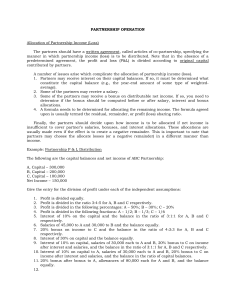

PARTNERSHIP OPERATIONS Average Capital Balance Beg. balance, additional investment, withdrawal 1. WW and RR share profits and losses equally, WW and RR receive salary allowances of P20,000 and P30,000, respectively, and both partners receive 10% interest on their average capital balances. Average capital balances are calculated at the beginning of each month regardless of when the capital contributions and capital withdrawals were made, and partners drawings are not used in determining the average capital balances. Total net income for 2011 is P120,000. WW RR January 1 capital balances P1OO.OOO P120,000 Yearly drawings (PI .500 a month) 18,000 18,000 Permanent withdrawals of capital: June 3 (12,000) May 2 (15,000) Additional investments of capital: July 3 40,000 October 2 50,000 What is the weighted average capital for WW and RR respectively for 2011? a. P110,667 and PI 19,583 c. P100,000 and P120,000 b. P105,333 and PI26,667 d. P126,667 and 105,333 2. Mr. Zoom and his very close friend Mr. Boom formed a partnership on January 1, 2013 with Zoom contributing P16,000 cash and Boom contributing equipment with a book value of P6,400 and a fair value of P8,000. During 2013 Boom made additional investments of P1,600 on April 1 and P1,600 on June 1, and on September 1, he withdrew P4,000. Zoom had no additional investments nor withdrawals during the year. The average capital balance at the end of 2013 for Mr. Boom is: a. P9,600 c. P8,800 b. P8,000 d. P7,200 Beg. balance, add'l investment, excess withdrawal 3. Partner A first contributed P50,000 of capital into an existing partnership on March 1,2012. On June 1,2012, the partner contributed another P20,000. On September 1, 2012, the partner withdrew PI 5,000 from the partnership, Withdrawals in excess of PI0,000 are charged to the partner's capital account. The annual weighted-average capital balance is a. 62,000 c. 60.000 b. 51,667 d. 48,333 Partnership Net Income Profit & loss statement given 4. Merlin, a partner in the Camelot Partnership, has a 30% participation in partnership profits and losses. Merlin's capital account has a net decrease of P1,200,000 during the calendar year 2011. During 2011, Merlin withdrew P2,600,000 (charged against his capital account) and contributed property valued at P500,000 to the partnership. What was the net income of the Camelot Partnership for year 2011 ? a. 3,000,000 c. 7,000,000 b. 4,666,667 d. 11,000,000 5. JJ and KK are partners who share profits and losses in the ratio of 60%: 40%, respectively. JJ's salary is P60,000 and P'30,000 for KK. The partners are also paid interest on their average capital balances. In 2012, J J received P30,000 of interest and KK, PI2,000. The profit and loss allocation is determined after deductions for the salary and interest payments. If KK's share in the residual income (income after deducting salaries and interest) was P 60,000 in 2012, what was the total partnership income? a. 192,000 c. 282,000 b. 345,000 d. 387,000 6. RR, a partner in the RD partnership, is entitled to 40% of the profits and losses. During 2013, RR contributed land to the partnership that cost her P50,000, but had a fair vlaue of P60,000. Also during 2013, RR had drawings of P80,000. The balance of RR's capital accounts was P120,000 at the beginning of the year and PI 50,000 at the end of the year. What is the partnership's comprehensive income (loss) for 2013. a. P(7 5,000) c. P150,000 b. P(50,000) d. P125,000 7. Arturo Perez, a partner in the AP Partnership, has a 30% participation in partnership profits and losses. Perez's capital account has a net decrease of P60,000 during the calendar year 2013. During 2013, Perez withdrew PI30,000 (charged against his capital account) and contributed property valued at P25,000 to the partnership. What was the net income of the AP Partnership for 2013? a. P150,000 c. P350,000 b. P233,333 d. P550,000 Partner's required share in income given 8. CC, PP, and AA, accountants, agree to form a partnership and to share profits in the ratio of 5:3:2. They also agreed that AA is to be allowed a salary of P28,000, and that PP is to be guaranteed P21,000 as his share of the profits. During the first year of operation, income from fees are P180,000, while expenses total P96,000. What amount of net income should be credited to each partner's capital account? a. CC, P28,000, PP, P16,800, AA, P11,200 b. CC, P25,000, PP.P21.000, AA, P38,000 c. CC, P24,000, PP, P22,000, AA, P38,000 d. CC, P25.000, PP, P21.000, AA, P39,000 9. On January 1,2012, A, B, C and D formed Bakya Trading Co., a partnership, with capital contributions as follows: A, P50,000; B, P25,000; C, P25,000; and D, P20.000. The partnership contract provided that each partner shall receive a 5% interest on contributed capital, and that A and B shall receive salaries of P5.000 and P3,000, respectively. The contract also provided that C shall receive a minimum of P2.500 per annum, and D a minimum of P6,000 per annum, which is inclusive of amounts representing interest and share of remaining profits. The balance of the profits shall be distributed to A, B, C, and D in a 3:3:2:2 ratio. What amount must be earned by the partnership, before any charge for interest and salaries, so that A may receive an aggregate of P12,500 including interest, salary and share of profits? a. 16,667 c. 30.667 b. 30,000 d. 32,333 Net Income 10. The Partnership has the following accounting amounts: (1) Sales = (2) Cost of Goods Sold = (3) Operating Expenses = (4) Salary allocations to partners = (5) Interest paid to banks = (6) Partners' withdrawals = The partnership net income (loss) is: a. 20,000 b. 18,000 P70,000 P40,000 P10,000 PI3,000 P2,000 P8,000 c. 5,000 d. (3,000) 11. A partnership has the following accounting amounts: Sales P 700,000 Cost of goods sold 400,000 Operating expenses 100,000 Salary allocations to partners 130,000 Interest paid to banks 20,000 Partners' drawings 80,000 What is the partnership net income (loss)? a. 200,000 b. 180,000 c. 50,000 d. (30,000) Indifference Point 12. Cab and Jo are considering forming a partnership whereby profits will be allocated through the use of salaries and bonuses. Bonuses will be 10% of net income after total salaries and bonuses. Cab will receive a salary of P30.000 and a bonus. Jo has the option of receiving a salary of P40.000 and a 10% bonus or simply receiving a salary of P52.000. Both partners will receive the same amount of bonus. Determine the level of net income that would be necessary so that Jo would be indifferent to the profit sharing option selected. a. 240.O00 c. 94,000 b. 300,000 d. 334,000 Dayag 2013 13. Lancelot is trying to decide whether to accept a salary of P 40,000 or a salary of P25,000 plus a bonus of 10% of net income after salary and bonus as a means of allocating profit among the partners. Salaries traceable to the other partners are estimated to be P100,000. What amount of income would be necessary so that Lancelot would consider the choices to be equal? a. 165,000 c. 265.000 b. 290,000 d. 305,000 14. MM is trying to decide whether to accept a salary of P40,000 or a salary of P25,000 plus a bonus of 10% of net income after salaries and bonus as a means of allocating profit among the partners. Salaries traceable to the other partners are estimated to be PI00,000. What amount of income would be necessary so that MM would consider the choices to be equal? a. P165,000 c. P265,000 b. P290,000 d. P305,000 Partner’s Share in Net Income Capital Contribution 15. The ABC Partnership reports net income of P60,000. If partners A, B, and C have income ratio of 50%, 30%, and 20%, respectively. What is the share of Partner C from the net income of the partnership, if he was given a capital ratio of 25%? a. 30,000 c. 18,000 b. 12,000 d. 15,000 Interest + Salaries + Residual Loss 16. Henry, Marta and Nestor are partners with average capital balances in 2013 of P240,000, PI20,000 and P80,000 respectively. Partners receive 10% interest on their average capital balances. After deducting salaries of P60,000 to Henry and P40,000 to Nestor, the residual profit or loss is divided equally. In 2008 the partner¬ ship sustained a P66,000 loss before interest and salaries to partners. By what amount should Nestor's capital account change? a. P30,000 decrease c. P48,000 increase b. P22,000 decrease d. P28,000 increase 17. Dexter and Joliver are partners agreeing to allow monthly salaries (P6,000 and P5,000 respectively), 6% interest on the capital investment at the beginning of the year (P300,000 and P230,000 respectively) and on the remaining balance, to be equally shared. The first year registered a net income of P 100,000 Profit share of the partners are: a. Dexter, P58,100 and Joliver, P41,900. b. Dexter, P50,000 and Joliver, P50,000. c. Dexter, P54,500 and Joliver, P45,500. d. Dexter, P56,600 and Joliver, P43,400. 