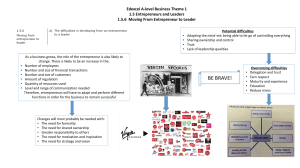

Economic-and-management-sciences-today-Grade-7-Learner-s-book-PDFDrive-pdf

advertisement