Journal of Housing Economics 63 (2024) 101970

Contents lists available at ScienceDirect

Journal of Housing Economics

journal homepage: www.elsevier.com/locate/jhec

The impact of subsidies on house prices in Mexico’s mortgage market for

low-income households 2008–2019

Gabriel Darío Ramírez Sierra *, Alayn Alejandro González Martínez , Miguel Ángel Monroy Cruz ,

Luis Gerardo Zapata Barrientos

Economic Studies Unit, Institute of the National Housing Fund for Workers (Infonavit), Mexico

A R T I C L E I N F O

A B S T R A C T

JEL classification:

R210

R310

R380

D820

H230

We estimate the effect of Mexico’s primary house-purchase subsidy program for low-income individuals on house

prices between 2008 and 2019, using administrative records from Infonavit, the nation’s largest mortgage

originator. We employ a fuzzy regression discontinuity design that leverages the existence of a threshold on the

borrower’s income that determined access to the subsidy program to identify the effect on house prices. Our

estimations yield statistically significant evidence that the subsidy led to an average increase in house prices of

863 US dollars for the program participants at the threshold during those years. This effect represents 28.9 % of

the average subsidy amount and 5.4 % of the average house price. The estimations control for individual, house,

and location characteristics. Furthermore, we find evidence that when an intermediary is involved in the

mortgage application process, there is a statistically significant price difference of 867 dollars for subsidy re­

cipients. On the contrary, this impact disappears when no external broker is involved. These intermediaries are

primarily real estate developers that build and sell the houses associated with the mortgages. These findings shed

light on how market structure could have nonnegligible impacts on equilibrium outcomes and on the welfare

effects of economic policy.

Keywords:

Housing market

Mortgage market

Housing subsidies

Price discrimination

1. Introduction

This study assesses the impact of Mexico’s primary house-purchase

subsidy program for low-income individuals during the period from

2008 to 2019. Specifically, it examines the effect of the subsidy program,

administered by the National Housing Commission (Conavi), the agency

in charge of implementing the Government’s housing policy, on house

price formation in that market. We employ administrative mortgage

records from the Institute of the National Housing Fund for Workers

(Infonavit) to study differences in house purchase prices between re­

cipients and non-recipients of the subsidy. Infonavit, a public financial

institution and the largest mortgage originator in the country, partici­

pated closely in the allocation of the subsidy among its clients.

Between 2008 and 2019, Infonavit originated 56.5 % of all mort­

gages nationwide and distributed 93.0 % of the housing subsidies. Over

this timeframe, the average subsidy amount an individual received for a

house purchase stood at 3338.6 dollars, this represents 17.8 % of the

total house price. Thus, for low-income individuals, the subsidy repre­

sents a significant proportion of the house price.

Utilizing a pseudo-experimental methodology grounded in a

discontinuity design, contingent upon eligibility criteria tied to indi­

vidual income, we assessed the difference between the price of subsi­

dized and non-subsidized houses over the period from 2008 to 2019.

Employing a fuzzy regression discontinuity design, we find statistically

significant evidence that the subsidy resulted in an average house price

increase of 863 US Dollars for beneficiaries of the program from 2008 to

2014. This effect represents 28.9 % of the average subsidy amount.1 The

estimation controls for state level and year fixed effects, as well as for

house and location characteristics.

Interestingly, we find evidence that these price differences are

accounted for mostly by supply-side considerations and the structure of

the market. When analyzing the effect of subsidies in house prices for

* Corresponding author at: Gustavo E. Campa 60, Guadalupe Inn 01020, Álvaro Obregón, Mexico City, Mexico.

E-mail addresses: gramirez@infonavit.org.mx (G.D. Ramírez Sierra), aagonzalez@infonavit.org.mx (A.A. González Martínez), mmonroyc@infonavit.org.mx

(M.Á. Monroy Cruz), lzapatab@infonavit.org.mx (L.G. Zapata Barrientos).

1

We consider the ratio of our estimated price difference between beneficiaries and non-beneficiaries (863 USD) to the average subsidy between 2008 and 2014

(2,991 USD).

https://doi.org/10.1016/j.jhe.2023.101970

Received 2 August 2022; Received in revised form 19 October 2023; Accepted 3 November 2023

Available online 12 November 2023

1051-1377/© 2023 Elsevier Inc. All rights reserved.

G.D. Ramírez Sierra et al.

Journal of Housing Economics 63 (2024) 101970

borrowers who received assistance in the mortgage application process

from an intermediary, our analysis reveals a statistically significant price

difference of 867 dollars between subsidized houses and not subsidized

houses in the same period. Furthermore, this impact disappears for the

subset of borrowers that did not receive the assistance of an interme­

diary.2 These intermediaries are primarily real estate developers who

construct and sell the houses linked with the mortgages. They partici­

pate actively in the mortgage origination process and often serve as

informal intermediaries for mortgage applications. As a result, real es­

tate developers wield substantial influence over individuals seeking to

purchase houses financed by Infonavit.

Standard economic theory predicts that when demand is subsidized

and supply exhibits inelasticity, the equilibrium price increases for all

market participants. The subsidy’s incidence depends on the relative

importance of demand and supply elasticities. However, theory also

suggests that when suppliers of a homogenous good have market power

and the ability to segment markets, they find optimal to set different

prices in each of these markets exploiting the differences in demand

elasticities.3 We argue that this phenomenon, in part, explains the price

effect that we estimated in the data. Developers, who possess knowledge

of the eligibility criteria for the subsidy, may employ market segmen­

tation strategies to set different prices for houses with similar attributes.

This paper contributes to a growing literature that analyzes the

relevance of market structure for public policy outcomes. Our results

provide valuable insights on how market structure could have non­

negligible impacts on equilibrium outcomes and on the welfare effects of

economic policy.

Regarding empirical research on the impact of housing subsidies, a

notable literature review conducted by Brackertz et al. (2015) examines

published studies on rent subsidies and their effects on prices. Their

primary finding relates to the regularity of the phenomenon across

different countries: it is common for property owners to partially absorb

monetary transfers intended for rent payments.4 The most recurrent

explanation provided by the authors is attributed to the short-term

inelasticity of housing supply. Due to the inability to adjust rapidly to

shifts in demand, suppliers are unable to increase the quantity or quality

of available housing. As a result, market mechanisms exert upward

pressure on rents.

From a theoretical perspective, the findings of this study demon­

strate the importance of examining market failures in the housing

market. Numerous research studies explain how this market is prone to

inefficient resource allocation. In general, the house placement business

carries fixed costs and sector-specific knowledge that serve as entry

barriers, resulting in a limited number of participants with high market

power. Notable works by Gyourko and Saiz (2006), Saiz (2010) and

Murphy (2018) focus on studying how building permit restrictions

constitute a significant barrier to entry in the housing market, as they

function as fixed costs that require substantial investments from

builders. Garmaise and Moskowitz (2004) examine the effect of infor­

mation asymmetries among builders on the real estate market. The au­

thors argue that the local knowledge possessed by certain producers

about the specific regional market in which they operate (particularly

regarding local permits) gives them greater power compared to other

potential market entrants.

In the literature on the introduction of direct transfers to demand,

Polyakova and Ryan (2021) study the impact of targeted subsidies for

low-income groups on market dynamics. By examining the insurance

market in the United States, the authors find that as fewer suppliers

participate, the mechanism that drives prices upward intensifies.