18. On January 1,2013, Zcep and Beep have capital balances of P20,000 and PI 6,000 respectively. On July 1,2013 Zeep invests an additional P4,000 and Beep with¬ draws PI,600. Profits and losses are divided as follows: Beep is the managing partner and as such shall receive PI6,000 salary and Zeep shall receive P7,200; both partners shall receive interest of 10% on their beginning capital balances to offset whatever difference in capital investments they have and any remainder shall be divided equally. Income of the Zeep-Beep partnership for the year 2013 is P9,600. Zeep's share in the ret income is: a. P9,200 c. P 4,800 b. P 880 d. P 600 = Salary + Residual Profit 19. S and T are in partnership and prepare their accounts to 31 December each year. On 1 July 2012, U joined the partnership. Profit sharing arrangements are: Salary Share of balance in profit S S T U 6 months to 30 June 2012 P15.000 60% 40% 6 months to 31 December 2012 P25,000 40% 40% 20% The partnership profit for the year ended 31 December 2012 was P350,000 accruing evenly over the year. What are the partners' total profit shares for the year ended 31 December 2012? S T U A. 196,000 124,000 P30,000 B. 217,000 108,000 25,000 C. 155,000 130,000 65,000 D. 175,000 145,000 35,000 20. AA and DD created a partnership to own and operate a health-food store. The partnership agreement provided that AA receive a salary of P10,000 and DD a salary of P5,000 to recognize their relative time spent in operating the store. Remaining profits and losses were divided 60:40 to AA and DD, respectively. Income for 2012, the first year of operations, of P13,000 was allocated P8,800 to AA and P4,200 to DD. On January 1, 2013, the partnership agreement was changed to reflect the fact that DD could no longer devote any time to the store's operations. The new agreement allows AA a salary of P18,000, and the remaining profits and losses are divided equally. In 2013 an error was discovered such that the 2012 reported income was understated by P4,000. The partnership income of P25,000 for 2013 included the P4,000 related to year 2012. In the reported net income of P25,000 for the year 2013, AA and DD would have: AA DD AA DD a. 21.900 3,100 c. O 0 b. 17,100 17,100 d. 12,500 12,500 21. In its first year of operations. Alba and Company, a partnership, made a net income of P20,000 before providing for salaries of P5,000 and P3,000 per annum for Alba and Bana, respectively, as stipulated in the partnership agreement. Capital contributions are as follows: Alba P30,000 Bana 20,000 Cada 10,000 Assuming that no profit-and-loss ratios are provided in the partnership agreement and that there has been no change in the capital contributions during the year, how much profit share would Alba be entitled to received? a. P10,000 c. P11,000 b. P 5,000 d. P15,000 Salary + Residual Loss 22. Red and White formed a partnership in 2010. The partnership agreement provides for annual salary allowances of P55,000 for Red and P45,000 for White. The partners share profits equally and losses in a 60/40 ratio. The partnership had earnings of P80,000 for 2006 before any allowance to partners. What amount of these earnings should be credited to each partner's capital account? Red White a. 40,000 40,000 b. 43,000 37,000 c. 44,000 36,000 d. 45,000 35,000 Interest + Residual Profit 23. The partnership agreement of XX, YY & ZZ provides for the year-end allocation of net income in the following order: First, XX is to receive 10% of net income up to P200,000 and 20% over P200,000. • Second, YY and ZZ each are to receive 5% of the remaining income over P300,000. • The balance of income is to be allocated equally among the three partners. The partnership's 2011 net income was P500,000 before any allocations to partners. What amount should be allocated to XX? a. 202,000 c. 206,000 b. 216,000 d. 220,000 24. ABC's partnership provided for the following distribution of profits and losses; "First". A to receive 10% of the net income up to P 1,000,000 and 20% on the amount of excess thereof; "Second", B and C each, are to receive 5% of the remaining income in excess of PI,500,000 after A's share as per above and; "The balance to be divided equally among the partners." For the year just ended, the partnership realized a net income of P2,500,000 before distribution to partners. The share of A is: a. P1,300,000 c. P1,080,000 b. P1,000,000 d. P1,100,000 Interest + Residual Loss 25. During 2010, Young and Zinc maintained average capital balances in their partnership of P160,000 and P100,0Q0, respectively. The partners receive 10% interest on average capital balances, and residual profit or loss is divided equally. Partnership profit before interest was P4,000. By what amount should Zinc's capital account change for the year? a. 1,000 decrease c. 11,000 decrease b. 2,000 increase d. 12,000 increase Interest + Salaries + Bonus + Residual Loss 26. AA and BB formed a partnership in 2012 and made the following investments and capital withdrawals during the year: AA BB Investments Draws Investments Draws March 1 P30,000 P20,000 Junel P10.000 P10,000 August 1 20,000 2,000 December 1 5,000 The partnership's profit and loss agreement provides for a salary of which P30,000 was paid to each partner for 2012. AA is to receive a bonus of 10% on net income after salaries and bonus. The partners are also to receive interest of 8% on average annual capital balances affected by both investments and drawings. Any remaining profits are to be allocated equally among the partners. Assuming net income of P60,000 before salaries and bonus, determine how the income would be allocated among the partners: a. AA,P31,138;BB,P28,862 c. AA, P30,633; BB, P29,367 b. AA, P33,537; BB, P26,463 d. AA, P30,684; BB,P29,316 Interest + Salaries + Bonus + Residual Profit 27. A, B, and C are partners in an accounting firm. Their capital account balances at year-end were A P90,000; B P110,000 and C P50,000. They share profits and losses on a 4:4:2 ratio, after the following special terms: 1. Partner C is to receive a bonus of 10% of net income after the bonus. 2. Interests of 10% shall be paid on that portion of a partner's capital in excess of P100,000. 3. Salaries of P10,000 and P12,000 shall be paid to partners A & C respectively. Assuming a net income of P44,000 for the year, the total profit share of Partner C was: a. 7,800 c. 19,400 b. 16,800 d. 19,800 28. Hunt, Rob, Turman, and Kelly own a publishing company that they operate as a partnership. The partnership agreement includes the following: • • • Hunt receives a salary of P20,000 and a bonus of 3% of income after all bonuses. Rob receives a salary of P10,000 and a bonus of 2% of income after dll bonuses. All partners are to receive 10% interest on their average capital balances. The average capital balances are as follows: Hunt P50,000 Rob 45,000 Turman 20,000 Kelly 47,000 Any remaining profits and loss are to be divided equally among the partners. Determine how a profit of P105,000 would be allocated among the partners. a. Hunt, P41,450; Rob, P29,950; Turman,P 15,450; Kelly, P18,150 b. Hunt, P28,000; Rob, P16,500; Turman,P 2,000; Kelly, P 4,700 c. Hunt, P39.700; Rob, P29,200; TurmaaP 16,700; Kelly, P19.400 d. Cannot be determined. Dayag 2013 29. Partners AA and BB have profit and loss agreement with the following provisions: salaries of P30,000 and P45,000 for AA and BB, respectively; a bonus to AA of 10% of net income after salaries and bonus; and interest of 10% on average capital balances of P20,000 and P35,000 for AA and BB, respectively. One-third of any remaining profits will be allocated to AA and the balance to BB. If the partnership had net income of P102,500, how much should be allocated to Partner AA? a. 44,250 c. 41,000 b. 47,500 d. 41,167 Interest + Bonus + Residual Profit 30. The partnership agreement of Donn, Eddy, and Fair provides for annual distribution of profit and loss in the following sequence: • Donn, the managing partner, receives a bonus of 10% of profit. • Each partner receives 6% interest on average capital investment. • Residual profit or loss is divided equally. Average capital investments for 2010 were: Donn P80,000 Eddy Fair 50,000 30,000 What portion of the P100,000 partnership profit for 2010 should be allocated to Fair? a. 28,600 c. 35,133 b. 29,800 d. 41,600 Interest Based on Weighted-Average Capital 31. The partnership agreement of RR and SS provides that interest at 10% per year is to be credited to each partner on the basis of weighted-average capital balances. A summary of the capital account of SS for the year ended December 31, 2012, is as follows: Balance, January 1 P420,000 Additional investment, July 1 120,000 Withdrawal, August 1 ( 45,000) Balance, December31 495,000 What amount of interest should be credited to SS's capital account for 2012? a. 45.750 c. 46,125 b. 49,500 d. 51,750 32. The partnership agreement of Reid and Simm provides that interest at 10% per year is to be credited to each partner on the basis of weighted-average capital balances. A summary of Simm's capital account for the year-ended December 31, 2010, is as follows: Balance, January 1 Additional investment, July 1 Withdrawal, August 1 Balance, December 31 P140,000 40,000 (15,000) 165,000 What amount of interest should be credited to Simm's capital account for 2010? a. 15,250 c. 16,500 b. 15,375 d. 17,250 33. The partnership agreement of Eve and Fred provides that interest at 10% per year is to be credited to each partner on the basis of weighted-average capital balances. A summary of Fred's capital account for the year ended 31 December 2013 is as follows: Balance, 1 January P280,000.00 Additional Invstment, July 1 80,000.00 Withdrawal, 1 August (30,000.00) Balance, 31 December 330,000.00 The amount of interest that should be credited to Fred's capital account for 2013 is a. P30,750 c. P34,500 b. P30,500 d. P33,000 Interest Based on Ave. Capital + Salaries + Residual Loss 34. The partnership of DD and BB was formed and commenced operations on March 1,2011, with DD contributing P30,000 cash and BB investing cash of PI0,000 and equipment with an agreed upon valuation of P20,000. On July 1,2011, BB invested an additional P 10,000 in the partnership, DD made a capital withdrawal of P4,000 on May 2, 2011 but reinvested the P4,000 on October 1, 2011. During 2011, DD withdrew P800 per month and BB, the managing partner, withdrew PI,000 per month. These drawings were charged to salary expense. A pre-closing trial balance taken at December 31,2011 is as follows: Debit Cash Receivable-net Equipment - net Other assets Liabilities DD, capital BB, capital Service revenue Supplies expense Utilities expense Salaries to partners Other miscellaneous expenses Total a. DD, P10,520; BB, PI3,480 c. b. DD, P12,000; BB, PI2,000 d. Credit P 9,000 15,000 50,000 19,000 P 17,000 30,000 40,000 50,000 17,000 4,000 18,000 5,000 P137,000 DD, P10,800; BB, PI3,200 DD, P10,600; BB, PI3,400 P137,000 Interest Based on Ave. Capital + Residual Profit 35. On January 1, 2012, DD and EE decided to form a partnership. At the end of the year, the partnership made a net income of PI 20,000. The capital accounts of the partnership show "the