lies on the party who asserts the absence of contractual intent. 8.76 It is not uncommon for parties to expressly state in their agreement that they have no intention to create legal relations. Where this is done in clear terms, the presumption is effectively rebutted. In Rose & Frank Co v J R Crompton & Bros Ltd (1923), the parties included the following clause (commonly known as an “honour clause”) in their agreement: This arrangement is not entered into as a legal or formal agreement, and shall not be subject to legal jurisdiction in the Law Courts but is only a definite expression of and record of the purpose and intention of the parties concerned to which they each honourably pledge themselves. 246 Chapter 8: Consideration and Intention to Create Legal Relations The court held that the arrangement was not enforceable as a contract as it was clear from the honour clause that they did not intend the agreement to have any legal consequence. 8.77 The issue of contractual intention frequently arises in relation to a letter of comfort. Typically, such letters are issued by a parent company or a substantial shareholder to encourage a financial institution to extend a loan facility to its subsidiary or investee company. The precise legal effect of a comfort letter depends on the intention of the parties as evidenced by the surrounding circumstances and the text of the letter. 8.78 In Kleinwort Benson Ltd v Malaysia Mining Corp Bhd (1989), the defendant parent company issued a comfort letter which contained the statement that “It is our policy to ensure that the business of [our subsidiary] is at all times in a position to meet its liabilities to you under the above arrangements.” Upon examining the wording of the letter, the English Court of Appeal held that the statement did not amount to a contractual promise. In contrast, the Australian Supreme Court upheld a letter of comfort containing a similarly worded statement as having contractual force in Banque Brussels Lambert SA v Australian National Industries Ltd (1989). In the latter case, Rogers CJ disapproved of the English court’s approach in attempting to resolve a commercial dispute with excessive emphasis on the text of a document. Rogers CJ also took the view that generally commercial agreements which resulted from hard bargaining should be given significant weight and not be lightly reduced to a “merely honourable engagement” except in the clearest of circumstances. 8.79 Significantly, the Singapore High Court has declined to give legal effect to a letter of comfort in the case of Hongkong and Shanghai Bank Corporation Ltd v Jurong Engineering Ltd (2000). Though the court acknowledged that the letter of comfort should, as a commercial document, be presumed to have legal effect, it nonetheless held that the presumption was displaced by two important considerations. First, the evidence showed that the parties did not seriously place any reliance on the comfort letter; and secondly, the text of the letter was not sufficiently certain to support the creation of binding obligations. This decision suggests that our courts may be more inclined towards a restrictive approach in interpreting letters of comfort, such that 247 Principles of Singapore Business Law documents of this nature are unlikely to be given contractual force except where there is irrefutable evidence of such intention. CONCLUSION 8.80 The reader should realise by now that much uncertainty still surrounds the concept of consideration and in particular, the necessity for such a concept. Though consideration is unlikely to be abandoned, its role in contract law has been considerably whittled down. 8.81 A traditional argument in favour of consideration is that it is good evidence of the contracting parties’ intention to create legal relations. This has been challenged on the basis that where other circumstantial evidence evinces such intention, there is no reason why agreements should be denied legal validity simply for lack of consideration. Indeed, it is often the need to give effect to the parties’ intention in such situations that prompted judges to “invent” consideration. In Chwee Kin Keong and others v Digilandmall.com Pte Ltd (2004), V K Rajah JC (as he then was) observed at [139], obiter, in the Singapore High Court thus: The modern approach in contract law requires very little to find the existence of consideration. Indeed, in difficult cases, the courts in several common law jurisdictions have gone to extraordinary lengths to conjure up consideration. (See for example the approach in Williams v Roffey Bros & Nicholls (Contractor) Ltd …). The learned judge went on to suggest (at [139]), obiter, that: Indeed, the time may have come for the common law to shed the pretence of searching for consideration to uphold commercial contracts. The marrow of contractual relationships should be the parties’ intention to create a legal relationship. 8.82 Perhaps the fate of the doctrine of consideration lies more tellingly in the comments of the Singapore Court of Appeal (comprising Judges of Appeal Chao Hick Tin, Andrew Phang Boon Leong and VK Rajah) in Gay Choon Ing v Loh Sze Ti Terence Peter and another appeal (2009). Andrew Phang JA (delivering the judgment of the court) observed, at [117], that the doctrine of consideration has survived much criticism and remains an established part of Singapore and the common law; albeit reform is still necessary as 248 Chapter 8: Consideration and Intention to Create Legal Relations theoretical incoherence and practical difficulties in application exist. On controversies surrounding the determination of which contractual promises to enforce, the court opined (at [118]), obiter, that having available a range of legal options — a diluted doctrine of consideration and alternative doctrines such as promissory estoppel, economic duress, undue influence and unconscionability — is the most practical approach towards achieving a fair and just result in any given case. The learned judge proffered this provisional view upon noting that, currently, no one doctrine is itself free of difficulties. 249 Chapter 9 Capacity and Privity of Contract 9.1–9.4 9.5 9.6–9.13 9.14 9.15–9.23 9.24 9.25–9.27 Introduction Incapacity 9.28–9.30 9.31 9.32–9.33 9.34–9.38 9.39 Minors Binding Contracts (1) Beneficial contract for necessaries (a) Loans for necessaries (2) Beneficial contract of employment, apprenticeship or education and analogous contracts Voidable Contracts Ratified Contracts Remedies Against a (Protected) Minor (1) Section 3(1) Minors’ Contracts Act (2) Section 2 Minors’ Contracts Act 9.40–9.44 Mental Incapacity 9.45–9.49 Corporations 9.50–9.54 Privity of Contract and Third Parties 9.55 9.56–9.57 9.58–9.62 9.63 9.64 9.65–9.66 9.67 Third Party Enforcement of Benefits under Contract: Techniques to Get Around the Privity Rule Statutory Techniques (1) Contracts (Rights of Third Parties) Act (Cap 53B, 2002 Rev Ed) (a) Scope of application (b) Rights of third party to enforce contractual term (c) Remedies available to a third party (d) Variation and rescission of contract (e) Other provisions (2) Other statutes Principles of Singapore Business Law 9.68–9.76 9.77 9.78–9.80 9.81 9.82 9.83 9.84 9.85 9.86 9.87 9.88 Common Law Techniques (1) Action by promisee on behalf of third party (2) Collateral contracts (3) Himalaya clause (4) Assignment (5) Tort of negligence (6) Agency (7) Law of trusts (8) Other common law techniques Imposing Burdens on Third Parties: Techniques to Get Around the Privity Rule Sub-bailment Contracts Land Law Unlawful Interference with Contractual Rights 252 Chapter 9: Capacity and Privity of Contract INTRODUCTION 9.1 Having considered the legal ingredients necessary for the formation of a contract, we go on to examine the questions of who has the right to sue and enforce promises under the contract, and who is liable to be sued. In this chapter, we will be looking at two separate and distinct situations. The first involves an individual or corporation who is a party to the contract but whom the law regards as lacking the legal capacity to contract. The second concerns an individual or corporation who is not a party to the contract. 9.2 Generally, parties to a contract are entitled to sue and, conversely, are liable to be sued in respect of promises made under the contract. However, the law seeks to protect certain individuals, namely minors (in Singapore, some minors but not all) and the mentally incapacitated (by mental disorders or intoxication), whom it regards as being too vulnerable to fully appreciate what they are committing themselves to in a contract. Thus, the law limits their capacity to enter into contracts. Where corporations are concerned, the law seeks to protect the owners’ investment in a corporation by placing limits on the corporation’s capacity to contract. Such limits generally result in the individual or the corporation not being liable under contracts entered into. Exceptions to the general rule exist to ameliorate any unfairness that may be caused to parties dealing in good faith with the individual or corporation. 9.3 As mentioned, only parties to a contract are entitled to sue and are liable to be sued under a contract. It follows then that an individual or corporation who is not a party or, in legal parlance, not privy to a contract cannot sue or be sued under that contract. Such an individual or corporation is also known as a “third party”. However, strict adherence to the “privity of contract” rule may result in unfairness to the third party especially where a term or terms of the contract confer a benefit to the third party. Hence, various techniques have been utilised to get around the privity rule. 9.4 In this chapter, we shall first consider the effect of incapacity upon an individual’s or corporation’s ability to sue or be sued under a contract to which it is a party. We shall then go on to consider the ability of an individual or corporation (ie, the third party) to sue or be sued under a contract to which it is not a party and some of the common techniques employed to get around the privity rule. 253 Principles of Singapore Business Law INCAPACITY 9.5 In a free market system, the law provides certainty to commercial dealings when contracts are upheld. Nevertheless, this ideal has to be counterbalanced against the need to protect the inexperienced and/or vulnerable individuals who may not be able to protect their own interests in the commercial arena. Investors in a corporation also deserve protection against their investment being applied towards unintended purposes by the persons running the corporation. But what of the interest of the party who dealt fairly with the individual or the corporation? A fine balancing act is required between these equally valid concerns. As will be observed, however, the law on incapacity, especially that concerning minors, is not entirely satisfactory and is considered by many textbook writers as requiring reform. MINORS 9.6 Minors comprise one of the groups considered vulnerable and requiring legal protection against improvident contracts. The premise is that they lack experience in commercial matters and maturity of judgment. The general common law approach is to deem minors as lacking the legal capacity to enter into contracts so that young people below the age of majority are protected. Some examples of countries that adopt this approach are the UK, Hong Kong and Malaysia. 9.7 In the UK, Hong Kong and Malaysia, the age of majority is 18 years (see s 1 UK Family Law Reform Act 1969; s 2 read with s 4 Malaysian Age of Majority Act 1971; and s 2 read with ss 3 & 4 Hong Kong Age of Majority (Related Provisions) Ordinance 1990). In the past, Singapore adopted a similar approach — that is, extending protection to all who are below the age of majority. However, the age of majority in Singapore is 21 (see Bank of India v Rai Bahadur Singh and another (1994)). This had the curious result of young people in Singapore aged 18 to 20 being regarded as still requiring legal protection in contracting while their counterparts in the UK, Hong Kong and Malaysia were not. Whether or not Singapore law actually reflected reality on the ground (then) was never verified by any empirical study. Regardless, the “anomaly” in Singapore law was removed in 2009. Legal amendments that took effect on 1 March 2009 decoupled the age of contractual capacity in Singapore from the age of majority. In other words, 254 Chapter 9: Capacity and Privity of Contract the age from which contractual capacity is conferred is no longer the age of majority. Instead, s 35(1) Civil Law Act (Cap 43 Rev Ed 1999) (“CLA”) provides that the age of contractual capacity is 18 years for most contracts. Legal protection is no longer extended to all minors in Singapore; only minors below 18 years of age are protected. 9.8 There remain some contracts all minors continue to lack legal capacity to enter into. These exceptions are stipulated in s 35(4)(a) to (d) CLA. For example, minors, as a whole, continue to lack capacity to enter into contracts dealing with interests in land (except for contracts for leases of land of 3 years or less) and for the sale or use as collateral of a minor’s beneficial interest under a trust (see s 35(4)(a) to (c) CLA). 9.9 Notably, the 2009 legal amendments only lowered the age of contractual capacity but left unchanged the general law pertaining to minors’ contracts. The sole impetus behind the amendments was to encourage and facilitate entrepreneurship among the young in Singapore. As already alluded to, the existing law on minors’ contracts is not wholly satisfactory. As such, the limited scope of the 2009 amendments have prompted some criticism for, inter alia, failing to consider holistic reform (see Loo Wee Ling, “Use of Age for Conferment of Capacity” (2010) Singapore Journal of Legal Studies pp 328–351). 9.10 Singapore law on minors’ contracts generally tracks the English common law. Thus in the sections to follow, English case authorities are highlighted in the discussion of the scope of law on minors’ contracts. However, the reader is cautioned that as the UK still confers contractual capacity from the age of majority, English cases inevitably refer to parties lacking legal capacity as minors (as a whole) and to their raising the defence of minority. The reader should bear in mind the crucial difference that, in Singapore, only some minors (those under 18 years) as opposed to minors as a whole, may raise the “defence of minority”. 9.11 What is the significance of a lack of contractual capacity? The general rule is that contracts entered into by one who lacks capacity are not enforceable against him. This means that the other contracting party (“the counterparty”) will not be able to sue the party lacking capacity for breach of contract and obtain remedies for breach (eg, claims for the price of goods or services provided, damages or equitable remedies). Thus, generally, 255 Principles of Singapore Business Law a minor in Singapore is not liable under a contract entered into while he is under 18 years of age. 9.12 A (relevant) minor is only allowed to set up his minority as a “defence” to a claim by the counterparty while his obligation is still executory, that is, where the minor has yet to perform his obligations under the contract. Hence, where the minor has already performed (executed) his obligations, he cannot plead his minority in order to recover any money paid or goods delivered unless there has been a total failure of consideration on the part of the counterparty. In Steinberg v Scala (Leeds) Ltd (1923), a minor applied for and was allotted shares in a company. She made partial payment for the shares but thereafter decided to terminate the contract on the ground of her minority and to claim the return of the partial payment. The court rejected her claim. Although she was allowed to terminate the contract and therefore free herself from liability to pay the balance of the price of the shares, she was not allowed to claim back the amount paid as there was no total failure of consideration. She received her shares and thus got something in return for her money. 9.13 Even if a contract cannot be enforced against a minor, the minor is nevertheless entitled to enforce the contract against the counterparty, that is, the counterparty is always bound under the contract. Obviously, this may result in unfairness towards the counterparty and certain rules have evolved through case law and statute to provide the counterparty with remedies against the minor (see discussion under the heading “Remedies Against a (Protected) Minor” at para 9.32 onwards). Certain exceptions to the general rule on the incapacity of minors have also evolved not only to prevent unfairness to the counterparty but also to shield minors from being prejudiced by, ironically, the very protection accorded to them. Traders may be deterred from contracting with minors given their lack of legal capacity but minors still have need for essentials such as food, clothing and employment. These exceptions are discussed under the three headings below: ° binding contracts ° voidable contracts ° ratified contracts 256 Chapter 9: Capacity and Privity of Contract Binding Contracts 9.14 The law recognises some contracts to be fully binding and enforceable against a (protected) minor. The types of contract that fall within this category are: beneficial contracts for necessaries, beneficial contracts of employment, apprenticeship and education, and contracts analogous to the latter category. (1) Beneficial contracts for necessaries 9.15 The rationale behind the binding effect of a contract for necessaries is said to be that unless the minor is bound, traders will not give the minor credit for necessaries. Necessaries can comprise either goods supplied or services rendered. However, the question whether the goods or services contracted for are necessaries is not a straightforward one. Rather it is a question of law and fact. Two considerations are pertinent: first, are the goods or services in question capable of being “necessaries” at law? Second, does the minor, in fact, have actual need for the goods or services? The supplier bears the burden of proving both in the affirmative. To be binding, the terms of the contract for necessaries must also, on the whole, benefit the minor. 9.16 In relation to goods, s 3(3) UK Sale of Goods Act (applicable in Singapore by virtue of the Application of English Law Act (Cap 7A, 1994 Rev Ed) and reprinted locally as Cap 393, 1999 Rev Ed) (“SGA”) defines necessaries to be “goods suitable to the condition in life of the minor … concerned and to his actual requirements at the time of the sale and delivery”. This is a codification of the common law definition. It should be noted that s 3(1) SGA provides that “the capacity to buy and sell is regulated by the general law concerning capacity to contract and to transfer and acquire property”. Thus, all references to a minor in s 3 SGA are to be understood as referring to a minor below 18 years of age. 9.17 At common law, items capable of being necessaries (at law) are “such articles as are fit to maintain the particular person in the state, station and degree … in which he is” (see Peters v Fleming (1840) at p 46) while, as noted above, s 3(3) SGA makes reference to “goods suitable to the condition in life of the minor”. These definitions indicate that necessaries encompass more than just the basic necessities of life and that the social status of the minor is relevant in its determination. Thus what may be necessaries for a “prince” may not be 257 Principles of Singapore Business Law necessaries for a “pauper”. To illustrate, English cases have held the following items, supplied to minors from well-to-do families, to be capable of being necessaries at law: rings, pins and a watch-chain (Peters v Fleming) and a servant’s uniform (Hands v Slaney (1800)). However, articles of mere luxury cannot be necessaries although luxurious articles of utility may sometimes be (see Chapple v Cooper (1844) at p 258). 9.18 Obviously, what may be considered suitable or fit to the condition in life of a minor would change with the times and the old English cases may now be of limited use as a guide. It is also not easy to distinguish articles of mere luxury from luxurious articles of utility. This led to a suggestion that the real question is “whether it was reasonable for the minor, however rich, to be supplied with articles of the kind in question” (see Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at para 12–006). 9.19 As mentioned, the supplier has the unenviable task of proving both that the goods or services supplied are capable of being “necessaries” at law and that the minor has actual need of them before he can successfully claim against the minor. If the minor is already adequately supplied, then he will not be liable for the price even though the supplier did not know this (see Barnes & Co v Toye (1884)). In Nash v Inman (1908), a Savile Row tailor failed in his claim against a minor (a Cambridge undergraduate and the son of an architect of good position) for payment of eleven fancy waistcoats supplied by him. The minor’s father had given unrefuted evidence that the minor was already adequately supplied with clothes at the time of sale and delivery. The burden placed on the supplier to prove the minor’s actual need has been criticised as being unduly harsh as such facts would usually not be within the supplier’s knowledge (see Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at para 12–006). 9.20 Even if the supplier succeeds in proving that the contract with the minor is for necessaries, the contract only binds the minor if it contains terms that, overall, benefit the minor. Thus, in Fawcett v Smethurst (1914), it was held that a contract for the hire of a car for the transport of a minor’s luggage did not bind the minor even though it was a contract for necessary services. It contained a harsh term making the minor liable for damage to the car “in any event”, that is, regardless of whether he was at fault. The court held that the contract, as a whole, was not to the minor’s benefit. 258 Chapter 9: Capacity and Privity of Contract 9.21 An unsettled question is whether a contract for necessaries that remains executory on the part of the counterparty binds the minor. These are cases where the counterparty has yet to perform his obligations under the contract, for example, he has not delivered goods or rendered services contracted for. For necessary goods, s 3(2) SGA provides that “[W]here necessaries are sold and delivered to a minor … he must pay a reasonable price for them” [emphasis added]. As the minor’s obligation to pay arises upon both sale and delivery, the minor is thus only liable when the contract for necessaries is executed (for other arguments for and against this conclusion, refer to Box 9.1). Box 9.1 Reflecting on the law Should executory contracts for necessaries bind the minor? Where the supplier has yet to perform his obligations under a contract for necessaries, the question is whether the minor is bound so that he cannot repudiate the contract on the ground of his minority. A plain reading of s 3(2) SGA appears to suggest that an executory contract for necessary goods would not bind a minor. Proponents of this view argue that a minor is liable for the price not because he has contracted (“contractual basis”) but because he has been supplied (“restitutionary basis”). That is why a minor is only liable to pay a reasonable price instead of the contracted price for necessary goods (see s 3(2) SGA). However, there is conflicting dicta on the basis of a minor’s liability (see Nash v Inman where Moulton LJ (at p 8) held that a minor’s liability rests upon restitution as he is incapable of making a contract, while Buckley LJ (at p 12) opined that a minor had the capacity to make a contract for necessaries). Arguments in favour of a restitutionary basis have also been challenged. Barring very young children, a minor is capable of giving true consent and is thus capable of contracting. And payment of a reasonable price does not conclusively point to a restitutionary basis: the law’s interference with the terms of a transaction does not necessarily strip it of its contractual nature (see Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at para 12–008 and Chitty on Contracts Vol 1 (30th ed, 2008) at paras 8–011 to 8–012). Further, although most textbook writers agree that the different approaches to contracts for necessary goods (ie, executory contracts are not binding) and to contracts for necessary services (ie, executory contracts are binding) are hard to reconcile, different solutions have been suggested to rationalise the law (see Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at para 12–008 and A Phang, Cheshire, Fifoot and Furmston’s Law of Contract (2nd ed, 1998) at p 752). The issue is still unsettled. 259 Principles of Singapore Business Law 9.22 For necessary services, the position is governed by common law and it has been held that executory contracts for services bind the minor, at least where contracts for education are concerned. In Roberts v Gray (1913), a minor had contracted to learn the occupation of a professional billiards player from a famous professional by going with him on a world tour and playing billiards with him during the tour. The court held that the contract was for necessary services in that it was a contract for teaching and instruction, and one which bound the minor even though it was still partly executory on the part of the professional when the minor repudiated the contract. Hence, the minor’s repudiation was wrongful and he was held liable for damages for breach of contract. As an aside, it is pertinent to note that contracts for education that equip a minor with necessary skills to earn a livelihood are considered contracts for necessaries. However, given the overlap, they are often also discussed under the category of contracts of employment, apprenticeship or education and contracts analogous thereto (see paras 9.25 to 9.27). 9.23 Where indeed the contract is one for necessaries, in relation to necessary goods, s 3(2) SGA provides that the minor need only pay a reasonable price. This suggests that the minor may not have to pay the price agreed in the contract. There is no statutory equivalent in relation to necessary services and case law would govern, which appears to require payment of a reasonable price (see Chapple v Cooper (1844)). (a) Loans for necessaries 9.24 Generally, a contract to lend money to a minor for the purchase of necessaries is unenforceable against the minor at common law (see Darby v Boucher (1694)). The rationale is probably that a loan can be easily misapplied to other purposes unlike an actual supply of necessaries. In equity, the lender can recover such part of the loan as is actually used for the purchase of necessaries (see Marlow v Pitfield (1719)). (2) Beneficial contract of employment, apprenticeship or education and analogous contracts 9.25 Contracts of employment, apprenticeship or education are binding on a minor as they provide him a means of earning his livelihood. Again, such contracts only bind a minor if the terms are, on balance, beneficial to the minor. Thus in Clements v L & NW Ry (1894), a minor was held bound by his contract of employment in which he agreed to relinquish his statutory 260 Chapter 9: Capacity and Privity of Contract rights to personal injury benefits and to join his employer’s own insurance scheme. The insurance scheme conferred the minor some rights which were more advantageous than his statutory rights and some rights which were less so. Nevertheless, taken as a whole, the court found that the insurance scheme was still to his benefit. But not every contract that is beneficial to a minor binds him. For example, a minor’s trading contracts do not bind him no matter how beneficial they may be. In Cowern v Nield (1912), a minor trading in hay and straw failed to deliver a consignment of hay to a buyer despite having already been paid. The buyer’s claim to recover the price paid failed. 9.26 This principle of beneficial contracts of employment, apprenticeship or education has been extended to analogous contracts. Examples of these include a contract to grant a publisher exclusive rights to publish a minor’s memoirs (see Chaplin v Leslie Frewin (Publishers) Ltd (1966)), a contract between a professional boxer (who is a minor) and the British Boxing Board of Control in which he agreed to abide by the rules of the Board as he could not earn his living as a boxer otherwise (see Doyle v White City Stadium Ltd (1935)), and a contract where a group of musicians, the members of which were minors, appointed a company to be their manager and agent (see Denmark Productions Ltd v Boscobel Productions Ltd (1967)). 9.27 A decision that provides an interesting contrast to the Denmark Productions case is Proform Sports Management Ltd v Proactive Sports Management Ltd (2007). In Proform Sports Management, an issue arose whether a representation contract for a soccer player, entered into when the player was a minor, was a contract analogous to a contract of “employment, apprenticeship or education” and thus binding on the minor. The case involved a famous English soccer player, Wayne Rooney, who entered into a representation contract when he was aged 15 with Proform Sports Management Ltd (“the company”). Under the contract, the company would act as Rooney’s executive agent and manage Rooney’s career as a professional footballer, provide advice and negotiate on Rooney’s behalf the terms of, inter alia, any contract of transfer from one football club to another. The court held (at [40]) that the representation contract was not a contract analogous to a contract for employment, apprenticeship or education on the ground that the company did not deal with matters essential to Rooney’s training or livelihood, unlike music group managers who “organise matters essential to the very business of the musical artiste”. The company did not provide Rooney training to hone his skills and 261 Principles of Singapore Business Law enable him to earn a living as a professional footballer or to begin to do so. Rooney was already receiving such training under his contract with the Everton Football Club. Voidable Contracts 9.28 At common law, under this exception to the general rule, a contract is binding and enforceable against a minor unless the minor avoids or repudiates the contract during his minority or within a reasonable time after he attains the age of majority. In Singapore, where contractual capacity does not take reference from the age of majority but is conferred from age 18 onwards, this exception will mean that the contract is binding on the minor under 18 unless he avoids it while below 18 or does so within a reasonable time of turning 18. In other words, the contract is voidable by the minor within the stated period. The types of contract within this category are: ° contracts to lease or purchase land; ° contracts to subscribe for or purchase shares in a company; ° partnership agreements; and ° marriage settlements. It is unclear if these are the only contracts that are capable of falling within this category but the usual rationale given for the effect of this category of contracts on a minor is that they concern interest in property of a permanent nature and involve recurring obligations. As such, a minor who retains the interest should, in fairness, be held liable for the obligations. However, the stated rationale has been criticised as vague and does not provide a satisfactory explanation for the inclusion of certain types of contracts within the category or the exclusion of others (see Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at para 12–025). For example, it is unclear what is meant by “permanent” and it has been held that a hire purchase contract for a car, though involving recurrent obligations on the part of the minor to pay instalments, does not fall within this class of contracts (see Mercantile Union Guarantee Corp Ltd v Ball (1937)). As such, the need for such a class of contracts has been questioned (see Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at para 12–026). 9.29 As mentioned, in Singapore, unless the minor repudiates whilst he is below the age of 18, he will have to do so within a reasonable time of turning 18. 262 Chapter 9: Capacity and Privity of Contract What will be considered a reasonable time would depend on the facts of the particular case. In this regard, an English case has held that taking nearly five years after attaining the age of majority to repudiate a marriage settlement was not reasonable even though for most of that time the minor concerned did not know of his right to repudiate (see Edwards v Carter (1893)). 9.30 Upon repudiation, the minor ceases to be bound by future obligations under the contract. However, the law is unclear as to whether he remains bound by outstanding obligations that have accrued prior to repudiation. For example, a minor, upon repudiating a lease of a flat, will no longer be bound to pay future rent but what about the rent for the past months that has yet to be paid? There are conflicting dicta and views by textbook writers on this question although the general view seems to be that a minor remains bound by obligations that have arisen prior to his repudiation of the contract (see Sutton and Shannon on Contracts (8th ed) at p 220 and Salmond and Winfield, Principles of the Law of Contracts at p 461 cited by A Phang, Cheshire, Fifoot and Furmston’s Law of Contract (2nd ed, 1998) at p 759, footnote 106. For an alternative view, see A Phang, as above, at p 759, which also cites in support of the opposing view Salmond and Williams, Principles of the Law of Contracts at p 300 in footnote 106). Finally, as mentioned in para 9.12, the minor cannot recover monies paid or goods delivered to the other party prior to the repudiation unless there has been a total failure of consideration (see Steinberg v Scala (Leeds) Ltd (1923)). Ratified Contracts 9.31 At common law, a contract that does not fall under the previous two exceptions to the general rule may still be binding and enforceable against a minor if the minor ratifies the contract upon attaining the age of majority. In the Singapore context, this exception will operate such that a contract ratified when a minor turns 18 will be enforceable and binding on that minor. Remedies Against a (Protected) Minor 9.32 Unless a contract with a minor falls within the exceptions discussed above, the counterparty will not be able to enforce the contract against the minor. This is the case even if the counterparty did not know that he was dealing 263 Principles of Singapore Business Law with a (protected) minor. Thus, to protect a supplier who has dealt fairly with the minor, a number of remedies exist at common law and equity, and under the Minors’ Contracts Act (Cap 389, 1994 Rev Ed) (“MCA”). This is an English Act introduced in 1987. It is applicable in Singapore by virtue of the Application of English Law Act 1993. 9.33 A thorough discussion of the remedies under common law and equity is beyond the scope of this chapter. It is sufficient to note that these remedies are very much restricted on account of the courts’ fear of diluting the protection given to the minor. They are thus insignificant in comparison to the remedy under the MCA which generally improves a supplier’s access to restitution of benefits transferred under a contract that is unenforceable against the minor. Hence, even though the MCA specifically preserves the counterparty’s rights against the minor at common law and equity (see s 3(2) MCA), it is unlikely that the counterparty will resort to those remedies. For the purposes of this chapter then, the focus will be on the remedies under the MCA with a brief mention of the remedies under common law and equity mainly for purposes of comparison. (1) Section 3(1) Minors’ Contracts Act 9.34 Section 3(1) MCA provides: Where — (a) a person (the plaintiff) has [after the commencement of the Act] entered into a contract with another (the defendant); and (b) the contract is unenforceable against the defendant (or he repudiates it) because he was a minor when the contract was made, the court may, if it is just and equitable to do so, require the defendant to transfer to the plaintiff any property acquired by the defendant under the contract, or any property representing it. 9.35 The section expressly provides for a remedy for the counterparty to the contract in circumstances where the contract does not bind a minor by virtue of his minority. This would include all situations where the contract is not for necessaries and where the minor has not ratified, and where the contract falls within the class of “voidable contracts” that has been repudiated by the minor. Examples of where the counterparty may be able to obtain a remedy: the tailor in Nash v Inman could probably claim back the eleven fancy 264 Chapter 9: Capacity and Privity of Contract waistcoats from the Cambridge undergraduate; and in Steinberg v Scala, if the shares had been allotted without any payment having been made yet when the minor chose to repudiate the contract, then the company would probably be able to claim back the shares allotted. 9.36 Under s 3(1) MCA, the nature of the remedy is restitutionary, that is, the court may order the minor to restore property acquired under the contract or “any property representing it” to the supplier. This is in contrast to the position at common law and equity. At common law, a claim for damages may be made against a minor, except for very young children, in tort. But the tortious remedy will be withheld if to grant it would be tantamount to enforcing the contract against the minor. In R Leslie Ltd v Sheill (1914), a minor lied about his age to obtain a loan. The court held that the minor cannot be sued for a breach of contract as such a contract is unenforceable against a minor. Neither could the minor be sued in the tort of deceit because the effect of granting damages against the minor would result in an indirect enforcement of the contract of loan. At equity, however, a restricted restitutionary remedy is available — the minor may be compelled to restore property but only if the minor had obtained them fraudulently, for example, by misrepresenting his age. Under s 3(1) MCA, the remedy of restitution is available in the absence of fraud. Further, while s 3(1) MCA expressly provides for restoration of “any property representing [the original acquired property]”, it is unclear if the remedy in equity extends to this. 9.37 Thus, under s 3(1) MCA, where the minor still has within his possession the original goods supplied by the counterparty, he may be ordered to return these goods to the counterparty. Moreover, if the minor has exchanged the original goods for other goods in a barter trade, the minor could be ordered to transfer to the counterparty these substitute goods. If the minor has consumed the goods, for example, he has eaten the caviar purchased from the counterparty, or given away the caviar as a gift, then he is no longer in possession of the property acquired under the contract and no order under s 3(1) may be possible. But what if the minor has sold the original goods for cash? The problem here is that the MCA does not provide a definition of the word “property” and it is unclear if “property” encompasses money. Most textbook writers, however, are of the view that money can be considered “property” under the MCA and thus the minor can be ordered to transfer cash representing the original goods to the counterparty (see, eg, Edwin Peel, Treitel: The Law of Contract (13th ed, 265 Principles of Singapore Business Law 2011) at para 12–041 and Chitty on Contracts Vol 1 (30th ed, 2008) at para 8–055). Box 9.2 Reflecting on the law “Any property representing [the original acquired property]” under s 3(1) MCA — further complications Consider the situation where the original goods are sold for cash which is used to partially pay for other goods purchased from another party, or where the cash is deposited into the minor’s savings account, mixed with his other savings, and then withdrawn to purchase other goods. In such situations, can the “other goods” be said to represent the original goods and be liable to be surrendered to the supplier of the original goods? It has been suggested that the difficulty in identifying the proceeds of sale of the original acquired property into these subsequently acquired goods should be considered by the court when exercising its discretion under s 3(1). Certainly, an order to restore property that does not clearly represent the original acquired property will increase the risk of an indirect enforcement of the minor’s contract, which in turn, will undermine the protection of minors under 18 (see Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at para 12–042 for a fuller discussion). 9.38 It should be borne in mind that the remedy under s 3(1) MCA is discretionary and not available as of right. The court will make an order only “if it is just and equitable to do so”. The MCA is silent on the factors to be considered by the court in the exercise of its discretion. However, the difficulty in determining if the minor has in his possession property representing the original goods would probably be an important one. The fairness of the original contract may be another. Hence, whether the supplier tried to take advantage of the minor’s vulnerability is relevant as is the minor’s appearance (whether it is mature or not) in the absence of any representation as to his age. Finally, the need to avoid an indirect enforcement of the minor’s contract may also be considered in the exercise of the court’s discretion. (2) Section 2 Minors’ Contracts Act 9.39 It has been mentioned that loans for the purchase of necessaries are not binding on a (protected) minor. Financial institutions therefore would not grant such loans unless repayment of the loan and interest is guaranteed by a 266 Chapter 9: Capacity and Privity of Contract party with contractual capacity. Where such guarantee is furnished, s 2 MCA reiterates that the guarantee is indeed enforceable against the guarantor: Where — (a) a guarantee is given in respect of an obligation of a party to a contract made [after the commencement of the Act]; and (b) the obligation is unenforceable against him (or he repudiates the contract) because he was a minor when the contract was made, the guarantee shall not for that reason alone be unenforceable against the guarantor. MENTAL INCAPACITY 9.40 A person may be mentally incapacitated in two ways: mental retardation or intoxication. The general rule is that contracts entered into by the mentally incapacitated bind them unless and until they choose to avoid or repudiate the contracts. In other words, the contracts are rendered voidable (see, for the mentally unsound, Che Som bte Yip and another v Maha Pte Ltd and another (1989); and for the drunk, Gore v Gibson (1843)). The law affords protection to those under a mental disability if: ° the mental incapacity prevents the person under such a disability from understanding what he is doing; and ° the other party knows or should have known about the incapacity at the time of entering into the contract. The burden of proving such knowledge is on the party seeking to avoid the contract. 9.41 The second requirement of knowledge can be contrasted with the law on protected minors which does not require knowledge by the counterparty of the minor’s lack of legal capacity. This has been the subject of criticism (see Hudson (1986) “Mental Incapacity Revisited”, The Conveyancer and Property Lawyer 178). 9.42 Though the mentally incapacitated may avoid the contract if the two requirements mentioned above are satisfied, the counterparty to the contract is always bound. However, if the counterparty does not know or, in the circumstances of the case, it cannot be shown that he ought to have known of the incapacity, he may enforce the contract against the person under the disability. 267 Principles of Singapore Business Law 9.43 In any event, in the case of a contract for the sale of goods, s 3(3) SGA provides that “where necessaries are sold and delivered to a person who by reason of mental incapacity or drunkenness is incompetent to contract, he must pay a reasonable price for them”. Hence, a contract for necessary goods would be an exception to the general rule on contracts with the mentally incapacitated. Even if the person under the mental impairment can prove that he did not understand what he was doing and that this was known to or ought to have been known by the other party, he will still have to pay a reasonable price for necessary goods that have been sold and delivered to him. 9.44 A contract will become absolutely binding on a person of unsound mind if he ratifies the contract when he is cured (see Manches v Trimborn (1946)). In the same way, a contract will absolutely bind a drunk if he ratifies after he becomes sober (see Matthews v Baxter (1873)). CORPORATIONS 9.45 When a company is incorporated, the common law confers upon it a legal personality in the sense that it is considered a separate legal entity from its owners (the shareholders) and has capacity to enter into contracts like any human being (see Chapter 21, paras 21.22–21.23). Issues relating to its capacity to enter into contracts arise in the two situations discussed below. 9.46 The first relates to the doctrine of ultra vires. The doctrine was originally introduced to protect shareholders who had invested in a company on the understanding that their money would be applied for certain purposes stated in the objects clause (a clause that states the purpose for which a company is incorporated) contained in a document of incorporation of the company, the memorandum of association. For example, if the objects clause states that the company was set up to carry on the business of selling men’s shoes, any contract entered into by the company to purchase designer watches will be considered ultra vires, that is, beyond the capacity of the company, and therefore, under common law, is null and void. However, while the doctrine protects the shareholders, it operates harshly upon innocent third parties who dealt in good faith with the company. Thus, steps were taken to provide some protection to third parties via s 25 Companies Act (Cap 50, 2006 Rev Ed) (“CA”). 268 Chapter 9: Capacity and Privity of Contract 9.47 Section 25 CA prevents a contract that is ultra vires from being rendered null and void automatically. Instead, restraint or the setting aside of the ultra vires contract will only be ordered by the court, upon application by a member or a debenture holder of the company, if the court considers it just and equitable to do so. Otherwise the contract is valid and binding on the company. Significantly, s 23 CA now allows the incorporators of a company a choice as to whether to include an objects clause in the memorandum of association or to omit it altogether. If it is omitted, the doctrine of ultra vires will no longer be relevant. For a detailed discussion of the doctrine of ultra vires see Chapter 21, para 21.17 onwards). 9.48 The second situation where the company’s capacity to contract may be in issue relates to pre-incorporation contracts. Prior to a company’s incorporation, contracts may need to be entered into to set into motion the process of incorporation. For example, lawyers may need to be engaged to draft the company’s constitutional documents: the memorandum of association and articles of association. However, at this stage, the company has not come into existence and, at common law, is incapable of contracting or to ratify a contract after its incorporation. 9.49 Section 41 CA changes the position. Section 41(1) allows contracts entered into prior to a company’s formation to be ratified by the company after its incorporation and to bind the company thereafter. In the absence of such ratification by the company, s 41(2) provides for persons who acted in the name of or on behalf of the company in entering into pre-incorporation contracts to be personally bound by the contract unless there is express agreement otherwise. Reference may be made to a discussion of s 41 CA in Chapter 20, para 20.21. PRIVITY OF CONTRACT AND THIRD PARTIES 9.50 As mentioned, under the doctrine of privity of contract, only parties to a contract can sue and are liable to be sued in respect of rights and obligations, respectively, under the contract. Two rules emanate from this doctrine: first, a third party to a contract cannot enforce a benefit promised under that contract; and second, the contracting parties cannot, by a contract between them, impose a burden on a third party. The first rule operates to protect the rights of parties to a contract insofar as it does not allow interference from third parties, while the second protects unsuspecting third parties from 269 Principles of Singapore Business Law being involuntarily burdened by obligations under a contract to which they are not privy. 9.51 The second rule is wholly understandable and uncontroversial. However, the first has worked harshly against third parties whom the contracting parties clearly intend to benefit under the contract. This is illustrated in the case of Beswick v Beswick (1968). Peter Beswick sold his coal business to his nephew, John Beswick, in return for a weekly payment of £6 10s from his nephew for the rest of his life, and if he died leaving his wife a widow, she was to receive £5 a week from the nephew for the rest of her life. John Beswick honoured the agreement until his uncle’s death whereupon he then made only one payment of £5 to his aunt. The widow claimed against the nephew for specific performance of the rest of the payments. She claimed in her own name as well as in her capacity as administratrix of her husband’s estate. The court held that she could not personally claim against the nephew as she was not privy to the contract between her husband and the nephew. However, her claim as administratrix of her husband’s estate succeeded because, here, she was claiming on behalf of her dead husband, and he had been privy to the contract. In this case, the widow’s ability to sue as administratrix of her husband’s estate “saved the day” for had she not been able to do so, she would have been left without a remedy. 9.52 The first rule has also caused commercial inconvenience where it prevents third parties, say employees, from being able to rely on “limitation of liability” clauses contained in contracts between their employers and the claimants (see Scruttons Ltd v Midland Silicones Ltd (1962)). Such limitation clauses may well be a reasonable and legitimate way of allocating business risks and the burden of insurance between the employer and the claimant. 9.53 As a result, there have been many judicial and ad hoc statutory attempts at evading this first rule. The repeated calls for reform were finally answered with the legislation of the Contracts (Rights of Third Parties) Act (Cap 53B, 2002 Rev Ed)) (“CRTPA”) in 2001. The CRTPA is closely modelled on the English Act of the same name. A significant difference between these Acts is that the Singapore CRTPA expressly dispels the possibility of any argument based on the doctrine of consideration being raised to defeat a third party’s claim (see s 2(5) which ends with the additional words “and such remedy shall not be refused on the ground that, as against the promisor, the third party is a volunteer”). 270 Chapter 9: Capacity and Privity of Contract Box 9.3 Reflecting on the law Privity of contract and consideration — a single or two distinct rules? The doctrines of privity of contract and consideration are closely connected. This is illustrated in Tweddle v Atkinson (1861) (see also, Chapter 8, para 8.18). The respective fathers of a bride and groom contracted with one another, each promising to pay a sum of money to the groom upon the couple’s marriage. The contract also conferred upon the groom full power to sue the contracting parties for the sums promised. The bride’s father failed to pay and upon his death, the groom sued his estate for the sum. The groom’s action failed as he did not provide any consideration for the promise. Although the privity rule was not used to explain the decision, it is clear that the groom’s action would also have failed for lack of privity. The relevant rule of consideration here is that “consideration must move from the promisee”. The groom, being a third party to the contract between his and his bride’s father, was neither a promisee nor had he provided consideration for the promises. This is the paradigm situation where third parties are conferred benefits under a contract and raises the question whether the doctrines of privity and consideration are one and the same or whether they are distinct concepts that present two separate hurdles to the enforcement of a third party benefit. Since the House of Lords decisions in Beswick v Beswick (1968) and Scruttons Ltd v Midland Silicones Ltd (1962), it is clear that consideration and privity are distinct doctrines. A simple example supports this position: A contracts with both B and C to supply C with a limited edition book in return for B’s promise to pay A $100. Should A fail to supply C with the book, C’s action against A may still fail, not for lack of privity, since he is a joint-promisee, but for lack of consideration moving from him. [Note: If the “joint-promisee doctrine” discussed in the Australian case of Coulls v Bagot’s Executor and Trustee Co Ltd (1967) is applied, C would be able to enforce A’s promise as B is deemed to have supplied consideration on behalf of the jointpromisee C. The joint-promisee doctrine presupposes that consideration and privity are distinct doctrines (for a fuller discussion of the doctrine, see A Phang, Cheshire, Fifoot and Furmston’s Law of Contract (2nd ed, 1998) at pp 160–163). It has also been argued that consideration and privity are distinct doctrines as each performs a different function: the former relates to the types of promises that can be enforced and the latter to who is entitled to sue (see, eg, D Beyleveld and R Brownsword, “Privity, Transitivity and Rationality” (1991) 54 Modern Law Review 48 at p 61). Nevertheless, it has been astutely observed that the close connection between the doctrines makes it is impossible to reform one without reforming the other (see Ewan McKendrick, Contract Law (9th ed, 2011) at p 119). One or the other may still prove a stumbling block to the enforcement of third party benefits. 9.54 The CRTPA does not override the existing common law or ad hoc statutory techniques for evading the privity rule (s 8(1)) nor does it prevent new techniques from being created. Thus, it is still necessary to consider, albeit 271 Principles of Singapore Business Law briefly, some of the more common judicial and statutory techniques that existed prior to the introduction of the CRTPA. The CRTPA and these existing techniques will be discussed before we look at the techniques of getting around the second rule; that of not imposing burdens on third parties. THIRD PARTY ENFORCEMENT OF BENEFITS UNDER CONTRACT: TECHNIQUES TO GET AROUND THE PRIVITY RULE Statutory Techniques (1) Contracts (Rights of Third Parties) Act (Cap 53B, 2002 Rev Ed) 9.55 Of the techniques to evade the privity rule, the CRTPA is the most important. It provides a “general and wide-ranging exception to the [privity] rule” (as is described of its UK counterpart in the UK Law Commission Report (1996) at para 5.16). Due to constraints of space, only certain provisions not already mentioned will be highlighted below. (a) Scope of application 9.56 The CRTPA automatically applies to contracts entered into from 1 July 2002 (s 1(2)). Between 1 January and 30 June 2002, the CRTPA applies only if the contract expressly provides for its application (s 1(3)). However, certain contracts are specifically excluded from the scope of the CRTPA. These are contracts on bills of exchange, promissory notes or other negotiable instruments (s 7(1)), registration documents of a limited liability partnership under the Limited Liability Partnerships Act 2005 or any such partnership agreement under the Act (s 7(2A)), and any contract binding on a company and its members under s 39 Companies Act (s 7(2)). For certain other contracts, the CRTPA only confers limited rights to third parties. A third party will not acquire a right under the CRTPA to enforce a term in a contract of employment against an employee (s 7(3)), and the third party may only acquire the right to enforce an exemption clause in contracts of carriage of goods by sea, rail or road, or air which are subject to their respective rules of international transport conventions (s 7(4)). 9.57 Apart from these specific exceptions and limitations, contracting parties are at liberty to exclude or impose conditions precedent upon the application of the CRTPA by inserting an express term to this effect in their contract (s 2(4)). 272 Chapter 9: Capacity and Privity of Contract (b) Rights of third party to enforce contractual term 9.58 To acquire a right to sue in his name to enforce a term of a contract, a third party must satisfy two requirements: (1) He must have been either “expressly identified in the contract by name, as a member of a class or as answering a particular description but need not be in existence when the contract is entered into” (s 2(3)). The groom in Tweddle v Atkinson (see Box 9.3) and the widow in Beswick v Beswick (see para 9.51) will have satisfied this requirement having been expressly identified. A subsequent purchaser of a property would come within this requirement, although not identified by name, if the contract between the property developer and the original purchaser provides that the developer shall be liable to the original and subsequent purchasers for defects in the development. (2) The third party must fall within either one of the following situations: 9.59 ° the contract expressly states that he may enforce the term (s 2(1)(a)). Thus, for example, s 2(1)(a) would enable the groom in Tweddle v Atkinson to sue his father-in-law’s estate for payment as the contract expressly conferred on him the right to sue; or ° a term in the contract purports to confer a benefit on him (s 2(1)(b)). This is subject to any contrary intention of the contracting parties (not to allow third party enforcement of the term) as can be gleaned from a proper construction of the terms of the contract (s 2(2)). The scope and application of ss 2(1)(b) and 2(2) were considered in the Singapore Court of Appeal decision of CLAAS Medical Centre Pte Ltd v Ng Boon Ching (2010). The facts of the case are complicated; so only facts relating to the issue of third party enforcement of a contract term will be set out. Ng Boon Ching (“Ng”) was a doctor who had for many years run his own successful private practice in aesthetic medicine and his own distributorship business dealing in machines used in aesthetic medicine (laser and intense pulse light machines) and skin care products. In 2004, six doctors inexperienced in aesthetic medicine persuaded Ng to enter into a joint-venture to help them establish an aesthetic medical practice. Ng agreed and in 2005, the six doctors incorporated CLAAS Medical Centre Pte Ltd (“CLAAS”) with all six as its shareholders. Ng subsequently also became a shareholder. Ng incorporated a holding company as a sole shareholder and transferred his private practice and distributorship business to the company. 273 Principles of Singapore Business Law CLAAS then purchased 60 per cent of Ng’s shares in the holding company and was given a 2-year-option to purchase the remaining 40 per cent. CLAAS exercised the option about 7 months later in November 2005 whereupon Ng entered into a shareholders’ agreement with the other six doctors. The shareholders’ agreement contained, inter alia, the following terms: ° Clause 11: a restraint of trade clause prohibiting any of CLAAS’ shareholders from being engaged in any business in Singapore which is in competition with the business of [CLAAS] and/or engage in the practice of Aesthetic Medicine while still a shareholder of CLAAS and for three years after ceasing to be one; ° Clause 11(c): a liquidated damages clause specifying that if Ng breached Clause 11, he is liable to pay damages of $1 million to CLAAS while the other doctors would, upon breach, have to pay CLAAS $700,000 each; ° Clause 12.1(ii): a termination clause allowing the shareholders’ agreement to be brought to an end if all parties agreed to do so in writing; and ° Clause 14.5: a prohibition of assignment clause restricting the assignment of rights and benefits under the agreement by any party without the prior written consent of the other parties to the agreement. In the following year, relations soured between Ng and the other doctors (the original six and a new doctor-shareholder). Ng sold all his shares in CLAAS to one of the original six doctors, resigned as director of CLAAS and the holding company and left. Almost a month later, Ng set up his own general and aesthetic medical practice at another location in Singapore. Significantly, CLAAS was not a party to the shareholders’ agreement. A dispute therefore arose as to whether CLAAS was entitled to rely on s 2(1)(b) CRTPA to enforce the restraint of trade clause (Clause 11) against Ng. 9.60 Chao Hick Tin JA, delivering the judgment of the court, made some illuminating observations and clarifications on the purpose and application of ss 2(1)(b) and 2(2) CRTPA as follows: ° The intent behind ss 2(1)(b) and s2(2) was to distinguish between intended and incidental beneficiaries to a contract — incidental beneficiaries were not entitled to sue under the contract (at [29]). ° Section 2(1) only required proof of a purpose to benefit a third party; it was not necessary to show a predominant purpose or intent to benefit (at [28]). 274 Chapter 9: Capacity and Privity of Contract ° The party of the contract who invoked s 2(2) bore the burden to prove that a proper construction of the contract indicated that the parties did not intend the term concerned to be enforceable by the third party (at [29]). ° A proper construction of the contract under s 2(2) would involve an objective approach to contractual interpretation (at [37]). Background facts were relevant but only if they were part of the factual matrix upon which the contract was entered into (at [37] and [41]). Further, mere failure to expressly state in the contract that the third party had a right to enforce the term did not of itself prevent a third party from acquiring such a right under s 2(1). The absence of such an express statement in the contract was also not proof that the parties did not intend to enable the third party to enforce the term under s 2(2) (at [37]). 9.61 On the facts, the Court found (at [28]) that Clause 11 was clearly intended to benefit the third party (CLAAS). The Court was satisfied that a presumption that CLAAS was intended to be able to enforce Clause 11 was made out since Clause 11(c) had expressly provided for liquidated damages for breach of Clause 11 to be paid to CLAAS. As to whether the presumption was rebutted, that is, whether a proper construction of the contract showed that the parties to the agreement (the shareholders) did not intend to enable the third party (CLAAS) to enforce the benefit under the contract under s 2(2), the court held (at [33]) that the mere existence of Clause 12.1(ii) did not rebut the presumption. Section 3(3) CRTPA spelt out the exact manner by which parties to the agreement could override the third party’s rights (see para 9.64). Clause 12.1(ii) provided for the shareholders to have a right to terminate the agreement but failed to expressly provide for the right to be exercisable without CLAAS’ consent, as would have been required by s 3(3) in order to override CLAAS’ rights. Section 3(3) CRTPA would be rendered superfluous if the mere presence of Clause 12.1(ii) was sufficient to rebut the presumption. The court was further of the view (at [35]) that Clause 14.5 was not inconsistent with an express conferment of a benefit to a third party — such conferment of benefit was not an assignment of the benefit. As such, the existence of a clause which restricted assignments of benefits did not rebut the presumption. The court also disagreed that the mere fact that the third party was a corporate entity, and thus a distinct entity in law from the shareholders, was not intended to be able to enforce a term in the agreement that was entered into for the benefit the shareholders. The court 275 Principles of Singapore Business Law found this argument to be senseless given that the shareholders had chosen the corporate vehicle to “advance and protect their interests” and further provided in their agreement for liquidated damages to be paid not to the shareholders but to the corporate vehicle (at [39]). 9.62 The CRTPA expressly provides that a benefit enforceable by the third party includes his being able to avail himself of the protection of an exemption clause in a contract between the original contracting parties (s 2(6)) as long as he would have been able to do so if he had been a party to the contract (s 4(6)). An example is a contract between A and B in which A excludes or limits his liability in the tort of negligence towards B and further states that the term is also for the benefit of A’s servants, agents and sub-contractors who may enforce the term. In this case, A’s sub-contractor may rely on the clause to exclude or limit his liability when sued by B in the tort of negligence, provided the exemption clause is valid and enforceable at law (on exemption clauses, see Chapter 11). (c) Remedies available to a third party 9.63 A third party who is entitled to enforce a term of the contract shall have available to him remedies for breach of contract as if he is a party to the contract (see, eg, Carriernet Global Ltd v Abkey Pte Ltd (2010)). The contractual remedies include damages, specific performance and injunction, and the usual rules governing the availability of these remedies apply (s 2(5)) (see Chapter 18 for the governing rules). (d) Variation and rescission of contract 9.64 Where the third party acquires a right to enforce a term under s 2, and the third party has either communicated his assent to the term to the promisor (the contracting party against whom the third party would enforce the term), or if he has relied on the term and this is known to or can reasonably be expected to have been foreseen by the promisor, the contract cannot be varied or rescinded so as to remove or alter the third party’s right without his consent (s 3(1)). But this limitation may be pre-empted by the contracting parties’ insertion of an express term reserving their right to vary or rescind their contract without the third party’s consent (s 3(3)(a)). Indeed, the contracting parties may, by an express term, even specify that the third party’s consent is required in circumstances other than those stated above (s 3(3)(b)). 276 Chapter 9: Capacity and Privity of Contract (e) Other provisions 9.65 Some other relevant provisions are as follows. A third party’s right of enforcement is subject to defences or set-offs available to the promisor (s 4). The promisor is also protected against double liability if sued by both the third party and the other contracting party (“the promisee”) (s 6) as the promisee’s right to enforce any term of the contract, including the term which confers a benefit on the third party, is preserved (s 5) (see Figure 9.1 for who is a “promisor” and “promisee”). PROMISEE of Third party Benet A A promises to, eg, sell his business to B C PROMISOR of Third party Benet B B promises to pay $X to C in return for As promise THIRD PARTY Figure 9.1 9.66 Promisor and promisee of the third party benefit Under s 8(2), a third party is precluded from challenging an exemption clause relied upon by the promisor (in his defence to a suit against him by the third party) on the basis of s 2(2) Unfair Contract Terms Act (Cap 396, 1994 Rev Ed) (“UCTA”). Thus, if the promisor negligently fails to honour the term conferring a benefit on the third party and this resulted in loss or damage to the third party other than death or personal injury, the third party cannot require that the promisor’s exemption clause be subject to the test of reasonableness under UCTA. Not surprisingly, this provision has been the subject of heavy criticism. Amongst others, it produces the odd result that a third party suing a promisor under the CRTPA is denied the safeguard of s 2(2) UCTA while it is possible that such a safeguard is available if he were to mount an action in the tort of negligence (see J Adams, D Beyleveld and R Brownsword, “Privity of Contract — The Benefits and Burdens of Law Reform” (1997) 60 Modern Law Review 238 at pp 258–263). 277 Principles of Singapore Business Law (2) Other statutes 9.67 Prior to the enactment of the CRTPA, legislation had been introduced on an ad hoc basis to deal with specific situations where it was felt that a third party should be entitled to enforce a benefit conferred upon him. For example, s 9(2) Motor Vehicles (Third-Party Risks and Compensation) Act (Cap 189, 2000 Rev Ed) entitles a third party injured in a motor accident to claim payment of the judgment sum awarded against the insured motorist directly from the insurance company in certain circumstances. Another example is s 2 Bills of Lading Act (Cap 384, 1994 Rev Ed) which provides that the lawful holder of a bill of lading — a shipping document — shall “have transferred to and vested in him all rights of suit under the contract of carriage [of goods by sea] as if he had been a party to that contract”. Common Law Techniques (1) Action by promisee on behalf of third party 9.68 If the privity rule prevents a third party from suing the promisor directly to enforce the promised benefit, can the promisee sue on the third party’s behalf? This avenue of recovering a third party’s loss is highly dependent on the willingness of the promisee to do so. Technically, the promisee is entitled to sue the promisor for a breach of any term of the contract. The real issue is the type of remedies recoverable on behalf of the third party. The remedy of specific performance would compel the promisor to do what he has promised to do in the contract and hence will be effective to enforce a third party’s benefit (see, eg, Beswick v Beswick). However, unlike damages, specific performance is not available as of right upon a breach of contract. It is a discretionary remedy and if damages are an adequate remedy, specific performance will not be ordered. Thus, if specific performance is unavailable but the promisee is willing to claim on behalf of the third party, can the promisee claim substantial damages in respect of the third party’s loss? 9.69 The general rule is that a promisee is entitled to sue for breach of contract to recover substantial damages in respect of the promisee’s own loss. Thus, where the promisee himself has suffered no loss upon a breach of a term, for example, to solely benefit a third party, the promisee will only be entitled to nominal damages (possibly only $1). Lord Denning made a radical attempt to introduce an exception to the general rule in Jackson v Horizon Holidays (1975). Mr Jackson (“the promisee”) had contracted for a holiday for himself 278 Chapter 9: Capacity and Privity of Contract and his family (“the third parties”) but the holiday turned out to be below the standard promised by Horizon Holidays (“the promisor”) who was clearly in breach of contract. The promisee sued and was awarded £1,100 of which £500 was for “mental distress”. The promisor appealed against the award as excessive but the appeal was dismissed. While the majority judges felt that the award was solely for the promisee’s loss (perhaps because his loss increased on witnessing the disappointment of his family), Lord Denning alone held that the award covered both the promisee and the third parties’ loss. His Lordship felt that in certain contracts, such as where a host contracts with a restaurant for dinner for himself and his friends or where a vicar books a coach outing for the church choir, the contracting party-promisee should be allowed to claim for the loss of the third parties. However, Lord Denning’s approach was disapproved by the House of Lords in Woodar Investment Development Ltd v Wimpey Construction UK Ltd (1980) which reiterated that a promisee cannot recover damages on behalf of a third party. Interestingly, the House also tentatively suggested that certain types of contracts might warrant special treatment: contracts for family holidays, for meals in a restaurant for a party or for hiring a taxi for a group. This suggestion has yet to be applied as law. 9.70 Another controversial exception to the general rule was introduced by Lord Browne-Wilkinson in Linden Gardens Trust v Lenesta Sludge Disposals (1994). In this case, a building contractor (“promisor”) was in breach of its contract with the owner of a site (“promisee”) for the development of the site into offices, shops and flats. However, the particular difficulty in this case was that defects appeared in the building works only after the development had been sold to a third party. When the original owner-promisee sued the contractorpromisor for loss suffered by the third party in rectifying the defects, the promisor argued that the promisee was only entitled to nominal damages as they were no longer owners of the development and had not themselves suffered any loss. The House of Lords held that the promisee was entitled to claim in respect of the third party’s loss by applying a principle summarised by Lord Diplock in The Albazero (1977) (at p 437e–f) as follows: [I]n a commercial contract concerning goods where it is in the contemplation of the parties that the proprietary interests in the goods may be transferred from one owner to another after the contract has been entered into and before the breach which causes loss or damage to the goods, an original party to the contract, if such be the intention 279 Principles of Singapore Business Law of them both, is to be treated in law as having entered into the contract for the benefit of all persons who have or may acquire an interest in the goods before they are lost or damaged, and is entitled to recover by way of damages for breach of contract the actual loss sustained by those for whose benefit the contract is entered into. [emphasis added] The majority of the House of Lords felt it appropriate to extend this principle (the “Albazero exception”) to cover cases involving real property (ie, land and building) but not to cases where the third party had a direct right of action against the promisor. On the facts, the House found that the promisor and promisee contracted with knowledge that the development would be occupied and, possibly, sold to third parties. The prohibition on the promisee’s ability to assign the contract to a third party without the promisor’s consent prevented the third party from suing on the contract (as the promisor refused consent). This led the House to conclude that it must have been the intention of the contracting parties that the promisee should be entitled to claim for the third party’s loss due to the promisor’s defective performance. 9.71 This approach was confirmed by the majority of the House of Lords in Alfred McAlpine Construction Ltd v Panatown Ltd (2000): it was held that the existence of a direct right of action by the third party (development owner) against the promisor (building contractor) conferred by a “duty of care deed” prevented the Albazero exception from being applied to enable the promisee (employer who contracted for the building works) to sue for the third party’s loss. Subsequent to the Linden Gardens case, the Albazero exception was also extended to cover a situation where the promisee (an employer who contracted for the building works) did not originally own the property which was the subject of the building contract with the promisor (building contractor) but nevertheless the promisee was held to be entitled to claim in respect of the loss of the third party (development owner) for defects in the property (see Darlington Borough Council v Wiltshire Northern Ltd (1995)). 9.72 The Albazero exception, as extended by the House in Linden Gardens, came to be known as the “narrow ground” of the Linden Gardens decision. The Albazero exception (or “narrow ground”) applies only if there exists a “legal black hole” that needs to be filled. The quaint metaphor refers to a situation where a party with the legal right to sue had not suffered substantial loss 280 Chapter 9: Capacity and Privity of Contract while the one who did has no such right for lack of privity of contract — precisely the situation that prevailed on the facts of the Linden Gardens case. There is no legal black hole to fill if the party suffering substantial loss has a right to sue. This explains why the House of Lords in Panatown found no room for the application of the Albazero exception (or “narrow ground”) as the third party concerned had a direct right to sue the promisor by virtue of the “duty of care deed”. 9.73 Lord Griffiths in Linden Gardens disagreed with the majority decision (based on the “narrow ground”) and preferred to characterise the third party loss as being the promisee’s own loss, that is, the loss of his performance interest in the contract because he did not receive what he bargained for (“the broad ground”). The analogy he used (at pp 96–97) to illustrate his point is illuminating: In everyday life contracts for work and labour are constantly being placed by those who have no proprietary interest in the subject matter of the contract. To take a common example, the matrimonial home is owned by the wife and the couple’s remaining assets are owned by the husband and he is the sole earner. The house requires a new roof and the husband places a contract with a builder to carry out the work. The husband is not acting as agent for his wife, he makes the contract as principal because only he can pay for it. The builder fails to replace the roof properly and the husband has to call in and pay another builder to complete the work. Is it to be said that the husband has suffered no damage because he does not own the property? Such a result would in my view be absurd and the answer is that the husband has suffered loss because he did not receive the bargain for which he had contracted with the first builder and the measure of damages is the cost of securing the performance of that bargain by completing the roof repairs properly by the second builder. In Panatown, again, the minority judges, Lords Goff and Millet, were in favour of Lord Griffiths’ approach and in fact held that the promisee could claim for defects to the property as being his own loss. The “broad ground” also received the qualified support of the majority judges in Panatown. 9.74 Locally, the “narrow ground” (or Albazero exception) has been applied by the Singapore Court of Appeal in Chia Kok Leong and another v Prosperland Pte Ltd (2005). Briefly, the facts of Chia Kok Leong are as follows: the claimant 281 Principles of Singapore Business Law was the developer of a condominium. The claimant initiated legal proceedings for breach of contract against (i) the main contractor for defective works in the construction of the condominium; and (ii) the architects for failure to exercise due care in the design and supervision of the building project. In this instance, the claimant was the “promisee” and, the main contractor and architects were the “promisors” in the respective contracts. However, legal action was only commenced after the individual units in the condominium had been sold to third parties and ownership of the common areas had been taken over by the management corporation of the condominium (“the MCST”), also a third party. The defects to the common areas (de-bonding of tiles of external wall façade and damaged glass bricks at the lobbies and stairways) only appeared after the claimant had ceased to be owner. At the time of the claim, the claimant had not incurred expenditure to rectify the defects and the MCST had yet to sue the claimant. As mentioned, the Court of Appeal applied the “narrow ground” or Albazero exception to allow the claimant (the promisee) to claim for substantial damages against the main contractor and architects (the promisors), on behalf of the MCST (the third party). This was despite the fact that the third party concerned, the MCST, had a direct action against the promisors in the tort of negligence (as to which, see Chapter 6, para 6.47). The Court of Appeal held (at [45]) that only an express contractual “provision of a direct entitlement” of claim against the promisor, such as the “duty of care deed” in Panatown will prevent the application of the Albazero exception. The third party’s right of action in tort did not completely remove the legal black hole as a claim in tort was subject to the third party being able to establish elements of the tort (as to the tort of negligence, see, generally, Chapter 6) and subject to certain defences. 9.75 Significantly, the Court of Appeal went on (at [48]–[59]) to consider and approve the “broad ground” as being more consistent with principle (at [52]). The Court held (at [59]) that, in principle, the promisee was entitled to claim substantial damages on the broad ground. The Court agreed (at [53]) with the rationale for the broad ground, that is, a promisee should be entitled to claim because he did not receive what he had bargained and paid for. The Court further agreed that the right to claim should not depend on: (1) whether the promisee had ownership in the property, the subject matter of the contract (at [53]); or (2) whether the third party had a direct right to claim against the promisor, that is, whether there was any legal black hole that needed to be filled (at [54]). Problems that might arise such as double recovery against the promisor could be guarded against by the court 282 Chapter 9: Capacity and Privity of Contract exercising its discretion to join the third party to the proceedings brought by the promisee under Order 15 rule 6 of the Rules of Court (Cap 322, Section 80, R5, 2006 Rev Ed) (at [56]). Additionally, the court opined (at [57]) that there should not be a pre-requisite that the promisee must show that he had carried out repairs or intended to do so before he was allowed to claim substantial damages. The Court would scrutinise the reasonableness of each claim in view of all relevant circumstances in any particular case. 9.76 Later, in Family Food Court v Seah Boon Lock and another (2008), the Singapore Court of Appeal had occasion to restate its views on the general scope of application of the “broad” or “narrow” grounds and to consider whether they could apply where an agent was seeking to claim substantial damages in the context of an undisclosed principal. The Court of Appeal’s comments were entirely obiter — the Court of Appeal, disagreeing with the High Court, had held the claimant to have contracted as a principal and not as an agent. Nevertheless, they provide useful indications of the Court’s likely approach to future cases. Essentially, the Court affirmed its endorsement of both the “broad” and “narrow” grounds and the views expressed in relation to each ground in Chia Kok Leong (while noting that the views on the “broad ground” were obiter (at [51])). Additionally, the Court observed as follows: ° The loss recoverable under the “broad ground” must be genuine and is subject to an objective test of reasonableness to prevent the promisee from obtaining a windfall (at [53]). ° Losses recoverable for breach of contract, whether under the “broad” or “narrow” ground, are subject to the usual legal controls on recovery, that is, the need to satisfy the requirements of causation, remoteness, mitigation and certainty (as to which, see Chapter 18, para 18.38 onwards) (at [55]). ° The “broad” and “narrow” grounds cannot be applied simultaneously as they are conceptually inconsistent (at [56]). ° Where an agent is seeking to claim substantial damages on behalf of an undisclosed principal, the “narrow ground” is inapplicable. The Albazero exception applies only if the parties, at the time of contract, contemplated that the proprietary interest in the subject matter of the contract would be transferred by the promisee to a third party after the contract was made but prior to any breach. Such contemplation is absent where a party contracts with an agent without knowledge that the other party is acting as an agent and that a principal exists (at [58]). 283 Principles of Singapore Business Law ° In the context of an undisclosed principal, the law is unsettled as to whether the “broad ground” applies. The Court chose not to decide the matter conclusively but noted that potential problems concerning the amount of damages recoverable by the agent could be resolved by joining the principal as a party to proceedings initiated by the agent (at [62]). (2) Collateral contracts 9.77 Sometimes, the courts are prepared to circumvent the privity rule through the implication of a collateral contract. This method has been criticised as being rather artificial. An oft-cited example of its use is Shanklin Pier LD v Detel Products LD (1951). The defendants were paint manufacturers who had assured the plaintiffs, the pier owners, that their paint would last for seven to ten years. On the basis of this assurance, the plaintiffs instructed the contractors whom they engaged to paint the pier, to purchase paint from the defendants for that purpose. As instructed, the contractor contracted to buy the defendants’ paint. But the paint was not as durable as represented; in fact, it only lasted three months. The plaintiffs sued the defendants and succeeded even though there was no express contract entered into between them. The court held that on the facts, it was able to imply a collateral contract in which the defendants had promised that their paint would last for seven to ten years and in consideration of this promise, the plaintiffs had requested their contractors to purchase and use the defendants’ paint for their pier. (3) Himalaya clause 9.78 Another method to evade the privity rule is illustrated in the cases of Scruttons Ltd v Midland Silicones Ltd (1962) and New Zealand Shipping Co Ltd v AM Sattherwaite & Co Ltd (The Eurymedon) (1975). This technique is applicable only to enable a third party to rely on an exemption clause in a contract to which they are not privy. The technique emerged in the context of the shipping industry in which a carrier of goods by sea sought to extend the benefit of an exemption clause in their contract of carriage with the owner of goods (“cargo owner”), to third parties (usually the stevedores employed by the carrier to unload the cargo owner’s goods from the carrier’s vessel). Such an exemption clause is usually negotiated as a method of allocating business risks and the burden of insurance between the parties involved. In 284 Chapter 9: Capacity and Privity of Contract the two cases mentioned above, the stevedores had negligently damaged the goods in the course of unloading and thus were sued by the cargo owners in the tort of negligence. In defence, the stevedores sought to rely on the exemption clause contained in the contract of carriage to which they were not privy. 