Furthermore, they identify externalities in prices affecting other groups

that are not beneficiaries of the subsidy. While their research focuses on

the insurance market, their conclusions are also relevant for other sec­

tors, such as housing. Similarly, Fillmore (2021) investigates the effects

of federal government financial support given to undergraduate and

graduate students in the United States on tuition fees. The author finds

that the universities’ access to information about the student applica­

tions for the program leads to a situation of price discrimination, which

intensifies when there is less competition.5

The structure of this paper unfolds as follows. First, we provide an

overview of the context in which the program was implemented, high­

lighting the main characteristics of the subsidy and the housing market

in Mexico for low-income individuals. Second, we discuss the data

sources, describing the variables contained in the database and speci­

fying their scope and the empirical strategy used to evaluate the subsidy

impact. Thirdly, we present the results of the analysis, and finally, we

provide our key insights and concluding remarks.

2. Institutional and housing policy background in Mexico

2.1. Conavi housing subsidy

The public policy we analyze is a nationwide housing subsidy aimed

at providing low-income individuals with access to suitable housing

solutions. In 2007, the National Housing Commission (Conavi), a

Mexican federal public agency, operated the program and established its

guidelines, which included different modalities such as the purchase of

new or used houses, house improvements, land purchase, and selfproduction. The resources could be allocated to cover a portion of the

house’s price, as well as mortgage origination fees, permits, taxes, and

other administrative expenses. This study specifically focuses on the

subsidy granted to the house purchase.

The program was implemented in 2007 and experienced its period of

greatest growth between 2014 and 2015. Over the period from 2007 to

2019, the amount of the subsidy that an individual received for a house

purchase was on average 3233.6 dollars and represented 17.8 % of the

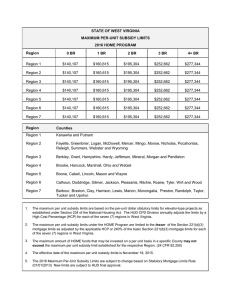

total price of the house.6 Table 1 illustrates the program’s budget evo­

lution. The program began with a budget of 147.6 million USD in 2007

and grew up to 621.8 million USD in 2015. From 2017 onwards, the

program decreased in scope, with a budget of 25.7 million USD in 2019.

Additionally, throughout the analyzed period, Infonavit loans that were

associated with subsidized purchases accounted for between 87.5 % and

100 % of the total program, reaching its highest level in 2019, with

100.0 % of subsidies channeled through Infonavit.

The operation of the subsidy program involved three key partici­

pants: Conavi, the beneficiaries, and a fund-distribution entity, collec­

tively referred to as "Onavi". Onavis are mostly organizations with

nationwide coverage whose purpose is to provide financing and credit

support for homebuyers. The most important of these entities is Info­

navit. This paper exclusively focuses on beneficiaries who were also

Infonavit borrowers, which distributed 93.0 % of the total subsidies

between 2007 and 2019. Conavi, as part of the Federal Government,

received a budget to finance the program and retained authority over its

direction, the design of its operational rules, its parameters’ update, and

the resolution of unforeseen issues. Subsidies were assigned until the

budget resources were spent totally. The potential beneficiary of the

program submitted a subsidy application at the same time when

5

The authors draw this conclusion by studying the effects of including a

greater number of applications to universities (more competitors for a given

student) in the program application process.

6

The average transfer of 3,233.6 dollars refers to the average across all the

program beneficiaries (with a mortgage from Infonavit and from other in­

stitutions). In the case of the subsidies channeled through Infonavit, their

average value was 3,338.6 USD between 2008 and 2019.

2

All monetary values are expressed in US Dollars, which we calculated using

an average exchange rate between 2008 and 2019 of 15.1 pesos per US Dollar.

3

This is an example of third-degree price discrimination.

4

The authors review articles that study the topic in New Zealand, the United

Kingdom, France, and Finland.

2

G.D. Ramírez Sierra et al.

Journal of Housing Economics 63 (2024) 101970

established a maximum price that the property could have, and starting

from 2012, additional measurements were incorporated that modified

the maximum amount for the subsidy. Specifically, Conavi included

variables related to the availability of infrastructure and services in the

neighborhood, its living conditions, ecological sustainability, and

accessibility.9

The amount of the subsidy was calculated as the difference between

the value of the house to be financed and the sum of the maximum loan

amount with the down payment of the borrower. However, there were

certain limits imposed on the subsidy amount based on the quality

conditions of the property and whether it was a newly built house or an

existing one. The average subsidy amount for Infonavit borrowers

changed during the study period: in 2008, it was of 2.2 thousand USD,

and in 2019, it was of 3.6 thousand USD. It is worth mentioning that in

2016, the average subsidy reached its maximum level of 4.2 thousand

USD.

Table 1

Conavi Housing Subsidy Growth.

Nationwide

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

Total 2007

- 2019

Infonavit

Number of

loans

Transfer

amount

(mUSD)1

Average

transfer

(USD)1

Share in the

number of loans

76,268

109,793

95,975

103,070

102,421

117,090

107,618

156,170

159,493

125,727

80,168

65,492

7060

1306,345

147.6

239.8

243.8

277.1

270.2

379.2

404.4

602.2

621.8

524.0

236.3

252.1

25.7

4224.2

1934.9

2184.0

2540.2

2688.1

2638.3

3238.4

3757.6

3856.0

3898.9

4167.9

2947.6

3849.7

3640.5

3233.6

95.5 %

90.1 %

87.5 %

90.8 %

90.2 %

92.2 %

94.4 %

97.3 %

92.4 %

92.3 %

96.9 %

98.2 %

100.0 %

93.0 %

2.2. Housing in Mexico

Note: Considers new and existing houses. 1 US Dollars, calculated using an

average exchange rate between 2008 and 2019 of 15.1 pesos per US Dollar.

mUSD referes to millions of dollars. Source: (Comisión Nacional de Vivienda,

2023)

To understand the context in which the program was implemented, it

is pertinent to identify the main participants involved in the housing

market in Mexico for low-income households:10 individual homebuyers,

real estate developers, real estate appraisers, public and private

financing companies, and the state as a regulator. Real estate developers

plan and build housing projects based on their own assessment of the

market and subject to housing regulations at the federal, state, and

municipality levels of government. They often play an active role as well

in the mortgage origination process as sales intermediaries.

The homebuyer selects the house he wishes to purchase and agrees

on a price with the seller based on the information available in the

market and can choose to finance it through private banks or through an

Onavi.11 Once with the price set, if the buyer applies for a mortgage loan

through an Onavi, he can use his accumulated savings in the Housing

Savings Account, which is part of the Pension Saving System (SAR), as a

down payment.12 At this step is when the borrower had the opportunity

to apply for a subsidy. The purchase transaction is then formalized with

the registration of the property deed carried out by public notaries.

In the Mexican housing market, there are specific conditions under

which the Conavi subsidy could have created distortions. On the one

hand, there is the way individuals inform themselves to choose a house

and its financing method. For years Infonavit has relied on sales in­

termediaries to originate mortgages, as it does not have many branches,

it only has 92 service centers across the country. Developers’ main

business activity is residential construction, but they play an essential

role in originating mortgages for Infonavit. They play a dual role: con­

structing developments of thousands of houses (known in Infonavit as

“bulk projects”) with the expectation of selling them to Infonavit cus­

tomers, and closely assisting these customers to apply for a mortgage at

Infonavit. As for the loan granting process, they help the customer

collect all the relevant information and requirements needed for a

applying for a mortgage with Infonavit, and Conavi directly provided

the subsidy to finance the house purchase. Thus, the subsidy functioned

as a non-repayable amount, delivered in a single payment, and did not

have allocation rules such as lotteries or waiting lists. It is important to

note that Infonavit distributed the subsidy without having any further

benefit or assuming any administrative or managerial responsibility.

Regarding the mortgage origination process, Infonavit, a public

institution offering universal housing financing schemes, uses a

distinctive credit procedure that distinguishes it from private mortgage

banks. Instead of evaluating credit applications based on the borrower’s

risk profile, Infonavit enables eligible beneficiaries to get housing

mortgages irrespective of their risk level, provided they meet specific

requirements primarily associated with job tenure. Consequently, the

beneficiaries with any level of income can obtain a mortgage loan.