following transactions. DD, Capital EE, Capital Dr. Cr. Dr. Cr. January 1 P40,000 - P25,000 April 1 P5,000 June 1 10,000 August 1 10,000 September 1 P3,000 October 1 5,000 1,000 December 1 4,000 5,000 Assuming that an interest of 20% per annum is given on average capital and the balance of the profits is allocated equally, the allocation of profits should be: a. DD, P60,000; EE, P59,400 c. DD, P67,200; EE, P52,800 b. DD, P61,200; EE, P58,800 d. DD, P68,800; EE, P51.200 Bonus + Residual Profit 36. The partners, A and B, share profits 3:2. However, A is to receive a yearly bonus of 20% of the profits, in addition to his profit share. The partnership made a net income for the year of P24,000 before the bonus. Assuming A's bonus is computed on profit after deducting said bonus, how much profit share will B receive? a. P15,200 c. P8,000 b. P9,600 d. P 9,000 Salary + Bonus + Residual Profit 37. On October 31, 2010, Zita and Jones formed a partnership by investing cash of P300,000 and P200,000, respectively. The partners agreed to receive an annual salary allowance of P360,000, and to give Zita a bonus of 20% of the net income after partners' salaries, the bonus being treated as an expense. If the profits after salaries and bonus are to be divided equally, and the profits on December 31, 2010 after partners' salaries but before bonus of Zita is P360,000, how much is the share of Zita in the profit? a. 100,000 c. 210,000 b. 120,000 d. 270,000 38. The Articles of Partnership of Adam and Eve the following provisions were stipulated: a. Annual salary of P60,000 each. b. Bonus to Adam of 20% of the net income after partners' salaries, the bonus being treated as an expense. c. Balance to be divided equally. The partnership reported a net income of P360,000 after partners' salaries but before bonus. How much is the share of Eve in the profit? a. 60,000 c. 150,000 b. 90,000 d. 210,000 Comprehensive Questions 1 & 2 are based on the following: In the calendar year 2010, the partnership of A and B realized a net profit of P240,000. The capital accounts of the partners show the following postings: A, capital B, capital Debit Credit Debit Credit Jan. 1 P120,000 P80,000 May 1 P20,000 P10,000 July 1 20,000 Aug. 1 10,000 Oct. 1 10,000 5,000 39. If the profits are to be divided based on average capital, the share of A and B, respectively are: a. b. c. d. 129,600 144,000 136,800 136,543 110,400 96,000 103,200 103,457 40. If 20% interest based on the capital at the end of the year is allowed and given and the balance of the P240,000 profit is divided equally, the total share of A and B, respectively are: a. 121,500 118,500 b. 124,000 116,000 c. 123,000 117,000 d. 122,625 117,375 Partner's Share in Net Income (Partial/Order of Priority) Salaries 41. Partners AA and BB have profit and loss agreement with the following provisions: salaries of P30,000 and P45,000 for AA and BB, respectively; a bonus to AA of 10% of net income after salaries and bonus; and interest of 10% on average capital balances of P20,000 and P35,000 for AA and BB, respectively. One-third of any remaining profits will be allocated to AA and the balance to BB. If the partnership had net income of P22,000, how much should be allocated to Partner AA, assuming that the provisions of the profit and loss,, agreement are ranked by order of priority starting with salaries? a. 13,200 c. 12,000 b. 12,500 d. 8,800 Salary + Interest 42. Luz, Vi, and Minda are partners when the partnership earned a profit of P30,000. Their agreement provides the following regarding the allocation of profits and losses: a. 8% interest on partners' ending capital in excess of P75,000. b. Salaries of P20,000 for Luz and P30.000 for Vi. c. Any balance is to be distributed 2:1:1 for Luz, Vi, and Minda, respectively. Assume ending capital balances of P60,000, P80,000, and PI00,000 for partners Luz, Vi, and Minda, respectively. What is the amount of profit allocated for Minda, if each provision of the profit and loss agreement is satisfied to whatever extent possible using the priority order shown above? a. (3,600) c. (2,000) b. 3,600 d. 2,000 Partner’s Share in Net Loss Share in Undistributed Losses 43. Downs, Frey, and Vick formed the DFV general partnership to act as manufacturer's representatives. The partners agreed Downs would receive 40% of any partnership profits and Frey and Vick would each receive 30% of such profits. It was also agreed that the partnership would not terminate for 5 years. After the fourth year, the partners agreed to terminate the partnership. At that time, the partners capital accounts were as follows: Downs, P20,000; Frey, P15,000; and Vick P10,000. There also were undistributed losses of P30,000. Vick's share of the undistributed losses will be a. 0 c. 9,000 b. 1,000 d. 10,000 Share of Industrial Partner 44. Alder, Benson, and Carl are capitalist partners and Denver, an industrial partner. The partnership reported a net loss of P100,000. How much is the share of Denver in the reported net loss? a. 0 c. 25,000 b. 10,000 d. 100,000 Interest + Residual Loss 45. FF, GQ and HH form a partnership and agree to maintain average investments of P2,500,000, PI,250,000 and PI,250,000, respectively. Interest on the excess or deficiency in a capital contribution is to be computed at 6% per annum. After the interest allowances, FF, GG, and HH are to share any balance in the ratio of 5:3:2. Average amounts invested during the first six months were as follows: FF, P3,000,000, GG, PI,375,000; and HH, PI,000,000. A loss from operations of P62,500 was incurred for the first six months. How is this loss distributed among the partners? FF GG HH P21,875 a. PI8,375 P22,250 b. 12,500 10,000 49,500 c. 31,250 18,750 12,500 d. 18,375 21,875 22,250 Salary + Interest + Residual Loss 46. AA, BB, and CC are partners with average capital balances during 2012 of P360,000, P180,000, and P120,000, respectively. Partners receive 10% interest on their average capital balances. After deducting salaries of P90,000 to AA and P60.000 to CC the residual profit or loss is divided equally. In 2012 the partnership sustained a P99,000 loss before interest and salaries to partners. By what amount should AA's capital account change? a. 21,000 increase c. 105,000 decrease b. 33,000 decrease d. 126,000 increase 47. Fox, Greg, and Howe are partners with average capital balances during 2010 of PI20,000, P60,000, and P40,000, respectively. Partners receive 10% interest on their average capital balances. After deducting salaries of P30,000 to Fox and P20,000 to Howe, the residual profit and loss is divided equally. In 2010, the partnership sustained a P33,000 loss before interest and salaries to partners. By what amount should Fox's capital account change? a. 7,000 increase c. 35,000 decrease b. 11,000 decrease d. 42,000 increase Partner's Ending Capital Balances 48. AA and BB entered into a partnership as of March 1, 2011 by investing P125,000 and P75,000, respectively. They agreed that AA, as the managing partner, was to receive a salary of P30,000 per year and a bonus computed at 10% of the net profit after adjustment for the salary; the balance of the profit was to be distributed in the ratio of their original capital balances. On December 31, 2011, account balances were as follows: Cash P70,000 Accounts payable . P 60,000 Accounts receivable . 67,000 AA, capital 125,000 Furniture and fixtures . 45,000 BB, capital 75,000 Sales returns 5,000 AA, drawing ( 20,000) Purchases 196,000 BB, drawing ( 30,000) Operating expenses... 60,000 Sales 233,000 Inventories on December 31, 2011 were as follows: supplies, P2,500, merchandise, P73,000. Prepaid insurance was P950 while accrued expenses were P1.550. Depreciation rate was 20% per year. The partners' capital balances on December 31, 2011, after closing the net profit and drawing accounts, were: AA BB AA BB A. P135,940 P47,960 C. P139,680 P48,680 B. P139,540 P49,860 D. P142,350 P47670 49. XX, YY and ZZ formed a partnership on January 1, 2012. Each contributed P120,000. Salaries were to be allocated as follows: XX YY ZZ P30.000 P30.000 P45,000 Drawings were equal to salaries and be taken out evenly throughout the year. With sufficient partnership net income, XX and YY could split a bonus equal to 25 percent of partnership net income after salaries and bonus (in no event could the bonus go below zero). Remaining profits were to be split as follows: 30% for XX; 30% for YY, and 40% for ZZ. For the year, partnership net income was PI 20,000. Compute the ending capital for each partner: a. XX, P155,100; YY, P155,100; ZZ, P169,800 b. XX, P126,000; YY, P126,000; ZZ, P124,500 c. XX, P125,100; YY, P125,100; ZZ, P124,800 d. XX, P125,500; YY, P125,500; ZZ, P124,000 50. HH, MM, and AA formed a partnership on January 1,2011, and contributed P150,00, P200,000, and P250,000, respectively. Their articles of co-partnership provide that the operating income be shared among the partners as follows: as salary, P24,000 for HH, P18,000 for MM, and P12,000 for AA; interest of 12% on the average capital during 2011 of the three partners; and the remainder in the ratio of 2:4:4, respectively. The operating income for the year ending December 31, 2011 amounted to P176,000. HH contributed additional capital of P30,000 on July 1 and made a drawing of P10,000 on October 1; MM contributed additional capital of P20,000 on August land made a drawing of P10,000 on October 1; and, AA made a drawing of P30,000 on November 1. The partners' capital balances on December 31, 2011 are: a. HH, P179,680; MM, P229,360; and, AA, P239,360 b. HH, P179,760; MM, P229,520; and, AA, P239,520 c. HH, P189,680; MM, P239,360; and, AA, P269,360 d. HH, P223,180; MM, P272,060; and, AA, P280,760 51. TM partnership begins its first year of operations with the following capital balances: Tan capital P200,000 May capital P100,000 According to the partnership agreement, all profits will be distributed as follows: a. Tan will be allowed a monthly salary ot P20,000 with P10,000 assigned to May. b. The partners will be