9.79 Perhaps in recognition of the commercial convenience of upholding such a clause, if it was a legitimate one under the law, Lord Reid (at p 474) in the Scruttons case was prepared to allow the third party stevedores to rely on the exemption clause if the following four conditions were satisfied: [T]he bill of lading [the contract of carriage of goods by sea] makes it clear that the stevedore is intended to be protected by the provisions in it which limit liability, the bill of lading makes it clear that the carrier, in addition to contracting for these provisions on his own behalf, is also contracting as agent for the stevedore that these provisions should apply to the stevedore, the carrier has authority from the stevedore to do that, and that any difficulties about consideration moving from the stevedore were overcome. These conditions are not easily satisfied. In fact, the clause in Scruttons itself failed to meet the four conditions as, amongst others, the clause made no reference to the stevedores at all. 9.80 The four conditions were found to be satisfied in the subsequent case of The Eurymedon. The exemption clause involved was lengthy and elaborate and is now known as the “Himalaya Clause”. The clause provides: It is hereby expressly agreed that no servant or agent of the carrier (including every independent contractor from time to time employed by the carrier) shall in any circumstances whatsoever be under any liability whatsoever to the shipper, consignee or owner of the goods or to any holder of this bill of lading for any loss or damage or delay or whatsoever kind arising or resulting directly or indirectly from any act neglect or default on his part while acting in the course of or in connection with his employment and, without prejudice to the generality of the foregoing provisions in this clause, every exemption, limitation, condition and liberty herein contained and every right, exemption from liability, defence and immunity of whatsoever nature applicable to the carrier or to which the carrier is entitled hereunder shall also be available and 285 Principles of Singapore Business Law shall extend to protect every such servant or agent of the carrier acting as aforesaid and for the purpose of all the foregoing provisions of this clause the carrier is or shall be deemed to be acting as agent or trustee on behalf of and for the benefit of all persons who are or might be his servants or agents from time to time (including independent contractors as aforesaid) and all such persons shall to this extent be or be deemed to be parties to the contract in or evidenced by this bill of lading. In The Eurymedon, the defendant stevedores were able to satisfy the first three conditions laid down by Lord Reid in Scruttons. The Himalaya Clause above, contained in the contract of carriage of goods by sea evidenced by the bill of lading, did clearly state that the exemption is also to protect any servant or agent of the carrier including any independent contractor from time to time employed by the carrier. The stevedores obviously fell within this category. The clause also made clear that the carrier contracted for the exemption clause as agent on their behalf. As the carrier in this case was a wholly owned subsidiary of the stevedores, they had the authority to act on behalf of the stevedores. The court, however, engaged in some strained and rather artificial reasoning in finding that the fourth condition was satisfied. They held that there was a unilateral collateral contract between the cargo owners and the stevedores analysed as follows: When the cargo owners entered into the contract of carriage of goods with the carrier, they made a unilateral offer to extend the benefit of the exemption clause to anyone who unloaded their goods at the port of destination. The stevedores’ act of unloading their goods thus constituted both the acceptance of the offer as well as the consideration in return for the benefit of the exemption clause. And this contract is collateral to the main contract of carriage of goods between the cargo owners and the carrier. Given that the provision under s 2(6) CRTPA (and under s 7(4)(a) where an exemption clause contained in a contract of carriage of goods by sea is concerned) now enables a third party a more direct method of enforcing an exemption clause in a contract to which he is not privy, there may no longer be a need to resort to this complicated technique. (4) Assignment 9.81 If A assigns or transfers his right(s) under his contract with B to a third party, the third party will be able to enforce those rights in his own name against B. In Singapore, a legal assignment can be effected under s 4(8) Civil Law Act (Cap 43, 1999 Rev Ed) through an absolute assignment of the 286 Chapter 9: Capacity and Privity of Contract right(s) in writing, signed by the assignor (A), and where written notice of the assignment has been given to the other party to the contract (B). The consent of B to the assignment is unnecessary. The main disadvantage of this technique to get around the privity rule is that the third party assignee takes “subject to equities”; any claim made by the third party upon B is subject to such valid defences as B may raise against A. An assignment that does not satisfy all the requirements under s 4(8) above may still be effective as an equitable assignment if there is clear evidence that the assignor clearly intended the assignee to have the benefit of his right(s) under the contract. (5) Tort of negligence 9.82 A common technique to get around the difficulty of mounting an action in contract is to make a claim in tort. Specifically, third parties have sought to base their claim in the tort of negligence to get around the privity rule. For example, a subsequent purchaser of a condominium unit finds defects appearing in the property and seeks to claim against the developer in respect of his loss. The privity rule would prevent a claim in contract against the developer as the subsequent purchaser is a third party to the contract between the developer and original purchaser. For the requirements to successfully mount an action in the tort of negligence, see Chapter 6. (6) Agency 9.83 An agent is a person authorised by his principal to enter into a contract with another on the principal’s behalf. The agent is the party who negotiates and concludes the contract with the intention that his principal (the ostensible third party) should be entitled to the rights and obligations under the contract. Where the other party is well aware that he is negotiating with an agent, no problem of privity arises for the ostensible third party principal. However, where the agent fails to disclose that he is acting for a principal, the principal may, in certain circumstances, still assert his rights under the contract with the other party. Here, the law of agency appears to permit the privity rule to be circumvented by the third party undisclosed principal (see Chapter 20, paras 20.35–20.37 for a fuller discussion). This is not so much a technique employed to get around the privity rule as an incident of the law of agency. 287 Principles of Singapore Business Law (7) Law of trusts 9.84 Where a trust has been constituted for a third party’s benefit, the law of trusts will enable the third party to enforce the benefit against a contracting party. The third party’s right of enforcement is not based on contract law but the specialised area of the law of trusts which is beyond the scope of this chapter. (8) Other common law techniques 9.85 To conclude this part, the technique introduced by the Canadian Supreme Court in London Drugs Ltd v Kuehne & Nagel International Ltd (1993) should be mentioned. The majority of the court, eschewing the analysis adopted by The Eurymedon (see para 9.80), held that third party employees were able to avail themselves of an exemption clause contained in a contract between their employer and the claimants provided: ° the benefit of the exemption clause was expressly or impliedly extended to these employees; and ° the employees seeking to rely on the exemption clause had been, at the time the loss and damage occurred, acting in the course of their employment and performing the very services undertaken in the said contract. IMPOSING BURDENS ON THIRD PARTIES: TECHNIQUES TO GET AROUND THE PRIVITY RULE Sub-bailment Contracts 9.86 Typically, a bailment arises when an owner of goods (“bailor”) parts with the possession of his goods by delivering them to another person (“bailee”) to hold for a time or to have something done to them before returning possession of the goods to the bailor. An example is where jewellery is taken to jewellers for repair. A sub-bailment arises when the bailee, in turn, bails the same goods to a sub-bailee. The relevant question is whether a third party (the bailor) is burdened by an exception clause contained in the sub-bailment contract between the contracting parties (the bailee and subbailee). The answer is that if the third party bailor has expressly or impliedly consented to the terms of the sub-bailment, then the bailor can indeed be bound (Morris v CW Martin & Sons Ltd (1966)). 288 Chapter 9: Capacity and Privity of Contract Land Law 9.87 A third party may be bound by a restrictive covenant contained in a contract for the sale of land between the contracting parties (see Tulk v Moxhay (1848)). This principle is unique to land law which is beyond the scope of this chapter. Unlawful Interference with Contractual Rights 9.88 If a third party knows that A and B have contracted with one another, the third party is under an obligation (burden) not to induce either A or B to breach his contract with the other. This is an obligation imposed by the law of tort (tort of inducing a breach of contract, discussed in Chapter 5) rather than by the contracting parties and as such, is not strictly a technique to evade the privity rule. 289 Chapter 10 Terms of the Contract 10.1–10.7 Introduction 10.8–10.22 The Parol Evidence Rule and the Interpretation of Contracts 10.23–10.26 10.27 10.28–10.29 10.30 10.31 10.32–10.35 Terms and Representations Introduction Request to Verify Importance of the Statement Timing of the Statement Oral Statements and Written Contracts Special Skill and Knowledge 10.36–10.39 10.40–10.43 10.44–10.47 10.48–10.56 Relative Importance of Terms Warranties, Conditions and Innominate Terms Differentiating between Conditions and Warranties The “Hong Kong Fir Approach” The New Singapore Approach: A Synthesis between the Condition– Warranty and Hong Kong Fir Approaches 10.57–10.61 10.62–10.68 10.69–10.72 10.73–10.74 10.75–10.76 Implied Terms Terms Implied in Fact Terms Implied in Law Terms Implied by Statute Terms Implied by Custom 10.77 Conclusion Principles of Singapore Business Law INTRODUCTION 10.1 Parties who acknowledge that there is a contract between them may disagree about the contents of the contract. The law on contractual terms provides rules on how to resolve this disagreement. This area of the law provides rules on how the precise obligations of the parties to a contract are to be ascertained, and once these have been ascertained, the manner in which such obligations should be categorised to determine the remedies available upon breach of such obligations. Judges have developed most of these rules. But important statutes, such as the Sale of Goods Act (Cap 393, 1999 Rev Ed), also contain rules on the subject that have been further clarified by judges who have to interpret such legislation. The law on contractual terms attempts to achieve several objectives designed to promote contractual efficacy without violating the principles, first, that courts do not make contracts for the parties and, second, that the various technical rules are designed to find out and give effect to the intentions of the parties on an objective basis. 10.2 In order to improve contractual efficacy, the first objective is to promote certainty and to fill the gaps relating to matters in the contract that were not addressed by the parties. Rules designed to separate contractual obligations from statements that are not part of the contract, rules for protecting written contracts from being undermined by extrinsic evidence and rules for implying terms in circumstances not envisaged by the parties are all designed to foster predictability. 10.3 The second objective is to integrate social and public interest policies in certain types of contracts so that these contracts will be performed in conformity with such policies. The next chapter discusses the circumstances under which the law intervenes to limit the scope of terms that attempt to relieve one party from liability for loss or damage caused to the other party. Finally, the law acknowledges the truism that some terms of a contract are so important that if they are breached, the innocent party will be deprived of a substantial benefit under the contract and that he or she should therefore be allowed to terminate the contract. On the other hand, there are other terms that are not so important and if breached, the contract must still be performed by the innocent party who can be compensated with damages for that breach. There may also be terms which, upon breach, result in the innocent party being deprived of a substantial benefit in some cases but not 292 Chapter 10: Terms of the Contract in others. It is of course open to the parties to structure their bargain in such a way that even the smallest infraction of an obligation could give the innocent party the right to terminate the contract. Conversely, the parties could agree explicitly that a breach of an important obligation does not give the innocent party the right to terminate the contract. In practice, this rarely happens and the courts have generally used rules to ascertain the contracting parties’ intentions as to the importance of the terms to determine the appropriate remedy for the innocent party upon a breach of any particular term. Not infrequently, the parties complicate matters by loosely referring to the “terms and conditions of the contract” and the courts have to separate the layperson’s usage of language from legal usage. Accordingly, the law of contractual terms attempts to promote contractual efficacy by creating a hierarchy of obligations within the contract itself so that breaches of a minor obligation and/or of a minor nature will not permit the destruction of the transaction by authorising the innocent party to terminate the contract. 10.4 In the thousands of contracts made every day, the parties explicitly agree only on a few main terms. A buyer-consumer and a supermarket-seller of a product usually engage in a sales transaction without considering critical issues such as the quality of the product and the seller’s title to the goods. Likewise, a householder-buyer and a home-repair services contractor could agree on the scope of the repair, the payment to be made and the completion date but leave out other important features in this type of contract. This is often the way it should be. If the parties to a contract try to anticipate and iron out every possible situation over which a dispute may arise, they will squander precious time and probably not agree on a contract. Moreover, the vast numbers of people who make contracts have not studied contract law and should not be expected to know everything that could go wrong in a particular transaction. Accordingly, the law allows people to contract freely, and what they explicitly agree on, the law refers to as “express terms”. After this, the law steps in and fills in the blanks, if and when necessary, by terms referred to as “implied terms” and the process of such gap-filling will be different depending on whether the terms to be implied are those which the courts would regard as terms implied in fact or implied in law. 10.5 In some cases, the parties enter into a contract after lengthy negotiations involving not only themselves but also their advisors such as lawyers and 293 Principles of Singapore Business Law accountants. During these negotiations, each side will try to persuade the other of their point of view and a seller will naturally make various claims for products or services that are the subject of the transaction. Because of their context, these negotiations could give rise to two sets of problems. First, when the parties enter into a written contract, one party may later allege that the written contract does not faithfully and comprehensively contain the entire agreement. This party may demand the right to introduce evidence of terms, whether they are a statement of fact or promises, not contained in the written contract. To deal with these situations, the law has a rule, the parol evidence rule, which excludes extraneous evidence meant to contradict or vary the language of a written contract except in limited circumstances (see para 10.8 onwards). Second, one party may allege that during the negotiation phase, the other party induced her to enter into the contract by making a statement of fact that became part of the contract. After the contract was concluded, she finds that the statement was untrue and wishes to sue for breach of contract. A court would examine her claim by finding out if the statement was a representation or a term and will allow her to sue for a breach of contract only if it was the intention of the parties to make the statement a term of the contract. If, on the other hand, the court finds that the statement is not a term but a representation that is false, the party who relied on that statement might have a possible action for misrepresentation (see, generally, Chapter 13). 10.6 Finally, even where the terms of a contract have been ascertained and precisely defined, the law does not treat all the terms as being of equal weight. As observed earlier, it is open to the parties to specify certain obligations as so important that their breach would give rise to a right of termination and to specify yet other obligations that do not give rise to a right of termination but only damages whereby the innocent party is required to continue performing her obligations under the contract and be satisfied with the damages given for the breach of the less serious obligation. However, in practice, parties rarely make such distinctions and a court must categorise the type of obligations the breach of which would give rise to different rights. For instance, in a computer sales contract, a small scratch on the casing of the CPU is not as serious as a defective hard disk. 10.7 The discussion that follows addresses four groups of circumstances, broadly illustrated below, that typically give rise to disputes over contract terms: 294 Chapter 10: Terms of the Contract (1) The parties A and B, who engaged in pre-contractual negotiations, concluded a contract in writing. Party A discovers that what she thought had been orally agreed with Party B is missing from the written contract or some other clause contradicts what she thought was a verbal understanding. May Party A prove the oral agreement to contradict, vary or add to the written contract? Additionally, what meaning should be given to the terms of a written contract, that is, how should the terms be interpreted? May Party A or B ask the court to consider matters not contained in the written contract, such as statements made in the pre-contractual negotiations or earlier drafts of the written contract, to decide what the parties had agreed on? (2) During the negotiations that preceded the contract, one party made certain claims in respect of the product or service to be sold. After the contract is concluded, the other party finds that the claim with regard to the product or service that she regarded as important proves to be false. May this other party allege that such statement is a part of the contract and sue the party who made the statement for breach of contract? (3) The terms of the contract do not carry equal weight. How does a court determine which terms give rise to extensive remedies upon breach and which do not? What factors or circumstances are relevant in the process of determination? (4) Where the contract does not provide for a particular eventuality, how do the courts “fill in the blanks” and what principles do they use to do so? THE PAROL EVIDENCE RULE AND THE INTERPRETATION OF CONTRACTS 10.8 The Singapore Evidence Act (Cap 97, 1997 Rev Ed) (“EA”) has codified the parol evidence rule, a rule that originated from the English common law, and some but not all, of the exceptions to the rule found at common law. The parol evidence rule states that when the parties have reduced their contract to writing, either party may not attempt to show by extrinsic evidence that the terms in the written contract must be changed, added to, or contradicted. Contract law attempts to reduce uncertainty wherever possible. The parol evidence rule supports this outcome by adopting the position that where the parties have taken the step of putting their contract in writing, none of these parties should be allowed the opportunity to displace the contents of the written contract by reference to evidence of anything not within the 295 Principles of Singapore Business Law written contract (ie, extrinsic evidence). Technically, “parol” evidence refers to evidence of any “oral” agreement or statement. In practice, the parol evidence rule has also been applied to exclude evidence not orally made, for example, evidence of terms recorded in another document not specifically referred to in the written contract. A little reflection shows why practical considerations require this rule. Without this rule, the written contract may not be worth the paper it is written on. Moreover, third parties, such as banks, that were induced to lend money to one party in reliance on the written contract may find that the cash flow anticipated under the written contract will be disrupted because of the operation of terms not found in the written contract. 10.9 Applied rigidly, however, the parol evidence rule can produce great injustice that could outweigh the benefits of certainty. In England, judges have devised certain exceptions to reduce injustices that may flow from an unwavering application of the parol evidence rule. The need for some of these exceptions is, on examination and reflection, quite obvious as they are based on avoiding injustice while other exceptions are based on technical contract rules. The main English common law exceptions are as follows: ° A party may dispute the validity of the written contract by showing, through extrinsic evidence, that the contract was the result of mistake, a lack of consideration, or of misrepresentation (see, eg, Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at para 6–015 and cases referred to; see also the equivalent in Singapore law — proviso (a) to s 94 EA). ° A party may show by extrinsic evidence a mistake in the written contract and prove what the contract should have read instead of its disputed term. For example, a written agreement to sell a recent model of a luxury car may refer to a selling price of $500. The seller will be allowed to introduce evidence to show that the real price agreed upon was $500,000. Reference may also be made to Joscelyne v Nissen (1970), where a daughter’s undertaking to pay utility bills, although not included in the written contract between father and daughter, was held enforceable. ° A party may also adduce extrinsic evidence to show that the written contract has not yet come into existence or that it is no longer in operation. Sometimes, parties agree that their contract would come into existence only upon the occurrence or non-occurrence of a certain event by a certain date, or that if something has not occurred by a certain 296 Chapter 10: Terms of the Contract date the contract would cease to exist. For example, in a contract of employment, the parties may verbally agree that the contract would come into existence only if the employee obtains her professional qualification by a certain date, or the contract would end if the employee did not obtain the qualification by a certain date. Reference may also be made to Pym v Campbell (1856) where extrinsic evidence was allowed to the effect that the obligation to buy shares in an invention contained in a written agreement was conditional upon a third party approving the invention, of which the approval had not been received (see also the local equivalent in proviso (c) to s 94 EA). ° A party may be allowed to offer extrinsic evidence to demonstrate that a particular custom of the trade must be implied into, and therefore become part of, the written agreement. See, for example, Smith v Wilson (1832), where evidence of local custom to show that “1,000 rabbits” in the written contract really meant “1,200 rabbits” was allowed. 10.10 In England, the numerous common law exceptions together with the English courts’ shift to the contextual approach to interpretation of terms in a written contract have stirred debate over whether the parol evidence rule still survives. Briefly, the contextual approach allows evidence of matters not within the written contract to be admitted in court to prove the factual context in which the contract was made to shed light on the meaning to be given to a term (see further, para 10.16 onwards). In Singapore, however, the Court of Appeal in Zurich Insurance (Singapore) Pte Ltd v B-Gold Interior Design & Construction Pte Ltd (2008) has declared (at [111]) that the parol evidence rule “lives on in s 94 of the [Singapore] Evidence Act”. 10.11 In Singapore, ss 93 and 94 EA codify the parol evidence rule and its major common law exceptions. Section 93 states that where the parties have reduced their contract to writing, “no evidence shall be given in proof of the terms of such contract … except the document itself, or secondary evidence … in which secondary evidence is admissible under the provisions of this Act”. Thus if parties have drawn up a written contract with the intention that the written document should embody the entire agreement between the parties, s 93 makes clear that parties may only prove the terms of their agreement by producing the written document alone. Secondary evidence merely refers, inter alia, to certified, electronic or other types of copies of the original document (see s 65 EA) and is not extrinsic evidence excluded 297 Principles of Singapore Business Law by the parol evidence rule. Section 94 states that where a written contract is shown to exist, no oral evidence shall be admitted “for the purpose of contradicting, varying, adding to, or subtracting from its terms” subject to certain exceptions. 10.12 In Zurich Insurance, VK Rajah JA (delivering the judgment of the court) explained the interplay between ss 93 and 94 EA thus (at [71]): Section 94 complements s 93 by ensuring that where the sole evidence of a contract consists of “the document itself ” (per s 93), that contract is not varied, contradicted, added to or subtracted from unless the circumstances described in one or more of the six accompanying provisos (ie, provisos (a)–(f) to s 94) are satisfied. Put another way, it is often said that s 93 makes documentary evidence exclusive while s 94 makes it conclusive … [emphasis in the original] 10.13 While s 94 EA enumerates six sets of circumstances in which extraneous evidence could be used to vary the terms of a written contract, the English common law recognises more exceptions — some of which are inconsistent with the exceptions in s 94 EA. For example, the common law exception relating to collateral contracts allows terms in the oral collateral contract to override inconsistent terms contained in the main written agreement (see, eg, the English High Court decision of City and Westminster Properties (1934) Ltd v Mudd (1959)). The facts of Mudd provide a good illustration of a collateral contract and the operation of this exception. In Mudd, a tenant had lived on the rented premises for some years. When it was time to renew the lease, the landlord wanted to insert a new term in the written lease to restrict the use of the premises to “showrooms, workrooms and offices only”. The tenant objected to the new term but the landlord insisted on its inclusion because of alleged rent control concerns. Thus, before agreeing to sign the new lease, the tenant sought assurance from the landlords that they would not object to his continuing to live on the premises. It was only upon receiving the landlord’s oral assurance that the tenant signed the lease. Years later, the landlords sued the tenant for breach of the restriction of use term. The court held that the tenant was not in breach as the term in the written lease (the main contract) had been overridden by the landlord’s oral assurance (in the collateral contract). The special circumstances of the case led the court to 298 Chapter 10: Terms of the Contract imply that a collateral contract existed that ran alongside the main contract. The terms of the collateral contract were the landlord’s oral promise given in return for the tenant agreeing to enter into the main contract. 10.14 In contrast, proviso (b) to s 94 EA states: [T]he existence of any separate oral agreement, as to any matter on which a document is silent and which is not inconsistent with its terms, may be proved; in considering whether or not this proviso applies, the court shall have regard to the degree of formality of the document. [emphasis added] Thus, in Latham v Credit Suisse First Boston (2000), the Singapore Court of Appeal refused to admit extrinsic evidence of an oral agreement pertaining to a guaranteed bonus, alleged to have been made during prior negotiations, to contradict the written employment contract which provided for a discretionary bonus. 10.15 An issue that has been raised in Singapore is whether it is possible to invoke exceptions from the English common law that are not reflected in the provisos to s 94 EA. In China Insurance Co (Singapore) Pte Ltd v Liberty Insurance Pte Ltd (2005), Phang JC (as he then was) reiterated (at [39]–[41] and [45]) the views he expressed as a legal academic, obiter, that the common law exceptions to the parol evidence rule insofar as they are consistent with the EA continue to be applicable as they are not expressly excluded by s 2(2) EA. Section 2(2) EA states that all “rules of evidence not contained in any written law, so far as such rules are inconsistent with any of the provisions of this Act, are hereby repealed” [emphasis added]. In response to the learned judge’s call for legislative reform to clarify this issue (among others, at [44] and [66]), the Law Reform Committee of the Singapore Academy of Law (“LRC”) reviewed the parol evidence rule and recommended in substance that the judge’s view be adopted (see LRC Report 2006 at [93] and [114]). 10.16 Another issue the learned judge thought needed clarification and reform was the applicability of the common law principle permitting extrinsic evidence to be admitted to determine facts surrounding the making of the contract to aid in the interpretation of the terms of the written contract — the contextual approach (see China Insurance at [46]). Specifically, whether the contextual approach was embodied by proviso (f) to s 94 EA and that 299 Principles of Singapore Business Law extrinsic evidence was admissible under proviso (f) without a prerequisite of ambiguity in the written terms in the first place. Some Court of Appeal decisions had indicated a need for such a prerequisite in the past (see Citicorp Investment Bank (Singapore) Ltd v Wee Ah Kee (1997) and Tan Hock Keng v L & M Group Investments Ltd (2002)). The LRC has since recommended not imposing a prerequisite of ambiguity before extrinsic evidence can be admitted under proviso (f) to s 94 EA. Significantly, the Zurich Insurance decision has clarified beyond doubt that the contextual approach applies in Singapore by virtue of proviso (f) to s 94 EA without any prerequisite of ambiguity. 10.17 VK Rajah in Zurich Insurance clarified the law in Singapore on “whether, when and to what extent extrinsic evidence may be admitted for the purposes of interpreting a written contract …” (see [109]). His summary of the law is as follows (at [132]): (a) A court should take into account the essence and attributes of the document being examined. The court’s treatment of extrinsic evidence at various stages of the analytical process may differ depending on the nature of the document. In general, the court ought to be more reluctant to allow extrinsic evidence to affect standard form contracts and commercial documents … (b) If the court is satisfied that the parties intended to embody their entire agreement in a written contract, no extrinsic evidence is admissible to contradict, vary, add to, or subtract from its terms (see ss 93–94 of the Evidence Act). In determining whether the parties so intended, our courts may look at extrinsic evidence and apply the normal objective test, subject to a rebuttable presumption that a contract which is complete on its face was intended to contain all the terms of the parties’ agreement … (c) Extrinsic evidence is admissible under proviso (f) to s 94 to aid in the interpretation of the written words. Our courts now adopt, via this proviso, the modern contextual approach to interpretation, in line with the developments in England in this area of the law to date. Crucially, ambiguity is not a prerequisite for the admissibility of extrinsic evidence under proviso (f) to s 94 … (d) The extrinsic evidence in question is admissible so long as it is relevant, reasonably available to all the contracting parties and relates to a clear or obvious context [surrounding the making of the contract] ... However, the principle of objectively ascertaining contractual intention(s) remains 300 Chapter 10: Terms of the Contract paramount. Thus, the extrinsic evidence must always go towards proof of what the parties, from an objective viewpoint, ultimately agreed upon. Further, where extrinsic evidence in the form of prior negotiations and subsequent conduct is concerned, … there should be no absolute or rigid prohibition against evidence of previous negotiations or subsequent conduct, although, in the normal case, such evidence is likely to be inadmissible for non-compliance with the requirements [that the evidence relates to a clear and obvious context and proves what parties objectively intended] … (We should add that the relevance of subsequent conduct remains a controversial and evolving topic ...) (e) In some cases, the extrinsic evidence in question leads to possible alternative interpretations of the written words (ie, the court determines that latent ambiguity exists). A court may give effect to these alternative interpretations, always bearing in mind s 94 of the Evidence Act. In arriving at the ultimate interpretation of the words to be construed, the court may take into account subjective declarations of intent … (f) A court should always be careful to ensure that extrinsic evidence is used to explain and illuminate the written words, and not to contradict or vary them. Where the court concludes that the parties have used the wrong words, rectification may be a more appropriate remedy … 10.18 To illustrate the application of some of these principles, the facts and decisions of a few cases are considered. In Zurich Insurance, Mediacorp Pte Ltd (“Mediacorp”) contracted with B-Gold Interior Design and Construction Pte Ltd (“B-Gold”) to carry out maintenance, repair, addition and alteration works at Mediacorp’s premises as and when required for a stated period. A term of the contract requires B-Gold to obtain “policies of insurance indemnifying Mediacorp, the Contractor [ie, B-Gold] and all its sub-contractors against damage to persons and property, for Workmen’s Compensation and fire”. Yeo, a director of B-Gold, contacted Lee, a general insurance agent with American International Group (“AIG”) to obtain a quote for the necessary cover. Lee told Yeo that AIG does not provide such cover and advised Yeo to approach other insurance companies. Yeo requested Lee’s help to do this. Lee contacted Long, an ex-colleague who was then an insurance agent with Zurich Insurance (Singapore) Pte Ltd (“ZI”), to inquire if ZI provided such cover. Upon Long’s positive reply, Lee faxed initial instructions to ZI through Long and provided B-Gold’s contract documents with Mediacorp. Lee later faxed an undated note to Long requesting, inter alia, a Contractor’s All 301 Principles of Singapore Business Law Risks (“CAR”) policy cover although the type of policy required of B-Gold was not specified in its contract with Mediacorp. Long then confirmed to Lee that ZI could offer the requested cover and this led to the issue of a CAR policy to B-Gold. The salient terms of the policy were: ° Section II which covered third party liability, that is, the damages B-Gold becomes liable to pay third parties upon “accidental loss or damage to third parties’ property”. ° Clause 4(b) (listed under the heading “SPECIAL EXCLUSION TO SECTION II”) excluded coverage of B-Gold’s “liability consequent upon loss of or damage to property belonging to or held in care, custody or control of the Contractor(s), the Principal(s) [ie, Mediacorp] or any other firm connected with the project …” B-Gold’s subcontractor negligently caused a fire at Mediacorp’s premises. Mediacorp successfully claimed against B-Gold in respect of its losses and B-Gold initiated third party proceedings against ZI under the policy for an indemnity of the damages it had to pay to Mediacorp. 10.19 The District Court held that clause 4(b) clearly applied to exclude ZI from liability to indemnify B-Gold. On appeal, the High Court disagreed, holding that although a literal reading of clause 4(b) indicated that it excluded ZI from liability, the clause should not be given effect to. The High Court (at [47] and [55]) took into account the factual context surrounding the issuance of the policy — the fact that B-Gold had been required to obtain insurance cover under its contract with Mediacorp and that the specific coverage had been made known to ZI when the contract documents were sent to ZI. Since B-Gold had depended on ZI to provide the cover it required, the High Court felt (at [56]–[60]) that it had to deny effect to an exclusion clause which purported to exclude the precise cover that B-Gold expected to obtain. On further appeal to the Court of Appeal, the High Court’s decision was overturned. VK Rajah JA held that: ° since the parties to the policy did not dispute that the policy document contained their complete agreement, the parol evidence rule in s 94 EA applied and no extrinsic evidence was admissible to contradict, vary, add to or subtract from the terms of the policy (at [134]). ° in denying effect to a whole exclusion clause, the High Court had done the impermissible, that is, to vary the terms of the policy — “There is a conceptual difference between attributing a meaning to words or phrases 302 Chapter 10: Terms of the Contract that might strain the contours of their penumbral meaning and simply ignoring a provision altogether” (at [134]). ° even if the High Court was relying on proviso (f) to s 94 EA to apply the contextual approach to the interpretation of clause 4(b), the extrinsic evidence to be taken into account had to be relevant, reasonably available to all contracting parties and relate to a clear and obvious context (at [135]). Lee and Long’s evidence on how the policy came to be issued was tendered as sworn statements and they were not present to testify or be cross-examined in court. Based on their sworn statements alone, the court found that the context surrounding the issuance of the policy was far from clear and obvious: it was unclear what was actually communicated between Lee and Long as to the kind of insurance cover required — indeed, the court found it puzzling why Lee requested for a Contractor’s All-Risks policy when it had not been called for under the contract between B-Gold and Mediacorp (at [135]). Given this, it was wrong for the High Court to allow the said extrinsic evidence to affect his interpretation of clause 4(b) (at [139]). 10.20 If an “entire agreement clause” is inserted into a written contract, this is an express indication that the parties intend the written document to embody their complete contract. In Lee Chee Wei v Tan Hor Peow Victor and others and another appeal (2007), the entire agreement clause read as follows: “This Agreement sets forth the entire agreement and understanding between the Parties in connection with the matters dealt with and described herein” (see [21]). VK Rajah JA in the Singapore Court of Appeal made some interesting observations, obiter, pertaining to the effect of an entire agreement clause: ° An entire agreement clause may be worded in many ways and its effect is ultimately a matter of contractual interpretation taking into account its precise wording and context (at [25]). For example, whether the effect of the clause is merely to confirm that parties’ intention that the written document contain all the terms of the agreement (a prerequisite to the application of the parol evidence rule) or whether it also excludes the exceptions to the parol evidence rule from applying altogether (see [30]–[35]). ° Such clauses promote certainty as they “define and confine the parties’ rights and obligations within the four corners of the written document thereby precluding any attempt to qualify or supplement the document by reference to pre-contractual representations” (at [25]). 303 Principles of Singapore Business Law ° However, they will not usually prevent a court from looking at extrinsic evidence in order to aid in ascertaining the meaning of particular terms in the written contract — that is, a court may still apply a contextual approach to interpretation of the written terms despite the presence of an entire agreement clause. This is subject to the theoretical possibility that the clause could expressly forbid it without being considered an unreasonable exclusion clause under the Unfair Contract Terms Act (Cap 396, 1994 Rev Ed), if the Act applies (at [41]). 10.21 An illustration of how extrinsic evidence may reveal a latent ambiguity in the meaning of an otherwise ostensibly clear written term of the contract can be found in the Singapore Court of Appeal decision in Sandar Aung v Parkway Hospitals Singapore Pte Ltd (trading as Mount Elizabeth Hospital) and another (2007). Sandar Aung’s mother was admitted to hospital to undergo a medical procedure called an angioplasty. On admission, Sandar Aung signed an estimate of hospital charges which indicated a total estimated cost of $15,227.30 for the angioplasty procedure. She also signed the hospital’s standard form contract that contained the hospital’s policies and terms of service and an undertaking agreeing to be jointly and severally liable with the patient for “all charges, expenses and liabilities incurred by and on behalf of the patient” (“the Undertaking”). As it turned out, unexpected complications developed as Sandar Aung’s mother was recovering from the angioplasty which inflated the final medical expenses to a sum much higher than that indicated in the estimate of charges. The issue before the court was whether, under the Undertaking, Sandar Aung was liable for all medical expenses incurred or merely for expenses that related to the angioplasty. 10.22 Andrew Phang JA (delivering the judgment of the court) explained the rationale for a contextual approach to interpretation of contract terms (at [29]): No contract exists in a vacuum and, consequently, its language must be construed in the context in which the contract concerned has been made. We would go so far as to state that even if the plain language of the contract appears otherwise clear, the construction consequently placed on such language should not be inconsistent with the context in which the contract was entered into if this context is clear or even obvious, since the context and circumstances in which the contract was made would reflect the intention of the parties when they entered into the contract and utilised the (contractual) language they did. It might well be the 304 Chapter 10: Terms of the Contract case that if a particular construction placed on the language in a given contract is inconsistent with what is the obvious context in which the contract was made, then that construction might not be as clear as was initially thought and might, on the contrary, be evidence of an ambiguity. It was argued that a plain reading of the phrase in the Undertaking “all charges, expenses and liabilities incurred by and on behalf of the patient” clearly referred to all charges for medical services rendered. However, the court, after considering extrinsic evidence pertaining to the factual context in which the Undertaking was signed — in this instance the estimate of charges for the angioplasty — concluded that the phrase in the Undertaking could well also mean all charges, expenses and liabilities in respect of the angioplasty procedure. The court thus held (at [18]) that the narrower interpretation of the phrase was warranted given the clear context in which the Undertaking was signed in the first place. TERMS AND REPRESENTATIONS Introduction 10.23 In many transactions, the parties first discuss aspects of the transaction before they conclude a contract. One party may think that something said by the other during these discussions is part of the deal that they agree on, while that other party may consider the statement as not involving a promise of any sort. Where the parties have reduced their contract to writing, the parol evidence rule could be used to exclude extraneous material but most contracts are made verbally. In the latter category of contracts, it becomes necessary to determine what statement or promise is part of the contract and what is not. Contract law makes this determination by drawing a distinction between terms and representations. 10.24 The courts will examine the pre-contractual negotiations and sift what was said into three categories. The first category consists of the puff, the normal exaggeration and grandstanding that is a part of contract negotiation. For example, a claim that the product is “the best beer in the world!”. The law regards claims such as these as legally insignificant because they are not meant to be taken seriously. Often, though not always, these statements will be on the borderline of opinion and a statement of fact. The second category consists of representations while the third category consists of terms. When 305 Principles of Singapore Business Law one party makes a statement of fact to another party with the intention of inducing the other party to enter into a contract and that factual statement does in fact induce the other party to enter into the contract but it cannot be said that the statement was intended by the parties to form part of the contract, a representation has been made. The critical feature of the representation is that it induces the contract but if it turns out to be false, the person who relied on it cannot sue for breach of contract. For example, if A tells B that she would sell a necklace to B for $1,000, the price may induce B to buy the necklace but the price is also a part of the contract and hence is a term of the contract. But, if in addition, A tells B that the necklace belonged to a celebrity, this statement may induce B to buy the necklace but it is uncertain whether it becomes a part of the contract (a term) such that B can sue A for breach of contract if she discovers, after making the purchase, that the necklace was never owned nor used by the celebrity in question. 10.25 By virtue of the Application of English Law Act (Cap 7A, 1994 Rev Ed), the UK Misrepresentation Act of 1967 (reprinted locally as Cap 390, 1994 Rev Ed), applies in Singapore and a literal reading of s 2(1) of this Act would expose a maker of a misrepresentation, who cannot prove that he had objectively reasonable grounds for making that misrepresentation, to the same liability as the maker of a fraudulent representation. See the English Court of Appeal decision of Royscot Trust Ltd v Rogerson (1991) which, “although subject to criticism, holds sway” according to the UK Court of Appeal in HIH Casualty & General Insurance Ltd v Chase Manhattan Bank (2001). In Ng Buay Hock v Tan Keng Huat (1997), the Singapore High Court referred to the decision in Royscot but held (at [31]) that the plaintiff ’s claim relieved him of making “a choice in regard to the measure of damages such as was made in the Royscot case”. His comments about Royscot must therefore be regarded as obiter dicta. As it is possible that Royscot might be accepted as good law in Singapore, the proper characterisation of a pre-contractual statement as a term or a representation will be of critical importance in terms of the types of remedies available under contract law or the Misrepresentation Act to both the maker of the statement and the other party who relied on the statement (see further, the discussion of misrepresentation in Chapter 13). 10.26 Whether something said by one party to another during a pre-contractual negotiation is a representation or a term depends on the intention of the 306 Chapter 10: Terms of the Contract parties and is thus a question of fact. This means that if the parties disagree about the status of the statement and go to court, the judge will examine the specific facts of the particular case to determine, on an objective basis, whether the parties intended the statement in question to be a representation or a term. In making this determination as to the intention of the parties, however, the judge will apply to the specific facts certain guidelines, discussed in the following sections, that the courts have developed over a hundred years. However, not all guidelines may apply to a particular scenario and no one guideline (even if it applies) can be said to be conclusive as to the intention of the parties. Ultimately, a conclusion can only be reached after a consideration of all relevant facts. Request to Verify 10.27 During a negotiation prior to the contract, when one party tells the other party something and then qualifies that statement by telling that party to the effect “don’t take my word for it, get an independent verification and satisfy yourself ”, the court will probably hold that the party made a representation. In Ecay v Godfrey (1947), the seller told the buyer of a boat that the boat did not have any flaws but then went on to invite the buyer to have the boat inspected. The buyer did not have the boat inspected and after the sale, the buyer found flaws in the boat. He sued for breach of contract. The court rejected this claim, holding that the seller’s statement about the lack of flaws was a representation and not a term. On the other hand, the court in Schawel v Reade (1913) held that the seller’s statement was a term. Here, the seller told the buyer, who wished to buy the seller’s horse for stud purposes, that the horse was perfectly sound and that the buyer need not look for anything that could be the matter with the horse. The buyer successfully sued the seller for breach of contact upon discovering that the horse was totally unfit for stud purposes. Importance of the Statement 10.28 If it appears to the court that the statement in question is so important to one party that they would not have entered into the contract but for such statement having been made, the court will likely hold that statement is intended to be a term and not a representation. In Bannerman v White (1861), the buyer asked the seller whether the hops that the seller offered had been 307 Principles of Singapore Business Law treated with sulphur. The buyer emphasised that he would not even bother to ask the price if the hops had been treated with sulphur. This exchange clearly showed that the buyer would only buy sulphur-free hops. The seller assured the buyer that no sulphur had been used on the hops. When, after the purchase the buyer found that sulphur had been used, he sued the seller for breach of contract. The court held that the assurance about the hops being free of sulphur was a term of the contract and not a representation. 10.29 A statement asserting a feature of intrinsic significance in relation to the subject matter of the contract is likely to be a term of the contract. In Darwish M K F Al Gobaishi v House of Hung Pte Ltd (1995), the plaintiff purchased some gemstones from the defendants. The defendants had stated that “all the gemstones the plaintiff agreed to purchase were genuine, natural, without flaws and not treated in any way” prior to the purchase. However, some of the gemstones purchased — beryls — turned out to be flawed as their colour faded when exposed to light and heat. The Singapore High Court held (at [80]) that the statement was a term of the main contract of sale and purchase and need not be treated as a term of a collateral contract. The court found that the subject matter of the contract, as intended by both the plaintiff and defendants, were gemstones (at [87]). Thus the subject matter had to have the properties of “gemstones” which included permanence or stability of colour (at [87]), a “very necessary feature in the jewellery trade” (at [88]). Timing of the Statement 10.30 If one party makes a statement about the subject matter of the contract to the other party shortly before they enter into the contract, the courts would probably hold that this statement is a term and not a representation. The relevant time frame would depend on the type of contract. For example, in a contract of employment over which the parties have negotiated for several months, a statement made during the start of the negotiations would probably be a representation and not a term. On the other hand, in a routine buy and sell transaction, there might be so much haggling that it would justify a court finding that a statement made just a week before the contract is a representation and not a term. Thus, in Routledge v McKay (1954), the seller had consulted the registration book of the motorcycle to be sold and told the buyer that the vehicle was a 1942 model. One week later, the 308 Chapter 10: Terms of the Contract parties signed the contract. The buyer found that the motorcycle, far from being a 1942 model, was a 1930 model. The court rejected the buyer’s claim for a breach of warranty holding that the statement about the year of the model was not a term of the contract. This case illustrates the point made earlier that whether a statement is a term or a representation is eventually a question of the intention of the parties, a fact to be determined by looking at the surrounding circumstances. In a country like Singapore, where vehicles are expensive and the parties are choosy and sensitive to the Certificate of Entitlement (“COE”) issues such as the scrap value of the vehicle, the courts may decide a similar case differently. The court might consider any statement about the model year to be so important that it would qualify as a term because it would be reasonable to hold that, in the context of automobile purchases in Singapore, the parties intend the year of manufacture to be a term and not a mere representation. Oral Statements and Written Contracts 10.31 Where the parties, after negotiations, put their agreement in writing, the courts would probably hold that what they say during the pre-contractual negotiation that is not put in writing, is a representation and not a term. Normally, the parol evidence rule would shut out such statements. However, in special circumstances, the court might hold that the parties entered into a contract that was partly written and partly oral. Special Skill and Knowledge 10.32 If a statement is made by or to a party on a matter about which that party has special knowledge or skill, that special knowledge or skill will be relevant in determining whether the statement is a representation or a term. This is because it is reasonable to assume that it is not the intention of a person making the statement, who has little or no expertise in the area, to someone, who has expertise in the area, to expose herself to a breach of contract action in case the representation proves false. Two contrasting English cases that deal with a statement on the model of the car that was the subject of the contract illustrate this approach. 10.33 In Oscar Chess Ltd v Williams (1957), the plaintiff, a hire-purchase firm, agreed with the defendant that he could trade in his car as a part of the 309 Principles of Singapore Business Law hire-purchase transaction. The defendant, who was not in the car business, consulted his registration book and told the plaintiff that the car was a 1948 model whereas in fact the car was a 1939 model. The defendant made this false statement in good faith and it was later found that some unknown person had fraudulently altered the particulars in the registration book. Because the plaintiff believed the defendant’s statement that the car was a 1948 model, the defendant received more credit than he would have if the plaintiff knew that the car was a 1939 model. The remedy of rescission was available if the false statement was an innocent misrepresentation. The plaintiff could not set aside the contract by the remedy of rescission since this relief must be sought in a timely manner, and the plaintiff had delayed in bringing the action. Not being able to bring an action to rescind the contract because of the delay, the plaintiff sued for breach of contract on the ground that the false statement was a term of the contract. The court disallowed the plaintiff ’s action for a breach of warranty. It reasoned that the defendant who was not a car dealer was not in a position to give a warranty on the year or the model, whereas the plaintiffs, a hire-purchase firm that dealt in automobiles, had the technical knowledge to protect themselves. 10.34 The roles were reversed in Dick Bentley Productions Ltd v Harold Smith (1965). Here, it was the seller who dealt in cars. The odometer of the car showed that it had done only 30,000 miles after a replacement engine had been fitted. In fact, the car had done 100,000 miles. The buyer successfully sued the seller–dealer for breach of warranty. 10.35 These two cases demonstrate that where the knowledge of the person who receives the statement is about the same or superior to that of the party making the statement, the courts would likely hold that such statement is intended as a representation and not a term of the contract. Even so, in Eian Tauber Pritchard v Peter Cook (1998), the English Court of Appeal held that the statements made by a seller of a rally motor car pertaining to the specifications for the car to be terms of the contract even though the seller had less technical knowledge of the car in comparison with the buyer. The buyer was a motor trader, a keen and experienced rally driver who had previously owned at least three cars similar to the one he bought in this case while the seller was a dealer in motorcycle clothing and accessories and collector of classic cars. The seller did not have personal knowledge of the technical specifications of the car he advertised to sell but had with him a 310 Chapter 10: Terms of the Contract copy of the specifications he obtained from Rally Engineering Development (“RED”), the company he had purchased the car from. Nevertheless the seller indicated in his advertisement that the specifications were available on request and had photocopied the specifications onto paper bearing his company letterhead before showing them to the buyer when the buyer requested to see them during his visit to inspect the car. The buyer had then checked the car against the specifications for accuracy as far as he could. The conduct of the parties led the court to find that both the seller and the buyer regarded the specifications as important — the seller had mentioned them in his advertisement and the buyer had requested for them and checked the car carefully against them. Further, that the seller had made the specification the basis of the sale when he photocopied the specifications on his own letterhead and did not disclaim responsibility for their accuracy by asking the buyer to check with RED instead. Based on the totality of facts, the court concluded that the specifications had become terms of the contract regardless of the seller’s relative lack of expertise. This case clearly illustrates that all relevant facts need to be considered before a conclusion can be reached as to the status of any statements made in the course of negotiations. Box 10.1 Reflecting on the law Impact of the Misrepresentation Act on pre-contractual misrepresentations The Misrepresentation Act (Cap 390, 1994 Rev Ed) has supplemented the common law relating to pre-contractual misrepresentation (see Chapter 13) and the continued relevance of old case law providing guidelines to determine whether a statement is a term or a representation must be assessed in the context of a growing body of consumer protection law, the pervasive influence of hyper-advertising in a mediasaturated culture on a sceptical consumer public and the possibility that a party who makes a misrepresentation whether innocent or negligent could be liable to the same extent as a person making a fraudulent misrepresentation unless the party making the representation had objectively reasonable grounds to believe and did believe up to the time the contract is made that the facts represented are true. In other words, the Act imposes legal liability on the party making the representation not to state facts during the course of contractual negotiations that they cannot prove that he or she had reasonable grounds to believe that the representation is true (see Howard Marine v Ogden & Sons (1978)). Advertisers and their clients who are averse to exposure to liability under the Act might opt to influence buyers with 311 Principles of Singapore Business Law Box 10.1 (Continued ) meaningless sounds and images that cannot be characterised as representations instead of providing information that are of a representational nature and thus attract potential liability under the Act. It should also be borne in mind that jurisdiction over most consumer disputes is now vested in the Small Claims Tribunals that use as a part of their procedure a mandatory mediation process. Insisting on the niceties of legal distinctions between representations and terms and invoking remedies under the Misrepresentation Act may not be an easy exercise in the specific context of effective consumer dispute resolution. RELATIVE IMPORTANCE OF TERMS Warranties, Conditions and Innominate Terms 10.36 Once a court finds that the contents of a contract include a statement, that is, the statement is a term and not a representation, the court has to decide on the remedy to accord the innocent party (ie, the party not in breach) for a breach of the term. Singapore law had traditionally tracked English law in this matter. However, the Singapore Court of Appeal has prescribed a somewhat different approach in its obiter statements in RDC Concrete PL v Sato Kogyo (S) Pte Ltd (2007) and Sports Connection Pte Ltd v Deuter Sports GmbH (2009). The English (traditional) approach will be explained before the new approach is considered. Under the traditional approach, the court typically classifies a term as a “condition”, a “warranty” or an “innominate term”. Where one party fails to perform a condition, the innocent party may claim damages in compensation for losses suffered. Additionally, the innocent party is given a choice as to whether he wishes to treat the contract as at an end (ie, to terminate the contract). If the breach is in respect of a warranty, the innocent party may seek damages but not termination. Thus if the innocent party mistakes a breach of warranty for a breach of condition, purports to terminate the contract because of this mistaken characterisation, and enters into another contract for the performance of the same obligation with a third party, that innocent party will be liable in damages as a result of the wrong assessment of the nature of the term. An innominate term is a term that, by its very nature, is difficult to classify as either a condition or a warranty. The remedy for breach of such a term would depend upon the 312 Chapter 10: Terms of the Contract nature and consequences of the breach. A breach that deprives the innocent party of substantially the whole benefit he is intended to receive under the contract will entitle the innocent party to the same remedy as is given for a breach of condition. A breach that results in trivial consequences (ie, it does not result in substantial deprivation of benefit) will entitle the innocent party to the same remedy as is given for a breach of warranty. 10.37 Accordingly, the court’s first task is to assess the objective language of the contract to determine whether the parties intended the term in question to be a condition, an innominate term or a warranty. The parties are free to agree expressly that a particular term in a contract will be regarded as a condition the result of which, if there is a breach of this term, the innocent party can terminate the contract regardless of how minor the consequence of the breach was. Sometimes, however, the court may conclude that, when the parties characterised a term as a “condition”, they did not intend that technical meaning (see L Schuler AG v Wickman Machine Tool Sales Ltd (1974)). Where there is no express characterisation of a term, the courts will look: at the contract in the light of the surrounding circumstances, and then [make up its mind] whether the intention of the parties, as gathered from the instrument itself, will best be carried out by treating the promise as a warranty sounding only in damages or as a condition precedent by the failure to perform which the other party is relieved of his liability (per Bowen LJ in Bentsen v Taylor, Sons & Co (1893) at p 281). Sometimes, previous cases examining a standard term in a generic contract would conclude that the term was a condition, and confronted with such a term in the same type of contract, a court may conclude that the term was a condition (see Maredelanto Compania Naviera SA v Bergbau-Handel GmbH, The Mihalis Angelos (1971)). Sometimes, a statute will classify a particular term as a condition and it will not usually be open to the parties to designate it as a warranty. However, if after examining the term in question, the court decides that it is not a condition but also concludes at the same time that the breach of the term “may be attended by trivial, minor or very grave consequences”, it will characterise the term as an innominate term and not as a warranty (see per Lord Scarman in Bunge Corporation, New York v Tradax Export SA Panama (1981) (at p 717)). 313 Principles of Singapore Business Law 10.38 The words “conditions” and “warranties” as they appear in contracts also have secondary meanings that are quite different from the meanings given above. Thus the word “condition” as used above, also known as “promissory condition”, differs from “contingent condition”. As its name implies, a contingent condition is a term in the contract that specifies an event or events that must occur if the contract is to come into force or remain in force. These “conditions precedent” and “conditions subsequent” are terms but are not “conditions” in the specialised sense used above. Rather, they are “conditions” in the layperson sense of the word as in “conditional”. Thus a sub-contract to build a garage in a house between the sub-contractor and the main contractor may contain a condition precedent to the effect that the contract will come into force only when the owner awards the building contract to the main contractor. Likewise, there might be a “condition subsequent” to the effect that the sub-contract to build the garage will remain in force only insofar as the main building contract remains in force. In L Schuler AG v Wickman Machine Tool Sales Ltd (1974), the majority of the judges in the House of Lords concluded that the characterisation of a term as a “condition” in the contract under review was not meant in the technical sense but in the layperson sense. However, if they had concluded that the parties knew what they were doing when they stated that a particular term was a condition, then they would have treated that term as a condition in the technical sense without regard to whether or not the term contained an objectively important obligation. 10.39 The word “warranty” is frequently used in consumer contracts for the sale of goods or of services. The meaning here is different from the technical term “warranty” when used to differentiate a term that is not a condition or an innominate term. In the consumer context, for example, a seller of a hand phone may give a warranty for a certain period. This usually just means that the seller or dealer of the hand phone will replace any faulty components and provide repairs free of charge during this warranty period. Differentiating between Conditions and Warranties 10.40 Because termination of the contract is an option for the innocent party where a condition in a contract has been breached and this could have serious consequences for both parties, it has been observed that courts should not be too ready to characterise terms as conditions (see Cehave 314 Chapter 10: Terms of the Contract NV v Bremer Handelsgesellschaft mbH (The Hansa Nord) (1976)). However, parties to commercial contracts place a high value on certainty and certain terms in mercantile contracts, for example, those relating to time, have been regarded as conditions in the absence of evidence to the contrary. A number of possible guidelines as to when a term might be classified as a “condition” have already been examined in para 10.37. Prior to the English Court of Appeal decision in Hong Kong Fir Shipping Co Ltd v Kawasaki Kisen Kaisha Ltd (1962), if the term is not a “condition”, it would be a “warranty”, thus not taking into account the concept of “innominate term” (as to which, see para 10.44 onwards). Bearing these observations in mind, just two of the classic cases, because of similar “factual matrixes”, may be considered. In these two leading cases, opera singers on contract failed to honour the terms of their contracts but one failure was regarded as a breach of condition while the other was held to be a breach of warranty. 10.41 In Poussard v Spiers (1876), Madame Poussard had contracted to sing in an opera, the first performance of which was due to take place on 28 November 1874. The singer fell ill on 23 November 1874, and the illness prevented her from being able to sing until 4 December 1874. The defendant company had engaged a substitute who had insisted upon being offered the role for the complete engagement. The defendant agreed to this requirement and hired the substitute for the complete engagement. Madame Poussard presented herself for the role on 4 December 1874, and the defendant refused to engage her. She sued the defendant for breach of contract. The court rejected her suit holding that her failure to appear on opening night was a breach of a condition entitling the defendant to repudiate the contract and treat it as discharged. 10.42 Bettini v Gye (1876) provides a useful contrast to the Poussard case. Here, too, the plaintiff, an opera singer, had agreed to sing. She had agreed to sing in England for a period commencing 30 March 1875, and to be in London for rehearsals for six days before the engagement. The plaintiff singer fell ill and arrived in England only on 28 March 1875, late for the rehearsals but in time for opening night. The defendant company rejected the singer’s services and treated the contract as terminated. The court upheld the plaintiff ’s action for breach of contract despite the fact that it was she who did not appear for the rehearsals on time. It held that the obligation to participate in rehearsals was not a condition because participating in rehearsals was merely 315 Principles of Singapore Business Law ancillary to the main purpose of the contract. The principal purpose of the contract was for the singer to engage in the actual performance, a task that she was able to perform. 10.43 These cases show that where the term goes to the root of the contract and deals with an obligation or statement of fact, the absence of which would have persuaded the innocent party not to enter into the contract in the first place, the term in question will be treated as a condition. On the other hand, if the term relates to a matter, the non-performance of which will not impair the substance of the bargain expected by the innocent party, the term will be regarded as a warranty. The “Hong Kong Fir Approach” 10.44 Although the distinction between conditions and warranties (the condition– warranty approach) has existed for more than a century, the characterisation of another class of terms, the innominate term, took place in the case of Hong Kong Fir Shipping Co Ltd v Kawasaki Kisen Kaisha Ltd (1962), particularly in the judgment of Diplock LJ (as he then was). However, in a later case, Bunge Corporation, New York v Tradax Export SA Panama (1981) (at p 717), Lord Scarman observed that Hong Kong Fir case represented merely a rediscovery and reaffirmation of a type of term that was neither a condition nor a warranty, while Lord Wilberforce called Diplock LJ’s judgment “seminal” and his analysis “classical”. Lord Diplock, the judge who authored the judgment in the Hong Kong Fir case, gave an account of his thinking as follows: This case arose out of the contractual obligations of a ship-owner under a charterparty to provide a vessel that was seaworthy and to maintain it in that state … there has been no previous decision binding on the Court of Appeal that has assigned this obligation to the category either of “condition” or “warranty”. This gave the Court an opportunity of recognising that it was too simplistic an approach to categorise so broad a stipulation ab initio as a condition, any breach of which, however minor, would entitle the charterer to terminate the charter, or as a warranty no breach of which, however serious, would entitle him to terminate the charter but only to recover monetary compensation for the loss the breach had caused him. There is no reason for supposing that, as sensible commercial men, such was the intention of the parties when 316 Chapter 10: Terms of the Contract they entered into a contract. Some breaches of the stipulation might be so serious as to deprive the charter of substantially the whole benefit contemplated by the parties to be derived from the charter, others so minor or so temporary as scarcely to disadvantage him at all. The breakthrough in Hong Kong Fir was the recognition of a third category of contractual stipulations which were neither conditions nor warranties but innominate terms some breaches of which would deprive one party of substantially the whole benefit contemplated by the parties to be derived from the performance of the contact, but other breaches would not. If a breach of the former kind occurred a rational and equitable law of contract would recognise the injured party’s right to be excused from further performance of his own obligations under it; but it would not if the breach were only the latter kind. Monetary compensation for any loss sustained would be fair enough. Andrew Phang JA had argued that the use of the phrase “Hong Kong Fir approach” to this type of term is more appropriate since the term is of a type radically different from the normal “condition” and “warranty” because of its focus on the nature and consequences of the breach of the term rather than on the intention of the parties (see A Phang, International Encyclopaedia of Laws — Contracts (Singapore) (2000) at para 465). 10.45 Innominate terms are those terms that, not explicitly characterised by the parties as “conditions”, cannot be immediately categorised as conditions or warranties simply by looking at their content because it is possible to envisage both serious as well as extremely trivial breaches of the term. An innominate term could operate either as a condition or a warranty depending on the nature and consequences of the breach. If the breach is serious, given the context of the contract, the courts will regard the breach as if it were a breach of condition with all the consequences that such a breach entails. In other words, in the event of a dispute, the task of the court will be to decide whether the parties, if they had been asked what would happen if the breach in question would occur, would have replied, “it goes without saying that, if that happens, the contract is at an end” (see Bunge Corporation, New York v Tradax Export SA Panama (1981) at p 717). On the other hand, if the breach were not serious when applying the foregoing criterion, then the court would hold that the breach was as if it were a breach of warranty with the consequence that the innocent party must continue performing the contract and seek only damages. To illustrate, contracts to rent ships, known 317 Principles of Singapore Business Law as charterparty contracts, frequently contain a term that the ship must be seaworthy. If the owner delivers the ship with a nail missing, they would be in breach of the term of seaworthiness, and would also breach the term if they delivered a ship whose engines did not work. Obviously, the two types of breaches, although in relation to the same term, are not the same. The absence of a nail would not lead to serious consequences while the defective engines would certainly lead to serious consequences. 10.46 In Bunge Corporation, New York v Tradax Export SA Panama (1981), the court held that applying the “Hong Kong Fir approach” involves a twostep process. First, the court must determine whether the language of the term requires it to be classified as a condition according to the traditional condition–warranty approach. Second, it is only after determining that the term is not a condition or a warranty but, rather, an innominate term, must the court consider whether in the circumstances of the case, the breach has deprived the innocent party of substantially the entirety of the benefit of the contract it was intended that the innocent party should have, in which case the consequences of a breach of a condition would follow. In the Bunge Corporation case, the House of Lords emphasised that it is always possible for the parties to agree that a particular term should be regarded as a condition even though the consequences of its breach could be minor, and if that were to happen, the court would accord such a term the status of a condition. This means that however minor the consequences of the breach may be, the innocent party would be allowed to terminate the contract. 10.47 This alternative approach leads to useful commercial results since it avoids the rigid dualistic classification and allows a court to achieve a pragmatic outcome with regards to terms that are worded in such general and wide language so as to admit minor and major breaches. It would work hardship on the parties if a minor infraction of such terms were to entitle the innocent party to treat the contract as discharged, and conversely, if a serious infraction prevents discharge by the innocent parties. Some critics argue that adopting such an approach could cause problems where an innocent party mistakenly terminates the contract because they thought that the breach of the innominate term was sufficiently serious. As they made this mistake, they could be liable for wrongfully repudiating the contract. While this possibility exists, the “Hong Kong Fir approach” may help to promote 318 Chapter 10: Terms of the Contract justice as illustrated by the case of The Hansa Nord (1974). Here, the buyers of citrus pulp rejected the shipment on the ground that it was not in good condition, but thereafter bought the shipment through one of their agents at more than a 60 per cent discount, and used the pulp for the purpose for which the buyers originally purchased the pulp. The court categorised the term relating to quality as an innominate term and found that the slight consequences of the breach did not justify termination. Instead, the buyers had to be content with damages. The New Singapore Approach: A Synthesis between the Condition–Warranty and Hong Kong Fir Approaches 10.48 In RDC Concrete Pte Ltd v Sato Kogyo (S) Pte Ltd (2007), the Singapore Court of Appeal conducted an extensive analysis of the case law and the academic literature relating to the development of the law on conditions and warranties and the modern classification of the various types of terms and the remedies for their breach. Andrew Phang JA (delivering the judgment of the court) proposed, obiter, a comprehensive approach to when, and on what grounds, an innocent party could terminate a contract on account of a breach of term by the other party (summarised in a table (at [113]). See Table 10.1 for a description of the proposal. The principal difference between the approach proposed in RDC Concrete and the traditional English approach relates to the method by which the court decides if the innocent party should be entitled to a right of termination for breach of a term that was not intended by the contracting parties to be a condition (see Table 10.1, Situations 3(a) and 3(b)). The intent behind the RDC Concrete proposal was to synthesise the condition–warranty and Hong Kong Fir approaches. Phang JA was of the view (at [105]) that the two approaches, as defined, could not co-exist but that each made sense in its own way: [A]n intermediate term is defined as one which is neither a condition nor a warranty simply because a breach of it could give rise to either very substantial or to very trivial consequences. Unfortunately, however, such an approach effectively and practically obliterates the distinction between a condition and a warranty because the breach of virtually any term could give rise to either very substantial or to very trivial consequences … In other words, a wholesale adoption of the Hongkong Fir approach in the manner just described would result in its complete 319 Principles of Singapore Business Law eclipse of the condition–warranty approach. We are of the view, however, that this should not be the case. There is an appropriate legal role for both approaches. [emphasis in the original] 10.49 To rationally synthesise both approaches in a way that achieves a judicious balance between fostering certainty and predictability of contract on the one hand, and fairness on the other (see [109]), the Court suggested as follows (at [106]–[107]): 106 In determining whether an innocent party is entitled to terminate a contract upon breach, the foremost consideration is (and must be) to give effect to the intentions of the contracting parties. If so, then the condition–warranty approach must take precedence over the Hongkong Fir approach because … it is premised on the intentions of the contracting parties themselves. Thus, in Bunge (at 716), Lord Wilberforce expressly cautioned that the Hongkong Fir approach would be unsuitable in cases where the parties had evinced an intention that the contractual obligation was to have the force of a condition. In such cases, regardless of the consequences of the breach, the innocent party would be entitled to terminate the contract. 107 If, however, the term breached is a warranty, we are of the view that the innocent party is not thereby prevented from terminating the contract (as it would have been entitled so to do if the condition– warranty approach operated alone). Considerations of fairness demand, in our view, that the consequences of the breach should also be examined by the court, even if the term breached is only a warranty (as opposed to a condition). There would, of course, be no need for the court to examine the consequences of the breach if the term breached was a condition since … the breach of a condition would … entitle the innocent party to terminate the contract in the first instance. Hence, it is only in a situation where the term breached would otherwise constitute a warranty that the court would, as a question of fairness, go further and examine the consequences of the breach as well. In the result, if the consequences of the breach are such as to deprive the innocent party of substantially the whole benefit that it was intended that the innocent party should obtain from the contract, then the innocent party would be entitled to terminate the contract, notwithstanding that it only constitutes a warranty. 320 Chapter 10: Terms of the Contract If, however, the consequences of the breach are only very trivial, then the innocent party would not be entitled to terminate the contract. [emphasis in the original] 10.50 The Court recognised (at [108]) that by the approach advocated, a term that is not a condition would necessarily be treated as an innominate term, thus obliterating the concept of the warranty for there would “virtually never be a situation in which there would be a term, the breach of which would always result in only trivial consequences.” However, this very result became the subject of academic criticism (as to which, see Chapter 16, paras 16.44– 16.46). Subsequently, in Sports Connection Pte Ltd v Deuter Sports GmbH (2009), the Court of Appeal responded (at [57]) to the criticisms by adding a qualification to the approach it prescribed in RDC Concrete: We would therefore reaffirm the approach laid down in RDC Concrete …, subject to the extremely limited exception that, where the term itself states expressly (as well as clearly and unambiguously) that any breach of it, regardless of the seriousness of the consequences that follow from that breach, will never entitle the innocent party to terminate the contract, then the court will give effect to this particular type of term (viz, a warranty expressly intended by the parties). [emphasis in the original] The reader should therefore bear in mind that the approach of RDC Concrete summarised in Table 10.1 is subject to the limited exception laid down in Sports Connection. See Chapter 16, Figure 16.1 for a diagram that highlights, inter alia, the RDC Concrete approach as qualified by Sports Connection. 10.51 The RDC Concrete approach has been applied by the Singapore Court of Appeal in the case of Man Financial (S) Pte Ltd v Wong Bark Chuan David (2008) (see [152]–[158]) and Sports Connection (2009) (at [23]–[26] and [65]) and in a number of other Court of Appeal and lower court decisions (see, eg, the High Court decisions in LTT Global Consultants v BMC Academy Pte Ltd (2011) and Cousins Scott William v The Royal Bank of Scotland plc (2010)). The RDC Concrete approach is thus a part of Singapore law. What remains obiter is the qualification of a “limited exception in the case of an express warranty” on which certain criticisms remain (as to which, see Chapter 16, para 16.47). 321 3( b) HongkongFi r appr oach 3( a) Condi t i onWar r ant y appr oach ( 2) Cont r actdoesnot cont ai nexpr ess pr ovi si onofar i ght t ot er mi nat e ( 1) Cont r act cont ai nsexpr ess pr ovi si onofa r i ghtt ot er mi nat e i nspeci ed ci r cumst ances Si t uat i on Thi sr ef er st oasi t uat i onwher et het er m br eachedi snotacondi t i on( asascer t ai ned byt hecour t s)buti t sbr eachr esul t si n consequenceswhi chdepr i vet hei nnocent par t yofsubst ant i al l yt hewhol ebenett hat t hei nnocentpar t ywast oobt ai nf r om t he cont r act . Thi sr ef er st oasi t uat i onwher et hecour t s er m br eachedi s haveascer t ai nedt hatt het acondi t i on. Thi si nvol vesascer t ai ni ngt hesever i t yoft heconsequencesoft hebr each. Ar i ghtoft er mi nat i onar i sesonl yi ft hebr eachr esul t si nconsequencest hat depr i vet hei nnocentpar t yofsubst ant i al l yt hewhol ebenetcont r act edf or andnotot her wi se. t i onWar r ant yappr oach,t hecour t Wher euponappl yi ngt heCondi di scer nst hatt hecont r act i ngpar t i esdonotr egar dt het er m br eachedt obe ani mpor t antone,t hesecondst epi st oappl yt heHongkongFi rappr oach. Ther stst epi st oappl yt heCondi t i onWar r ant yappr oachwhi chi nvol ves di scer ni ngt hei nt ent i onoft hecont r act i ngpar t i esonanobj ect i vebasi s. I ft hecont r act i ngpar t i esr egar dt het er mt obeani mpor t antone,t he cour twi l lcat egor i sei tasacondi t i onwi t ht hecons equencet hatar i ghtof t er mi nat i onar i sesuponi t sbr each. Wher eSi t uat i ons( 1)and( 2)descr i bedabovedonotappl y ,t hecour thas t oascer t ai nt het ypeoft er m br eachedi nor dert odeci dei ft hei nnocent par t yhasar i ghtt ot er mi nat et hecont r act . Wher esuchapr ovi si onexi st s,t hecour tdoesnotneedt oascer t ai nt he t ypeoft er m br eachedi nor dert odeci dei far i ghtoft er mi nat i onar i ses. Comment Thi sr ef er st oasi t uat i onwher et hepar t y Wher et hi soccur s,ar i ghtoft er mi nat i onar i seswi t houtt hecour thavi ngt o enouncest hecont r act( i e,t he i nbr eachr ascer t ai nt het ypeoft er m br eached. def aul t i ngpar t y di sownst hecont r act )and cl ear l yi nf or mst hei nnocentpar t yt hati twi l l notper f or m anyofi t scont r act ualobl i gat i ons. Thi sr ef er st oasi t uat i onwher et hecont r act cont ai nsat er mt hatcl ear l yl i st st heevent s t heoccur r enceofwhi chwi l lper mi tt he i nnocentpar t yt ot er mi nat et hecont r actand aneventl i s t edhasoccur r ed. Ci r cumst anceswher er i ghtoft er mi nat i on ar i ses Table 10.1 The RDC Concrete approach to situations entitling an innocent party to terminate the contract at common law prior to the qualification in Sports Connection Chapter 10: Terms of the Contract 10.52 Notably, the traditional English approach continues to apply for the purpose of determining whether or not a given term is a condition. The focus of inquiry is “on ascertaining the intention of the contracting parties themselves by construing the actual contract itself (including the contractual term concerned) in light of the surrounding circumstances as a whole” (see Man Financial at [161]). Emphasising that there is no magical formula and that much depends on the actual factual matrix of the particular case (at [174]), the Court of Appeal in Man Financial (at [162]–[173]) highlighted four familiar non-exhaustive factors (see para 10.37) that might, if applicable, be taken into account: ° Whether a statute classifies the term as a condition ° Whether the term itself expressly states that it is a condition although this factor is not conclusive as the word “condition” might have been used in the lay rather than the legal sense ° Whether a prior precedent is available ° Whether the contractual term is given in the context of a mercantile transaction 10.53 On the facts of Man Financial, none of the four factors applied. The Court thus proceeded to construe the term and the contract against its factual backdrop to decide if it was a condition. The brief facts are: Wong Bark Chuan (“Wong”) was the CEO of Man Financial (S) Pte Ltd (“MF”). Wong expressed a wish to step down as CEO and was asked to resign with immediate effect so that a newly appointed CEO would not be in the awkward position of performing in the presence of a former CEO. Wong was put on “garden leave” while serving out a three-month notice period. Concurrently, negotiations began on a Termination Agreement between Wong and MF. After many rounds of negotiation, the Termination Agreement was finalised and executed. It contained clause C.1 which prohibited solicitation by Wong of MF’s “officer, director, representative or employee” and Clause C.3 which prohibited Wong from, inter alia, rendering advice to any business in competition with MF. The Agreement provided for Wong to receive compensation of approximately S$1 million if he did not breach the terms. Subsequently, MF discovered that Wong had breached both Clauses C.1 and C.3 and refused to pay the compensation. The trial judge found on the evidence that both Clauses C.1 and C.3 were breached but held that they were unreasonable restraint of trade clauses and unenforceable (see 323 Principles of Singapore Business Law generally, Chapter 15 para 15.29 onwards on restraint of trade clauses). Thus MF could not rely on breaches of the clauses to discharge itself from its obligation to pay Wong the promised compensation. On appeal, the Court of Appeal upheld (at [15]–[16]) the trial judge’s decision on Clause C.3 but reversed the decision on Clause C.1, holding that Clause C.1 was a reasonable restraint of trade clause. To decide if a breach of Clause C.1 entitled MF to discharge itself from the Termination Agreement, the Court of Appeal applied the RDC Concrete approach. Taking account of the circumstances leading to the conclusion of the Termination Agreement, the court found Clause C.1 to be a condition. Specifically, the court found (at [179]) that the correspondence exchanged between the parties in finalising the Agreement demonstrated their intention pertaining to the contract and the importance attached to Clause C.1. They showed the trouble Wong took to ensure that the Clause C terms (which included Clause C.1) were acceptable to him by negotiating to reduce the period of restraint from twelve to seven months (at [188]). Further, they showed that MF had redrafted a clause to insert an italicised qualification indicating that the compensation was not payable upon a breach of any term in the Agreement, and that this was accepted by Wong (at [189]–[190]). 