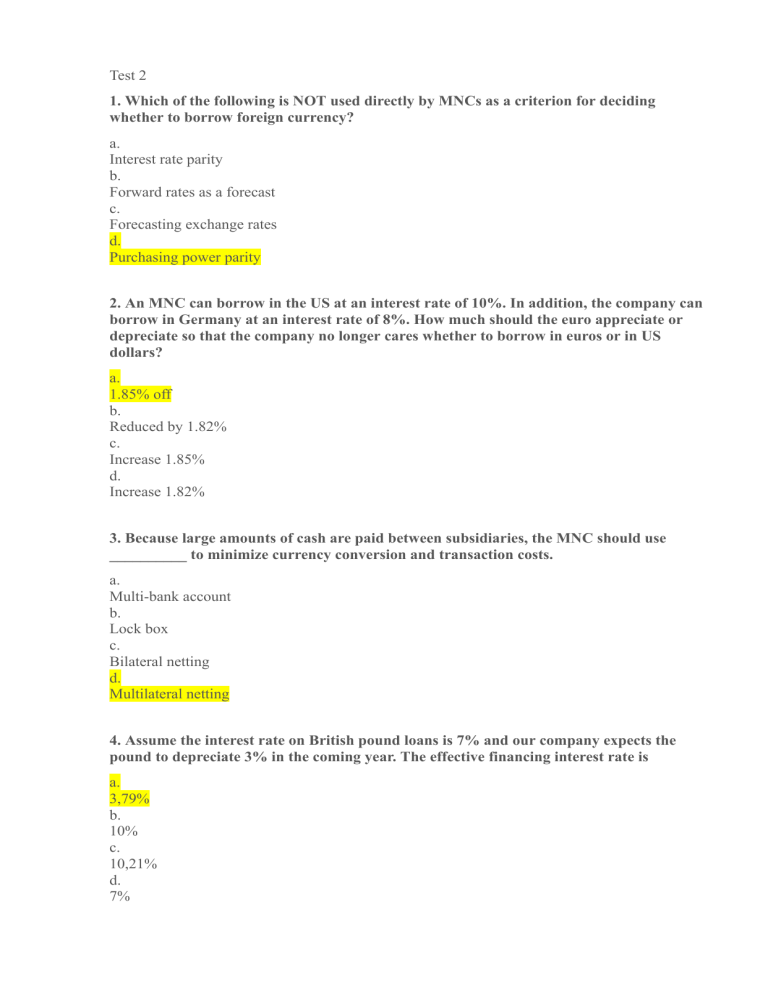

Test 2 1. Which of the following is NOT used directly by MNCs as a criterion for deciding whether to borrow foreign currency? a. Interest rate parity b. Forward rates as a forecast c. Forecasting exchange rates d. Purchasing power parity 2. An MNC can borrow in the US at an interest rate of 10%. In addition, the company can borrow in Germany at an interest rate of 8%. How much should the euro appreciate or depreciate so that the company no longer cares whether to borrow in euros or in US dollars? a. 1.85% off b. Reduced by 1.82% c. Increase 1.85% d. Increase 1.82% 3. Because large amounts of cash are paid between subsidiaries, the MNC should use __________ to minimize currency conversion and transaction costs. a. Multi-bank account b. Lock box c. Bilateral netting d. Multilateral netting 4. Assume the interest rate on British pound loans is 7% and our company expects the pound to depreciate 3% in the coming year. The effective financing interest rate is a. 3,79% b. 10% c. 10,21% d. 7% 5. If an American MNC expects an effective financing rate of 10% when borrowing in yen, the loan interest rate in Japan is 8%, then the company expects the Japanese yen to have depreciated. a. Correct b. Until 6. Suppose A has to pay B 1 million dollars and C 1.5 million dollars every month; B pays A $2.2 million and pays C $100,000; C pays A $600,000 and B $500,000. Doing bilateral netting will make the total payment amount to__________ and multilateral netting will make the total payment amount to__________ a. 2 million dollars, $800,000 b. $2.5 million, $1.6 million c. $2.5 million, $800,000 d. $2 million, $1.6 million 7. Netting can do all of the following except a. Reduce foreign exchange risk b. Reduce legal risks c. Reduce floating money d. Reduce currency conversion costs 8. Advantages of centralized cash management are a. Eliminate payment delays b. Reduce sponsorship costs c. The parent company has information about operations throughout the MNC d. All of the above are true 9. Suppose a company in Thailand can borrow US dollars at an interest rate of 8% or borrow Thai baht at an interest rate of 14%. If Thai baht is expected to decrease in price from 30 THB = 1 USD at the beginning of the year to 32 THB = 1 USD at the end of the year. Calculate the effective loan interest rate in dollars a. 9,15% b. 8,39% c. 15,2% d. 1,52% 10. Assume MNC finances in euros and does not hedge exchange rate risk. Interest rate parity exists. The effective financing rate will ___________ the domestic interest rate if the euro spot rate ____________ the forward rate. a. Higher, lower b. Lower, lower c. Lower, higher d. Equal, equal