allowed with interest equal to 10 percent of the capital balance as of the first day of the year. c. Tan will be allowed a bonus of 10 percent of the net profit after bonus. d. The remainder will be divided on the basis of the beginning capital for the first year and equally for the second year. e. Each partner is allowed to withdraw up to P10,000 a year. Assume that the net loss for the first year of operations is P15,000 with net income of P55,0O0 in the subsequent year. Assume further that each partner withdraws the maximum amount from the business each period. What is the balance of Tan's capital account at the end of the second year? a. P264,750 c. P180,000 b. P284,750 d. P184,750 52. Roy and Sam was organized and began operations on March 1,2013. On that date, Roy invested PI50,000 and Sam invested computer equipment with current fair value of PI80,000. Because of shortage of cash, on November 1, 2013 Sam in¬ vested additional cash of P60,000 in the partnership. The partnership contract includes the following remuneration plan:* Roy Sam Monthly salary (recognized as expense) PI0,000 P20,000 Annual interest on beginning capital 12% 12% Bonus on the net profit before salaries and interest but after bonus 20% Balance equally. The salary was to be withdrawn by each partner in monthly installments. The partnership's net profit for 2013 is P120,000. What are the capital balances of the partners on December 31, 2013? Roy Sam a. P243,500 P266,500 b. P136,000 P350,000 c. P 86,000 PI54,000 d. P 87,000 PI55,000 53. Adam and Eve are CPA's who have been operating their own separate practices as sole proprietors. They decided to combine the two firms as a partnership on January 5, 2013. The following assets were contributed by each: Adam Eve Cash P100,000 P100,000 Accounts receivables 225,000 190,000 Furniture and equipment 35,000 38,000 Computer equipment 46,000 The partners agreed to split profits on the basis of gross cash collections from billing generated from clients. During 2013, Adam's clients paid the firm a total of PI,500,000 and Eve's clients paid Pl,625,000. Expenses for the year were PI,080,000 of which P480,000 were attributable to Adam and P600,000 to Eve. During 2013 Eve withdrew P750,000 cash for personal needs and contributed an additional computer valued at P22,000. What is the capital balance of Eve at December 31, 2013? a. P576,000 c. P709,400 b. P839,400 d. P889,400 54. KK, SS and WW formed a partnership on January 1, 2013. Each contributed PI 44,000. Salaries were to be allowed as follows: KK P36,000 SS 36,000 WW 54,000 Drawings were equal to salaries and be taken out evenly throughout the year. With sufficient partnership net income, KK and SS could split a bonus equal to 25 percent of partnership net income after salaries and bonus (in no event could the bonus go below zero). Remaining profits were to be divided as follows: 30% for KK; 30% for SS, and 40% for WW. For the year, partnership total comprehensive income was P144,000. What are the capital balances of the partners on December 31, 2013. a. KK, P186,120; SS, P186,120; WW, P203,760 b. KK,151,200; SS,151,200; WW,149,400 c. KK,150,120; SS,150,120; WW,149,760 d. KK,150,600; SS,150,600; WW,148,800 55. Tim and Tom entered into a partnership on March 1, 2013 by investing P125,000 and P75,000, respectively. They agreed that Tim, as the managing partner, is to receive a salary of P30,000 per year and a bonus computed at 10% of the net profit after adjustment for the salary and bonus; the balance of the profit was to be distributed in the ratio of their original capital balances. On December 31, 2013, account balances were as follows: Cash P70,000 Accounts payable P60,000 Accounts receivable 67,000 Tim, capital 125,000 Furniture and fixtures 45,000 Tom, capital 75,000 Sales returns and allowances 5,000 Tim, drawing (20,000) Net Purchases 196,000 Tom, drawing (30,000) Operating expenses 60,000 Sales 233,000 Inventories on December 31, 2013 were as follows: supplies, P2,500; merchan¬ dise, P73,000. Prepaid insurance was P950 while accrued expenses were PI,550. Depreciation rate was 20% per year. The partner's capital balances on December 31, 2013, after closing the net profit and drawing accounts, were: Tim Tom a. P142,350 P 47,670 b. P135,940 P 47,960 c. P139,540 P49,860 d. P139,491 P49,909 56. On January 2, 2013 Phil, Art, and Rey formed the PAR partnership contributing cash as follows: Phil PI 92,000 Art 288,000 Rey 432,000 The partnership contract provides the following provisions in respect with partner's remuneration: 1. Interest of 12% on average capital balances. 2. Annual salaries as follows: Phil P28,800 Art P24,000 Rey P27,200 3. Remainder of the net income divided 40% to Phil, 30% to Art, and 30% to Rey. Income before partner's salaries and interest for the year ended December 31, 2013 was P184,160. Phil invested additional cash of P48,000 to the partnership on July 1,2013. Rey withdrew P72,000 from the partnership on October 1,2013. The partners also withdrew PI,500 monthly agianst their share of net income for the year. What is the capital balance of Phil on December 31, 2013? a. P274,320 c. P235,200 b. P286,992 d. P257,280 57. The partnership of Gary, Jerome, and Paul was formed on January 1, 2013. The original investments were as follows: Gary P80,000 Jerome PI 20,000 Paul PI 80,000 According to the partnership agreement, net income or loss will be divided among the respective partners as follows: Salaries of P12,000 for Gary, P10,000 for Jerome, and P8,000 for Paul. Interest of 8% on the average capital balance during the year of Gary, Jerome, and Paul Remainder divided equally. Additional information is as follows: Net income of the partnership for the year ended December 31, 2013 was P70,000. Gary invested an additional P20,000 in the partnership on July 1,2013. Paul withdrew P30,000 from the partnership on October 1,2013. Gary, Jerome and Paul made regular drawings against their shares of net income during 2013 of PI 0,000 each. The partner's capital balances as of December 31, 2013 are: Gary Jerome Paul a. P112,333 P132,733 P164,934 b. 102,333 122,733 154,934 c. 92,000 102,000 134,934 d. 122,333 132,733 164,934 58. Herm, Mar and Ama formed a partnership on January 1, 2013 and contributed PI 50,000, P200,000 and P250,000, respectively. The Articles of Co-partnership provides that the operating income be shared among the partners as follows: As salary, for Herm in the amount of P24,000, for Mar, PI 8,000 and for Ama, P12,000. Interest of 12% on the average capital during 2013 of the three (3) partners and the remainder in the ratio 2:4:4 respectively. Additional information: Operating income for the year ended December 31, 2013, P 176,000. Herm contributed additional capital on July 1, P30,000 and made a drawing on October 1, PI0,000, Mar contributed additional capital on August 1, P20,000 and made a drawing on October 1, PI0,000, and Ama made a drawing of P30,000 on November 1 The partners' capital balances on December 31, 2013 are: a. Herm, PI79,680; Mar, P229,360; Ama, P239,360 b. Herm, PI79,760; Mar, P229,520; Ama, P239,520 c. Herm, P189,680; Mar, P239,360; Ama, P269,360 d. Herm, P223,180; Mar, P272,060; Ama, P280,760 59. A and B entered into a partnership as of March 1,2013 by investing PI 25,000 and P75,000, respectively, they agreed that A, as the managing partner, was to receive a salary; P30,000 per year and a bonus computed at 10% of the net profit after adjustment for the salary; the balance of the profit was to be distributed in the ratio of their original capital balances. On December 31, 2013, account balances were as follows: Cash P 70,000 Accounts Payable P60,000 Accounts receivable 67,000 A, capital 125,000 Furnitures and fixtures 45,000 B, capital 75,000 Sales returns 5,000 A, drawing 20,000) Purchases 196,000 B, drawing 30,000) Operating expenses 60,000 Sales 233,000 Inventories on December 31,2013 were as follows: supplies, P2,500, merchandise, P73,000, prepaid insurance was P950 while accrued expenses were PI,550. Depreciation rate was 20% per year. The partners' capital balances on December 31, 2013, after closing the net profit and drawing accounts, were: A B a. P135,940 P47,960 P49,860 b. P139,540 c. P139,680 P48,680 d. P142,350 P 47,670 Bonus Computations Based on Profit Before Salary, Interest & Bonus 60. On January 2,2011, BB and PP formed a partnership. BB contributed capital of P175,000.00 and PP, P25,000.00. They agreed to share profits and losses 80% and 20%, respectively. PP is the general manager and works in the partnership full time and is given a salary of P5,000.00 a month; an interest of 5% of the beginning capital (of both partner) and a bonus of 15% of net income before the salary, interest and the bonus. The profit and loss statement of the partnership for the year ended December 31, 2011 is as follows: Net Sales P875,000 Cost of goods sold 700,000 Gross profit P175,000 Expenses (including the salary, interest and the bonus) 143,000 Net income P 32,000 The amount of bonus to PP in 2011 amounted to: a. 13,304 c. 18,000 b. 16,456 d. 20,700 61. Garcia and Henson formed a partnership on January 2, 2013 and agreed to share profits 90%, 10%, respectively. Garcia contributed capital of P25,000. Henson contributed no capital but has a specialized expertise and manages the firm full time. There were no withdrawals during the year. The partnership agreement provides for the following: Capital accounts are to be credited annually with interest at 5% of begining capital. Henson is to be paid a salary of PI,000 a month. Henson is to received a bonus of 20% of income calculated before deducting his salary and interest on both capital accounts. Bonus, interest, and Henson's salary are to be considered partnership expenses. The partnership 2011 income statement follows: Revenues P96,450 Expenses (including salary, interest, and bonus) 49,700 Net income P46,750 What is Henson's 2013 bonus? a. P11,688 c. P15,000 b. P12,000 d. P15,038 Based on Profit After Bonus 62. If a partnership