10.54 Another illustration of how the intention of parties pertaining to the nature of a term is ascertained can be found in Sports Connection. Additionally, the Court of Appeal clarified the precise steps involved in determining if a breach deprived an innocent party of substantially the whole benefit he was intended to obtain under the contract. The case involved a Distributorship Agreement (“Agreement”) between Sports Connection Pte Ltd (“Sports”) and Deuter Sports GmbH (“Deuter”). Sports had been the exclusive local and regional distributor of Deuter’s products from 1992 to 2005 with a number of written agreements for renewal of distributorship entered into during that period. In 2002, for the first time, an Agreement entered into included a clause prohibiting Sports from selling competing products without Deuter’s prior written consent (“the Non-Competition clause”). Sports and Deuter had an understanding that the Non-Competition clause would not be activated as long as Sports purchased US$1 million worth of Deuter’s products annually. When Sports failed to do so in 2004, Deuter activated the Non-Competition Clause and subsequently terminated the Agreement in early 2005 for a breach of the clause. Sports commenced legal action against Deuter for wrongful repudiation (termination) of the Agreement. The Singapore High Court held 324 Chapter 10: Terms of the Contract in favour of Deuter finding that the Non-Competition clause was breached in a way that deprived Deuter of substantially the whole benefit Deuter was entitled to receive under the Agreement — that is, to ensure that Deuter’s exclusive distributor should continue to look after its interests that included market penetration and brand building for its products. The High Court had implicitly decided that the term was not a condition. 10.55 On appeal, the Court of Appeal applied the RDC Concrete approach and found that the Non-Competition clause was not a condition. To determine this, the court considered the background facts and noted (at [69]) that Deuter had always known that Sports sold competing products both before and after the Non-Competition clause was inserted in the 2002 Agreement, and had no intention of treating the Non-Competition clause as a strict prohibition. This was especially evident from an email sent by Deuter’s export manager to Sports’ managing director three days after the signing of the 2002 Agreement stating “As you know we are dependent on you for good sales success in southeast Asia. So far it has worked with you selling competitive brands and we are not saying that we want you to stop. Potentially it poses a risk and could cause [Deuter] to lose what it has gained. That is why we want the benefit of you asking our approval …” (at [69], emphasis in original). This finding, together with the fact that parties understood that the Non-Competition clause would not be triggered unless the annual purchase target of US$1 million was not met, persuaded the court that the parties never intended the clause to be a condition (at [72]). 10.56 The next step involves determining whether the breach resulted in the innocent party being deprived of substantially the whole benefit he was intended to obtain. Emphasising that this question also depended very much on the precise factual matrix (at [64]), the court went on to highlight a twostep process. First, it must be ascertained “what exactly constituted the benefit that it was intended the innocent party should obtain from the contract” and second, the actual consequences of the breach that had occurred at the time the innocent party purported to terminate the contract must be closely scrutinised (at [62]). On the facts, the Court of Appeal agreed with the High Court’s identification of the benefit Deuter was to receive under the clause. However, the court found that the actual consequences of the breach at the time Deuter purported to terminate the contract — the drop in purchases by Sports from US$1 million to US$788,031.45 and the potential compromise 325 Principles of Singapore Business Law of market penetration and brand position of Deuter products — did not substantially deprive Deuter of the benefit it was intended to obtain for the following reasons: ° the drop in sales, though not insignificant, did not by itself result in substantial deprivation of benefit (at [78]); ° the objectives of market penetration and brand positioning may be achieved by aggressive promotional activities — sales of Deuter’s products was not the sole means to achieve these objectives (at [81] and [82]); ° Sports’ reduced purchases of Deuter’s products did not mean that there had been little or no market penetration and brand position achieved — Deuter’s export manager acknowledged success in sales in his email despite Sports selling competing products (at [81]); ° the long and successful business relationship between Deuter and Sports which did not rely on a Non-Competition clause in the earlier period suggested that Deuter was aware of and accepted Sports’ business strategy of selling competing products to maximise sale of Deuter’s products (at [82]); ° Deuter’s allegations in its Termination Notice indicated that Deuter did not really regard the sale of competing products by Sports to be the cause of failure to achieve market penetration and brand positioning (at [83]–[85]). Deuter was thus not entitled to terminate the Agreement upon breach of the Non-Competition clause. In wrongfully doing so, Deuter was itself in breach of the Agreement and Sports was entitled to claim damages against Deuter (at 91)). IMPLIED TERMS 10.57 The express terms of a contract, that is, those terms that the parties explicitly incorporate in their contract, can hardly envisage and provide for all eventualities, especially in complex transactions. Sometimes, the parties envisage eventualities but prefer not to address them to save time or to avoid a disagreement from preventing the formation of the contract. The law supplements the express terms of a contract by a category of terms known as implied terms. This category of implied terms can itself be divided into sub-categories depending on how the term is implied. 326 Chapter 10: Terms of the Contract 10.58 First, there is the category of terms implied in fact. The theory here is that for whatever reason the parties had certain intentions that they did not express. The idea here is to give effect to this unexpressed intention. Hence, when confronted with a gap in the contract that needs to be filled in order to resolve the dispute before it, the court asks itself what the parties would have unequivocally agreed upon had they addressed their minds to the problem or alternatively the court tries to supply a term that would give business efficacy to the contract. 10.59 Second, there is the category of terms implied by law or, to use computer terminology favoured by Lord Steyn in Malik v Bank of Credit and Commerce International SA (1998) (at pp 108–109) called “default terms”. This category concerns specific types of contracts, usually defining relationships between the parties such as landlord and tenant or employer and employee, where the courts imply a term not because of the presumed intention of the parties but because the implied term gives effect to policies intended to make the relationship work in that particular category of contract. Thus, for example, in employment contracts, the courts will presume that certain terms apply unless the parties negate those implied terms by other terms. 10.60 Third, there is a category of terms that must be implied in some types of contract pursuant to a law passed by Parliament. The Sale of Goods Act furnishes the best example of this category. 10.61 Finally, there is a category of terms pertaining to contracts relating to specialist subjects such as the sale of commodities. These contracts take place in the context of trade associations and practices that have developed rules on how the contract is to be performed and expands on the obligations of the parties. Terms Implied in Fact 10.62 While the courts have frequently declared that they are unwilling to make contracts on behalf of the parties, they are willing to imply a term into a contract when the term to be implied is obvious or where the implication is necessary in order to give business efficacy to the contract. Frequently, there is an overlap in these standards. 327 Principles of Singapore Business Law 10.63 A court would imply a term in a contract if it is satisfied that the parties, if they had been asked by an officious bystander whether they would have included the term to be implied as an express term, would both testily answer “Oh, of course!” (per Mackinnon LJ in Shirlaw v Southern Foundries (1926) Ltd (1939) at p 124). Because the term to be implied must be so obvious as to not admit possible disagreement, if there are different possible answers or answers with qualifications, the implication may not take place. 10.64 The courts would also imply terms to inject business efficacy into the contract. In The Moorcock (1889), the defendants were the owners of a jetty in the Thames River. They contracted with the plaintiff to have the plaintiff ’s boat, The Moorcock, docked at the jetty. Both parties knew that when the tide was low, the vessel would lie on the riverbed. During the low tide, the vessel settled on a ridge of hard ground beneath the mud and was damaged. The defendants had not given a warranty to the effect that the place was safe and that the ship could rest on it without damage. Despite this omission, the court held that there was an implied warranty by the defendants to this effect and therefore were liable for damages caused by the breach of warranty. The court observed that the warranty was implied from the presumed intention of the parties. The purpose of the implication was to give business efficacy to the transaction that both parties must have intended. The alternative, which was unacceptable, was to impose on one party all the risks of the transaction or to free the other side from all chances of failure. 10.65 It may be asked if the “officious bystander” test is different from the “business efficacy” test. The relationship between the two tests was not very clear. Andrew Phang J (as he then was) dealt with this question in the Singapore High Court case of Forefront Medical Technology (Pte) Ltd v Modern-Pak Pte Ltd (2006). The learned judge opined (at [40]) that the logical approach would be to treat the two tests as tests that complement one another and not as two different tests. The “officious bystander” test is merely the practical method by which the “business efficacy” test is implemented. In support, the learned judge cited (at [35]) Scrutton LJ’s observation in the English Court of Appeal case of Reigate v Union Manufacturing Company (Ramsbottom), Limited and Elton Copdyeing Company, Limited (1918), at p 605: A term can only be implied if it is necessary in the business sense to give efficacy to the contract; that is, if it is such a term that it can confidently be said that if at the time the contract was being negotiated some one 328 Chapter 10: Terms of the Contract had said to the parties, “What will happen in such a case,” they would both have replied, “Of course, so and so will happen; we did not trouble to say that; it is too clear.” Unless the Court comes to some such conclusion as that, it ought not to imply a term which the parties themselves have not expressed. [emphasis added by Andrew Phang J (as he then was)] 10.66 The learned judge also helpfully clarified (at [41]) that that any term implied in fact for a particular contract does not set a precedent for future contracts of the same type: In other words, the court is only concerned about arriving at a just and fair result via implication of the term or terms in question in that case — and that case alone. The court is only concerned about the presumed intention of the particular contracting parties — and those particular parties alone. [emphasis in the original] 10.67 There have been scores of cases that have expanded on the criteria for implying terms in fact. In BP Refinery (Westernport) Pty Ltd v Shire of Hastings (1977), the Privy Council, a court that hears appeals from some Commonwealth countries, enumerated the following conditions that must be present in order for a term to be implied: ° the term to be implied must be reasonable and equitable; ° the term implied must be necessary to give business efficacy to the contract. Thus, no term will be implied if the contract is effective without it; ° the term implied must be so obvious that “it goes without saying”; ° it must be capable of clear expression; and ° it must not contradict any express term of the contract. 10.68 The criterion of “reasonable and equitable” implication (in the quotation at para 10.67), while vague, merely provides a ground for refusing implication where the term sought to be implied is manifestly unfair or unreasonable. However, unlike “terms implied in law” (considered in the following paragraph), the criterion of reasonableness alone is insufficient; what is required, rather, is the stricter criterion of necessity, which (as we have seen) is embodied within both the “business efficacy” and “officious bystander” tests. 329 Principles of Singapore Business Law Terms Implied in Law 10.69 As Lord McLaren said in William Morton & Co v Muir Brothers & Co (1907) at p 1224: The conception of an implied condition is one with which we are familiar in relation to contracts of every description, and if we seek to trace any such implied condition to their source, it will be found that in almost every instance they are founded either on universal custom or in the nature of the contract itself. If the condition is such that every reasonable man on the one part would desire for his own protection to stipulate for the condition, and that no reasonable man on the other part would refuse to accede to it, then it is not unnatural that the condition should be taken for granted in all contracts of the class without the necessity of giving it formal expression. The foregoing observation provides the pragmatic reason as to why courts imply terms in certain types of contracts. Often these contracts are those that establish a relationship between the parties such as an employer and an employee. The advantages of having such standardised terms are that certainty is promoted, risk can properly be estimated and important social policies can be given effect to. For instance, a human resources manager in a company can find out what terms the law will imply in the employment relationship and can provide for risks by taking insurance. Likewise, a lessor will know what duties will be implied in a lease and can adjust the rent to be charged in order to pay for the costs associated with discharging those duties. Borrowing a term from computer technology — “default printer” — the House of Lords has referred to these terms as “default terms” because they will apply unless overridden by the parties to the particular transaction (see, eg, Malik v Bank of Credit and Commerce International SA (1998)). 10.70 In the leading case of Liverpool City Council v Irwin (1977), a landlord of a block of apartments was held to be under an implied obligation to take reasonable care of the common areas and keep them in a reasonable state of repair, and in Scally v Southern Health and Social Services Board (1992), employees who had been represented by a union that had negotiated certain pension rights for them, were able to obtain damages from the employer who had failed to notify them of these rights because the court implied a term requiring the employers to bring this to the notice of the employees. The House of Lords reasoned that since these rights were derived from a 330 Chapter 10: Terms of the Contract collective bargain, the employees could not be expected to become aware of them on their own. In Lister v Romford Ice & Cold Storage Ltd (1957), the court implied a term of faithful service by the employee in the contract of employment. The implied term also required the employee to indemnify his employer where the employee caused losses to the employer in the course of employment. In Malik v Bank of Credit and Commerce International SA (1998), the court held that there was an implied term in employment contracts, that the relationship between employer and employee was one of trust and confidence and that neither party would do anything, without good cause, that would damage this relationship. 10.71 The courts are also willing to imply a term in order to facilitate global commerce and the smooth functioning of arbitral agreements. Thus, it is an implied term of an arbitration agreement that the parties will perform the award issued by the arbitral tribunal (see Associated Electric & Gas Insurance Services Ltd v European Reinsurance Company of Zurich (2003)). 10.72 Andrew Phang J (as he then was) in Forefront highlighted (at [42]) that in contrast to a term implied in fact, any term implied in law will result in the same term implied in all future contracts of that particular type. As a result, the learned judge opined (at [44]) that the court should exercise the same, if not a higher degree, of caution in implying a term in law as when implying a term in fact. Terms Implied by Statute 10.73 A statute may imply terms in a particular type of contract. When a statute implies terms in a contract, it is not trying to anticipate and provide for the intentions of the parties. Instead, the implication is on grounds of public policy with Parliament believing that such contracts must contain these implied terms unless explicitly dislodged by the parties. Perhaps, the most well-known instance of terms implied by statute is the sales of goods legislation contained in the UK Sale of Goods Act (“SGA”), applicable in Singapore pursuant to the Application of English Law Act, and the United Nations Convention on Contracts for the International Sale of Goods (“CISG”), which has been made a part of Singapore law (Sale of Goods (United Nations Convention) Act (Cap 283A, 1996 Rev Ed)). The terms implied by sale of goods legislation attempt to provide coherence and a 331 Principles of Singapore Business Law framework to a type of contract that is entered into thousands of times a day. These implied terms allow the seller to price goods by reference to the risk exposure created by the implied terms and allow the buyer and seller to routinely engage in sales without wasting time in hammering out details. The following illustrations of terms implied by SGA show that the content of what is implied is necessary for the smooth functioning of a sale of goods system in a country. For example, s 12(1) SGA implies a condition that the seller has a right to sell the goods. Section 12(2) implies a warranty that the goods are free from charges or encumbrances in favour of third parties. Section 13(1) implies a condition that goods sold by description will correspond with their description and s 15(2) that goods sold by sample will correspond with their sample. Section 14(2) provides that where a seller sells goods in the course of his business, there is an implied condition that the goods supplied under the contract are of a satisfactory quality. 10.74 By incorporating this “shorthand” in sale of goods transactions, the SGA allows the seller and the buyer to focus on the main elements of the transaction and not be distracted by the need to cross the “t”s and dot the “i”s. This in turn, reduces transaction costs and frees up time for the parties to engage in more productive economic transactions. Thus, a grocery store manager may work on managing the store without having to meet customers and assure them on these matters while they stand in line at the checkout queue. Terms Implied by Custom 10.75 Contracts are rarely divorced from their surroundings and context. A particular trade practice, the features of the market and even the customs of the locality may be relevant to the operation of the contract. Accordingly, where a party engages in contracting within a particular trade, for example, the coffee trade, that party will be bound by the usage in that trade if the usage is well-known, certain, reasonable and legal (see Nelson v Dahl (1879)). In Hutton v Warren (1836), the dispute centred on a tenant farmer’s claim to a fair share for seeds and allowance. The plaintiff farmer gave the landlord notice of his intention to quit farming the land. However, the lease required the farmer to continue to plant during the notice period. He would no longer be in a contractual relationship when harvest time came around. The issue was whether the farmer was entitled to a fair allowance even though 332 Chapter 10: Terms of the Contract the crop had not been harvested. The court reasoned (at p 475) that this was a type of contract where “the parties did not express in writing the whole of the contract by which they intended to be bound but to contract with reference to known usages”. If it can be shown that those doing business in a particular community had a generally accepted custom and that anyone inquiring would have been told about that custom, then this custom would bind the parties even if both of them were ignorant of its existence (see Chan Cheng Kum v Wah Tat Bank Ltd (1971)). 10.76 To be implied in a contract, a custom must be a usage that is sufficiently uniform and accepted by the relevant community as controlling in the absence of express agreements. Pointing to the impact of rapid globalisation and industrialisation in Singapore, it has been argued that the emergence of significant local custom that could be implied in Singapore contracts is remote (see A Phang, International Encyclopaedia of Laws — Contracts (Singapore) (2000) at para 358). For a diagrammatical illustration of express and implied terms and their characteristics, see Figure 10.1. Content of contract: Terms EXPRESS Oral IMPLIED Written Fact Court Statute Law Terms implied in fact by Court v Ofcious bystander test the practical method to implement the business efcacy test v Terms implied depends on facts of case does not set a precedent same term will not necessarily be implied in all other contracts of the same type v Term will not be implied if it is contrary to expressed intention of contracting parties Usage/Custom Eg, Sale of Goods Act implied terms Terms implied in law by Court v Terms implied to promote certainty and give effect to important social policies v Terms implied set a precedent same term will also be implied in all other contracts of the same type v Default terms that is, terms that apply unless expressly overridden by contracting parties Figure 10.1 Express and implied terms 333 Principles of Singapore Business Law CONCLUSION 10.77 Communications technologies have made telex and facsimile communication obsolete and have replaced these with email, short message services (“sms”) and voicemail. In a commercial context, the result is an abundance of material, scattered in various formats and places, that provides evidence of negotiations and agreement. Sifting through this material to ascertain what part is puff, what part are terms and what part are representations can be a challenging task for a lawyer. A “writing” could now be an email and it may be necessary to determine whether the contract has been reduced to writing so as to trigger the parol evidence rule. In a teleconference negotiation, a visual and audio record of what was said would be available. In determining whether a particular statement was a term or a representation, a judge may have to consider not only the traditional rules found in the cases but visual cues and other pointers generated by advances in communications technology. As technology advances, the law relating to contractual terms would have to respond not only in a pragmatic way but also in a way that is theoretically coherent. 334 Chapter 11 Exemption Clauses 11.1–11.5 Introduction 11.6 11.7–11.12 11.13 11.14 11.15–11.16 11.17–11.19 11.20–11.22 11.23–11.24 Incorporation Incorporation by Signature Incorporation by Notice (1) Type of document (2) Time of notice (3) Adequacy of notice (4) Effect of the clause Incorporation by Previous Course of Dealing 11.25–11.26 11.27–11.29 11.30–11.35 11.36–11.40 Construction Contra Proferentem Rule Rule in Cases of Negligence Liability Doctrine of Fundamental Breach 11.41–11.43 Statutory Limitations on the Use of Exemption Clauses: Unfair Contract Terms Act Contracts to Which UCTA Does Not Apply Applicability of UCTA to “Business Liability” Applicability of UCTA to Negligence Liability Applicability of UCTA to Breach of Contract UCTA and Sale or Supply of Goods UCTA and Consumer Contracts Test of Reasonableness 11.44–11.45 11.46 11.47–11.49 11.50–11.51 11.52–11.53 11.54–11.55 11.56–11.65 11.66–11.70 Exception Clauses and Consumer Protection Legislation in Singapore 11.71–11.72 Conclusion Principles of Singapore Business Law INTRODUCTION 11.1 Exemption clauses, which are sometimes also known as exclusion clauses or exception clauses, form part of the terms of the contract that we dealt with in the previous chapter. They are terms that seek to exclude or limit the liability of one of the parties in the event of a breach of contract. Such terms are common in everyday commercial contracts, especially the standard form contracts. They seek to exclude or limit liability arising from the contract or common law liability that might arise independently of the contract, for example, tort liability for loss or damage by negligence. From a functional point of view, exemption clauses can be divided into three types: (1) exemption (or exclusion) clauses that seek to exclude the liability completely; (2) limitation of liability clauses that seek to limit the liability (eg, to a certain money amount); and (3) indemnity clauses that seek to pass liability (or the risk thereof) to a third party. The reference to “exemption clauses” in this chapter includes all three types. It may be noted here that though the first two types of exemption clauses are essentially similar, the courts are likely to interpret the clauses excluding liability more strictly than the clauses limiting the liability (see para 11.29). 11.2 A review of the law relating to exemption clauses must take into account two developments: first, the idea of freedom of contract where the parties to the contract have unrestrained rights to enter into contracts of their choosing and second, the subsequent intervention by the courts and the legislature to control its excesses. 11.3 Under the concept of freedom of contract, the parties must be free to negotiate their mutual rights and obligations under the contract without the interference from the courts or the legislature. This would enable the parties to allocate the risks and divide the responsibilities, and where they deal on the basis of a standard form contract, it will help them to reduce the costs of negotiation by mass producing the contracts. Theoretically the parties are at liberty to make their own bargains when they negotiate on an equal footing. However, often this may not be so, especially in the case of standard form contracts. A supplier of goods and services may want to exclude his potential liability by the use of his own pre-printed standard form of contract, and he 336 Chapter 11: Exemption Clauses may assert that he will contract on his own terms and no other. This “take it or leave it” situation affords no choice for the customer. Either he must go without the goods or services, or take them subject to the exemption clause. It is apparent that such contracts are not freely negotiated. 11.4 While it may be acceptable for parties with equal bargaining power to impose exemption clauses, the courts and Legislatures have been reluctant to allow them when imposed by a stronger party on a weaker party. The courts have disapproved such clauses and have been sympathetic towards the weaker party by interpreting the exemption clauses narrowly and by providing for certain requirements for their validity. The Legislature has intervened by introducing the UK Unfair Contract Terms Act 1977, made applicable in Singapore by the Application of English Law Act (Cap 7A, 1994 Rev Ed) and reprinted locally as Cap 396, 1994 Rev Ed, and provisions in other statutes. 11.5 This chapter will first deal with the courts’ approach to exemption clauses. For an exemption clause to be valid, it must satisfy the requirements laid down by the courts concerning incorporation and construction. The chapter will then consider the statutory limitations on the use of exemption clauses under the Unfair Contract Terms Act (“UCTA”). For an exemption clause to be valid it must satisfy the following requirements: ° it must be properly incorporated into the contract; ° it must be properly construed; and ° its operation must not be excluded or restricted by statute, namely, UCTA. INCORPORATION 11.6 The courts will require the person relying on an exemption clause to show that the other party agreed to its incorporation into the contract at the time of or prior to the contract: otherwise, it will not be part of the contract. An exemption clause is incorporated into the contract in three ways: (1) by signature; (2) by notice; and (3) by a previous course of dealing. 337 Principles of Singapore Business Law Incorporation by Signature 11.7 Where a contract is made in writing, the general rule is that the person signing the contract is bound by everything contained in the document, whether he has read it or not. Thus a person signing a pre-printed standard form contract cannot later complain that he did not read it before signing. In L’Estrange v F Graucob Ltd (1934), the plaintiff signed a hire-purchase agreement for a cigarette vending machine. The contract contained, “in regrettably small print”, a clause that provided that “any express or implied condition, statement or warranty … is hereby excluded”. Although the plaintiff had not read the document, it was held that the clause bound her, and she had no remedy when the machine proved defective. Scrutton LJ said (at p 403), “When a document containing contractual terms is signed, then in the absence of fraud … or … misrepresentation, the party signing it is bound, and it is wholly immaterial whether he has read the document or not.” In Press Automation Technology Pte Ltd v Trans-Link Exhibition Forwarding Pte Ltd (2003) the Singapore High Court held (at [39]) that the fact that the incorporating clause was contained in a document that was signed by the plaintiff resulted in the conditions being incorporated as part of the contract between the parties notwithstanding that the plaintiff did not have a copy of them and had not read them. In another case, Tjoa Elis v United Overseas Bank Ltd (2003), the plaintiff disputed that the signatures on instructions to the bank were hers. The Singapore High Court held (at [64]) that even if the signatures on the disputed instructions were not hers, the signatures were appended to those instructions with her authority either before each instruction was sent or thereafter and hence were binding on her. 11.8 There are four exceptions to this general rule: ° where non est factum is relied on; ° where there is misrepresentation; ° where an express warranty that has become part of the contract overrides an exemption clause; and ° where a statement overriding an exemption clause is not part of the main contract but which is enforced by way of a collateral contract. These are discussed below. 338 Chapter 11: Exemption Clauses 11.9 A party may be able to avoid a contract that he has signed if he can bring himself within the doctrine of non est factum (“it was not my deed”). This narrow doctrine is available especially to vulnerable persons (eg, the blind or illiterate) who sign documents under a mistaken belief as to their nature or effect (Saunders v Anglia Building Society (1971)). 11.10 The general rule does not apply where there is any misrepresentation as to the nature of the document signed. In Curtis v Chemical Cleaning and Dyeing Co (1951), the plaintiff took a wedding dress for cleaning, and was asked to sign a document that exempted the cleaners from liability “for any damage howsoever arising”. When she queried the document, the defendant’s employee told her that the clause simply meant that the cleaners would not accept any responsibility for any sequins and beads. She then signed the document. When she collected the dress, it had a stain which was not there before, but the cleaners, relying on the exemption clause, denied liability. The English Court of Appeal held that even though the plaintiff had signed the document, the cleaners could not rely on the exemption clause since their employee had misrepresented to her the effect of the exemption clause. 11.11 As regards the express warranty, the Singapore Court of Appeal considered the issue in Anti-Corrosion Pte Ltd v Berger Paints Singapore Pte Ltd and another appeal (2012). Anti-Corrosion (“A”) was a painting subcontractor for building projects. Berger Paints (“B”), a paint manufacturer, contracted to supply A with paint on four occasions. B initially gave a paint plan according to which it was not necessary to apply a sealer coat to the surface to be painted. In response to the concerns expressed by A, it was alleged that B gave assurances that a sealer coat would not be necessary and gave a five-year warranty on the paint to be used on any project which was based on their paint plans. Three projects were completed successfully but on the fourth occasion, there was serious discolouration of the internal surfaces of the building project that were painted. A eventually sued for its losses and B counterclaimed for the balance sum due on the paint sold to A. The Court found (at [22]) on the evidence that B had verbally assured A that a sealer coat was unnecessary and that a warranty would be provided and noted (at [24] and [25]) that since B’s tax invoices and delivery orders did not comprise the entire contractual relationship between the parties, the parol evidence rule did not prevent B’s verbal assurances (the express warranty) 339 Principles of Singapore Business Law from forming part of the contract. This raised the question as to whether B was still entitled to rely upon the exemption clauses contained in their tax invoices and delivery orders that conflicted with the express warranty to limit their liability to A. The court held that the exemption clauses were not effective in the light of the express warranty. The court said (at [46]) that it was well established that an exemption clause contained in a written contract can be overridden by an express warranty given at or before the time the contract was concluded. 11.12 In the situation discussed above the oral assurances given by one of the parties had become part of the contract thereby overriding the exemption clauses. We now go on to consider situations where such assurances were given at the time of entering into the contract but for some reason they did not form part of the (main) contract. In such cases a court may give effect to them by implying a collateral contract which may override the written contract. It is sometimes possible that an oral undertaking given at the time of signing a written contract may overshadow the written contract and neutralise the exemption clause in the written contract. In such a case, the oral undertaking creates a second or subsidiary contract — the collateral contract (see Chapter 10, para 10.13). A collateral contract may be implied by court and runs parallel to the main contract. A collateral contract does not violate the English parol evidence rule (see the collateral contract exception to the English parole evidence rule in Chapter 10, para 10.13) and may vary the terms of the written main contract and render ineffective an exemption clause contained in it. In Evans (J) & Son (Portsmouth) Ltd v Andrea Merzario Ltd (1976), the plaintiff imported Italian equipment regularly and engaged the defendant as its forwarding agent on standard written contracts. The equipment was always stored below deck during the voyage to avoid corrosion. When the defendant started using containers in 1967, he orally assured the plaintiff that their goods will be stored below deck. Based on this assurance, the plaintiff continued to engage the defendant. But, contrary to the assurance, the written contract in fact specified that the plaintiff ’s equipment may be carried on deck. One shipment was lost when the equipment stored on deck was lost at sea. On being sued, the defendant sought to rely on the exemption clause in the written contract. The English Court of Appeal held that the oral assurance created a collateral contract that neutralised the exemption clause and the printed conditions in the written contract. However, the collateral contract exception to the parol evidence 340 Chapter 11: Exemption Clauses rule laid down in proviso (b) to s 94 of the Singapore Evidence Act (see Chapter 10, para 10.14) does not permit evidence of any oral undertaking in a collateral contract that is inconsistent with the terms of the main written contract to be proved (see the Singapore Court of Appeal decision in Latham v Credit Suisse First Boston (2000)). This exception would thus not apply in the Singapore context. Incorporation by Notice 11.13 Where the contract is not written or where the terms are in an unsigned document, the exemption clause may still be incorporated into the contract. In such a case, the person seeking to rely on it must show that the other party knew, or ought to have known that the document was one which could be expected to contain such terms. He must also show that he has done everything reasonable to give sufficient notice of the exemption clause to the other party. The guiding principle was laid down in Parker v South Eastern Railway (1877). The plaintiff left a bag in the station cloakroom and obtained a ticket in return. On the front of the ticket were printed details such as the opening hours of the office, and also the words “See Back”. On the back was a clause limiting the liability of the company to £10 for the loss of any item left with them. When the plaintiff returned to claim the bag, it had been lost. He claimed the worth of the bag which was £24.10s, but the company maintained that their liability was limited to £10. The Court of Appeal held that a party could be deemed to have had reasonable notice if he knew of the clause, or if reasonable steps were taken to bring the clause to his notice. As to what makes a notice reasonably sufficient is a question of fact. Some of the factors to consider are the type of document, the time of notice, the adequacy of notice, and the effect of the clause. These are discussed below. (1) Type of document 11.14 An exemption clause will not be part of the contract if it is contained in an unsigned document where a reasonable person would not be expected to find contractual terms, for example, tickets, receipts and vouchers. Thus in Chapelton v Barry Urban District Council (1940), Chapelton hired two deck chairs from the defendant at Brighton beach. There was a notice near the stack of chairs which requested customers to obtain tickets from the attendant and retain them for inspection. Chapelton obtained the ticket and 341 Principles of Singapore Business Law put it into his pocket without reading it. When he sat on one of the chairs, it collapsed under him. He sued the Council for damages for his injuries, but it sought to rely on the exemption clause printed on the ticket. The English Court of Appeal held the Council liable. It held that the clause that was printed on a ticket was not a term of contract because the ticket in this case was not a contractual document. No reasonable person would expect to find contractual terms on such a ticket since it would be regarded simply as a receipt for money paid. In most cases, such a ticket would be received after the hirer had sat in the chair. (2) Time of notice 11.15 For the exemption clause to be effective, the notice must be given before or at the time of the contract. A notice given after the contract was made is ineffective. Thus, in Olley v Marlborough Court Ltd (1949), a couple rented a hotel room for one week and paid in advance. Upon entering the bedroom they saw a notice containing an exemption clause that exempted the hotel from liability for loss or theft of articles, unless they had been given to the management for safe custody. Later, their property was stolen. They sued the hotel who then sought to rely on the exemption clause. The English Court of Appeal held that the clause was not incorporated into the contract. The contract was already concluded at the reception desk when the hotel agreed to take the couple as guests, and therefore, the notice given on the bedroom door was too late. 11.16 A similar issue arose in Thornton v Shoe Lane Parking Ltd (1971). Thornton parked his car in the defendant’s automated car park. There was a notice at the entrance which stated: “All cars parked at owners’ risk”. Upon entry, a machine issued a ticket which contained printed words that referred to conditions displayed in another part of the car park. Thornton did not see the conditions, which included an exemption clause denying liability for damage to property and personal injury. Thornton suffered an injury due to an accident while collecting his car. He sued and the defendant sought to rely on the exemption clause. The English Court of Appeal held that the defendant had failed to prove reasonable sufficiency of notice. The contract was formed when Thornton paid his money into the machine which later issued the ticket. For the exemption clause to be incorporated, there must have been reasonable sufficiency of notice prior to or at the time of contract. A notice on the ticket would be too late. Similarly, a 342 Chapter 11: Exemption Clauses notice located at a different section of the car park would be too late. The following statement by Lord Denning MR (at p 689), which is obiter dicta, is very instructive: The customer pays his money and gets a ticket. He cannot refuse it. He cannot get his money back. He may protest to the machine, even swear at it; but it will remain unmoved. He is committed beyond recall. He was committed at the very moment when he put his money into the machine. The contract was concluded at that time. It can be translated into offer and acceptance in this way. The offer is made when the proprietor of the machine holds it out as being ready to receive the money. The acceptance takes place when the customer puts his money into the slot. The terms of the offer are contained in the notice placed on or near the machine stating what is offered for the money. The customer is bound by those terms as long as they are sufficiently brought to his notice beforehand, but not otherwise. He is not bound by the terms printed on the ticket if they differ from the notice, because the ticket comes too late. The contract has already been made. (3) Adequacy of notice 11.17 The person relying on the exemption clause must show that he did take reasonable steps to bring the notice to the attention of the other party. This means, among other things, that the notice must be sufficiently conspicuous and legible. There is no need to show that the injured party had actual notice of it. In Thompson v London, Midland and Scottish Railway Co (1930), the English Court of Appeal held that the test of reasonably sufficient notice had been satisfied. The plaintiff, an illiterate, asked her niece to purchase a railway excursion ticket for her. On the face of the ticket were the words, “For conditions see back”. On the back of the ticket were the words to the effect that the ticket was issued subject to the conditions set out in the defendant company’s time table. Thompson suffered an injury and sued the defendants. The court held that reasonably sufficient notice had been given. In this context the ticket was a common form of contractual document. Since it did refer to the time table, the clause was held to be an integral part of the contract. The fact that Thompson could not read was not material, since “illiteracy is a misfortune, not a privilege”. However, the decision does seem wrong because it is arguable whether the steps taken by the defendant to bring the exemption clause to the notice of the plaintiff were adequate. 343 Principles of Singapore Business Law 11.18 A different outcome may result where the party relying on the exemption clause knows from the very beginning that the injured party is under some disability. In Geier v Kujawa, Weston & Warne Bros (Transport) Ltd (1970), Geier, who could not understand English, was a passenger in a taxi where there was a notice in English containing an exemption clause. The driver realised that Geier did not understand English though he pointed to the exemption clause. In an action by Geier, the defendant sought to rely on the exemption clause. The court held that there was no reasonable sufficiency of notice, since the driver knew of Geier’s disability but did not take reasonable steps to translate the notice. This suggests that in Singapore, with its multi-racial and multi-lingual population, extra steps may be needed to bring the clause to the notice of persons known not to understand the language of the clause. 11.19 Adequacy of notice was again the issue in a Singapore case, Jet Holding Ltd and others v Cooper Cameron (Singapore) Pte Ltd and another (2005). The plaintiff, the owner of the oil exploration drill ship, Energy Searcher, sued the defendant for breach of contract when the ship’s slip joint manufactured by the defendant broke into two. The defendant tried to rely on standard form exemption clauses that it claimed had been incorporated into the contract by way of a separate provision in a sales quotation. The exemption clauses were not printed on the reverse of the quotation but were merely referred to in the notes to the quotation. The Singapore High Court noted (at [112]) that there was difficulty in establishing what exactly were the terms and conditions of sale that formed part of the sales quotation. Accordingly the court held (at [114]) that no adequate notice was given as the standard form clauses involved should have been brought fairly and reasonably to the plaintiff ’s attention “by pointing them out, more so when the terms and conditions were not printed on the reverse of the quotation.” Consequently, the exemption clauses were not incorporated into the contract. (4) Effect of the clause 11.20 This issue is related to the issue of adequacy of notice discussed above. The case law indicates that the more onerous or unusual the clause, the greater the degree of notice required to incorporate it. Such clauses cannot be incorporated simply by handing over or displaying a document containing the clause; the party seeking to rely on it must take special steps to draw attention to it. This principle formed part of the reasoning in Thornton v Shoe 344 Chapter 11: Exemption Clauses Lane Parking Ltd (1971) (see para 11.16). Although it was fairly common for car park conditions to exclude liability for damage to cars, exclusion of liability for personal injury was not a term that motorists would usually expect in such a transaction. Thus, though steps taken by the proprietor might have been sufficient to exclude or limit liability for property damage, they could not be deemed to have given sufficient notice of the more unusual term concerning personal injury. 11.21 This issue was highlighted again in Interfoto Picture Library v Stiletto Visual Programmes Ltd (1989). The defendants were an advertising agency who had hired photographic transparencies from the plaintiffs. Stiletto had not dealt with Interfoto before but, on request, the latter delivered 47 photographs, along with a delivery note. This stated that the pictures should be returned within 14 days, and included a list of conditions. One of the conditions was that if the pictures were kept longer than 14 days, they would be charged a holding fee of £5 per picture per day until they were returned. Stiletto, apparently without reading the conditions, decided that the pictures were not suitable for their purpose, and put them aside. When they returned the pictures almost a month later, Interfoto submitted an invoice for £3,783.50 towards the holding fee. The English Court of Appeal held that Stiletto was not contractually bound to pay the charge. The daily charge was much higher than what would usually be charged. The term was merely printed on the plaintiff ’s standard terms, whereas due to its particularly onerous nature, it called for a greater degree of notice. The court quoted, with approval, Lord Denning’s statement in Spurling v Bradshaw (1956) (at p 466) to the effect that: Some clauses are so onerous they would need to be printed in red ink on the face of the document with a red hand pointing to it before notice could be held to be sufficient … onerous or oppressive clauses must be drawn clearly to the other party’ notice, otherwise they will not be incorporated. In the instant case, the court allowed Interfoto to recover £3.50 per week for each transparency returned late, as being a reasonable sum due on a quantum meruit. 11.22 The Interfoto case was applied by the English Court of Appeal in O’Brien v MGN Ltd (2001). Here the plaintiff had won a substantial amount in prize money in a scratchcard game promoted by a newspaper. Due to an error 345 Principles of Singapore Business Law on the part of someone in the newspaper a large number of people were informed that they had won. On the cards was printed “Full rules and how to claim see Daily Mirror”. Rule 5 provided: “Should more prizes be claimed than are available in any prize category for any reason, a simple draw will take place for the prize”. Consequently a special draw was held and an additional prize of the same amount was shared by other winners. The claimant got a small amount of the latter and brought an action to recover the full prize. The issue was whether the contract between the parties incorporated the newspaper’s rules of the game. The Court of Appeal held that they were. The test was whether the newspaper could be said fairly and reasonably to have brought the rules to the notice of the claimant and whether those rules were particularly onerous or outlandish. The court held that they were not. In the particular context of the game, the court was satisfied that the newspaper had done just enough to bring the rules to the claimant’s attention. Incorporation by Previous Course of Dealing 11.23 Where the parties have previously made a series of contracts, and those contracts contained an exemption clause, that clause may have been incorporated in a subsequent contract even though neither party made a reference to it at the time. In Spurling v Bradshaw (1956), the parties had been doing business together for many years. The defendant delivered eight barrels of orange juice to the plaintiffs, who were warehousemen, for storage. He received a document from them, acknowledging the receipt of the barrels. Words on the front of the document referred to clauses printed on the back. One of them exempted the plaintiffs “from any loss or damage occasioned by the negligence, wrongful act or default” of themselves or their employees. When the defendant went to collect the barrels, they were empty. He consequently refused to pay the storage charges and the plaintiffs sued for recovery. He counter-claimed for negligence and the plaintiffs sought to rely on the exemption clause. The defendant argued that the clause was not applicable because it was only sent to him after the contract had been concluded. However, he admitted that he had received similar documents earlier but he had never bothered to read them. The court held that the clause was incorporated into the contract by previous course of dealing. 346 Chapter 11: Exemption Clauses 11.24 In order for a term to be incorporated on the basis of a course of dealing between the parties, the course of dealing must be well established. In Hollier v Rambler Motors (AMC) Ltd (1972), the plaintiff had taken his car for repair at the defendants’ garage three or four times in the previous five years. Each time a form containing an exemption clause had been signed. The clause contained the words: “The company is not responsible for damage caused by fire to customers’ cars on the premises.” The plaintiff made an oral contract to have the car repaired. The car was destroyed by fire, owing to the defendant’s negligence. Although no form had been signed on this occasion, the defendants argued that this clause was incorporated into the contract by previous course of dealing. The English Court of Appeal held that the previous course of dealing in this case was not sufficient to justify the inclusion of the exception clause. CONSTRUCTION 11.25 The incorporation of an exemption clause into a contract does not automatically exempt the relying party from liability. Once it is established that the clause is part of the contract, the next step is to construe or interpret it to determine whether it actually covers the breach that has occurred. The construction is important because it determines the effectiveness of the clause. The scope of protection available to the relying party depends on how broadly the clause is interpreted. 11.26 In trying to limit the scope and applicability of exemption clauses, the English courts have used different approaches in the construction of contractual terms. These include the following: ° the contra proferentem rule; ° the rule in cases of negligence liability; and ° the doctrine of fundamental breach. Contra Proferentem Rule 11.27 Contra proferens means, against the maker. Traditionally, the courts have construed exemption clauses contra proferentem if there is ambiguity or doubt, that is, in the manner least favourable to the person who inserted 347 Principles of Singapore Business Law them into the contract. If there is any doubt as to the meaning and scope of the exemption clause, the ambiguity will be resolved against the party who had inserted the exception clause into the contract and who is now relying on it. In Houghton v Trafalgar Insurance Co (1954), an insurance policy excluded claims in cases where the car was carrying “any load in excess of that for which the car was constructed”. The car was a five-seater, but was carrying six people at the time of the accident. The English Court of Appeal held that the word “load” should be given a narrow interpretation, referring to goods and not people. The word could refer to weight as well as the number of passengers and hence was ambiguous. Consequently, the clause did not exclude the insurer’s liability. 11.28 Similarly in Middleton v Wiggin (1996) a narrow interpretation was given to an exemption clause in an insurance policy. The rotting waste on the claimant’s landfill produced gases which caused an explosion and destroyed a nearby house. The claimant had to pay damages to the home owner and claimed this expense from the insurers. The insurance company refused to pay, relying on the exemption clause which excluded liability for loss arising from the disposal of waste material. The English Court of Appeal rejected this argument as the accident had not occurred from the disposal of waste, but from the unforeseen escape of gas resulting from the process of decomposition. The Singapore Court of Appeal applied the contra proferentem rule in Tay Eng Chuan v Ace Insurance Ltd (2008). 11.29 Since the passing of the UCTA, the courts have been somewhat more restrained in applying the rules of construction, such as the contra proferentem rule, to regulate the use of exemption clauses. Though technically the contra proferentem rule applies to all exemption clauses, the courts have tended to apply it less rigorously to those that merely limit liability rather than exclude it completely. Thus, in Ailsa Craig Fishing Co Ltd v Malvern Fishing Co Ltd and Securicor (Scotland) Ltd (1983), Securicor had contracted to provide security services for certain ships moored in Aberdeen harbour. As a result of their default, two ships sank. A clause in the contract limited Securicor’s liability to £1,000. The shipowners claimed that the clause was ambiguous and should therefore be interpreted in their favour. The House of Lords upheld Securicor’s reliance on the clause, stating that limitation clauses need not be construed as strictly as exclusion clauses. Limitation clauses are more likely to express the genuine intentions of the parties, and 348 Chapter 11: Exemption Clauses to be considered as part of the bargain than exclusion clauses. The Singapore High Court followed Ailsa Craig in “The Neptune Agate” (1994) (at [57] and [59], Rapiscan Asia Pte Ltd v Global Container Freight Pte Ltd (2002) (at [63]); and PT Soonlee Metalindo Perkasa v Synergy Shipping Pte Ltd (2007) (at [76] and [79]. Rule in Cases of Negligence Liability 11.30 In cases of negligence, the party relying on the exemption clause to escape liability must show that clear words in the clause fully cover the facts that have occurred. Where the clause does not clearly cover negligence, the courts have held that the exemption clause is inapplicable. In White v John Warrick & Co Ltd (1953), White hired a bicycle from the defendants. While he was riding it, the saddle tilted forward and he was injured. The contract of hire stated that “nothing in this agreement shall render the owners liable for any personal injury”. If the term had not been inserted the defendants might have been liable on two grounds, namely, for negligence in tort and in contract. The English Court of Appeal held that the term was ambiguous and applied the contra proferentem rule. It held that the clause only excluded liability for breach of contract, and therefore the defendants were not protected if they were found to be negligent in tort. Likewise, in Hollier v Rambler Motors (AMC) Ltd (1972) (see para 11.24), where the plaintiff ’s car was damaged by fire caused by the defendants’ negligence, the defendants argued that this fell within the scope of the exemption clause. The English Court of Appeal disagreed. It held that the clause was not sufficiently clear and unambiguous to cover negligence since it was possible to interpret the clause as attempting to exclude liability for fire damage caused, both by and in the absence of negligence. 11.31 It is perhaps arguable that there is no longer a need for the courts to apply such strict interpretation, given that UCTA now deals specifically with attempts to exclude or limit liability for negligence. Further, it is possible to make the language of the clause clear and unambiguous by use of appropriate words. 11.32 While it is possible for a contracting party to exclude liability for his own negligence by use of clear words, the courts are also aware that it is inherently unlikely that one party will readily agree to allow the other to 349 Principles of Singapore Business Law exclude liability for his own negligence. In view of such situations, the courts have evolved certain rules of construction. In Canada Steamship Lines Ltd v R (1952), the court set out the following guidelines: (1) If a clause contains language which expressly exempts the party relying on the exemption clause from the consequences of his own negligence then effect must be given to the clause; (2) If the first rule is not satisfied, then the court will proceed to apply the second and third rule. Under the second rule, the court must consider whether the words are wide enough, in their ordinary meaning, to cover negligence on the part of the party relying on the exemption clause. If there is any doubt as to whether the words are wide enough to cover negligence, the doubt must be resolved against the party relying on the clause; and (3) If the second rule is satisfied, the court must apply the third rule and consider whether the exemption clause may yet cover some kind of liability other than negligence. If there is such a liability, the clause will then apply to such liability and will not extend to negligence. These statements of the Privy Council have since been applied as guidelines for construction, rather than as strict rules of law in cases of negligence liability. 11.33 In National Westminster Bank plc v Utrecht-America Finance Co (2001), a term excluding negligent and even fraudulent non-disclosure was upheld. Here there was no scope for applying Canada Steamship rules because the contract was between large banks dealing at arm’s length and advised by commercial lawyers. The term was not unfair as it operated both ways. 11.34 The House of Lords in HIH Casualty and General Insurance v Chase Manhattan Bank (2003) affirmed the general authority of these rules and said that the court’s primary task was to give effect to the intention of the parties. 11.35 The Singapore Court of Appeal considered these rules in Marina Centre Holdings Pte Ltd v Pars Carpet Gallery Pte Ltd (1997). In this case Pars Carpet Gallery (“the lessee”) leased certain premises from Marina Centre Holdings (“the lessor”) under a lease agreement. During the term of the lease, water seeped through the ceiling above the premises and damaged the lessee’s 350 Chapter 11: Exemption Clauses goods. The claim for damage was met by the insurers who sued the lessor in the lessee’s name in exercise of their right of subrogation. The lessee claimed that the lessor was in breach of the covenants, and that it was negligent at common law. The lessor denied the breach and negligence and argued that it was in any event absolved from any liability by the exemption clauses contained in the lease. In particular the lessor relied on cl 36.1(b), which stipulated that the lessor and its officers, servants, employees and agents should not be liable or in any way responsible for any injury or damage to persons or property or any consequential loss resulting from an entire list of events “unless caused by the willful misconduct of [the lessor] or [its] officers, servants, employees or agents”. The trial judge dismissed the lessee’s claim on the ground that cl 36.1(b) exempted the lessor from all heads of liability. On the lessee’s appeal to the High Court, it was held that the clause did not absolve the lessor from liability for negligence. The lessor then appealed to the Court of Appeal. Like the courts below, the Court of Appeal applied (at [7]) the guidelines laid down by the Privy Council in Canada Steamship. The court held (at [13]) that the cl 36.1(b) did not satisfy the first test as it did not expressly exempt the lessor from liability in negligence, nor did it contain the word “negligence” or any synonym for it. As to the second test the court held (at [21]) that the qualifying words at the end of cl 36.1(b), namely, “unless caused by wilful misconduct of the Landlord or its officers” clearly implied that negligence liability is excluded. Under the third test the question was whether there are other heads of damage founded on liability other than that for negligence which are covered by cl 36.1(b). In this case, it was suggested (at [38]) that apart from negligence there could be liability (a) for breach of the covenants for quiet enjoyment and for repair, (b) for nuisance, and (c) under the rule in Rylands and Fletcher. The court held (at [47]) that cl 36.1(b) on a true construction was not apt to cover any of these heads of damage or loss. Thus Lord Morton’s second and third tests were satisfied and the clause was effective to exclude liability in negligence. The lessor was entitled to rely on the clause to absolve itself from such liability to the lessee. Doctrine of Fundamental Breach 11.36 Can an exemption clause defeat the main purpose for which the contract was entered into? Can it go against the core or fundamental term of the contract to render it totally different from what the contract contemplated? There was 351 Principles of Singapore Business Law a general presumption that the parties do not intend an exemption clause to defeat the main purpose of the contract. Hence it was thought that such a clause would be ineffective where there was a breach of a fundamental term. 11.37 In such cases, the courts earlier had a choice between two possible rules: to treat it as a rule of law or to treat it as a rule of construction (interpretation). If it is the former, as a matter of law, a fundamental breach cannot be excluded or limited by an exemption clause even if the wording of the clause clearly covered the breach that had occurred. Thus the earlier court decisions generally took it to be a rule of law whereby in the event of a fundamental breach, the exemption clause was automatically rendered ineffective. On the other hand, if it is a rule of construction, whether or not a fundamental breach could be so excluded or limited depended upon the proper interpretation of the exception clause. Thus, while no exclusion or limitation of loss flowing from the fundamental breach was allowed under the first rule, it was possible to do so under the second rule. 11.38 The House of Lords in Suisse Atlantique Societe d’Armement Maritime SA v NV Rotterdamsche Kolen Centrale (1967) rejected the doctrine of fundamental breach and stated obiter that there was no rule of substantive law that an exclusion clause could never excuse liability for such a breach. They unanimously favoured the second rule, that is, that it was a matter of construction. Whether the clause covered the breach in question would always be a question of fact involving the interpretation of the contract. However, as mentioned, the House of Lords’ endorsement was made obiter and there was a lack of unanimity amongst five judges. 11.39 This approach was later confirmed by the House of Lords in Photo Productions Ltd v Securicor Transport Ltd (1980) when they held the doctrine to be a rule of construction. If the parties are of equal bargaining power, the clause will be examined in the context of the contract as a whole. If the exemption clause is clear and comprehensive, the courts will uphold it even in cases of fundamental breach. In Photo Productions, Securicor contracted to guard the plaintiff ’s factory. A clause in their contract provided that “under no circumstances shall the company [Securicor] be responsible for any injurious act or default by any employee of the company”. One night, a guard lit a small fire inside the factory that accidentally got out of control and destroyed 352 Chapter 11: Exemption Clauses the factory. The Court of Appeal held that the exemption clause was invalid because the breach by Securicor was a fundamental breach. However, on appeal, the House of Lords unanimously construed the exemption clause to be valid and protecting Securicor from the fundamental breach. The House of Lords reaffirmed that there was no rule of law that fundamental breach could not be covered by an exemption clause. In commercial contracts, the parties were likely to be of roughly equal bargaining power and able to cover their own risks by insurance. Therefore, there was no need for a doctrine of fundamental breach. The decision in Photo Productions was affirmed by the Singapore Court of Appeal in Sun Technosystems Pte Ltd v Federal Express Services (M) Sdn Bhd (2007) (at [20]). 11.40 However, this does not cover deliberate repudiatory conduct by one party. Thus in Internet Broadcasting Corp Ltd v MAR LLC (2009) it was held that the defendant’s deliberate abandonment of the contract was not covered by the exemption clause because no reasonable person could have intended it to cover such an act. As for consumer contracts, the UCTA now regulates the use of exemption clauses in such contracts. STATUTORY LIMITATIONS ON THE USE OF EXEMPTION CLAUSES: UNFAIR CONTRACT TERMS ACT 11.41 With the proliferation of exemption clauses, it was only a matter of time before some parties sought to abuse them by inserting unfair terms in contracts. The most effective way to remedy this situation was by legislation. The legislature in the UK intervened by passing the Unfair Contract Terms Act 1977. As mentioned, this Act is now part of the law of Singapore by virtue of the Application of English Law Act, 1993 (Cap 7A, 1994 Rev Ed) and is published locally as Cap 396, 1994 Rev Ed, although some sections have been excluded from the Singapore law. Contracts that are governed by Singapore law that contain exemption clauses, therefore, may be subject to the limitations imposed by the UCTA. 11.42 The UCTA will apply to contracts and to exemption clauses that fall within its scope. In this context, it should be noted that the title UCTA is somewhat misleading in two aspects. First, UCTA applies to exemption clauses not 353 Principles of Singapore Business Law only in contract but also in non-contractual situations like tort (as in s 2). Second, despite its title, UCTA does not aim to provide a general standard of fair and unfair contract terms. It does not deal with all the unfair terms in a contract, only unfair exemption clauses. Most of the provisions of UCTA apply to “business liability” (defined in s 1(3)) or to “consumer” transactions (defined in s 12). 11.43 The primary focus of UCTA is to protect the parties, especially the consumers. Additionally, UCTA will apply even in non-consumer or non-business situations where exemption clauses are invoked in cases of misrepresentation. In pursuing this objective, the UCTA does not purport to change the common law relating to exemption clauses. It is therefore necessary to consider the applicability of the exemption clause under common law (as discussed above), and if found applicable to the case, to then examine the effect of UCTA on that clause. Where an exemption clause falls within the scope of UCTA, one out of two possible outcomes will ensue. Either the clause is rendered totally inoperative, or it is subject to the test of reasonableness. In the latter case, it will be inoperative if it fails the test of reasonableness. Contracts to Which UCTA Does Not Apply 11.44 The First Schedule to the UCTA lists contracts to which ss 2–4 (which are primary sections applicable to exemption clauses that attempt to exclude or restrict liability) will not apply. Under para 1 First Schedule, these include contracts of insurance. Sections 2–4 are also inapplicable insofar as certain contracts deal with the following stated matters, viz, contracts relating to the creation, transfer or termination of rights or interests in land or intellectual property; contracts relating to the formation or dissolution of a company, or to its constitution or the rights and obligations of the corporation or its members; and contracts relating to the creation or transfer of securities or any rights or interests therein. Paragraph 2 First Schedule provides that where marine salvage or towage contracts, ship or hovercraft charterparties, or contracts for the carriage of goods by ship or hovercraft are concerned, ss 2(2)–4 and 7 will not apply to these contracts except in favour of a person “dealing as a consumer”. Further, in relation to contracts involving the carriage of goods by ship or hovercraft, where the means of carriage are concerned, para 3 of the First Schedule excludes the applicability of ss 2(2)–4 as well, 354 Chapter 11: Exemption Clauses again except in favour of a person “dealing as a consumer”. Paragraph 4 First Schedule provides that s 2 will not apply to clauses excluding or restricting negligence liability in contracts of employment, except in favour of the employee. 11.45 Lastly, s 26 UCTA excludes from its purview certain international supply contracts. In Trident Turboprop (Dublin) Ltd v First Flight Couriers Ltd (2009) where certain aircraft leases excluded Trident Turboprop’s liability for misrepresentation, the English Court of Appeal held that the clauses fell within the scope of s 3 Misrepresentation Act 1967 which, as substituted by s 8 Unfair Contract Terms Act 1977, ordinarily imposed a requirement of reasonableness on terms excluding liability for misrepresentation. However, the court held that the lease agreements were international supply contracts for the purposes of s 26 of the 1977 Act and therefore the normal requirement as to reasonableness did not apply. Applicability of UCTA to “Business Liability” 11.46 The UCTA provides that ss 2–7 apply in the case of both contract and tort only in cases where the exemption clause concerns a “business liability” (s 1(3)). Such liability is explained in the sub-section as “liability for breach of obligations or duties arising from things done or to be done by a person in the course of a business (whether his own or another’s)”. “Business” includes a profession and the activities of any Government department or local or public authority (s 14). It is thus clear that ss 2–7 cannot be relied upon by a party to exclude or limit liability under an exemption clause where such liability arises other than in the course of business. Applicability of UCTA to Negligence Liability 11.47 “Negligence” is defined in s 1(1) UCTA as either the breach of “any obligation, arising from the express or implied terms of a contract, to take reasonable care or exercise reasonable skill in the performance” of that contract or the breach of “any common law duty to take reasonable care or exercise reasonable skill (but not any stricter duty)”. It is apparent from this definition that the UCTA, despites its name, also applies to cases of negligence that arise other than in the context of contract. Section 2 confirms this view. 355 Principles of Singapore Business Law 11.48 Section 2(1) UCTA states that a person cannot exclude or restrict his liability for death or personal injury resulting from negligence “by reference to a contract term or to a notice given to persons generally or to particular persons”. The inclusion of the word “notice” implies that this provision of UCTA would operate also in non-contractual cases of negligence. Section 14 reinforces this view, as it provides, inter alia, that the word “notice” “includes an announcement, whether or not in writing, and any other communication or pretended communication”. 11.49 Section 2(2) UCTA deals with damage other than death or personal injury, for example, property damage. The sub-section provides that in cases of such loss or damage, a person cannot exclude or restrict his liability for negligence except “in so far as the term or notice satisfies the requirement of reasonableness”. The requirement of reasonableness is dealt with in s 11 UCTA (see paras 11.56–11.65). Applicability of UCTA to Breach of Contract 11.50 Section 3 UCTA applies in cases of breach of contract that includes claim of a contractual performance that is “substantially different” or of nonperformance. The section applies only where the contracting party against whom the exception clause is being relied upon either “deals as consumer or on the other’s written standard terms of business”. The issue as to when a party “deals as consumer” is discussed further at para 11.54. 11.51 Section 3(2) deals with the effect of an exemption clause in a consumer contract or a standard form contract. In such contracts, the party relying on the exemption clause, when he himself is in breach of a contract, cannot exclude or restrict liability in respect of this breach or claim to be entitled “to render a contractual performance substantially different from that which was reasonably expected of him; or … in respect of the whole or any part of his contractual obligation, to render no performance at all”. Thus, the section covers the whole range of breach of contract situations. In such instances, the party relying on the exemption clause in the contract will only be permitted to do so “in so far as … the contract term satisfies the requirement of reasonableness”. To illustrate how ss 2 and 3 operate, see Figure 11.1. 356 Chapter 11: Exemption Clauses Step 1 Does contract fall within scope of UCTA? (see First Schedule) No Yes Step 2 UCTA has no effect on EC Only common law restrictions apply. Does EC fall within scope of UCTA? Yes Does EC exempt or limit business liability? (see s 1(3)) No Yes UCTA has no effect on EC Only common law restrictions apply. UCTA applies Step 3 Which relevant section(s) regulate(s) EC? This diagram only shows regulation of EC under ss 2 and 3. Other regulating sections (eg, ss 47) not shown. EC excludes or restricts liability due to negligence (see s 2) Negligence results in death or personal injury EC is not allowed (see s 2(1)) EC excludes or restricts liability between contracting parties where (see s 3(1)): one of them deals as a consumer (see s 12); OR one of them deals on the others written standard terms of business And/Or Negligence results in other damages EC allowed if it satisfies test of reasonableness under s 11 (see s 2(2)) Where EC is used by a contracting party against a consumer and/or party dealing on the first contracting partys written standard terms of business to: exclude or restrict liability in respect of breach of contract; OR claim to be entitled: (i) to render a substantially different contractual performance from that reasonably expected of him; OR (ii) to render no performance at all for the whole or part of his contractual obligations EC allowed if it satisfies test of reasonableness under s 11 (see s 3(2)) Figure 11.1 Regulation of exemption clauses (“EC”) under ss 2 and 3 UCTA: An illustrative framework 357 Principles of Singapore Business Law UCTA and Sale or Supply of Goods 11.52 Section 6 deals with the contracts of sale and hire-purchase. Section 6(1) provides that a seller’s implied undertaking as to title (under s 12 Sale of Goods Act (Cap 393, 1999 Rev Ed) (“SGA”) and under s 6(1) Hire-Purchase Act (Cap 125, 1999 Rev Ed) (“HPA”)) cannot be excluded or restricted by reference to any contract term. In the case of consumer contracts (where the buyer is “dealing as a consumer”), s 6(2) prohibits the exclusion or restriction of liability by the seller relating to his implied undertakings as to conformity of goods with their description or sample or their quality or fitness for a particular purpose (under ss 13, 14 or 15 SGA and ss 6(2) and (3) HPA). However, such liability can be excluded or restricted in nonconsumer contracts subject to the test of reasonableness (s 6(3)). 11.53 Where a contract is not governed by the law of sale of goods or hire-purchase as regards the passing of ownership or possession of goods as discussed in para 11.52, s 7 UCTA states that the same principles apply to such contracts (ss 7(2) and 7(3)). The section further provides that liability for breach of obligations arising under s 2 Supply of Goods Act (Cap 394, 1999 Rev Ed) cannot be excluded or restricted (s 7(3A)). However, s 7(4) provides that the right to transfer the liability in respect of the ownership of goods or give possession or assurance of quiet possession can be excluded or restricted subject to the test of reasonableness. UCTA and Consumer Contracts 11.54 As noted above, the UCTA makes a distinction between two types of contracts, viz, consumer contracts and non-consumer contracts. A consumer contract is one where one party to the contract “deals as consumer”. Under s 12(1) a party deals as a consumer where: (a) he “neither makes the contract in the course of business nor holds himself out as doing so”; (b) the other party makes the contract in the course of a business; and (c) in the case of contract for sale of goods or hire-purchase, the goods in question “are of a type ordinarily supplied for private use or consumption”. However, a buyer in a sale by auction or competitive tender is not regarded as dealing as consumer (s 12(2)). The burden of proof is upon the party who claims that the other party does not deal as consumer (s 12(3)). 358 Chapter 11: Exemption Clauses 11.55 Merely because a party is a business does not necessarily prevent it from “dealing as a consumer”. In R & B Customs Brokers Co Ltd v United Dominions Trust Ltd (1988), the plaintiffs were a shipping company owned and controlled by a Mr and Mrs Bell. The company bought a second-hand car from the defendants for business and personal use. They had made two or three similar purchases in the past. The UCTA provision on which they sought to rely would only apply if they were dealing as consumers. Despite the fact that the purchase was made by the company and the car would be used partly for business, the English Court of Appeal held that the Bells were dealing as consumers. Dillon LJ made the following helpful observations as to what would not constitute “dealing as consumer” (at pp 330–331): … there are some transactions which are clearly integral parts of the businesses concerned, and these should be held to have been carried out in the course of those businesses; this would cover, apart from much else, the instance of a one-off adventure in the nature of trade, where the transaction itself would constitute a trade or business. There are other transactions, however, … which are at highest only incidental to the carrying on of the relevant business; here a degree of regularity is required before it can be said that they are an integral part of the business carried on, and so entered into in the course of that business. Test of Reasonableness 11.56 The requirement of reasonableness underlies the provisions of UCTA. Section 11(1) UCTA gives a broad definition of reasonableness. It provides that, for contractual terms, the test of reasonableness requires that “the term shall have been a fair and reasonable one to be included having regard to the circumstances which were, or ought reasonably to have been, known to or in the contemplation of the parties when the contract was made”. 11.57 As regards exception clauses covered by ss 6 and 7, s 11(2) refers to a set of guidelines given in the Second Schedule. It would thus appear that there might be a difference between the concepts of reasonableness envisaged in ss 11(1) and 11(2). However, in practice the courts generally refer to the guidelines given in the Second Schedule in every case. 359 Principles of Singapore Business Law 11.58 The Second Schedule lists the following as matters that may be relevant: ° the strength of the bargaining positions of the parties relative to each other and whether there were any alternative means for meeting the customer’s requirements; ° whether the customer received an inducement to agree to the exemption clause or could have entered into a similar contract without the need for such a term; ° whether the customer knew or ought to have known of the existence and extent of the term, having regard to any custom of the trade or a previous course of dealing; ° where the term excludes or restricts any relevant liability for non- fulfillment of a condition, whether it was reasonable at the time of the contract to expect that the compliance with that condition would be practicable; and ° whether the goods in question were manufactured, processed or adapted to the special order of the customer. Any of the abovementioned factors insofar as they appear to be relevant are “matters to which regard is to be had in particular” (Second Schedule, UCTA). However, these are only guidelines and are not limited to those enumerated above. Case law has considered other factors to be relevant. Thus in Smith v Eric Bush (1990) the court considered the following factors to be relevant, viz, whether it would have been reasonably practicable to obtain advice from an alternative source having regard to the time and cost involved; whether the liability in question was for a difficult task or obligation that may impose additional burden on the performing party; and the practical consequences of determining whether or not the clause is in fact reasonable (eg, whether it would have been open to either party to protect themselves against the risk by taking insurance). 11.59 Reasonableness is a very factual enquiry and the guidelines merely assist the courts in the enquiry. For example, in George Mitchell (Chesterhall) Ltd v Finney Lock Seeds Ltd (1983), where a firm contracted to sell winter cabbage seeds but delivered autumn seeds of inferior quality. The House of Lords held that the exemption clause was unreasonable because, among other things, the buyer could not discover the breach until the plants grew whereas the 360 Chapter 11: Exemption Clauses seller was at all times in a position where it should have known whether the wrong seed was supplied. 11.60 In Motours Ltd v Euroball (West Kent) Ltd (2003) the defendant who provided telephone services to the plaintiff, a travel agency, sought to exclude all liability for all consequential loss howsoever arising. Although it was a commercial bargain between businessmen, the court found the term to be unreasonable. They considered the following factors to be relevant: the exclusion for negligence could not have been within Motour’s contemplation; exclusion clauses were common in the industry so that Motour had no choice; the term was not negotiated; and the unequal bargaining position of the parties whereby Motours was not in a position to negotiate and Euroball could adopt a “take it or leave it” attitude. 11.61 In Regus (UK) Ltd v Epcot Solutions Ltd (2008), Regus hired serviced office accommodation to Epcot. Epcot sought substantial damages for loss of business due to faulty air-conditioning. A standard term in the contract excluded any liability for loss of business, profits, anticipated savings, third party claims or any consequential loss, or loss of or damage to data. The English Court of Appeal found the clause to be reasonable. It held so on the basis that Epcot could still sue for defective air-conditioning; the exclusion did not cover fraud, or willful, reckless or malicious damage which would be unreasonable; Regus reasonably limited its liability to the higher of 125 per cent or £50,000; Regus advised its customers to protect themselves by insurance for business losses; and there was no inequality of bargaining power. 11.62 The UCTA test of reasonableness came up for consideration in a number of Singapore cases. In Consmat Singapore (Pte) Ltd v Bank of America National Trust & Savings Association (1992), Consmat sued Bank of America for amounts paid by the bank under forged cheques. The bank relied on an exemption clause in its standard contract. Although UCTA was held inapplicable on the facts, the High Court found that, were it to be applicable, the clause in question would have been reasonable. The court noted the fact that both parties were commercial entities who entered into the contract freely; Consmat had had a choice of banks; the parties entered into the contract freely; and the clause contained a grace period for Consmat to 361 Principles of Singapore Business Law challenge any alleged discrepancies, and as a business entity, it had the resources to verify its bank statements within this period. 11.63 In the subsequent case of Kenwell & Co Pte Ltd v Southern Ocean Shipbuilding Co Pte Ltd (1999), the High Court held that the defendant failed to adduce evidence of reasonableness and hence the clause could not be relied upon. Whether a particular exemption clause is reasonable or not depends on the facts of the particular case. A clause which is reasonable in one context may be unreasonable in another. In particular, an exemption clause commonly used in the industry may still be unreasonable under the UCTA. Moreover, the more unreasonable an exemption clause, the greater is the burden upon the party relying upon it to establish reasonableness. In passing, it was noted that the fact that the parties entered into the contract willingly does not prevent one party from later questioning the reasonableness of an exemption clause. The Kenwell case was followed as clear authority and applied in Press Automation Technology Pte Ltd v Trans-Link Exhibition Forwarding Pte Ltd (2003). 