Conavi neither established a registry of potential subsidy benefi­

ciaries nor executed extensive promotional campaigns. Individuals

became aware of the program while applying for their mortgage to

purchase a house when they received guidance on applying for the

subsidy to finance their pre-selected house. Furthermore, the subsidy

operated on a first-come, first-served basis, with subsidies being granted

until the annual budget was exhausted. As a result, it is possible that two

individuals with similar characteristics and housing needs could have

different outcomes, with one receiving the subsidy and the other not,

depending on whether budgetary resources were available at the time of

application.

The program’s target population consisted of low-income house­

holds with housing needs.7 As an initial criterion to identify potential

beneficiaries, two metrics were established: (1) the applicant’s income

and (2) the characteristics of the financed house. Regarding income,

maximum thresholds were established to determine eligibility. The

threshold was of approximately USD 11.5 per day in 2008 and under­

went three modifications in the following years.8 In terms of the pro­

gram rules related to the houses eligible for subsidy financing, Conavi

9

The use of the subsidy was limited to the purchase of houses with purchase

prices below certain thresholds that changed according to the property kind

(single family house or department) and its condition (new or existing).

10

There is a large mortgage and housing market in Mexico for higher income

individuals with a widespread participation of commercial banks. This paper

focuses in low-income population which is one of the main targets of Infonavit.

Nonetheless, Infonavit does originate mortgages for individuals with high

incomes.

11

As mentioned before, Onavis are mostly organizations with nationwide

coverage whose purpose is to provide financing and credit support for

homebuyers.

12

The Pension Saving System was initiated in Mexico in July 1997 and

designed the creation of an individual account for workers in the formal mar­

ket. The worker, the employer, and the state make regular contributions to

provide the worker with housing finance solutions and a pension.

7

The information was self-reported by the beneficiaries and Infonavit vali­

dated it according to the program’s operational rules.

8

As a reference, 44.1% of Infonavit borrowers between 2008 and 2014

earned 11.5 USD per day or lower at the time of applying for a mortgage.

During the peak period of subsidy growth in 2015, when the maximum

threshold for eligibility was set at 22.5 USD per day, 80.5% of Infonavit bor­

rowers had an income at or below that level.

3

G.D. Ramírez Sierra et al.

Journal of Housing Economics 63 (2024) 101970

mortgage (and presumably for the subsidy) and assist them in applying

for it.

On the other hand, developers have a vast knowledge about Info­

navit’s mortgage origination process as a result of their active involve­

ment in the sales process. As a result, when selling the houses, the

customers are more likely to be price-takers in the price bargain process

with the developer. It is worth emphasizing that internal estimates

reveal that approximately 65 % of sales intermediaries registered with

Infonavit are housing developers themselves. In the analytical frame­

work presented in this study, we refer to loans assisted by sales in­

termediaries as those in which the transaction was assisted by an

intermediary, as well as those coming from bulk projects. This inclusion

is justified by the observed active involvement of developers in the

marketing and promotion of both the houses in bulk projects and the

associated credit facilities.

number of housing subsidies between 2008 and 2019. On average, it

accounted for 93.0 % of the subsidized housing loans granted nation­

wide, as shown in Table 1. Based on this, we can state that, on the one

hand, our data covers the biggest portion of the mortgage market in

Mexico and, on the other hand, it lets us study nearly all the Conavi

subsidy recipients.

To study the conditions in which the houses in our data were pur­

chased, we refer to two operational aspects of Infonavit’s financing

process. First, the institute records the transaction price and all relevant

data regarding the appraisal of purchased houses. Infonavit collects

relevant information about the physical characteristics of the property,

the amenities of its neighborhood, and its location. Therefore, the data

source allows us to incorporate into the analysis the purchase price and

all variables that are used to appraise a house and that affect its value.

Second, we can identify in the data which houses were purchased with

the assistance of a sales intermediary. As discussed in the introduction,

Infonavit has historically relied on sales intermediaries to originate

loans. The developers possess a vast knowledge about Infonavit’s

mortgage origination process and about the economic housing market

conditions. As a result, when selling the houses, the customers are more

likely to be price-takers in the price bargain process with the developer.

Table 2 shows the main characteristics of the loans granted between

2008 and 2019 for the overall borrower universe of Infonavit, as well as

for those loans that were placed with a subsidy. For illustrative purposes,

we only show the mean and standard deviation of each variable in the

years 2008, 2010, 2012, 2014, 2016, 2018, and 2019. On the one hand,

we observe that Infonavit’s annual mortgage origination ranged from

241.4 thousand to 351.4 thousand credits during the study period,

showing a decreasing trend. The number of loans granted with a sub­

sidy, as well as their share in the total placement, grew between 2008

and 2014 and then progressively decreased until 2019. This trend is

consistent with the evolution of the subsidy program’s budget discussed

in the policy background.

On the other hand, Infonavit borrowers in the period from 2008 to

2019 had an average income of 17.6 USD per day, exceeding the median

income of workers in Mexico (13.6 USD per day) by 28.4 % when

averaging the annual surplus in the period.13 The decision to purchase a

house occurred around ages 32–34 years old with 4–6 years of work

experience, showing a declining trend over time. Men were over­

represented among borrowers, possibly reflecting gender disparities in

the labor market.14 In terms of the purchased house price, its value more

than doubled between 2008 and 2019, from 16,043 USD to 33,203 USD,

exhibiting a compound annual growth rate of 6.8 %. To cover this price,

borrowers contributed an average down payment ranging from 1813

USD to 3707 USD, which remained stable as a proportion of the house

price (averaging 12.1 % over the period).

In contrast, the monthly income of the subsidized borrowers, and the

price of their houses remained lower than the average Infonavit loan.

While the average income of borrowers remained, on average, 28.4 %

above the national median for the employed population, borrowers with

the subsidy had an income that was, on average, 36.5 % lower than the

national median. The price of houses purchased with a subsidy was, on

average, 20.8 % lower than that of the complete universe of Infonavit

borrowers. Additionally, there was a higher participation of women in

the program and of workers with less job tenure at the time of applying

for the loan. Finally, a significant aspect highlighted by Table 2 is that

sales intermediaries had consistently higher participation in the place­

ment of subsidized houses compared to non-subsidized ones, ranging

from 89 % to 100 %.The individual income of the subsidy recipient

3. Conceptual framework

In this section we provide the theoretical framework needed for our

analysis. The subsidy works as an incentive granted by the government

to house demanders and producers, aiming to increase the quantity

demanded by the former and produced by the latter. A recurring theo­

retical finding in the literature is that a subsidy generates a deadweight

loss that can be offset by positive externalities. If we use a partial

equilibrium model assuming perfect competition, after delivering a

lump-sum subsidy to buyers for the purchase of a house, the new equi­

librium will feature higher housing consumption, and higher prices with

respect to the scenario without a subsidy. Therefore, the subsidy’s

incidence will depend on the relative elasticities between supply and

demand.

In contrast, in a monopolistic market setting with third-degree price

discrimination, suppliers of a homogenous good have market power and

the ability to segment markets, and they find optimal to set different

prices in each of these markets exploiting the differences in demands

elasticities. Individuals with similar characteristics that are eligible for

the subsidy that increases their income have different demands than

those that are not eligible for the subsidy. These income differences,

depending on their preferences, might induce different demand elas­

ticities that the supplier could exploit to maximize its profits charging

different prices. Fig. 1 shows that in such a setting, individuals receiving

subsidies will face a higher price (P*) than those who do not receive one

(P).