has net income of P44,000 and Partner X is to be allocated bonus of 10% of income after the bonus. What is the amount of bonus Partner X will receive? a. 3,000 c. 4,000 b. 3,300 d. 4,400 63. Michelle, an active partner in the Michelle-Esme partnership receive an annual bonus of 25% of the partnership income after deducting the bonus. For the year ended, December 31, 2013, partnership income before the bonus amounted to P240,000. The bonus of Michelle for the year 2013 is: a. P45,000 c. P80,000 b. P48,000 d. P60,000 Comprehensive 64. X, Y and Z, a partnership formed on January 1, 2011 had the following initial investments: X P100,000 Y 150,000 Z - ' 225,000 The partnership agreement states that profits and losses are to be shared equally by the partners after consideration is made for the following: Salaries allowed to partners: P60,000 forX, P48,000 for Y and 36,000 forZ. Average partner's capital balances during the year shall be allowed 10%. Additional information: On June 30, 2011 X invested an additional P60,000 Z withdrew P70,000 from the partnership on September 30,2011. Share in the remaining partnership profit was P5.000 for each partner. The total partnership capital on December 31, 2011 was: a. 405,000 c. 480.000 b. 671,500 d. 672,750 65. MM, NN and OO partners, share profits on a 5:3:2 ratio. On January 1,2012, PP admitted into the partnership with a 10% share in profits. The old partners continue to participate in profits in their original ratio. For the year 2012, the net income of the partnership was reported as P12,500. However, it was discovered that the following items were omitted in the firm's books: Unrecorded at year end 2011 2012 Prepaid expense P800 Accrued expense P600 Unearned income 700 Accrued income 500 (1) The new profit and loss ratio for N, and (2) the share of partner OO in the 2012 net income: a. (1)30%;(2)P2,214 c. (1) 27%; (2) P2.286 b. (1)27%;(2)P2,214 d. (1) 30%; (2) P2.286 Questions 1 & 2 are based on the following: 66. AA, BB and CC are partners with average capital balances during 2011 of P472,500, P238.650, and PI62,350, respectively. The partners receive 10% interest on their average capital balances; after deducting salaries of P122,325 to AA and P82,625 to CC, the residual profits or loss is divided equally. In 2011, the partnership had a net loss of PI 25,624 before the interest and salaries to partners. By what amount should AA's and CC's capital account change - increase (decrease)? AA CC AA CC a. 30.267 (40,448) c. (40,844) 31.235 b. 29,476 17,536 d. 28,358 32,458 67. The same information in Number 32, except the partnership had a loss of P125,624 after the interest and salaries to partners, by what amount should BB's capital account change increase (decrease) ? a. (115,443) c. (41,875) b. 23,865 d. (18,010) Questions 1 & 2 are based on the following: Hanz, Ivy, Jasper, and Kelly own a publishing company that they operate as a partnership. Their agreement includes the following: • • • • Hanz will receive a salary of P20,000 and a bonus of 3% of income after all the bonuses. Ivy will receive a salary of PI 0,000 and a bonus of 2% of income after all the bonuses. All partners are to receive the following: Hanz P5,000; Ivy P4,500; Jasper - P2,000; and Kelly - P4,700, representing 10% interest on their average capital balances. Any remaining profits are to be divided equally among the partners. 68. How would a net loss of P40,000 would be allocated among the partners? Hanz Ivy Jasper Kell a. 3,261.75 (7,169.25) (18,181.25) (17,911.25) b. 3,450.00 (7,050.00) (19,550.00) (16,850.00) c. 4,116.75 (6,764.25) (20,026.25) (17,326.25) d. 45,000.00 4,500.00 (8,000.00) (5,300.00) 69. Assuming a profit of P40,000, how would this amount be distributed to them given the following order of priority: Interest on invested capital, then bonuses, then salary, and then according to profit and loss percentage? Hanz Ivy Jasper Kelly a. 23,261.75 12,830.75 1,818.75 2,088.75 b. 20,867.00 12,433.00 2,000.00 4,700.00 c. 20,740.00 12,560.00 2,000.00 4,700.00 d. 18,038.00 15,262.00 2,000.00 4,700.00 70. K, L, and M are partners with average capital balances during 2013 of P472,500, P238,650, and P 162,350, respectively. The partners receive 10% interest on their average capital balances; after deducting salaries of P 122,325 to K and P82,625 to M, the residual profits or loss is divided equally. In 2013, the partnership had a net loss of PI 25,624 before the interest and salaries to partners. By what amount should K's and M's capital account change? a. b. c. d. K's Capital Account P40,844 decrease P28,358 increase P29,476 increase P30,267 increase M's Capital Account P31,235 decrease P32,458 increase P17,536 increase P40,448 decrease Solution 1 . (a) The weighted average capital would be: WW: January July August P.100,000 x 6 (Jan. - Jun.) P 88,000 x 1 (July) P128,000 x 5 (Aug.-Dec.) Divided by: Months per annum P 600,000 88,000 640,000 P 1,328,000 12 months P110,667 It should be noted that the number of months in the computation includes the current month (before the date of investment or date of withdrawal! since the counting should start at the beginning of the month (let's say June 3, therefore the month of June should be included in the counting to compute the average capital for the PI 00,000). January P120,000 x 5 (Jan. - May) June P105.000 x 5 (June - Oct.) November P155,000 x 2 (Nov. - Dec.) PI,435,000 Divided by: Months per annum RR: P 600,000 525,000 310,000 12 months P119,583 Drawings are ignored as stated in the problem. 2. Date Capital Balances January 1 P8,000 April 1 9,600 June 1 11,200 September 1 7,200 Months Unchanged Peso Months 3 P24,000 2 19,200 3 33,600 4 28,800 12 P105,600 Average Capital of Boom (105,600 + 12) = P8,800 Partnership Operations - Solutions Page 27 3. (b) The annual weighted average capital would be: March 1: P50.000 x 3 June 1: P70.000 x 3 September 1: P65.000 x 4 P620.000 Divided by: Months per annum PI50,000 210,000 260,000 12 months P 51,667 The following should be noted: 1. Only P5.000 withdrawals should be deducted from capital to compute average capital. 2. The question is based on annual, therefore the denominator should be twelve (12 months. However, the 10-month weighted average capital would be P62.000 (P620.000 / 10 months) 4. (a) 5. (c) Withdrawals Investment Share in net income (balancing figure). Net (decrease) increase Net income of the partnership: P90.000 , 30% Salary Interest Balance or Residual profit P(2,600,000) 500,000 900,000 P( 1,200,000) P 3,000,000 JJ P60.000 30.000 KK P30.000 12,000 60,000® Total P 90,000 42,000 150,000 P282.000 Given P60.000 + 40% profit and loss ratio = P150,000 6. Capital balance, beginning Additional investment (land at fair value) Profit share (squeeze) Drawings Capital balance, end Net profit (P50,000 / 40%) ANSWER KEY P120,000 60,000 50,000 ( 80,000) P150,000 P125,000 Page 28 7. Investment Withdrawals Decrease in capital Net decrease in capital Profit share (30%) Net income (45,000 + P 25,000 ( 130,000) 105,000 60,000 P 45,000 P150,000 8. CC PP AA Total Salary P28.000 P28,000 Balance (P84.000-P28,000), .5:3:2 P28.000 PI6,800 11,200 56,000 Additional profit to PP (P21,000 - PI 6,800) (3,000) 4,200 (1,200) P25,000 P21,000 P38.000 P84,000* (b) Net Income would be: Fees P18C000 Less: Expenses 96,000 P 84,000 It should be noted that the additional profit given to PP actually came from CC and AA based on their respective revised P&L ratio (5:2!. The P4,200, additional profit should not be added to total net income because by doing so, it would be tantamount to distorting the net income of P84,000. On the other hand, assuming the P4.200 would be added to net income of P84.000, the total net income will now be P88.200, but an adjustments of P4.200 should be reflected to make it P84.000, and such adjustments will be shared accordingly by CC and AA (5:2!. Mathematically, the final results remain the same 9. (d) A 5% interest on capital* P 2,500 Salaries Balance (3:3:2:2) Additional profit A : P50,000 x 5% = P2,500 B :P25,000x5%= C :P25,000x5%= D :P20,000x5%= 5,000 5,000 PI2,500 B P1.250 3,000 5,000 C P1.250 3,333 P9,250 P4,583 D P1,000 3,333 1,667 P6,000 Total P 6,000 8,000 ]6,666 1,667 P32,333 (d) 1,250 1,250 1,000 Partnership Operations - Solutions Page 29 First, determine who among the partners will receive a fixed amount, then, compute for the residual amount, i.e. for AA P12.500 - P2.500 - P5.000 resulting to a share in the residual profits of P5,000. The P5,000 share in residual profits of AA represents 30%, therefore capitalize P5.000 by 30% to arrive at P/6,666 which will be allocated to all partners based on their profit and loss ratio. Second, determine who among the partners will receive a minimum amount. Any partner who receives an amount lower than the minimum amount is required to have an additional profit, i.e. for partner DD, which in DD's case PI.667 is needed to satisfy the minimum amount provided therein. Any partner who receive an amount equal, or more than the minimum amount obviously does not need an additional profit. 