11.64 In Lee Chee Wei v Tan Hor Peow Victor and others and another appeal (2007) the Court of Appeal considered, obiter, the test of reasonableness in the context of an “entire agreement” clause. The court stated that the effect of an entire agreement clause was essentially a matter of contractual interpretation and necessarily depended upon its precise wording and context. Generally, such clauses were conducive to certainty as they defined and confined the parties’ rights and obligations within the four corners of the written document, thereby precluding any attempt to qualify or supplement the document by reference to pre-contractual representations (at [25]). However, the court cautioned and emphasised (at [37]) that the intent and purport of the clause, in certain contracts, may find itself subject to the strictures of the reasonableness test as provided for in the UCTA if the contract is embraced by it. Moreover, it is only when the nature of the liability which the clause is seeking to exclude or restrict has been ascertained that it is possible to inquire whether the term was a fair and reasonable one having regard to the circumstances which were or ought reasonably to have been in the contemplation of the parties when the contract was made. The court found the first four guidelines in the Second Schedule of the UCTA to be relevant in assessing the reasonableness of the entire agreement clause. The court noted (at [39]) that the entire agreement 362 Chapter 11: Exemption Clauses clauses perform a useful role as legitimate devices for the allocation of risk between the parties, subject to an overriding judicial right to police clauses which are oppressively employed against consumers or parties of unequal bargaining power. 11.65 In Jiang Ou v EFG Bank AG (2011) the issue before the High Court was the reasonableness of the conclusive evidence clauses. Mdm Jiang Ou opened an account with EFG Bank in June 2008 and deposited nearly S$5 million. Between August 2008 and April 2009 without any instructions, written or verbal, from her an employee of the bank and her relationship manager executed a series of 160 high volume and/or high risk leveraged foreign exchange and securities transactions purportedly on her behalf. As a result her account suffered a loss of about S$2.3 million. She claimed that prior to August 2009 she did not receive any of the 160 transaction confirmation slips or bank statements except for 18 documents received from 29 July 2008 to 5 January 2009. The bank denied liability for the loss on the premise that Mdm Jiang was precluded from challenging the correctness of the transaction documents by reason of the conclusive evidence clauses in the bank’s documentation. Clause 4 of the General Conditions of the account opening documents gave rise to a presumption of delivery of the transaction documents to Mdm Jiang. Conclusive evidence clauses, such as cll 3.1 and 3.2 imposed two concurrent duties on customers: first, it placed the onus on the customers to verify their bank statements and second, it required customers to notify the bank if there was any discrepancy. If the customer failed to do so within the stipulated time, he or she would be precluded from challenging the correctness of the statement. The court held (at [56]) that the bank had failed to discharge its burden of proof that the transaction documents were sent to Mdm Jiang and therefore the presumption of delivery as provided in cl 4 of the General conditions did not arise. This alone rendered cll 3.1 and 3.2 to be ineffective. The court stated further (at [108]) that the risk of fraud by the bank’s employee is a unique risk that typically resides with the bank. If EFG Bank had intended to shift such risk to its customers, nothing short of express reference in the relevant clause to such risk would have sufficed. Clauses 3.1 and 3.2 clearly did not expressly or impliedly cover unauthorised transactions carried out fraudulently by its employee in the absence of instructions. In any event, conclusive evidence clauses which 363 Principles of Singapore Business Law purport to exclude liability for the fraud of banks’ employees would stand contrary to public policy and would run foul of the reasonableness test under UCTA. EXCEPTION CLAUSES AND CONSUMER PROTECTION LEGISLATION IN SINGAPORE 11.66 Singapore has enacted the Consumer Protection (Fair Trading) Act (Cap 52A, 2009 Rev Ed) which came into force on 1 March 2004. The Act defines a “consumer” as an individual who, otherwise than exclusively in the course of business, receives or has a right to receive goods or services from a supplier; or has a legal obligation to pay the supplier for goods or services. A “consumer transaction” means the supply of goods or services by a supplier to a consumer as a result of a purchase, lease, gift, contest or other arrangement; or an agreement between a supplier or consumer for that purpose (but excluding the transactions specified in the First Schedule) (s 2(1)). 11.67 Section 4 of the Act refers to “unfair practices”. It is an unfair practice for a supplier, in relation to a consumer transaction, to do or say something, or omit to do or say anything, if, as a result, a consumer might reasonably be deceived or misled; to make a false claim; to knowingly take advantage of a consumer, where the consumer is not in a position to protect his own interests or is not reasonably able to understand the character, nature, language or effect of the transaction; or to do certain other acts specified in the Second Schedule (such as misrepresenting the price of a product, the sponsorship, benefits, standard or quality thereof). 11.68 A consumer who has entered into a consumer transaction involving an unfair practice is entitled to go to court against the supplier (s 6(1)). The Act also gives a consumer the right to cancel certain contracts within a cancellation period (s 11(1)). However, a person who, in the ordinary course of his business “prints, publishes, distributes, broadcasts or telecasts an advertisement in good faith” on behalf of a supplier is exempted from liability (s 16). 11.69 The consumer protection given by the Act is in addition to any right or remedy that the consumer may have apart from this Act (s 15(1)). Further, it 364 Chapter 11: Exemption Clauses is not possible to contract out of the provisions of the Act (s 13). This would mean that any exemption clause would be invalid if and to the extent that it is inconsistent with the provisions of the Act. 11.70 The Act was amended by the Consumer (Fair Trading) Amendment Bill passed by Parliament in March 2012 and came into force on 1 September 2012. The new law (termed in the media as “Lemon Law”) seeks to give consumers added protection against defective goods that do not conform to the contract of sale of goods (including a contract for the transfer of goods and a hire-purchase agreement) at the time of delivery. The law will apply if three criteria have been met: (i) the transferee deals as a consumer; (ii) the goods do not conform to the applicable contract; and (iii) the contract was made on or after 1 September 2012. Where a consumer is able to rely on this law he may have the right to require the seller to repair or replace the goods at seller’s discretion. Where it is not feasible to do so, then the consumer will be entitled to require the seller to reduce the amount to be paid by an appropriate amount or to rescind the contract. For further details see Chapter 22, paras 22.131–22.138. CONCLUSION 11.71 We noted at the beginning of this chapter that while it is essential to ensure freedom of contract on one hand, it is equally important on the other to control its excesses so that they do not lead to unfairness. The courts played an important part as to the latter by assisting the weaker party through various devices. These included first, the requirement for the stronger party to prove incorporation of the exemption clauses into the contract. An exemption clause could be incorporated into the contract by signature, notice or by a prior course of dealing. Second, the courts would then decide on its validity by employing various rules of construction such as the contra proferentem rule, the rule in cases of negligence liability and the rule in cases of fundamental breach. However, over time the courts’ intervention proved to be insufficient and the legislature had to step in. The legislature in the UK intervened by passing the Unfair Contract Terms Act 1977 which is now part of the Singapore law as Cap 396, 1994 Rev Ed. 11.72 Another development to be noted in this context is the growth of consumer protection legislation in tandem with the law on exemption clauses. Singapore 365 Principles of Singapore Business Law enacted the Consumer Protection (Fair Trading) Act (Cap 52A, 2009 Rev Ed) in 2004 which was in turn amended in 2012. The enactment of this legislation regulating fair trading in Singapore has provided an additional avenue for legal redress for consumers. As a result of this Act, the practice of using restrictive or one-sided exemption clauses, at least with respect to consumer transactions, are likely to be curtailed. Although the Act, unlike UCTA, does not specifically provide that certain exception clauses are invalid, it does permit an aggrieved consumer to sue a supplier and be awarded restitution of the money he has paid or damages for loss he has suffered as a result of the supplier’s unfair trading practices. This legislation thus seeks to achieve fairness between the parties, the same objective that has guided the development of the law relating to exemption clauses. 366 Chapter 13 Misrepresentation 13.1–13.5 13.6 13.7 13.8 13.9 13.10–13.11 13.12 13.13–13.14 13.15–13.19 13.20–13.21 13.22 13.23–13.24 13.25–13.28 Introduction Operative Misrepresentation Elements of Misrepresentation Statement of Fact (1) Puffs (2) Opinions (3) Intentions (4) Law Representation by Conduct (1) Express representations (2) Implied representations (3) Silence Ambiguity and Falsity Materiality Inducement Addressed to the Other Party 13.34 13.35 13.36 13.37–13.38 13.39 Types of Misrepresentations Introduction Fraudulent Misrepresentation Negligent Misrepresentation (1) Negligence at common law (2) Section 2(1) of the Misrepresentation Act (3) Measure of damages (4) Burden of proof Innocent Misrepresentation 13.40–13.41 Representation as a Term 13.42–13.44 13.45 13.46 Rescission General (1) Restitution impossible (2) Affirmation 13.29 13.30–13.33 Principles of Singapore Business Law 13.47 13.48 13.49 13.50 13.51 13.52–13.53 (3) Lapse of time (4) Third party rights Section 2(2) of the Misrepresentation Act (1) General (2) Types of misrepresentation (3) Where right to rescind is lost (4) Measure of damages 13.54–13.60 Exclusion of Liability 13.61–13.62 Conclusion 400 Chapter 13: Misrepresentation INTRODUCTION 13.1 The aim of a business is to sell a product or a service and, sometimes, in a bid to secure a sale, much more is said than should have been said. If an untrue statement is part of the contract, the innocent party has his rights for breach of contract. But if the statement is not part of the contract, the innocent party may still have rights under the law of misrepresentation. 13.2 The law of misrepresentation is found in the common law, equity and statute. Originally, at common law, there was liability for misrepresentation only if the misrepresentation was fraudulent or formed part of the contract. Subsequently, after the House of Lords decision in Hedley Byrne & Co Ltd v Heller & Partners Ltd (1964) (referred to at para 13.34), there was also, possibly, liability for negligent misrepresentation. Non-contractual statements which were neither fraudulent nor negligent did not give rise to a claim for damages although the representee could seek, in equity, rescission and, possibly, an indemnity. 13.3 The UK Misrepresentation Act 1967 was made applicable by the Application of English Law Act (Cap 7A, 1994 Rev Ed) and reprinted locally as Cap 390, 1994 Rev Ed. Under this Act, a representee could claim damages for negligent misrepresentation in the same way as he could claim had the representation been fraudulent (see para 13.35). Compared to the common law claim under the Hedley Byrne case, this species of statutory negligence is easier to mount as a cause of action. 13.4 It should be mentioned that the law of misrepresentation straddles the two broad areas of contract law and tort law. As such, in a situation of misrepresentation, the innocent party may have rights under both contract and tort. The concurrent existence of duties in contract and tort was confirmed by the House of Lords in Henderson v Merrett Syndicates Ltd (1995). 13.5 As a final introductory remark, it may be observed that misrepresentation sometimes overlaps with breach of contract. Indeed, where a representation is or becomes part of the contract, the innocent party may have remedies in both misrepresentation and breach, and s 1 of the Act makes it clear that a person is not to be deprived of the right to rescind for misrepresentation 401 Principles of Singapore Business Law merely because the representation has become part of the contract. In general, there are some broad similarities between the liabilities and remedies for misrepresentation and those for breach. For example, in each area, the innocent party generally has remedies of termination and damages. However, as one goes into the details, there are significant differences between these two areas of law. OPERATIVE MISREPRESENTATION Elements of Misrepresentation 13.6 A misrepresentation is a false statement of fact made by one party to another party, which induced the other party to enter into the contract. The statement must be one of a past or an existing fact, not a commendatory puff, an opinion, a statement of intention or a statement of law (see Figure 13.1). It has been said that a statement will be treated as true if it is substantially correct and the difference would not have induced a reasonable person to enter into the contract (per Rix J in the English decision of Avon Insurance v Swire Fraser (2000)). Statement made during negotiations Puff Term Representation No legal effect True False Representee can sue if there was: False representation of fact Made by one contracting party to the other Which induced the other to enter into the contract No problem Figure 13.1 Classification of pre-contractual statements and elements of an operative misrepresentation 402 Chapter 13: Misrepresentation Statement of Fact (1) Puffs 13.7 It is usual for salespersons to use glowing terms to describe their product, such as “best value money can buy”, “excellent product” or “very fast car”. In general, such commendatory expressions or puffs are harmless and are regarded as mere sales talk, to which the law attaches no legal liability. However, as the statements get more detailed or precise, they are more likely to be representations, for example, going beyond saying a car is fast to asserting that it has a top speed of 200 kmh. (2) Opinions 13.8 In general, a statement of opinion which turns out to be unfounded does not give rise to liability. But there are exceptions. First, a statement of opinion can be a statement of fact in that the representor impliedly stated that he held the opinion. If he did not hold the opinion or could not, as a reasonable man having his knowledge, honestly have held it, there would be a misrepresentation. The misrepresentation here would be one concerning his state of mind, and it has been said that the state of a person’s mind is “as much a fact as the state of his digestion” (per Bowen LJ in Edgington v Fitzmaurice (1885)). Likewise, a statement of another person’s opinion involves an assertion that the latter holds that opinion. Secondly, a statement of opinion may carry with it the implication that the representor had an objectively reasonable basis for his opinion, for example, that he had the handbook which contained the information. (3) Intentions 13.9 A statement of intention is an expression as to the future and does not involve any past or existing fact. However, as with opinions, if the intention was not so held, there would be a false statement of fact. Likewise also, a person who states his intention to do something may be impliedly asserting that he has reasonable grounds for thinking that he has the capacity to do it. (4) Law 13.10 The traditional view is that a statement of law cannot be a misrepresentation. As with opinions and intentions, a statement of law can be a misrepresentation 403 Principles of Singapore Business Law if the representor did not hold that opinion or belief of the law, or if the statement carries an implication of fact which is untrue. Where the statement involves both fact and law, the tendency of the courts is to regard it as a statement of fact. 13.11 The House of Lords in Kleinwort Benson v Glasgow City Council (No 2) (1997) allowed a restitutionary claim for money paid under a mistake of law, jettisoning the traditional distinction between payments made under a mistake of fact and those made under a mistake of law. One can expect that in the near future, the distinction may also be abandoned as regards misrepresentation. Representation by Conduct (1) Express representations 13.12 The most obvious form of express representation is the spoken or written word. But expression can also be through a picture, a photograph, a drawing, a chart or any other visual media. (2) Implied representations 13.13 An express statement may also contain an implied representation. For example, it was argued in Cassa di Risparmio della Repubblica di San Marino SpA v Barclays Bank Ltd (2011) that a statement that a financial product carried an “AAA” rating contained an implied representation that the product was of low risk. The test is whether a reasonable person in the position of the representee would have understood that an implied representation was being made. 13.14 Representation can also be through a person’s conduct. For example, a person who sits down in a restaurant and orders a meal impliedly represents that he has the ability to pay for the meal. Likewise, a nod of the head may signify agreement, just as a shake of the head may show disapproval. So long as it is intended to induce the other party to believe in a certain state of facts, the gesture or conduct can amount to a representation (see Walters v Morgan (1861)). In the situations just discussed, the conduct is intended to convey a certain message. Sometimes, the conduct may be intended to conceal certain facts. A very simple example is where a fruit seller deliberately sticks the label on the part of the fruit that is damaged. In principle, such conduct 404 Chapter 13: Misrepresentation would also amount to a representation. In the case of the fruit seller, the implied representation is that the fruit is undamaged. (3) Silence 13.15 The general rule is that silence in itself does not amount to a representation; some active conduct is required. Under general contract law, one party does not have a duty to disclose to the other party material facts which the former knows may influence the latter’s decision whether or not to enter into the contract. This rule is subject to several exceptions. 13.16 The first is where the silence makes what has been said a half-truth or an untruth. For example, to say that a pop group currently comprises five named individuals without going on to say that one of them will be leaving, is a misrepresentation (see Spice Girls v Aprilia World Service (2002)). While a contracting party has no duty to make statements, once he begins, he must make full and frank disclosure. 13.17 Secondly, where a statement (which the representor knows is false) is made by the representor or by a third party to the representee while the representor listens in silence, his reticence may amount to tacit confirmation of the truth of the statement (see Pilmore v Hood (1838)). By keeping silent, he is impliedly representing that the statement is true. 13.18 The law regards a representation as having a continuing effect until the contract is concluded. For this reason, if a statement, which though true when made to the representor’s knowledge, ceases to be true before the contract is concluded, the representor is required to inform the representee of the change in circumstances. The representor has a duty to ensure that his representation remains true up to the time of the contract (see, eg, With v O’Flanagan (1936) and Spice Girls v Aprilia World Service (2002)). 13.19 Finally, in certain contracts, the law imposes a duty of utmost good faith. The prime example of this is the insurance contract, where the law imposes on the proposed insured the duty to disclose to the insurer all material facts that may influence the insurer’s decision whether or not to insure. Such non-disclosure entitles the insurer to avoid the contract of insurance. The rationale for this is that often the special facts and risks are known to the insured but not the insurer. 405 Principles of Singapore Business Law Ambiguity and Falsity 13.20 Sometimes, a statement may be ambiguous and may bear two (or more) meanings, one of which is true and the other(s) false. Whether such a statement by a contracting party amounts to a misrepresentation depends on two things. First, the representee must prove that he understood the statement in the sense which is in fact false. Secondly, the representor must have intended the statement to be understood in the sense that is false; he is not liable if he honestly intended it in the sense that is true. This is so even if the sense in which the representee understood the statement is the one which, on its true construction, it ought to bear (see Akerhielm v De Mare (1959)). 13.21 There has been the suggestion (see, eg J Cartwright, Misrepresentation (2002) at para 4.18) that an ambiguous statement can amount to fraudulent misrepresentation but not negligent or innocent misrepresentation. The logicality of such dichotomy is not so evident. The representor’s intention is relevant for determining the type of misrepresentation: fraudulent, negligent or innocent. Whether or not there is falsity (as opposed to culpability) should be an objective matter. Materiality 13.22 There is doubt whether the law requires a misrepresentation to be material in the sense that a reasonable man would have been influenced by it to enter into the contract. Is there misrepresentation if the representee was induced by a misstatement which a reasonable man would have ignored? While there are some judicial statements which support a requirement of materiality, the position is not settled. Certainly, a representee who is induced by an immaterial misrepresentation will have difficulty persuading the court that he was so induced. But it is another matter to deny a representee who was truly induced by the misrepresentation. Commentators are divided on this issue. Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at para 9–016 confidently asserts that materiality is a requirement. The issue is debatable. For an alternative viewpoint, see eg, Chitty on Contracts, Vol 1 (30th ed, 2008) at para 6–037. Inducement 13.23 In order for a misrepresentation to be operative, it must induce the representee to enter into the contract. Stated another way, the representee must have 406 Chapter 13: Misrepresentation relied on the representation. This requirement is an obvious and logical one. There are several scenarios where the representee is not induced by the false statement. The first is where he was not even aware of the representation. Secondly, the representee may have been aware of the representation but knew it was untrue or did not believe it to be true. The third situation is that he simply was not influenced by it, as where he would have entered into the contract even if he had known the true facts. In all these situations, there is no inducement and therefore no operative misrepresentation. The misrepresentation need not be the sole cause that induced the representee to enter into the contract. It is sufficient that, in deciding whether to enter into the contract, he was materially influenced by the misrepresentation, as where the representee was induced by a misrepresentation as well as by his own mistaken belief (see Edgington v Fitzmaurice (1885), followed by the Singapore Court of Appeal in Panatron v Lee Cheow Lee (2001)). 13.24 Sometimes, the representee has the opportunity to verify or ascertain the truth for himself. Generally, the fact that a representee had the opportunity to discover the truth but did not use the opportunity does not disentitle him of relief (Redgrave v Hurd (1881)). But where it is reasonable to expect the representee to avail himself of the opportunity to discover the truth, the legal position is less clear. In Panatron v Lee Cheow Lee (2001), Yong CJ held (at [24]) that once inducement is proved, it is no defence that the representee failed to take the steps which a prudent man would have taken to verify the truth. Panatron was followed by the Court of Appeal in JTC v Wishing Star (No 2) (2005), where it was held (at [113]) that a representee who chooses “to act carefully but fails, through negligence or otherwise” to discover the fraud, is nonetheless, regarded as having been induced (see Box 13.1). But the Redgrave principle is now open to doubt. In Peekay Intermark Ltd v ANZ Banking Group Ltd (2006), the UK Court of Appeal accepted the notion that where a representee signs a written contract inconsistent with, and subsequent to, earlier oral representations, he may have been induced not by the oral representation but by “his own assumption” that the subject matter of the contract corresponded to the description that he had previously been given. This aspect of Peekay was cited, it would seem with approval, by the Singapore Court of Appeal in Orient Centre Investments Ltd v Societe Generale (2007) (at [51]–[53]). Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at para 9–024 suggests that a claim for misrepresentation, other than for fraud, may be defeated where it is reasonable to expect the representee to make use of the opportunity to discover the truth. 407 Principles of Singapore Business Law Box 13.1 Reflecting on the law Misrepresentation and the representee’s own inquiry It is quite often asserted by the representor that the representee was not induced by the representation but rather by his own inquiry. In JTC v Wishing Star (No 2) (2005), JTC was a developer of the Biopolis, a large research complex, and was assisted by JCPL, its consultant. The tender for façade works for the complex was awarded to WSL. Three months later, the contract was terminated for inter alia, misrepresentation as to the satisfaction of the tender evaluation criteria. The trial court found that although there had been misrepresentation, JTC had relied not upon the misrepresentation but on JCPL’s own evaluation. The Court of Appeal allowed the appeal and held that JTC was induced by the misrepresentation even though it partly relied on JCPL’s evaluation and expertise. Woo Bih Li J was of the view (at [113]) that a person who has made a false representation cannot escape its consequences just because the innocent party has made his own inquiry or due diligence but failed, whether due to negligence or otherwise, to discover the fraud. So long as the innocent party does not learn of the misrepresentation, the misrepresentation remains operative. The Court of Appeal’s stance reinforces the position taken in earlier English and Singapore cases. From the policy standpoint, the position makes sense — the representee should not be penalised for choosing to make an inquiry; neither should a contracting party be encouraged to make false statements. It should be noted, however, that the representations in Wishing Star were fraudulent. Where the misrepresentation is a negligent one, the case becomes less compelling. After all, in principle, contributory negligence is a partial defence to a negligence claim. Addressed to the Other Party 13.25 Generally speaking, it is the direct addressee or recipient of a representation who may bring an action for misrepresentation. It should be noted that a direct recipient can be a person who is a member of a class of persons to whom the representation is addressed, such as through a media announcement. There are situations, however, where one who is not a direct recipient may have recourse. 13.26 The first is where the representation is made to the representee’s authorised agent. Here, there are two possible scenarios. In the first scenario, the recipient, to the representor’s knowledge, is only an agent for passing on the representation to his principal. In the second, the representor intends 408 Chapter 13: Misrepresentation that both the agent and principal will be influenced by the representation, as in the case of partners of a firm. In the first, the principal is the representee, while in the latter, both the principal and the agent are representees. 13.27 The second situation is where, even though there is no agency between the direct recipient and the indirect recipient, the representor intended or reasonably expected the representation to be passed on to the indirect recipient. Thus, where A by a misrepresentation induces B to buy an item and B later induces C by a similar misrepresentation to buy it from B, C could rely on the misrepresentation as against A if A knew that B intended to resell and was likely to repeat the misrepresentation (see Gross v Lewis Hillman (1970)). 13.28 It should be noted that an indirect misrepresentation arises either through agency or through the intention or knowledge of the representor. In the past two decades, there has been, in the context of guarantees and mortgages by spouses, substantial development on the issue of the extent of a bank’s liability for misrepresentation (and other misconduct) of the principal debtor. In essence, the position is that the bank is affected by the principal debtor’s misrepresentation to the guarantor if either the principal debtor may be regarded as the bank’s agent or the bank had constructive notice of the misrepresentation. For the detailed rules as to when a bank would be put on inquiry and the reasonable steps it would then have to take, see the House of Lords decision in Royal Bank of Scotland plc v Etridge (No 2) (2002). TYPES OF MISREPRESENTATION Introduction 13.29 As mentioned above, it is now clear that there can be three types of misrepresentation and that they are, on a scale of diminishing culpability, fraudulent misrepresentation, negligent misrepresentation and innocent misrepresentation. Broadly speaking, the remedies of rescission and damages (indemnity, in the case of innocent misrepresentation) are available for all three. As we shall see, however, there are differences in the respective legal positions insofar as the recovery of damages is concerned (see Figure 13.2). 409 Principles of Singapore Business Law Fraudulent Statement made: knowing it is untrue not believing it to be true recklessly, not caring if it is true or not Negligent Statement made: with no reasonable ground to believe it is true (s 2(1) MA) Innocent Statement made: honestly, and with reason to believe it is true Remedy: innocent party may rescind or affirm contract + Damages Court may order damages instead of rescission (s 2(2) MA) + Damages + Indemnity Figure 13.2 Types of misrepresentations and remedies Fraudulent Misrepresentation 13.30 At common law, fraud is defined quite narrowly, as a charge of fraud “is such a terrible thing as to bring against a man that it cannot be maintained unless it is shown that he had a wicked mind” (per Lord Esher in Le Lievre v Gould (1893) at p 498). In Derry v Peek (1889), the House of Lords held that a fraudulent statement is one made knowingly, without belief of its truth, or recklessly — not caring whether it is true or false. A person who deliberately shuts his eyes to the facts or purposely abstains from investigating the facts does not have an honest belief in its truth. Where there has been a fraudulent misrepresentation, the representee may recover damages in an action under the tort of deceit. Damages are awarded to compensate the representee for all the losses which can properly be said to have been caused by his reliance on the fraudulent misrepresentation (as contrasted with the contract measure of expectation loss). (See the House of Lords decision in Smith New Court Securities v Scrimgeor Vickers (Asset Management) (1997)). Further, in such 410 Chapter 13: Misrepresentation an action, contributory negligence is not a defence (see Standard Chartered Bank v Pakistan National Shipping (No 2) (2002)). 13.31 The motive of the representor is irrelevant. It is not necessary that he had a bad motive or intended to cause loss to the representee; it suffices that the false statement was made knowingly with the intention that the representee should act upon it (see Standard Chartered Bank v Pakistan National Shipping (No 2) (2002)). It is also immaterial that the representor thought the statement irrelevant or unimportant. 13.32 Where the responsibility for a statement is shared between a principal and an agent, or between two agents, the position is more complex. If an agent knowingly makes a false statement within the scope of his authority, the principal is liable for fraudulent misrepresentation. Likewise, if an agent knowingly makes a false statement to another agent intending that agent to pass the statement on to a third party, the first agent is liable to the third party for the misrepresentation of the second agent. 13.33 If the agent makes a statement which he honestly believes is true but which the principal knows is untrue, then the position depends on the culpability of the principal. If the principal was aware that the statement will be or had been made and did not intervene, the principal is liable for fraudulent misrepresentation. If he was not aware that the statement will be or had been made, he is not liable (see Armstrong v Strain (1952)). Negligent Misrepresentation (1) Negligence at common law 13.34 A negligent misrepresentation is one which is made carelessly or without reasonable grounds for believing it to be true. Prior to and apart from the Misrepresentation Act, a misrepresentation would not be considered negligent unless the representor owed a duty of care to the representee. A “special relationship” must have existed between the parties before such duty of care can arise (Hedley Byrne & Co Ltd v Heller & Partners Ltd (1964)). The law on negligent misstatements was further developed and qualified by subsequent cases (see, generally, Chapter 6, para 6.36 onwards). So far as negligent misrepresentation is concerned, the importance of these refinements is largely eclipsed by the Misrepresentation Act. 411 Principles of Singapore Business Law (2) Section 2(1) of the Misrepresentation Act 13.35 Section 2(1) Misrepresentation Act (Cap 390, 1994 Rev Ed) (“MA”) provides as follows: Where a person has entered into a contract after a misrepresentation has been made to him by another party thereto and as a result thereof he suffered loss, then, if the person making the misrepresentation would be liable to damages in respect thereof had the misrepresentation been made fraudulently, that person shall be so liable notwithstanding that the misrepresentation was not made fraudulently, unless he proves that he had reasonable ground to believe and did believe up to the time the contract was made that the facts represented were true. The uninitiated reader may find the above paragraph at best awkward and at worst incomprehensible. Adopting what has been termed a “fiction of fraud”, the provision first says indirectly that a non-fraudulent misrepresentation carries the same liability as a fraudulent misrepresentation. It then gives the qualification that the representor will not be liable if he proves that he had reasonable grounds to believe that his statement was true. In effect, what the section does is to provide that a negligent misrepresentation (ie, one where the representor does not have reasonable grounds to believe his statement is true) attracts the same liability as a fraudulent misrepresentation. (3) Measure of damages 13.36 There is much debate as to the correct basis for measuring damages for negligent misrepresentation. One view is that the contract measure — to put the representee into the position he would have been had the representation been true — should apply. Another view is that the tort measure is the appropriate one. In tort, the claimant is to be put in a position he would have been if the tort (the misrepresentation) had not been committed. If the tort measure is the correct one, there is a further complication: should the deceit (fraud) measure or the negligence measure be applied? In cases of fraud, losses may be recoverable even though they were not of a foreseeable kind; this is not the case for negligence. There are no easy answers to this problem. For further discussion of these issues, see A Phang, Cheshire, Fifoot & Furmston’s Law of Contract (2nd ed, 1998) at pp 488–489 and Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at paras 9–059 to 9–060. It was recently said that the words of s 2(1) MA do not necessarily compel the conclusion that the liability in damages for negligent misrepresentation 412 Chapter 13: Misrepresentation under s 2(1) is to be the same as that for fraud (see Cassa di Risparmio della Repubblica di San Marino SpA v Barclays Bank Ltd (2011) at [223]). (4) Burden of proof 13.37 At common law, a representee who alleges fraudulent misrepresentation bears the burden of proving fraud and the onus is a heavy one. Upon reading s 2(1) MA, it is clear that for negligent misrepresentation, the burden is reversed. Once the representee proves that the statement was false, the burden shifts to the representor to prove that he had reasonable grounds to believe that the statement was true. In effect, the representor has to show that his misrepresentation was not negligently made. In this respect, negligent misrepresentation is a more favourable option for the representee than fraudulent misrepresentation. 13.38 Although the use of the words “reasonable grounds” may give rise to the argument that negligent misrepresentation, like negligent misstatement at common law, requires the representee to establish a duty of care and a special relationship, it is clear from the case judgments that this is not so (see Howard Marine & Dredging v Ogden & Sons (Excavations) (1978) and Ng Buay Hock v Tan Keng Huat (1997)). On the contrary, it is the representor’s responsibility to show that he was not “negligent”. Whether a representee’s claim for damages for negligent misrepresentation in principle should be reduced by the representee’s contributory negligence is more debatable (see Chitty on Contracts, Vol 1 (30th ed, 2008) at para 6–074). Innocent Misrepresentation 13.39 The least culpable type of misrepresentation is innocent misrepresentation. Here, the false statement is made honestly and with care. The common law provided no remedies for an innocent misrepresentation but, in equity, the representee is entitled to rescission and, possibly, an indemnity. The latter remedy allows the representee to be indemnified against all obligations necessarily created by the contract (see Whittington v Seal-Hayne (1900)). REPRESENTATION AS A TERM 13.40 A representation is a statement made before or at the time of the contract, which induced the representee to enter into the contract. It is conceivable, 413 Principles of Singapore Business Law perhaps even likely, that such a statement could be a term of the contract. There are several guidelines for determining whether a pre-contractual statement is a term. For one, the statement is unlikely to be a term if the representor asks the representee to verify its truth (Ecay v Godfrey (1947)). Another consideration is the relative abilities of the parties: if the representee is in a better position, for instance through special knowledge or experience, to ascertain the truth, the representation is unlikely to be a term (Oscar Chess Ltd v Williams (1957)). Finally, the importance of the statement is relevant. If the statement is so important that the representee would not have entered into the contract had the statement not been made, the statement is likely to be a term of the contract (Bannerman v White (1861)). 13.41 A representation may, however, be precluded from being a term of contract by the parol evidence rule (see Chapter 10, para 10.8 onwards). The rule basically says that where a contract is in writing, extrinsic (including oral) evidence cannot be used to add to, vary or contradict the terms of the written agreement. An exception to this is the collateral contract. The argument here is that there are two agreements: the main (written) agreement and the collateral oral contract. A representation may amount to a collateral contract upon which the representee may bring an action. RESCISSION General 13.42 An operative misrepresentation makes the contract voidable at the option of the representee. The representee is entitled to rescind the contract, that is, to terminate it ab initio (ie, from the beginning) as if the contract never existed. In contrast, where a contract is rescinded for a breach of contract, the contract is terminated as regards the future; while the parties are released from obligations that have not fallen due, they are still liable for obligations which had accrued before the repudiation. 13.43 The right to rescind for a misrepresentation is one which existed prior to the MA. At common law, a representee had a right to rescind for fraudulent misrepresentation while, in equity, rescission was available for innocent misrepresentation and, presumably, negligent misrepresentation. With s 2(1) MA, it is now certain that rescission is available for negligent misrepresentation. 414 Chapter 13: Misrepresentation However, with regard to negligent and innocent misrepresentation, the right to rescind is subject to the court’s discretion to award damages in lieu of rescission under s 2(2) MA (see para 13.49). 13.44 As the effect of rescission can be quite severe for the representor or for third parties, the law puts some bars or restrictions on its availability: where restitution is impossible, where there has been affirmation or lapse of time, where third party rights are affected, and where the court exercises its statutory discretion under s 2(2) MA to give damages in lieu of rescission. (1) Restitution impossible 13.45 Rescission contemplates the representee terminating the contract and returning what he received under the contract. For example, a buyer who wishes to rescind for misrepresentation and recover his purchase money must return the goods to the seller. If such restoration or restitution is not possible, it makes sense that rescission should not be permitted. However, what is required is not precise restitution but substantial restitution; equity allows a representee to rescind if he returns the subject matter in its altered state and makes an allowance for any diminution in its value or accounts for any benefit he derived from using it. Equity seeks to make such adjustments as are necessary to do practical justice between the parties. Where substantial restitution is not possible, the representee is not barred from rescinding if the diminution is due either to the very defect in the subject matter which it was represented not to have or to external causes, such as damage caused by a third party. (2) Affirmation 13.46 Upon discovery of the misrepresentation, the representee may elect either to affirm or to rescind the contract. Upon affirmation, the right to rescission is lost. Affirmation can be express or implied by conduct (though very clear evidence is required). An example of the latter is where the representee uses the goods after knowing of the misrepresentation. However, before an election can be made, the representee must have knowledge not only of the untruth but also that the law gives him a right to rescind; and where an election is conditional, upon the failure of the condition, the right to rescind re-emerges (JTC v Wishing Star (No 2) (2005)). 415 Principles of Singapore Business Law (3) Lapse of time 13.47 If, subsequent to the discovery of the truth, a reasonable period of time has passed and the representee still does not exercise his right to rescind, his inaction may be evidence of affirmation. Apparently, for innocent and, it would appear, negligent misrepresentation, the lapse of reasonable time may be a bar to rescission even if the representee has not discovered the truth (see Leaf v International Galleries (1950)). Such a position is somewhat disconcerting since there can be no affirmation without knowledge of the untruth. So far as fraudulent misrepresentation is concerned, lapse of time without discovery of the truth would not prevent a representee from rescinding. (4) Third party rights 13.48 Misrepresentation makes a contract voidable, not void. If before a representee avoids (rescinds) a contract, an innocent third party (that is, one who acts in good faith and gave consideration) has acquired an interest in the subject matter, the right to rescission is lost. Section 2(2) of the Misrepresentation Act (1) General 13.49 Section 2(2) provides as follows: Where a person has entered into a contract after a misrepresentation has been made to him otherwise than fraudulently, and he would be entitled, by reason of the misrepresentation, to rescind the contract, then, if it is claimed … that the contract ought to be or has been rescinded, the court … may declare the contract subsisting and award damages in lieu of rescission, if of opinion that it would be equitable to do so, having regard to the nature of the misrepresentation and the loss that would be caused by it if the contract were upheld, as well as to the loss that rescission would cause to the other party. Essentially, the provision fetters the representee’s right to rescission for negligent and innocent misrepresentation. It gives the court the discretion to declare that the contract subsists and to award damages in place of rescission. In deciding whether to exercise the discretion and the amount of damages, it gives regard to the nature of the contract, the loss that upholding the contract would cause as well as the loss that rescission would cause. 416 Chapter 13: Misrepresentation (2) Types of misrepresentation 13.50 The subsection does not apply to fraudulent misrepresentation; the representee’s right at common law to rescission and to damages is unaffected. As for negligent misrepresentation, the representee’s right to rescission and damages is affected in that the right to rescission is now subject to the court’s power to give damages instead. Technically speaking, the representee to a negligent misrepresentation may get two sets of damages: he may claim damages as of right (under s 2(1)) and may also be awarded damages in lieu of rescission (s 2(2)). As for innocent misrepresentation, the representee’s rights in equity to rescission and indemnity are now qualified by the court’s power to award damages in lieu of rescission. (3) Where right to rescind is lost 13.51 There is substantial controversy as to whether s 2(2) allows a court to award damages in lieu where the representee has lost the right to rescind. For example, he may have affirmed the contract or third party rights may have intervened. A purely linguistic interpretation suggests that the entitlement to rescind must still be available in order for damages to be given in lieu (see Government of Zanzibar v British Aerospace (Lancaster House) (2000)). (4) Measure of damages 13.52 There is uncertainty as to how damages under s 2(2) are to be assessed. Two possibilities are the tortious measure and the contractual measure, respectively. The tortious measure seems inappropriate for innocent misrepresentation since no tort has been committed. For negligent misrepresentation, the further complication is whether the tortious measure, assuming it is to apply, is the fraud measure or the negligence measure (see para 13.36). 13.53 Section 2(3) goes on to provide that damages may be awarded under subs (2) whether or not the representor is liable to damages under subs (1), and that any damages awarded under subs (2) will be taken into account in assessing the damages under subs (1). EXCLUSION OF LIABILITY 13.54 Contracting parties sometimes seek to exclude the consequences of misrepresentation by inserting a clause to that effect in the contract. At 417 Principles of Singapore Business Law common law, apart from where the representor is fraudulent, such a clause is valid and is subject to the normal rules of construction applicable to exemption clauses. This freedom to include exclusion clauses is now circumscribed by statute. 13.55 Section 3 MA, as amended by s 8 Unfair Contract Terms Act, reads: If a contract contains a term which would exclude or restrict (a) any liability to which a party to a contract may be subject by reason of any misrepresentation made by him before the contract was made; or (b) any remedy available to another party to the contract by reason of such a misrepresentation, that term shall be of no effect except in so far as it satisfies the requirement of reasonableness as stated in s 11(1) of the Unfair Contract Terms Act, and it is for those claiming that the term satisfies that requirement to show that it does. In essence, the provision invalidates exclusion clauses that exclude or restrict any liability or remedy for misrepresentation unless they are reasonable. It should be noted that the burden of proving that an exclusion clause is reasonable lies with the party seeking to rely on it. 13.56 For exclusion clauses in general, a distinction can be drawn between clauses which exclude liability and those which seek to prevent liability from arising by negativing one or more of the elements of liability, with the former attracting the operation of the UCTA provision but not the latter. As regards misrepresentation, examples of the former would include one which expressly seeks to exclude liability, such as “All liabilities for and all remedies in respect of any misrepresentations made are excluded” and one which states that the contract is not cancellable or voidable by either party. It should be noted that clauses which seek to limit rather than altogether exclude liability, for example, by limiting liability to a certain sum of money, are viewed less stringently by the courts (Ailsa Craig Fishing v Malvern Fishing (1983)). On exemption clauses generally, see Chapter 11. 13.57 Overbrooke Estate v Glencombe Properties (1974) provides a good example of a clause which seeks to prevent misrepresentation liability from arising. In that case, the defendants were successful bidders for a property. A few days before the auction, they made enquiries with the auctioneers and received inaccurate answers. The terms of the sale included a clause which stated that “neither the auctioneers nor any person in the employment of the auctioneers 418 Chapter 13: Misrepresentation has any authority to make or give any representation or warranty”. The court held that the provision was not an exclusion clause but a limitation on the apparent authority of the auctioneers. 13.58 Other clauses which seek to negative the elements of misrepresentation include clauses stating that no representation has been made or that neither party has relied on any representation. The general approach of the law is that if the clause is genuine, that is, that there really had been no representation, or no reliance, or no authority (as the case may be), then the clause is effective to prevent misrepresentation liability from arising (see, eg, Government of Zanzibar v British Aerospace (Lancaster House) (2000)). The clause should not avail, for example, where the party seeking to rely on the clause is well aware that representations have in fact been made (see Cremdean Properties Ltd v Nash (1977)). Even so, where both parties to the contract are sophisticated, commercial entities of similar bargaining power, courts have been willing to find that even clauses falling within the latter category are reasonable (see, eg, Raiffeisen Zentralbank Osterreich AG v Royal Bank of Scotland plc (2010)). 13.59 Generally, in deciding whether a clause excluding liability for misrepresentation is reasonable, a relevant factor is the relative knowledge or access to knowledge of the parties (see South Western General Property v Marton (1982)). If, for example, the facts on which the representation is based are only within the knowledge of the representor, the clause is likely to be unreasonable. The guidelines set out in Second Schedule of the UCTA, such as the relative bargaining power, are also generally applicable (see, generally, Chapter 11, para 11.58). 13.60 In recent times, such exclusionary clauses have been challenged from another angle — that they operate to estop (or prevent) a representee from alleging misrepresentation. Two forms of estoppel have been pleaded — estoppel by representation and contractual estoppel. The requirements for estoppel by representation were laid down by Diplock J (as he was then) in Lowe v Lombank (1960) as follows: ° there must be a clear and unambiguous statement (here, the statement that there has been no representation, or no reliance, etc); ° the maker of the statement intended the recipient to rely on the statement; and ° the recipient believed the statement and was induced by it. 419 Principles of Singapore Business Law In contrast, contractual estoppel, which is a recent doctrine, merely requires that there was a clear and unambiguous statement. Although contractual estoppel has gained acceptance in the English Court of Appeal (see Peekay Intermark Ltd v ANZ Banking Group Ltd (2006) and Springwell Navigation Corp v JP Morgan Chase Bank (2010)), the doctrinal basis of this new species of estoppel is seriously doubted. For a discussion of the legal developments in this important and complex area, see Raiffeisen Zentralbank Osterreich AG v Royal Bank of Scotland plc (2010) and Low Kee Yang, “Misrepresentation and Contractual Estoppel: The Raiffeisen Clarifications” (2011) 23 SAcLJ 390. CONCLUSION 13.61 The law of misrepresentation performs the important function of providing rights and remedies against false statements in the contractual context, especially if these statements do not find their way into the written agreement. The elements of an operative misrepresentation are clear enough, apart from the nagging doubt regarding materiality. Although misrepresentation provides a drastic remedy in the form of rescission, its availability is moderated by sensible restrictions. This is especially the case for negligent and innocent misrepresentation, where the court has discretion to award damages in lieu of rescission. The protection which the law of misrepresentation provides is further safeguarded by the legislative requirement that any attempt to exclude or restrict liability for misrepresentation must be reasonable to be valid. 13.62 Fundamental to understanding the law of misrepresentation is an appreciation of the Misrepresentation Act provisions — what they mean to say and how they modify the previous position. The manner by which negligent misrepresentation is established as a recognised concept is unfortunate. Indeed, the indirect approach of using the “fiction of fraud” results in confusion and several legal issues still remain debatable and speculative, though in recent times courts have been challenges by the use of estoppel to defeat misrepresentation claims. However, taking a holistic view of the subject, one may conclude that the law of misrepresentation does provide a reasonably satisfactory regime for ensuring accountability for the making of pre-contractual statements. 420 Chapter 15 Illegality and Public Policy 15.1–15.3 Introduction 15.4–15.7 15.8–15.10 Statutory Illegality Situations Where There is No Statutory Prohibition 15.11 15.12–15.13 Illegality at Common Law Introduction Types of Common Law Illegality 15.14–15.15 15.16 15.17–15.20 15.21–15.23 15.24–15.28 Consequences or Effects of Illegality Introduction Recovery of Benefits Conferred Under Illegal Contract (Restitution) (1) Recovery where parties are not in pari delicto (2) Timely repudiation or repentance (3) Recovery when plaintiff does not rely on the illegal contract 15.29–15.32 15.33–15.38 15.39–15.52 15.53–15.54 15.55–15.57 Contracts in Restraint of Trade Introduction Validity of “Restraint of Trade” Clause Employment Contracts Sale of a Business Other Categories 15.58 15.59 15.60–15.63 Severance Introduction Severance of Entire Clauses Severance within Covenants: “Blue Pencil Test” Principles of Singapore Business Law INTRODUCTION 15.1 The general rule that no action will arise from a wrong done is derived from the Latin phrase “ex turpi causa non oritur actio”. This means that the courts will not assist a person whose action is based on a contract which is tainted by illegality or is contrary to public policy. Accordingly, such contracts may be totally or partially unenforceable. If both parties are before the courts with a contract that is illegal or contrary to public policy then the court through its own observation of the presence of either of these features will decline enforcement of the contract. The spirit of this area of law is in the refusal of the courts to allow a party to benefit from his wrongdoing and to have that rule so manifestly stated that it discourages illegal contracts and contracts that are contrary to public policy. It is important to note at the outset that the party who tries to rely on illegality will be the party who does not want to observe his contractual obligations. 15.2 In Holman v Johnson (1775), Lord Mansfield provided (at p 343) this extremely useful perspective: The objection that a contract is immoral or illegal as between plaintiff and defendant sounds at all times very ill in the mouth of the defendant. It is not for his sake, however, that the objection is ever allowed; but it is founded in general principles of policy, which the defendant has the advantage of, contrary to the real justice, as between him and the plaintiff, by accident if I may say so. In the interest of the greater public good, the courts are prepared to override the contractual rights of the parties. In almost all situations concerning illegality of contracts or contracts that are otherwise contrary to public policy, the general rule is that the loss will lie where it falls. In other words, the courts will not aid any of the parties since to do so would be to enforce a contract that has already been adjudged to be against the greater public good. The issue thus is the enforceability of such contracts and inaction appears to be the order of the day. There are exceptions to this general rule which will be dealt with later. 15.3 There are two broad categories that this area is divided into: ° statutory illegality; and ° illegality at common law. 452 Chapter 15: Illegality and Public Policy Statutory illegality is as controversial as the concept of public policy. This is because there is no clear theoretical framework for it. In addition, there are difficulties when the courts are required to try and discover the legislative intention of the provisions before them. STATUTORY ILLEGALITY 15.4 Statutory illegality can only arise when there has been a contravention of the statute in question. The key focus is whether the object of the statute is only to prohibit the conduct that is the subject of the statutory penalty or is the object also to prohibit the making of such contracts. Where the legislative intention is clear on the face of the provision, there will be no need to resort to interpreting the statute to decipher the legislative intention. Accordingly, in the Professional Engineers Act (Cap 253, 1992 Rev Ed), s 11 provides that: Subject to the provisions of this Act, no person shall employ as a professional engineer any person who is not a registered professional engineer. The section thus prohibits the engaging of persons as professional engineers who have not been duly registered. 15.5 Where a statute expressly prohibits certain contracts and contracts of such nature are entered into, then the result will clearly be an illegal contract which is unenforceable and the innocence of either or both parties would be irrelevant. An illustration of this can be found in the English Court of Appeal decision of Phoenix General Insurance Co of Greece SA v Administratia Asiguralor de Stat (1988). By statute, proper authorisation was required before a person could carry on the insurance business. There were criminal sanctions for non-compliance. It was held that the statute prohibited the conduct of insurance contracts without authorisation. It is important to note that the prohibition affected both the business of effecting contracts of insurance and the business of carrying out contracts of insurance. It is thus both the contracts and the performance of them that are prohibited by statute. 15.6 Another interesting case illustrating an express prohibition by statute is Re Mahmoud and Ispahani (1921). The Defence of the Realm Regulations prohibited the sale or purchase of linseed oil without a licence. The seller 453 Principles of Singapore Business Law had the requisite licence and was assured by the buyer that he, the buyer, had the licence as well. The buyer subsequently refused to accept delivery and pleaded that his lack of licence rendered the contract illegal. It was held that the language of the statute was plain irrespective of guilt or innocence, knowledge or otherwise; a contract for the purchase of linseed oil without the necessary licence was prohibited. Unfair though it may appear from the innocent party’s perspective, the general rule requires that the courts are not to enforce an illegal contract. The innocent party could have found a way of getting what he wanted without relying on illegality but if he insists on relying on the illegal contract to found his action, he will meet a dead end. 15.7 Where the legislative intention is not clear from the plain wording of the relevant provision, statutory interpretation is necessary to discern if the provision impliedly prohibits the contract. This will entail a consideration of the objective(s) for introducing the provision in the first place, that is, the mischief for which the provision is to prevent. An example of an implied prohibition by a statute can be found in the case of Cope v Rowlands (1836). Statute made it an offence for persons to act as a broker in the City of London without a licence, with a penalty of £25 for such offences. The plaintiff sued the defendant for his services as a broker although he did not have the necessary licence. Parke, B held (at p 159): The legislature had in view, as one object, the benefits and security of the public in those important transactions which are negotiated by brokers. The clause, therefore, which imposes a penalty, must be taken … to imply a prohibition of all unadmitted persons to act as brokers, and consequently to prohibit, by necessary inference, all contracts which such persons make for compensation to themselves for so acting. However, as observed by Kerr LJ (at p 273) in the Phoenix General Insurance: [W]here a statute merely prohibits one party from entering into a contract without authority and/or imposes a penalty on him if he does … it does not follow that the contract itself is impliedly prohibited so as to render it illegal and void. Whether or not the statute has this effect depends on considerations of public policy in the light of the mischief which the statute is designed to prevent, its language, scope and purpose, the consequences for the innocent party, and any other relevant consideration. 454 Chapter 15: Illegality and Public Policy Box 15.1 Reflecting on the law Contracts illegal per se vs contracts illegal in performance — a useful distinction? There is a distinction that is sometimes made between contracts which are illegal per se and contracts which are lawful but performed in a way that attracts criminal liability. Where a contract is illegal per se both parties will be implicated with the wrongdoing. On the other hand, if a contract is performed in an illegal manner it is not always the case that both parties will be implicated. An example of the former can be found in s 3 Residential Property Act (Cap 274, 2009 Rev Ed) where the statute expressly forbids foreigners from purchasing residential property without the necessary approvals and expressly declares agreements in contravention of the Act void (see Cheng Mun Siah v Tan Nam Sui (1980–1981) and Lim Xue Shan and another v Ong Kim Cheong (1990)). Often it is the case that a statute may require a licence or permit before certain contracts can be performed and it is silent on the effect of non-compliance on the contractual rights of parties to such agreements. An example will be a permit to commence building works which is required by legislation (see, eg, s 5 Building Control Act (Cap 29, 1999 Rev Ed)). The commencement of building works without the requisite permit may not render the contract illegal. However, in performing the contract without the said permit the statute will be contravened. The question that arises is whether the statute prohibited the making of such contracts or whether an otherwise lawful contract is illegal because its performance involves the breach of a statute. The difficulty with the distinction between contracts which are illegal per se and those that are legal but performed in a way that attracts criminal liability becomes patent with this example. The approach neglects the central issue of whether the legislature intended that such contracts should be prohibited, bearing in mind that even if the legislature did not intend such a result directly that there may be public policy considerations which may still render the contract illegal. Taking the example above, in the case where there is a contractual term to commence building works without a permit, the contract would be illegal. Situations Where There is No Statutory Prohibition 15.8 As a general rule, in cases where there are no prohibitions affecting a contract, the contract is enforceable. This would be the situation if the statute merely imposes a penalty and does not deprive the parties of their contractual rights. In which case, both parties would be entitled to sue on the contract. In St John Shipping Corporation v Joseph Rank Ltd (1957), in contravention of the Merchant Shipping (Safety and Load Line Conventions) Act 1932 a ship was overloaded. The master of the ship was prosecuted, convicted and fined. The defendant and another cargo owner withheld a sum equivalent to the freight on the additional cargo by which the ship had been overloaded. The plaintiff 455 Principles of Singapore Business Law sued for the balance of the freight. The Court of Appeal held that the plaintiff could recover the freight in full because all the statute did was to impose a criminal penalty for overloading. It did not render the contract unenforceable. 15.9 The exception to the general rule focuses on the intention or knowledge of one or both of the contracting parties. The exception applies if both parties enter into a contract with the intention of contravening a statute. The consequence of the “guilty intent” of both parties is that neither of them will be able to enforce the contract. The English Court of Appeal decision of Ashmore, Benson, Pease & Co Ltd v AV Dawson Ltd (1973) conveys the last point clearly. The plaintiff manufactured two 25-ton loads of goods and engaged the defendants, a small road haulage firm, to transport them to the port of shipment. The plaintiff company’s transport manager was present when the goods were being loaded. He witnessed the contravention of s 64(2) Road Traffic Act 1960, which specified that the maximum weight laden was not to exceed 30 tons for the lorry, but did not object in any way. On the journey, the lorry overturned and the plaintiff ’s goods were damaged. The defendants claimed that the transportation contract was void for illegality. It was held that although the contract was lawful in its inception, it had been performed in an unlawful manner. Lord Denning said (at p 832): Not only did the plaintiff ’s transport manager know of the illegality. He participated in it by sanctioning the loading of the vehicle with a load in excess of the regulations. That participation in the illegal performance of the contract debars [the plaintiff] from suing [the defendant] on it or suing [the defendant] for negligence. 15.10 If only one party has such an intention or knowledge, then that party, being the guilty party, will be not be able to enforce it. To actually become the “guilty party”, some degree of participation is necessary. As shown in the case of Archbolds (Freightage) Ltd v S Spanglett Ltd (1961), the innocent party will be able to sue successfully. In Archbolds v Spanglett, the plaintiffs engaged the defendants to carry their goods, namely whiskey, from Leeds to London. Unknown to the plaintiffs, the defendants did not have the necessary licence. The goods were stolen while they were being transported. The plaintiffs’ action for damages for breach of contract succeeded because the contract was legal when formed and although it was performed in an illegal manner by the defendants, the plaintiffs were unaware and did not participate in the illegality. 456 Chapter 15: Illegality and Public Policy ILLEGALITY AT COMMON LAW Introduction 15.11 The previous segment dealt with statutory illegality, where the source of the illegality is a statute enacted by parliament and on a true construction of the statute it prohibits the making of such contracts or, exceptionally, where parties or a party enter into a contract with the intention of contravening a statute. In contrast, in this segment, the source of the illegality lies in general principles propounded in case law which have evolved through decisions of judges and is generally referred to as the common law. In such cases, the principles of the illegality have been identified in case law as being capable of tainting the contract, and it is important to realise that it may apply in the context of a prohibition even in a statute. Types of Common Law Illegality 15.12 The following are the various heads of public policy developed by the common law: ° Contracts prejudicial to administration of justice. Examples under this category can be found in contracts to either stifle prosecution or perhaps to give false evidence in a court of law. ° Contracts to deceive public authorities. In Alexander v Rayson (1936), the plaintiff leased a flat to the defendant. There were two separate agreements. The first agreement was a lease for the sum of £450 per annum, including services to be rendered by the plaintiff. The second agreement was for the same services as the first agreement but for the sum of £750 per annum. The defendant refused to pay an instalment due under the agreements and argued that the object of the agreements was to deceive the local authority into reducing the rateable value of the flat by only disclosing the lease document to them. It was held that the agreements were for an illegal purpose and the plaintiff could not enforce either of them. ° Contracts to oust jurisdiction of the courts. This is where a contract or agreement deprives a party of the right to seek the redress of the courts. An example would be a separation agreement in which a wife undertakes not to apply for maintenance. In Hyman v Hyman (1929), it was held that the courts’ power to award maintenance could not be ousted by such an agreement. 457 Principles of Singapore Business Law ° Contracts to commit (or involving) a crime, tort or fraud. A contract to commit a crime is clearly illegal. A crime is also committed at the time the agreement takes place as it amounts to a criminal conspiracy such as for example, to commit a murder. A contract to commit a civil wrong or tort can also be illegal. In the case of fraud, it has both criminal and civil consequences. So, in Taylor v Bhail (1996), the headmaster of a school agreed with a builder that the builder will submit an inflated estimate for repair works necessitated by storm damage so as to defraud the insurance company. The builder completed the work and sued for payment of the balance. The Court of Appeal held that the contract was tainted by fraud. The builder could not recover any further payment, nor could the headmaster recover what he had paid out. ° Contracts prejudicial to public safety. An apparent example under this segment will be trading with the enemy. ° Contracts promoting sexual immorality. In Pearce v Brooks (1866), the plaintiffs hired out an ornamental brougham to the defendant woman for the purposes of prostitution. The plaintiffs’ cause of action for the recovery of sums due for the hire failed as they were fully aware of the defendant’s intention to use the brougham for an illegal purpose. ° Contracts which are liable to corrupt public life. An agreement to buy public office or to get a person of influence in the civil service to use his position to obtain benefits would come within this category. 15.13 In many of the cases falling within the various heads mentioned above, there was no statute that had been contravened. Instead these agreements were for an illegal purpose and they were unenforceable for that reason. CONSEQUENCES OR EFFECTS OF ILLEGALITY Introduction 15.14 As mentioned earlier, the general rule is that no action will arise from a wrong done. It offends the dignity of the court to have anything to do with a contract tainted by illegality or one that is contrary to public policy. In fact, the general rule could, arguably, aim to deter parties from entering into illegal contracts. Accordingly, such contracts are unenforceable and the loss lies where it falls. The significance of the general rule is also that a 458 Chapter 15: Illegality and Public Policy party trying to claim any rights, including the right to damages for breach of contract, will be unsuccessful. The consequences and remedies that normally follow the non-performance by one of the parties to the contract will not apply. 15.15 Having said that, there are circumstances under which money paid or property transferred under an illegal contract can be recovered. Benefits in some form or other may have passed under the illegal contract and really here we are dealing with a form of restitution. Recovery under this latter category is clearly restrictive as there is no question of recovering the full contractual losses. Recovery of Benefits Conferred Under Illegal Contract (Restitution) 15.16 The general rule is that money paid or property transferred under an illegal contract is not recoverable. The Latin maxim “in pari delicto potior est conditio defendentis” applies. Thus, where both parties are at fault the law favours the defendant and the result is that gains and losses remain where they have accrued or fallen. It signifies the law’s refusal to grant any assistance whatsoever. There are several exceptions to the general rule. (1) Recovery where parties are not in pari delicto 15.17 This exception applies where one of the parties is deemed, in law, not to be equally at fault. There are three examples where it could apply. First, the parties are certainly not in pari delicto when one party is guilty of fraud. In Hughes v Liverpool Victoria Legal Friendly Society (1916), the plaintiff took out a life insurance policy, on the advice of the insurance agent, on the life of a person in whom he had no insurable interest. The contract was therefore illegal. It was held that the plaintiff could recover the money he paid as he entered into the contract as a result of a fraudulent misrepresentation. 15.18 Second, the parties cannot be said to be equally at fault if there has been oppression by one party on the other. In Kiriri Cotton Co Ltd v Ranchhoddas Keshavji Dewani (1960), the plaintiff paid his landlord, who was committing an offence by accepting it, a premium for a flat. The statute that rendered such contracts illegal, namely the Rent Restriction Ordinance, did not provide that such premiums were recoverable. It was held that the plaintiff was not to blame for evading the legislation but his landlord was. The landlord was 459 Principles of Singapore Business Law using his property rights to exploit those in need of a roof over their heads and in that sense there was oppression. 15.19 As Lord Mansfield said (at p 792) in Browning v Morris (1778): Where contracts or transactions are prohibited by positive statutes, for the sake of protecting one set of men from another set of men; the one from their situation and condition being liable to be oppressed and imposed upon by the other; there the parties are not in pari delicto; and in furtherance of these statutes the person injured after the transaction is finished and completed, may bring his action and defeat the contract. 15.20 Lord Mansfield provides the third example of where a statute is a class protecting statute, that is, the statute protects one group of people against another. This exception is also illustrated on the facts of the Kiriri case where the statute protects tenants from landlords who seek to obtain inflated rental. (2) Timely repudiation or repentance 15.21 This exception applies when one party repudiates in time. Before an illegal contract is performed it is open to either party to repent while the contract is still executory. In a sense, the law provides the parties with an “opportunity of repentance” and encourages the parties to pull out of the illegal contract. In the case of Taylor v Bowers (1876), the plaintiff fraudulently assigned some machinery to X to prevent it falling into the hands of his creditors. He then had several meetings with his creditors but failed to reach a settlement with them. The plaintiff then claimed the machinery from the defendant who had obtained it from X knowing of the fraudulent scheme. It was held that the plaintiff could recover the machinery as the illegal purpose had not been carried out. 15.22 In contrast is the case of Kearley v Thomson (1890). The plaintiff agreed with the defendants, a firm of solicitors, to pay them if they did not appear at his friend’s public examination, and did not oppose his friend’s discharge of bankruptcy. He paid them the money. The defendants entered into such a contractual arrangement as the bankrupt’s estate, from which their costs were to be paid, lacked the requisite funds. The defendants did not appear at the public examination. However, before the friend was discharged, the plaintiff 460 Chapter 15: Illegality and Public Policy sought to recover the money paid. It was held that the plaintiff could not recover the money because the contract was partly performed. 15.23 As demonstrated by the case of Bigos v Boustead (1951), there must be genuine repentance for this exception to apply. This was a case of statutory illegality. In contravention of a statute, the defendant agreed to supply the plaintiff with Italian currency. As security for the loan, the plaintiff deposited a share certificate with the defendant. The defendant failed to supply the Italian currency and the plaintiff sued for recovery of the certificate. It was held that the plaintiff was not entitled to succeed. The plaintiff ’s repentance was not genuine or voluntary. The plaintiff ’s change of heart was a result of the scheme having failed. (3) Recovery when plaintiff does not rely on the illegal contract 15.24 Under this category, recovery is allowed because the plaintiff relies upon a basis that is separate and independent of the illegality. There are two main categories of recovery under this particular approach: in tort and under a collateral contract. 15.25 When a person wants to assert his rights to goods, especially his rights of ownership, against a person who has the goods, that person will usually rely on the tort of conversion. For example, if A owns a car and it is stolen and sold by the thief to B, A will rely on the tort of conversion in an action against B. There are many ways in which the tort of conversion can be committed. It can be committed by doing either of the following: ° wrongfully taking possession of goods; ° wrongfully disposing of them; or ° wrongfully refusing to give them up when demanded. 15.26 In a contract of bailment, although there is the delivery of goods by A to B, the goods still belong to A. The owner is the bailor and the possessor is the bailee. A striking example of a contract of bailment is when a car is hired. In Bowmakers Ltd v Barnet Instruments Ltd (1945), it was held that in an illegal contract of bailment, the bailor/owner can recover the goods as he is relying on his proprietary rights and not on the contract of bailment. 15.27 The Court of Appeal in Strongman (1945) Ltd v Sincock (1955) allowed recovery by way of a collateral contract despite the main contract being 461 Principles of Singapore Business Law tainted by illegality. In that case, a builder carried out renovation works after being assured that the owner would obtain the necessary licences for the works. The owner refused to pay for the works which were not covered by licences and relied on the illegality of the contract. The Court of Appeal held that the assurance given by the owner that he would obtain the necessary licences gave rise to a collateral contract. The builder was thus entitled to damages for breach of the collateral contract. 15.28 The contradiction posed by this route of recovery, is the fact that if recovery is permitted by way of a collateral contract, the plaintiff would be allowed to recover what could not otherwise be recovered under the illegal contract which precludes all recovery whatsoever. The Court of Appeal stressed that only in exceptional circumstances will recovery be allowed by way of a collateral contract for failure to observe a statutory obligation. CONTRACTS IN RESTRAINT OF TRADE Introduction 15.29 Covenants in contracts in restraint of trade are very common and take many forms. Such covenants restrict the freedom of contracting parties in one way or another. Literally, restraint of trade covenants curtail the freedom of trade. However, in employment contracts, it not only attempts to prevent an employee from leaving the employment, it usually seeks to prevent the employee from working for the employer’s competitor. Employers use these covenants to protect the investment they have made in terms of training an employee. In addition, they also use it to protect other interests which include trade secrets and their clientele. In some cases, where the employee has brought in skills which are integral to the employer’s business, the employer may try to use these covenants to hold back the employee. 15.30 When faced with a covenant in restraint of trade, the courts usually bear in mind two competing public policy considerations. First, it is in the interest of society to encourage competition and such clauses are not in the interest of society generally as they prevent competition. However, it is also equally important and in the interest of society that covenants voluntarily entered into should be upheld. Initially, the courts supported the first consideration and held that all covenants in restraint of trade are absolutely void. 462 Chapter 15: Illegality and Public Policy 15.31 This approach was rather restrictive and ignored commercial practicalities, such as the fact that the salary paid may have taken into account the restrictive covenants that the employee had willingly accepted. Although it may be argued that employees very often do not have sufficient bargaining power to negotiate favourable terms in view of the restrictive clause, they are nonetheless not compelled to enter into such agreements. In fact, even though an employee has agreed to the restrictive covenants, he is not precluded from arguing later that the covenants are restrictive (see the cases of TSC Europe (UK) Ltd v Massey (1999) and National Aerated Water Co Pte Ltd v Monarch Co Inc (2000)). However, in the situation where the employee proposes a period of restraint in return for a not inconsiderable payment, it has been held that the employee cannot argue later that the duration was unreasonable especially where his entitlement to receive the payment is in return for the clause in restraint of trade (See Man Financial (S) Pte Ltd (formerly known as E D & F Man International (S) Pte Ltd) v Wong Bark Chuan David (2007) (“Man Financial”)). 15.32 In addition to the points made earlier, it is also in society’s interest to encourage the sale and purchase of businesses and the transfer of knowledge from employers to employees. These considerations required recognition by the courts that certain interests can be protected through the voluntary agreement of the parties. Box 15.2 Reflecting on the law Nature of “restraint of trade” clauses “Restraint of trade” clauses are obligations undertaken voluntarily and are not themselves illegal in the sense that an offence has been committed by having such undertakings. Such clauses necessarily involve some element of “restraint” on the part of the employee. The employer will seek to enforce the covenants in “restraint” by requiring the ex-employee to observe the restraining obligations he had undertaken by, for example, not working for competitors. The employee will try and argue that it should not be enforced on the ground of illegality in relation to some aspect of the clause which is against the interest of the public. Hence, the illegality hinges on public policy considerations, the freedom to trade being at the crux of it. 463 Principles of Singapore Business Law Validity of “Restraint of Trade” Clause 15.33 The validity of a “restraint of trade” clause hinges on two requirements. First, there must be a legitimate interest that the party relying on the clause is seeking to protect. Second, the clause has to be reasonable, having regard to the interest of the parties and the public generally. Accordingly, Lord Macnaghten in the significant House of Lords decision in Nordenfelt v Maxim Nordenfelt Guns and Ammunition Co (1894), set the balance between the competing interests in perspective when he said (at p 565): The public have an interest in every person’s carrying on his trade freely: so has the individual. All interference with individual liberty of action in trading, and all restraints of trade of themselves, if there is nothing more, are contrary to public policy, and therefore void. This is the general rule. But there are exceptions: restraints of trade … may be justified by the special circumstances of the particular case. It is a sufficient justification, and indeed it is the only justification, if the restriction is reasonable — reasonable, that is, in reference to the interests of the parties concerned and reasonable in reference to the interests of the public, so framed and so guarded as to afford adequate protection to the party in whose favour it is imposed, while at the same time it is in no way injurious to the public. 15.34 In view of the Nordenfelt decision, the general rule is that all covenants in restraint of trade are prima facie void and unenforceable, and may only be valid if it is reasonable both in the interests of the parties and in the interests of the public. The measure of reasonableness is viewed from the standpoint of both the public and the parties. 15.35 The legal test of whether a restrictive covenant is in unreasonable restraint of trade is well settled by the Singapore Court of Appeal decision of Man Financial and can be summarised as follows: 1. The court conducts a preliminary inquiry as to whether or not there was a legitimate proprietary interest to be protected by the restrictive covenant, over and above the mere protection of the employer from competition by way of a bare and blatant restriction of the freedom to trade ((at [79]); See also the Court of Appeal decisions of CLAAS 464 Chapter 15: Illegality and Public Policy Medical Centre Pte Ltd v Ng Boon Ching (2010) (at [44]) and Smile Inc Dental Surgeons Pte Ltd v Lui Andrew Stewart (2012) (“SMILE”) (at [19]). 2. If the answer to the preliminary inquiry is affirmative, then the court applies the twin tests of reasonableness (at [70]) enunciated in Nordenfelt: ii. is the restrictive covenant reasonable in reference to the interests of the parties; and ii. is the restrictive covenant reasonable in reference to the interests of the public. 15.36 In SMILE, Phang JA (at [19]) made it clear that the application of twin tests of reasonableness assumes that there is a legitimate proprietary interest meriting protection in principle in the first place, and as such, the court will enforce the covenant only if it goes no further than necessary to protect legitimate proprietary interests. 15.37 In line with the general rule, that such covenants are prima facie unenforceable, the burden of proof is on the party seeking to rely upon the covenant in restraint of trade to show that the covenant was reasonable at the time at which the contract was made. Although there are several factors that influence a court’s decision on the reasonableness of such covenants it is important to bear in mind that none of them are entirely conclusive. For example, the courts do take into consideration the expanse that the restraint covers in terms of geographical area and the duration of time. 15.38 In terms of geographical range, Singapore is unique and this was recognised by G P Selvam in Heller Factoring (Singapore) Ltd v Ng Tong Yang (1998) when he said (at [22]): [A]s to the geographical limit, the area must be no more than adequate for the protection of the plaintiffs. This in effect means the area where the plaintiffs’ customers are situated. In the case of Singapore, a small country, a prohibition applicable for the whole country would be necessary in the context of the factoring industry. Customers would be spread all over the island and it would be well nigh impossible to specify pockets to which the clause should be restricted. Further, a competitor of the plaintiffs could be situate anywhere in Singapore. For these reasons the space limit is also eminently reasonable. 