Finally, it is important to note that if the producer does not have the

ability to engage in price discrimination, the price charged by the sup­

plier to demanders would lay at some point between (P*) and (P), uni­

formly across both groups. However, the price paid by the subsidized

demand would still be lower than the price paid by the non-subsidized

demand. This indicates that in the absence of a monopolistic structure

with the ability to engage in price discrimination, consumer surplus

would be greater compared to the existence of such a structure.

4. Data and empirical strategy

4.1. Data

We used Infonavit’s administrative records of the mortgage granting

process to conduct the analysis. We studied a total of 3.6 million

approved loans granted between January 1, 2008, and December 31,

2019, out of which 1.1 million (30.5 %) were granted with a Conavi

subsidy. Our study universe is limited to those loans used to purchase a

house regardless of its condition (newly built or existing) and that were

fully financed by Infonavit. Regarding the value of our data source, it is

important to highlight that Infonavit is the largest mortgage lender in

Mexico. Its total mortgage origination accounted for 56.5 % of the total

market during the study period. Furthermore, as discussed in the

introduction, Infonavit was the institution that channeled the highest

13

Refers to the median national income of the employed population, as re­

ported by the National Institute of Statistics and Geography through its Na­

tional Survey of Occupation and Employment.

14

For further details, refer to the research titled "Infonavit from a Gender

Perspective" (Infonavit bajo la perspectiva de género) in Infonavit (2019).

4

G.D. Ramírez Sierra et al.

Journal of Housing Economics 63 (2024) 101970

Fig. 1. The effect of a lump-sum subsidy in a third-degree price discrimination setting.

Table 2

Mortgage application variables.

Total mortgages originated

With subsidy

With subsidy (% of total)

All mortgages

Individual Daily Income (USD)1

Age (years)

Sex (Man=1)

Down payment (USD)1

Current job tenure (years)

House price (USD)1

Intermediary (=1)2

Mortgages with a subsidy

Individual Daily Income (USD)1

Age (years)

Sex (Man=1)

Down payment (USD)1

Current job tenure (years)

House price (USD)1

Subsidy amount (USD)1

Intermediary (=1)2

2008

2010

2012

2014

2016

2018

2019

347,579

101,183

29 %

351,399

90,675

26 %

305,952

100,434

33 %

300,848

152,114

51 %

281,468

111,434

40 %

276,821

59,109

21 %

241,420

7060

3%

13.48

(11.6)

32.19

(8.4)

0.65

(0.5)

1813

(2568.9)

4.69

(3.0)

16,043

(4301.4)

0.82

(0.4)

15.27

(14.5)

33.49

(8.7)

0.65

(0.5)

2576

(3902.7)

5.20

(3.3)

18,016

(4837.9)

0.83

(0.4)

14.12

(13.3)

33.05

(8.3)

0.65

(0.5)

2378

(3680.6)

3.81

(1.9)

19,274

(4959.0)

0.85

(0.4)

15.97

(14.3)

32.43

(8.2)

0.66

(0.5)

2509

(3975.9)

3.53

(1.3)

22,395

(7726.3)

0.82

(0.4)

19.83

(17.1)

32.46

(8.2)

0.67

(0.5)

3054

(4785.6)

3.63

(1.3)

25,863

(10,086.7)

0.75

(0.4)

24.27

(20.4)

32.49

(8.0)

0.66

(0.5)

3576

(5501.8)

3.69

(1.3)

30,960

(14,143.6)

0.73

(0.4)

26.31

(20.5)

32.23

(7.8)

0.67

(0.5)

3707

(5529.6)

3.71

(1.3)

33,203

(14,604.4)

0.71

(0.5)

6.35

(1.7)

32.42

(8.7)

0.57

(0.5)

847

(640.0)

4.11

(2.7)

12,941

(1097.9)

2125

(807.5)

0.89

(0.3)

6.79

(2.0)

33.01

(8.2)

0.57

(0.5)

1094

(821.2)

4.54

(2.8)

14,941

(1236.6)

2699

(1011.5)

0.92

(0.3)

7.43

(3.0)

33.17

(8.1)

0.59

(0.5)

1248

(1008.8)

3.68

(1.8)

16,744

(1900.6)

3246

(1203.7)

0.95

(0.2)

8.83

(3.5)

32.12

(8.2)

0.62

(0.5)

1341

(1107.2)

3.32

(1.2)

19,241

(2370.8)

3854

(873.9)

0.95

(0.2)

11.38

(4.3)

31.98

(8.1)

0.63

(0.5)

1536

(1323.2)

3.40

(1.3)

22,499

(3294.8)

4184

(974.4)

0.98

(0.2)

10.62

(2.8)

32.26

(7.8)

0.60

(0.5)

1520

(1302.6)

3.35

(1.2)

23,842

(2603.7)

3882

(1308.4)

0.98

(0.1)

11.35

(2.7)

32.32

(7.5)

0.56

(0.5)

1600

(1317.8)

3.54

(1.2)

25,065

(2560.1)

3641

(978.1)

1.00

(0.0)

Note: All variables with (=1) are indicator variables. Standard deviations (in parenthesis). 1 All monetary values are expressed in US Dollars, which we calculated using

an average exchange rate between 2008 and 2019 of 15.1 pesos per US Dollar. 2 Refers to the proportion of houses purchased with the assistance of a sales

intermediary.

population increased during the study period. The operating rules of the

program stated that it would be granted to people who could apply for

an Infonavit loan and who had an individual income (as registered in the

social security system) below a certain threshold that changed at

different points. We use this threshold to implement a regression

discontinuity design, as detailed in the methodology section. Between

2008 and 2014, the threshold was equivalent to USD 11.5 per day;

between 2015 and February 2017, it was equivalent to USD 22.2 per

day; between February 2017 and March 2018, it was equivalent to USD

17.7 per day, and finally between March 2018 and December 2019, it

was USD 12.4 per day.

A significant percentage (44.1 %) of the overall borrower population

between 2008 and 2014 exhibited a daily income below the threshold of

11.5 USD, thereby meeting the eligibility criteria for the subsidy

5

G.D. Ramírez Sierra et al.

Journal of Housing Economics 63 (2024) 101970

program. In 2015, the income requirement was substantially relaxed,

resulting in a higher percentage of the borrower population (80.5 %)

potentially being eligible for the subsidy in that year. However, the

percentage gradually declined thereafter, eventually leading to the

program’s complete termination in 2019.

Table 3 summarizes on the one hand the key characteristics of the

universe of houses acquired with an Infonavit loan, and on the other

hand, it summarizes the same characteristics of the universe that

received a subsidy. The table provides information for the years 2008,

2010, 2012, 2014, 2016, 2018, and 2019. Although a limited set of

variables is presented for illustrative purposes, a comprehensive table

with the complete set of characteristics, which were used as control

variables in the econometric analysis, is provided in the appendix

(Tables A.1 and A.2).

Regarding the provision of basic services, it is important to highlight

that most houses (over 90 %) had access to the drinking water and the

sewage collection networks (Table A.1 in the appendix). However,

approximately one-fourth of the entire universe of houses had a natural

gas connection (26.2 % on average between 2008 and 2019). As for the

property size, it changed importantly in this period. In terms of built-up

area, there was a growing trend in which the average size increased from

48.59 m2 in 2008 to 57.23 m2 in 2019. The lot size experienced more

substantial fluctuations: it changed from 116.04 m2 in 2008 to 96.07 m2

in 2019, but it did not consistently decrease in those years. It initially

increased to an average level of 141.76 m2 in 2012 and then declined

until 2019. Finally, regarding the location and neighborhood amenities,

it was found that, on average, 30.7 % of the houses had an extended set

of amenities (at least a market and a church within a 2.0-kilometer

radius of the property or other amenities such as public squares, hos­

pitals, and banks). Additionally, on average, 90.7 % of houses were in an

economic housing area, meeting minimum habitability standards or part

of a standardized prototype development (bulk projects, explained in

the background section).