10. (b) Sales Less: Cost of goods sold Gross profit Less: Operating expenses Operating income Less: Other expenses: Interest expense Net Income P70.000 40,000 P30,000 10,000 P20.000 2,000 PI8,000 (b) Salaries to partners are considered as an allocations of net income rather than as determinant of net income. In other words, salaries to partners are not expenses of the partnership, but part of profit and loss sharing plan. 11. Suggested answer: (b) 180,000 Sales 700,000 Less cost of goods sold 400,000 Gross profit 300,000 Less operating expenses 100,000 Operating profit 200,000 Less interest paid to banks 20,000 Net income 180,000 Salaries, like interest on capital investments, are viewed as a means of allocating income rather than as an expense. The drawing account is a temporary account and is periodically closed to the partner's capital account, and has nothing to do with the computation of net income. ANSWER KEY Page 30 12. (d) To equate P52.000 to P40.000 plus bonus, the bonus should amount to P12.000 (P52.000 - P40,000j to be indifferent under the two profitsharing options. Since Cab would receive the same bonus, the total bonus would have to be P24.000 (P12.000 x 2j. Based on the foregoing, the following equation should be developed: Bonus = 10% (Net income - Salaries - Bonus) P24.000 = .10 [Nl - (P30,000 + P40.000) - P24.000] P24,000= .10 [NI-P94.000] P24,000 = .10 Nl - P9.400 P33,400 = .10 Nl P33,400/.10 = NI Nl = P334.000 (d) or, alternatively: Bonus = P52.000 P24.000-.10 (Nl P24.000 = .10 (Nl P24.000 = .10 Nl P33,400 = .10 Nl Nl = P334.000 P40,000 = PI2,000 x 2 = P24.000 Salaries - Bonus) P70,000 - P24,000) P9,400 13. (b) To equate P40,000 to P25.000 plus bonus, the bonus should amount to P15,000 (P40,000 - P25.000!. Based on the foregoing the following equation should be developed: Bonus= P15,000 PI5,000 P15.000 P29,000/.l Nl 10% (Nl - Salaries - Bonus) = .10 [Nl - (P100.000 + P25.000) = .10 [Nl-PI40,000] = .10 NI-P14.000 = Nl = P290.000 (b) Partnership Operations - Solutions PI 5,000] Page 31 or, alternatively: P40.000 P40.000 (PI00.000 + P25.000) P40,000 P40,000 P40,000 P29,000 Nl P25.000 + 10 (Nl - salaries - bonus) P25,000 + 10 [NlPI 5,000] P25.000 + 10 [Nl-PI40,000] P25.000 + 10NI-PR000 PI 1,000 + 10 Nl .10 Nl P290.000 (b) 14. Bonus required (P40,000 - P25,000) Divided by Total comprehensive income after bonus and salaries Add back: Salaries (P25,000 + P100,000) Bonus Net profit before bonus and salaries P 15,000 10% 150,000 P125,000 15,000 140,000 P290,000 15. Partnership net income or net loss is shared based on capital contribution of the partners, unless the partnership contract specifically indicates otherwise. As a result, it is customary to refer to the basis as the income ratio, income and loss ratio, or the profit or loss ratio. Thus, the share of Partner C, should be P 12,000 (60,000x20%). 16. Interest Salaries Balance, equally Total Total Henry P 44,000 P 24,000 100,000 60,000 (210,000) ( 70,000) P(66,000) P(14,000) Annual salary Interest Balance, equally Total Dexter P72,000 18,000 (31,900) P 5 8,100 17. 18. Salaries Interests Balance, equally Total 19. (a) ANSWER KEY Zeep P 7,200 2,000 ( 8,600) P 600 Joliver P60,000 13,800 (31,900) P41,900 Beep P16,000 1,600 ( 8,600) P 9,000 Marta P 12,000 40,000 ( 70,000) P(58,000) Nestor P8,000 ( 80,000) P(22,000) Total PI 32,000 31,800 (63,800) PI 00,000 Total P 23,200 3,600 ( 16,600) P 9,600 Page 32 First 6 months Salaries Balance (60%:40%) 175,000 Second 6 months Salaries Balance (40%:40%:20%) 175,000 196,000 Evenly means average S 15,000 96,000 T U Total 15,000 160,000 64,000 25,000 60,000 60,000 30,000 25,000 150,000 124,000 30,000 350,000 AA P18.000 1,500 PI 9,500 2,400 P21,900 DD Total PI 8,000 3,000 P21,000 4,000 P25,000 20. (a) Salary Balance: Equally Income for year 2013 only Income for year 2012 (60:40) Reported income for year 2013 21. Salaries Balance, capital ratio Total Alba Bana P5,000 P3,000 6,000 4,000 P11,000 P7,000 Cad a P8,000 2,000 P2,000 PI,500 PI,500 1,600 P3,100 Total 12,000 P20,000 22. Suggested answer: (b) 43,000, 37,000 Salary allowances Loss after allowances (60:40) Earnings credited to partners Red 55,000 (12,000) 43,000 White 45,000 (8,000) 37,000 Total 100,000 (20,000) 80,000 The earnings before any allowance of P80.000 is reduced by the salary allowances in the total amount of P100,000 which resulted to a loss after allowances of P20,000, because credits to partners capital accounts are based on earnings after allowances (e.g. interest, salary, and bonus). It should be pointed out that per partnership agreement profits should be shared equally and losses in a 60/40 ratio, thus the loss of P20.000 was shared at 60/40 ratio 23. (b) XX Partnership Operations - Solutions YY 11 Total Page 33 XX First P200.000 x 10% Over P200.000: (500,000 P200.000) x 20% YY and ZZ: 5% of remaining income over P300,000: (P500,000 - P20.000 P60.000 - P300,000) x 5%.. Balance: Allocate equally 24. To A(P 1,000,000x10%) (1,500,000x20%) To B & C (2,500,000-400,000 1,500,000=600,000x5%) Balance, equally Total P 20,000 P 20,000 60,000 60,000 P 6,000 P 6,000 12,000 136,000 136,000 136,000 408,000 P216,000 PI42,000 PI42,000 P500.000 A P 100,000 300,000 B P 400,000 P 30,000 680,000 Pl,080,000 P 30,000 60,000 680,000 680,000 2,040,000 P710,000 P710,000 P2,500,000 C Total 25. Suggested answer: (a) 1,000 decrease Young Zinc Total BB P30.000 Total P30,000 P60,000 2,167 ( 1,483) P30,684 800 ( 1,484) P29,316 2,967 ( 2,967) P60,000 (d) 10% interest on ave. capital: (10% x 160,000) PI6,000 (10% x 100,000) PI 0,000 P26.000 Balance (equally) (11,000) (11,000) (22,000) Total P 5,000 (PI,000) P 4,000 The partnership profit before interest was P4.000, however, it resulted to a loss of P 2 2,000 after interest. Thus, the capital balance of Zinc decreases by PI,000. 26. (d) AA Salaries Bonus* Interest on Average Capital** Balance (equally) *No bonus, since the basis of such computation would be zero. "Interest on Average Capital: AA: P30.000 x 3 = P 90,000 ANSWER KEY Page 34 P20.000 x 2 = P 40,000x4 = P35,000 x 1 = 40,000 160,000 35,000 P325.000 10-Month Average Capital: P325,000 / 10 = P32.500 x 8% x 10/12 = P2,167 Annual Average Capital: P32,500 / 12 = P27,083 x 8% = P2.167 BB: P20.000 x 3 = P 60,000 P10,000x2= 20,000 P 8,000-x5= 40,000 P120,000 10-Month Average Capital: P120.000 / 10 = P1Z000 x 8% x 10/12 = P800 Annual Average Capital: P120,000 / 12 = P10.000 x 8% = P800 27. (c) Bonus Interest: 10% (PI 10,000-P 100,000) .. Salaries Balance: 4:4:2 Bonus = 10% (Nl - Bonus) B = .10(P44,000-B) B= PA.400- JOB 1.108=P4,400 B = P4.000 A B C Total P4,000 P4,000 P1.000 1,000 P10.000 12,000 22,000 3,400 17,000 P19,400 P44.000 28. Salaries Bonus 10% Interest on Average Cap. Balance (equally) Hunt P20.000 3,000 Rob P10,000 2,000 Partnership Operations - Solutions Turman - Kelly - Total P30,000 5,000 Page 35 5,000 4,500 P2,000 P4,700 16,200 13,450 13,450 13,450 13,450 53,800 P41,450 P29,950 P15,450 P18,150 PI05,000 Bonus = (3% + 2%) (Net Income - Bonus) B = 5% (P105,000.-B) B = P5,250 - .05 B 1.05B = P5,250 B = P5,250 / 1.05 B = P5.000, therefore Hunt should receive P3.000 (P5.000 x 3/5), while Rob will receive P2.000 (P5,000 x 2/5). 29. Suggested answer (c) 41,000 Salaries 30,00.0 45,000 75,000 Bonus (after bonus) NY before Bonus 27,500 NY after Bonus (27,500/110%) 25,000 2,500 2,500 10% interest 2,000 3,500 5,500 Balance (1/3:2/3) 6,500 13,000 19,500 Total 41,000 61,500 102,500 One of the alternatives in profit allocations if the net income is not sufficient is to completely satisfy all provisions of the profit and loss agreement and use the profit and loss ratios to absorb any deficiency or additional loss caused by such action. 30. Suggested answer: (a) 28,600 10% bonus to Donn 6% interest on average capital Balance (equally) Total Donn 10,000 Eddy Farr Total 10,000 4,800 26,800 41,600 3,000 26,800 29,800 1,800 26,800 28,600 9,600 80,400 100,000 In some instances, a managing partner is allowed a bonus that is to be based on the earnings of the business. The bonus is commonly stated as a percentage of profits, but the agreement should indicate whether the percentage is to be applied to the profit determined bejbre deduction of the bonus or after deduction of the bonus. Based on the data provided in this problem, the "10% bonus of the profit" was assumed to be applied to the profit before deduction of the bonus. 31 . (c) The weighted-average capital is computed as follows: ANSWER KEY Page 36 January 1 -July 1 July 1 - August 1 August 1 -December 31 P5,535,000 Divided by: Weighted-average capital Multiply by: Interest rate peryear Amount of interest per year P420.000 x 6 months P540,000 x 1 month P495,000 x 5 months P2,520,000 540,000 2,475,000 12 months P 461,250 10% P 46,125 32. Date Balances Unchanged January 1 PI40,000 6 July 1 180,000 1 August 1 165,000 5 Total 12 Weighted average capital (1,845,000/ 12 months) Interest rate Interest to be credited to Simm Total P 840,000 180,000 825,000 PI,845,000 PI53,750 10% P 15,375 When partners wish to distribute profits in terms of relative investments, the 'use of average capitals, which provides for the recognition of capital changes during the period, normally offers the most equitable method. From the data given above, partners investment were expressed in terms of peso-month. Under this method (peso-day, peso-month), withdrawals and investments made during the first half of the month should be treated as if they were made on the first day of the month, while withdrawals and investments made during the later half of the month should be treated as if they were made on the first day of the following month 33 Capital Balances P280.000 360,000 330,000 Months Peso Date Unchanged Months January 1 6 PI,680,000 1 360,000 July 1 August 1 5 1,650,000 P3,690,000 Average capital (P3,690,000 /12) P 307,500 Interest (P307,500 x 10%) P 30,750 34. (d) Salary Allowances Interest on Average Capital ................. Partnership Operations - Solutions DD P 8,000* 2,800** BB PI 0,000* 3,600** Total PI 8,000 6,400 Page 37 Balance (equally) ( 200) PI 0,600 200) PI 3,400 Net income of P24.000 would be computed as follows: Service Revenue Less: Expenses: Supplies PI 7,000 Utilities '. 4,000 Other miscellaneous expenses 5,000 Net Income. *DD : P800x 10 = P8.000 *BB : Pl.OOOx 10 = P10.000 Refer to No. 16 for discussion on salaries. ""Interest on Average Capital: DD: P30.000 x 2 = P 60,000 P26,000x5= 130,000 P30.000 x 3 = 90,000 P280.000 400) P24,000 (d) P50,000 26,000 P24.000 10-month Average Capital: P280.000 / 10 = P28.000 x 12% x TO/12 = P2,800 Annual Average Capital: P280.000 / 12 = P23.333 x 12% = P2.800 BB: P30,000x4= PI 20,000 P40.000 x 6 = 240,000 P36O000 10-month Average Capital : P360.000 / 10 = P36.000 x 12% x 10/12 = P3.600 Annual Average Capital : P36.000 / 12 = P30.000 x 12% = P3.600 35. (b) Interest on Average Capital: DD: 20% x P 42,000^ EE: 20% x 30,000" Balance: equally Average Capitals: © DD: 1/1 -4/1 : P40,000x3 4/1 -8/1 : P35.000x4 ANSWER KEY DD EE Total P 6,000 52,800 P58,800 P 14,400 105,600 PI20,000 (b) P 8,400 52,800 P61,200 PI 20,000 140,000 Page 38 8/1 - 10/1 : P45,000 x 2 10/1 - 12/1 : P50,000x2.. 