465 Principles of Singapore Business Law Employment Contracts 15.39 There have been several recent decisions of importance on restrictive covenants relating to employment contracts. SMILE is the most recent Court of Appeal decision and Phang JA provides a seminal decision in which he states that the courts adopt a stricter approach when considering restrictive covenants in the context of a contract of employment as compared to a sale of a business. This is because of the differing nature of the legitimate proprietary interest to be protected and also because of the greater inequality of bargaining power in an employment context (see Man Financial (at [48]) and SMILE (at [20])). In addition, the public policy reason in construing restrictive covenants more strictly in the employment context is that “every man shall be at liberty to work for himself, and shall not be at liberty to deprive himself or the state of his labour, skill, or talent, by any contract that he enters into.” (see Herbert Morris Ltd v Saxelby (1916) (at p 701) and SMILE (at [21])). 15.40 When an employee leaves an employer, the employer would have obtained whatever it has paid for in terms of the employee’s services (see Man Financial (at [48]) and SMILE (at [20])). Therefore, in order to justify a covenant in restraint of trade, the employer must have some proprietary interest that requires protection. Trade secrets and business connections are clearly owned by the employer and are considered legitimate interests that an employer can protect with a suitably drafted covenant. The maintenance of a stable workforce can be a legitimate interest that an employer may seek to protect with a restrictive clause (see Man Financial (at [121])). In the context of business connections or clientele, the employee must have personal knowledge of and influence over the customers of the employer (see Faccenda Chicken Ltd v Fowler (1987)). However, where an employee has acquired additional skill and knowledge of a trade or profession in the course of his employment it belongs to the employee and the use of it will be extremely difficult to inhibit by an employer (see Mason v Provident Clothing and Supply Co Ltd (1913)). 15.41 In the leading House of Lords decision of Mason v Provident Clothing and Supply Co Ltd (1913), the covenant provided that the employee, a canvasser, will not work in any similar business for three years within 25 miles of London. It was held that the employee’s duties were confined to Islington and that the clause was wider than reasonably necessary to protect the 466 Chapter 15: Illegality and Public Policy employer’s legitimate interest. It was stated that the success of the employee was predominantly due to the employee’s natural gifts and that the training provided by the employer was of lesser significance. See also the similar case of Herbert Morris Ltd v Saxelby (1916) where the restrictive covenant was also wider than necessary for the protection of the employer’s interest. 15.42 In the House of Lords decision of Fitch v Dewes (1921), a solicitor’s managing clerk covenanted that he would not be engaged in solicitors’ work within seven miles of the town hall in the place where he worked. The House upheld the covenant as being reasonable, even though it was for an unlimited duration. Clearly, the severely restricted scope of the clause in terms of locality was a significant factor that influenced their decision. 15.43 In Buckman Laboratories (Asia) Pte Ltd v Lee Wei Hoong (1999), the Buckman Group dealt in speciality chemicals used by many industrial sectors including industries dealing in pulp and paper, leather and water treatment. Lee was employed for four years as a technical services specialist mainly for specialty chemicals for the pulp and paper industry in Singapore. His employment contract contained a “restraint of trade” clause. When Lee left Buckman in 1998, he joined EEC International, one of three global competitors of Buckman in respect of specialty chemicals for the pulp and paper industry. Buckman sought an injunction to enforce the “restraint of trade” covenant. The Singapore High Court refused to grant the injunction as the clause was too wide. The legitimate interest was not specified and the width of the clause led to the inference that it was intended primarily to stifle competition. The geographical scope of the clause was also too wide as it sought to protect not only Buckman’s actual but potential business in regions where they were merely trying to establish a permanent presence. Buckman should have limited the business scope of the clause to the pulp and paper industry. Instead the clause covered all products and services of Buckman and associated companies. To determine the interest intended to be protected by a restraint of trade covenant, the court must first of all construe the contractual wording to determine whether it indicates what that interest is. Where the wording of a restriction does not specifically state the interest of the employer which it is intended to protect, the court is entitled to look both at the wording and the surrounding circumstances for the purpose of ascertaining that interest by reference to what appear to have been the intentions of the parties. But if the 467 Principles of Singapore Business Law employer states specifically what interest the covenant is intended to protect, the employer cannot thereafter seek to justify it by reference to a separate interest which has not been specified. 15.44 In Stratech Systems Ltd v Nyam Chiu Shin (alias Yan Qiuxin) and others (2005), the Singapore Court of Appeal found that the court would never uphold a restrictive covenant which served only to protect an employer from competition from a former employee. There had to be some subject matter which an employer could legitimately protect by a restrictive covenant. 15.45 In Man Financial, the High Court was faced with a post-employment termination agreement which contained restrictive clauses. The plaintiff was the managing director and chief executive officer of the defendant company. He was asked to resign and placed on garden leave for three months from 13 June 2005. The plaintiff and defendant entered into a termination agreement. The termination agreement provided for the plaintiff to receive benefits if he did not breach the terms of the agreement, which included restrictive covenants. The defendant refused to pay the benefits on the ground that the plaintiff had breached certain restrictive covenants. Clause C.1 prohibited him from soliciting the employment of employees of the defendant and Clause C.3 prohibited him from participating in or rendering advice to a competitor which the court found that he had breached. However, the High Court held that the defendant had not discharged their burden of establishing the interests that were meant to be protected by the restrictive covenants and the reasonableness of the same. As such, the plaintiff was held to be entitled to receive the benefit in terms of compensation under the agreement. The defendant appealed. In a significant judgment by Phang JA, the Court of Appeal allowed the appeal and found, inter alia, as follows: ° Generally, the doctrine of restraint of trade applies to settlement agreements. However, the doctrine would not apply to settlement agreements when: (1) the settlement agreement related to the settlement of a prior dispute over a clause in restraint of trade in an existing contract; and (2) the settlement itself was not tainted by one or more vitiating factors (at [65]). ° Given the nature of the appellant’s business, there was a legitimate proprietary interest in the appellant maintaining a stable, trained workforce and that was a fortiori the case in the light of the respondent’s 468 Chapter 15: Illegality and Public Policy access to and use of confidential knowledge gained in the course of his employment (at [136]). ° Clause C.1 was reasonable as between the parties. The terms in the Termination Agreement (of which Clause C.1 was an integral part) were arrived at in earnest and in good faith. Significantly, it was the respondent who had proposed the period of seven months for the covenants to last as a gesture of goodwill. It was therefore not open to the respondent to later argue that the seven-month duration was unreasonable especially since he received a not inconsiderable consideration which he was clearly not entitled to otherwise from a legal point of view (at [137] to [139] and [142]). ° Clause C.1 was reasonable both in the interests of the parties as well as in the interests of the public and as such valid. A breach of Clause C.1 entitles the appellant to terminate the contract. Therefore, the respondent could not enforce his claim for the compensation under the Termination Agreement (at [192]). ° The Court of Appeal also observed that Clause C.3 could not be invoked to disentitle the respondent from claiming the compensation. There was insufficient evidence adduced by the appellant to demonstrate an underlying legitimate proprietary interest which Clause C.3 was intended to protect. Clause C.3 was also far too wide, particularly with regard to the area covered (at [15]). 15.46 In the context of the medical practitioners (including dentists), solicitors and accountants, there is ample authority to show that a legitimate proprietary interest exists in the form of “special and intimate knowledge of the patients of the business”. (See Routh v Jones (1947) at p 181E-H and SMILE (at [22] and [24]); Robin M Bridge v Deacons (1984) at pp 719H–720A; and Campbell v Park (1954) at [10], respectively). 15.47 In the interesting recent local decision of SMILE, Dr Lui was employed as an associate dental surgeon for Smile Inc Dental Surgeons Pte Ltd (“Smile Clinic”) located at the Forum Shopping Mall. Dr Lui and another dentist colleague, Dr Gareth Pearson, accounted for 80 per cent of the patients at the said clinic. On 7 January 2009, Dr Lui incorporated Dental Essence Pte Ltd (“Dental Essence”) while still employed by Smile Clinic. On 27 February 2009, Dr Lui entered into a one-year tenancy for premises only five minutes 469 Principles of Singapore Business Law away from Smile Clinic and resigned on that same day. On 19 March 2009, Dr Pearson joined Dental Essence as a shareholder and dentist. Smile Clinic agreed that Dr Lui’s last day of work would be 18 April 2009. Smile Clinic experienced a significant drop in its monthly income after Dr Lui left and received numerous requests from its patients for their dental records. Smile Clinic later discovered that many of its patients became patients of Dental Essence and closed down its branch in September 2009. It commenced action against Dr Lui on 8 October 2009 basing its case on, inter alia, Dr Lui’s breach of the following express terms (Clauses 23, 24 and 25) of their Employment Contract: 23. Upon leaving The Practice, Dr. Lui will not seek to damage or injure The Practice’s reputation or to canvass, solicit or procure any of The Practice’s patients for himself or any other persons. 24. In the event that Dr. Lui leaves (whether resignation or dismissal) The Practice, Dr. Lui shall not practice within a 3 kilometre radius distance from the Smile Inc. Dental Surgeons practices at Suntec City Mall and from Forum The Shopping Mall, and a 3 kilometre radius from any other new Smile Inc. Dental Surgeons practices that have been set up before and during his cessation of work at The Practice. 25. In the event that Dr. Lui leaves (whether resignation or dismissal) The Practice, existing and new corporate and non-corporate contracts, as well as existing and new patients, shall remain with The Practice. Patient data and records, office data and records and computer software programmes and data shall remain the property of The Practice, and such records, in full or in part, shall not be copied manually, electronically or otherwise be removed from the Practice. 15.48 The trial judge, Justice Woo Bih Li, found that Dr Lui had breached the Restrictive Covenants in Clauses 24 and 25 but as there was no evidence of solicitation, there was no breach of Clause 23. However, the learned judge also found that the Restrictive Covenants were in unreasonable restraint of trade and therefore void and unenforceable, mainly because they were unlimited in duration. The Court of Appeal affirmed this reasoning when Phang JA stated (at [29]): A restraint of trade that operates for an indefinite period of time is (absent the most exceptional circumstances, which are not present in this case) necessarily void and unenforceable … 470 Chapter 15: Illegality and Public Policy 15.49 Yet another recent local decision turned on the doctrine of restraint of trade. In Mano Vikrant Singh v Cargill TSF Asia Pte Ltd (2012), the Court of Appeal in another seminal decision dealt with a covenant in restraint of trade in a Forfeiture Provision which was contained in an Incentive Award given at the end of each financial year. The covenant operated to restrain Mr Singh from leaving Cargill to join a competitor, by way of a threat to forfeit a not insubstantial financial reward which already belonged to Mr Singh if he joined a competitor. Although the learned Justice of Appeal found that the doctrine of restraint of trade applied to the terms and conditions of the Incentive Award which included the Forfeiture Provision, he also found that the Forfeiture Provision had taken away a right or entitlement that had already vested in Mr Singh and, hence, constituted an unreasonable restraint of trade. 15.50 In order for an employer to rely on restrictive covenants in a contract he has to establish a valid interest. The courts have recognised that trade secrets, business connections and the maintenance of a stable workforce can form the basis of legitimate interests of an employer which he may seek to protect. Having identified the employer’s interest in relation to a particular employee, the employer will be able to protect his interest with a clause that is reasonable as between the employer and employee and in the interest of the public. 15.51 Often employers cannot resist the temptation of inserting the most stringent of restraint of trade clauses in their favour. Employees rarely consider the consequences of leaving the employer at the time when they are about to be employed and accept such clauses rather than risk losing the opportunity presented by the potential employment. Such stringent clauses may have some deterrent effect on some of the employees who have signed contracts with them. However, employers will be well advised to adopt a less stringent approach by using a reasonable clause which can be enforced bearing in mind that a clause intended to operate for an indefinite period of time would, barring the most exceptional circumstances, be considered to be unreasonable as between an employer and employee. 15.52 Clauses that operate to forfeit benefits or rights that have accrued to an employee in return for the employee undertaking covenants in restraint of trade would be very difficult to enforce. Employers seeking to introduce such clauses may want to introduce some new element of benefit to the employee 471 Principles of Singapore Business Law in return for a clause which is reasonable as between the parties and in the interest of the public. The new element need not necessarily be monetary, it could be a new position or additional paid leave or generally better terms of employment. Sale of a Business 15.53 Restraint of trade clauses in contracts for the sale of a business are more readily upheld by the courts than in employment contracts. Sale-and-purchase agreements that deal with a business will usually include a restrictive covenant protecting the goodwill of the business. In addition, there is also more likely to be equality of bargaining power between the vendor and purchaser in the sale of business. As with “restraint of trade” clauses that are found in employment contracts, the purchaser of a business must be protecting a legitimate proprietary interest which will generally include the goodwill of the business. 15.54 Consequently, in Vancouver Malt and Sake Brewing Co Ltd v Vancouver Breweries Ltd (1934), the sellers held a brewer’s licence which entitled them to brew beer in their premises. In fact, they only brewed sake (Japanese wine). The buyers held a similar licence and did engage in brewing beer. The sellers purported to sell the goodwill of their brewer’s licence, except in relation to sake, but agreed not to manufacture beer for the next 15 years. It was held since the sellers were not brewers of beer: they had no proprietary interests to transfer under the contract to which the restraint of trade could apply. Other Categories 15.55 There are other categories which are outside the scope of this chapter. One worthy of mention is the case where there is extreme inequality between the parties. The case most often cited is the House of Lords decision in A Schroeder Music Publishing Co Ltd v Macaulay (1974). The plaintiff, an unknown song writer at that time, entered into a standard form contract with the defendants, who were music publishers. The agreement was extremely unfair and totally unfavourable to the plaintiff. The plaintiff assigned full copyright of his existing works and in his future works for the next five years. The five years was to be extended to ten if his royalties 472 Chapter 15: Illegality and Public Policy exceeded £5,000. The defendants on the other hand had no corresponding obligations to develop the plaintiff ’s works. If they did not do so, the plaintiff could not do anything even after he had terminated the contract. The House of Lords held that the agreement was contrary to public policy and thus void. 15.56 Another category is the solus agreement or the exclusive purchasing agreement. By such an agreement, a retailer (garage owner) undertakes, amongst others, to purchase motor spirit for a specified period from the wholesaler and not to purchase motor spirit from any other wholesaler usually in return for a loan from the wholesaler to finance the purchase or development of the garage premises. In Esso Petroleum Co Ltd v Harper’s Garage (Stourport) Ltd (1968), the defendants owned two garages and entered into solus agreements with the plaintiff. They agreed to buy all their fuel requirements from the plaintiff for four years and five months for one garage and for 21 years for the other garage (there was a 21-year mortgage to the plaintiff in return for a loan of £7,000 in relation to this garage). They also agreed that if they sold the garages, they would procure from the buyer similar solus agreements. In addition, they had agreed to keep the garage open at all reasonable hours. The House of Lords held that both agreements were contracts in restraint of trade. They also held that the contract with the tie for less than five years was reasonable, while the other for 21 years was unreasonable and unenforceable. The tie of less than five years was found to be reasonable and adequate in protecting the plaintiff ’s legitimate interest of maintaining a stable system of distribution. The tie of 21 years went beyond any period necessary to protect the legitimate interest of the plaintiff. Apart from the loan the garage owner appears to get no greater advantage from the longer tie than the five-year tie. The plaintiff failed to establish some advantage to them for which a shorter period would not have been adequate. 15.57 However, in Alec Lobb (Garages) Ltd v Total Oil (Great Britain) Ltd (1985), the Court of Appeal upheld as reasonable a tie for 21 years. It was found, inter alia, that the plaintiff had received £35,000 for the tie, something which was undoubtedly beneficial and that there was a clause that allowed the plaintiff to terminate the tie after seven years. Therefore, it is a question of looking at all the terms in the agreement and the factual matrix to determine the enforceability of a solus agreement. 473 Principles of Singapore Business Law SEVERANCE Introduction 15.58 The doctrine of severance is used to save a contract which would otherwise be illegal or contrary to public policy, by excising or cutting away the illegal portion. Deletion could be of whole terms or clauses or alternatively, of portions within clauses, if appropriate. Man Financial recognised two forms of severance of contractual terms (at [126]): (1) severance of entire or whole clauses in a contract; and (2) severance via the “blue pencil test”. Severance of Entire Clauses 15.59 In order to remove an entire covenant, the test that is applied is whether the covenants in restraint of trade constitute the whole or main consideration for the promise sought to be enforced. If that is not the case, then the doctrine of severance may be applied. A remarkable example of the former position can be found in the case of Wyatt v Kreglinger & Fernau (1933). Here, a retired employee was given a pension on the basis that after he retired he was at liberty to engage in any other trade except the wool trade which if he did the pension would cease. The Court of Appeal held that the former employee was not entitled to the arrears of the pension as he had provided no consideration for the promise except his agreement to or performance of an invalid provision in restraint of trade. Severance within Covenants: “Blue Pencil Test” 15.60 Severance of portions of a covenant is also possible in order to save it. The general guideline is that such excision is permissible so long as the “blue pencil” running through and striking out the objectionable words in the covenant concerned does not alter the meaning of the covenant and does not “mutilate” the covenant to the point where it does not make any sense. Chao Hick Tin JA in CLAAS Medical Centre Pte Ltd v Ng Boon Ching (2010) clarified (at [70]) what is meant by “not altering the meaning of the covenant” as follows: … “not altering the meaning” does not mean that the original version of the clause and the modified clause (after running the blue pencil through) must mean the same. … The phrase “not altering the meaning” 474 Chapter 15: Illegality and Public Policy just means not altering the sense of what remains of the clause after running the blue pencil through. All it means is that the obnoxious portion must be capable of being removed without the necessity of adding to or modifying the wording of what remains … 15.61 A striking example of the application of the doctrine of severance can be found in the English decision of Goldsoll v Goldman (1915). In that case, the seller was a London dealer in imitation jewellery. On selling the business, he covenanted not to compete with the buyer as “a dealer in real or imitation jewellery in … any part of the United Kingdom … the United States of America, Russia or Spain”. The covenant was clearly unreasonable in extending the restraint to real jewellery and to competition outside the United Kingdom. It was held that the words “real or” and the listed places outside the United Kingdom could be struck out leaving only a reasonable clause which could be enforced. 15.62 “Cascading clauses” have originated in Australia in order to take advantage of the doctrine of severance and the use of the “blue pencil” test. Such clauses provide for a variety of durations or geographical scopes. These clauses have been held to be valid by the New South Wales Court of Appeal decision in Hanna v OAMPS Insurance Brokers Ltd (2010). As stated in SMILE (at [31]), such cascading clauses are engineered specifically to accommodate the “blue pencil” test, in order that the court may strike out provisions for, for example, unreasonably long durations of restraint, whilst preserving the restrictive covenant concerned if at least one of the durations passes the tests of reasonableness. 15.63 However, it may be argued that the cascading clauses are conflicting to the extent that they fail to provide a clear basis on which agreement had been reached by the parties on the nature and duration of a restrictive covenant. Applying the doctrine of severance and using the blue pencil test would give the employer the benefit of enforcing one of the covenants in restraint of trade even though the employee did not know which one was applicable to their contract. In that regard, if any of the cascading clauses are to be enforced, it is arguable that the clause least favourable to the employer should apply so that the employer does not receive the benefit of the ambiguity he has created with the contrasting clauses on the same issue. 475 Chapter 16 Performance, Breach and Agreement 16.1 Introduction 16.2 16.3 16.4 16.5–16.6 16.7–16.8 16.9–16.16 Discharge by Performance Strict and Relative Obligations Precise Performance and De Minimis Defects Personal Obligations or Vicarious Performance Alternative Modes of Performance Time of Performance 16.17 16.18 16.19 16.20–16.22 16.23 16.24–16.30 16.57–16.65 Discharge by Breach of a Promissory Obligation Lawful Excuses for Breach of Contract (1) Discharge by agreement (2) Contractual provision for termination (3) Frustration of contract (4) Promissory and contingent obligations, interdependent and independent obligations Manner and Timing of Breach of Contract (1) Repudiatory breaches (“I won’t do it”) (2) Making performance impossible (“I won’t let you do it”) Effects of a Breach of Contract (1) Actual breach giving rise to right of discharge (a) Effect of election to discharge contract for actual breach (b) Effect of election to affirm contract despite an actual breach (2) Anticipatory repudiatory breach (a) Effect of election to discharge contract for anticipatory repudiatory breach (b) Effect of election to affirm contract despite an anticipatory repudiatory breach Limits on Right of Election to Affirm Contract 16.66–16.69 Partial Performance and Discharge by Breach 16.31–16.32 16.33–16.35 16.36–16.39 16.40 16.41–16.48 16.49 16.50–16.51 16.52 16.53–16.54 16.55–16.56 Principles of Singapore Business Law 16.70–16.73 16.74–16.75 16.76–16.78 16.79–16.82 16.83–16.85 Entire Obligations and Substantial Performance Apportionment Act Quantum Meruit (1) Quantum meruit on a contractual basis (2) Quantum meruit on a restitutionary basis 16.86–16.87 Severable or Divisible Obligations and Substantial Performance 478 Chapter 16: Performance, Breach and Agreement INTRODUCTION 16.1 A contract may be brought to an end or “discharged” by any one of the following means: ° full performance by all parties to a contract of their mutual rights and obligations (“discharge by performance”); ° breach of a term of the contract by one party (the “party-in-breach”) which gives the other party not in breach (the “innocent party”) the power to end the contract (“discharge by breach”); ° mutual agreement between the parties (“discharge by agreement”) or operation of a contract clause (“contractual termination”). (These two types of discharge are not usually problematic if the terms of the agreement or the termination clause have been clearly drafted. The issues encountered in such cases are therefore related to the construction of the relevant terms); or ° an unforeseeable event beyond the control of any party to the contract occurs, making performance of the contract impossible or, at the very least, essentially different from that originally envisaged by parties to the contract (“discharge by frustration”). (This type of discharge arises through no fault of any of the parties to the contract and raises distinct and complicated issues of its own which are discussed in Chapter 17.) In this chapter, we will focus on the issues encountered in contracts discharged by performance or breach. DISCHARGE BY PERFORMANCE 16.2 When all the obligations in a contract are fully and precisely performed, the contract is brought to an end or “discharged” by performance. Sometimes, this may not be obvious and the contract terms may need careful interpretation to see just what, precisely, had been contractually promised, how each contractual promise was to be performed, and when it was supposed to be performed. These are questions of construction of the contract’s terms which cannot be discussed fully in the abstract. However, in construing or interpreting the terms, note may be taken of the concerns set out in the following sections. 479 Principles of Singapore Business Law Strict and Relative Obligations 16.3 Most contracts will provide that the performance of its terms must be “strict”. A contract to paint the exterior of a house for $5,000 is only performed when the house has been painted. Painting the house part of the way will not do. On the other hand, in certain kinds of contracts, such strict terms are unrealistic, for example, in contracts to provide professional advice. Unless the advisor is also insuring the advisee against loss, the contract will most likely only require the advisor to provide advice with “reasonable care”, “due diligence” or some similar formula. Precise Performance and De Minimis Defects 16.4 “Precise” or “exact” performance is required by most contracts. As the House of Lords case of Arcos, Ltd v E A Ronaasen & Son (1933) noted (at p 479): If the written contract specifies conditions of weight, measurement and the like, those conditions must be complied with. A ton does not mean about a ton, or a yard about a yard. Still less when you descend to minute measurements does an inch mean about an inch … However, as Lord Atkin went on to note (at p 480): No doubt there may be microscopic deviations which business men and therefore lawyers will ignore … But apart from this consideration, the right view is that the conditions of the contact must be strictly performed. So some degree of “microscopic” or “de minimis” shortfall in performance will be ignored — it will be treated as if no breach had occurred at all. Personal Obligations or Vicarious Performance 16.5 Many contracts are concerned only that the contractual performance be provided by someone, not necessarily the promisor, although the promisor remains contractually liable to ensure that the contracted-for performance is provided in accordance with the contract terms. So, in a contract for renovation of a house, the house owner is usually just concerned to ensure that the renovation works are completed by someone, not necessarily the renovation contractor he has entered into the contract with, though the 480 Chapter 16: Performance, Breach and Agreement renovation contractor would still be responsible should the end-result fall below the standard and requirements set out in the contract. Where the contractual obligations are not “personal”, the renovation contractor may engage sub-contractors to handle those parts of the work which might more efficiently be “out-sourced”. In such contracts, therefore, though the promisor remains liable for any defects in the performance of his sub-contractors, the promisee cannot object to such “vicarious” performance if it otherwise causes no loss — such vicarious performance may still amount to full performance if the end-result fulfils the contracted-for standard. 16.6 However, there are some contracts where this is not the case. For example, in many situations, employment contracts are said to be “personal” as the obligations (particularly those of the employee) are undertaken in light of the unique capabilities and attributes of the employee. Usually, if an employer discovers that the work for which a particular employee has been employed to do is, in fact, being provided for by someone else, such vicarious performance would not satisfy the requirements of the contract and would amount to a breach. Alternative Modes of Performance 16.7 Some contracts provide for alternative modes of performance. For example, a contract for the painting of a house may give the painters a choice as to which brand of paint to use, “so long as it is white”. This is not problematic where the contract states clearly which party is empowered to exercise the choice. Where the contract does not, however, difficulties may arise. 16.8 Care should also be taken where it is alleged that a particular “alternative mode of performance” is the payment of a sum of money instead of the contracted-for performance. Such a clause may be construed to be a form of “liquidated damages” clause and will then be analysed as such (see Chapter 18, paras 18.10–18.12), instead of a clause permitting an alternative mode of performance. But, as the Singapore Court of Appeal has observed (in the context of a contract for the sale and purchase of an HDB flat): The court must always construe the contractual provision in question to determine whether it is intended by the parties to provide the vendor with a choice of an alternative method of performance, or whether it is intended by the parties to be a true liquidated damages clause that 481 Principles of Singapore Business Law sets out the question of damages in the event of the vendor’s nonperformance of the contract (Tay Ah Poon v Chionh Hai Guan (1997), per Karthigesu JA, at [17]). Time of Performance 16.9 Many contracts will expressly stipulate when the various contractual obligations undertaken by the contracting parties are to be performed. Where a date is set for delivery of goods sold by a vendor, the vendor must complete delivery by the end of that day to claim that he has performed his obligation. Where no date or timing for performance is expressly specified, it is likely that a term requiring performance to be provided within a reasonable time from the formation of contract will be implied. 16.10 Generally, time is not of the essence unless it has been either expressly or impliedly made to be so (ie, making the time of commencement or completion of performance a condition of the contract). If the requirement as to timing of performance is a condition such that time has been made of the essence, failure to comply with the time stipulations will entitle the other party to choose to discharge the contract for breach. If there is neither an express nor implied provision at the time of formation of contract, time may be made of the essence if, following undue delay by one party, the other party gives notice that the contract will be treated as at an end unless performance is completed within a reasonable space of time: see Charles Rickards Ltd v Oppenheim (1950) and Lee Christina v Lee Eunice (Executors of the Estate of Lee Teck Soon) (1993). 16.11 But the timing of performance may also be set by reference to other contingent events. A good example is the obligation of an insurer to pay the sum insured on a residential property in the event that it is destroyed by fire: until the property is destroyed by fire, the insurer is under no obligation to pay any such sum. The destruction of the property by fire is therefore a contingent condition. 16.12 Most contracts will impose obligations on both contracting parties. In many, there will be a sequence to the performance of these obligations. Such obligations may be interdependent and concurrent, or interdependent and consecutive. 482 Chapter 16: Performance, Breach and Agreement 16.13 For example, in a contract for the sale and purchase of a television set, the contract may provide that the purchaser’s obligation to pay will only arise when the vendor delivers the television set (“payment on delivery”). But conversely, the vendor’s obligation to deliver and give the ownership of the television set to the purchaser only arises when the purchaser pays the price. These two obligations are therefore interdependent and concurrent (in the case of the sale of goods, this is now statutorily provided for by s 28 Sale of Goods Act (Cap 393, 1999 Rev Ed). In essence, the contract for sale and purchase imposes on the vendor and purchaser concurrent (ie, simultaneous) obligations of delivery and payment. 16.14 But not all interdependent obligations are concurrent. It is open to the contracting parties to negotiate for their obligations to arise one after the other, that is, consecutively. For example, in a contract for sale and delivery of a television set which provides that the purchaser is to pay 40 per cent of the purchase price on ordering the television, and then the balance 60 per cent on delivery, the vendor’s obligation to deliver would be subsequent to the purchaser actually paying the initial 40 per cent of the purchase price. 16.15 One point remains: it should be obvious that interdependent obligations will usually require the cooperation of the other party for full performance to occur. So, a contractual promise to deliver goods sold cannot be completed unless the purchaser cooperates by taking delivery and accepting the goods. What happens if it is not possible to complete such performance because the other party refuses to cooperate? In the example given above at para 16.13, the vendor would not be entitled to claim for the price payable since he cannot complete delivery without cooperation by the purchaser. Can the vendor, however, be said to be in breach of his obligation to deliver the goods? The law would certainly be absurd if that were the case, and the doctrine of “tender of performance” prevents that. Simply put, if the other party to the contract refuses to accept performance in such cases, the promisor may plead tender as a defence to any action by the other party against him for failure to perform. As to what amounts to “tender”, briefly, the promisor must show that he has always been willing to perform his side of the contract, and has done so as far as is possible given the non-cooperation of the other party. For completeness’ sake, it should further be noted that such refusal to cooperate may also give the promisor the option to elect to discharge the contract (see para 16.36). 483 Principles of Singapore Business Law 16.16 Lastly, not all obligations are necessarily interdependent. It is open to the contracting parties to contract on the basis that their obligations should be independent of each other. The distinction between interdependent and independent obligations is further discussed at paras 16.24–16.30. DISCHARGE BY BREACH OF A PROMISSORY OBLIGATION 16.17 We have encountered the phrases “promissory” and “contingent” condition previously (see Chapter 10, para 10.38). Obviously, it is not possible to “breach” a contingent condition. So in our discussion of discharge for breach of contract, we are generally concerned with instances when a promissory condition giving rise to a promissory obligation has not been performed. Where a promissory obligation has arisen but is not performed or is performed defectively in a non-trivial fashion, Singapore law provides for a variety of legal responses and remedies, depending on the nature of the failure of performance. Lawful Excuses for Breach of Contract 16.18 If the failure of performance is not subject to any lawful excuse, the contract is said to be “breached”. In this context, “lawful excuses” may take the following forms. (1) Discharge by agreement 16.19 Just as parties are free to agree to bind themselves to a contract, they are free to negotiate the release of each other from the obligations of that contract. Contracting parties may release themselves from the obligations of the original contract by entering into a subsequent contract of release. Where each contractual party is still subject to contractual obligations which have yet to be performed, the mutual release of their outstanding obligations is generally effective under Singapore law without the need for any further formalities or any further consideration. However, where the party, who is owed the obligation in question, does not have any outstanding obligations under the original contract, the party seeking to be released from that obligation will have to provide some form of valuable consideration in exchange for the release. In the alternative, the release must be executed under seal to be effective. 484 Chapter 16: Performance, Breach and Agreement (2) Contractual provision for termination 16.20 Some kinds of contract will often provide for a mechanism for the parties to bring it to an end, even in the absence of any breach of contract. A good example may be found in employment contracts which typically provide both the employer and the employee with the option to bring the employment contract to an end by giving each other a reasonable period of notice. Such notice may be given, in most cases, as a matter of will and need not depend on there being any basis for dissatisfaction with the other party. It is also conceivable for a contract to be time-limited, for example, a contract to lease premises for a fixed term. When the period of the lease runs out, the contract simply comes to an end. 16.21 There are also instances where the contracting parties may have expressly provided in their contract to excuse non-performance following from certain events. A good example of this would be a force majeure clause. Typically, such a clause will excuse the contracting parties for non-performance of their obligations due to reasons of acts of God (such as catastrophic and unusual weather conditions), the enactment of legislation which outlaws the contracted performance or the outbreak of war. However, it is up to the ingenuity (and relative bargaining power) of the contracting parties to specify which events would qualify to “excuse” their non-performance and each case will depend on the construction of the relevant clause. 16.22 Where a contract is brought to an end in accordance with a contractually specified term, it is also open to the contracting parties to provide for such issues as the return and refund of advance payments, reimbursements for expenses incurred in preparation for the performance of the contract, and so forth. Such provisions will generally be given effect by Singapore law. (3) Frustration of contract 16.23 Where the reason for the failure of performance lies in events beyond the control of the contracting parties and which neither party could have reasonably foreseen, the contract is said to be “frustrated”. In such cases, there are statutory rules which set out the extent to which advance payments made before the frustrating event intervened may be refunded and work done in preparation of the performance of the contract in advance of the frustrating event may be reimbursed. This doctrine is further discussed in greater detail in Chapter 17. 485 Principles of Singapore Business Law (4) Promissory and contingent obligations, interdependent and independent obligations 16.24 Sometimes, it may be that the obligation which has not been performed is conditional upon the prior occurrence of certain specified events. These may be contractually specified events, or some contractually specified counterperformance by the other party to the contract. To illustrate, consider the following examples: ° A enters into a contract with B, paying B a sum of $1,000 in exchange for B’s promise that if he decides to sell his 30,000 shares in Bravo Ltd, a public company listed on the Singapore Stock Exchange within the next 12 months, he will offer the shares to A first for $30,000. Before the 12 months lapse, B informs A that he has decided to hold on to the Bravo shares for the next five years. B is not in breach of the contract. Why? ° Same facts as above, except that B now informs A that he has decided to sell the Bravo shares to C. B is in breach of contract. Why? 16.25 In the first example, B has not breached the contract because his obligation to offer the shares to A first is contingent on B making the decision to sell. Properly construed, B only promised to make A an offer to sell them, if he decided to sell the shares within the 12-month period specified. Accordingly, B did not breach any “promissory obligation” to make A any offer for sale of Bravo shares: no such obligation ever arose, since the contingency on which it was to arise did not occur. Furthermore, that contingency was only a contingent condition and not a promissory one — at no point did B promise A that he would come to a decision to sell the shares within that period. 16.26 In contrast, in the second example, B’s obligation to make A an offer has arisen because the contingency for it to arise — B deciding to sell the shares — has occurred. As a result, in the second example, B’s promissory obligation to make A an offer is now “due” and, if unperformed, will give rise to certain legal consequences. 16.27 Next, consider the following: ° X contracts to buy Y’s car for $35,000. X pays 10 per cent up-front, with the balance to be paid on delivery by Y in one week’s time. Y fails to deliver the car. X refuses to pay Y the balance 90 per cent of the purchase price. Y is in breach of contract, but X is not. 486 Chapter 16: Performance, Breach and Agreement ° P contracts to rent an apartment owned by Q for three years at $1,600 per month, the rent being due and payable on the 15th day of each month. Q’s obligations as landlord are numerous and include an obligation to keep the apartment in good repair. Unfortunately, Q has allowed the apartment’s condition to deteriorate, and problems of leaking ceilings, mould and peeling paint emerge within a few months of P moving in. Even though P has made many complaints about the defects to Q, Q refuses to do anything about it. P decides to withhold payment of the rent due, even though it is already the 20th. Q is in breach of contract, but so is P. 16.28 The difference between the two examples above, lies in the nature of the obligations undertaken by X and P. In the case between X and Y, as in most contracts, their obligations are interdependent. That is to say, first, X’s obligation to pay Y the balance 90 per cent of the purchase price does not arise until Y makes delivery (X’s obligation to pay is contingent on Y performing his obligation of delivery), and second, X’s obligation to pay is dependent on Y making delivery. If Y does not make delivery, so long as X is ready, willing and able to pay Y, it is Y who is in breach and not X, even though X does not actually perform his obligation of payment either. Significantly, where the parties’ contractual obligations are construed to be interdependent upon each other, that is, where performance by, say, X in our example above, of its obligations is contingent upon due performance by the other, Y, breach by Y could entitle X to legitimately withold performance of its obligations on the ground that its performance was not yet due. Thus, so long as Y fails to make delivery, X only needs to remain ready, willing and able to pay Y – X may, however, withhold payment as X’s obligation to pay was only to arise upon delivery by Y. This often gives the non-defaulting party a significant amount of bargaining power to encourage the other party to rectify its breach. 16.29 On the other hand, certain obligations are construed as being independent of each other. One typical example is in relation to the obligations of landlords and tenants. So, in the example of the rental agreement between P and Q, the obligation of P to pay rent is usually construed to be independent of the obligation of Q to keep the premises in good repair. In this example, P’s obligation to pay rent is contingent on a contractually specified event (the passing of time — rent is due and payable by the 15th day of each month). 487 Principles of Singapore Business Law However, it is independent of and not contingent upon Q’s performance of his obligation to keep the premises in good repair. In such a case, although Q is in breach of his obligation, it is not enough that P is ready, willing and able to perform his part (in relation to payment of rents due). If P does not actually pay the rent, P would himself be in breach and would be liable to Q for that breach. 16.30 Thus, unlike the case of interdependent obligations, where the contractual obligations are construed to be independent of each other, breach by one party would not excuse the other from having to perform his independent obligations. A contracting party whose obligations are independent of the others would, therefore, not be able to threaten to withhold performance of his own obligations unless the other rectified his breach. Conscious of the loss of bargaining power in such cases, when construing the terms of a contract, the courts usually begin by assuming that the parties would have intended the contract to impose obligations which are interdependent. That said, in some contracts, the usual market practice inclines towards having independent obligations (as in the rental agreement example above), and of course, the contracting parties may have explicitly provided for it in their agreement. Ultimately, the question is one of construction of the contract. Manner and Timing of Breach of Contract 16.31 Broadly speaking, the contract may be breached if a party to the contract: ° completely fails to perform, or defectively performs his own obligations under the contract, thereby breaching a condition, or breaching an innominate term which goes to the root of the contract (“I couldn’t do it”); ° “repudiates” his obligations under the contract (“I won’t do it”); or ° makes further performance of the obligations in the contract impossible (“I won’t let you do it”); unless such non-performance is de minimis (see para 16.4) or is lawfully excused (see paras 16.18–16.30). 16.32 Obviously, all three types of discharge by breach may occur at the actual point in time where the party in breach ought to have performed his obligations under the contract (in which case, there will have been an “actual breach” 488 Chapter 16: Performance, Breach and Agreement of the contract). The latter two types of discharge, however, may occur while the contract is in an “executory” stage, that is, before the actual point in time when the obligation was supposed to have been performed. In such a situation, the breach is said to be an “anticipatory” breach. (1) Repudiatory breaches (“I won’t do it”) 16.33 Where the time of performance has arrived and one party has failed to perform in compliance with the contract, that actual failure will constitute a breach of the contract. However, it is just as much a breach of contract if that party clearly and unequivocally informs the other party that he cannot or will not perform any of his obligations under that contract. This may be done orally, in writing or may be inferred from his conduct. Indeed, it is conceivable that a repudiatory intention may even be inferred from inactivity. So long as an intention not to be bound by the terms of the contract has been clearly demonstrated, the contract may be repudiated and the repudiating party will be in actual or anticipatory breach, depending on the timing of the repudiation. 16.34 It should be kept in mind, however, that: [N]ot every intimation of an intention not to perform or of an inability to perform some part of a contract will amount to a renunciation. In the case of an entire and indivisible contract, a refusal to perform any part of the agreement will normally entitle the innocent party to treat the contract as discharged. Otherwise, a renunciation of some but not all the obligations under a contract will not entitle the innocent party to rescind [ie, discharge] the contract unless the renunciation amounts to a breach of a condition of the contract or deprive [sic] him of substantially the whole benefit which it was the intention of the parties that he should obtain from the obligations of the parties under the contract then remaining unperformed [emphasis added] (per Karthigesu JA delivering the decision of the Singapore Court of Appeal in San International Pte Ltd v Keppel Engineering Pte Ltd (1998) at [25]). 16.35 Proof of such repudiatory intention from the parties’ actions, or, in some cases, their failure to act, is particularly problematic. In the case of San International Pte Ltd v Keppel Engineering Pte Ltd (1998), the Singapore Court of Appeal appears to have accepted (at [20]) the following passage 489 Principles of Singapore Business Law from Chitty on Contracts (27th ed, 1994) Vol 1 at para 24–016, as correctly setting out the state of the law: Short of an express refusal or declaration the test [whether the party’s actions demonstrate a repudiatory intention] is to ascertain whether the action or actions of the party in default are such as to lead a reasonable person to conclude that he [the party in default] no longer intends to be bound by its provisions … Also the party in default “may intend in fact to fulfil (the contract) but may be determined to do so only in a manner substantially inconsistent with his obligations” or may refuse to perform the contract unless the other party complies with certain conditions not required by its terms. In such a case there is little difficulty in holding that the contract has been renounced. (2) Making performance impossible (“I won’t let you do it”) 16.36 As mentioned in para 16.15, if one party is prevented from performing their contractual obligations because of the refusal of the other party to cooperate, the defence of tender is available to excuse the promisor for the non-performance. But that refusal to cooperate can go further — it may also give the promisor the option to elect to treat the contract as having been discharged by breach. A contract may also be discharged by breach where the actions of one contracting party make it impossible for the other contracting party or parties to perform their obligations. This should not be confused with cases where further performance is rendered impossible (or, at the very least, “essentially different” from that which was originally contemplated) due to the occurrence of a supervening event which is beyond the control — and not due to the fault — of any of the parties to the contract: that results in a discharge of contract by frustration (which is dealt with in Chapter 17). 16.37 Where the election is made and the contract is said to be discharged due to the acts or default of a contracting party which renders performance of the contract impossible, the aggrieved party who wants to discharge the contract must show that further performance is in fact impossible. It is not enough to show that a reasonable person would conclude that further performance is impossible. This distinction can be illustrated by considering the decision of Devlin J in the English case of Universal Cargo Carriers Corporation v Citati (1957). Universal Cargo Carriers (“UCC”) hired a ship to Citati. Citati agreed that he was to nominate by a certain date: (1) a location for the 490 Chapter 16: Performance, Breach and Agreement ship to be berthed, (2) someone who would provide cargo for shipment on the vessel and (3) the cargo. Three days before that deadline, Citati had not performed any of these obligations, although he indicated that he would be willing to perform the contract if he could. UCC attempted to discharge the contract and found another party to hire the vessel from them, instead of Citati. 16.38 Devlin J held that Citati had not renounced the contract (and hence there was no discharge by breach pursuant to the principles discussed in paras 16.33–16.37). However, UCC was still entitled to discharge the contract because it managed to show that it was in fact impossible for Citati to actually perform his obligations without incurring such a delay as would negate the commercial purpose of the hire contract. 16.39 Although they are distinct, facts amounting to discharge by repudiation may also amount to discharge by the impossibility of further performance through the default of one of the contracting parties. Surely the argument exists that the actions or default of one party which have made further performance of the contract by the other impossible, also amounts to an implied statement of repudiation of the contract (or in other words, such action or default objectively demonstrates an intention not to be bound by the terms of the contract any more). Indeed, where the fact of impossibility of further performance is equivocal, great difficulty in continued performance may well be enough in certain circumstances as to amount to an implied repudiation. Effects of a Breach of Contract 16.40 In the absence of any lawful excuse, whether actual or anticipatory, a breach of contract has two significant effects. (1) The breach may give the aggrieved party the right to bring the contract to an end, that is, to discharge the contract for breach. Unlike judgeordered remedies, this is a “self-help” remedy: the aggrieved party may choose to discharge the contract without needing the prior sanction or approval of the courts. (2) If the breach of contract by one contracting party (the “party in breach”) causes loss to the other (the “aggrieved party”), the party in breach may be ordered by the courts to compensate the aggrieved party a sum of 491 Principles of Singapore Business Law money for those losses (“damages”). However, contractual damages (which are compensatory and not punitive in nature) are not the only judge-ordered or judicial remedy available. Other types of remedies may be available instead of, or sometimes in addition to, damages. These judicially ordered remedies will be discussed in Chapter 18. The differences between these two types of breach will be discussed below from paras 16.41–16.65, and a diagrammatic summary of these differences may be found in Figure 16.1. (1) Actual breach giving rise to right of discharge 16.41 Though some Singapore cases (the most significant of which are discussed at paras 16.44–16.47) may have thrown the following into some doubt, traditionally, an aggrieved party may elect to discharge the contract for breach if the contractual term which has actually been breached is: ° a “condition”; or ° an “innominate term”, the breach of which deprives the aggrieved party of substantially the whole of the benefit of the contract. 16.42 In either case, over and above any claim for compensation in damages for the losses suffered as a result of the breach, an aggrieved party may elect to discharge the contract. If it suits his purposes, however, the aggrieved party may elect to “affirm” the contract instead. 16.43 Traditionally, the aggrieved party has no power to discharge the contract if the contractual term which has been breached is: ° a “warranty”; or ° an “innominate term”, the breach of which does not deprive the aggrieved party of substantially the whole of the benefit of the contract. In such cases, unless the contract is brought to an end by some other event, the contract is not discharged by the breach. For details as to how a contract term may be categorised as a “condition”, a “warranty” or an “innominate term”, see Chapter 10, from para 10.37 onwards. 16.44 The traditional position described above, however, was thought to have been upset by the Court of Appeal when it handed down its decision in RDC Concrete Pte Ltd v Sato Kogyo (S) Pte Ltd (2007). The most challenging 492 Chapter 16: Performance, Breach and Agreement point made by the court (albeit by way of obiter dicta) was that even when a warranty had been breached, it was not always the case that discharge for such breach would be precluded. The following paragraphs of the judgment (ie, [107] and [108]) are instructive [emphasis in original in italics, emphasis added in bold italics]: 107 If, however, the term breached is a warranty, we are of the view that the innocent party is not thereby prevented from terminating the contract (as it would have been entitled so to do if the conditionwarranty approach operated alone). Considerations of fairness demand, in our view, that the consequences of the breach should also be examined by the court, even if the term breached is only a warranty (as opposed to a condition). There would, of course, be no need for the court to examine the consequences of the breach if the term breached was a condition since, ex hypothesi, the breach of a condition would (as we have just stated) entitle the innocent party to terminate the contract in the first instance. Hence, it is only in a situation where the term breached would otherwise constitute a warranty that the court would, as a question of fairness, go further and examine the consequences of the breach as well. In the result, if the consequences of the breach are such as to deprive the innocent party of substantially the whole benefit that it was intended that the innocent party should obtain from the contract, then the innocent party would be entitled to terminate the contract, notwithstanding that it only constitutes a warranty. If, however, the consequences of the breach are only very trivial, then the innocent party would not be entitled to terminate the contract. 108 It is true that the approach adopted in the preceding paragraph would, in effect, result in the concept of the warranty, as we know it, being effectively effaced since there would virtually never be a situation in which there would be a term, the breach of which would always result in only trivial consequences. In other words, if a term was not a condition under the condition-warranty approach, it would necessarily become an intermediate term, subject to the Hongkong Fir approach (see, in this regard, the perceptive observations by Robert Goff J (as he then was) in the English High Court decision of The Ymnos [1982] 2 Lloyd’s Rep 574 at 583). In other words, the traditional three-fold classification of contractual terms (comprising conditions, warranties and intermediate terms, respectively) would be a merely theoretical one only. However, the 493 Principles of Singapore Business Law concept of the intermediate term was itself only fully developed many years after the condition-warranty approach (in Hongkong Fir). Further, and more importantly (from a practical perspective), it should also be observed that the spirit behind the concept of the warranty would still remain in appropriate fact situations inasmuch as the innocent party would not be entitled to terminate the contract if the consequences of the breach were found to be trivial (although it would, as we shall see, be entitled to damages that it could establish at law). As importantly, this last-mentioned result, viz, the right to claim damages, is precisely that which would have obtained, in any event, had the court found that the term concerned was a warranty under the condition-warranty approach. This aspect of the decision has received some measure of criticism — see P Koh, C H Tham & P W Lee, “Contract Law” (2007) 8 Singapore Academy of Law Annual Review of Singapore Cases 150 at paras 10.67–10.77; J W Carter, “Intermediate Terms Arrive in Australia and Singapore” (2008) 24 Journal of Contract Law 226 at pp 243–245; Goh Yihan, “Towards a Consistent Approach in Breach and Termination of Contract at Common Law: RDC Concrete Pte Ltd v Sato Kogyo (S) Pte Ltd” (2008) 24 Journal of Contract Law 251. 16.45 One difficulty with the suggested approach in RDC Concrete is this: following Hong Kong Fir, promissory terms are now accepted to be of three types; they may be conditions, warranties or innominate terms. Indeed, this trifurcated categorisation of promissory terms was explicitly accepted by the Court of Appeal in RDC Concrete to be part of Singapore law. 16.46 If promissory terms may be categorised to be one of three types, a term which has been ascertained not to be a condition may be either an innominate term or a warranty. As noted previously in Chapter 10, what distinguishes an innominate term from a warranty is that in the latter, the courts are satisfied that the contracting parties intended that breach of the term would not give rise to a discharge of the contract. But if that were the case, the Court of Appeal’s suggestion in RDC Concrete that it might still be open for a contracting party to elect to discharge the contract for breach of a warranty if the effects of the breach were sufficiently severe would run counter to what the parties originally intended. 494 Chapter 16: Performance, Breach and Agreement 16.47 To some extent, this difficulty has been acknowledged by the Court of Appeal in a subsequent decision, namely Sports Connection Pte Ltd v Deuter Sports GmbH (2009). In this case, the Court of Appeal recognised that where the parties had expressly provided for a promissory term to be treated as a warranty, then breach of that “express warranty” would not attract any possibility of discharge of the contract. However, it nevertheless maintained that there could be instances where a term might amount to what the Court of Appeal labelled as an “implied warranty”. Where an “implied warranty” had been breached, the Court of Appeal maintained that discharge might still be possible if the impact of the breach was sufficiently severe. This seems to leave open the question as to when a promissory term might be said to be an “implied warranty” rather than an innominate term. Arguably, the true dichotomy is not between “express” and “implied” warranties. It is suggested that the heart of the matter is ascertaining what the parties intended in connection with the breach of a particular promissory term, whether: ° the breach would entail discharge, regardless of its impact — in which case the term would be held to be a “condition”; ° the breach would lead to discharge only if the impact was sufficiently severe — in which case the term would be held to be an “innominate term”; or ° breach would never lead to discharge at all. Notwithstanding the Court of Appeal’s introduction of the concept of an “implied warranty”, it remains to be seen if the distinction between “implied” and “express” warranties will take root. Given that all of these statements by the court on the nature of a “warranty” were mere obiter dicta, the true state of the law on the point remains open for discussion and debate. Perhaps a suitable case will arise to settle the issue more definitively, but until then, the most that can be said is that the law is still somewhat uncertain on this issue. 16.48 It should be noted, however, that the availability of judicial remedies such as damages does not have any necessary relationship to the question as to whether a contract has been discharged or affirmed, and the two sets of issues should not be confused. That said, the question of rescission of a contract may have an effect on the quantum of the losses which an aggrieved party may suffer as a result of the breach of contract. 495 Principles of Singapore Business Law (a) Effect of election to discharge contract for actual breach 16.49 If the aggrieved party chooses to discharge the contract on account of an actual breach by the defaulting party, the contract is brought to an end prospectively. Although the contract ceases to bind the parties to the contract from the time the election is effectively communicated to the other contracting parties, if there are any obligations which arise prior to the time of such discharge, those obligations would continue to bind the parties to the contract. In other words, discharge for breach has no retrospective effect. Communication of the decision to discharge the contract may take the form of words, acts or even (in exceptional cases) silence. Prior to receipt of such communication, such an election may be withdrawn. (b) Effect of election to affirm contract despite an actual breach 16.50 The aggrieved party may choose, however, not to discharge the contract. Instead, the aggrieved party may choose to affirm it. If so, the entire contract is kept alive and the aggrieved party loses the right to have the contract discharged. Nevertheless, the right to sue the party in breach and recover money damages for any losses incurred as a result of the delay in procuring full performance will usually be retained, unless the aggrieved party also elects to waive his or her right to compensatory money damages. 16.51 The effect of keeping the contract “on foot” by rejecting the breach may give the party in breach a second chance to rectify the non-performance or defective performance. (2) Anticipatory repudiatory breach 16.52 A breach of contract may also occur anticipatorily (in advance of the time of actual performance). If this breach is also repudiatory (where the evidence demonstrates that one party intends not to be bound by the terms of the contract, nor to honour his or her contractual obligations as and when they fall due), the aggrieved party has the right to choose whether to discharge or to affirm the contract. (a) Effect of election to discharge contract for anticipatory repudiatory breach 16.53 A party aggrieved by an anticipatory repudiatory breach may exercise his or her right to discharge the contract immediately without waiting until the time of actual performance. If the aggrieved party elects to discharge 496 Chapter 16: Performance, Breach and Agreement the contract, the contract is immediately brought to an end. The aggrieved party is then immediately entitled to sue the party in breach for damages as compensation for any loss suffered by the aggrieved party as a result of the non-performance of the contract. 16.54 As observed by Lord Reid in the case of Moschi v Lep Air Services Ltd (1973) (at pp 345–346): [W]hen a contract is brought to an end by repudiation accepted by the other party all the obligations in the contract come to an end and they are replaced by operation of law by an obligation to pay money damages. The damages are assessed by reference to the old obligations but the old obligations no longer exist as obligations. Were it otherwise there would be in existence simultaneously two obligations, one to perform the contract and the other to pay damages. But that could not be right. The only legal nexus remaining is the obligation to pay the damages … (b) Effect of election to affirm contract despite an anticipatory repudiatory breach 16.55 On the other hand, the aggrieved party may elect to affirm the contract. If so, the contract continues to bind all parties to the contract and the anticipatory breach is ignored. Consequently, once the aggrieved party affirms the contract, there can be no liability for money damages for that anticipatory breach since it is treated as if the breach never occurred. 16.56 Unless and until an anticipatory breach is accepted by the innocent party, the contract will stay on foot and the anticipatory breach will be ignored as if it had never occurred. In the colourful (and oft-quoted) words of Asquith LJ in the English Court of Appeal case of Howard v Pickford Tool Co Ltd (1951) (at p 421): An unaccepted repudiation is a thing writ in water and of no value to anybody: it confers no legal rights of any sort or kind … Limits on Right of Election to Affirm Contract 16.57 As noted above, once the election to discharge a contract for breach has been exercised and becomes effective, the right to affirm the contract will be lost. Apart from that, though, the aggrieved party’s right of election to 497 Principles of Singapore Business Law discharge or affirm a contract following an actual or anticipatory breach is largely unqualified. 16.58 The most significant remaining qualification, however, is set out in the Scottish case of White and Carter (Councils) Ltd v McGregor (1962). White and Carter (Councils) Ltd (“White and Carter”) supplied litter bins to various local authorities in Scotland. It offered advertising space on these litter bins for a fee. McGregor was the proprietor of a garage who had previously placed such advertisements with White and Carter. Upon the termination of one such contract, purporting to act on behalf of his employer, McGregor’s sales manager entered into another contract with White and Carter to continue advertising for another three years, although he had no actual authority to do so. When this was discovered the next day, McGregor informed White and Carter about the mistake and attempted to repudiate the contract. However, White and Carter’s management decided to continue with performance of their obligations under the contract: they prepared the necessary plates for attachment to the bins and exhibited them on the bins from 2 November 1957. The contract provided that the first annual payment would become due seven days after the first display. If unpaid for four weeks, the entire amount due for the three years (being £196 4s) would become payable. When McGregor failed to make the first year’s payment on time, the full price for the three years’ worth of advertising became payable and White and Carter sued for the entire amount due, instead of suing for the loss of profit from McGregor’s breach of contract. White and Carter’s action failed at first instance, as did their initial appeal to the Second Division of the Scottish Court of Session. 16.59 On further appeal to the House of Lords, though, a bare majority of their Lordships accepted that the appellants, White and Carter, were entitled to act as they did and allowed their claim against the respondent, McGregor. Their Lordships were faced with a dilemma because the facts of this case brought up two conflicting principles, namely: ° that an anticipatory breach does not discharge the contract unless the innocent party exercises his option to do so; and ° that the innocent party has to mitigate his losses as a result of the breach of contract. 16.60 Three out of five of their Lordships held that the appellants did not need to mitigate and had the right to choose to perform the contract in full, 498 Chapter 16: Performance, Breach and Agreement which therefore entitled them to claim for the price from the respondent. Consequently, Lord Reid, Lord Tucker and Lord Hodson decided that the appellants’s claim should succeed. Indeed, Lord Hodson (with whom Lord Tucker agreed) took the robust view (at p 445) that: [I]t may be unfortunate that the appellants have saddled themselves with an unwanted contract causing an apparent waste of time and money … [T]here is no equity which can assist the respondent. It is trite that equity will not rewrite an improvident contract where there is no disability on either side. There is no duty laid upon a party to a subsisting contract to vary it at the behest of the other party so as to deprive himself of the benefit given to him by the contract. To hold otherwise would be to introduce a novel equitable doctrine that a party was not to be held to his contract unless the court in a given instance thought it reasonable so to do. In other words, there is no duty to “mitigate” or to act reasonably insofar as the innocent party has a free choice whether to affirm or discharge the contract (mitigation of loss is further discussed in Chapter 18, paras 18.67–18.73). 16.61 Alone of the three judges in the majority, Lord Reid suggested (at pp 430– 431) that the right to affirm the contract could (possibly) be curtailed on the basis of some “general equitable principle or element of public policy”. Lord Reid observed (at p 431) that: [I]f it can be shown that a person has no legitimate interest, financial or otherwise, in performing the contract rather than claiming damages, he ought not to be allowed to saddle the other party with an additional burden with no benefit to himself. If a party has no interest to enforce a stipulation, he cannot in general enforce it: so it might be said that, if a party has no interest to insist on a particular remedy, he ought not to be allowed to insist on it. And, just as a party is not allowed to enforce a penalty, so he ought not to be allowed to penalise the other party by taking one course when another is equally advantageous to him. [emphasis added] 16.62 The difficulty with this limitation is that it is unclear when and where such an interest may be found. In the passage above, Lord Reid suggests that the legitimate interest could include the financial interests of the parties. 499 Principles of Singapore Business Law However, in the very same paragraph, he appears to contradict himself by observing (at p 431): If I may revert to the example which I gave of a company engaging an expert to prepare an elaborate report and then repudiating before anything was done, it might be that the company could show that the expert had no substantial or legitimate interest in carrying out the work rather than accepting damages: I would think that the de minimis principle would apply in determining whether his interest was substantial, and that he might have a legitimate interest other than an immediate financial interest. But if the expert had no such interest then that might be regarded as a proper case for the exercise of the general equitable jurisdiction of the court. [emphasis added] 16.63 Lord Reid also observed (at p 431) that the respondent: [D]id not set out to prove that the appellants [White and Carter] had no legitimate interest in completing the contract and claiming the contract price rather than claiming damages; there is nothing in the findings of fact to support such a case, and it seems improbable that any such case could have been proved. [emphasis added] The above extracts pose a number of interesting points. First, it would appear that the party seeking to prevent the other party from affirming the contract must establish that the other party had no legitimate interest to do so. Second, Lord Reid also suggested that in his view, given the facts before him in that case, the respondent would not have successfully established this negative proposition that there was no legitimate interest in performance of the contract, even if he had contested the point. In other words, whatever might be the threshold requirements to establish that there had been no legitimate interest, the facts and circumstances in White and Carter were insufficient to cross that threshold. This case, therefore, provides no guidance as to what would be enough to establish the absence of legitimate interest in performance. 16.64 Locally, the scope of Lord Reid’s requirement of “legitimate interest” has been the subject of further discussion by Selvam J in the Singapore High Court case of MP-Bilt Pte Ltd v Oey Widarto (1999). This case involved a dispute over the payment of a second instalment of $486,039.80 by Oey for the purchase of a condominium unit being developed by MP-Bilt. One 500 Chapter 16: Performance, Breach and Agreement of the issues raised was whether MP-Bilt was under a duty to mitigate or to act reasonably in exercising its option to discharge the contract or to affirm it. Applying White and Carter (1962), Selvam J had no hesitation in holding that there was no such duty. Of greater interest, however, are his observations on the doctrine of “legitimate interest” raised by Lord Reid in White and Carter (1962). 16.65 Accepting that the doctrine of “legitimate interest” was part of Singapore law, Selvam J observed (at [37]–[39]) that it was subject to the following restrictions: First, it [the requirement of “legitimate interest”] cannot apply retrospectively to accrued debts. Accrued debts can be sued for even after acceptance of repudiation. Next, it does not apply where the innocent party can reasonably perform his obligation without the co-operation of the contract-breaker … Thirdly and more importantly, the doctrine was conceived in the context of the innocent party rejecting the repudiation by the other party and exercising his right to complete performance when the former has a legitimate interest to protect. A fortiori, the doctrine cannot apply when the innocent party is under a legal obligation or practical compulsion to complete performance of the contract in question and other contracts he has entered into on the basis of the contract in question. [emphasis in original] The first two limitations set out by Selvam J are fairly self-explanatory. However, the third of these restrictions is a little puzzling as Selvam J appears to have accepted that it would not be permissible to prevent an innocent party from electing to affirm a contract if it were “under a legal obligation or practical compulsion to complete performance of the contract in question and other contracts he has entered into on the basis of the contract in question.” The difficulty, though, is that Selvam J did not elaborate what he meant by a “legal obligation or practical compulsion”. PARTIAL PERFORMANCE AND DISCHARGE BY BREACH 16.66 Consider the facts of the following case: ° A is engaged by B to renovate his home for a total sum of $20,000. Forty per cent of the price is paid up-front, and the balance is to be paid on completion of all the works. Among the works to be carried out, the 501 502 Cont ractcont inues BUT Damages payabl e* Cont ractends AND Damages payabl e* Cont ractcont inues BUT NO damages: Breachnotl egal l y si gni cant Promisee el ect edt o wai vet hebr each: Cont ractAFFIRMED Cont ractcont inues BUT NO damages: Treat edas ifbreach neveroccur r ed Promisee el ect edt o accept t hebr each: Cont ractDISCHARGED Has t he promisee accept edor wai vedt hebr each? Breach is NON-REPUDIATORY Figure 16.1 Legal consequences of a breach of contract Ot her Whatf orm has t he ant icipat ory br eacht aken? Impossibil it yof perf ormance caused byPromisor Breach is REPUDIATORY Renunciat ionof cont ractby Promisor (Breach is REPUDIATORY) Promisee el ect edt o accept t hebr each: Cont ractDISCHARGED Has t he promisee accept edor wai vedt hebr each? Pr omi seedepr i vedof subst ant ial l yt he whol eoft hebenet oft he cont ract Promisee el ect edt o wai vet hebr each: Cont ractAFFIRMED Promisee NOT depr i vedof subst ant ial l y t he whol e of t hebenetof t he cont ract Whatwas t he impact oft he breach? A condit ion Bef or eper f or mancewasdue: ANTICIPATORY breach * Assumi ngpr omi seehasnotal sowai vedhi sr i ghtt odamagesAND al lr equi r ement sf ordamagesar esat i sf act or i l yr esol ved( seeChapt er18) . * *Quest i on:Thedi st i nct i onbet weenexpr essandi mpl i edwar r ant i es t sConnect i onPt eLt dvDeut erSpor t sGmbH ( 2009)i sopent oquest i on.Seedi scussi onatpar as16. 4416. 47. suggest edinSpor (Breach is NON-REPUDIATORY) An impl ied warrant y* * Anexpress warrant y* * or aninnominat et erm Whatsortof pr omi ssor yt erm was breached? Att i mewhenper f or mancewasdue: ACTUALbreach Todet er mi net hel egalconsequencesofabr eachofcont r act ,wer staskour sel ves: Whenwas t he cont ractbreached? Principles of Singapore Business Law Chapter 16: Performance, Breach and Agreement contract clearly spells out that it is a condition of the contract that each room is to be given four coats of paint. ° Unfortunately for A, although he completes each and every item of work in the contract, he puts only two coats of paint in the rooms. This would have been indiscernible to anyone, except that in a moment of unguarded frankness, A admitted that he had only partially performed the contract, admitting that he had not painted the rooms as many times as the contract had specified. ° In the meantime, B has moved in and has no complaints about the work done, and even though the paintwork in the rooms is not as contractually specified, this has not affected his enjoyment of the property, or its market value. Putting on the additional two coats of paint in each room would have cost a further $100. – Is B entitled to discharge the contract for A’s breach of condition? If he does, can A insist on being paid the balance of the price outstanding? – Do you think this is fair? 16.67 In cases such as Hoenig v Isaacs (1952) and H Dakin v Lee (1916), the English courts have been faced with a problem similar to that above. On the one hand, it is clear that the aggrieved party ought to be entitled to discharge the contract for breach. But, on the other, it seems rather disproportionate to permit the aggrieved party to completely withhold payment of the outstanding sum from the party in breach, particularly in circumstances where the partial performance appears to afford the aggrieved party substantially what was sought in the first place, because it seems as if the aggrieved party has obtained a benefit for which he has not had to pay. 16.68 In contrast, consider the following counter-example: ° X has a large extended family. For her mother’s 100th birthday (which will come to pass in six months’ time), X thinks it would be nice to present her with a family portrait. Y, a well-known artist who works from photographs of his subjects and paints in a “super photo-realistic” style, is engaged by X to paint this. Y agrees to do it for $10,000 (to be paid on completion), and promises to complete and deliver the portrait one week before X’s mother has her 100th birthday. X impresses on Y 503 Principles of Singapore Business Law that the deadline is crucial and provides Y with photographs of each family member. One day prior to the deadline, though, the portrait is still incomplete — it is still missing one member. 16.69 – Is X entitled to discharge the contract? – Is this fair? How is this different from the example above? This, in fact, was the problem facing the English courts in the case of Cutter v Powell (1795). In that case, Cutter was employed as second mate in a vessel sailing from Jamaica to Liverpool. It was agreed that he would be paid 30 guineas upon the completion of the entire voyage. However, Cutter passed away 19 days before the vessel reached Liverpool. Cutter’s widow attempted to recover a proportion of the agreed fee of 30 guineas in her capacity as administratrix of his estate. Unfortunately, her claim was dismissed on the basis that Cutter had not completed his part of the bargain. The view taken by the court was that Cutter’s completion of the journey was a condition precedent to payment of the 30 guineas. Alternatively, Cutter’s obligation to complete the journey was an “entire” one, the partial fulfilment of which did not amount to any benefit. ENTIRE OBLIGATIONS AND SUBSTANTIAL PERFORMANCE 16.70 One way to distinguish between the two examples above is to ask ourselves whether the contractual obligation which has been partially performed by the party in breach is an entire one. In other words, is the complete and entire performance of the obligation a condition precedent to counter-performance by the aggrieved party? 16.71 In the second example, the position that Y’s obligation to complete and deliver a family portrait was an entire one is clearly defensible: a partially painted portrait, even if it is almost completed, is not the same thing as a fully completed portrait. But in the first example, even though the obligation to put four coats of paint on the walls of each room was a condition, that in itself does not seem to strongly suggest that failure to do so ought to be treated as a failure to perform an entire obligation (with the consequences thereof). The question, therefore, is one of construction of the obligation which has not been fully performed. 504 Chapter 16: Performance, Breach and Agreement 16.72 Assuming, then, that the obligation which has only been partially performed is not an entire obligation, if the partial performance amounts to substantial performance of that obligation, there is some authority to support the proposition that the party in breach will be entitled to claim the full price for that substantial performance. That said, he is, nonetheless, still in breach of contract and must, therefore, compensate the aggrieved party for any loss which she may have incurred on account of the breach. The price payable will thus be set off against any such damages. Box 16.1 Reflecting on the law Quality of performance as an entire obligation In prior editions of the highly influential contract textbook that still bears his name, Professor Treitel suggested that, as a matter of construction or interpretation of a promissory term drafted in a way which seems to impose an entire obligation, one might be able to distinguish between the quantity and the quality of the work (G H Treitel, The Law of Contract (11th ed, 2003) at pp 787–788). That approach could be adapted to provide another way of addressing the hypothetical problem between A and B set out above at para 16.66. Borrowing Professor Treitel’s suggestion, it may be possible to distinguish between the “quantity” and “quality” of the paintwork to be supplied by A. Assuming this is possible, one might then take the view that as a matter of construction or interpretation, though the implicit obligation to provide a specified quality of work might be an entire one, the express obligation to provide a specified quantity might not be. If so, in the example involving A and B above, one might then take the view that the obligation to put four coats of paint on each room ought to be construed as meaning that so long as A provided paintwork of a quality equivalent to that which one would expect with four coats of paint, he would have performed this obligation as to quality in its entirety and would thus be entitled to payment. However, the obligation as to the quantity of work done might be construed as being something other than an entire obligation; if so, the breach of the obligation to put four coats of paint on the walls of every room would entitle B to damages which could then be set-off (or “abated”) against the price payable to A. 16.73 Assuming it can be shown that the obligation only partially performed is not an entire obligation, apart from the doctrine of substantial performance, various other legal arguments may be made to permit the party in breach to recover some of the contractual price. 505 Principles of Singapore Business Law Apportionment Act 16.74 Where the obligation is not entire, apportionment of the sum payable by reference to that part of the obligation which has been completed is possible. However, how should such apportionment be achieved? In some contexts, legislation passed in England in the form of the Apportionment Act in 1870 addresses this issue. This English Act was incorporated into the statutes of Singapore and takes its latest form in the similarly named Apportionment Act (Cap 8, 1998 Rev Ed). 16.75 This Act provides in s 3 that “rents, annuities, dividends and other periodical payments in the nature of income” (which would include most forms of salary paid to an employee) “shall … be considered as accruing from day to day, and shall be apportionable in respect of time accordingly”. As a result, if the obligation to pay is of a periodic nature and is by way of income, partial completion of work for which such income is payable will be apportioned in accordance with the number of days for which performance had been rendered. Quantum Meruit 16.76 Sometimes, the tendered performance falls so far short that the doctrine of substantial performance may not be applicable. The facts might also disallow application of the Apportionment Act. However, it may be that the party in breach may still recover a proportion of the contract price by using the doctrine of quantum meruit. 