In contrast, subsidized houses had consistently smaller built-up areas

(14.2 % smaller on average) and, in some years, it is observed that the lot

size of these subsidized houses exceeded that of the average Infonavitpurchased house. Additionally, they had a lower provision of services

(such as natural gas installation), a lower provision of infrastructure in

the neighborhood (such as public squares, hospitals, and banks) and

throughout all years, subsidized houses were more frequently located in

sprawl areas (on average 4 percentage points more likely). These char­

acteristics are consistent with the housing market trends observed be­

tween 2008 and 2019: the house developers focused on promoting the

purchase of smaller houses situated on the suburbs of urban centers.

eligibility cutoff that we consider to be comparable to each other. They

are part of same income groups, but those with an income marginally

bigger than the cutoff have an abrupt drop in their probability of

receiving the subsidy. This setting allows us to increase the compara­

bility between two groups: those slightly below the cutoff (i.e., those

with an income slightly smaller than the eligibility cutoff) and those

slightly above it. These two groups are supposed to be similar enough to

let us estimate a local average treatment effect when comparing their

housing choices.

More formally, let Wi ∈ {0, 1} denote the treatment variable, with

Wi = 1 if individual i received the subsidy and Wi = 0 otherwise.15 We

are interested on calculating an average treatment effect of Wi on the

house price Pi . In the standard Sharp Regression Discontinuity Design

(SRD), one observes that all the individuals that score below a certain

value c of a running variable Xi , income, receive the treatment and all

those above c do not receive it. In such a perfect compliance setting, the

probability of receiving the treatment drops from 1 to 0 when crossing

the cutoff. In our study, however, there is not perfect compliance. It is

true that limPr(Wi = 1|Xi = x) ∕

= limPr(Wi = 1|Xi = x). Therefore, we

x↓c

x↑c

observe a discontinuity at the cutoff on the probability of receiving the

subsidy, but the drop is not as large as in the SRD: there are individuals

above c receiving the subsidy and others below c not receiving it. The

Fuzzy Regression Discontinuity Design (FRD) estimator of the average

treatment effect of Wi on Pi is

limE(Pi |Xi = x) − limE(Pi |Xi = x)

τFRD =

x↓c

x↑c

limE(Wi |Xi = x) − limE(Wi |Xi = x)

x↓c

(1)

x↑c

As in a local average treatment effect setting, τFRD can be interpreted

as the treatment effect on Yi for those individuals that received the

treatment because their income was smaller than the eligibility cutoff c

and that would have not received it if their income had been bigger than

c. In other words, it adjusts a sharp design estimator so it incorporates

the fact that some people below the cutoff would have not participated

in the program despite being eligible and some people above the cutoff

would have participated regardless of having an income higher than the

cutoff. To identify τFRD we use a two-stage strategy that calculates a

reduced form estimate (which is equivalent to SRD) on the one hand and

a first stage estimate (that measures the treatment probability jump at

the cutoff) on the other hand. More specifically, the two stage models are

calculated as follows.

4.3. Reduced form

We restrict the data to a window of borrowers within a distance h of

the cutoff on the income. We estimated a weighted linear regression

function with triangular kernel weights that decrease with the distance

to c and, in our preferred specification, a set of covariates Zi (credit

application, house, and neighborhood characteristics, state-level, and

year fixed effects). Our estimation method solves the following optimi­

zation problem.

4.2. Empirical strategy

To evaluate the impact of Conavi’s subsidy, we compare house prices

across properties purchased by individuals who were part of the pro­

gram (treated population) and properties purchased by individuals who

were not. Specifically, we use a regression discontinuity design (RDD) to

measure the average treatment effect on prices at the individual income

cutoff that determined the possibility to participate in the program. The

estimate incorporates control variables for the house characteristics and

neighborhood characteristics. Since our database was built with Info­

navit’s administrative records, we refer to individuals in the database as

borrowers.

Given that Conavi subsidy’s operating rules established a cutoff on

the personal income of an applicant to determine his or her eligibility to

participate in the program, we exploit the discontinuity that such rule

generated on the proportion of borrowers receiving the subsidy. Since

the cutoff changed between 2008 and 2019, we study separately the

periods in which the cutoff had different values. Periods of analysis have

different lengths because the operating rules changed at different points

in time, as explained in the previous section. For each of these period

specifications, we find sets of borrowers in a neighborhood of the

N

∑

min

αP− ,αP+ ,βP− ,βP+ ,γ

i=1

[Pi − 1(Xi < c)(αP− + βP− Xi ) − 1(Xi ≥ c)(αP+ + βP+ Xi ) − Zi ]2

(2)

The values of αP+ and αP− lead then to the estimator of the reduced

form, τRF , expressed as follows.

̂

τRF = α̂

P+ − α

P−

(3)

15

Our notation is based on Imbens and Lemieux (2008) and on Calonico et al.

(2017).

6

G.D. Ramírez Sierra et al.

Journal of Housing Economics 63 (2024) 101970

Table 3

House characteristics of all houses purchased with an Infonavit loan.

All mortgages

With a natural gas connection (=1)

2

Built-up area (m )

Lot size (m2)

Single family home (=1)1

Extended urban infraestructure (=1)2

Sprawl location (=1)3

Economic housing area (=1)4

Mortgages with a subsidy

With a natural gas connection (=1)

Built-up area (m2)

Lot size (m2)

Single family home (=1)1

Extended urban infraestructure (=1)2

Sprawl location (=1)3

Economic housing area (=1)4

2008

2010

2012

2014

2016

2018

2019

0.37

(0.5)

48.59

(22.4)

116.04

(298.8)

0.94

(0.2)

0.46

(0.5)

0.21

(0.4)

0.91

(0.3)

0.26

(0.4)

49.63

(47.5)

110.89

(414.2)

0.87

(0.3)

0.24

(0.4)

0.24

(0.4)

0.90

(0.3)

0.21

(0.4)

50.45

(18.2)

141.76

(1001.6)

0.75

(0.4)

0.26

(0.4)

0.28

(0.4)

0.89

(0.3)

0.24

(0.4)

54.30

(20.3)

104.34

(280.3)

0.76

(0.4)

0.28

(0.5)

0.22

(0.4)

0.92

(0.3)

0.26

(0.4)

55.78

(20.8)

96.83

(255.2)

0.75

(0.4)

0.30

(0.5)

0.18

(0.4)

0.92

(0.3)

0.26

(0.4)

57.25

(22.6)

96.03

(235.6)

0.73

(0.4)

0.29

(0.5)

0.13

(0.3)

0.90

(0.3)

0.27

(0.4)

57.23

(22.4)

96.07

(201.7)

0.75

(0.4)

0.28

(0.4)

0.12

(0.3)

0.89

(0.3)

0.33

(0.5)

41.90

(11.9)

98.31

(94.6)

0.94

(0.2)

0.46

(0.5)

0.23

(0.4)

0.94

(0.2)

0.23

(0.4)

42.37

(11.7)

115.75

(438.8)

0.82

(0.4)

0.29

(0.5)

0.28

(0.5)

0.93

(0.3)

0.15

(0.4)

44.90

(10.6)

161.18

(1343.0)

0.56

(0.5)

0.27

(0.4)

0.32

(0.5)

0.91

(0.3)

0.22

(0.4)

47.21

(10.3)

89.37

(264.9)

0.66

(0.5)

0.32

(0.5)

0.27

(0.4)

0.96

(0.2)

0.21

(0.4)

48.00

(8.3)

74.80

(119.8)

0.60

(0.5)

0.34

(0.5)

0.22

(0.4)

0.98

(0.1)

0.19

(0.4)

47.33

(6.7)

67.70

(36.4)

0.49

(0.5)

0.32

(0.5)

0.13

(0.3)

0.98

(0.1)

0.12

(0.3)

46.66

(4.8)

68.35

(37.1)

0.44

(0.5)

0.38

(0.5)

0.19

(0.4)

0.99

(0.1)

Note: All variables with (=1) are indicator variables. Standard deviations (in parenthesis). 1 Refers to the type of building, which can be a single-family home, a

condominium, an apartment, or a multiple dwelling. Multiple dwelling refers to a house in which more than one family lives. 2 Refers to houses with additional

amenities, including at least a church, and a market within a 2.0-kilometer radius of the house. 3 Refers to the location of the property based on its accessibility and its

recognition by the government as part of the urban area. The proximity classification can be central, intermediate, peripheral, sprawl and rural. Sprawl locations are

recognized by the government as potential growth areas, but that are not currently bounded by primary roads or expressways. 4 Refers to the predominant classification

of houses in the area. We group houses as "social interest" when they either meet minimum habitability standards or that are constructed in clusters based on stan­

dardized prototypes.

