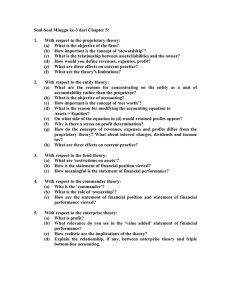

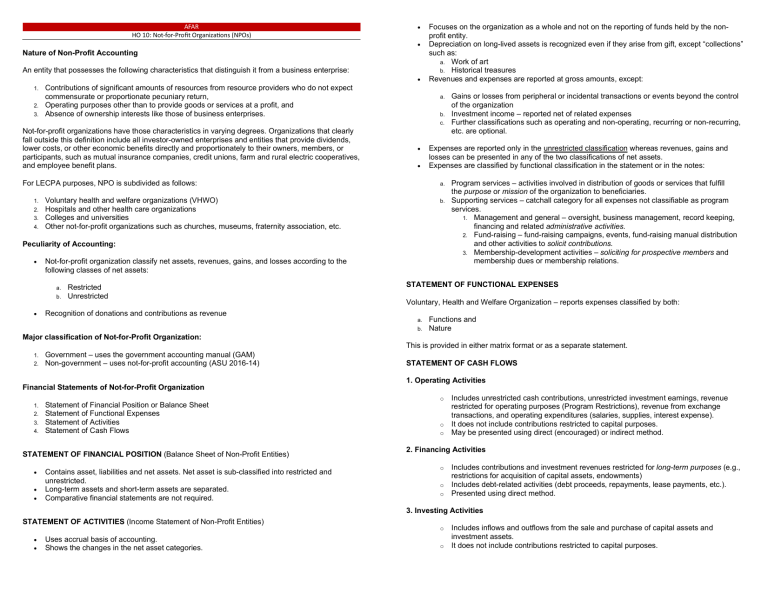

AFAR HO 10: Not-for-Profit Organiza ons (NPOs) Nature of Non-Profit Accounting An entity that possesses the following characteristics that distinguish it from a business enterprise: 1. 2. 3. Contributions of significant amounts of resources from resource providers who do not expect commensurate or proportionate pecuniary return, Operating purposes other than to provide goods or services at a profit, and Absence of ownership interests like those of business enterprises. Focuses on the organization as a whole and not on the reporting of funds held by the nonprofit entity. Depreciation on long-lived assets is recognized even if they arise from gift, except “collections” such as: a. Work of art b. Historical treasures Revenues and expenses are reported at gross amounts, except: a. b. c. Not-for-profit organizations have those characteristics in varying degrees. Organizations that clearly fall outside this definition include all investor-owned enterprises and entities that provide dividends, lower costs, or other economic benefits directly and proportionately to their owners, members, or participants, such as mutual insurance companies, credit unions, farm and rural electric cooperatives, and employee benefit plans. For LECPA purposes, NPO is subdivided as follows: 1. 2. 3. 4. Expenses are reported only in the unrestricted classification whereas revenues, gains and losses can be presented in any of the two classifications of net assets. Expenses are classified by functional classification in the statement or in the notes: a. Voluntary health and welfare organizations (VHWO) Hospitals and other health care organizations Colleges and universities Other not-for-profit organizations such as churches, museums, fraternity association, etc. b. Peculiarity of Accounting: Not-for-profit organization classify net assets, revenues, gains, and losses according to the following classes of net assets: a. b. Restricted Unrestricted Recognition of donations and contributions as revenue 1. 2. Government – uses the government accounting manual (GAM) Non-government – uses not-for-profit accounting (ASU 2016-14) Financial Statements of Not-for-Profit Organization 1. 2. 3. 4. Statement of Financial Position or Balance Sheet Statement of Functional Expenses Statement of Activities Statement of Cash Flows STATEMENT OF FINANCIAL POSITION (Balance Sheet of Non-Profit Entities) Contains asset, liabilities and net assets. Net asset is sub-classified into restricted and unrestricted. Long-term assets and short-term assets are separated. Comparative financial statements are not required. Program services – activities involved in distribution of goods or services that fulfill the purpose or mission of the organization to beneficiaries. Supporting services – catchall category for all expenses not classifiable as program services. 1. Management and general – oversight, business management, record keeping, financing and related administrative activities. 2. Fund-raising – fund-raising campaigns, events, fund-raising manual distribution and other activities to solicit contributions. 3. Membership-development activities – soliciting for prospective members and membership dues or membership relations. STATEMENT OF FUNCTIONAL EXPENSES Voluntary, Health and Welfare Organization – reports expenses classified by both: a. b. Major classification of Not-for-Profit Organization: Gains or losses from peripheral or incidental transactions or events beyond the control of the organization Investment income – reported net of related expenses Further classifications such as operating and non-operating, recurring or non-recurring, etc. are optional. Functions and Nature This is provided in either matrix format or as a separate statement. STATEMENT OF CASH FLOWS 1. Operating Activities Includes unrestricted cash contributions, unrestricted investment earnings, revenue restricted for operating purposes (Program Restrictions), revenue from exchange transactions, and operating expenditures (salaries, supplies, interest expense). o It does not include contributions restricted to capital purposes. o May be presented using direct (encouraged) or indirect method. o 2. Financing Activities Includes contributions and investment revenues restricted for long-term purposes (e.g., restrictions for acquisition of capital assets, endowments) o Includes debt-related activities (debt proceeds, repayments, lease payments, etc.). o Presented using direct method. o 3. Investing Activities STATEMENT OF ACTIVITIES (Income Statement of Non-Profit Entities) Uses accrual basis of accounting. Shows the changes in the net asset categories. Includes inflows and outflows from the sale and purchase of capital assets and investment assets. o It does not include contributions restricted to capital purposes. o o Presented using direct method. Cash restricted for long-term purposes must be separated from cash and cash equivalent. There must be a reconciliation of the change in net assets in the statement of activities to net cash flows from operating activities. Classifications of Contributions Contributions are separated into the three classes of net assets. Those that increases: 1. 2. Unrestricted net assets Restricted net assets CONTRIBUTION Contribution is unconditional transfer of cash or other assets to an entity or a settlement or cancellation of its liabilities in a voluntary, nonreciprocal transfer by another entity acting other than as owner. Promise to give – is a written or oral agreement to contribute cash or other assets to an entity. Contributions of Services Contributed services are recognized as revenue only when they: 1. 