16.77 As discussed and identified by the Singapore Court of Appeal case of Lee Siong Kee v Beng Tiong Trading, Import and Export (1988) Pte Ltd (2000), there are two varieties of quantum meruit: ° quantum meruit on a contractual basis; and ° quantum meruit on a restitutionary basis. 16.78 As with the doctrine of substantial performance though, these possibilities do not excuse any potential liability in damages for the partial performance. 506 Chapter 16: Performance, Breach and Agreement (1) Quantum meruit on a contractual basis 16.79 Some contracts may expressly provide that payment in return for performance will be made in proportion to the amount of work done. In the appropriate circumstances, such a term may even be implied. If so, payment of the price will simply be made in accordance with the manner of apportionment as described in such a term. 16.80 The implication of a term to apportion payment on a quantum meruit basis is particularly common in the area of sale of goods where s 30(1) Sale of Goods Act (Cap 393, 1999 Rev Ed) provides that: Where the seller delivers to the buyer a quantity of goods less than he contracted to sell, the buyer may reject them, but if the buyer accepts the goods so delivered, he must pay for them at the contract rate. 16.81 Therefore, in all situations of sales of goods where s 30(1) applies, it will be a term of the contract that partial deliveries will be met with proportional payment at the “contract rate” (or, in other words, the price per unit measure of the goods in question). Of course, in addition to terms implied by statutes such as the Sale of Goods Act, a term providing for quantum meruit payment can be implied in fact at common law. 16.82 In some cases and textbooks, it has also been suggested that it may even be possible to imply the existence of an entirely new contract with such terms. Thus, where the innocent party “accepts” the partial performance by the party in breach, it may be possible to infer or imply a fresh agreement between the two parties, wherein they agree that payment will be made for the work already done (albeit incomplete) or for the goods already delivered (despite being short or otherwise defective). This type of analysis also requires that the defendant must have had the option to take or refuse the benefit of the work done, following the English decision of Sumpter v Hedges (1898). However, in the light of the analysis taken by the Singapore Court of Appeal in Lee Siong Kee v Beng Tiong Trading, Import and Export (1988) Pte Ltd (2000), the better position today may be to view this as having been subsumed and superseded by the language and analysis of restitutionary quantum meruit (which is discussed in the next section). 507 Principles of Singapore Business Law (2) Quantum meruit on a restitutionary basis 16.83 Strictly speaking, this doctrine lies outside the law of contract. Instead, it lies within the complex and developing realm of the law of unjust enrichment (or law of restitution). In some texts or in very old judgments, it is sometimes described as being part of the law of quasi-contract. 16.84 Even in the complete absence of any contractual provision, where partial performance by one party has conferred a benefit upon another, retention of such benefit without a corresponding payment to reflect the value of that benefit, may be “unjust”. To use the language of the Roman civil law (as explained and applied by Professor Birks in his seminal work, An Introduction to the Law of Restitution (1989 Rev Ed) at p 23): It is fair by the law of nature that nobody should be made richer through loss and wrong to another (cum alterius detrimento et injuria). 16.85 Therefore, in certain cases, a claim may be made for a reasonable sum in relation to the partial provision of work or services, if the party who has received the alleged benefit of this partial performance had the option of freely accepting or rejecting the benefit of this partial performance. This remedy is more fully discussed in Chapter 18. SEVERABLE OR DIVISIBLE OBLIGATIONS AND SUBSTANTIAL PERFORMANCE 16.86 A lengthy or complex agreement may consist of a number of divisible or severable parts. A common example can be found in construction contracts, where the main contractor will usually agree to make staggered payments to its sub-contractors, depending on the stage of completion of the overall project achieved by the sub-contractor. Such contracts may provide that once the sub-contractor completes, say, the pouring of the concrete for the foundations for the building, the main contractor agrees to pay, say, 15 per cent of the total contract price. Employment contracts where the salary of the employee is payable on a periodic basis (eg, every month) are yet another common example. 16.87 If a contract may be interpreted or construed to be divisible in the manner described above, having taken into account the terms of the contract, customary business practices and any common understanding between the 508 Chapter 16: Performance, Breach and Agreement parties due to their past dealings with one another, complete performance of each divisible portion of the contract will make payable that part of the contract price apportioned to that completed part. That said, the arguments and considerations as to what should happen where there is only partial performance of any of these distinct parts will simply be a replication of the discussion above (at paras 16.4 and 16.70–16.85). It is therefore possible to argue that there may have been a de minimis breach in relation to a particular severable part of the contract, or that that severable part has been substantially performed, and so forth. 509 Chapter 17 Frustration 17.1–17.2 17.3–17.4 17.5 Introduction Scenario Legal Development Juristic Basis 17.6 17.7–17.8 17.9 17.10 17.11 Concept of Frustration Elements of Frustration (1) Radically different performance (2) Neither party at fault (3) Time of frustration (4) Foresight and foreseeability 17.12 17.13–17.14 17.15–17.16 17.17 17.18 17.19 17.20–17.21 17.22 17.23 17.24 17.25 Classification General Impossibility (1) Destruction of subject matter of contract (2) Death or incapacity (3) Unavailability (4) Failure of source of supply (5) Method of performance impossible Illegality Radical Change (1) Frustration of purpose (2) Delay, unavailability (3) Impracticability, increased costs Frustration of a Lease/Sale of Land 17.26–17.27 17.28–17.29 17.30–17.31 Self-induced Frustration General Negligence Choosing between Several Contracts 17.32–17.33 Partial Frustration Principles of Singapore Business Law 17.34–17.35 17.36 Express Provision General Construction 17.37 17.38–17.40 Foresight and Foreseeability Foreseen Events Foreseeable Events 17.43 17.44–17.47 17.48 17.49 Effects of Frustration Introduction Frustrated Contracts Act (1) General (2) Payments, expenses, benefits (3) Severability (4) Ambit of act 17.50–17.52 Conclusion 17.41–17.42 512 Chapter 17: Frustration INTRODUCTION Scenario 17.1 As with life in general, businesses and business transactions are subject to uncertainties and unexpected events. If, after a contract has been entered into, an event takes place which severely affects the performance of the contract, issues arise as to the rights and liabilities of the parties in the light of the new development. Does the contract continue or does it come to an end? In either case, what are the respective parties’ rights and remedies? These and other questions are dealt with by the law of frustration. 17.2 It may be observed that frustration is quite similar to common mistake (see Chapter 12, para 12.9) in that both doctrines are concerned with unexpected states or events which make the performance of the contract difficult or impossible. However, whilst mistake relates to matters occurring before or at the time of the contract, frustration deals with matters which arise subsequently; and the two doctrines have developed separately and differently. Legal Development 17.3 At one time, the law held on to a strict theory of contractual performance, that contractual duties are absolute and have to be carried out, supervening events notwithstanding (see, eg, Paradine v Jane (1647)). Over time, it was felt that such a position was too harsh and was not a satisfactory way of allocating losses between the parties. Eventually, in 1863, in Taylor v Caldwell (1863), which involved the accidental destruction of a music hall which was the subject of a hire contract, the doctrine of frustration was introduced into the common law. Through a period of development, the doctrine was applied to other scenarios of unexpected events, such as cases of supervening illegality and those involving the frustration of the commercial purpose. 17.4 The extension of the doctrine, however, was one which proceeded cautiously. There are several reasons for narrowing its application. First, the doctrine should not be used by a contracting party to escape what has turned out to be a bad bargain. Second, parties are free to make contractual provision with respect to eventualities. In any case, until the position was rectified by legislation, the common law effect of frustration — that losses lie where they fall (see para 17.41) — in many instances could hardly be considered a fair allocation of losses as between the two parties. 513 Principles of Singapore Business Law Juristic Basis 17.5 Whilst the doctrine of frustration is now well established, its legal basis is still uncertain. Three theories, amongst others, have been put forward. The first is the implied term theory that the parties had contracted “on the footing that a particular thing or state of things would continue to exist” (per Lord Loreburn in Tamplin Steamship v Anglo-Mexican Petroleum Products (1916) at p 403). The second is that where the “foundation” of the contract disappears, the contract itself also vanishes (Viscount Haldane in the Tamplin case at pp 406–407). The third justification is that a court may exercise its discretion and hold that a contract is frustrated when justice demands it. Some commentators have observed that there does not appear to be any practical implication as to which is the true basis of the doctrine. CONCEPT OF FRUSTRATION Elements of Frustration 17.6 The classical definition of frustration was provided by Lord Radcliffe in the leading House of Lords decision of Davis Contractors v Fareham UDC (1956) (at p 729): [W]ithout default of either party, a contractual obligation has become incapable of being performed because the circumstances in which performance is called for would render it a thing radically different from that which was undertaken by the contract. [emphasis added] This definition covers the “physical impossibility” scenarios, such as the destruction of the subject matter, the cancellation of an event and the death or illness of a performer, but it goes further. It encompasses supervening illegality and, more importantly, cases where the commercial objective or purpose is defeated or has disappeared. The test, simply stated, is: does the event make the performance of the contract now radically different from what was originally contemplated by the parties? (1) Radically different performance 17.7 As mentioned above, the question is whether performance of the contract in the changed circumstances would be something radically different from that which was originally undertaken. Essentially, the court looks first at the 514 Chapter 17: Frustration contractual promise and the circumstances that existed at the time of the contract. It then looks at the supervening event and what performance would be like if the promise were to be enforced in the new circumstances. Finally, it would compare the performance in the two scenarios and ask whether the latter is radically or significantly different from the former. 17.8 In Davis Contractors v Fareham UDC (1956), the contractors agreed to build for the Fareham local authority 78 houses within eight months for £92,425. Without the fault of either party, inadequate labour supply delayed the completion by 14 months and increased the contractors’ expenses by some £17,000. The contractors argued that the contract had been frustrated and that they could therefore claim, on a quantum meruit basis (payment of a reasonable sum for work done), a sum higher than the contract price. The court held that the fact that increased labour costs made the contract more onerous did not make the contractual performance radically different from the performance contemplated at the time of the contract. (2) Neither party at fault 17.9 Frustration is premised upon neither party being at fault. Indeed, if a contract is discharged by frustration, this takes place by operation of law, as opposed to any action on the part of a contracting party. In general, if one party is at fault, it is likely that he has breached an express or implied term of the contract. Even in the absence of such a term, the law would not excuse a contracting party whose conduct causes or leads to the event. This policy finds expression in the principle that a contracting party cannot rely on “self-induced” frustration (see para 17.26). (3) Time of frustration 17.10 When a frustrating event occurs, the contract is discharged automatically. The frustrating event may discharge a contract prospectively, in that the time of performance has yet to arrive. The effect of a supervening event is determined at the time the event occurs, or a reasonable time thereafter; one need not, indeed should not, wait till the day of the scheduled performance in order to see how the event would affect the performance of the contract. The rationale for taking a reasonable view of the probable effect of a supervening event upon or shortly after its occurrence is that the parties’ rights should not be left indefinitely in suspense. Whether the situation is the outbreak of war affecting a charter of ships or the onset of illness affecting an employee, 515 Principles of Singapore Business Law the contract is frustrated as soon as “a sensible prognosis of the commercial probabilities” can be made (The Evia (No 2) (1983)). (4) Foresight and foreseeability 17.11 The notion of frustration is somehow naturally associated with the idea of unexpected events. It would seem that a frustrating event is one which was not expected, foreseen or even foreseeable. But the matter is far from simple and is quite debatable. The complexities are dealt with in paras 17.37–17.40. CLASSIFICATION 17.12 The issue of frustration has arisen in many different settings and different types of contracts. Perhaps the most useful means of classification, for the purpose of analysis and understanding, is to categorise them into three major categories: impossibility, illegality and radical change. These categories may be divided, in turn, into sub-categories, which may raise particular problems and issues of their own. General Impossibility (1) Destruction of subject matter of contract 17.13 The destruction of the subject matter of the contract is a clear and obvious application of the doctrine of frustration. Case law examples include the destruction of premises, the failure of a crop and the sinking of cargo. However, total destruction may not be necessary; it suffices if the thing is so seriously damaged that, for commercial purposes, it has become something else; or that destruction of a part of the subject matter defeats the main purpose of the contract. The destruction of something which is not the subject matter of the contract but is nevertheless necessary for its performance, such as the building in which the machinery is to be installed, will also frustrate the contract. 17.14 In certain contracts, different rules of discharge apply. A prime example is a contract for the sale of goods, where rules as to the passing of risk in the goods are provided for by legislation. For instance, where goods sold are destroyed after the risk has passed to the buyer, the buyer is not discharged from his duty to pay the seller. There is no frustration in such a case. Another 516 Chapter 17: Frustration example concerns building contracts where, generally, the risk of damage or destruction lies with the builder until the work is completed. (2) Death or incapacity 17.15 Contracts of a personal nature — those where the promisor has to perform the obligation(s) personally — are frustrated by the promisor’s death or incapacity. Such contracts include contracts of apprenticeship, employment and agency. The critical factor is the personal nature or character of the contract. If the personal element is absent, the contract may still have to be performed, albeit by another on behalf of the promisor. 17.16 In the case of incapacity, such as illness, imprisonment or conscription, whether the contract has been frustrated depends on the likely duration of the incapacity or unavailability, and whether the disruption would make a radical change to the contractual performance. The sudden illness of a performer for a one-night-only concert is certainly quite different from the illness of an employee for a term of years. In the latter situation, the relevant factors for determining whether the contract is frustrated include the nature and duration of the employment, the length of past employment, and the prospects of recovery. (3) Unavailability 17.17 The above situation of the illness of an employee may also fall within the sub-category of the unavailability of the subject matter or the person or thing essential to the performance of the contract. The types of situations and contracts in which this may occur are varied. A charterparty (contract for chartering a ship) may be frustrated by the seizure or detention of the ship; a contract for the sale of goods may be frustrated by the government requisitioning the goods; the sale and purchase of a piece of property may be frustrated by compulsory acquisition by the authorities; and so on. Whether temporary unavailability results in frustration would again depend on various factors such as the length of the anticipated unavailability, the period of the contract and the commercial purpose of the contract. (4) Failure of source of supply 17.18 Where it is expressly provided that goods are to be supplied by a particular source, the contract may be frustrated by the failure of that source. The posi- 517 Principles of Singapore Business Law tion is similar where, though there is no express provision, both parties contemplated supply by the particular source. But where only one party intends to use that source, failure of that source does not amount to frustration. (5) Method of performance impossible 17.19 A contract may provide for, or the parties may have contemplated, a particular method of performance. In such a case, if that method becomes impossible, the contract is frustrated. But the method stipulated must have been intended to be exclusive; otherwise, alternative methods may have to be resorted to, so long as they are not fundamentally different from the prescribed method. The classic illustration is the House of Lords decision of Tsakiroglou & Co Ltd v Noblee Thorl GmbH (1960) (see Box 17.1). Box 17.1 Reflecting on the law Frustration and the closure of the Suez Canal Africa is a large continent, and any shipment of goods to or from Western Europe on the one hand, and the Middle East and South Asia on the other, would either go via the Cape of Good Hope or take a short cut through the narrow water channel called the Suez Canal; the latter route, of course, saves time and expense. The closure of the Suez Canal in 1956 and in 1967 resulted in litigation that brought the issue of frustration to the forefront. The leading Suez Canal case is Tsakiroglou & Co Ltd v Noblee Thorl GmbH (1960), which involved the sale and shipment of goods from Port Sudan to Hamburg. Though there was no express stipulation to that effect, the parties had anticipated shipment to be via the Suez Canal. With the sudden closure of the Suez Canal, the alternative route was via the Cape, a journey more than twice the distance and incurring twice the expense. The House of Lords held that shipment via the alternative route was not a substantially different performance, and that the contract had therefore not been frustrated. The court’s reasoning appears to be in accord with the principle of frustration as laid down in Davis Contractors. There is, arguably, no radical change to the contract — the sale of goods for shipment from Port Sudan to Hamburg. But one cannot help but empathise with the sellers, especially since both parties expected the Suez Canal to be used. Is not frustration generally understood to involve unexpected events? Certainly, if the contract had specified shipment via the Suez Canal, the case for frustration would have been much stronger. However, the facts in Tsakiroglou must be borne in mind: the goods involved were groundnuts, not perishables, there was no date fixed for delivery at Hamburg, and there was sufficient shipping available to carry the goods via the Cape. Had the facts been otherwise, the contract might well have been frustrated. 518 Chapter 17: Frustration Illegality 17.20 Where at the time of contract the performance is one which is already prohibited by law, the contract is void ab initio (from the start) for illegality (see, generally, Chapter 15). The contract is not enforceable because, as a matter of public policy, the law will not give assistance to parties to an illegal transaction. Similar policy considerations apply where there is supervening illegality. Common instances of frustration brought about by supervening illegality include wartime prohibition against trading with the enemy, and subsequent changes in the law, such as a prohibition against exporting a particular product, or a restriction on the movement of capital. Where the contract is to be performed abroad and its performance has become illegal by the law of the place of performance, the contract is generally frustrated (for further complexities in this area, see the discussion in Chitty on Contracts, Vol 1 (30th ed, 2008) at para 23-027). 17.21 While the doctrine of frustration can be excluded by express agreement, frustration through supervening illegality cannot be so excluded. The reason for this is the strong public interest of not upholding such contracts and transactions. In a similar vein, a contract may be frustrated by supervening illegality which was foreseeable or even foreseen but for which no express provision has been made. Radical Change (1) Frustration of purpose 17.22 Sometimes, after a turn of events, the literal performance of a contractual obligation remains possible but performance under the changed circumstances would not fulfil the original commercial purpose of the parties. Instinctively, the “cancellation of event” cases, as in the leading English decision of Krell v Henry (1903), which involved the hire of premises to view the coronation procession of King Edward VII (who, unfortunately, fell ill), come to mind. The key question is whether the enjoyment of the event, such as a procession, a fireworks display or the eclipse of the sun, was the common purpose of both parties. If it was, then the cancellation of the event frustrates the contract even though the continuation of the contract — such as the hire of premises — is physically possible. The failure of the purpose of one party alone does not bring about frustration. 519 Principles of Singapore Business Law (2) Delay, unavailability 17.23 The subject of temporary unavailability was discussed in para 17.17. Contracts may be delayed by various causes, such as the stranding of a ship, wartime requisitions, bad weather, labour shortages and so forth. In order for a delay to render performance a thing “radically different”, the delay must be so abnormal in its effect or expected duration as to fall outside what was the reasonable contemplation of the parties at the time of contract. Consonant with the approach as to the time of frustration (see para 17.10), at the onset of the supervening event, or soon thereafter, based on the evidence of what has occurred and is likely thereafter to occur, a judgment has to be made as to whether the delay has frustrated the contract (per Lord Roskill in the House of Lords decision of The Nema (1982)). (3) Impracticability, increased costs 17.24 In the US, many states recognise the doctrine of commercial impracticability as a ground for discharge by supervening events, and this concept of impracticability includes extreme and unreasonable difficulty, expense or loss. The UK (and Singapore) position, however, is that impracticability in itself is insufficient to frustrate a contract. The Tsakiroglou v Noblee Thorl (as mentioned in para 17.19) and Davis Contractors decisions are clear testimony of the strict approach taken by English courts. Men of business are taken to be cognisant of the risks and vicissitudes in the business environment, such as rises and falls in prices, interruptions in supply, currency fluctuations, inflation and so on. Impracticability or increased costs, in general, does not frustrate a contract. But where the supervening impracticability is so abnormal as to be outside the ordinary range of commercial risk (such as an astronomical rise in price), performance in the changed circumstances may be considered radically different performance (see per Lord Reid and Lord Hodson in Tsakiroglou & Co Ltd v Noblee Thorl GmbH (1960)). These principles were recently endorsed by the Singapore Court of Appeal in Holcim (Singapore) Pte Ltd v Precise Development Pte Ltd (2011), which observed at [53] that “while a mere increase in prices of source materials was generally insufficient, in and of itself, to constitute a ‘hindrance’ or ‘prevention’ that could invoke a force majeure clause … the issue was open as to what the legal position would be if the increase in prices was astronomical.” 520 Chapter 17: Frustration Frustration of a Lease/Sale of Land 17.25 For a time, there was uncertainty as to whether the doctrine of frustration could apply to leases and other contracts pertaining to land. It was thought that the doctrine did not apply for the reason that a lease creates not merely a contract but also an estate. It is now quite settled that, under Singapore law, the doctrine applies to a lease of land (see Singapore Woodcraft Manufacturing v Mok Ah Sai (1979)). Similarly, the Singapore Court of Appeal, in Lim Kim Som v Sheriffa Taibah bte Abdul Rahman (1994), has held that the doctrine of frustration can apply to a contract for the sale of land. In the case itself, it was held that the sale and purchase agreement was frustrated by the supervening compulsory acquisition of the property by the government. (For further discussion on the topic, see A Phang, Cheshire, Fifoot and Furmston’s Law of Contract (2nd ed, 1998) at pp 968– 972 and the references there cited.) SELF-INDUCED FRUSTRATION General 17.26 A critical element of frustration is that neither party is at fault. More specifically, frustration should not be due to the act or election of the party seeking to rely on it. A party to a contract cannot rely on self-induced frustration, that is, on frustration due to his own conduct or the conduct of those for whom he is responsible. The act may be a breach of contract, but it need not be so. The onus of proving that the frustration was self-induced lies with the party who asserts that it is so. 17.27 Although a contracting party cannot rely on frustration induced by his own conduct, the other contracting party is entitled to do so. So, for example, where an employee commits an offence (not related to his employment and therefore not amounting to a breach of contract) and is imprisoned, the employer is entitled to rely on the circumstances as frustrating the contract of employment (see Harrington v Kent (1980)). Negligence 17.28 A difficult point is whether a contracting party can rely on an event brought about by his own negligence as a ground of frustration. In principle, it seems 521 Principles of Singapore Business Law correct that a party who has been negligent should not escape liability since he is at fault. The problem is that negligence encompasses a wide spectrum of conduct ranging from mere carelessness to gross negligence. In Joseph Constantine v Imperial Smelting (1942), Viscount Simon (at pp 106–107) seemed to lean towards the view that a prima donna who loses her voice through carelessly catching a cold could plead frustration so long as her incapacity “was not deliberately induced in order to get out of her engagement”. At first blush, Viscount Simon’s statement of law sounds simple and correct. Upon closer analysis, there are difficulties. The central problem is the relationship between negligence and deliberateness. The conventional delineation is that a person’s action is either intentional (deliberate) or negligent. Viscount Simon’s dictum, however, seems to suggest that a person can be deliberately careless. In this writer’s view, there is sense in what his lordship had said. 17.29 Take the example of a singer who is considering a night walk on the eve of her performance. She knows the air is rather cold and there is a slight chance of her catching a chill. However, she thinks and hopes that she will not catch a cold. In this situation, she may be careless but she does not deliberately want to catch a cold; in fact, she does not want to catch a cold. Suppose we change the scenario a little. She knows that there is a small risk but hopes to catch the cold as, for some reason, she does not want to perform the next day. In this scenario, her action is careless (but not grossly negligent since the chance of catching the cold is slight) but, in a sense, deliberate. If she does catch a cold and is therefore unable to perform, there is frustration in the first scenario but not in the second. Choosing between Several Contracts 17.30 A situation can arise whereby as a result of a supervening event, a contracting party is in a position where he is not able to perform all of several contracts but can perform some of them. For example, the supervening event may have substantially reduced his supply of goods or materials. Judicial authority (see Maritime National Fish v Ocean Trawlers (1935) and The Super Servant Two (1990)) suggests that if the contracting party chooses to perform some of the contracts, he cannot rely on frustration to discharge him from the other contracts; with regard to these other contracts, the frustration would be considered self-induced. The fairness of such a position 522 Chapter 17: Frustration is questionable as it seems harsh to fault the contracting party for making the best of an unexpected situation. On the other hand, it may be argued that he took the commercial risk of ending up in such an invidious situation. 17.31 An alternative is to hold that all the contracts affected by the supervening event are partially frustrated and that the contracting party is permitted to pro-rate the delivery to all the parties. But this solution is problematic from both the practical and theoretical perspectives (see para 17.32). A satisfactory solution has yet to be found. PARTIAL FRUSTRATION 17.32 In the preceding paragraph, we have seen that if supervening events put a contracting party in a position where, being unable to perform all of several contracts, he has to choose which to perform, he is not discharged as regards the contracts which he chose not to perform. The reasoning is that the frustration would have been self-induced. Suppose then that the contracting party entered into one contract only and, because of a supervening event, the contract can only be partially performed, as in Sainsbury v Street (1972) where, as a result of crop failure, the harvest yielded only 140 tons of barley whereas the contract quantity was 275 tons. It was there held that the seller remained bound to deliver the 140 tons though he was excused with regard to the remaining 135 tons. It would seem, then, that the case is authority for a doctrine of partial frustration. Unfortunately, the term “frustration” was not used in the judgment at all and the decision proceeded on the basis of construction of the terms of the contract. 17.33 The issue is a difficult one. The traditional thinking on frustration takes an all-or-nothing approach; the contract (assuming it is not a divisible contract; see Chapter 16, paras 16.86–16.87) as a whole ends if there is frustration or continues if there is no frustration. If partial frustration is accepted as a doctrine, one difficulty is whether and where a line should be drawn as to the proportion of the contract that is performable before it can be said that the contract is partially frustrated, thus keeping the rest of the contract intact. The author suggests that, consistent with the law’s approach to discharge by performance, a reasonable threshold would be whether the contract is still 523 Principles of Singapore Business Law “substantially performable” in the changed circumstances. Meanwhile, the current legal position remains unclear. EXPRESS PROVISION General 17.34 Frustration, it should be recalled, deals with allocation of risks. If the parties have made their own allocation of risks with regard to possible supervening events, generally the law would uphold their contractual allocation. One exception, which has been mentioned earlier, is supervening illegality. In exceptional circumstances, a court may imply a provision excluding frustration where, for example, the nature of the contract makes it clear that it was intended that one party assumes the risk of the supervening event. 17.35 Express contractual provisions regarding supervening events are often called force majeure (act of God) clauses. A force majeure clause may deal with supervening events in a variety of ways. For example, it could put the risks of the supervening events on one party alone, in effect making his performance obligation an absolute one. Or, it could provide that upon the occurrence of any of the supervening events, the contract is at an end and the clause could provide in further detail for the legal consequences. Alternatively, it could provide that upon the occurrence of a supervening event, the parties will meet and negotiate as to the continuation of the contract (see, eg, the Singapore case China Resources v Magenta Resources (1997) where the clause provided that “[s]hould the effect of the force majeure continue for more than 120 consecutive days, the buyer and the seller shall discuss through friendly negotiation … their obligation to continue to perform …”). Construction 17.36 While an express provision can exclude frustration, the courts have tended to construe such a provision narrowly. A force majeure clause, it is said, must be “full and complete” (Bank Line v Arthur Capel (1919)) and intended to cover the supervening event in question. The more devastating or catastrophic the event, the more the courts would require particularly clear words to be used. The supervening events which a force majeure clause purports to 524 Chapter 17: Frustration cover are not restricted to what the law would consider frustrating events. Events which would not have frustrated a contract may also be dealt with, and where, pursuant to such a clause, a contract is discharged following such an event, the contract is discharged not by frustration but rather by a contractual term either automatically or upon one party exercising his right to cancel, as the clause so provides. The precise construction of the clause is paramount as it would define the precise scope and ambit of the clause itself. The court is — in accordance with the principle of freedom of contract — to give full effect to parties’ intentions manifested through the language of the clause, subject to commercial practicability and commonsense (Holcim (Singapore) Pte Ltd v Precise Development Pte Ltd (2011)). In Holcim, the Singapore Court of Appeal thus rejected a construction of a force majeure clause that would allow one party to avail itself to its benefit even when the supposed triggering event was selfinduced. The court also agreed (at [66]) that there was no blanket principle that all reasonable steps should be taken before relying on the force majeure clause. FORESIGHT AND FORESEEABILITY Foreseen Events 17.37 As was pointed out in para 17.11, despite the fact that frustration is implicitly about unexpected events, the authoritative judicial definitions of frustration omit reference to this aspect. There is much doubt and uncertainty about whether frustration applies to foreseen or foreseeable events. For foreseen events, the view generally adopted by commentators is that the occurrence of such events does not frustrate a contract. The reasoning is that since the parties had already envisaged the possibility of such an event and yet chosen not to make any express provision regarding it, they must have contracted with reference to the risk of such occurrence. Insofar as Singapore law is concerned, given the position taken on foreseeable events (see para 17.38), it may be assumed that an event foreseen by both contracting parties does not frustrate a contract. Foreseeable Events 17.38 Events not foreseen but nevertheless are foreseeable give rise to greater difficulty. A foreseen event is high on the scale of likelihood of occurrence 525 Principles of Singapore Business Law and, logically, should not be a frustrating event. Conversely, a very remote contingency should qualify as a frustrating event. A foreseeable event, however, covers a wider spectrum of likelihood. The preponderance of academic opinion is that a foreseeable event would not lead to frustration if the degree of foreseeability is high and is one which any person of ordinary intelligence would regard as likely to occur (see Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at paras 19–076 to 19–081 for a good discussion of the subject). 17.39 The current English position with regard to foreseen and foreseeable events remains unclear, and one is still faced with judicial dicta (see, eg, Lord Denning MR in The Eugenia (1964)) to the effect that the essential thing is that the event was not provided for in the contract. 17.40 Insofar as Singapore is concerned, it is quite established that an event which is highly foreseeable cannot frustrate a contract. In Win Supreme Investment v Joharah bte Abdul Wahab (1997), Chao J (as he then was) held (at [33]) that frustration is inapplicable if the event was “clearly … foreseeable”. In a similar vein, in Glahe International Expo v ACS Computer (1999), Khoo J decided (at [39] that an event which is “reasonably foreseeable” does not bring about frustration. In fact, Thean JA, in the Court of Appeal in Glahe International Expo (at [26]), went so far as to say that “the doctrine of frustration concerns the treatment of contractual obligations upon the onset of an unforeseeable event” [emphasis added], which may suggest that even a very low level of foreseeability would displace the notion of frustration. If a very low level of foreseeability suffices to negate frustration, then the application of the doctrine will be very limited. Time will tell whether Singapore courts indeed take such a strict approach towards frustration. EFFECTS OF FRUSTRATION Introduction 17.41 The effect of frustration on a contract is that it brings the contract to an end from the time of the frustrating event. Frustration operates automatically, without the need for any election by either party. At common law, the effect of frustration on the parties’ remedies is summarised by the phrase “the losses lie where they fall”. While the parties are released from future 526 Chapter 17: Frustration obligations, accrued obligations remain. Sums paid prior to the event are not recoverable, while sums payable at the time of frustration remain payable. 17.42 Originally, it was also said that in the case of a frustrated contract, there can be no recovery of monies for a failure of consideration. Later, following a House of Lords decision (Fibrosa Spolka Akcyjna v Fairbairn Lawson Combe Barbour, Ltd (1943)), such a claim was permitted. There was, however, no such recourse where the failure of consideration was only partial. These and other inadequacies were eventually dealt with by legislation. The Singapore Frustrated Contracts Act (Cap 115, 1985 Rev Ed) is identical in substance to the UK Law Reform (Frustrated Contracts) Act 1943. Frustrated Contracts Act (1) General 17.43 The Frustrated Contracts Act (“FCA”) alters and adds to the common law position. The common law effect that all future obligations cease is untouched by the Act, but the Act does alter the remedies in three respects: payments, expenses and benefits (see Table 17.1). Table 17.1 Changes made to the effects of frustration at common law by the Frustrated Contracts Act Aspects Common Law Released Released Accrued obligations Remain Released Sums paid Not recoverable Recoverable Sums payable Remain payable No longer payable Expenses Not applicable Recoverable Benet Not applicable Recoverable Future obligations Frustrated Contracts Act (2) Payments, expenses, benefits 17.44 Section 2(2) FCA provides that all sums paid before the time of discharge are recoverable, while all sums payable at that time cease to be so payable. This is a reversal of the common law position. 527 Principles of Singapore Business Law 17.45 The subsection goes on to provide that if the party to whom the sums are paid or payable had incurred expenses prior to the time of discharge in or for the performance of the contract, the court may, if it considers it just to do so, allow him to retain or recover (as the case may be) part of the sum so paid or payable. Of course, he cannot recover more than his actual expenses. 17.46 The third key aspect of the Act is that it recognises and compensates for benefits enjoyed, supervening event notwithstanding. Section 2(3) FCA provides that if a contracting party has, by reason of any act done by the other party in performance of the contract, obtained a valuable benefit before the time of discharge, the court may, if it considers it just to do so, allow that other party to recover a sum (not exceeding the value of the benefit) which is appropriate in the circumstances. 17.47 In arriving at such a just sum, the court is to have regard to the expenses that the benefited party had incurred in the performance of the contract as well as the payments retained or recoverable by the first party under s 2(2) FCA (see para 17.45). The court also has to consider the effect, if any, that the frustrating event had on the benefit. For example, the event may have damaged the work performed so far and thereby reduced the benefit obtained by the partial performance, whereas if the event brought about the complete destruction of the subject matter, the benefit may be nil (for the intricacies on the subject, see Edwin Peel, Treitel: The Law of Contract (13th ed, 2011) at paras 19–101 to 19–103). (3) Severability 17.48 Section 3(4) FCA provides for severable parts of a contract to be treated separately, so that parts of a contract may be frustrated while other parts continue unaffected. (4) Ambit of act 17.49 The Act has general application but does not apply to contracts for the carriage of goods by sea, insurance contracts and contracts for the sale of specific goods where the cause of frustration is the perishing of the goods (see s 3(5)). 528 Chapter 17: Frustration CONCLUSION 17.50 The concept of frustration is an important one and has serious implications on the performance of contracts. The key elements are reasonably clear: absence of fault on the part of both parties, a supervening event and radical change in performance. Further, under Singapore law, foreseen and reasonably foreseeable events would not frustrate a contract. 17.51 Where frustration applies, the contract comes to an end. Under the Frustrated Contracts Act, existing payment obligations cease and sums paid are recoverable, and the court has wide discretion to make orders, taking into account expenses incurred and benefits received. The Act makes vast improvements over the previous common law position and facilitates a more equitable settlement of rights and remedies in the event of frustration. 17.52 As with many areas of contract law, the application of the doctrine of frustration is subject to the parties’ freedom of contract. Contracting parties may come to an agreement as to how they wish to deal with supervening events. By and large, such wishes receive the endorsement of the courts. 529 Chapter 18 Remedies for Breach of Contract 18.1–18.2 18.3 18.4–18.6 18.7 18.8–18.9 18.10–18.12 18.13 18.14–18.15 18.16 18.17 18.18–18.20 18.21–18.24 18.25–18.35 18.36–18.37 18.38 18.39–18.44 18.45–18.50 18.51 18.52 18.53–18.56 18.57–18.59 18.60–18.63 Introduction Judicial Remedies Contrasted with Self-help Remedies Types of Judicial Remedies Availability of Judicial Remedies: Limitation Periods and Laches Contract Damages at Common Law: Compensation for Pecuniary Loss Compensation Only Liquidated Compared with Unliquidated Damages Quantification and Measurement of Unliquidated Damages (1) Quantification by reference to “expectation”, “reliance” or other losses (a) Expectation loss (b) Reliance loss (c) Other losses (2) Placing the innocent party in the position as if contract was fully performed (3) Electing between different methods of quantifying loss (a) Expectation or reliance basis: Bad bargains, overly speculative expectation loss and pre-contract reliance expenditure (b) Different bases for quantifying expectation loss: “Diminution in value” or “cost of cure” Time of Quantification Restrictions on Recovery of Unliquidated Damages (1) Non-pecuniary loss (2) Causation of loss (3) Remoteness of loss (a) “Naturally arising damages” and “damages arising from special circumstances” (b) Imputed and actual knowledge (c) Probability of type of loss (d) Types and extent of loss Principles of Singapore Business Law 18.64–18.66 18.67–18.73 18.74 18.75–18.78 (e) The rationale for the rule in Hadley v Baxendale and the role of assumption of responsibility (4) Mitigation of loss 18.79 18.80 18.81 18.82 18.83–18.85 Action for a Fixed Sum No Damages for Breach of an Obligation to Pay Money Exceptions Permitting Damages for Breach of Obligation to Pay Money (1) Contractual provision for interest (2) Knowledge that breach would cause losses (3) Damages arising apart from non-payment Timing of Claim Where Plaintiff is in Breach of Contract 18.86–18.88 18.89–18.90 Specific Performance Limitations on Availability of Specific Performance 18.91–18.94 Injunction 18.95–18.97 Statutory Damages in Lieu of or in Addition to Specific Performance or Injunction 18.98–18.101 18.102–18.111 18.112–18.119 18.120–18.125 Restitutionary Awards Benefits in Money: Total Failure of Consideration Benefits in Kind: Quantum Meruit and Quantum Valebant Restrictions on Recovery for Unjust Enrichment 532 Chapter 18: Remedies for Breach of Contract INTRODUCTION Judicial Remedies Contrasted with Self-help Remedies 18.1 Following a breach of a condition of a contract, or where the breach causes one party to be deprived of substantially the whole of the benefit of the contract, the aggrieved party may elect to bring the contract to an end. When this happens, as discussed in Chapter 16, both the aggrieved party and the party in breach will be released from any outstanding obligations under the contract. 18.2 The act of election to discharge the contract is sometimes said to be a “self-help” remedy because the release is effected without the need for any court approval or intervention, and in many cases, this alone may be sufficient to bring the contractual dispute to a close without the need for any further judicial remedy. Nevertheless, where the aggrieved party has suffered financial losses as a result of the breach, or where release of the party in breach from outstanding obligations will cause financial loss, discharge of contract alone may not be an adequate remedy. Recourse to other judicial remedies may be needed. Types of Judicial Remedies 18.3 In relation to contract law, the following types of judicial remedies are commonly sought: ° the common law remedy of damages; ° the common law remedy of an action for a fixed sum; ° the equitable remedy of specific performance; and ° the equitable remedy of injunction. Outside of the law of contract, certain common law restitutionary remedies in the law of unjust enrichment may also be available. It is important to draw the distinction between the common law and equitable remedies because, while the former are available as of right, the latter are discretionary. It is also important to distinguish between remedies originating in contract and those drawn from the law of unjust enrichment because they are each subject to different requirements and restrictions. 533 Principles of Singapore Business Law Availability of Judicial Remedies: Limitation Periods and Laches 18.4 Urgency should be the order of the day when seeking judicial remedies as access to judicial remedies may be barred by lapse of time. This can arise through the operation of the Limitation Act (Cap 163, 1996 Rev Ed) (“LA”), as amended by the Arbitration Act (No 37 of 2001); or through the equitable doctrine of laches. 18.5 Generally speaking, no action may be brought for a breach of contract after six years have lapsed from the time when the contract was breached (s 6 LA) (although the statute does provide that the time from which the limitation period starts running may be postponed in certain circumstances, eg, where the plaintiff was ignorant of the breach of contract). If the statutory limitation period has elapsed, access to judicial remedies such as damages for breach of contract or an action for a fixed sum due under a contract will be barred. The LA, however, does not apply to any legal action rooted purely in unjust enrichment (see the decision of the Singapore Court of Appeal in Management Corporation Strata Title No 473 v De Beers Jewellery Pte Ltd (2002) at [32]). 18.6 In relation to the equitable remedies of specific performance and injunction, the equitable doctrine of laches applies. This doctrine is preserved by s 32 LA. Shortly put, applicants who delay in applying for such equitable relief from the courts may be turned away where the delay is inordinate and inexcusable such that it would be inequitable to grant such relief. An application for an order for specific performance or an injunction to remedy a breach of contract may be denied if the application is not made as soon as the nature of the case might permit. Two important factors to be considered are the length of delay (from the time the plaintiff knew he could have brought the case to court), and whether the defendant acquiesced in the delay. CONTRACT DAMAGES AT COMMON LAW: COMPENSATION FOR PECUNIARY LOSS 18.7 Contractual damages are awarded at common law to an aggrieved party in the form of a sum of money in compensation for any pecuniary losses which have been incurred as a result of the breach of contract. 534 Chapter 18: Remedies for Breach of Contract Compensation Only 18.8 In general, damages are compensatory in nature. As was pointed out in the House of Lords case of Addis v Gramophone Company, Ltd (1909), the common law does not traditionally award punitive damages in cases of breach of contract. This may be contrasted with damages that may be awarded in tort: it is accepted that exemplary and punitive damages may be awarded by the courts against a wrongdoer who has committed a particularly serious tort. 18.9 In the appropriate case, however, it seems that damages may be awarded for breach of contract on other bases. For example, in the Canadian Supreme Court case of Whiten v Pilot Insurance Co (2002), Mrs Whiten had a contract of insurance with the Pilot Insurance Co (“Pilot”), insuring her home against the risk of fire. Unfortunately, Mrs Whiten’s home was razed in a fire and as a result, Mrs Whiten claimed on her insurance policy. Pilot contested the claim, alleging arson on the part of Mrs Whiten or members of her family, even though there was absolutely no evidence in support of such an allegation. This appeared to be a cynical ploy on Pilot’s part to force Mrs Whiten to settle her claim for a lower sum than she was otherwise entitled to. Unsurprisingly, given the lack of any evidence to support their claim of arson, Pilot’s defence against Mrs Whiten’s suit failed and they were ordered to pay her a sum of around C$300,000 based on the terms of their insurance policy with Mrs Whiten. However, Pilot was also found to have contested her claim in bad faith, thereby breaching their duty of good faith and fair dealing under the contract of insurance. At the end of the trial, the jury also awarded C$1 million to Mrs Whiten as punitive damages in denunciation of Pilot’s exceptionally reprehensible behaviour. This decision was upheld on appeal to the Canadian Supreme Court. Liquidated Compared with Unliquidated Damages 18.10 In some cases, compensation for losses resulting from breach may have been pre-agreed by the contracting parties as a term of the contract. If the agreed sum is a genuine pre-estimate of the loss which could be suffered as a result of a breach of the contract, the court will order that sum to be paid in compensation as liquidated damages. 535 Principles of Singapore Business Law 18.11 If, however, the sum is intended to be a penalty aimed at “punishing” the party in breach, the court will strike down the “penalty” clause and award unliquidated damages instead. This may, sometimes, have the somewhat perverse result where the aggrieved party is able to recover unliquidated damages in a sum greater than that set by the penalty clause (see Public Works Commissioner v Hills (1906)). 18.12 The principles setting out the distinctions between a liquidated damages clause and a penalty clause were summarised in the House of Lords case of Dunlop Pneumatic Tyre Company, Limited v New Garage and Motor Company, Limited (1915) by Lord Dunedin (at pp 86–88) as follows: I shall content myself with stating succinctly the various propositions which I think are deducible from the decisions which rank as authoritative: 1. Though the parties to a contract who use the words “penalty” or “liquidated damages” may prima facie be supposed to mean what they say, yet the expression used is not conclusive. The Court must find out whether the payment stipulated is in truth a penalty or liquidated damages. This doctrine may be said to be found passim in nearly every case. 2. The essence of a penalty is a payment of money stipulated as in terrorem of the offending party; the essence of liquidated damages is a genuine covenanted pre-estimate of damage. 3. The question whether a sum stipulated is penalty or liquidated damages is a question of construction to be decided upon the terms and inherent circumstances of each particular contract, judged of as at the time of the making of the contract, not as at the time of the breach. [emphasis added] 4. To assist this task of construction various tests have been suggested, which if applicable to the case under consideration may prove helpful, or even conclusive. Such are: (a) It will be held to be penalty if the sum stipulated for is extravagant and unconscionable in amount in comparison with the greatest loss that could conceivably be proved to have followed from the breach. 536 Chapter 18: Remedies for Breach of Contract (b) It will be held to be a penalty if the breach consists only in not paying a sum of money, and the sum stipulated is a sum greater than the sum which ought to have been paid. (c) There is a presumption (but no more) that it is penalty when “a single lump sum is made payable by way of compensation, on the occurrence of one or more or all of several events, some of which may occasion serious and others but trifling damage”. On the other hand: (d) It is no obstacle to the sum stipulated being a genuine preestimate of damage, that the consequences of the breach are such as to make precise pre-estimation almost an impossibility. On the contrary, that is just the situation when it is probable that pre-estimated damage was the true bargain between the parties. Quantification and Measurement of Unliquidated Damages (1) Quantification by reference to “expectation”, “reliance” or other losses 18.13 In order to better understand the various types of losses which may be incurred by a plaintiff due to a defendant’s breach of his contractual obligations, it may be useful to consider the following example: ° Peter has inherited a run-down warehouse and sets up a wholesale food and beverage business in Singapore. He starts his business with cash-inhand of $100,000 as capital. ° On 1 January, he enters into a contract (governed by Singapore law) with David to buy 500 bottles of French wine originating from one particular vineyard, David being a wine importer based in Singapore and the exclusive distributor for that vineyard. David agrees that he will be paid the contract price of $32,000 only upon delivery, which is agreed will occur on 1 February. ° While awaiting delivery, Peter contracts to resell the wine to Tim (who runs a number of French restaurants) for $50,000, with payment upon delivery on 15 February. This resale contract provides that damages for non-delivery of the wine are agreed in the liquidated sum of $10,000 (as Tim’s usual profit margin for wine sold at his restaurants hovers around the 20 per cent mark). 537 Principles of Singapore Business Law ° The warehouse is in a suitable condition to store most types of goods. ° However, certain insulation works must be carried out to ensure that the wine is kept cool. Peter therefore contracts with Richard to install the insulation for the warehouse for $7,500 so it can be used to store the wine when it is delivered on 1 February prior to its delivery to Tim on 15 February. If not for the contract with David, Peter would not have made any renovations at all. Richard is not agreeable to delayed payment, however, so Peter pays Richard in full, and Richard immediately starts work (and completes it on 14 January). ° On 1 February, David delivers the wrong type of wine — instead of the promised French wine, David delivers 500 bottles of Italian wine of completely different description to Peter, telling Peter that he has found a buyer who is willing to pay a much higher price for the French wine, and he is therefore supplying the Italian wine in substitution. ° Peter refuses to accept the substitution and instead discharges the contract due to David’s actual repudiatory breach. This releases him from having to pay David anything, since delivery was a precondition to payment. In turn, he regretfully informs Tim that he will be unable to deliver the French wine as contracted, since there is no distributor for the wine other than David. ° Tim accepts David’s anticipatory repudiatory breach and discharges their contract, but insists on compliance with the liquidated damages clause — so Peter pays Tim $10,000 as liquidated damages. ° Peter also incurs $3,000 in transport costs in sending the Italian wine back to David when David unreasonably refuses to take back the defective shipment of wine. ° Out of his initial capital of $100,000, the sum which Peter now has in hand is $79,500: Starting capital Less Costs actually incurred: (1) Cost of renovations to warehouse (2) Liquidated damages paid to Tim (3) Cost of transport of Italian wine Peters cash in hand after the breach by David 538 $100,000 ($7,500) ($10,000) ($3,000) $79,500 Chapter 18: Remedies for Breach of Contract (a) Expectation loss 18.14 The first type of loss that Peter can try to recover from David is his (nett) expectation loss. This is the nett profit that Peter expects to make on the basis that his contract with David is performed. In tabular form, this might be derived as follows: Expected revenue had contract with Tim been performed Less Costs incurred had contract with Tim been performed: (1) Cost of wine (2) Cost of renovations to warehouse Nett profit had contract with David not been breached $50,000 ($32,000) ($7,500) $10,500 = Nett expectation loss Had David performed his part of the contract, Peter would have been able to earn a nett profit of $10,500. But David’s breach has the effect of preventing Peter from earning this sum: it has caused Peter to lose this gain that he expected to earn. Thus, Peter will seek to recover his nett expectation loss of $10,500. 18.15 Care should be taken in interpreting the phrase “expectation loss”. If no deduction were made for the expenditures needed to “earn” the revenue of $50,000, the resulting figure may be said to be Peter’s “gross” expectation loss. Unfortunately, the phrase “expectation loss” is sometimes used loosely on its own without the preceding adjective in cases and secondary material. When encountering this phrase on its own, care should be taken to verify whether it is being used to refer to a loss calculated on a nett or gross basis. (b) Reliance loss 18.16 In addition to the nett expectation loss calculated in the above manner, Peter may choose to recover the $7,500 paid to Richard. This amounts to a form of reliance loss on Peter’s part: in reliance on David performing his side of the contract, Peter actually incurred $7,500 in renovation costs. This label would not, however, be appropriate for the $32,000 that Peter now does not have to pay David (since no wine was delivered and the contract has been discharged by David’s breach). This sum does not form part of Peter’s reliance loss since Peter has not actually incurred this expenditure. 539 Principles of Singapore Business Law (c) Other losses 18.17 Beyond “expectation” and “reliance” losses, other types of losses may sometimes be inflicted on the victim of a breach of contract, for example, “consequential” losses. To illustrate: on the facts of our example above, Peter has also suffered a loss of $10,000 when he paid the liquidated damages to Tim. This is sometimes referred to as Peter’s “indemnity loss”. As for the $3,000 worth of transport costs in sending the wine back to David incurred by Peter after David’s breach had come to his attention, this kind of loss is sometimes referred to as “incidental loss”. (2) Placing the innocent party in the position as if contract was fully performed 18.18 The labels mentioned in the previous section are, however, purely descriptive of the various losses which the victim of a breach of contract might incur. In quantifying the damages which a court may award to compensate the victim for any losses howsoever they might be described, the central principle is this: without considering any of the many restrictions on recovery (which will be discussed below in the sections commencing from para 18.38), Peter’s damages will be quantified at a figure that will place him in the position as if the contract with David had been fully performed. The general principle, therefore, is that the court will usually quantify unliquidated damages so as to place the aggrieved party, as far as money can do so, in the position he or she would have been had the contract been performed fully instead of being breached (per Parke B in Robinson v Harman (1848) at p 855). 18.19 Peter’s losses as identified above are: Nett expectation loss Reliance loss Incidental loss Indemnity loss Total losses suffered $10,500 ← derived in para 18.14 $7,500 $3,000 $10,000 $31,000 = Total damages awardable (leaving aside questions of mitigation, remoteness of damages, etc) Peter should therefore recover damages totalling $31,000 (being the sum of his nett expectation loss, reliance loss, incidental loss and indemnity loss). Taken together with the $79,500 of capital that Peter had left, assuming 540 Chapter 18: Remedies for Breach of Contract David complies with the court order in full, Peter’s cash position will then equal $110,500. 18.20 This reflects the fundamental compensatory principle underlying recovery in contract: that the plaintiff is to be put in the position as though the contract was fully performed, in which case no liquidated damages would have had to be paid to Tim, nor would any transportation costs for the Italian wine have been incurred. On that basis, Peter would (also) have ended up with $110,500 had David performed his part of the contract. Peter starts out with Expects to generate revenue from Tim Less Expenses necessarily incurred to fulfill contract with Tim: (1) Cost price for wine payable to David (2) Cost of renovations paid to Richard Had there been no breach of contract, Peter would have ended up with $100,000 $50,000 ($32,000) ($7,500) $110,500 = Total damages awarded + sum in hand actually left over (3) Electing between different methods of quantifying loss (a) Expectation or reliance basis: Bad bargains, overly speculative expectation loss and pre-contract reliance expenditure 18.21 In general, the aggrieved party is free to choose how best to quantify his or her losses. However, it has been established that quantification on the basis of reliance losses may be precluded in cases where the party in breach proves that the aggrieved party made a bad bargain such that the reliance expenditure would have exceeded any expected gains (see, eg, the cases of C & P Haulage v Middleton (1983) and CCC Films (London) Ltd v Impact Quadrant Films Ltd (1985); the facts of CCC Films (London) are particularly interesting). 18.22 In the case of CCC Films, CCC contracted to pay Impact US$12,000 for a licence allowing them to exploit, distribute and exhibit in various countries three motion pictures. A deposit of 25 per cent was paid by CCC in advance. When the balance 75 per cent was paid, CCC requested that the tapes be sent by Impact to Munich via recorded delivery, together with the appropriate insurance. In fact, Impact sent the tapes by ordinary post without any insurance to cover their loss. The tapes never arrived at their 541 Principles of Singapore Business Law destination and no replacement tapes were provided by Impact. Consequently, CCC sued Impact for breach of contract. Since CCC could produce no evidence of loss of profits from their inability to exhibit or otherwise exploit the films, they pursued an alternative claim for the US$12,000 spent in acquiring the licence. On the other hand, Impact produced no evidence either that CCC would have failed to recoup their expenditure had there been no breach at all, that is, that CCC had made a “bad bargain” right from the outset. 18.23 Faced with a situation where neither party provided any evidence as to whether CCC would have made a profit on the transaction, Hutchison J held that a plaintiff ’s choice whether to claim loss of profits or wasted expenditure can only be limited if the defendant is able to prove that the plaintiff would never have recovered his expenditure in reliance on the contract, even if the contract had been properly performed. This is a reversal of the usual burden of proof: usually, the plaintiff has to establish every element of his claim. However, since it was the defendant’s breach which had caused this situation to arise, the usual burden of proof would be reversed. 18.24 But even where there is no evidence that the aggrieved party had made a bad bargain, it may sometimes be advisable for the aggrieved party to avoid quantifying his damages on an expectation basis where such losses are speculative. A good example of this is the case of Anglia Television Ltd v Reed (1972). Oliver Reed entered into a contract with Anglia Television to act in a film to be produced by them. Reed then changed his mind and informed Anglia Television that he no longer wished to act in the film. Prior to the actual signing of the contract and following on from the signing, Anglia Television had expended a significant amount of money in preparation for the production of the film. Anglia Television sued Reed for breach of contract. However, given the speculative nature of the likely profitability of films, Anglia Television sought to recover its reliance losses instead of its expectation losses from Reed. The English Court of Appeal agreed that it was impossible to establish what profits would have been made and held that Anglia Television could indeed recover damages on the reliance basis. However, when it came to quantifying the amount of such reliance, Anglia Television was permitted to recover both (1) the expenses incurred following from the time the contract was signed and (more controversially) (2) the expenses incurred prior to its formation, subject to satisfaction of the tests of remoteness. 542 Chapter 18: Remedies for Breach of Contract (b) Different bases for quantifying expectation loss: “Diminution in value” or “cost of cure” 18.25 Damages which are assessed on an expectation basis are not, however, always straightforward. In some instances, a further choice may have to be made whether such expectation losses are to be assessed from the viewpoint of a “diminution in value” or from the perspective of the “cost of cure”. 18.26 An award based on diminution of value aims to give the plaintiff the financial benefit that he would otherwise have obtained if the contract had been performed. This may take two forms: either (1) the difference between the market or resale value of the contractual performance and the value as stated in the contract; or, (2) where the contractual performance entails the production of something which the plaintiff intends to use in order to generate a profit, the loss of user profit which ought to have been earned had the defendant performed his obligations. 18.27 On the other hand, an award based on cost of cure aims to give the plaintiff a sum of money to repair any defects due to the defendant’s breach of contract. As a result, he is put in as good a position as if the defendant had performed his part of the contract, that is, it aims to award the plaintiff the sum which he has paid or would have to pay for substitute performance equivalent to that which the defendant ought to have provided under the contract. 18.28 To illustrate the difference between “diminution in value” and “cost of cure”, consider the following example: ° Henry has bought a new house for $750,000 and would like to replace the roof. He receives the keys to his new house on 15 January and enters into a contract with Connie to supply materials and labour for the roof replacement works for a total fee of $15,000. ° Connie’s staff finishes the re-roofing works on schedule. However, the works are defective and there are leaks all over the roof. In addition, due to the poor quality of the tiles supplied, all of the tiles have become discoloured. ° Henry gets a quotation from a rival contractor to perform rectification works to replace the entire roof, and is quoted $20,000. Henry also gets a valuation from a valuer as to the market value of his property in its current defective state, and is told that it is now only valued at $720,000 543 Principles of Singapore Business Law due to the hideous state of the roof. How much should Henry recover in damages: $30,000 (diminution in value of the house due to Connie’s defective work) or $20,000 (cost of cure)? 18.29 In the above example, Henry cannot recover both the diminution in value as well as the cost of cure. He has to elect to recover one or the other. This is strikingly demonstrated by the case of Radford v De Froberville (1977) which also goes further to show that the cost of cure can be recovered even if there is no diminution in value. In that case, it was agreed that the defendant would erect a permanent wall (specified to be seven feet high, with bricks of a specific type or alternatively, subject to the plaintiff ’s approval) to screen off the plaintiff ’s property from a new property development. In breach of contract, the defendant failed to build the wall. This did not cause any change in the market value of the plaintiff ’s property, but it could not be denied that the plaintiff had not been supplied with what he had contracted for. In such circumstances, Oliver J observed (at p 1270) that: If he [the plaintiff] contracts for the supply of that which he thinks serves his interests — be they commercial, aesthetic or merely eccentric — then if that which is contracted for is not supplied by the other contracting party I do not see why, in principle, he should not be compensated by being provided with the cost of supplying it through someone else or in a different way, subject to the proviso, of course, that he is seeking compensation for a genuine loss and not merely using a technical breach to secure an uncovenanted profit. 18.30 Consequently, the plaintiff ’s damages were assessed as the full cost of erecting the wall in accordance with the very detailed specifications contained in the agreement. The court declined to award a smaller sum sufficient to merely build a lower cost pre-fabricated boundary fence (as was suggested by the defendants), even though this would arguably provide the plaintiff with an equivalent degree of security against encroaching weeds and trespassers. 18.31 Are there any clear principles, then, that limit the plaintiff ’s choices as to how he is to quantify his expectation loss? The cases are not completely consistent with one another, but in Professor Burrows’ Remedies for Torts and Breach of Contract (3rd ed, 2004), it has been suggested (at pp 209–210) that the following factors may influence the court: 544 Chapter 18: Remedies for Breach of Contract ° where the plaintiff has sought to mitigate his losses, he will recover the cost of cure where he has, or ought to have, incurred that cost in reasonably seeking to minimise his losses; ° where the plaintiff has cured or intends to cure the defective performance by the defendant, the court is more likely to allow the award of damages based on the cost of cure; ° lastly, the plaintiff ’s intentions or aims in entering into the contract and desiring the defendant’s performance may be important. So if the plaintiff wanted performance in order to profit from it in the sense of making an economic gain, difference in value would more likely than not be adequate compensation; if the plaintiff wanted performance for other purposes, perhaps for his own use and enjoyment, difference in value would not, or not as fully, compensate him. 18.32 These three factors provide some guidance to determine where recovery on a cost of cure measure would be reasonable. In particular, the last issue can be seen to have been critical in the court’s assessment of reasonableness in cases such as Tito v Waddell (No 2) (1977), Ruxley Electronics and Construction Ltd v Forsyth (1996), Radford v De Froberville (1977) and Dean v Ainley (1987). In the first two cases, the courts were not satisfied that recovery on the “cost of cure” basis would be reasonable since it was not clear that the plaintiff intended to use such damages (if awarded) to make good the defective performance of the defendant. Accordingly, the courts refused to order damages based on the “cost of cure” measure. In contrast, in the third and fourth cases, the plaintiff was able to satisfy the court that he intended to use the damages to rectify the defendant’s defective performance — “cost of cure” damages were therefore viewed as being reasonable, and were ordered accordingly. 18.33 These factors, though, are really just indications as to whether it would be reasonable to award “cost of cure” damages. As observed by Lord Jauncey in Ruxley Electronics and Construction Ltd v Forsyth (1996) (at p 359): [I]n the normal case the court has no concern with the use to which a plaintiff puts an award of damages for a loss which has been established. Thus irreparable damage to an article as a result of a breach of contract will entitle the owner to recover the value of the article irrespective of whether he intends to replace it with a similar one or to spend the money 545 Principles of Singapore Business Law on something else. Intention, or lack of it, to reinstate can have relevance only to reasonableness and hence to the extent of the loss which has been sustained. 18.34 Consequently, it is not the case that the plaintiff must demonstrate that he intends to use the damages (if awarded) to “cure” the breach before the court is willing to allow them. Instead, it is all a question of reasonableness of such an award and a number of other factors may come into play. For example, Lord Jauncey in Ruxley Electronics and Construction Ltd v Forsyth (1996) (at p 358) appears to have also been influenced by the fact that contractual objectives for the construction of the swimming pool had been “achieved to a substantial extent”. Lord Mustill in the same case was influenced (at p 361) by the perception that the “cost of cure” measure would result in damages which were “disproportionate to the non-monetary loss suffered by the employer [Forsyth]”. Therefore, it may well be that even if there had been a finding of fact by the court of first instance that Forsyth had formed the intention to rebuild the pool, or had given an undertaking to the court that he would do so, the House of Lords would still have refused to allow recovery on the cost of cure measure, since Forsyth could not be allowed “to create a loss, which does not exist, in order to punish the defendants for their breach of contract” (per Lord Lloyd at p 373). 18.35 Interestingly, it appears that Lords Jauncey and Lloyd were both applying an objective test as to what was reasonable or proportionate in the circumstances so as to limit the employer’s ability to recover his loss in the context of quantification. To put it baldly, Mr Forsyth was not allowed to recover damages based on the cost of digging up the imperfectly built (though perfectly safe and adequate) swimming pool and re-constructing it to the contractual dimensions because, in the court’s opinion, such actions were unreasonable. This may be distinguished from the more-or-less subjective tests used in relation to establishing remoteness of damage (which will be discussed below at length at paras 18.51–18.63), wherein the courts are concerned with establishing the kinds of losses which are irrecoverable because they are too remote from the contemplation of the contracting parties, given the state of their knowledge as to each others’ affairs and the general conduct of contractual obligations at the time of the contract. 546 Chapter 18: Remedies for Breach of Contract Time of Quantification 18.36 In most instances, unliquidated damages will be assessed as at the time of the breach. However, this is not an inflexible rule. The court retains a wide discretion to assess damages at later points in time if this would serve the justice of the case better, given its particular facts and the need for the plaintiff to mitigate his losses (see, eg, the Singapore Court of Appeal decision of Tay Joo Sing v Ku Yu Sang (1994) which concurred with the House of Lords decision of Johnson v Agnew (1980) in holding that where appropriate, damages could be assessed at a point in time other than the date of breach). 18.37 In the current edition of Treitel on the Law of Contract (13th ed, 2011), it is suggested (at pp 1031–1048) that such flexibility may be guided by the following: ° As a starting point, one should ascertain the damage suffered by the plaintiff as at the time of the breach. This assumes that the plaintiff knows of the breach once it has been committed, and is able to take steps to mitigate his losses. ° If it was not possible for the plaintiff to know of the breach or to discover it with reasonable diligence at the time it occurs, then the court is likely to assess damages at the time when the plaintiff would have discovered the breach with reasonable diligence. ° However, if at the time of reasonable discovery, it is not possible to act on that knowledge to cut his losses (or to “mitigate” them), then the court may delay assessment until the point at which when it is possible for the plaintiff to do so. ° Given reasonable discovery and possibility of mitigation, if the plaintiff can nonetheless demonstrate that he has failed to act to mitigate at that point in time because there was a reasonable probability that the defendant would make good his default, then the court may defer the time of assessment until the time when it is no longer probable that this would be the case. ° In cases of late performance (as opposed to non-performance), it appears that the time of assessment will be the time of the late performance, and not the time when it ought to have been performed. 547 Principles of Singapore Business Law ° Lastly, in cases of an anticipatory breach which has been accepted leading to the discharge of the contract, the court will also assess damages as at the time when the defendant ought to have performed his part of the bargain, and not at the point when the anticipatory breach was accepted. This is, however, a starting point only, and there are a number of further qualifications discussed in that text (at pp 1035–1038), though consideration of those qualifications would take us beyond the introductory nature of the present work. Restrictions on Recovery of Unliquidated Damages 18.38 It is not the case, however, that unliquidated damages are available for all losses. Recovery is subject to certain restrictions. These will be described in the following sections, and a diagrammatic summary may be found at Figure 18.1. STEP 1 Causation in fact: Was the breach an effective cause of the loss? Apply but-for test No Damages not claimable Yes STEP 2 Remoteness (or Causation at law): Are the losses too remote? Consider tests in Hadley v Baxendale read with The Heron II Yes No STEP 3 STEP 4 Quantification (or Assessment) of damages: What is the sum required to put the innocent party in a position as though the contract has been properly performed? Mitigation: Have reasonable steps been taken to minimise the loss? No Quantum of damages awarded will be reduced by amount that could have been saved through mitigation. Figure 18.1 Summary of steps to claim unliquidated damages 548 Chapter 18: Remedies for Breach of Contract (1) Non-pecuniary loss 18.39 First, non-pecuniary losses (ie, for hurt feelings, disappointment, mental distress and so forth), are generally not compensable on policy grounds (as Bingham LJ pointed out in the case of Watts v Morrow (1991) at p 1445). 18.40 Any loss of reputation or embarrassment suffered by the injured party because of the breach of contract is also not recoverable (see Addis v Gramophone Company, Ltd (1909)). This reluctance to allow recovery for such losses can also be found in local cases, for example, the decision of G P Selvam J in the High Court decision of Arul Chandran v Gartshore (2000). 18.41 Nevertheless, even in Addis v Gramophone Company, Ltd (1909), Lord Atkinson accepted (at p 495) that non-pecuniary losses could be recovered in three exceptional cases: [1] actions against a banker for refusing to pay a customer’s cheque when he has in his hands funds of the customer’s to meet it, [2] actions for breach of promise of marriage, and [3] actions … where the vendor of real estate, without any fault on his part, fails to make title. 18.42 These three “well-known” exceptions do not appear to be exhaustive. Since 1909, the courts have also allowed recovery for mental distress damages in the following situations: ° Where there is substantial physical inconvenience or discomfort as a result of the breach of contract (Hobbs v The London and South Western Railway Company (1875); Bailey v Bullock (1950)). ° Where distress is directly consequent upon physical loss caused by the breach of contract (Perry v Sidney Phillips & Son (1982): anxiety and distress of living in a house in poor condition which had been bought in reliance on negligence in breach of contract in a surveyor’s report; Calabar Properties Ltd v Stitcher (1984): unpleasantness of living in deteriorating premises until they became uninhabitable because of the landlord’s delay in repairs). ° Where loss of reputation caused by grossly defective performance of an employer’s obligations results in financial loss to the employee (Malik v Bank of Credit and Commerce International SA (1998): here, the court was willing to imply a term of implied trust and confidence between employer and employee wherein the employer was obliged not to 549 Principles of Singapore Business Law conduct its affairs in such a corrupt and dishonest way as would tarnish the reputation of its employees). ° Where the very object or purpose of the contract is to provide enjoyment or to prevent distress (Jarvis v Swans Tours Ltd (1973); Heywood v Wellers (1976); Reed v Madon (1989); Farley v Skinner (2002)). 18.43 Farley v Skinner (2002) in particular, points to a possibly more expansive view in a number of these categories. In relation to the category of physical discomfort, Lord Scott observed (at [85]) as follows: In my opinion, the critical distinction to be drawn is not a distinction between the different types of inconvenience or discomfort of which complaint may be made but a distinction based on the cause of the inconvenience or discomfort. If the cause is no more than disappointment that the contractual obligation has been broken, damages are not recoverable even if the disappointment has led to a complete mental breakdown. But, if the cause of the inconvenience or discomfort is a sensory (sight, touch, hearing, smell, etc) experience, damages can, subject to the remoteness rules, be recovered. 18.44 Farley v Skinner (2002) also points to a potentially more relaxed approach where non-pecuniary losses by consumers are concerned. Lord Steyn observed (at [20]): I am satisfied that in the real life of our lower courts non-pecuniary damages are regularly awarded on the basis that the defendant’s breach of contract deprived the plaintiff of the very object of the contract, viz, pleasure, relaxation and peace of mind. The cases arise in diverse contractual contexts, eg, the supply of a wedding dress or double glazing, hire purchase transactions, landlord and tenant, building contracts, and engagements of estate agents and solicitors. The awards in such cases seem modest. For my part what happens on the ground casts no doubt on the utility of the developments since the 1970s in regard to the award of non-pecuniary damages in the exceptional categories. … (2) Causation of loss 18.45 Common sense dictates that compensation from the defendant is due only if the defendant’s breach of contract caused the plaintiff ’s loss. This 550 Chapter 18: Remedies for Breach of Contract is an evidential and factual enquiry. In general, however, a “but for” test of causation is applied, and usually, this is sufficient to discriminate between cases where causation is satisfied, and those where it is not. 18.46 Consider the following example: ° A contracts to buy B’s vintage car which is in practically mint condition and has never been involved in an accident. Based on the successful bid of $200,000 at a recent auction for a very similar car in a similar “mint” condition, A agrees to pay B the same price. A anticipatorily repudiates the contract by informing B that he has changed his mind. B accepts this and discharges the contract. B incurs further costs totalling $200 for another month of season car parking charges and in having to place further advertisements. Unfortunately, while the car is parked, an unknown vehicle backs into it and causes a bad dent. This is repaired and the costs of repair totalling $5,000 are taken care of by B’s insurers. But since the car is no longer in mint condition, the market price of the car has fallen to $140,000 even with the expert repairs which have already been done to it. Had it been in mint condition, C would have been willing to pay $200,000 for it. 18.47 – B suffers the following losses: (1) Additional parking charges and advertising costs ($200) and (2) Fall in value of car ($60,000). – A is most likely to be found to have “caused” B’s loss in relation to the additional $200 of parking charges and advertising costs. “But for” A’s breach, B would not have had to pay for further parking charges for this vehicle. – B may face some difficulty in relation to his claim for the fall in the value of the car — it is debatable whether this was “caused” by A. A’s breach of contract is certainly not the immediate cause of this head of loss: that would have to be the driver of the unknown vehicle which collided into the car while it was parked. However, “but for” A’s breach, the car would not have been parked at that spot. As noted above, problems with causation arise where there may be more than one sufficient cause leading to the loss. This kind of problem gives rise to extremely difficult issues, as the House of Lords decision in South Australia Asset Management Corporation v York Montague Ltd (1997) (sometimes 551 Principles of Singapore Business Law referred to as Banque Bruxelles Lamberts SA v Eagle Star Insurance Co, or the SAAMCO case) illustrates. But sometimes, such issues can be resolved by considering more carefully the precise nature of the obligation undertaken by the party in breach. 18.48 SAAMCO (1997) was a consolidated appeal from three different cases. All were concerned with the damages which ought to be recovered by lenders who had been advised carelessly by valuers of certain assets which were provided as security for loans made by the lenders. In breach of their contractual obligation to carry out such valuation with reasonable care, the valuers over-valued the security. The lenders alleged that this caused them to make loans which they would never have made otherwise. After the loans were made, the general market for the assets in question fell tremendously, and the lenders claimed that the entire loss suffered by them following from defaults in the loans should be recovered from the valuers. 