12/1 - 12/31 : P54,000x P504.000 Divided by: Weighted - average capital. EE: 6/1 : P25,000 x 5 1/1 6/1 - 9/1 : P35,000x3 9/1 - 10/1 : P32.000 x 1 ... 10/1 -12/I : P31.000x2. 12/1 12/31 : P36,000 x 1 P360,000 Divided by: Weighted - average capital. 36 Bonus to A [(P24,000 + 120%) x 20%] Balance, 3:2 Total 37 Salaries (360,000x2/12) Bonus Balance (equally) Total A B P 4,000 P 4,000 12,000 3,000 PI6,000 P 8,000 Zita 60,000 60,000 150,000 270,000 90,000 100,000 1 54,000 12 months P 42,000 PI 25,000 105,000 32,000 62,000 36,000 12 months P 30,000 Total 20,000 P 24,000 Jones 60,000 150,000 210,000 Total 120,000 60,000. 300,000 480,000 Net income before bonus 360,000 Net income after bonus (360,000/120%) 300,000 Bonus 60,000 Note that based on the given information, the net income after salaries is P360.000 (300,000 + 60,000), which is equivalent to P480,000 net income before salaries, bonus and distribution of balance using profit and loss ratio (equally). 38. Suggested answer (d) 210,000 Adam Eve Total Salaries 60,000 60,000 120,000 Bonus to Adam: NY before bonus P360,000 Partnership Operations - Solutions Page 39 - NY after bonus (360,000/ 120%) Balance (equally) 300,000 Total 300.000 60,000 150,000 270,000 150,000 210,000 60,000 300,000 480,000 It should be pointed out that it was clearly mentioned in the problem that the P360,000 net income is after salaries but before bonus, therefore, the net income before salaries and bonus should be P480,000 (120,000 + 360,000). 39. Suggested answer: (d) 136,543, 103,457 A, capital: Date January 1 May 1 Aug. 1 Oct. 1 Total PI20,000 100,000 110,000 100,000 Months Balances 4 3 2 3 12 Unchanged Total P 480,000 300,000 220,000 300,000 Pl,300,000 Average capital - A = PI,300,000/12 = PI08,333. B, capital: Months Date Balances Unchanged January 1 P80,000 4 Mayl 70,000 2 Julyl 90,000 3 Oct. 1 85,000 3 Total 12 Average capital - B = P985,000/12=E8Zfl82 A P240,000x (108,333/190,417) B 240,000 x (82,083/190,417) Total Total P320,000 140,000 270,000 255,000 P985,000 P136,543 103,457 P240,000 Again, under this method (peso-day, peso-month), withdrawal and investments made during the first half of the month should be treated as if they were made on the first day of the month, while withdrawals and investments made during the latter half of the month should be treated as if they were made on the first day of the following month. 40. Suggested answer: (a) 121.500, 118,500 ANSWER KEY Page 40 A B Total Interest on ending capital (100,000 x 20%) P 20,000 (85,000x20%) P 17,000 P 37,000 Balance (equally) 101,500 101,500 203,000 Total P121,500 P118,500 P240,000 The capital contributions to be considered as the basis for the distribution of profits and losses should be clearly defined in the agreement, because it may be based on the original capital contribution, on the capitals at the beginning of each period, on the capitals at the end of each period, or on the average capitals during the period 41. Suggested answer (d) 8,800 AA BB Total Salaries (30:45) 8,800 13,200 22,000 Another alternative in profit allocation if the net income is not sufficient is to satisfy each of the provision to whatever extent it is possible. In other words, the allocation of salaries would be satisfied to whatever extent possible before the allocation of interest is begun. If the provision of the profit and loss agreement are ranked by order of priority starting with salaries, and the total salaries amounted to P75,000, therefore the net income of P22,000, which is insufficient, will be distributed between AA and BB based on the degree of salary claims 42. Interest 8% x 80,0008% x 100,000Salary (20:30) Luz Vi 75,000 75,000 11,040 400 16,560 Minda 2,000 Total 2,400 27,600 Total 11,040 16,960 2,000 30,000 Again, where income is not sufficient or an operating loss exists, two alternatives may be employed: 1.) all provisions of the profit and loss agreement may be satisfied and any deficiency will be absorbed using the profit and loss ratio; and 2.) each of the provision may be satisfied to whatever extent possible. The second alternative, as applied above, requires that provisions of the profit and loss agreement be ranked by order of priority 43. Vick's share of undistributed losses (30% x 30,000) 9,000 If the partners agree to distribute profits based on profit sharing ratio but are silent on loss sharing, partnership losses will be divided based on the agreed profit sharing proportions. 44. Suggested answer: (a) 0 In case there is an industrial partner, and there is no profit and loss sharing agreement, an industrial partner shall not be liable for the losses. As to profit, the share of an industrial Partnership Operations - Solutions Page 41 partner shall be that which is just and equitable under the circumstances. In order for an industrial partner be liable for the losses, there should be an expressed stipulation to that effect. 45. FF Interest on excess (deficiency): FF (P2,500,000 - P3,000,000) x 6% x 1/2 GG (P1,250,000 - P1,375,000) x 6% x 1/2 HH(Pl,250,000-Pl,000,000)x6%xl/2 Balance, 5:3:2 Total GG HH Total P 15,000 3,750 (7,500) P 11,250 ( 36,875) ( 27,135) ( 14,750) (73,750) P(2l,87S) P(18,37S) P(22,250)P(62,S00) 46. (a) AA Interest on Average Capital: AA:P360,000xl0% BB: PI 80,000x10% CC: PI20,000x10% Salaries Balance or Residual: Equally. Increase (decrease) BB CCTotal P36.000 PI 8,000 PI 2,000 P66,000 90,000 60,000 ' 150,000 (105,000) (105,000) (105,000) (315,000) P21,000 P(87,000) P(3,000) P(99,000) 47. Suggested answer: (a) 7,000 increase 10% interest on average capital Salaries Bal. (equally) Total inc(dec) ' Fox Greg Howe Total 12,000 30,000 (35,000) 7,000 6,000 4,000 20,000 (35,000) (11,000) 22,000 50,000 (105,000) (33,000) (35,000) (29,000) Again, v/hen the partnership agreement provides without qualification that interest is to be allowed on investment, interest must be allowed even though operations have resulted in earnings that are less than the allowable interest or in a loss. And when agreement also provides for salaries without qualification, salary distribution must be made even though profit is inadequate to cover salaries or there is a loss. Interest and salary allowances allocated to partners increase their capital balances as well as the amount of loss. Accordingly, the amount of loss will reduce the partners' capital accounts. The resulting loss in the total amount of PI 05,000 after the interest and salary allowances was allocated among partners equally based on their agreement, that profit and loss is divided equally. ANSWER KEY Page 42 48. (b) Capital, March 1,2011 Add: Net Income* Total Less: Drawings Capital, December 31, 2011 *Allocation of Net Income Salary (10 months) Bonus* Balance: 125:75.. AA P125,O00 34,540 P159,540 20,000 PI39,540 AA P 25,000 1,440 8,100 P 34,540 Sales Less: Sales returns Net Sales Less: Cost of goods sold: Inventory, March 1 Add: Purchases Cost of goods available for sale Less: Inventory, December 31 Gross profit Less: Operating Expenses [P60.000 - P2.500 - P950 + PI,550 + (20% x P45,000 x 10/12)] Net Income Bonus = 10% [Nl - Salaries] B = .10 [P39.400 - (P30.000 x 10/12)] B = .10 (PK400) B = PI,440 49. (c) XX Capital, January 1,2012 P120.000 Salaries P 30,000 Bonus* 1,500 Balance: 30%: 30%: 40%.. 3,600 Share in Net Income P 35.100 Partnership Operations - Solutions YY P120,000 P 30,000 1,500 3,600 P 35,100 BB P75,000 4,860 P79,860 30,000 P49,860 BB P 4,860 P 4,860 Total P200,000 39,400 P239,400 50,000 PI89,400 (b) Total P 25,000 1,440 12,960 P 39,400 P233.000 5,000 P228.000 P -0196,000 P196,000 73,000 123,000 P105,000 65,600 P 39,400 ZZ P120,000 P 45,000 4,800 P 49,800 Total P360.000 PI05,000 3,000 12,000 P120,000 Page 43 Less: drawings - personal 30,000 P5,100 Capital, December31, 2012.P125,100 30,000 P5,100 P125,100 45,000 P4,800 P124,800 105,000 P 15,000 P375,000 Bonus=25%(Nl-Salaries-Bonus) B = .25 (P120,000 - P105,000 - B) B = P3.750 - .25 B 1.25B = P3,750 B = P3.000; P1,500 for XX and YY. 50 . (d) Capital, January 1,201 Add:lnvestment Net Income Total Less: Withdrawals Capital, December 31,2011 HH MM PI50,000 P200,000 30,000 20,000 53,180 62,060 P233,180 P282,060 10,000 10,000 P223,180 P272,060 AA P250,O00 60,760 P310,760 30,000 P280,760 Total P600,000 50,000 176,000 P826.000 50,000 P776,000 HH MM P 24,000 P 18,000 AA P 12,000 Total P 54,000 29,400 19,360 P 60,760 73,600 48,400 PI76,000 Salary Interest on Average Capital* HH: 12% x PI 62,500 ......................... MM : 12% x P205,833... AA:12%xP245,000 ......................... Balance: 2:4:4 Average Capitals: HH" 1/1 -7/1 7/1 - 10/1 10/1 - 12/31 24,700 9,680 19,360 P 53,180 P 62,060 : P150,000x6 : P180,000x3 : P170,000x3. Divided by: Months per annum . months ANSWER KEY 19,500 P 900,000 540,000 510,000 P1,950,000 12 Page 44 Weighted-average capital MM: 1/1 -8/1 8/1- 10/1 10/1- 12/31 P162,500 : P200,000x7 : P220.000 x 2 : P210,000x3 P1,400,000 440,000 630,000 P2,470,000 12 Divided by: Months per annum. months Weighted-average capital AA: 1/1 11/1 : P250.00X10 11/1 12/31 : P220,000x2 P Divided by: Months per annum. months Weighted-average capital 51. P205,833 P2,500,000 440,000 2,940,000 12 P245,000 Capital balances, beginning-1 st year Net loss: Annual salary Interest Balance, beg capital ratio Total Total Drawings Capital balances, beginning-2nd year Tan P200,000 May PI 00,000 Total P3 00,000 240,000 20,000 ( 270,000) ( 10,000) 190,000 ( 10,000) P180,000 120,000 10,000 ( 135,000) ( 5,000) 95,000 ( 10,000) P 85,000 360,000 30,000 ( 405,000) ( 15,000) 285,000 ( 20,000) P265,000 Total comprehensive income: Annual salary Interest Bonus Balance, equally' Total Total Drawings Capital balances, end of 2nd year 240,000 18,000 5,000 ( 168,250) 94,750 274,750 ( 10,000) P264,750 120,000 8,500 Partnership Operations - Solutions 360,000 26,500 5,000 ( 168,250) ( 336,500) ( 39,750) 55.000 45,250 320,000 ( 10,000) ( 