2. Recognized as contributions if verifiable and substantiated by evidence such as pledge cards or tape recording of oral promises. Create or enhance nonfinancial asset of the organization or Require specialized skills, are provided by those individuals possessing those skills, and would typically be purchased if not provided by donation Contributed Collection Items Types of promises: 1. Conditional promise to give a. b. c. Depends on the occurrence of a specified future and uncertain events to bind the promisor. Initially recognized as liabilities (conditional grants) Recognized as contribution revenue and receivable when the conditions are substantially met or when the promise becomes unconditional. An entity need not recognize contributions of works of art, historical treasures, and similar assets if the donated items are added to collections that meet all of the following conditions: 1. 2. 3. Are held for public exhibition, education, or research in furtherance of public service rather than financial gain Are protected, kept unencumbered, cared for, and preserved Are subject to an organizational policy that requires the proceeds from sales of collection items to be used to acquire other items for collections. 2. Unconditional promise to give Contributions of Long-Lived Assets a. b. c. d. e. Promises are unconditional if the possibility that a condition will not be met is remote. Depends only on the passage of time or demand by the promisee for performance. Recognized as contribution revenue and receivable in the period received. Reported as restricted support (temporary due to natural restriction), even if the resource is not restricted by the donor for specific purposes When the donor explicitly stipulates that the unconditionally promised contribution is intended to support current-period activities, it is reported as unrestricted support. 1. 2. With Restrictions - The asset is recognized in the restricted net assets. Depreciation is provided as expense in the unrestricted category. Without Restrictions - The entity either classify, by accounting policy, the long-lived assets as: a. Restricted net assets with time restriction over the life of the asset. (Note: This accounting policy assumes that the long-lived asset has time restriction.) b. Unrestricted support upon receipt Special disclosures required for unconditional promises Restrictions and Conditions Unconditional promises to give should be disclosed as amounts of promises receivable in: Less than a year 1 to 5 years More than 5 years Donor imposed conditions – provides that the donor’s money be returned, or the donor be released from the promise to give if the condition is not met. Donor imposed restrictions – limits the use of contributed assets. They expire upon satisfaction of all restrictions. Measurements and Valuation of Contributions Contributions are valued at fair value and recognized in the period received. For contributions in kind if fair value cannot be determinable, no value is assigned but they are recorded as sales revenue when they are eventually sold. Multi-year promises are recorded as revenues at the present value of the future collections net of estimated uncollectibles. If the fair value of contributed pledges changes substantially from the pledge date to the receipt date, any increase is conservatively not recognized; an impairment in value is fully recognized in the period of occurrence. Collectors’ items (historical treasures or works of art) received by the entity is encouraged, but not required, to be capitalized at either cost or fair value. If collection items are capitalized, they are credited to revenues or gains. If it is unclear whether donor’s stipulations are conditions or restrictions, the organization should presume that the promise is conditional. Types of Restrictions 1. 2. Donor-imposed restrictions a. Time restriction b. Purpose restriction Internal restriction or Quasi-endowment – restriction either as to time or purpose that the NPO’s trustee has designated for the use of a resource. Such internal restriction is ignored and should be reported as unrestricted. Fulfillment of restrictions during the year of receipt of contributions Entities may report the restricted contribution received as unrestricted if: Revenues of Hospitals and Health Care Organizations: 1. Direct deductions to Patient Service Revenue a. Courtesy discounts – discounts for employees or doctors b. Contractual adjustments – discounts arranged from third party payors such as Red Cross and PhilHealth) that frequently have agreements to reimburse at less-thanestablished rates. The gross patient service revenue is initially recognized, these direct deductions operates to reduce the gross patient service revenue. The amount net of these deductions is net patient service revenue. Conditional gift of cash or other assets that may have to be returned to the donor if the condition is not met is treated as a liability (refundable advance). 2. Contributions with restrictions that do not lapse are called permanently restricted. These include pure endowments wherein both principal and income are non-expendable by the entity. 