18.49 The answer, according to the House of Lords in SAAMCO (1997), was that the valuer’s duty of care (whether in contract or even in the tort of negligence) did not cause all the loss claimed by the plaintiffs. Even if the valuers had done their job properly, the general fall in the market value would still have occurred and would still have caused loss to the vendors. The only damage which the valuers “caused” then was the extent of the over-valuation of the assets in question at the time of the original valuation. The cause of any further losses was really the fall in the market. 18.50 Since the valuers were only obliged to provide one piece of information which the lenders would take into consideration in formulating their decision whether or not to proceed with the transaction, it was not correct to make the valuers responsible for all subsequent market fluctuations. To do so would amount to making the valuers insurers for the viability of the transactions. (3) Remoteness of loss 18.51 Losses which are too remote are not compensable — but what does it mean to say that a loss is too remote? In brief, losses which arise in the usual course of things as a result of the breach are not too remote, and 552 Chapter 18: Remedies for Breach of Contract are compensable. Losses which are out of the ordinary and which would not ordinarily have been in the contemplation of either party to the contract are not — unless the party in breach knew or ought to have known about the possibility of such unusual losses at the time of entering into the contract. (a) “Naturally arising damages” and “damages arising from special circumstances” 18.52 The distinction between these two types of damages was set out in the seminal judgment of Alderson B in the case of Hadley v Baxendale (1854) (at pp 354–355) as follows: Where two parties have made a contract which one of them has broken, the damages which the other party ought to receive in respect of such breach of contract should be such as may fairly and reasonably be considered either arising naturally, ie, according to the usual course of things, from such breach of contract itself, or such as may reasonably be supposed to have been in the contemplation of both parties, at the time they made the contract, as the probable result of the breach of it. Now, if the special circumstances under which the contract was actually made were communicated by the plaintiffs to the defendants, and thus known to both parties, the damages resulting from the breach of such a contract, which they would reasonably contemplate, would be the amount of injury which would ordinarily follow from a breach of contract under these special circumstances so known and communicated. But … if these special circumstances were wholly unknown to the party breaking the contract, he, at the most, could only be supposed to have had in his contemplation the amount of injury which would arise generally, and in the great multitude of cases not affected by any special circumstances, from such a breach of contract. For, had the special circumstances been known, the parties might have specially provided for the breach of contract by special terms as to the damages in that case; and of this advantage it would be very unjust to deprive them … Under either limb, the knowledge of the defendant as to the probability and nature of the losses that could be suffered by the plaintiff in the event of a breach of contract is critical. 553 Principles of Singapore Business Law (b) Imputed and actual knowledge 18.53 The first and second limbs of damages identified in Hadley v Baxendale require different degrees of awareness of the surrounding circumstances. This point was highlighted in the judgment of Asquith LJ in Victoria Laundry (Windsor) Ltd v Newman Industries Ltd (1949) which distinguished between: ° imputed knowledge — knowledge which everyone, as reasonable persons, must be taken to know; and ° actual knowledge — knowledge which one actually has. 18.54 As noted by Asquith LJ (at p 539) in his judgment in Victoria Laundry, (2) In cases of breach of contract the aggrieved party is only entitled to recover such part of the loss actually resulting as was at the time of the contract reasonably foreseeable as liable to result from the breach. (3) What was at that time reasonably so foreseeable depends on the knowledge then possessed by the parties or, at all events, by the party who later commits the breach. (4) For this purpose, knowledge “possessed” is of two kinds; one imputed, the other actual. Everyone, as a reasonable person, is taken to know the “ordinary course of things” and consequently what loss is liable to result from a breach of contract in that ordinary course. This is the subject matter of the “first rule” in Hadley v Baxendale … But to this knowledge, which a contract-breaker is assumed to possess whether he actually possesses it or not, there may have to be added in a particular case knowledge which he actually possesses, of special circumstances outside the “ordinary course of things”, of such a kind that a breach in those special circumstances would be liable to cause more loss. Such a case attracts the operation of the “second rule” so as to make additional loss also recoverable. [emphasis added] These paragraphs were cited with approval by the Court of Appeal in Robertson Quay Investment Pte Ltd v Steen Consultants Pte Ltd (2008) (at [54]) and undoubtedly form part of the law in Singapore on remoteness of loss arising from a breach of contract. 554 Chapter 18: Remedies for Breach of Contract 18.55 Applying the first limb of the rule in Hadley v Baxendale, where the plaintiff is trying to recover ordinary losses which flow naturally from the defendant’s breach, there is no need to prove that the defendant had any actual knowledge that this might be the result of his breach — such knowledge will be imputed to him by the court and he is taken to know that such damage would ordinarily result from his breach. On the other hand, if the plaintiff is trying to recover special losses that would not ordinarily be expected to flow from a breach, he can only recover if he can prove that the defendant had actual knowledge of the special circumstances that gave rise to these special losses. 18.56 How does a plaintiff satisfactorily prove that the defendant had actual knowledge of such special circumstances? It appears that an objective test will be imposed, as was observed by Robert Goff J in his judgment in Satef-Huttenes Albertus SpA v Paloma Tercera Shipping Co SA (The Pegase) (1981) (at p 183): [H]ave the facts in question come to the defendant’s knowledge in such circumstances that a reasonable person in the shoes of the defendant would, if he had considered the matter at the time of making the contract, have contemplated that, in the event of a breach by him, such facts were to be taken into account when considering his responsibility for loss suffered by the plaintiff as a result of such breach[?] (c) Probability of type of loss 18.57 But the test of remoteness entails one further point: the information or knowledge must be within the actual or imputed knowledge of the defendant, but what must the defendant know? In order for the plaintiff ’s loss to be sufficiently proximate, the defendant must actually, or, by way of imputation, reasonably contemplate that the damage in question is liable to result from the breach. In other words, given the knowledge which the defendant actually or imputedly possesses, a reasonable man would have foreseen that there was an appreciable degree of likelihood that damage would result from the defendant’s breach. 18.58 The exact degree of perceived probability as to whether the damage will occur as a result of the breach is still a matter of some dispute. 555 Principles of Singapore Business Law In Victoria Laundry (Windsor) Ltd v Newman Industries Ltd (1949), Asquith LJ described (at p 540) the requisite degree of probability as being “on the cards”. But this turn of phrase was roundly criticised by the House of Lords in the case of Koufos v C Czarnikow Ltd (The Heron II) (1969), where Lord Reid suggested that the degree of probability required was that the occurrence of the damage following the breach must have been “not unlikely”; Lord Morris of Borth-y-Gest preferred the term “liable to result or at least … not unlikely to result”; Lord Hodson also put forward the term “liable to result” (while rejecting the phrase “likelihood”); and lastly, both Lord Pearce and Lord Upjohn were in favour of the terms “serious possibility” and “real danger”. Common ground, however, may be found in their Lordships’ acceptance that the degree of probability required to demonstrate that contract damages are not too remote is higher than that in tort. (The analogous test in tort only requires “reasonable foreseeability”: see Overseas Tankship (UK) Ltd v Morts Dock & Engineering Co Ltd (Wagon Mound) (No 1) (1961) in relation to the tort of negligence and Overseas Tankship (UK) Ltd v The Miller Steamship Co Pty (1967) in relation to other torts — both cases were decided by the Privy Council on appeal from the Supreme Court of New South Wales.) 18.59 The confusion as to the precise level of probability required, post-Heron II, has been noted by Lord Denning MR in the difficult case of H Parsons (Livestock) Ltd v Uttley Ingham & Co Ltd (1978). In that case, the defendants supplied the plaintiff a defective container for pig feed which caused the nuts stored inside to become mouldy. When these mouldy nuts were fed to the plaintiff ’s pigs, they contracted a rare intestinal disease and subsequently died. On appeal, the English Court of Appeal held that the damage suffered by the plaintiff in the loss of his pigs was not too remote. Lord Denning MR, after making reference to the impossibility of dealing with the “sea of semantic exercises” posed by the judgments of the House of Lords in the Heron II, went on to propose (at pp 802–803) an unconventional approach involving two tests for remoteness depending on the type of damage or loss involved. Where the loss was physical, a more relaxed test of “reasonable foreseeability” of the type of damage as a bare possibility (similar to that applied in tort cases) should be applied. On the other hand, in cases involving economic loss (eg, loss of profit) in contract, the stricter approach of “reasonable contemplation” was more appropriate. Lord Denning MR characterised the damage suffered by the plaintiff before him as falling 556 Chapter 18: Remedies for Breach of Contract within the first category and applied a test of “reasonable foreseeability”. Since it was reasonably foreseeable that the defective hopper would cause the nuts stored within it to become mouldy, and there was a foreseeable possibility that pigs fed such nuts would fall ill, the damage suffered by the plaintiff was not too remote. (d) Types and extent of loss 18.60 Lord Denning’s approach in H Parsons (Livestock) Ltd v Uttley Ingham & Co Ltd (1978) is difficult, as it requires the court to characterise the damage suffered into “physical” and “economic” categories. This may not be as simple as it looks. On the facts of H Parsons (Livestock) Ltd v Uttley Ingham & Co Ltd (1978) itself, it cannot be denied that the plaintiff, ultimately, was interested in recovering the profits that he would have made, had his pigs survived and made it to market, as opposed to the pigs themselves. 18.61 The majority of the English Court of Appeal in H Parsons (Livestock) Ltd v Uttley Ingham & Co Ltd (1978) distinguished between the type and the extent of the damage. Scarman LJ proposed (at p 813) as follows: [I]t would be absurd to regulate damages in such cases upon the necessity of supposing the parties had a prophetic foresight as to the exact nature of the injury that does in fact arise. It is enough if upon the hypothesis predicated physical injury must have been a serious possibility … It does not matter … if they [the defendants] thought that the chance of physical injury, loss of profit, loss of market, or other loss as the case may be, was slight, or that the odds were against it, provided they contemplated as a serious possibility the type of consequence, not necessarily the specific consequence, that ensued upon breach. [emphasis added] 18.62 Orr LJ agreed with Scarman LJ’s reasoning. On the majority view, the plaintiff ’s damage (that the pigs would fall ill because of mouldy nuts caused by the defendant’s breach of contract by the supply of a defective hopper) was reasonably within the contemplation of the defendant as liable to occur. This constituted a type of damage that could be reasonably contemplated as liable to occur. The eventual death of the pigs because they had contracted a rare intestinal disease would not have been within reasonable contemplation. However, this was irrelevant because the outcome (death) was merely reflective of the extent of the damage. 557 Principles of Singapore Business Law Box 18.1 Reflecting on the law “Type” versus “extent” of loss — a practicable distinction? Consider the facts of the case in Victoria Laundry (Windsor) Ltd v Newman Industries Ltd (1949) itself. Victoria Laundry entered into a contract to purchase a boiler from the defendants in order to expand their business. The defendants contracted to deliver a certain boiler of the specified capacity on 5 June. This boiler, however, was damaged prior to actual delivery, and was not actually delivered until 8 November. The defendants were aware of Victoria Laundry’s business and had been informed many times before the contract was concluded that Victoria Laundry were “most anxious” to put the boiler to use in the “shortest possible space of time”. In light of the delay, Victoria Laundry sued to recover damages from the defendants in respect of losses following from their inability to take on large numbers of new customers in the course of their laundry business (which was held by the English Court of Appeal to be recoverable as being part of the usual loss that would follow as a matter of course and of which everyone has imputed knowledge); and a number of highly lucrative dyeing contracts for the Ministry of Supply (which was ultimately held to be irrecoverable since it was an unusual loss of which the defendants had no prior actual knowledge). Could it not be said that the exceptional loss of profit from the potential Ministry of Supply contracts represented merely the extent of the plaintiff’s loss; and that such losses should be recoverable as they were of a type (loss of profit from contracts which would have been entered into if not for the defendant’s breach) which was reasonably within the contemplation of the defendants in that case? 18.63 To date, Lord Denning’s approach has not been followed. On the other hand, despite its difficulties, the approach put forward by Scarman LJ and Orr LJ has been applied in a series of cases, including one in the 1990s, in Brown v KMR Services Ltd (1995). Even so, these developments focusing on “type” and “extent” of damages suggest that the apparently simple division put forward in Hadley v Baxendale (1854) and Victoria Laundry (Windsor) Ltd v Newman Industries Ltd (1949) between losses of ordinary profits and losses of exceptional profits may no longer be so clear. But leaving such difficulties aside, in summary, damage suffered by a plaintiff may be recoverable as not being too remote if he can demonstrate that: ° the defendant can be taken to have known or actually knew of the circumstances surrounding the plaintiff which resulted in the plaintiff ’s loss; and 558 Chapter 18: Remedies for Breach of Contract ° it would have been obvious to a reasonable man in the defendant’s shoes that if he breached the contract, there was a significant likelihood or serious possibility that such a breach would result in loss of the type which the plaintiff suffered. (e) The rationale for the rule in Hadley v Baxendale and the role of assumption of responsibility 18.64 Having set out the rule in Hadley v Baxendale, it is appropriate at this juncture to examine its rationale. Helpfully, this was set out by the Court of Appeal in Robertson Quay Investment Pte Ltd v Steen Consultants Pte Ltd (2008) at [81]–[83]: To elaborate, damage which falls under the first limb of Hadley (which may be termed “ordinary” damage …) ought to be well within the reasonable contemplation of all of the contracting parties concerned. Since everyone (including the contracting parties) must, as reasonable people, be taken to know of damage which flows “naturally” … from a breach of contract, the first limb of Hadley does no violence to the original bargain between the contracting parties who, ex hypothesi, have not expressly provided for what is to happen in the event of a breach of their contract. However, if the contracting parties had thought about this issue, they would, in all likelihood have agreed that the contract-breaker should be liable in damages for all such “ordinary” damage. … Damage which falls under the second limb of Hadley (ie, “extraordinary” or “non-natural” damage) is not, by its very nature, within the reasonable contemplation of the contracting parties. In the circumstances, it would be both unjust and unfair to impute to them knowledge that such damage or loss would arise upon a breach of contract. However, if the contracting parties, having had the opportunity to communicate with each other in advance, had actual (as opposed to imputed) knowledge of the special circumstances which resulted in the “extraordinary” or “non-natural” damage, then they must be taken to have agreed that should such damage occur, the contract-breaker would be liable for such damage. … The above extract makes it plain that the underlying rationale for the rule in Hadley v Baxendale is based on what the parties are to be taken as 559 Principles of Singapore Business Law having undertaken or agreed in terms of responsibility for loss. Insofar as the loss which is sustained is “ordinary”, unless the parties specify otherwise, the right inference to be drawn from the facts would be that they had agreed that there would be liability for such “ordinary” loss. On the other hand, if the loss were “extraordinary”, absent any provision otherwise the right inference to be drawn as to whether the parties had agreed that there would or would not be liability for such “extraordinary” loss would depend on whether the promisor had actual knowledge of the circumstances associated with the occurrence of that “extraordinary” loss. If the promisor actually knew about such circumstances, and did not make any provision as to such loss, then such promisor would be taken to have agreed to be responsible for such “extraordinary” loss. However, if the promisor had no actual knowledge of such circumstances, it would not be appropriate to treat the promisor as if he had agreed to be responsible for such losses. 18.65 To some extent, the analysis in Robertson Quay mirrors the analysis of Lord Hoffman in his judgment in the House of Lords case of Transfield Shipping Inc v Mercator Shipping Inc (The Achilleas) (2009). In that case, Lord Hoffmann observed as follows (at [12]): It seems to me logical to found liability for damages upon the intention of the parties (objectively ascertained) because all contractual liability is voluntarily undertaken. It must be in principle wrong to hold someone liable for risks for which the people entering into such a contract in their particular market, would not reasonably be considered to have undertaken. 18.66 Given the above, some English academics have taken the view that these remarks should be understood as posing an additional test that had to be satisfied, over and above what had been set out in Hadley v Baxendale: that one would also have to show (on an objective basis) that the defaulting promisor had voluntarily undertaken responsibility or liability for the type of loss which the promisee was claiming. This, however, is arguably not the case given the rationale underlying the rule in Hadley v Baxendale as sketched out by the Court of Appeal in Robertson Quay: assumption of liability is part of the test in Hadley v Baxendale, not something distinct from it. Indeed, in Singapore, this very point is now beyond doubt, given the Court of Appeal’s 560 Chapter 18: Remedies for Breach of Contract decision in MFM Restaurants Pte Ltd v Fish & Co Restaurants Pte Ltd (2011). In that case, the Court of Appeal noted as follows (at [101]): … it is our view that, even if … we accept Lord Hoffmann’s approach in The Achilleas, both the limbs in Hadley would necessarily embody and encompass the necessary criteria for ascertaining (on an objective basis) whether or not there had been an assumption of responsibility on an implied undertaking on the part of the defendant … If so, then, with the greatest of respect, Lord Hoffmann has not really added anything new to the existing law, which continues to operate based on the legal rules and principles laid down in the seminal decision of Hadley … [emphasis in italics in original, emphasis in bold italics added] (4) Mitigation of loss 18.67 Losses which the aggrieved party could have taken reasonable steps to avoid, but did not, are not compensable. As stated by Viscount Haldane LC in the case of British Westinghouse Electric and Manufacturing Co Ltd v Underground Electric Railways Company of London Ltd (1912) (at p 689): I think that there are certain broad principles which are quite well settled. The first is that, as far as possible, he who has proved a breach of a bargain to supply what he contracted to get is to be placed, as far as money can do it, in as good a situation as if the contract had been performed … [B]ut this first principle is qualified by a second, which imposes on a plaintiff the duty of taking all reasonable steps to mitigate the loss consequent on the breach, and debars him from claiming any part of the damage which is due to his neglect to take such steps … [T]his second principle does not impose on the plaintiff an obligation to take any step which a reasonable and prudent man would not ordinarily take in the course of his business. 18.68 The duty is to take all reasonable steps to minimise or to “mitigate” one’s loss. If, in taking objectively reasonable steps to mitigate, the aggrieved party incurs greater loss than if no steps have been taken at all, such increased losses will still be recoverable from the party-in-breach (see, eg, Banco de Portugal v Waterlow & Sons Ltd (1932) (per Lord MacMillan at p 508). These observations have been approved and followed in Singapore (eg, the Singapore High Court decision of Tan Soo Leng David v Lim Thian Chai Charles (1998)). 561 Principles of Singapore Business Law 18.69 Ultimately, as noted by Bankes LJ in Payzu, Limited v Saunders (1919) (at p 588), everything turns on the reasonableness of the plaintiff ’s actions to try and minimise his loss and: [I]t is plain that the question [of] what is reasonable for a person to do in mitigation of his damages cannot be a question of law but must be one of fact in the circumstances of each particular case. 18.70 As to what facts might suggest that the actions taken by the plaintiff were reasonable, some consideration might be made as to the following: ° “In certain cases of personal service it may be unreasonable to expect a plaintiff to consider an offer from the other party who has grossly injured him; but in commercial contracts it is generally reasonable to accept an offer [of alternative performance] from the party in default” (per Scrutton LJ in Payzu, Limited v Saunders (1919) at p 589); ° the plaintiff is not usually required to take steps in mitigation of its loss which it is financially unable to afford; ° the plaintiff is not required to take steps in mitigation of its loss which would place its commercial reputation or good public relations at risk; ° the plaintiff is not required to take steps in mitigation of its loss which would involve complex litigation. Box 18.2 Reflecting on the law Is there a “duty” to mitigate? Since the 1980s, there has been a view that casting mitigation as a “duty” of the plaintiff is misleading. Hence, in the case of Sotiros Shipping Inc and Aeco Maritime SA v Sameiet Solholt (The Solholt) (1983), Sir John Donaldson MR observed (at p 608) that: [a] plaintiff is under no duty to mitigate his loss, despite the habitual use by the lawyers of the phrase “duty to mitigate”. He is completely free to act as he judges to be in his best interests. On the other hand, a defendant is not liable for all loss suffered by the plaintiff in consequence of his so acting. A defendant is only liable for such part of the plaintiff’s loss as is properly to be regarded as caused by the defendant’s breach of duty. [emphasis added] 562 Chapter 18: Remedies for Breach of Contract Box 18.2 (Continued ) This recasting of the language of mitigation highlights the similarity between mitigation and the issue of causation. One might then wonder, what would happen if a mitigation attempt goes seriously wrong: does this break the chain of causation? Some guidance may be found in the judgment of Lord Hoffmann in the SAAMCO (1997) case (discussed earlier at paras 18.48–18.50) wherein the answer appears to be “no”. Lord Hoffmann quoted with approval the New Zealand case of McElroy Milne v Commercial Electronics Ltd (1993). In McElroy, a lawyer was engaged by a property developer to prepare certain documentation relating to a lease. The lawyer negligently failed to ensure that the lease contained a guarantee from the lessee’s parent company. As a result, instead of being able to sell the property together with the benefit of the lease soon after completion, the developer found himself in dispute with the parent company. The dispute dragged on for more than two years, during which time the market fell. The New Zealand Court of Appeal in McElroy held that the developer was entitled to the difference between what the property would have fetched if sold soon after its completion with a guaranteed lease and what it eventually fetched two years later. The lawyer had a duty to take reasonable care to ensure that his client got a properly guaranteed lease. He was therefore responsible for the consequences of his error, which was producing a situation in which the client had a lease which was not guaranteed. All the reasonably foreseeable consequences of that situation were therefore within the scope of the duty of care. The only remaining issue, then, was whether the developer’s delay in selling the property negatived the causal connection between that situation and the ultimate loss. The New Zealand Court of Appeal decided this question by asking whether the client had reacted reasonably to his predicament. Therefore, it seems that so long as the attempt at mitigation is reasonable, there is little to suggest that a court will find that it has broken the chain of causation, even if the mitigation has worsened the loss. 18.71 The burden of proof remains on the defendant to show that the plaintiff has not taken steps towards mitigation of his loss, that is, on a balance of probability, he has not mitigated his loss. This is unlikely to be easy, since the courts appear to be willing to find in favour of the plaintiff even in doubtful cases (see Strutt v Whitnell (1975)). 18.72 Before leaving the issue of mitigation, a few words on where mitigation has no application are apposite. First, the need to mitigate only arises after the contract has been discharged, following the breach of contract. As discussed previously in Chapter 16 at paras 16.58–16.60, the victim of a breach of contract has the option of whether or not to accept a breach of contract so 563 Principles of Singapore Business Law as to discharge the contract and mitigation has no part to play in limiting his freedom to exercise this choice. 18.73 Second, mitigation has no relevance in relation to the manner in which the victim of the breach seeks to have his damages quantified. As decided by Oliver J, in the case of Radford v De Froberville (1977), a plaintiff can be awarded damages to enable him to have performed for him what the defendant failed to provide under their agreement, even if more cost-effective ways of enabling him to achieve that performance can be found. Among others, Oliver J reasoned (at p 1284) that: [I]t [a pre-fabricated brick wall] was not what the plaintiff stipulated for and what, in effect, he paid for when he sold the plot. I know of no principle of damages which would dictate that a plaintiff who has stipulated for an article of a certain quality should be fobbed off with an inferior substitute merely because it is cheaper for a defendant who has broken his contract to supply it. ACTION FOR A FIXED SUM 18.74 Damages, whether liquidated or unliquidated, are not the only remedy at common law. Where the contractual breach relates solely to an obligation to pay a fixed sum of money, instead of damages, the court will order that the fixed sum, due and owing, be paid. Such a claim based on an action for payment of a fixed sum or the payment of a debt is completely distinct from the remedy of damages and concepts such as remoteness of loss, mitigation and even quantification of damages have no application to claims based on an action for a fixed sum. This follows from the basis of such claims: they simply allow the innocent party to recover what was promised to him. As observed by G P Selvam J in the Singapore High Court case of MP-Bilt Pte Ltd v Oey Widarto (1999) (at [19]–[20]): Common sense and authorities affirm the principle that there is no duty to mitigate where a debt is claimed. A creditor is entitled to recover a debt and it is independent of his duty to mitigate damages if and when he accepts a breach by the other party … By definition a debt is a sum of money fixed by the contract for the completed performance of a given obligation while the contract is alive … It follows that once a debt has crystallised there is nothing for the creditor to mitigate. Once a debt 564 Chapter 18: Remedies for Breach of Contract always a debt. There being no claim for damages no duty to mitigate can arise. No Damages for Breach of an Obligation to Pay Money 18.75 The distinction between an action for a fixed sum and damages for breach of contract is important because, in general, where the breach of contract solely relates to an obligation to pay money, no damages can be recovered for such a breach. Instead, the only possible remedy is an action for a fixed sum. As observed by G P Selvam J in MP-Bilt Pte Ltd v Oey Widarto (1999) (at [20]), “[a]fter a debt has fallen due the debtor cannot decide to dishonour it and convert it into damages”. 18.76 This position was set out in the old House of Lords case of the London, Chatham and Dover Railway Company v The South Eastern Railway Company (1893) where Lord Herschell made the following observations (at p 437): [T]he appellants contended that … interest might be given by way of damages in respect of the wrongful detention of their debt. I confess that I have considered this part of the case with every inclination to come to a conclusion in favour of the appellants, to the extent at all events, if it were possible, of giving them interest from the date of the action … But I have come to the conclusion, upon a consideration of the authorities, agreeing with the Court below, that it is not possible to do so. 18.77 The above position was reviewed by the House of Lords in the case of President of India v La Pintada Compania Navigacion SA (1985). But although it was unanimously agreed that the rule was undesirable, the House of Lords refused to overrule London, Chatham and Dover Railway (1893). In coming to this decision, the House of Lords was heavily influenced by the British Parliament’s apparent satisfaction with the status quo when it did not accept a Law Commission proposal in 1982 for that case to be legislatively overruled. 18.78 The view taken in these cases, however, fails to consider the commercial reality of the time value of money. In the commercial context, it does not take much imagination to realise that late payment costs money, either because the payor is unable to benefit from interest upon that sum, or because he 565 Principles of Singapore Business Law has to incur interest because he is not able to reduce any outstanding loans which he might have done with the proceeds from the late payment. The law has therefore left open some exceptions to this general rule. Exceptions Permitting Damages for Breach of Obligation to Pay Money (1) Contractual provision for interest 18.79 A contract may contain terms which specify that interest should be paid on sums due but which are late in payment. Ideally, such terms should be expressly provided for, but on the appropriate facts, the courts may be willing to imply such a provision (see, eg, the English Court of Appeal case of F G Minter v Welsh Health Technical Services Organisation (1980)). (2) Knowledge that breach would cause losses 18.80 In the case of Wadsworth v Lydall (1981), the English Court of Appeal had to consider whether a plaintiff could recover interest and costs incurred from having to undertake additional financing arrangements to cover a shortfall in his finances because of the defendant’s failure to fully honour a money debt. The defendant and the plaintiff were informal partners holding a tenancy of a farm on which the plaintiff lived. When the partnership was dissolved, it was agreed that the plaintiff would give up possession of the farm by a specified date when he would receive £10,000 from the defendant. Relying on this agreement, the plaintiff agreed to purchase another property from a third party. This required him to pay the £10,000, which by then he should have received, to the third party. Unfortunately, the defendant only paid £7,600 and as a result, the plaintiff had to take out a mortgage from the third party for the balance. Ultimately, the plaintiff sued the defendant and tried to recover the interest incurred on the mortgage and the transaction costs involved as special damages. On appeal to the English Court of Appeal, Brightman LJ said (at p 603): If a plaintiff pleads and can prove that he has suffered special damage as a result of the defendant’s failure to perform his obligation under a contract, and such damage is not too remote on the principle of Hadley v Baxendale … I can see no logical reason why such special damage 566 Chapter 18: Remedies for Breach of Contract should be irrecoverable merely because an obligation on which the defendant defaulted was an obligation to pay money and not some other type of obligation. This case was subsequently approved by the House of Lords in President of India v La Pintada Compania Navigacion SA (1985). The principles of Hadley v Baxendale (1854) have been set out above (from para 18.52). As for the reference to special damages used by Brightman LJ, it should be noted that this has been clarified to refer to the second limb of Hadley v Baxendale (1854) (not least by Lord Brandon in the La Pintada case) relating to unusual losses which do not flow naturally from the breach. As clarified by subsequent judges, Brightman LJ was not referring to special damages in the context of legal pleadings (where special damages refer to claims which must be specifically pleaded or itemised in a plaintiff ’s statement of claim). (3) Damages arising apart from non-payment 18.81 In many cases, loss may be incurred as a result of matters other than the non-payment of money. Although damages are not available to compensate for losses incurred from the late or non-payment of money per se, if it is possible to characterise the loss as arising from matters which are distinct from the failure to pay, the bar is lifted. In such a case, the plaintiff could possibly recover damages as well as the fixed sum owed. Overstone Ltd v Shipway (1962) is an example of such a case. Shipway entered into a hirepurchase contract with Overstone Ltd for the hire-purchase of a car. The contract provided that Shipway, as hirer, should pay the sums specified in the agreement punctually and interest on any late payments. The contract also provided that any default in punctual payment or any breach of the conditions would entitle Overstone Ltd to terminate the hiring and retake possession of the vehicle. Shipway paid the deposit and took delivery of the car but paid none of the monthly instalments. In consequence, Overstone Ltd terminated the contract and repossessed the car. On 22 January 1960, Overstone Ltd sued and recovered the four monthly instalments then due from Shipway in an action for debt. Meanwhile, they sold the car for £265 and subsequently brought a second action claiming £48 15s 4d in damages, being the balance of the price they would have recovered under the agreement if it had not been terminated, less the total of the following items: the initial deposit (£73), the four monthly instalments 567 Principles of Singapore Business Law recovered earlier in the action for debt (totalling £43 3s 8d), the proceeds from the sale of the car (£265) and a rebate of interest charges (£23 14s). A majority of the judges sitting in the English Court of Appeal held that this claim for damages was not precluded by the earlier action for debt. The majority of the English Court of Appeal accepted that, here, Overstone Ltd rightfully accepted Shipway’s repudiatory breach in failing to make any payments at all and terminated the contract as a result of such breach, instead of relying on its contractual right of termination. Following from this, Overstone was entitled to make a claim for damages arising from that breach. Timing of Claim 18.82 A claim based on an action for a fixed sum or for the payment of the debt can only be successful if the sum or the debt is due — that is to say, when the contractual obligation to pay the innocent party has arisen. Thus, in the case of White and Carter (Councils) Ltd v McGregor (1962) (see Chapter 16, paras 16.58–16.63), the plaintiffs only pressed their suit for payment of the contract price for their services after they had finished performance of the contractually stipulated obligations on their part. Once they had done so, according to the terms of their contract with the defendants, the defendants were obliged to pay, and when the defendants refused, the plaintiffs were perfectly entitled to sue them to recover the sum owed in an action for debt (subject, of course, to the possible limitation of legitimate interest raised in White and Carter (Councils) Ltd v McGregor (1962)). Where Plaintiff is in Breach of Contract 18.83 What happens when the plaintiff is also in breach of contract? What if, for example, in a contract of sale of goods between the plaintiff (vendor) and the defendant (purchaser), the plaintiff failed to perform his part of the bargain precisely by delivering goods which did not conform to the contract description? Clearly, the plaintiff would be liable to pay damages to the defendant in compensation for any losses resulting from the breach. However, would such a breach prevent the plaintiff from making a claim for the sums which would have been owed to him under the contract? 568 Chapter 18: Remedies for Breach of Contract 18.84 Much of the following was discussed (some at greater length) in Chapter 16 on discharge by performance, breach and agreement, and so reference should also be made to the discussion there at paras 16.4 and 16.66–16.87. In brief: ° Where the plaintiff is himself in breach, it may be that he can still successfully make a claim for some, if not all, of the price if the term which is breached is not a condition or an innominate term which goes to the root of the contract. ° First, if the plaintiff ’s breach is de minimis, that is, so inconsequential in all the circumstances it can be regarded as being trifling, it will be ignored and the full price is payable. ° Second, even if the plaintiff ’s breach cannot be said to be de minimis, if he has substantially performed his part of the bargain, he may still be entitled to recover the full price. If the defective performance has caused the defendant loss, however, the defendant may recover damages for such loss from the plaintiff. Therefore, where the plaintiff attempts to sue the defendant for the price of his substantial but defective performance, he will most probably have to set off against the price any damages which the defendant may claim for his losses. ° Third, if the contract (expressly or impliedly) provides that payment is to be in proportion to the amount of work done, then upon the ascertainment of the amount of work done, the proportionate price becomes due and may be claimed by the plaintiff as a debt. This is sometimes referred to as a claim for quantum meruit under contract. ° Fourth, if the contract is severable, and it can be said that the plaintiff has completely performed his obligations under each severable component, then the price payable for each completed component can be recovered as a separate debt. Of course, in relation to any severable parts of the contract which have been defectively performed, the associated payment cannot be claimed, unless arguments like those in the three preceding paragraphs can be made for those parts, in which case partial payment for those portions completed may be possible. 18.85 In the discussion on discharge of contract by performance in Chapter 16, we also discussed the possibility of making a quantum meruit claim under 569 Principles of Singapore Business Law the law of unjust enrichment. Such a claim is not a claim for debt. Instead, it falls more aptly under a claim for a restitutionary award and will be dealt with in that section below (see below, from para 18.98). SPECIFIC PERFORMANCE 18.86 Sometimes, damages will not be an adequate remedy for a breach of contract. In such cases, the equitable remedy of specific performance may be sought instead: “The court gives specific performance instead of damages, only when it can by that means do more perfect and complete justice” (per Lord Selbourne LC in Wilson v Northampton and Banbury Junction Railway Company (1874) at p 284). 18.87 This may be the case where the breach involves delivery of property which is unique (such as a piece of land). In such instances, the aggrieved party may make an application for the court to make an order of specific performance, that is, an order to the party who is threatening to be in breach to perform in accordance with the terms of his or her contractual promise. Failure to obey such an order would amount to a contempt of court, and would attract penal sanctions such as a fine, or even imprisonment. Given that non-compliance results in such draconian penalties, equitable remedies are not granted as a matter of course. 18.88 Specific performance is, however, not available against the Singapore Government in any civil proceedings to which the state is a party (see s 27(1)(a) Government Proceedings Act (Cap 121, 1985 Rev Ed)). Limitations on Availability of Specific Performance 18.89 Specific performance is a discretionary remedy. It may be withheld if it would be inequitable to make such an order. Karthigesu JA observed in the Singapore Court of Appeal case of Tay Ah Poon v Chionh Hai Guan (1997) (at [19]) that “[t]he right [to seek specific performance of a contract] exists in equity independently of any contractual provision that stipulates for its preservation. After all whether the right will be granted or not is in the discretion of the court”. 570 Chapter 18: Remedies for Breach of Contract 18.90 As mentioned above, substantial delay in applying for such relief may be enough to cause the court to withhold such relief due to the operation of the doctrine of laches. Relief may also be withheld if the applicant does not come to court with “clean hands”. The order for specific performance may also be made on terms so as to balance the interests of the parties to the dispute. Specific performance might also be refused in a number of other instances, most notably where: ° the proposed order would require constant supervision by the court; ° the court is not able to specify the terms of the order which is to be complied with; ° the proposed order would require the performance of something which is impossible to achieve (or, perhaps, would entail the performance of excessively burdensome and futile actions); ° the order relates to a contract of personal service because such an order could amount to judicial compulsion of involuntary servitude; and ° an order, if granted, would adversely affect the rights of third parties to the contract between the applicant and the respondent. INJUNCTION 18.91 Not all contractual obligations are susceptible to orders of specific performance. Sometimes, the contractual obligation in question is a negative one, where the party in breach fails to honour his or her promise not to do something. In such circumstances, an application for a prohibitory injunction may be made by the aggrieved party. 18.92 In the absence of factors such as those mentioned in para 18.90, prohibitory injunctions are likely to be granted unless: ° the remedy would be inequitable or oppressive; or ° the balance of convenience does not favour making such an order. 18.93 If the breach of the negative obligation lies wholly in the past, the aggrieved party may seek a mandatory injunction instead. Such an order requires the party in breach to reverse the effects of the breach so as to restore the 571 Principles of Singapore Business Law aggrieved party to the position he or she would have been, had the negative obligation not been breached. 18.94 The discretion whether to issue a mandatory injunction is also generally subject to the “balance of convenience” test. In general, injunctions will also be refused in relation to contracts of personal service, where the practical effect of the proposed injunction would be to compel the performance of a contract for personal service for which no order of specific performance would have been made in the first place. STATUTORY DAMAGES IN LIEU OF OR IN ADDITION TO SPECIFIC PERFORMANCE OR INJUNCTION 18.95 What happens if the court takes the view that an order of specific performance or injunction cannot be made? If this occurs where only nominal damages could have been recovered by the plaintiff, the plaintiff may be left without any effective remedy. In response to this, the English courts of equity have long been given (via statute) the power to award damages in lieu of or in addition to an order for specific performance or injunction. 18.96 The courts in Singapore are similarly empowered under the Supreme Court of Judicature Act (Cap 322, 2007 Rev Ed) wherein para 14 First Schedule (read with s 18(2)) provides that the High Court has power to grant all reliefs and remedies at law and in equity, including damages in addition to, or in substitution for, an injunction or specific performance. These powers are also extended to the District and Magistrates’ Courts via ss 31(1) and 52 Subordinate Courts Act (Cap 321, 2007 Rev Ed), respectively. One example where the High Court exercised this power may be found in the case of Ho Kian Siang v Ong Cheng Hoo (2000). This case also highlights the fact that damages in lieu of or in addition to specific performance or injunction are also discretionary, and hence are distinct from damages for breach of contract (which are available as of right). 18.97 It should be noted, however, that although both common law contract damages and statutory damages in lieu of an order for specific performance or injunction are compensatory, there is no direct analogy in terms of the time of assessment. Hence, in Ho Kian Siang (at [28]), Lee Seiu Kin JC 572 Chapter 18: Remedies for Breach of Contract followed the English position on the matter (as set out in para 960 of Volume 44(1) of Halsbury’s Laws of England (4th ed, 1984) at p 388): Where damages are awarded in lieu of specific performance, the principle that damages should be assessed as at the date of the breach of contract (which is the usual rule in relation to commercial contracts) does not normally apply. The selection of the appropriate date is a matter for the court’s discretion, but the date usually chosen is the date at which the remedy of specific performance ceases to be available. [emphasis added] RESTITUTIONARY AWARDS 18.98 “Restitution” is not, strictly speaking, a response to a breach of contract. Unlike damages, which seek to provide monetary compensation for loss suffered by a plaintiff due to a defendant’s breach of contract, restitution seeks to reverse any “unjust enrichment” gained by the defendant at the expense of the plaintiff. Some academic commentators (and indeed judges) place the remedy of restitution within an entirely different legal regime: that of the law of unjust enrichment. 18.99 The law of unjust enrichment forms a different area of the law and confers a distinct “cause of action” with its own rules and principles (just as the law of tort is distinct from the law of contract). It is a rapidly developing area and much of its boundaries remain undefined. What is common ground in this area amongst most Commonwealth academics is that the plaintiff can establish liability for unjust enrichment so long as he can show that: ° the defendant was enriched; ° at the expense of the plaintiff; ° in circumstances such that the enrichment was “unjust”, which is to say that there is some reason (an “unjust factor” or on some views, the lack of any justificatory factor) within the law which would make it unfair for the defendant to keep that enrichment; and ° there is no defence available to the defendant to resist the justice of disgorgement of his unjust enrichment in favour of the plaintiff. 18.100 It is also commonly accepted that the law of unjust enrichment is subservient to the law of contract. It is only when there is no contract at 573 Principles of Singapore Business Law all, or perhaps, after a contract has been terminated or vitiated that the law of unjust enrichment may be applied to determine the rights and liabilities between parties (see, eg, the reasoning of the Singapore High Court in Info-communications Development Authority of Singapore v Singapore Telecommunications Ltd (No 2) (2002) at [89]). 18.101 We will now examine two areas where restitutionary remedies often intersect with breaches of contract: ° total failure of consideration; and ° quantum meruit and quantum valebant. Benefits in Money: Total Failure of Consideration 18.102 Money which has been paid to a defendant on the basis that he will perform his obligations under a contract may be recovered if he fails to perform those obligations in such a way that it can be said that the basis of the money payment has failed. This is known as the doctrine of “total failure of consideration” and is a clear example of the law of unjust enrichment in action. 18.103 The terminology is deceptive and likely to cause confusion with the concept of consideration in relation to the formation of a contract. The two contexts in which the term “consideration” is used should be kept distinct. As Viscount Simon LC noted in the House of Lords case, Fibrosa Spolka Akcyjna v Fairbairn Lawson Combe Barbour, Ltd (1943) (“Fibrosa (1943)”) (at p 48): In English law, an enforceable contract may be formed by an exchange of a promise for a promise, or by the exchange of a promise for an act … and thus, in the law relating to the formation of contract, the promise to do a thing may often be the consideration, but when one is considering the law of failure of consideration and of the quasi-contractual right to recover money on that ground, it is, generally speaking, not the promise which is referred to as the consideration, but the performance of the promise. 18.104 Therefore, “consideration” in the context of a claim in unjust enrichment does not refer to the same “consideration” which is furnished by either party 574 Chapter 18: Remedies for Breach of Contract at the time the contract is formed. “Consideration” here refers to the actual performance and completion of the contractual promises. 18.105 Failure of consideration can occur in many different contexts, some contractual, some not (eg, in relation to failed gifts). However, in the business context, the most common reason for failure of consideration is the termination or vitiation of an otherwise valid contractual relationship. 18.106 The language of “total failure” suggests that success of such a claim depends on the claimant being able to establish that he or she received no part of the promised benefit. Unfortunately, the decided cases demonstrate that the determination of exactly what was promised and what constitutes “benefit” for this purpose is by no means clear-cut. For example, in the case of Rowland v Divall (1923), the English Court of Appeal had to decide whether there had been total failure of consideration by a vendor of a car when it turned out that the vendor, through no fault of his own, had no title to it (he had been sold the car by a fraudster who had stolen the car from the true owner). The plaintiff purchaser of the stolen car had to return it to the true owner, after having driven it for only two months or so, and sought a refund of its purchase price from the defendant vendor. The English Court of Appeal held that as the plaintiff had not been given good title to the car, there was indeed a total failure of consideration and ordered the defendant to refund the purchase price to him. 18.107 Even more strikingly, in Fibrosa (1943), the plaintiffs paid the defendants to manufacture and deliver certain machinery. Advance payment of £1,000 was made but before the machinery could be completed and delivered, the contract was frustrated by the outbreak of World War II. This case was decided before the enactment of the English Law Reform (Frustrated Contracts) Act 1943 and the House of Lords held that there was indeed a total failure of consideration, despite the fact that the defendants had expended significant sums in the manufacture of the contract machinery. 18.108 It may also be noted that this type of argument appears to be available regardless of whether the plaintiff is in breach of its own obligations under the contract, as can be discerned from the case of Rover International Ltd v Cannon Film Sales Ltd (1989). For our present purposes, we are interested in the suit within this case between Proper Film Ltd and 575 Principles of Singapore Business Law Cannon Film. Proper Film contracted with Cannon Film for the right to screen certain films on Italian television for a total of US$1,800,000, payable in three instalments of US$360,000, US$540,000 and US$900,000. The first two instalments were paid without incident. Unfortunately, the rights to broadcast the most important of the films were assigned by Cannon Film to another exhibitor. Proper Film took the view that Cannon Film had, as a result, wilfully disabled themselves from performing the contract, evincing thereby an intention to no longer be bound by it. Due to the dispute over whether or not Cannon Film had breached the contract, Proper Film did not pay Cannon Film the final instalment and offered to pay it into a special account, pending the outcome of the litigation over this matter. However, the contract expressly provided that the time of payment of the instalments was of the essence. Accordingly, failure to pay the third payment on time constituted a breach of condition entitling Cannon Film to discharge the contract, which Cannon Film did. Cannon Film then sued Proper Film for the final instalment of US$900,000 as a debt owed to them. 18.109 The issue before the court was whether Cannon was entitled to recover the final instalment even though they had discharged the contract due to Proper Film’s breach of condition of timely payment. Proper Film argued that if they had paid this instalment before discharge of the contract for breach, then it would now be recoverable by them on the basis of total failure of consideration (since at the time the contract was discharged, they had not yet been given any films to exhibit). Consequently, and a fortiori, since there was now no contract at all, they could not be held liable to pay it. The English Court of Appeal agreed with Proper Film’s arguments and dismissed Cannon Film’s claims for the last instalment to be payable to them as a debt, although it recognised that Cannon Film could still recover damages for Proper Film’s breach. 18.110 This part of the case is said to support the position that a contract-breaker claimant can still have restitution because of certain observations by the two judges who delivered the reasons for their decision (the third agreed with both of them). Most obviously, Kerr LJ observed (at p 932) that: [I]n the present case it is entirely clear, in my view, that this instalment was payable in advance of any consideration for the payment which 576 Chapter 18: Remedies for Breach of Contract fell to be provided from the side of Thorn EMI/Cannon. Indeed, when Proper declined to pay it, it was rightly pointed out on behalf of Cannon that nothing in the way of performance was as yet due from their side. This instalment would accordingly have been recoverable by Proper if it had been paid, and it is therefore irrecoverable by Cannon for the same reason. 18.111 The basis for dismissing Cannon Film’s claim for the final instalment was therefore total failure of consideration. If Proper Film had paid the final instalment, since there was a total failure of consideration and Proper Film had obtained nothing of the benefit bargained for under the contract, Proper Film would have been entitled to a repayment. Consequently, it made no sense to allow Cannon Film to recover the last instalment as a debt, only to have it returned to Proper Film. Given this line of reasoning, it would have followed that Proper Film could also have recovered the first two instalments which were actually paid to Cannon Film. Strangely, however, Proper Film did not pursue a claim to recover those amounts. Benefits in Kind: Quantum Meruit and Quantum Valebant 18.112 When the basis for the payment of money has completely failed, the common law looks to the law of total failure of consideration. What about situations where the basis for a benefit in kind has completely failed? Is there a doctrine that provides for restitution of non-monetary benefits (such as goods and/or services) that mirrors total failure of consideration? 18.113 Extension of the doctrine of total failure of consideration to a situation where goods or services are supplied on a particular basis which has failed, is not completely straightforward. Practically speaking, there may be difficulties with returning goods, and services once rendered cannot be readily returned. So very often, what we are thinking about when we consider the possibility of a “refund” of goods or services is their money’s worth (often termed “quantum valebant” in the case of goods and “quantum meruit” in the case of services), and there are numerous cases based on a reasonable valuation of benefits provided by a plaintiff. Although none expressly provides that they are merely manifestations of the doctrine of total failure of consideration, now extended to include non-monetary “refunds”, the reasoning seems obvious enough. 577 Principles of Singapore Business Law 18.114 But can quantum meruit or valebant be successfully pleaded by a plaintiff who has provided non-money benefits to the defendant, where the value of such quantum meruit or valebant would exceed the contractually agreed price, had such price been payable? There appears to be no local or English case on this point as yet, but the case of Lodder v Slowey (1901), a decision of the Privy Council on appeal from the New Zealand Court of Appeal, suggests that it can. 18.115 In that case, Slowey was contracted to carry out certain construction works by Lodder. In breach of the agreement, Lodder prevented Slowey from completing his work. Without considering at all what Slowey could have recovered from Lodder under the terms of the contract had he been allowed to complete his work, Lord Davey, delivering the opinion of the Privy Council, agreed with the decision of the New Zealand Court of Appeal and allowed Slowey to recover on the basis of quantum meruit for the value of the work he had completed up to the time when the contract was breached, and therefore brought to an end by Lodder. 18.116 But is the contract price completely irrelevant? It should be noted that the defendant in Lodder v Slowey (1901) benefited from the part-performance of the plaintiff in that case. However, it should not be assumed that every case of partial performance of an obligation amounts to a benefit to a defendant since “benefit”, in this context, is determined subjectively. In other words, the defendant is sometimes entitled to “subjectively devalue” the plaintiff ’s partial performance by arguing that he does not subjectively find the partial performance to be of any benefit at all. 18.117 Such an argument is extremely difficult where the benefit is incontrovertible, as in the case where the benefit takes the form of money: receipt of a sum of money is invariably valuable and beneficial, even if it is only a partial payment. And in relation to benefits in kind, sometimes, the plaintiff may be able to show that his partial provision of benefits in kind (ie, goods and services) has relieved the defendant from expenses which he would inevitably have had to incur. If so, the defendant’s benefit of having saved inevitable and necessary expenses should be treated as an incontrovertible benefit and cannot be subjectively devalued. In such cases of incontrovertible benefit, it has been argued that the pro rata contract price should rightfully be ignored 578 Chapter 18: Remedies for Breach of Contract (see, eg, Professor Burrows’ analysis in the Law of Restitution (3rd ed, 2011) at pp 349–350). 18.118 Secondly, as incontrovertibly beneficial partial performance is likely to be the exception rather than the rule, most plaintiffs will have to demonstrate benefit by other means. One possible alternative is the concept of a “requested-for” benefit. Professor Burrows suggests that, “[a] request is the most obvious way by which a person chooses to have a benefit conferred by another. The request shows that the person making it desires and values the objective benefit conferred. Even if the request is not explicit, encouraging (ie, impliedly requesting) another to render a benefit also constitutes a choice of that benefit and again is a sufficient indicator that the person desires and values that benefit.” (Law of Restitution, 3rd ed (2011) at p 52). This, Professor Burrows clarifies, reflects “…a general factual truth: in general — but clearly not always — people regard themselves as benefitted by receiving part of what they requested. …” (at p 53). In that work, Professor Burrows also makes a further point — that in such cases, it could be that the question as to whether the receipt of part of that which had been requested might well be taken to be of “benefit” to the recipient if the recipient conducted itself in such a way which would indicate that it desired or valued the part performance, for example, by failing to return that part performance, particularly in cases where return would have been a straightforward process (at pp 53–54). 18.119 In contrast with the position in relation to recovery of advance payments on unjust enrichment grounds (as to which, see discussion above, at paras 18.108–18.111), it appears that the success of a plaintiff ’s quantum meruit or quantum valebant claims in unjust enrichment does depend on the plaintiff ’s non-blameworthiness. Where the plaintiff is himself at fault for causing the contract to come to an end, the Singapore Court of Appeal decision of Lee Siong Kee v Beng Tiong Trading, Import and Export (1988) Pte Ltd (2000) hints that quantum meruit is not available to a contract-breaker. Even so, this problem was not specifically in issue before the court and the true position has yet to be clearly and authoritatively formulated, given that it appears to be inconsistent with the position which seems to have been adopted in relation to claims based on total failure of consideration (see above at para 18.108). It is hoped that the courts may be able to clarify the position further in an appropriate case. 579 Principles of Singapore Business Law Restrictions on Recovery for Unjust Enrichment 18.120 Even in its present nascent form, the law of unjust enrichment recognises that having established a cause of action, certain defences may nonetheless apply to restrict recovery for unjust enrichment. However, apart from the defence of “change of position” (which will be expanded upon in the next few paragraphs), the extent to which a number of other “restitutionary” defences that have been recognised in other Commonwealth jurisdictions will be applied in the courts of Singapore is doubtful, following the decision of the Singapore Court of Appeal in the case of Management Corporation Strata Title No 473 v De Beers Jewellery Pte Ltd (2002) (“De Beers (2002)”) (see [46]–[53] of the judgment). In particular, the Court of Appeal in De Beers (2002) rejected the applicability of estoppel as a defence to a claim under unjust enrichment, since the requirements for estoppel (discussed in Chapter 8, para 8.45 onwards) overlap greatly with those for “change of position” and yet would be overly broad, since it would prevent any recovery at all, and not just that portion of the benefit which had been dissipated by the defendant’s change of position. It did, however, suggest in obiter dicta that a number of other defences were possible, for example, a defence of “payment under a settled view of the law”. Since this chapter is focused on remedies for breach of contract, it is probably inappropriate to provide a detailed discussion of the various viewpoints and approaches. Therefore, we will just provide a brief outline of the defence of “change of position” which has clearly been approved and applied locally. 18.121 The defence of change of position was recognised in England by the House of Lords in the case of Lipkin Gorman (a firm) v Karpnale Ltd (1991). Locally, the Singapore Court of Appeal in Seagate Technology Pte Ltd v Goh Han Kim (1995) has recognised that it is applicable in Singapore and in the Singapore High Court case of Info-communications Development Authority of Singapore v Singapore Telecommunications Ltd (No 2) (2002), Lai Kew Chai J identified four constituent elements. A defendant recipient of a benefit from the plaintiff will be able to resist or minimise restitution if: ° the payee has changed his position; ° the change is bona fide; ° it would be inequitable to require him to make restitution or to make restitution in full; and 580 Chapter 18: Remedies for Breach of Contract ° there is a causal link between receipt of the benefit and the recipient’s change of position. 18.122 An example as to the application of the defence might take the following form. Following receipt of a benefit in money from the plaintiff, the defendant spends the increase in his wealth on an expensive luxury holiday which he would not have gone on if not for the benefit received. Since he would not have decreased his overall wealth by expenditure on such a holiday but for the benefit from the plaintiff, it would be inequitable now to require him to disgorge that benefit. 18.123 The payee’s disenrichment would not be bona fide if he had acted dishonestly or in bad faith. The disenrichment would also not be bona fide if he had accepted the benefit knowing of facts which would entitle the plaintiff to restitution. However, care must be taken not to assume that every bona fide disenrichment would result in a change of position. As observed by Lord Goff in Lipkin Gorman (a firm) v Karpnale Ltd (1991) (at p 580): [T]he mere fact that the defendant has spent the money, in whole or in part, does not of itself render it inequitable that he should be called upon to repay, because the expenditure might in any event have been incurred by him in the ordinary course of things. 18.124 As for causality, “[i]t is clear that … the change of position must occur after the receipt of the payment …” (per Lai Kew Chai J at [141] of Info-communications Development Authority of Singapore v Singapore Telecommunications Ltd (No 2) (2002)). 18.125 The requirement of inequity, however, awaits further elucidation in our courts. 581 Chapter 20 Agency 20.1–20.4 20.5–20.6 Introduction True Agency Against Commercial Agency 20.7 20.8–20.9 20.10–20.11 20.12–20.14 20.15–20.17 20.18–20.19 20.20–20.23 20.24–20.28 How Agency Arises By Agreement (1) Express authority (2) Implied authority Without Agreement: Agency of Necessity Ratification (1) Requirements (2) Effects 20.29 20.30–20.32 20.33–20.34 20.35–20.37 20.38–20.42 20.43 20.44–20.45 20.46 20.47 20.48–20.49 20.50–20.52 20.53–20.56 Effects of Agency Principal–Third Party Relationship (1) Disclosed agency (2) Undisclosed agency (3) Apparent authority Principal–Agent Relationship (1) Duties of an agent (a) Duty to avoid a conflict of interests (b) Duty not to make a secret profit (c) Duty not to delegate (2) Rights of an agent Agent–Third Party Relationship 20.57–20.60 Termination of Agency 20.61–20.62 Conclusion Principles of Singapore Business Law INTRODUCTION 20.1 The law of agency is an important part of commercial law. This is because agents are integral to the conduct of modern business. An agent, at the most rudimentary level, is one who acts on someone else’s behalf and a significant part of the law of agency deals with the ability of the agent to affect the legal position of that someone else. It has often been observed that commercial activity would be severely curtailed if all business transactions had to be conducted personally. Indeed, personal attention to all aspects of a business would not only be inconvenient but also impracticable where time, knowledge or expertise is lacking, and certain business structures, like the partnership and the company, would not be able to operate at all. 20.2 The term “agent” is bandied about very frequently in the marketplace, especially when referring to middlemen, or persons who represent others. Thus it is common to find persons described as employment agents, sales agents, estate agents, insurance agents and sole agents. This led to Lord Herschell’s observation in Kennedy v De Trafford (1897) (at p 188) that “[n]o word is more commonly and constantly abused than the word ‘agent’”. It needs to be pointed out however, that the law of agency may not necessarily apply in all of these situations. Thus, in the words of Lord Herschell again, “[a] person may be spoken of as an ‘agent’, and no doubt in the popular sense of the word may properly be said to be an ‘agent’, although when it is attempted to suggest that he is an ‘agent’ under such circumstances as create the legal obligations attaching to agency that use of the word is only misleading”. 20.3 What exactly then, is agency? In Thai Kenaf Co Ltd v Keck Seng (S) Pte Ltd (1992) (at [49]), KS Rajah JC defined it as “the relationship that exists between two persons when one, called the agent, is considered in law to represent the other, called the principal, in such a way as to be able to affect the principal’s legal position in respect of strangers to the relationship by the making of contracts or the disposition of property”. In the same vein, Gummow J, in the High Court of Australia, observed in Scott v Davis (2000) (at p 1451) that: [t]he term “agency” is best used … to connote an authority or capacity in one person to create legal relations between a person occupying the 618 Chapter 20: Agency position of principal and third parties … Usually the legal relations so created will be contractual in nature … The resultant contract is formed directly between the principal and the third party and there is no contract between the agent and the third party which is attributed to the principal. 20.4 The agency relationship is sometimes represented as being triangular as it involves three parties: the agent, the principal on whose behalf the agent acts, and the third party with whom the principal ultimately contracts. The agency relationship may also be seen as comprising an internal aspect, which is the relationship between the agent and his principal, and an external aspect, which affects the legal position of the principal vis-à-vis the third party. In any case, what is crucial in the relationship is the power of the agent to alter his principal’s legal position, and the complementary liability of the principal that comes with the altered position (see Dowrick, “The Relationship of Principal and Agent” (1954) 17 Modern Law Review 24 at p 36). Whilst the agent might be responsible for negotiating, concluding and perhaps even executing (but in the name or on behalf of the principal) the contract, he is himself typically not personally bound by the concluded contract between his principal and the third party. It is therefore often said that, provided he acts within his authority, the agent “drops out of the picture” as soon as the contract is concluded. Any recourse that the third party has under the contract will therefore be against the principal and not the agent. For an overall picture of the relationship between the three parties, see Figure 20.1. Agent Deals with Authorises Principal Resulting contract Third party Figure 20.1 The “triangular” agency relationship 619 Principles of Singapore Business Law True Agency Against Commercial Agency 20.5 Many commonly called agents are really not, in the legal sense, genuine agents because they are themselves in fact acting as principals. A distributor of goods for the manufacturer, for example, may refer to itself as the “sole agent” or “exclusive agent” for these goods. In legal reality, the distributor probably buys the products, and then resells these to consumers. The sale contracts with ultimate consumers are not made by the distributor on behalf of the manufacturer; rather, any contract of sale entered into by the distributor will be on its own behalf as principal. 20.6 The distributor may undertake, under the contract of supply, to furnish the necessary advertising and promotion, in return for exclusive distributorship rights. In such contracts, the manufacturer could be in breach of contract if it sells the goods itself. Thus, in the case of WT Lamb & Sons v Goring Brick Co (1932), a manufacturer of bricks and other building materials, who appointed the plaintiffs as “sole selling agents of all bricks and other materials manufactured at their works” for a certain period was held to be in breach of contract when it decided to sell all bricks manufactured by it without the intervention of an agent before the expiration of this period. Clearly, if the relationship had been one of agency, the manufacturer would (as principals) have been free to sell as well. The Court of Appeal found, however, on a proper construction of the agreement, that it was one of vendor and purchaser and not one of agency, and the manufacturer was thus precluded contractually from so selling. HOW AGENCY ARISES 20.7 An agency relationship may arise as a result of an agreement between the principal and agent, but may also arise in the absence of such an agreement where the law imposes an agency of necessity. The significance of establishing that there is an agency relationship is that it confers on the agent the power to bind his principal, provided he has acted within the authority conferred upon him, whether by agreement or by operation of law. 620 Chapter 20: Agency By Agreement 20.8 Typically, an agency relationship arises when there is an agreement between the principal and the agent that the latter should act for the former. The essence of such an agency is consent. It is, however, not necessary for the agreement to amount to a contract. In Yasuda Fire and Marine Insurance Co of Europe Ltd v Orion Marine Insurance Underwriting Agency Ltd (1995), Colman J observed (at p 57) that: Although in modern commercial transactions agencies are almost invariably founded upon a contract between principal and agent, there is no necessity for such a contract to exist. It is sufficient if there is consent by the principal to the exercise by the agent of authority and consent by the agent to his exercising such authority on behalf of the principal. This consent is objectively ascertained because whether an agency relationship exists or not is a question of law. As Lord Pearson explained in Garnac Grain Co Inc v HMF Faure & Fairclough Ltd (1968) (at p 1137), the principal and the agent “will be held to have consented if they have agreed to what amounts in law to such a relationship, even if they do not recognise it themselves and even if they have professed to disclaim it … But the consent must have been given by each of them, either expressly or by implication from their words and conduct”. This test was applied by Judith Prakash J in the Singapore decision of Win Line (UK) Ltd v Masterpart (Singapore) Pte Ltd (2000). 20.9 In agencies that are premised on agreements, it is important to determine the scope of the agent’s authority, because the principal is only bound by the agent’s acts when the agent has acted within his authority. In such cases, the agent is said to be conferred actual, or real, authority, which may be either expressly or impliedly conferred. (1) Express authority 20.10 Express authority is, as the description implies, conferred by express appointment and the agent would be specifically told what he is authorised to do. There is no formality required in the appointment of an agent and an oral appointment is equally effective to confer express authority. The scope 621 Principles of Singapore Business Law and extent of the agent’s authority will primarily be determined on a true construction of the words of the appointment itself. 20.11 Where the appointment is contained in a written agreement, the extent of the agent’s authority will depend generally on an examination of the agreement, applying the ordinary principles for the construction of contracts. Where the agreement is oral, this will be a matter of evidence. In Ashford Shire Council v Dependable Motors Pty Ltd (1961), Lord Reid observed (at p 349) that “the extent of an agent’s authority, if in doubt, must be determined by inference from the whole circumstances”. (2) Implied authority 20.12 Authority may arise by implication or inference from the conduct or the relationship of the parties. Sometimes, a person is made an agent by his appointment to a particular post or designation. He would then have the implied authority to do all those things that would normally be necessary for the proper execution of his duties in that particular post or designation. As Lord Denning MR explained in Hely-Hutchinson v Brayhead Ltd (1968) (at p 583): [Actual authority] is implied when it is inferred from the conduct of the parties and the circumstances of the case, such as when the board of directors appoint one of their number to be managing director. They thereby impliedly authorise him to do all such things as fall within the usual scope of that office. 20.13 Additionally, an agent, who is conferred express authority, will have the implied authority to do all such things that are incidental to and necessary for the execution of that express authority. 20.14 Finally, an agent appointed in a particular trade, business or profession, will be impliedly authorised to do those things that are normally or ordinarily done in that trade, business or profession. Without Agreement: Agency of Necessity 20.15 An agency relationship may arise even without the parties’ agreement. In certain limited circumstances, the law confers authority on a person to act for, and bind, another because he is confronted with a situation that requires 622 Chapter 20: Agency him to act expeditiously in order to protect the property or interests of that other person. The origin of this doctrine lies in mercantile law, particularly in shipping cases, where the shipmaster was given authority to act as the ship owner’s agent in emergencies so as to preserve the ship and its cargo. 20.16 The doctrine applies, in cases of pre-existing agencies, to confer on an authorised agent a further or more extensive authority, and also to confer authority by necessity on a person who was hitherto not in any agency relationship with the principal. In both situations, there are policy concerns with over-extending the applicability of the doctrine. In the first, the concern is over-condoning, in the name of necessity, all that an agent does such that the agent becomes in effect the principal. In the second, the law is disinclined to confer authority on the “officious intermeddler” (see I Brown, “Authority and Necessity in the Law of Agency” (1992) 55 Modern Law Review 414 at p 418) so as to subject the principal to obligations without his consent. The doctrine is therefore kept within narrow boundaries. 20.17 The doctrine of necessity has specific requirements. First, the agent must have been unable to obtain, or it must have been practically impossible to obtain, timely instructions from the principal. Second, the agent must have acted, reasonably and in good faith, in the interests of the principal and, third, there must have been a necessity or emergency that compelled the agent to act as he did. Ratification 20.18 As a general rule, if the agent has neither actual nor ostensible authority (as to ostensible or apparent authority, see paras 20.38–20.42), the principal is not bound by the agent’s acts. However, the principal may choose to adopt, or ratify, the agent’s acts subsequently. When this occurs, the agent is conferred with authority retrospectively and the principal thereby assumes full contractual obligations and rights with respect to the agent’s earlier acts. Lord Sterndale MR in Koenigsblatt v Sweet (1923) explained (at p 325) the concept in the following terms: [Ratification] is equivalent to an antecedent authority … and when there has been ratification the act that is done is put in the same position as if it had been antecedently authorised. 623 Principles of Singapore Business Law 20.19 Ratification may be express or implied from the principal’s conduct, although in the latter case, the principal’s conduct must unequivocally indicate an affirmation of the agent’s acts. (1) Requirements 20.20 There are a number of requirements for ratification to be effective. First, there can be ratification only by the person in whose name or on whose behalf the act was purportedly done. Thus, if the agent had professed to be acting on his own, and not on the principal’s behalf, or who had intended to act on the principal’s behalf but failed to disclose this fact to the third party, the principal cannot ratify. The facts of Keighley, Maxsted & Co v Durant (1901) illustrate this point. An agent was authorised to purchase, at a certain price, wheat on a joint account for himself and the defendants. Acting in excess of authority, he purchased wheat at a higher price from the plaintiffs but in his own name and without disclosing that he was also buying on behalf of the defendants. The defendants ratified the purchase the next day but failed subsequently to take delivery of the wheat. The House of Lords held that the action for breach of contract must fail. The purported ratification was ineffective as the agent had contracted in his own name. The defendants were therefore under no contractual obligation to the plaintiffs. 20.21 Secondly, the principal must have been in existence at the time the transaction was completed and was legally competent to act then and at the time of ratification. This particular requirement presented difficulties in the context of pre-incorporation contracts entered into by the incorporators (or promoters) of a company that is yet to be incorporated. At common law, a company was not bound by contracts made prior to its incorporation and it could not ratify the contract either. The position has been legislatively changed by s 41 Companies Act (Cap 50, 2006 Rev Ed) which provides as follows: Any contract or other transaction purporting to be entered into by a company prior to its formation or by any person on behalf of a company prior to its formation may be ratified by the company after its formation and thereupon the company shall become bound by and entitled to the benefit thereof as if it had been in existence at the date of the contract or other transaction and had been a party thereto. 624 Chapter 20: Agency Where the company does not ratify, or where the company fails to get incorporated, s 41(2) provides for the promoter, in the absence of any express agreement otherwise, to be personally liable on the pre-incorporation contract (reference may also be made to Chapter 9, para 9.49). 20.22 With regard to what transactions may be ratified, the general rule is that anything that can be done through an agent, including even unlawful acts, may be ratified by the person on whose behalf that act was done. However, a transaction that is void at its inception cannot be ratified, neither can acts that are prohibited by statute. 20.23 Finally, the ratification must be in time. If there is a time fixed for the performance of the contract, ratification must clearly be within this particular period of time. If there is no fixed time, then the ratification should occur within a reasonable time of the principal acquiring knowledge of the unauthorised transaction. (2) Effects 20.24 Ratification has a retrospective effect, which means that the parties involved, viz, the principal, the third party and the agent, will be placed in the position they would respectively have been in if the agent’s acts had been authorised all along. In Bolton Partners v Lambert (1889), Cotton LJ said (at p 306): The rule as to ratification by a principal of acts done by an assumed agent is that the ratification is thrown back to the date of the act done, and that the agent is put in the same position as if he had the authority to do the act at the time the act was done by him. Thus, the principal acquires rights and obligations under the contract with the third party, and the agent drops out of the picture. 20.25 This rule, known as the doctrine of relation-back, does at first glance appear to favour the principal unfairly over the third party. Whilst the principal may or may not decide to ratify, the third party does not have the same choice. 20.26 Under the rules of offer and acceptance (see Chapter 7), we know that an offer may be revoked any time prior to it being accepted. But in this agency context, if the principal does later ratify, the effect of ratification is 625 Principles of Singapore Business Law retrospective, and relates back to the time the agent purportedly contracted on behalf of the principal. Thus, although the principal is not bound by the contract until he ratifies, the third party would appear to be effectively bound from the date of the contract. The facts of Bolton Partners v Lambert illustrate the point. Scratchley, a director of the plaintiff company, was unauthorised to bind the plaintiff but nevertheless accepted an offer made by the defendant. Prior to the plaintiff ’s ratification, the defendant purported to withdraw his offer. The plaintiff subsequently ratified. The court held that the defendant was bound to the contract. In the words of Cotton LJ (at pp 307–308): I think the proper view is that the acceptance by Scratchley did constitute a contract, subject to its being shewn that Scratchley had authority to bind the company. If that were not shewn there would be no contract on the part of the company, but when and as soon as authority was given to Scratchley to bind the company the authority was thrown back to the time when the act was done by Scratchley, and prevented the Defendant withdrawing his offer because it was then no longer an offer, but a binding contract. 