20,000) P 35,250 P300,000 Page 45 52. Capital balances, March 1,2013 Additional investment, Nov. 1 Total Total comprehensive income, P120,000 distributed as follows: Interest (10 months) Bonus (Schedule 1) Balance, P17,000 equally Salaries (10 months) Total Drawings Capital balances, December 31, 2013 Schedule 1: Total comprehensive income before salaries, interest and bonus (P120,000 + P300,000) Total comprehensive income after bonus (P420,000 / Bonus Roy PI 50,000 Sam PI 80,000 60,000 P240,000 PI 50.000 15,000 70,000 8,500 100,000 P343,500 (100,000) P243,500 120%) 18,000 8,500 200,000 P466,500 (200,000) P266,500 P420,000 350,000 P 70,000 53. Eve's capital balance, January 1 Additional investment Profit share (Schedule 1) Drawings Eve's capital balance, December 31 P 374,000 22,000 1,063,400 ( 750,000) P 709,400 Schedule 1 Total receipts (PI,500,000 + PI ,625,000) Expenses Comprehensive income P3,125,000 1,080,000 P2,045,000 Distributed as follows: Adam (Pl,500,000/P3,125,000 x P2,045,000) Eve (Pl,625,000/P3,125,000 x P2,045,000) P 981,600 Pl,063,400 54. Capita! balances, Jan. 1,2011 Net profit: Salaries Bonus (Schedule 1) ANSWER KEY KK P144,000 SS P144,000 WW P144,000 Total P432,000 36,000 1,800 36,000 1,800 54,000 126,000 3,600 Page 46 Balance, 3:3:4 Total Total Drawings Capital balances, Dec. 31,2013 4320 42,120 186,120 36,000 P150,020 4,320 42,120 186,120 36,000 PI50,020 5,760 59,760 203,760 54,000 PI49,760 14,400 144,000 576,000 126,000 P450,000 Schedule 1: Total comprehensive income before bonus and salaries Less salaries Total comprehensive income before bonus Total comprehensive income after bonus (PI8,000/125%) Bonus P 144,000 126,000 18,000 14,400 P 3,600 Equally to KK and SS. 55 Capital balances before closing Comprehensive income, P39,400 (Sch. 1): Salaries (P30,000 x 10/12) Bonus (P3 9,400 - P25,000) -=- 10% x 10% Balance, 125:75, P12,960 Total Drawings Capital balances, Dec. 31, 2013 Schedule 1: Sales Sales returns and allowances Net sales Cost of sales: Purchases Merchandise inventory, Dec. 31 Gross income Operating expenses: Unadjusted Supplies Partnership Operations - Solutions Tim P125,000 P Tom 75,000 25,000 1,309 8,182 4,909 159,491 79,909 ( 20,000) (30,000) P139,491 P49,909 P233,000 5,000 228,000 PI 96,000 73,000 105,000 123,000 P 60,000 ( 2,500) Page 47 Prepaid expenses Accrued expenses Depreciation (P45,000x 20% x 10/12) Total comprehensive income ( 950) 1,550 7,500 56 Phil Capital, January 2,2013 Additional investment Profit share, (Schedule 1) Drawings (Pl,500x 12) Phil capital balance, December 31, 2013 Schedule I. Phil Interest, (Schedule 2) P25,920 Salaries 28,800 Remainder, 4:3:3 ( 2,400) Total P52,320 Schedule 2: Phil: 1/1 P192,000 x6/12= P 7/1 240,000 x6/12= P216,000 x 12% Art: 1/1 P288,000 x 12% Rey: 1/1 P432,000 x9/12= 10/1 360,000 x3/12= P414,000 x 12% 57. Balances at January 1, 2013 Additional Investment Withdrawal Net income (Sch. 1) Regular drawings Balances at December 2013 Schedule 1 Salaries Interest on average capital ANSWER KEY 65,600 P39,400 P192,000 48,000 52,320 (18,000) P274,320 Art P34,560 24,000 ( 1,800) P56,760 Rey P49,680 27,200 ( 1,800) P75,080 Total PI 10,160 80,000 (6,000) P184.160 96,000 120,000 = P25,920 = P34,560 P324,000 90,000 = P49,680 Gary P 80,000 20,000 22333 ( 10,000) Pll2,333 P410,000 Gary P 12,000 Jerome P120,000 22,733 ( 10,000) P132J33 Paul P180,000 (30,000) 24,934 ( 10,000) P164,934 Total P380,000 20,000 (30,000) 70,000 30,000 Jerome P 10,000 Paul P 8,000 Total P 30,000 Page 48 balance (Sch. 2) Total Remainder divided equally Division of comprehensive income 7,200 19,200 3,133 9,600 19,600 3,133 13,800 21,800 3,134 30,600 60,600 9,400 P 22,333 P 22,733 P 24,934 P 70,000 Schedule 2: Gary P80,000 x8%x6/12 P100,000 x8%x6/12 Jerome PI20,000 x 8% Paul PI80,000 x8%x9/12 P150,000 x8%x3/12 Total P 3,200 4,000 10,800 3,000 P 7,200 9,600 13,800 P30,600 58. To compute the answer a statement of partner's capital should be prepared as follows: Herm Mar Capital balances, 1/1/013 P150,000 P200,000 Additional Investment 30,000 20,000 Drawing ( 10,000) ( 10,000) Net income (sch. 1) 53,180 62,060 Capital balances, 12/31/013 P223,180 P272,060 Schedule 1 - Distribution of Net Income: Salaries P 24,000 P 18,000 Interest (Sch. 2) 19,500 24,700 Remainder, 2:4:4 9,680 19,360 Total P 53,180 P 62,060 Schedule 2 - Computation of Interest: Herm: P150,000 x 12% x 6/12= P 9,000 180,000 x 12% x 3/12= 5,400 170,000 x 12% x 3/12= 5,100 Total PI 9,500 Mar. 200,000 x 12% x 7/12= 220,000 x 12% x 2/12= 210,000 x 12% x 3/12= Total 14,000 4,400 6,300 P24,700 Ama: 25,000 250,000 x12x10/12= Partnership Operations - Solutions Ama P250,000 ( 30,000) 60,760 P280,760 Total P600,000 50,000 ( 50,000) 176,000 P776,000 P 12,000 29,400 19,360 P 60,760 P 54,000 73,600 48,400 P176,000 Page 49 220,000 Total x12x2/12= 4,400 P29,400 59. Schedule 1 - Computation and Distribution of Net Profit Net Sales (P233,000- 5,000) Cost of Sales (PI 96,000- 73,000) Expenses: Operating expense P60,000 Supplies ( 2,500) Prepaid insurance (950) Accrued expenses 1,550 Depreciation (45,000 x 20% x 10/12) 7,500 Comprehensive income Distribution Salary: (P30,000 x 10/12) Bonus: (P39,400 - P25,000) x 10% Remainder, at 5:3 Total Total P25,000 1,440 12,960 P39,400 Partners' capital balances, Dec. 31, 2013: Initial investments Share in Profit (Schedule 1) Drawing Dec. 31, 2013 capital balances P228,000 P123,000 65,600 A P 25,000 1,440 8,100 P 34,540 A P125,000 34,540 ( 20,000) PI 39,540 ( 188,600) P 39,400 B 4,860 P4,860 B P 75,000 4,860 ( 30,000) P49,860 60. (c) Bonus = .15 (Nl before salaries, interest and bonus) B = .15 (Nl after salaries, interest and bonus + salaries + interest + bonus) B = .15 [P32,000 + (P5,000 X 12) + (5% x P200.000) + B] B. = .15 [P32.000 + P 60,000 + P10,000 + B] B = .15 [PI02,000 + B] B = P15.300 + .15B B - .15 B = P15,300 .85 B = PI5,300 B = P15,300/.85 B = PI8,000 (c) 61. Comprehensive income P 46,750 ANSWER KEY Page 50 Add: Salary (PI,000 x 12 mo.) 2,000 Interest (P25,000 x 5%) 1,250 Comprehensive income before salary and interest* P 60,000 Divide by + 80% Comprehensive income before salary, interest and bonus P 75,000 Less income before salary and interest 60,000 Bonus to Henson PI5,000 *Since P60.000 is the total comprehensive income before salary and interest and the bonus is 20% before deducting salary and interest, then P60.000 = 80% of the income base to be used for computing the bonus. 62. Net income before bonus Less net income after bonus (44,000/110%) Bonus (10%) 44,000 40,000 4,000 Note that the provision for bonus is 10% of income AFTER the bonus, thus the bonus is the difference between the net income before and after the bonus. 63. Comprehensive income before Bonus Comprehensive income after Bonus (240,000 - 125%) Bonus P240,000 192,000 P 48,000 64. (d) Total P475.000 60,000 207,750 P742.750 70,000 P672.750 Capital, January 1, 2011 Add: Investment Net Income* Total Less: Withdrawals Capital, December 31, 2011 Net Income: Salaries Interest on Average Capital: Partnership Operations - Solutions X Y z P60.000 P 48,000 P36.000 Total P144.000 Page 51 X: 10% x P130.000 Y : 10% x P150.000 Z: 10% x P207,500 Balance P207.750 65. 13,000 5,000 15,000 5,000 Average Capital: X: P100,000x6 P160,000x6 = PI,560,000 = P 600,000 960,000 + 12 = P130,000 Z: P225,000x9 P155,000x3 P2,490,000 P2,025,000 465,000 +.12 = P207,500 = = 20,750 5,000 48,750 15,000 1. Profit and loss ratio: Old MM50%X90% NN 30%X90% OO20%X90% PP 100% New 10% 100% =45% =27% =18% =10% 100% (2) Reported Net Income P12,500 Add (deduct): adjustments a. Prepaid expense-2011 ( 800) b. Accrued expense-2012 ( 600) c. Unearned income-2011 700 d. Accrued income-2012 500 Adjusted Net Income P12,300 Multiply by: P & L ratio of 00 18% Share of OO in net income P 2,214 (b) a. Omission of prepaid expense at the end of 2011 indicates the expense was recognized when paid in 2011 and not when used in 2012, thereby ANSWER KEY Page 52 b. c. d. 66. understating the expenses and overstating income in 2012. Omission of accrued expense at the end of 2012 understate expenses and overstate income. Omission of unearned income at the end of 2011 indicates income was recognized when received in 2011 and not when earned in 2012, thereby understating the 2012 income. Omission of accrued income at the end of 2012 understate income AA BB CC Total 10% Interest on average capital* P47,250 P 23,865 P 16,235 P 87,350 Salaries 122,325 82,625 204,950 Balance equally... (139,308) (139,308) (139,308) (417,924) Increase (decrease) P30267 P( 115,443) P(40,448) P( 125,624) AA : 10% x P472.500 = P47,250 BB : 10% x P238,650 = P23.865 CC : 10% x PI 62,350 = P16,235 67. (d) AA BB P47,250 P23,865 122,325 (41,875)* (41,875)* P 85,200 P(18,010) *Not rounded due to discrepancy of PI 10% Interest on average cap. Salaries Balance: Equally 68. Suggested answer (b) 3,450, (7,050), (19,550), (16,850) Hanz Ivy Jasper Salaries 20,000 10,000 Interest 5,000 4,500 2,000 Balance (equally) (21,550) . (21,550) (21,550) Total 3,450 (7,050) _(19,550) Kelly 4,700 Total 30,000 16,200 (21,550) (16,850) (86,200) (40,000) Based on the information provided in the problem, the profit and loss ratios are used to absorb any deficiency or any additional loss. Partnership Operations - Solutions Page 53 69. Interest Bonus (3:2) Salaries (20:10) Total Hanz 5,000 1,1,43 14,597 " 20,740 Ivy 4,500 762 7,298 12,560 Jasper 2,000 Kelly 4,700 2,000 4,700 Net income before bonuses Net income after bonuses (40,000/105%) Bonuses Total 16,200 1,905 21,895 40,000 40,000 38,095 1,905 If each of the provision of the profit and loss agreement are satisfied to whatever extent it is possible based on the given order of priority, at such provision (salaries) the remaining amount (21,895) shall be allocated using the degree of the claims. 70. Total 10% interest on average capital balances Salary allowances Balance (deficit), equally Total ANSWER KEY K P87350 P47,250 204,950 122,325 ( 417,924) (139,308) P(125,624) P30,267 M N P 23,865 82,625 ( 139,308) P(l 15,443) P 16,235 (139,308) P(40,448) Page 54