3. Charity Care – services provided free of charge to patients who qualify under a hospital’s charity care policy. Charity care is an exclusion from patient service revenue, meaning, they do not form part of both gross and net patient service revenue. Premium fees – also known as subscribers’ fees or capitation fees. These are charges under agreement wherein the hospital provides necessary patient services for a specific fee. This is almost similar to an insurance contract where the insurer collects premium for certain risk coverage. Other Operating Revenues – includes revenues from sales or services provided to: a. Patients other than for health care and b. Non-patients. 1. 2. Such accounting policy is adequately disclosed and is consistently applied Same accounting policy is employed with investment income whose restrictions are met in the same period as the income is recognized. Effects of Non-Fulfillment or Restrictions Investments and Investment Income 4. Similar accounting policies under PFRS 9, PAS 27, PAS 28 or PFRS 11 are employed. Accounting for Transfers Other Than Contributions 1. 3. a. Exchange Transactions – involves bilateral or reciprocal transfer in which both parties give commensurate or equal value such as sales and barter. Exchange occurs when a donor receive gift from the entity (fund raising premiums such as giveaways, calendars, etc.) that approximate the value of their donations. Resources received in an exchange transaction are treated as revenue as they are earned and are classified as unrestricted revenues in the unrestricted net assets category even if the resource provider limits the use of the resources. 2. Examples: Receipt of any resources from members or donors must be carefully analyzed if they contain exchange elements. The contribution element is recognized as contribution when received. Agency Transactions – involves the entity receiving an asset but the entity has no or little discretion over the use of the asset and the asset is designated by the transferor to a third party. The non-profit entity merely acts as an intermediary or pass-through entity for the asset. Assets received from such transfers are recognized as a liability and not as contributions. Non-Cash Contributions a. b. With little or no discretion as to use – account as if agency transactions With discretion as to use – recognized as contributions b. c. d. e. telephone or television charges on hospital rooms tuition from schools operated by hospitals rental of hospital space medical reproduction charge proceeds from cafeterias, gift shops and snack bars 5.Non-Operating Revenues – this includes any revenues not related to operations of the non-profit hospital such as: a. b. Gifts and bequests Investment income (dividends and interests) Functional Expense Category of Non-Profit Hospital and Health Care Organizations: 1. 2. 3. 4. 5. Nursing services – medical and surgical, intensive care, nurseries and operating rooms. Other professional services – laboratory, radiology, anesthesiology and pharmacy General services – housekeeping, maintenance and laundry Fiscal services – accounting, cashier, credit and collections and interest Administrative services – personnel, purchasing, insurance, governing boards, data processing and depreciation provisions Major Classifications of NPO And Special Considerations A. Voluntary Health and Welfare Organization (VWHO) VHWO classifies their expenses by functional classification such as: 1. 2. 3. 4. Management and general Recreational programs Community service Fund-raising Recreational programs Fund-raising C. Non-Profit Colleges and Universities Revenues of Non-Profit Colleges and Universities: 1. 2. 3. 4. 5. B. Hospitals and Health Care Organizations Patient Service Revenue – revenues of hospitals and health care organizations from: 1. 2. 3. Rooms and board Nursing services Other professional services 6. 7. Tuition and Fees Appropriation from the Government Student Financial Aid Sales and Services of Auxiliary Enterprises Contributions Sales and Services of Educational Activities Endowments Functional Expenses of Non-Profit Colleges and Universities: 1. 2. Instruction – expenses incurred in instruction program Research – expense to product research outcome 3. 4. 5. 6. 7. 8. Public service – expenses to provide non-instructional services to external groups Academic support – expenses provide for instruction, registrar and publication Student services – amounts expended for admission and registrar, and amounts expended for student’s emotional, social and physical well-being Institutional support – administration and long-range planning of the university Operation and maintenance of plant – expenses for current operating funds for operating and maintaining the physical plant Student aid – expenses from restricted or unrestricted funds in the form of grants, scholarships, or fellowship to students Funds held by Non-Profit Educational Institutions: 1. 2. 3. 4. Loan funds – group of resources which under agreement is to be used to provide loans to students, faculty or staff. Endowment funds – consists of gifts with specifications as to the manner in which the cash or donated item should be maintained and distributed. Annuity and life income funds – special types of endowment funds whereby the donor or an identified beneficiary receives a return from the gift for a specified period of time after which the gift belongs to the non-profit institution. Agency funds – assets held by the institution for individual student and faculty members and for their organizations (student body funds). D. Other Non-Profit Entities 1. 2. 3. 4. 5. 6. Cemetery associations Libraries Civic organizations Museum Libraries Museum Religious organization Political organization