4.4. First stage

difference of 863 USD between beneficiaries and non-beneficiaries close

to the income eligibility cutoff of 11.5 daily USD for the period that

spans between 2008 and 2014. This Local Average Treatment Effect for

those borrowers close to the cutoff represents 5.4 % of the average house

purchased with a subsidy and 28.9 % of the average subsidy amount.

The estimates come from a Fuzzy Regression Discontinuity Design (FRD)

that measures the local average treatment effect on prices at the income

cutoff. Our estimates remain robust when we add control variables for

housing and neighborhood characteristics, yearly, and state-level fixed

effects. We also find that this effect was only statistically significant in

the group of borrowers that bought the property with the assistance of a

sales intermediary.

Fig. 2 shows the distribution of the borrowers’ income, which is the

running variable of our FRD models. Each of the four graphs in the figure

display a specific period of analysis in which the cutoff changed between

2008 and 2019, as explained in the data section. The first period runs

from January 1st, 2008, to December 31st, 2014; the second one, from

January 1st, 2015, to February 3rd, 2017; the third one, from February

4th, 2017, to March 7th, 2018, and the final one, from March 8th, 2018,

to December 31st, 2019. The cutoff of each period is depicted with a red

vertical line. Visually, we cannot affirm that the density function is

continuous at the cutoff in all periods. Further, we visually identify that

the density function shows discontinuities at 11.5 USD between 2008

and 2014 and at 17.7 USD between 2017 and 2018.

With the McCrary test for continuity, we reject at the 0.01 level the

null hypothesis of continuity at the cutoff in three out of the four periods

studied (the period from 2018 to 2019 is the only one in which we did

not reject the null hypothesis). However, we know that borrowers above

As in the reduced form, we restrict the data to a window of borrowers

within a distance h to the cutoff on the income, but with the treatment

indicator Wi as the dependent variable instead of the price Pi .

N

∑

min

αW− ,αW+ ,βW− ,βW+

[Wi − 1(Xi < c)(αW− + βW− Xi ) − 1(Xi ≥ c)(αW+ + βW+ Xi )]2

i=1

(4)

The values αW+ and αW− are then used to derive the estimator for the

reduced form, denoted as τFS , which can be expressed as follows.

̂

τFS = α̂

W+ − α

W−

(5)

4.5. Fuzzy regression discontinuity design estimator

The interest effect from Eq. (1) can be calculated then as follows.

τFRD =

̂

α̂

τRF

P+ − α

P−

=

̂

τFS

α̂

W+ − α

W−

(7)

For the estimation of τFRD we use the bias-corrected inference pro­

cedure proposed by Calonico et al., 2017.

5. The effect of subsidies on house prices

5.1. The effect of CONAVI’s subsidy on house purchase prices

Our main result is that Conavi’s housing subsidy generated a price

7

G.D. Ramírez Sierra et al.

Journal of Housing Economics 63 (2024) 101970

Fig. 2. Density of the borrowers’ income.

the cutoff would have not been able to manipulate their income value.16

To address the discontinuity in our income density function, we

examine eight conditional mean functions for mortgage application

variables covering the period from 2008 to 2014 (Fig. A.1 in the ap­

pendix). We can visually detect that down payment, age, and marital

status present different mean values below and above the income cutoff.

To a smaller extent, sex presents a mean difference at the cutoff as well.

All of these conditional mean functions for the covariates are expected to

be continuous at the cutoff point, as the relationship between income

and these variables should remain unaffected by receiving a housing

subsidy. However, we do observe that borrowers on the left-hand side

were at the cutoff less likely to be married with respect to the ones in the

right-hand side, paid a lower down payment for their mortgage (which is

in this case the Housing Savings Account amount they had at Infonavit)

house, were less than a year older, and marginally more likely to be a

woman.

Figs. 3 and 4 show, respectively, conditional mean functions for

program receipt and house prices below and above the income cutoff.

On the one hand, the conditional program receipt (Fig. 3) presents a

jump at the income cutoff in three out of the four study periods (only the

period from 2017 to 2018 does not show a discontinuity). Further, the

largest difference of 29 percentage points was calculated in the period

from 2008 to 2014.17 On the other hand, mean house prices show a

significant jump in the period from 2008 to 2014: house prices are

estimated 281 USD higher in the left-hand side of the cutoff than in the

right-hand side.18 As mentioned before, the fact that we observe such a

sharp discontinuity on the price exactly above 11.5 USD contributes to

the hypothesis of a market segmentation implemented by the house

sellers, since it is based on a borrower characteristic rather than on a

difference of the house he or she purchased. However, we further study

the conditional mean functions of the house variables as well.

Regarding the conditional mean functions of house characteristics,

we examine those described in the data section to evaluate their possible

impact on the price difference we found at the income cutoff (Fig. A.2 in

the appendix, for the period from 2008 to 2014). These house and

neighborhood variables are widely used in the appraisal process that is

necessary to purchase a property with a mortgage from Infonavit.

Although three out of eleven of them present statistically significant

differences at the cutoff at a 0.05 level, we identify that only two could

lead up to an identification problem of the effect of the subsidy itself on

prices.

An interesting result is that property size and location seem to have

been affected by the subsidy. Built-up area is calculated to be less than a

square meter bigger on the right-hand side of the cutoff with respect to

the left-hand side of it. Similarly, houses with a parking space or with a

natural gas connection are less than a percentage point more frequent in

one side of the cutoff with respect to the other. Only lot size and location

appear to be more significant: houses on the left side were calculated to

be at the cutoff 29.79 m2 bigger, 0.87 percentage points more frequent

in a sprawl area, and 1.1 percentage points less frequent in an inter­

mediate area.19 To assess the effect of these differences on our calcula­

tion, we add these characteristics as control variables across our model

specifications to see if they change the price difference estimate at the

cutoff.

To assess the economic significance of the covariate differences

observed at the discontinuity, we conducted a standardized balance test,

as presented in the appendix (Fig. A.3). Notably, price exhibits the most

substantial standardized deviation when compared to all other study

16

The income used to evaluate program eligibility was calculated automati­

cally based on the monetary contributions made by the employers to Infonavit,

as a social security institution that collects such contributions to save into

employee Housing Savings Accounts.

17

This estimate comes from the first stage estimation used in our FRD model

without control variables. As in the main result, the estimation was made using

a bandwidth of 0.6 USD.

18

This estimate comes from the reduced form estimation used in our FRD

model without control variables. As in the main result, the estimation was made

using a bandwidth of 0.6 USD.

19

The initial balance analysis comes from estimating Sharp Regression

Discontinuity Designs for each of the covariates in the period between 2008 and

2014. As in the main result, the estimation was made using a bandwidth of 0.6

USD. The proximity classification can be central, intermediate, peripheral,

sprawl and rural. Sprawl locations are recognized by the government as po­

tential growth areas, but that are not currently bounded by primary roads or

expressways. Intermediate locations refer to those with access to primary roads

but typically bounded by intermediate speed ones.