20.27 This perceived inequity of the doctrine of relation-back should not, however, be over-stated. The real “hardship” or inconvenience suffered by the third party is the uncertainty as to whether and when the principal will ratify the transaction. In this regard, it has already been pointed out that ratification must be effected within a reasonable time. As to what amounts to a “reasonable time”, Bowen LJ said in Re Portuguese Consolidated Copper Mines Limited (1890) (at p 35) that: [T]here is no hard-and-fast line in any case: the measure of the reasonableness of the time depends entirely upon the circumstances of the case. You cannot take a hypothetical case and say that if this had been an instance of an offer made and nothing done, with all the parties silent and the silence continuing for two or three months, then the [ratification] would have come too late … It must be a question of fact in each case what the reasonable limit is. Mere time is nothing except with reference to the circumstances. On the facts of Re Portuguese Consolidated Copper Mines Limited, the English Court of Appeal placed considerable emphasis on the fact that the third party did not “repudiate” or intimate that he would like to withdraw the offer on the ground of the agent’s lack of authority in concluding that a ratification 626 Chapter 20: Agency that came after two to three months was effected within a reasonable time. It would, therefore, be open to the third party to require the principal to ratify quickly or not at all. 20.28 The doctrine of relation-back has no application when the agent contracts subject to the principal’s approval or ratification and the third party may therefore withdraw his offer anytime prior to ratification. As Maugham J explained in Watson v Davies (1931) (at pp 468–469): In a case where the agent for one party to a negotiation informs the other party that he cannot enter into a contract binding his principal except subject to his approval, there is in truth no contract or contractual relation until the approval has been obtained. The agent has incurred no responsibility … An acceptance by an agent subject in express terms to ratification by his principal is legally a nullity until ratification, and is no more binding on the other party than an unaccepted offer which can, of course, be withdrawn before acceptance. EFFECTS OF AGENCY 20.29 When an agency is created or imposed by law, a triangular relationship results from the agency. The most important characteristic of agency is the agent’s power to affect the legal position of the principal vis-à-vis third parties. As such, we will begin this section with a consideration of this aspect, and proceed thereafter to consider the effects of agency on the principal–agent relationship and on the agent–third party relationship. Principal–Third Party Relationship 20.30 Generally, a principal is entitled to the benefit of, and would be liable under, a contract made by his agent on his behalf and which is within the scope of the agent’s actual authority (see Figure 20.2). In the normal agency situation, the third party when dealing with the agent would know that the agent is in fact acting on behalf of someone else (the principal). The third party therefore deals with the agent as an agent. The principal in these cases is known as a disclosed principal. Where the third party is aware of the existence of the principal, it does not appear relevant that the principal is unnamed. An unnamed principal is still a disclosed principal. 627 Principles of Singapore Business Law Express Actual Implied Authority of Agent Incidental Ratification Usual Inferred from facts Figure 20.2 The Agent’s actual authority 20.31 There are also situations in which the third party deals with the agent in the latter’s capacity as principal, and who is therefore unaware of the existence of the agent’s own principal, and that the agent was in fact acting on behalf of his principal. In these situations, the principal is said to be undisclosed. The undisclosed principal, notwithstanding the third party’s ignorance of his existence, has a right to enforce the contract against the third party if the agent has acted within his authority. The rules to determine the principal’s rights against the third party depend partly on the distinction between disclosed and undisclosed principals. As such, each category will be dealt with separately in the ensuing paragraphs. 20.32 Finally, there are situations in which a principal is bound by a contract with a third party made by another even though that person is not his agent at all or is an agent who had exceeded his authority in the particular instance. The liability of the principal in these cases arises by operation of the doctrine of apparent authority. (1) Disclosed agency 20.33 Generally, where an agent acts within the scope of his actual authority, whether express or implied, a disclosed principal is bound by and becomes liable for the acts of his agent. Direct contractual relations would therefore 628 Chapter 20: Agency be established between the principal and the third party. The main concern in such cases is to determine the scope of the agent’s authority. If the agent’s acts fall within the scope of his authority, his principal is not only imposed with obligations to the third party, but also acquires rights against the third party. Even where the agent has acted outside the scope of his authority, the disclosed principal may ratify the contract. When this occurs, the principal may sue and be sued on the contract with the third party. The agent drops out of the picture, and accordingly, neither the third party nor the principal can, as a general rule, discharge their respective liability to each other by settling with the agent. Thus, in Butwick v Grant (1924), payment for goods by a third party purchaser to the agent of the seller did not discharge the third party’s liability to the principal-seller. The court held that authority to an agent to sell goods does not necessarily imply authority to receive payment for the goods. In Irvine & Co v Watson & Sons (1880), the principal’s payment to his own agent, of the purchase price for the oil that the latter had contracted for on the principal’s behalf, did not discharge his liability to the third party. Bramwell LJ said (at p 416): I think it is impossible to say that it discharged them, unless they were misled by some conduct of the plaintiffs into the belief that the broker had already settled with the plaintiffs, and made such payment in consequence of such belief. 20.34 The situation is slightly different when the agent acts without authority and the principal does not ratify. If the agent had acted within an authority he appeared to possess, that is, his apparent or ostensible authority, the principal will undoubtedly be liable to the third party. However, it is unlikely that the principal will be able to initiate an action against the third party on contracts purportedly made by these “apparent agents”. (2) Undisclosed agency 20.35 An undisclosed principal, as alluded to before, may be able to enforce a contract entered into by his agent with a third party, and this is so even though the third party was under the impression that he was dealing only with the agent in the latter’s own capacity. As such, this rule is generally thought of as anomalous because it goes against the fundamental principles of privity of contract, which is logically only established between the third party and the agent. The rule is, however, justified on grounds of commercial 629 Principles of Singapore Business Law convenience (per Lord Lloyd in Siu Yin Kwan v Eastern Insurance Co Ltd (1994) at p 207). Lord Lindley explained the justification in Keighley, Maxsted & Co v Durant (1901) (at p 260) in the following manner: As a contract is constituted by the concurrence of two or more persons and by their agreement to the same terms, there is an anomaly in holding one person bound to another of whom he did not, in fact, intend to contract. But middlemen, through whom contracts are made, are common and useful in business transactions, and in the great mass of contracts it is a matter of indifference to either party whether there is an undisclosed principal or not. If he exists it is, to say the least, extremely convenient that he should be able to sue and be sued as a principal, and he is only allowed to do so upon terms which exclude injustice. 20.36 The rules that apply to an undisclosed agency was summarised by Lord Lloyd in Siu Yin Kwan v Eastern Insurance Co Ltd (1994) (at p 207) as follows: (1) An undisclosed principal may sue and be sued on a contract made by an agent on his behalf, acting within the scope of his actual authority. (2) In entering into the contract, the agent must intend to act on the principal’s behalf. (3) The agent of an undisclosed principal may also sue and be sued on the contract. (4) Any defence which the third party may have against the agent is available against his principal. (5) The terms of the contract may, expressly or by implication, exclude the principal’s right to sue, and his liability to be sued. The contract itself, or the circumstances surrounding the contract, may show that the agent is the true and only principal. In order for the undisclosed principal to intervene in the contract made by his agent, it is of great importance that the agent acted within his actual authority, and that he intended to act on his principal’s behalf. The undisclosed principal’s right of intervention is “subject to any defences or equities which without notice may exist against the agent” (per Sir Montague Smith in Browning v Provincial Insurance Co of Canada (1873) at p 272). Thus, the third party may utilise any right of set-off against the agent which may have accrued in his favour before he has notice of the principal’s existence. In a similar manner, if the third party settles on the contract with the agent prior to his discovery of the principal’s existence, this would provide a complete defence to any action brought by the principal. The 630 Chapter 20: Agency position here is clearly different from that of the disclosed principal (discussed in para 20.33), because the undisclosed principal had allowed the agent to act as though he (ie, the agent) is the principal. As long as the principal remains undisclosed, the agent, who has contracted with the third party in his own name, will be able to sue and be sued on the contract. However, once the principal decides to intervene in the contract, the agent loses his right to sue. 20.37 Once the third party becomes aware of the existence of the principal, the law confers on the former the right to elect (or choose) whether to sue the principal or the agent on the contract. In the words of Earl Cairns LC in Kendall v Hamilton (1879) (at p 514): [W]here an agent contracts in his own name for an undisclosed principal, the person with whom he contracts may sue the agent, or he may sue the principal, but if he sues the agent and recovers judgment, he cannot afterwards sue the principal, even although the judgment does not result in satisfaction of the debt. Point (5) in the quotation by Lord Lloyd in para 20.36 is necessary in order to prevent any injustice that the principal’s unqualified right to intervene may cause to the third party because of the third party’s ignorance of the principal’s existence. Thus, the undisclosed principal will not be permitted to intervene if this would contradict the express or implied terms of the contract. (3) Apparent authority 20.38 Sometimes, a person, by his conduct or representation, creates an impression that another, the “agent”, has the requisite authority to act on his behalf. If the third party has relied on the impression so created and alters his legal position, then the person creating that impression is not allowed to deny the purported agent’s authority, and would therefore be bound by that agent’s acts. Apparent, or ostensible, authority, therefore, is the authority which an agent appears to have but in fact does not. 20.39 What are the essential elements of apparent authority? In Rama Corporation v Proved Tin and General Investments Ltd (1952), Slade J said (at pp 149– 150): 631 Principles of Singapore Business Law Ostensible or apparent authority … is merely a form of estoppel, indeed, it has been termed agency by estoppel, and you cannot call in aid an estoppel unless you have three ingredients: (i) a representation, (ii) a reliance on the representation, and (iii) an alteration of your position resulting from such reliance. 20.40 The basis of apparent authority is therefore the principal’s “holding out”, or representation, to the third party that the “agent” is authorised to act as his agent. This representation of authority is often implied from the conduct of the principal in appointing the agent to a particular position, which might usually carry with it the authority to conclude contracts of the type in question, or from a previous course of dealings between the principal and the third party. Thus, a representation of authority could be made when the supposed principal allows the alleged agent, who has not in fact been properly appointed as agent, to appear as if he is the principal’s agent. This occurred in Freeman & Lockyer v Buckhurst Park Properties (Mangal) Ltd (1964) (see also Chapter 21, para 21.41). The articles of association of the company authorised the board of directors to appoint a managing director, but none was in fact appointed. The board, however, allowed one director to act as managing director, and he contracted with a third party to do some work for the company. The company claimed that it was not bound by the contract because the director had no authority. It was held that although the director had no actual authority to so contract, the company had, through its board of directors, created an impression of authority by acquiescing in the director’s conduct. The company was therefore bound by any act within the ambit of that apparent authority. Diplock LJ explained (at p 503) the basis of apparent authority: An “apparent” or “ostensible” authority … is a legal relationship between the principal and the contractor (third party) created by a representation, made by the principal to the contractor, intended to be and in fact acted upon by the contractor, that the agent has authority to enter on behalf of the principal into a contract of a kind within the scope of the “apparent” authority, so as to render the principal liable to perform any obligations imposed upon him by such a contract. To the relationship so created the agent is a stranger. He need not be (although he generally is) aware of the existence of the representation but he must not purport to make the agreement as principal himself. The representation, when acted upon by the contractor by entering into a contract with the agent, operates as an estoppel, preventing the principal from asserting that he is not bound 632 Chapter 20: Agency by the contract. It is irrelevant whether the agent had actual authority to enter into the contract. Perhaps more commonly, the impression of authority is generated when the principal either revokes or limits the authority his agent actually possesses, but fails to inform those third parties with whom the agent had dealings. In this situation, the agent would appear to continue to possess authority, when in fact his actual authority has either been revoked or curtailed. The previous course of dealings therefore constitutes the principal’s representation. Lord Denning gave an example of this in Hely-Hutchinson v Brayhead Ltd (1968) (at p 583): [W]hen the board appoint one of their number to be managing director, they invest him not only with implied authority, but also with ostensible authority to do all such things as fall within the usual scope of that office. Other people who see him acting as managing director are entitled to assume that he has the usual authority of a managing director. But sometimes ostensible authority exceeds actual authority. For instance, when the board appoint the managing director, they may expressly limit his authority by saying he is not to order goods worth more than £500 without the sanction of the board. In that case his actual authority is subject to the £500 limitation, but his ostensible authority includes all the usual authority of a managing director. The company is bound by his ostensible authority in his dealings with those who do not know of the limitation. [emphasis in original] It should be noted that the representation must come from the principal, or someone actually authorised by the principal, in order for the estoppel to arise against him. It is generally insufficient for the representation to have come from the agent himself. In United Bank of Kuwait v Hammond (1988), Lord Donaldson MR observed (at p 1066) that “it is trite law that an agent cannot ordinarily confer ostensible authority on himself. He cannot pull himself up by his own shoe laces”. 20.41 The second element that is necessary to establish the estoppel against the principal is that the third party must have relied on the representation. There can be no reliance if the third party did not deal with the “agent” as agent. Equally, where the third party knows, ought to know or suspects that the agent is in fact without authority, he will not then be allowed to rely on the doctrine of apparent authority to bind the principal. 633 Principles of Singapore Business Law Box 20.1 Reflecting on the law Apparent authority and representations Whether an agent can create his own appearance of authority so as to bind the principal is a difficult question. Whilst the orthodox position appears to be that an agent without actual authority to act for the principal cannot make the representation on the principal’s behalf, the reality is that in the corporate commercial world, the creation of an impression of authority comes often as much from the agent’s actions, as from the corporate principal’s appointment of the agent to a particular position. After all, who would communicate with and have face-to-face dealings with third parties other than the agent himself? In this regard, a careful consideration of the facts of the case is of particular importance. A conclusion might be reached, as was the case in First Energy (UK) Ltd v Hungarian International Bank Ltd (1993), that although the agent may not have had actual authority vis-à-vis the contract itself, he nevertheless had the authority to communicate the agreement to contract on behalf of the principal. The ultimate result in such a case would be a binding contract. It should be pointed out, however, that the Court of Appeal has cautioned, in Skandinaviska Enskilda Banken AB (Publ), Singapore Branch v Asia Pacific Breweries (Singapore) Pte Ltd (2011) that the case of First Energy (UK) Ltd should be confined to its own unique facts. 20.42 Finally, there must be an alteration of the third party’s position as a result of the reliance. The third party’s entering into the contract is sometimes considered sufficient alteration (see, eg, Arctic Shipping Co Ltd v Mobilia AB, The Tatra (1990) at p 59), although other cases appear to require that the third party suffers a detriment (Norfolk County Council v Secretary of State for the Environment (1973)). Principal–Agent Relationship 20.43 The rights and duties of the principal and the agent derive from the terms of the contract, if any, between the parties. Additionally, and independently of contract, certain duties arise from the agency relationship itself. (1) Duties of an agent 20.44 Where the agent is appointed under a contract, he is clearly bound to perform in accordance with the terms of the contract and with the instructions stipulated therein. The obligation to perform with reasonable care and diligence will, if not expressly stipulated, be an implied term of the 634 Chapter 20: Agency contract (see Chapter 10). If he acts in a manner that is not authorised, he will be in breach of the contract. Even an agent who is not appointed pursuant to a contract is required to act with due care and skill, although it is likely that a higher standard might be expected of a paid, as opposed to a gratuitous, agent. 20.45 In addition, agents are fiduciaries. A fiduciary is a person who stands in a position of trust and confidence vis-à-vis another, and is conferred discretion to act for the benefit of that other (ie, the beneficiary). A fiduciary possesses the mandate to exercise individual discretion, and is able (like the agent) to affect the legal position of the beneficiary. However, the very power held by the fiduciary that allows him to benefit the other, also allows him to “indulge his own interest and to injure” that other (see D A DeMott, “Beyond Metaphor: An Analysis of Fiduciary Obligation” (1988) Duke Law Journal 879 at p 914). Thus, as McCardie J explained in Armstrong v Jackson (1917) (at p 826): The position of principal and agent gives rise to particular and onerous duties on the part of the agent, and the high standard of conduct required from him springs from the fiduciary relationship between his employer and himself. His position is confidential. It readily lends itself to abuse. A strict and salutary rule is required to meet the special situation. A number of fiduciary duties are therefore imposed on agents. A breach of the agent’s fiduciary obligations will render the agent liable to surrender his ill-gotten gains to his principal. The main fiduciary obligations are discussed below. (a) Duty to avoid a conflict of interests 20.46 An agent is under an obligation not to put himself in a position where his duties as agent conflict with his personal interests unless the conflict has been fully disclosed to the principal and the latter’s consent obtained. An agent who gained a benefit in breach of this duty will have to surrender that benefit to his principal. This rule is necessary because of the agent’s power to affect his principal’s legal position. It has been said that “human infirmity” (per Eldon LC in Ex Parte Bennett (1805) at p 897) renders it difficult to resist the temptation to favour oneself over one’s principal. This temptation is particularly acute if the agent, employed to buy, were allowed to purchase his own goods on behalf of his principal or if the agent, employed to sell, 635 Principles of Singapore Business Law were allowed to himself buy the principal’s property. The purpose of the noconflict rule is thus to remove that temptation. (b) Duty not to make a secret profit 20.47 In a similar vein, the agent is not allowed to use his position (including property or confidential information acquired in his position as agent), without the knowledge and assent of the principal, to make personal profits or for a personal advantage. Neither is he allowed to accept bribes or secret commissions from the third parties with whom he is dealing on behalf of his principal. Slade J defined, in Industries and General Mortgage Co Ltd v Lewis (1949) (at p 575), a “bribe” as follows: A bribe means a payment of a secret commission, which only means (i) that the person making the payment makes it to the agent of the other person with whom he is dealing; (ii) that he makes it to that person knowing that that person is acting as the agent of the other person with whom he is dealing; and (iii) that he fails to disclose to the other person with whom he is dealing that he has made that payment to the person whom he knows to be the other person’s agent. Both the agent who receives the bribe and the third party who pays it may be criminally liable under the Prevention of Corruption Act (Cap 241, 1993 Rev Ed). In addition, the bribe received by the agent may be confiscated or forfeited under the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act (Cap 65A, 2000 Rev Ed). (c) Duty not to delegate 20.48 The general rule is that an agent cannot appoint and delegate his authority to a sub-agent except with the express or implied authority of the principal, and where confidence in the person of the agent is the root of the agency relationship, the authority to delegate cannot be implied as an ordinary incident in the contract (per Thesiger LJ in De Bussche v Alt (1878) at p 310). However, it is recognised that the exigencies of business do sometimes require that a sub-agent be appointed. The authority to delegate may (in such situations) be implied, as Thesiger LJ explained (at p 310): [W]here, from the conduct of the parties to the original contract of agency, the usage of trade, or the nature of the particular business which 636 Chapter 20: Agency is the subject of the agency, it may reasonably be presumed that the parties to the contract of agency originally intended that such authority should exist, or where, in the course of the employment, unforeseen emergencies arise which impose upon the agent the necessity of employing a substitute. 20.49 However, even where such authority to delegate exists, there appears to be no general principle of law that privity of contract then arises as between the principal and the sub-agent so that the sub-agent, and not the agent, becomes directly responsible to the principal in connection with the performance of the original mandate. Wright J stated, in Calico Printers’ Association Ltd v Barclays Bank (1930) (at p 109) as follows: English law … has in general applied the rule that even where the subagent is properly employed there is still no privity between him and the principal. The latter is entitled to hold the agent liable for breach of the mandate which he has accepted, and cannot in general claim against the sub-agent for negligence or breach of duty. I know of no English case in which a principal has recovered against a sub-agent for negligence. The agent does not as a rule escape liability to the principal merely because employment of the sub-agent is contemplated. To create privity it must be established not only that the principal contemplated that a sub-agent would perform part of the contract, but also that the principal authorised the agent to create privity of contract between the principal and the sub-agent, which is a very different matter requiring precise proof. In general, where a principal employs an agent to carry out a particular employment, the agent undertakes responsibility for the whole transaction and is responsible for any negligence in carrying it out, even if the negligence be that of the sub-agent properly or necessarily engaged to perform some part, because there is no privity between the principal and the sub-agent. (2) Rights of an agent 20.50 The agent has a number of rights against his principal. Very importantly, the agent has a right to be remunerated for carrying out his mandate, but this is a right that depends on the agreement between the parties. Where the agent is appointed pursuant to a contract, the terms of the contract will govern his right to remuneration. 637 Principles of Singapore Business Law 20.51 The agent is also entitled to be reimbursed for expenses incurred and indemnified by the principal against all liabilities which he has reasonably incurred in the execution of his mandate. However, the agent is not entitled to reimbursement or to an indemnity in respect of expenses incurred outside of his authority unless the principal ratifies the agent’s acts. This rule applies equally to expenses that result from illegal acts or from the agent’s own breach of duty. 20.52 Finally, an agent is entitled to a lien over his principal’s property in respect of all claims against the principal that arise out of the agency. A lien is essentially a security interest that allows the agent to retain possession of his principal’s property until the principal satisfies all of the agent’s claims. Agent–Third Party Relationship 20.53 The general rule is that the agent who contracts on behalf of his principal owes no liability to, nor does he have any rights against, the third party. 20.54 There are, however, exceptions. An agent may have agreed or undertaken to be personally liable. This is a matter of proper construction of the contract concluded with the third party, it may be common practice in the particular trade or business for the agent to be personally liable and entitled, or this could be the usual course of business between the specific parties. The agent may also be liable, as we saw above, where the principal is an undisclosed principal. 20.55 Statute may also render an agent personally liable. Section 26 Bills of Exchange Act (Cap 23, 2004 Rev Ed), for example, provides that “where a person signs a bill as drawer, indorser, or acceptor, and adds words to his signature, indicating that he signs for or on behalf of a principal, or in a representative character, he is not personally liable thereon; but the mere addition to his signature of words describing him as an agent, or as filling a representative character, does not exempt him from personal liability”. In a similar manner, s 41 Companies Act (see para 20.21) renders the agent (ie, the promoter of the company) personally liable on pre-incorporation contracts if these are not subsequently ratified by the company after it is incorporated. 638 Chapter 20: Agency 20.56 An agent who contracted in excess of authority, and whose principal does not adopt the agent’s acts through the process of ratification, may be liable to the third party for breach of the agent’s implied warranty of authority. In the words of Willes J in Collen v Wright (1857) (at p 657): [A] person who induces another to contract with him as the agent of a third party by an unqualified assertion of his being authorised to act as such agent, is answerable to the person who so contracts for any damages which he may sustain by reason of the assertion of authority being untrue … The fact that the professed agent honestly thinks that he has the authority affects the moral character of his act; but his moral innocence, so far as the person whom he has induced to contract is concerned, in no way aids such person or alleviates the inconvenience and damage which he sustains. It should be obvious that if the third party knows or must be taken to know of the agent’s lack of authority, the agent cannot be made liable on this ground. Also, where the principal ratifies the agent’s unauthorised acts, the agent will also not be liable for a breach of warranty of authority. TERMINATION OF AGENCY 20.57 Agency may be terminated by the acts of the parties themselves or by operation of law. Certain classes of agency are, however, deemed by law to be irrevocable. 20.58 Where the agency is created by an agreement that amounts to a contract, it may, as a general rule, be determined in a similar manner as a contract. Thus the contract of agency may be discharged by performance and breach or frustration (see Chapters 16 and 17 respectively). As agency is mostly a consensual relationship based on agreement between the parties, its termination too may be effected by agreement. Either party may also give notice of his intention to withdraw from the agency, subject to liability in damages if the agency is derived from a contract. Whilst these acts terminate the relationship of the principal and the agent, they do not necessarily terminate the agent’s apparent or ostensible authority unless the third party has notice of this. Vis-à-vis the third party, therefore, the principal may remain liable for the acts of his former agent. 639 Principles of Singapore Business Law 20.59 Even where the parties do not themselves act to terminate the agency, certain events do so by operation of law. Death of either party determines the agency whether the surviving party has notice of the death or not. But where it is the principal who has died, the agent may be liable to the third party for breach of warranty of authority. In a similar manner, the supervening insanity of either the principal or the agent determines the agency. Whilst the bankruptcy of the principal (which amounts to legal incapacity) will automatically terminate the agency relationship, the bankruptcy of the agent will determine the relationship only if the agent is thereby made unfit to perform his duties. 20.60 The authority of an agent may become irrevocable in certain situations. Specifically, authority given to an agent by contract or deed for the purpose of protecting a pre-existing interest of the agent, cannot be revoked by the principal without the agent’s consent. In this sense, the authority is irrevocable. The facts of Gaussen v Morton (1830) illustrate the operation of this doctrine. A principal owed money to another, and therefore conferred authority on the latter to sell certain property and to use the proceeds to discharge the debt. The purpose of the creation of the agency was therefore to secure a benefit to the agent (ie, the repayment of the debt). It was therefore held that the agent’s authority could not be revoked without the agent’s consent. CONCLUSION 20.61 In this chapter, we considered the main principles of agency law. An agent is a person who acts on behalf of another, known as his principal. As a general rule, a transaction with a third party that is properly entered into by an agent on his principal’s behalf binds the principal, and the agent is not liable on the resulting contract. However, this is the case only if the agent acted within the authority that was conferred on him either by his principal, or by law. Where the agent has acted without authority, the agent may be liable, not only to the principal if loss has been occasioned by the agent’s actions, but also potentially to the third party for breach of his implied warranty of authority. Whether or not liability on the agent is imposed depends on the particular circumstances of the case. 640 Chapter 20: Agency 20.62 Although a principal is generally bound only by the acts of his authorised agent acting within the scope of his authority, we saw that, in some circumstances, a principal may be bound, notwithstanding the agent’s lack of authority. It is also possible for a principal to adopt an unauthorised act retrospectively. This process is known as “ratification”, and when it occurs, will allow the principal to take the benefit, as well as the liability, of the otherwise unauthorised transaction. 641 Chapter 21 Business Organisations 21.1–21.3 21.4–21.6 21.7–21.8 21.9–21.15 21.16–21.21 21.22–21.25 21.26–21.28 21.29–21.36 21.37 21.38–21.44 21.45–21.47 21.48–21.50 21.51–21.55 21.56 21.57–21.58 21.59–21.60 21.61–21.66 21.67 21.68–21.69 21.70 21.71 21.72 Introduction Overview Registering a Business Companies Overview Categories and Classification Company Formation Persona Ficta (1) Legal personality (2) Looking behind the veil of incorporation How Companies Operate (1) Rules of attribution (2) Division of powers (3) Corporate contracting Directors (1) General (2) Directors’ obligations and duties (a) Equitable and fiduciary duties (b) Duty of skill, care and diligence (3) Enforcement of directors’ duties Relationship between Shareholders (1) Statutory contract (2) Majority rule and protection of the minority Non-corporate Business Organisations Sole Proprietorships Partnerships (1) General partnership (a) Dealings with third parties (b) Unlimited personal liability of partners (c) Dissolution Principles of Singapore Business Law 21.73–21.74 21.75–21.77 (2) Limited partnership (3) Limited liability partnership 21.78–21.79 Business Trusts 21.80 Conclusion 644 Chapter 21: Business Organisations INTRODUCTION Overview 21.1 A person contemplating starting a business has a number of options as to how to structure his business. The major basic structures are, traditionally, the sole proprietorship, partnership and company, and these will be considered in this chapter. Apart from these traditional forms, legislation has introduced other hybrid forms with the intention of widening the options available for businesses and investments in Singapore. One of these newer structures is the limited liability partnership (“LLP”) (see the Limited Liability Partnerships Act (Cap 163A, 2006 Rev Ed)), which combines the favourable attributes of the ordinary partnership and the company. A variant of the ordinary partnership is the limited partnership, to which the general principles of partnership law apply, albeit subject to a number of modifications imposed by the Limited Partnerships Act (Cap 163B, 2010 Rev Ed). Then there is the business trust (see the Business Trusts Act (Cap 31A, 2005 Rev Ed)) which is essentially an orthodox trust constituted to manage an asset for the purposes of generating returns for its investing unit holders. We will revisit these forms later in the chapter. In addition, there are organisational structures such as societies, cooperative societies and trusts. These are generally utilised for purposes other than that of business and profit-making. 21.2 There are also methods of association that may be used for business purposes. The joint venture is one such common example. Other examples include the syndicate and the consortium. These are effectively facilitative arrangements between two or more parties (who may themselves be individuals, partnerships or companies) who come together to cooperate commercially for a particular purpose. The actual legal form through which these associations pursue their shared undertaking is usually either the partnership or the company. 21.3 The law does not, as a general rule, dictate the structure that a business must adopt. However, if the proposed association is formed for the purposes of gain and consists of more than 20 persons, then s 17(3) Companies Act (Cap 50, 2006 Rev Ed) (“CA”) mandates that it be incorporated as a company. Otherwise, the particular business form chosen is very much a 645 Principles of Singapore Business Law private decision. The final decision as to the form to adopt will depend, first of all, on whether the businessman does it alone or with others, and secondly, on a careful evaluation and weighing of a number of factors including the nature of the business contemplated, the potential for liability, the management process and the present and future capital requirements of the business and tax incentives. Registering a Business 21.4 There is one other matter that needs to be at least briefly mentioned before we look in more detail at the basic business forms, and this is the requirement for the registration of businesses. The Business Registration Act (Cap 32, 2004 Rev Ed) (“BRA”) makes it compulsory for every person who intends to carry on a business in Singapore to make an application to the Registrar of Businesses (who is an officer of the Accounting and Corporate Regulatory Authority (“ACRA”)) in the prescribed manner for the registration of the business. This application must be made before the commencement of business (s 5 BRA). Section 4 exempts from registration certain small businesses (as listed in the First Schedule including that carried on by licensed hawkers, taxi drivers, trishaw riders and, subject to certain conditions, craftsmen and farmers) and businesses that are carried on by bodies already regulated under other laws (accountants and lawyers fall within this exemption). Companies and limited liability partnerships, which are regulated under the CA and the Limited Liability Partnerships Act respectively, do not need to be registered under the BRA, unless the company or the LLP carries on a business under a name that is not its registered name (ss 4(2) and 4(3) BRA). The requirement for registration serves to provide the public with a repository of information on persons who do business in Singapore, and in so doing, protects the public against being misled as to the real identity of such persons. To ensure that the registered information is kept updated, the BRA imposes the further obligation to notify the Registrar of any changes to particulars already registered (s 12 BRA). 21.5 There are both civil and criminal consequences for failing to register. Section 21 provides that a person who defaults on the registration requirements in respect of a business (including the requirement to update registered 646 Chapter 21: Business Organisations particulars) shall not be able to enforce his rights under any contract which relates to that particular business. This section does not prejudice the rights of the other party to the affected contract; the intention is clearly to penalise only the defaulting party. It should be obvious, however, that if the disability was to be a strict and absolute one, this section might stand to be abused by the other contracting party as a means to avoid his contractual obligations and injustice would thereby be suffered by the defaulter. The disability therefore is not absolute and the court is given “the widest possible powers of granting relief to persons in default” (per Christopher Lau JC in Federal Lands Commissioner v Benfort Enterprises & Anor (1998) at [13]) where it is satisfied that the default was “accidental or due to inadvertence or some other sufficient cause, or that on other grounds it is just and equitable to grant relief ” (s 21(3) BRA). The justification for this is explained by Lush J (with whom Christopher Lau JC expressly agreed) in Weller v Denton (1921) as follows (at p 109): The reason why this wide power of granting relief should be given to the court can well be understood. Where the defendant has not been misled, and knew the members of the firm or other persons with whom he was dealing, it might be most unjust and inequitable to hold that the plaintiff ’s action should not be maintained merely because he did not know that he ought to have been registered under the Act. Whilst this might give the impression that relief is readily granted on request as long as the defaulter “did not know that he ought to have been registered”, this is not the case. In Watson v Park Royal (Caterers) Ltd (1961), Edmund Davies J made it clear that however broadly the English equivalent of s 21 is to be construed, it is still a requirement that the court be satisfied of the matters set out therein as grounds for relief. In his Honour’s words, “to hold that [relief] is automatically granted on request would simply be to put a pencil through the provisions of an Act of Parliament which obviously had security and stability in business dealings as its object” (at p 736). 21.6 Section 27 imposes criminal sanctions for non-compliance with the BRA. This does not, however, render the contract entered into by a defaulter void on the ground of illegality (Lim Feng Chieh (formerly trading as Intra-Smit Agencies) v GS Auto Supply Pte Ltd (1993)) (on the BRA generally, see H M Zafrullah, “The Law of Business Registration in Singapore” (1985) 2 Malayan Law Journal ccxvii). 647 Principles of Singapore Business Law COMPANIES Overview 21.7 The word “company” is used in this chapter to denote a corporation that is formed through the process of registration or incorporation laid down in the CA. Indeed, this is the definition the CA ascribes to the word. The effect of complying with the requirements of registration is to bring into being “a body corporate by the name contained in the memorandum capable forthwith of exercising all the functions of an incorporated company and of suing and being sued and having perpetual succession and a common seal with power to hold land” (s 19(5) CA). Companies are therefore really a sub-category of associations known as “bodies corporate” or “corporations”, all of which share in common the possession of corporate status. This means that the law conceptualises the corporation as an entity possessing artificial personality. The effect of this will be discussed in the ensuing paragraphs. 21.8 Corporations include those that are created directly by an Act of Parliament. The Maritime and Port Authority of Singapore, for example, is a body corporate created directly by the Maritime and Port Authority of Singapore Act (Cap 170A, 1997 Rev Ed). These statutory corporations do not fall within the definition of “corporations” that are subject to the provisions of the CA (s 4 CA). Categories and Classification 21.9 The CA classifies companies according to the method by which the liability of the members to contribute to the assets of a company is determined. In an unlimited company, there is no limit placed on the liability of its members who may therefore be personally liable for the whole of the company’s liabilities to its creditors. In a limited company, this liability is restricted to an amount fixed by reference to the terms by which shares are held or by the company’s constitutional documents. 21.10 The CA recognises two types of limited company: a company limited by shares and a company limited by guarantee. 21.11 A company limited by shares has a share capital. Most of the companies registered under the CA are companies limited by shares as this provides 648 Chapter 21: Business Organisations perhaps the most appropriate form for commercial purposes. A share represents the holder’s financial undertaking in the company and provides the basis on which he is conferred membership rights, such as the right to vote and the entitlement to participate in the profits of the company, in the form of dividends. The terms “shareholder” and “member” are generally used interchangeably, although technically, a shareholder becomes a “member” only when his name is entered into the company’s register of members (s 19(6) CA). 21.12 The liability of a member or shareholder of a company limited by shares is limited to the amount that remains unpaid on his shares. For example, if a company allots to X a share at the price of $1, and X pays $0.50 to the company on the issue of that share, X’s maximum potential liability to meet the company’s debts is then limited to the outstanding balance of $0.50. The company may require X to contribute the outstanding amount by making a call on the unpaid balance even when the company is not being wound up. An unpaid call amounts to a debt owing to the company. 21.13 In a company limited by guarantee, a member (note that there cannot be “shareholders” in such companies as there is no share capital) is only liable to contribute to the assets of the company in the event of its winding up, and then only at the (usually nominal) amount fixed by the memorandum. Such companies are used mainly for non-profit making purposes such as charities or recreational clubs. The Singapore Management University, for example, is a company limited by guarantee. This chapter deals only with the company limited by shares. 21.14 The CA also classifies companies as private or public. Under the CA, only companies having a share capital may be incorporated as private companies. A private company must, in its memorandum or articles of association, restrict the right to transfer its shares and limit the number of its members to 50 (s 18(1) CA). Within this class of private companies, there is a further division into companies that are conferred exempt status and those that are not. An exempt private company is defined in the CA as “a private company in the shares of which no beneficial interest is held directly or indirectly by any corporation and which has not more than 20 members” or any private company wholly held by the Government and which is declared, in the national interest, as an exempt private company (s 4). These companies are exempted from certain accounting requirements under the CA. 649 Principles of Singapore Business Law 21.15 A public company is any company that is not a private company (s 4 CA). Public companies, because of their generally unrestricted ability to raise funds from the public, are subject to a correspondingly higher degree of regulation by the law. A public company may be listed or unlisted. Where the shares of a public company are listed on a stock exchange, there is a ready market for the company’s shares. The stock exchange will have its own listing and ongoing requirements that will have to be complied with by listed companies. Listed companies are regulated separately by the Securities and Futures Act (Cap 289, 2006 Rev Ed). For a broad classification of incorporated entities generally, see Figure 21.1. Incorporated entities Registered under Companies Act Created by specific statutes Private Unlimited Limited by shares Limited by guarantee Public Exempt Listed Non-exempt Unlisted Figure 21.1 Classification of incorporated entities Company Formation 21.16 Any individual may incorporate a company. The CA requires a company to have at least one member (s 20A), and the sole member may also be the sole director of the company provided he is ordinarily resident in Singapore 650 Chapter 21: Business Organisations (s 145(1)). The CA prescribes the process of incorporation. It requires the drawing up of the company’s constitution and the lodging of this with the Registrar of Companies, together with certain prescribed forms and the prescribed fee (s 19). If all is in order, the Registrar will issue a certificate of incorporation whereupon “the subscribers to the memorandum together with such other persons as may from time to time become members of the company shall be a body corporate” (s 19(5)). The incorporation of companies is now done electronically through BizFile, which is an electronic filing system maintained by ACRA. 21.17 Currently, the company’s constitution comprises two documents: the memorandum of association and the articles of association. Section 22 CA prescribes the minimum information that must be contained in the memorandum. It was previously mandated that the memorandum should include the objects of the company. This statement of the company’s objects formed the basis for the development of the difficult “ultra vires” doctrine. The doctrine is a rule of company law that is concerned with the capacity of the company. By the doctrine, a company cannot do anything that is not within the scope of its objects clause as it would be without the capacity to do so. In the eyes of the law, an ultra vires transaction would be null and void, and would not be capable of being authorised or ratified (retrospectively approved), not even by a unanimous decision of the shareholders. Operating together with the doctrine of constructive notice, which deems all who deal with the company to have notice of the contents of the company’s constitution and other lodged documents, the doctrine of ultra vires has been the cause of significant injustice to outsiders who may have supplied goods or services to the company for a purpose not contained in the memorandum. 21.18 Section 23(1) CA now provides that, unless otherwise provided, a company has full capacity to undertake any business or do any act, with full attendant rights, powers and privileges. Nevertheless, the company may include a statement of its objects in its memorandum (s 23(1A)) and may, by a provision in its memorandum or articles, restrict its capacity, rights, powers or privileges (s 23(1B)). In this case, the doctrine of ultra vires, as modified by s 25, remains relevant. 21.19 Section 25 CA reformed the doctrine of ultra vires. The section provides that, with respect to outsiders, “no act or purported act of a company … 651 Principles of Singapore Business Law shall be invalid by reason only of the fact that the company was without capacity or power to do such act …”. However, as a matter of internal administration, the fact of corporate incapacity may be relied upon by a member who wants to restrain the company from doing an ultra vires act. Unlike the position at common law, where the ultra vires transaction is automatically void, restraint or the setting aside of the ultra vires transaction under s 25(3) will only be ordered if the court considers that it would be just and equitable to do so. The company’s lack of capacity may also be relied upon in any action by the company or by any member against the company’s officers for breach of duty. 21.20 The articles of association of the company regulate the internal administration of the company. The Fourth Schedule of the CA contains Table A, a default set of articles which may be adopted by companies who do not have articles specially drafted for them. 21.21 It has been recommended that the requirement for separate memorandum and articles of association be eliminated and replaced by a single model constitution. Indeed, with the removal of the requirement to include objects in the company’s memorandum, the significance of the memorandum has been correspondingly reduced. There is therefore no real need for separate constitutional documents, with different rules applicable to the valid alteration of each. However, any merger of the documents is unlikely to have any significant impact on the substantive law. Persona Ficta (1) Legal personality 21.22 According to Lord Hoffman in Meridian Global Funds Management Asia Ltd v Securities Commission (1995) (at p 506), a company “exists because there is a rule (usually in a statute) which says that a persona ficta shall be deemed to exist and to have certain of the powers, rights and duties of a natural person”. Legal personality is the capacity to enjoy legal rights and to owe legal obligations. It is possessed, not only by “natural persons”, ie, human beings, but also by “artificial persons” created by the law through the process of incorporation. The company is one such artificial person. 652 Chapter 21: Business Organisations 21.23 A consequence of being a persona ficta is that the company is considered separate and distinct from the humans who caused the company to be incorporated. This means that the company may, on its own account, hold property, make contracts and carry on business irrespective of its current shareholders. The corollary to this is that, individually, the shareholders do not own the company’s assets or property, and any rights or obligations that arise out of the company’s contracts do not belong to the shareholders. 21.24 The well-known case of Saloman v A Saloman & Co Ltd (1897) illustrates the effect of this principle. Mr Saloman ran a successful boot and shoe manufacturing business as a sole proprietor. He incorporated a limited liability company to take over the business. He with his wife and five grown-up children were the subscribers to the memorandum (ie, the initial shareholders). His business was transferred to the company, which gave Mr Saloman in consideration therefor, £1,000 in cash, £10,000 in debentures (which represented the company’s indebtedness to Mr Saloman repayable at a later time) and 20,000 shares of £1 each. The company unfortunately fell on difficult times and had to be wound up. While the company’s assets were sufficient to pay off the debentures, there was in that event nothing left to pay the trade creditors. It was therefore alleged on behalf of the trade creditors that the debentures were invalid as Mr Saloman and the company were one and the same, and he therefore could not lend money to himself. The House of Lords held that “the company is at law a different person altogether from the subscribers to the memorandum; and though it may be that after incorporation the business is precisely the same as it was before, and the same persons are managers, and the same hands receive the profits, the company is not in law the agent of the subscribers or trustee for them. Nor are the subscribers as members liable in any shape or form …” (per Lord MacNaughten at p 51). The debentures were therefore valid and Mr Saloman was entitled to repayment. 21.25 The other consequence of incorporation is that the company has perpetual succession. This means that, once incorporated, the company continues to exist notwithstanding changes in its shareholders until it is properly wound up through the legal process of liquidation. This is one of the advantages that the corporate form has over non-incorporated business forms like the general (as opposed to the limited liability) partnership, which generally 653 Principles of Singapore Business Law dissolves should there be a change in its constitution, whether through death, discharge or bankruptcy. (2) Looking behind the veil of incorporation 21.26 The conferment of a separate legal status on the company upon incorporation is often likened to a “veil of incorporation” that descends to separate the human incorporators from the company. Because this veil shields the shareholders from being liable on the company’s debts, there is potential for the corporate form to be abused by persons seeking to avoid their legal obligations and liabilities. Where this is the case, the courts will “lift the veil” and ignore the separate personality of the company, affixing liability on the wrongdoing shareholders. 21.27 In Trade Facilities Pte Ltd v Public Prosecutor (1995), the company was implicated in the sale of adulterated Hennessy XO in genuine Hennessy XO bottles, and was later prosecuted for selling and importing goods to which a trade mark had been falsely applied. Looi owned all but one share in the company and was its sole directing mind and will. On the question of whether Looi or the company did the prohibited act, the High Court of Singapore held that as the evidence showed that the company was nothing more than a vehicle that Looi employed as and when it suited him, it was the alter ego of Looi. It would therefore be appropriate to lift the corporate veil and impose liability on Looi. However, the fact that the corporate veil had been lifted did not absolve the company of all liability. The court further held that as the company had allowed itself to be used as a vehicle of Looi’s, it was also liable. 21.28 The corporate veil, particularly that which exists between a parent company and its subsidiaries within the same group, is, however, not to be cast aside merely because it would appear just to do so. As the English Court of Appeal explained in Adams v Cape Industries plc (1990) (at p 536): [S]ave in cases which turn on the wording of particular statutes or contracts, the court is not free to disregard the principle of Saloman v A Saloman & Co Ltd merely because it considers that justice so requires. Our law, for better or worse, recognises the creation of subsidiary companies, which though in one sense the creatures of their parent companies, will nevertheless under the general law fall to be treated 654 Chapter 21: Business Organisations as separate legal entities with all the rights and liabilities which would normally attach to separate legal entities. How Companies Operate (1) Rules of attribution 21.29 Although a company has legal existence, its existence is really only a legal fiction. In practical terms, it cannot operate except through human individuals. It is therefore a necessary part of corporate personality that there are “rules of attribution” to help us ascertain what acts should count as acts of the company. This is necessary for deciding not only what rights a company is entitled to, but also what liabilities it is subject to. There are “primary” as well as “general” rules of attribution. 21.30 The primary rules of attribution, as Lord Hoffman explained in Meridian Global Funds Management Asia Ltd v Securities Commission (1995), attributes decisions taken by the company’s organs to the company. The shareholders in general meeting and the board of directors are the two organs of the company. With the exception of the single-member company with only one director, decisions of each organ (known as resolutions) are usually made at meetings. The meeting, and its collective nature, is therefore the bedrock of corporate decision-making. Where the company only has one member and/or one director, a signed record of the resolution suffices to pass it (s 184G CA in the case of members’ resolutions, and Fourth Schedule, Table A, Art 90A CA, in the case of directors’ resolutions). 21.31 The constitution of the company, typically the articles of association, lays down the framework by which the company is run internally, including details as to the proper conduct of shareholder as well as directors’ meetings. As long as the proper procedure for decision-making by these organs is followed, the company’s organs are “identified” with the company. Decisions made at a general meeting of the shareholders, or at a meeting of the board of directors are then considered decisions of the company. 21.32 Decisions are taken by shareholders in general meeting through a process of voting and by a majority of votes. In most cases, a simple majority (ie, more than half of the shareholders present and voting) is sufficient to 655 Principles of Singapore Business Law carry the decision, but a higher percentage of majority may be required for certain decisions. A decision to wind up the company, for example, requires a majority of at least 75 per cent. Resolutions that are carried by a simple majority are known as ordinary resolutions, whilst resolutions requiring a minimum majority of 75 per cent are known as special resolutions (s 184 CA). Decisions of the shareholders may also be made through written means (ss 184A–184F CA). This involves circulating a document that contains the text of the resolution to the shareholders who may then indicate their agreement or disagreement to it on the document. This method of procuring the shareholders’ agreement to a particular resolution dispenses with the need for physical meetings. 21.33 The directors are appointed by the shareholders in general meeting, and together they comprise the board. The board’s powers to act as the company (except in the case of the company with only one director) is a collective one, ie, through a board resolution. Individual directors therefore do not, unless specifically authorised, have the power to bind the company. Directors are generally left to regulate their meetings as they think fit (Table A, Art 79 CA). 21.34 However, it should be obvious that a company does not act only through board or shareholder resolutions which, because of the formal requirements to hold valid meetings, can be significantly slower and more cumbersome to obtain. It is therefore usual for the company to appoint agents to act on its behalf. The general rules of attribution, which are the principles of agency, attribute the acts of the agents to the company (see Chapter 20). To recapitulate, an individual (the agent), who is actually or apparently authorised to act on behalf of another (the principal), will be able to bind that other if the agent had acted within this actual or apparent authority. 21.35 In a similar manner, the company will be bound by the acts of its agents if these agents have been either actually or apparently authorised. However, unlike the comparatively straightforward case of a human individual appointing an agent, an additional question needs to be addressed in the case of the company: whether the company has, by the rules of attribution, taken the decision to appoint an agent. The answer is determined both by the application of the primary rules of attribution and, somewhat circuitously, the general rules of attribution. It is not unusual for the articles of association to provide that the power to make commercial 656 Chapter 21: Business Organisations decisions is vested in the board and, further, for the board to have the power to delegate its functions to one or more of its number. When the power to delegate is exercised by the board, this would be a decision of the company by the primary rule of attribution. The director to whom certain functions of the board is delegated is then an authorised agent and when he acts to appoint yet other agents, his act will bind the company by the general rules of attribution. 21.36 The agency principles, when applied to companies, are additionally affected by the operation of two other company law doctrines, the indoor management rule and the rule of constructive notice. These concepts will be explained in later paragraphs. (2) Division of powers 21.37 How the company is managed generally depends on its constitution. It is usual for the articles to provide that general managerial powers shall vest in the board, and where this is the case, the courts have consistently maintained that it is not open to the shareholders in general meeting to intervene in or dictate the exercise of those powers. Thus, although the shareholders are the owners of the company, they cannot countermand what their appointed directors have done within the latter’s powers, even if they are unhappy with the directors’ actions. In the oft-quoted words of Greer LJ in John Shaw & Sons (Salford) Ltd v Shaw (1935), “if powers of management are vested in the directors, they and they alone can exercise these powers. The only way in which the general body of the shareholders can control the exercise of powers vested by the articles in the directors is by altering their articles, or if opportunity arises under the articles, by refusing to re-elect the directors of whose actions they disapprove. They cannot themselves usurp the powers which by the articles are vested in the directors any more than the directors can usurp the powers vested by the articles in the general body of shareholders …” (at p 134). This position is now enshrined statutorily in s 157A CA, which provides that the business of a company “shall be managed by or under the direction of the directors”. (3) Corporate contracting 21.38 Two issues inevitably arise when considering the enforceability of contracts purportedly entered into by companies. The first relates to the capacity of 657 Principles of Singapore Business Law the company, as determined by the doctrine of ultra vires. This doctrine, as we saw earlier, is no longer as significant as it used to be. The second but more relevant issue relates to the authority of the company’s agents to bind the company. 21.39 As we saw in the preceding discourse, management of the company is usually in the hands of the board of directors. The board may, and indeed often will, in turn delegate certain decision-making powers to a particular director. The constitution may also specify a particular office — the office of the managing director for example — which is authorised to act for the company, and any limitation that is placed on the scope of that officer’s authority. A company’s agent may therefore be appointed through a board resolution by which board functions are delegated to him, or by appointment to a particular office. The actual authority of these agents will depend on the relevant provisions of the constitution, as well as the terms of any board resolution in relation to their appointment. In addition, these agents may themselves appoint or employ yet other agents, and the scope of authority of these agents will then depend on their respective contracts of employment. 21.40 We saw in Chapter 20 that apparent or ostensible authority is the authority that an agent appears to have. Certainly a managing director, by virtue of his appointment to that position, may appear to have more authority than he actually has. The doctrine of ostensible authority is premised on principles of estoppel, that is, where there is a representation of authority by the principal, which induced a person to alter his position (usually by contracting with the principal through the agent), the principal is estopped from denying that the agent had the requisite authority. It appears that only representations that are made by agents who have actual (as opposed to apparent) authority from the company will be capable of founding the estoppel against the company. 21.41 In the corporate context, the representation by the company may be made by either of the company’s organs or by an agent who has been authorised to make representations on the company’s behalf. It should be noted that the making of such a representation is itself an act of management of the company’s business (per Diplock LJ in Freeman & Lockyer v Buckhurst Park Properties (Mangal) Ltd (1964) (at p 505)). The representation may take 658 Chapter 21: Business Organisations the form of an appointment to a particular position within the company’s hierarchy or the acceptance of or acquiescence to a particular factual state. The facts of Freeman & Lockyer v Buckhurst Park Properties (Mangal) Ltd (1964) illustrate this. The company was a property development company incorporated to buy and resell a large piece of land, the shares of which were held equally by K and H. The board of directors comprised K and H and a nominee of each. Although the company’s constitution provided for the appointment of a managing director, none was appointed. H travelled frequently and left the day-to-day management of the company to K. K employed a firm of architects for the purposes of applying for planning permission for the development of the land. When this fell through, the company refused to pay the firm’s fees on the grounds that K did not have the authority to appoint it. The court found that the board of directors was aware throughout that K was effectively running the company’s affairs on a day-to-day basis. As such, although K did not have the actual authority to appoint the architect as he was never appointed to the office of managing director, he nevertheless had the apparent authority to do so. As Diplock LJ explained (at p 505): The commonest form of representation by a principal creating an “apparent” authority of an agent is by conduct, namely, by permitting the agent to act in the management or conduct of the principal’s business. Thus, if in the case of a company the board of directors who have “actual” authority under the memorandum and articles of association to manage the company’s business permit the agent to act in the management or conduct of the company’s business, they thereby represent to all persons dealing with such agent that he has authority to enter on behalf of the corporation into contracts of a kind which an agent authorised to do acts of the kind which he is in fact permitted to do usually enters into in the ordinary course of such business. 21.42 We also saw in Chapter 20 that where the other contracting party is aware of the agent’s lack of authority, he will not be able to raise the estoppel against the principal. In the corporate context, the company’s constitution may place limitations on the agent’s scope of authority. In the past, a contracting party seeking to rely on the agent’s apparent authority to bind the company would have been affected by the doctrine of constructive notice. By this doctrine, third parties were deemed to know the contents of a company’s 659 Principles of Singapore Business Law lodged documents, as lodgment with the regulatory authority permitted discovery through searches, even if they had not read the documents. The burden was placed firmly upon third parties to search the lodged documents. The doctrine of constructive notice has now been abolished. Section 25A CA provides that a person is not to be deemed to have notice of the contents of any document relating to the company merely because the document is lodged or available for inspection. 21.43 When the doctrine of constructive notice operated, the rule in Turquand’s case, also known as the “indoor management rule”, was developed to ameliorate the injustice that could be caused by the doctrine of constructive notice. This rule, which has not been abolished, provides that third parties, who deal with the company in good faith and with no notice of any irregularity, are entitled to assume that matters relating to the internal administration and regulation of the company have been duly complied with. The facts of Turquand’s case (Royal British Bank v Turquand (1856)) itself illustrate this rule. The company had given to the plaintiff bank a bond for £2,000 under the seal of the company and signed by two directors and the secretary. However, the company, by its constitution, could issue bonds of only such sums as was authorised by the company in general meeting, and it was alleged that no specific resolution had been passed. The court held that a third party, like the plaintiff bank, on reading the company’s constitution, “would find, not a prohibition from borrowing, but a permission to do so on certain conditions. Finding that the authority might be made complete by a resolution, he would have a right to infer the fact of a resolution authorising that which on the face of the document appeared to be legitimately done” (at p 332). Thus, as all that was required to authorise the borrowing was an ordinary resolution, which unlike a special resolution did not have to be lodged with the Registry, the doctrine of constructive notice would not apply and the third party was entitled to assume that the resolution had been properly obtained. 21.44 Now that the doctrine of constructive notice as applicable to a company’s documents has been abolished, the scope for operation of the indoor management rule would be reduced. Nevertheless, it would come to the aid of a contracting party who is aware of the limits placed on a corporate agent’s authority, whether in the company’s constitution or other docu- 660 Chapter 21: Business Organisations ments that are available for inspection. In such a case, the contracting party should be entitled to assume that the relevant internal matters have been complied with. Directors (1) General 21.45 Every company must have at least one director who is ordinarily resident in Singapore (s 145 CA). Only natural persons of full age and capacity may act as directors. Subsequent directors are usually elected by the shareholders in a general meeting, which will also fix their remuneration (Fourth Schedule, Table A, Arts 68 and 70 CA). The general meeting is also conferred the power to remove any director by an ordinary resolution (Table A, Art 69 CA). 21.46 We have already been introduced to the managing director, who is an executive director. Executive directors are the working directors of the company and they are frequently appointed pursuant to service contracts. They are, in addition to holding the office of director, in effect employees of the company. A removal of a director prior to the end of his contractual term, even if done in accordance with the provisions of the constitution, could amount to a breach of the service contract (Southern Foundries (1926) Ltd v Shirlaw (1940)). 21.47 Non-executive (or outside) directors are directors who do not hold a managing or executive position in the company. They are therefore not involved in the day-to-day running of the company’s affairs. Non-executive directors play an important role in corporate governance as independent monitors of management decisions in public companies. (2) Directors’ obligations and duties 21.48 Directors owe a number of duties to the company. These duties are found, not only in the rules of common law and equity, but also in the terms of any contract with the company and in the provisions of the CA. In addition, the CA, as well as the regulations promulgated under it, contains many requirements and rules with which the directors have to comply. 661 Principles of Singapore Business Law 21.49 The law does not draw any distinction between the executive and the non-executive director for the purposes of imposing duties on them, although the standard of skill, care and diligence expected of an executive director is likely to be higher than that expected of a non-executive director. 21.50 The area of directors’ duties is not an easy area of company law, not least because of the overlapping common law, equitable and statutory rules. In fact, there are many unresolved issues beyond the scope of this chapter but which will become patent on reading the specialist texts on company law. The ensuing paragraphs introduce the directors’ duties in brief. (a) Equitable and fiduciary duties 21.51 Directors have wide management powers conferred on them and, as such, stand not only in a position of trust and responsibility vis-à-vis the company, but also in a position of considerable power and control. The law therefore obliges the directors, as a collegiate body, to exercise the powers conferred on them in good faith and in the company’s interests. In addition, the law treats the director as being in a fiduciary relationship with the company. Being a fiduciary obliges the director, as an individual, to always place the company’s interests ahead of his own. Section 157 CA, which requires a director to act honestly at all times, has been interpreted as encapsulating the general law of equitable and fiduciary duties (Lim Weng Kee v PP (2002)). 21.52 The basic equitable duty owed by the directors is to act bona fide in what they believe (and not what a court may consider) to be in the interests of the company. But with whom should the “company” be identified for the purposes of ascertaining its interests in this context? Other than most obviously the shareholders, present and future, there are other stakeholders in the company whose interests might be of relevance and should be considered. The claims of the company’s employees, for example, are recognised legislatively (s 159 CA). A corresponding duty requires the directors to exercise the powers conferred on them for proper and not collateral purposes. A breach of the director’s equitable duties will entitle the company to equitable compensation. 662 Chapter 21: Business Organisations Box 21.1 Reflecting on the law Duty to creditors? In the Australian High Court decision of Walker v Wimborne (1976), Mason J opined (at p 532) that “the directors of a company in discharging their duty to the company must take account of the interests of its shareholders and creditors”. The idea that directors owed any duty at all to the company’s creditors, whose interests are often diametrically opposed to that of the company, is clearly at odds with the trite principle that directors must exercise their powers for the benefit of the company. It is now generally accepted that directors are only obliged to consider the interests of creditors when the company is insolvent or near insolvency. This is because the assets of an insolvent company no longer, in a practical sense, belong to the shareholders. However, creditors do not acquire an independent right of enforcement against errant directors. Instead, it is the liquidator of the company who may bring an appropriate action against directors who have failed to give due consideration to the interests of the creditors. 21.53 As a fiduciary, the director owes a strict duty of loyalty to the company. There are two aspects to this duty. First, he must not allow his personal interest to come into conflict with the company’s interest, and secondly, he must not make a profit out of his position unless the informed consent of the company has been obtained. A conflict of interests is present if, in any transaction to which the company is party, the director has an interest adverse to, or different from, that of the company. In the absence of disclosure, the company may avoid the transaction. Thus, a director cannot, without full disclosure, enter into a contract with the company or cause the company to enter into a transaction if he has an interest in that contract. This rule is supplemented statutorily by an obligation to disclose on pain of criminal penalties (s 156 CA). The articles will usually also require the interested director to abstain from voting on the transaction (Table A, Art 81 CA). 21.54 Interestingly, and somewhat inconsistently, directors are permitted, as a general rule, to serve on the boards of more than one company simultaneously and even to compete with the company on their own account (London & Mashonaland Explorations Co Ltd v New Mashonaland Exploration Co Ltd (1891)). Whilst this position was assumed correct by Lord Blanesburgh in Bell v Lever Brothers, Ltd (1932) (at p 195), many company law commentators (see, eg, P L Davies, Gower and Davies Principles of Modern Company Law (8th ed, 2008) at 16.72) have expressed doubt over its correctness. In the 663 Principles of Singapore Business Law UK Court of Appeal decision of Plus Group Ltd and others v Pyke (2002), Sedley LJ opined (at [84]) that “if one bears in mind the high standard of probity which equity demands of fiduciaries, and the reliance which shareholders and creditors are entitled to place upon it, the Mashonaland principle is a very limited one”. Clearly, there is nothing objectionable about competing with the company (whether as a director on the board of a competing company or on the director’s own account) if the director concerned had disclosed and obtained the company’s consent (Kea Holdings Pte Ltd v Gan Boon Hock (2000)). The question is whether consent is likely to be given (for further reading on this topic, see M Christie, “The Director’s Fiduciary Duty Not to Compete” (1992) 55 Modern Law Review 506). 21.55 The no-profit rule prohibits the director from making a secret profit out of his office, and he cannot divert corporate contracts or business opportunities meant for the company to himself. This rule is strictly applied, even if the director had acted in good faith and for the benefit of the company because “liability arises from the mere fact of a profit having, in the circumstances, been made” (per Lord Russell in Regal (Hastings) Ltd v Gulliver (1942) at p 386). The company is entitled to ask for an account of the profits made by the director in breach of his fiduciary duties. (b) Duty of skill, care and diligence 21.56 Directors are expected to exercise, when performing their functions as directors, at least that level of skill, care and diligence that might reasonably be expected of any director occupying a similar position. The standards may be further elevated if the director in question possessed specific qualifications or expertise. Section 157 CA reflects the general law obligation by requiring the director to exercise reasonable diligence in performing the duties of his office. (3) Enforcement of directors’ duties 21.57 Directors owe their duties to the company and not to individual shareholders (Percival v Wright (1902)). Breach of a common law or equitable duty owed to the company is therefore a civil wrong against the company, and enforceable only by the company. The power to commence and conduct litigation in the name of the company is generally considered a management power and therefore vested in the board of directors. However, where the board as a whole has committed a wrong against the company, the power to call the 664 Chapter 21: Business Organisations directors to account must rightly revert to the company in general meeting, where the decision rests with the majority. 21.58 There is an alternative procedure for the redress of a corporate wrong, including a breach of directors’ duties, which may be commenced by an individual shareholder. This is the statutory derivative action under s 216A CA, which lays down a procedure by which a shareholder, or other “proper person”, may apply to court for leave to commence an action in the name of the company. To convince the court, the applicant bears the burden of showing not only that he is acting in good faith, but also that it is prima facie in the interests of the company that the action be brought. In recognition of the fact that the course of action is a corporate one, the applicant must have first given notice to the company’s board of directors of his intention to bring the action. This gives the board, acting as the company, the opportunity to take over the action itself. Relationship between Shareholders (1) Statutory contract 21.59 The relationship between the shareholders of a company is governed by the constitution. Pursuant to s 39 CA, the constitution takes effect as a contract which binds the company and the shareholders as if it had been “signed and sealed by each member and contained covenants on the part of each member to observe all the provisions of the constitution”. 21.60 This “contract” is, however, unlike the normal contract that is dealt with in the other chapters of this book. First, it is alterable by special resolution, which as we saw earlier, requires only a three-fourths majority, not unanimity, so that the alteration takes effect even if there are members who do not agree. Second, the cases have held that this statutory contract binds members qua members only. What this means is that the “contract” can only be relied upon to enforce what are properly members’ rights, and not other non-member or outsider rights. In Beattie v E & F Beattie Ltd (1938), for example, a director was sued for the return of certain sums that had allegedly been improperly paid to him. As he was also a member of the company, he sought, relying on a clause contained in the articles of association, to refer the dispute to arbitration. The court, however, held that as the dispute had arisen in his capacity as a director and not in his capacity as a member, he could not rely on the “contract” comprised in the articles. 665 Principles of Singapore Business Law (2) Majority rule and protection of the minority 21.61 We saw earlier that decisions are made for the company by either of its two organs on the basis of the majority vote. Whilst the director’s vote is controlled by strict fiduciary duties, there are no such constraints on the shareholder’s vote. As Dixon J of the High Court of Australia explained, “shareholders are not trustees for one another, and, unlike directors, they occupy no fiduciary position and are under no fiduciary duties. They vote in respect of their shares, which are property, and the right to vote is attached to the share itself as an incident of property to be enjoyed and exercised for the owner’s personal advantage” (see Peter’s American Delicacy Co Ltd v Heath (1939) at p 504). 21.62 The shareholders who control the majority of the votes in a company therefore wield substantial power in the company which is likely to be run in accordance with their wishes. Indeed, this must naturally be so as the majority’s control is a result of the correspondingly higher investment that it has made in the company. The greater say therefore comes at a higher price. The shareholders who fall in the minority must generally accept this as a fact of commercial life. 21.63 Acknowledging this, however, does not mean that the minority has to accept unfair or wrongful acts that result from abuses of the majority power, opportunity for which clearly exists. Attempts have been made, both legislatively and judicially, to achieve some balance between the opposing interests of the majority and the minority. In this chapter, we consider in brief the duty imposed on the majority in seeking to alter the company’s constitution, to vote bona fide for the benefit of the company as a whole and the oppression action under s 216 CA. 21.64 The relationship between the members and their rights inter se are usually governed by the company’s constitution. But, as we saw earlier, it is possible for the provisions of the constitution to be altered with a three-fourths majority. The opportunity thus exists for such a majority to alter the constitution to improve their position at the expense of the minority. The courts have therefore laid down the rule that the power to alter the constitution must be exercised bona fide for the benefit of the company as a whole (Allen v Gold Reefs of West Africa Ltd (1900)). In this case, the company’s articles gave it a lien (which is a security interest) for all debts and liabilities of any member 666 Chapter 21: Business Organisations “upon all shares (not being fully paid) held by such member”. Z owed the company money and was the only holder of fully paid shares. An alteration was made to the articles to give the company a lien over fully paid shares as well. The court held that the alteration was valid. Although Z was at the time of the alteration the only holder of paid-up shares, the alteration applied to all holders of fully paid shares and did not distinguish amongst them. Since the alteration would allow the company to recover moneys owing to it, it was made bona fide for the benefit of the company. 21.65 There are, however, difficulties with the application of the test, and these were pointed out by the Australian High Court in Peter’s American Delicacy Co Ltd v Heath (1939). Dixon J explained (at p 512): If the challenged alteration relates to an Article which does or may affect an individual, as, for instance, a director appointed for life or a shareholder whom it is desired to expropriate or to an Article affecting the mutual rights and liabilities inter se of shareholders or different classes or descriptions of shareholders, the very subject matter involves a conflict of interests and advantages. To say that the shareholders forming the majority must consider the advantage of the company as a whole in relation to such a question seems inappropriate, if not meaningless … If the alteration to the company’s constitution results in unfairness to a member, the member may consider applying under section 216 CA for relief. We turn now to consider this section. 21.66 Legislatively, s 216 CA gives any member the right to petition to court if the affairs of the company are being conducted in a manner that is oppressive or in disregard of his interests, or some act of the company has been done or is being threatened that unfairly discriminates against him, or is otherwise prejudicial to him. In the Privy Council decision (on appeal from the Federal Court of Malaysia) of Re Kong Thai Sawmill (Miri) Sdn Bhd (1978), Lord Wilberforce made the following comments (at p 229): [T]he mere fact that one or more of those managing the company possess a majority of the voting power and, in reliance on that power, make policy or executive decisions, with which the complainant does not agree, is not enough. Those who take interests in companies limited by shares have to accept majority rule. It is only when majority rule passes over into 667 Principles of Singapore Business Law rule oppressive of the minority, or in disregard of their interests, that the section can be invoked … [T]here must be a visible departure from the standards of fair dealing and a violation of the conditions of fair play which a shareholder is entitled to expect before a case of oppression can be made … And similarly “disregard” involves something more than a failure to take account of the minority’s interest: there must be awareness of that interest and an evident decision to override it or brush it aside or to set at naught the proper company procedure … His Lordship’s comments have been adopted and followed locally. In Low Peng Boon v Low Janie (1999), the Singapore Court of Appeal observed that the court’s discretionary power to make an appropriate order is unfettered and that each case has to be considered on its own merits. NON-CORPORATE BUSINESS ORGANISATIONS Sole Proprietorships 21.67 A sole proprietorship is essentially a business that is owned and managed by one person, the proprietor. Apart from the requirement for the registration of the business name under the BRA, there are no other formalities that have to be complied with in the creation of a sole proprietorship. The debts of the business are really the debts of the person, for which the sole proprietor is personally liable, without limit. There is also no legal process for the business to carry on following the sole proprietor’s incapacity or death. The main advantage of the sole proprietorship as a form of business structure is the flexibility that accompanies its operation. This results not only from the relative lack of formal requirements, but also from the fact that the sole proprietor is the only person in control of the business. The necessary corollary t