8

G.D. Ramírez Sierra et al.

Journal of Housing Economics 63 (2024) 101970

Fig. 3. Program receipt around the cutoff.

variables, with a deviation of 0.13. The next larger deviations are

associated with credit application variables, particularly age (0.09) and

marital status (− 0.06). As for the house characteristics, the indicators

for natural gas on the property registered a deviation of − 0.05, while

sprawl location showed a deviation of 0.04. These findings suggest that

the covariate differences identified at the cutoff are not the primary

drivers of our main results, which are presented in Table 4.

We show our main results in Table 4. Our identification strategy

leads to an estimate of 963 USD in the specification without controls for

the period between 2008 and 2014. When adjusted for the exposure to

the subsidy, an initial difference of 227 USD (Fig. 4) increases more than

threefold.20 In order to assess the robustness of our results to the in­

clusion of control variables, we begin by incorporating those used in the

credit application process. These variables, while not expected to be

influenced by the receipt of the subsidy, were identified as not entirely

balanced at the cutoff. Although the estimate increases to 1115 USD, it

remains positive and statistically significant at the 0.01 level. Then, our

third model adds house and neighborhood characteristics as control

variables to find that the effect is only 31 USD smaller than the speci­

fication with no controls.

20

The initial difference of 227 USD comes from the reduced form estimation

used in our FRD model without control variables.

9

G.D. Ramírez Sierra et al.

Journal of Housing Economics 63 (2024) 101970

Fig. 4. House prices around the cutoff.

Finally, our fourth specification led to our preferred result of 863

USD when controlling for yearly and state-level fixed effects. Our esti­

mate shows then to be robust for the 2008 to 2014 period. Regarding the

relative size of the house price difference we found, our preferred esti­

mate represents 5.4 % of the average house price purchased between

2008 and 2014 and 28.9 % of the average transfer in the same period. As

for the rest of the periods, we do not find statistically significant effects

in any of the other specifications. Therefore, we do not consider any

other estimate as one in our results. Our model exhibits significant ef­

fects only in the period between 2008 and 2014, when the subsidy was

specifically aimed at the lowest income population.

We believe that there may be several reasons for this result, but our

hypotheses follow three lines. First, it is likely that the increase in the

income threshold (from $11.5 to $22.2 per day) may have altered the

profile of the borrowers at the cutoff. It could be the case that borrowers

at higher income levels display greater financial knowledge, giving them

a better position to negotiate with the seller or exhibit more price

elasticity. Second, the discontinuity in participation is less pronounced

after 2014. Probably, a smaller jump in participation at the cutoff leads

to less precise estimates from our model for the years from 2015 on­

wards. Finally, third, there is a possibility of greater homogeneity among

houses targeted at individuals with a daily income of $11.5 or less

compared to those with $22.2. The substantial changes in our estimation

results for periods after 2014, as well as the increased size of the

10

G.D. Ramírez Sierra et al.

Journal of Housing Economics 63 (2024) 101970

Table 4

Regression Discontinuity Models of Changes in House Prices in the Presence of a Subsidy.

(Dollars,1 Fuzzy Regression Discontinuity Designs)

R1

Cutoff1

January 2008 to December 2014

11.5

January 2015 to February 2017

22.2

February 2017 to March 2018

17.7

March 2018 to December 2019

12.4

963

(111.5)

− 18

(1043.1)

21,879

(33,258.8)

− 729

(684.2)

Controls

Credit Application

X

House characteristics

Neighborhood characteristics

State-level fixed effects

Year fixed effects

***

R2

R3

1115

(109.8)

− 147

(1008.5)

16,848

(22,735.5)

− 618

(643.2)

***

R4

932

(113.8)

− 213

(1031.8)

22,023

(37,194.2)

− 769

(670.7)

***

X

X

X

863

(115.2)

− 164

(998.2)

39,488

(140,202.9)

− 87

(673.2)

***

X

X

X

X

Note: Standard errors in parenthesis and using the bias-corrected inference procedure proposed by Calonico et al. (2017). All estimations were calculated withtin a

distance of 0.6 Dollars around the cutoff. House variables include the built-up area, floor area, and indicator variables for more than one bedroom, more than one

bathroom, parking space, natural gas connection, and metropolitan area. Neighrborhood variables include neighborhood kind (economic housing or other) and urban

proximity classification (sprawl or other). 1 US Dollars, calculated using an average exchange rate between 2008 and 2019 of 15.1 pesos per US Dollar.

Table 5

Regression Discontinuity Models of Changes in House Prices in the Presence of a Subsidy for Groups of Borrowers with and without the Assistance of a Sales

Intermediary.

(Dollars,1 Fuzzy Regression Discontinuity Designs)

R5

Purchased without an intermediary

Purchased with an intermediary

Controls

Credit application

House variables

Neighborhood variables

State-level fixed effects

Year fixed effects

− 6

(751.0)

1038

(111.2)

***

R6

R7

R8

99

(703.2)

1196

(109.1)

81

(741.0)

1007

(113.7)

627

(603.4)

867

(112.1)

X

***

X

X

***

***

X

X

X

X

Note: Standard errors in parenthesis and using the bias-corrected inference procedure proposed by Calonico et al. (2014). All estimations were calculated withtin a

distance of 0.6 Dollars around the cutoff. House variables include the built-up area, floor area, and indicator variables for more than one bedroom, more than one

bathroom, parking space, natural gas connection, and metropolitan area. Neighrborhood variables include neighborhood kind (economic housing or other) and urban

proximity classification (sprawl or other). 1 US Dollars, calculated using an average exchange rate between 2008 and 2019 of 15.1 pesos per US Dollar.

standard errors for those periods, may reflect increased variability in the

types of houses purchased.

We observe these results to be differentiated in the years that our

main period (2008- 2014) covers (Table A.3 in the appendix). Between

2008 and 2010, the estimate was calculated to be of between 835 and

1035 USD, reaching its biggest magnitude in 2010. From 2011 onwards,

we observe a change in which the effect is reduced first (it decreases its

size and statistical significance) and increases very significantly to 1461

USD in 2014. We consider this could be related to the fact a new gov­

ernment took office in Mexico in that year and published later in 2014 its

housing policy guidelines. This led to an overall higher house demand,

as Infonavit’s mortgage origination increased by 10.2 % in that year. As

shown in Table 1 in the introduction of this document, the number of

borrowers with a subsidy increased by 45.1 % between 2013 and 2014.

As noted previously, the introduction of the subsidy very probably

had an impact on the quality of houses purchased by the subsidized

population. However, the robustness of our findings when controlling

for crucial variables in the appraisal process suggests that another un­

derlying mechanism could explain the observed price difference. Spe­

cifically, we explore the role of sales intermediaries in inducing an

effect, which will be discussed in the following section.

When it comes to the spillover effects that the program may have

generated, it is true that it had a significant penetration in the housing

market. As discussed in Table 2, subsidized mortgages accounted for

more than 20 % of the total origination of Infonavit until 2018. There­

fore, although it exceeds the scope of this study, we acknowledge that

the program could have raised the average level of house prices beyond

the difference we estimated at the eligibility cutoff. As a result, our

estimation of the total effects of the subsidy on price levels in the market

may underestimate its overall impact, as it is limited to the local effect

observed close to the eligibility threshold on income and does not pro­

vide a counterfactual of how prices would have evolved in the market in

the absence of the subsidy.

11

G.D. Ramírez Sierra et al.

Journal of Housing Economics 63 (2024) 101970

5.2. Intermediation, subsidies, and effects on house prices

We believe that the combination of inefficiencies in the subsidy

allocation rules, along with the characteristics of the Mexican housing

market, resulted in an information asymmetry between house suppliers

and subsidy beneficiaries. Sales intermediaries, who had a better un­

derstanding of the program, could have imposed higher prices on sub­

sidized houses through a third-degree price discrimination setting.

These results highlight the significance of addressing inefficiencies and

information asymmetries in the housing markets. Such a situation holds

significant relevance for the development of public policies aimed at

ensuring the provision of affordable and quality housing for low-income

populations. It is crucial to adjust the operational rules of such programs

to ensure they achieve their objectives while minimizing the market

distortions they could generate.

This research also underscores the need for regular and rigorous

evaluation models to assess the impact of such programs. It is essential to

explore alternative approaches that mitigate the inherent information

asymmetries in Mexico’s housing market, which stem from factors such

as the decentralized nature of housing supply. Coordinated efforts be­

tween individuals, suppliers, and the government are crucial for estab­

lishing a national housing supply database that allows all market

participants to geolocate and access relevant information regarding

housing availability, characteristics, and prices. Moreover, within the

academic sphere, it is vital to extend research on information asym­

metries in the Mexican real estate market and its core inefficiencies. By

addressing these issues and fostering greater transparency and coordi­

nation, policymakers and researchers can work to create a more efficient

and equitable housing market that meets the needs of the population.

In concern to the channels that generated the estimated house price

difference, we argue that the presence of third-degree price discrimi­

nation practiced by housing developers targeting potential buyers could

play a relevant role in the price effect. We base our hypothesis on the

notion that developers may have selectively offered different prices

depending on their customer characteristics, which they could have

identified in the process to originate mortgages. To explore this hy­

pothesis, we changed our strategy to focus on the subset of buyers that

actively engaged with sales intermediaries during their house purchas­

ing process, as explained in the introduction.

We show in Table 5 that our price difference is driven by the

intermediary-assisted group, attaining a significance level of 0.01. The

magnitude of this effect ranged from 867 to 1196 USD. Our preferred

specification, which incorporates fixed effects at both state and year

levels, yielded an estimated effect of 867 USD. In contrast, in the group

of buyers without developer assistance, statistical significance was not

observed in any of the four specifications, and its size was not robust

across our sets of control variables.

Our results show that there was a statistically significant difference

between the prices of houses purchased with and without a housing

subsidy. Our estimate was driven by the group of borrowers that had the

assistance of a sales intermediary to purchase a property. This result was

calculated at the individual income level that was required to qualify for

the subsidy program, ensuring better comparability within houses than

other methodologies. Furthermore, it is shown that the differences

persist when adding control variables for characteristics that were not

fully balanced at the cutoff. Based on our results, we believe that the

estimated price difference could be consistent with a phenomenon of

price discrimination by sales intermediaries, who may have actively

participated in promoting the subsidy with their customers.

The active role of sales intermediaries on mortgage origination could

have played an important role to let them segment the market, as they

help the customer collect all the relevant information and requirements

needed for a mortgage and assist them in applying for it. In this setting,

demanders were likely to reveal relevant information about their in­

come profiles and identify themselves them as potential beneficiaries of

the subsidy. Furthermore, in the Mexican market, sales intermediaries

play a role wider than merely supplying houses to the market. They also

actively promote financing solutions for their purchase. In this context,

they have firsthand information about Infonavit’s credit process and the

interaction it may have with housing policy instruments, such as the

Conavi subsidy.

CRediT authorship contribution statement

Gabriel Darío Ramírez Sierra: Conceptualization, Methodology,

Writing – review & editing. Alayn Alejandro González Martínez:

Conceptualization, Formal analysis. Miguel Ángel Monroy Cruz:

Software, Data curation. Luis Gerardo Zapata Barrientos: Formal

analysis, Writing – original draft.

Declarations of Competing Interest

The authors declare that they have no known competing financial

interests or personal relationships that could have appeared to influence

the work reported in this paper.

Data availability

The data that has been used is confidential.

6. Concluding remarks

This study presents an assessment of the impact of Conavi’s housing

purchase subsidy on price dynamics. Our research hypothesis argues the

existence of a price premium paid by the program beneficiaries for very

similar houses compared to the ones purchased by non-beneficiaries.

Our empirical findings reveal that the implementation of Conavi’s

subsidy is associated with an increase in the average purchase price for

beneficiaries from 2008 to 2014, amounting to 863 USD. This increase

represents 28.9 % of the average subsidy value in that period. Moreover,

our analysis suggests that the participation of sales intermediaries as key

stakeholders in the house purchase process could explain the price

premium. We found robust and statistically significant price differences

in the subset of buyers that actively engaged with sales intermediaries

during their house purchase process, while no evidence of price in­

creases was found in subsidized housing transactions without

intermediaries.

Acknowledgments

Hugo Alejandro Garduño Arredondo, Óscar Vela Treviño, Mitzi Yael

Camba Almonaci, Sebastián Ocampo Palacios, Isaac Medina Martínez

and Francisco Felipe Villegas Rojas, from Infonavit’s General SubDirectorate of Financial Planning and Fiscalization, for their technical

comments and support in the construction of inputs, as well as to Rosa

María Escobar Briones, Moisés Nahmad Fierro and Rosa Isela Rodríguez

Ayala, from Infonavit’s Credit Sub-Directorate, for their support in un­

derstanding in depth the housing appraisal process in Mexico. This

research did not receive any specific grant from funding agencies in the

public, commercial, or not-for-profit sectors. During the preparation of

this work the authors used ChatGPT in order to improve writing. After

using this tool/service, the authors reviewed and edited the content as

needed and takes full responsibility for the content of the publication.

12

G.D. Ramírez Sierra et al.

Journal of Housing Economics 63 (2024) 101970

Appendix

Table A.1

House characteristics of all houses purchased with an Infonavit loan.

Basic services

With drinking water supply (=1)

Sewage collection access (=1)

With a natural gas connection (=1)

House characteristics

Built-up area (m2)

2

Lot size (m )

Single family home (=1)1

More than one bathroom (=1)

More than one bedroom (=1)

With a parking space (=1)

Neighborhood characteristics

Extended urban infraestructure (=1)2

Central location (=1)

3

Sprawl location (=1)3

Intermediate location (=1)3

Peripheral location (=1)3

Rural location (=1)3

Economic housing area (=1)4

Mean housing area (=1)4

Residential housing area (=1)4

In a metropolitan area (=1)

2008

2010

2012

2014

2016

2018

2019

0.96

(0.2)

0.96

(0.2)

0.37

(0.5)

0.98

(0.2)

0.93

(0.3)

0.26

(0.4)

0.97

(0.2)

0.92

(0.3)

0.21

(0.4)

0.97

(0.2)

0.94

(0.2)

0.24

(0.4)

1.00

(0.1)

0.98

(0.2)

0.26

(0.4)

1.00

(0.0)

0.98

(0.1)

0.26

(0.4)

1.00

(0.0)

0.97

(0.2)

0.27

(0.4)

48.59

(22.4)

116.04

(298.8)

0.94

(0.2)

0.02

(0.1)

0.63

(0.5)

0.93

(0.3)

49.63

(47.5)

110.89

(414.2)

0.87

(0.3)

0.05

(0.2)

0.66

(0.5)

0.92

(0.3)

50.45

(18.2)

141.76

(1001.6)

0.75

(0.4)

0.03

(0.2)

0.76

(0.4)

0.91

(0.3)

54.30

(20.3)

104.34

(280.3)

0.76

(0.4)

0.05

(0.2)

0.85

(0.4)

0.91

(0.3)

55.78

(20.8)

96.83

(255.2)

0.75

(0.4)

0.06

(0.2)

0.88

(0.3)

0.91

(0.3)

57.25

(22.6)

96.03

(235.6)

0.73

(0.4)

0.08

(0.3)

0.90

(0.3)

0.91

(0.3)