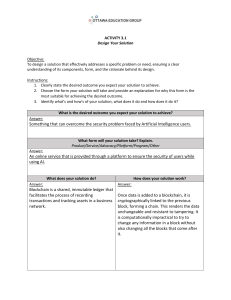

FUTURE OF MONEY TABLE OF CONTENTS Foreword Executive Summary Chapter 1 Introduction Chapter 2 History of Money Chapter 3 Payments gone global Chapter 4 DLT & Blockchain Chapter 5 Bitcoin - The OG Chapter 6 Evolution of Stablecoins Chapter 7 Rise of Altcoins Chapter 8 Regulation - The necessary evil Chapter 9 State’s comeback Chapter 10 Commercial banks enter the ring Chapter 11 Our take Annexure FOREWORD In 2018, during an interview at Money2020 USA, Sopnendu Mohanty, the Chief Fintech Officer of Monetary Authority of Singapore, responded with one-word replies: Moderator: Cryptocurrencies? Sopnendu: Overrated Moderator: Blockchain? Sopnendu: Underrated My personal version of this conversation is that Cryptocurrency is the classic tail wagging the dog moment for Blockchain. Over the last few years, the world has witnessed an unprecedented wave of Crypto assets and the key question in my head was to try and understand whether crypto is money in the first place and if so, what are the elements that allow it to be qualified to be called a Currency. The endeavor of this report is to take our ecosystem on a journey through the realm of blockchain, bitcoin, and digital assets, seeking to uncover the future of money. We assert that while cryptocurrency in general and bitcoin specific may not necessarily represent the future of money, it can be viewed as a digital asset or a store of value. That doesn't take away anything from the fact that Bitcoin is the best Crypto Asset that has existed so far and will continue to be so for sometime. The true driver lies within the potential of blockchain and its embedded technologies, propelling transformative changes in the financial services ecosystem and beyond. Already revolutionising sectors such as finance, supply chain, and healthcare, blockchain and distributed ledger technology (DLT) hold significant promise. The surge in popularity of digital assets has prompted regulators and central authorities worldwide to embrace this groundbreaking technology, integrating it into their financial and monetary policies. This integration goes beyond a mere adoption of blockchain; it marks a profound paradigm shift in the functioning of a nation's monetary system. All through the journey over the last 12 years, Blume has limited its investments in the crypto space to two founder-driven bets. I have spent a fair bit of time putting out our thoughts during one on one conversations with founders and LPs of ours on what factors have been driving our thought process. Earlier this year, Subhendu volunteered to work together and we spared a lot on our respective sides and finally decided to take a plunge on putting out this thesis together. At one point in time, we had views that were divergent enough that we were going to put out the report in a pros and cons format but over a period of doing more work, we finally converged our thoughts to bring out this report. Congratulations to Subhendu & the Fintech Team @ Blume, its Investment Partners and extended team for all the work and learnings and sharing it out in public domain. Our two-part thesis delves into the history of money, its evolutionary journey, and the defining impact of blockchain on the future of money. While part one focuses on selected aspects, the second part will conduct a comprehensive exploration, presenting a deep dive into the subject matter. Ashish Fafadia Partner Blume Blockchain & Future of Payments by Subhendu & Ashish How to Navigate Through the Thesis "Blockchain & Future of Money" Our comprehensive thesis, titled "Blockchain & Future of Money," is a two-part exploration that delves deeply into the realms of money, blockchain technology, cryptocurrencies, and the emerging CBDC ecosystem. To ensure the thorough coverage of these intricate topics and to establish a solid foundation for our argument, we've meticulously structured our report. Recognising the diverse stakeholders within the fintech and blockchain landscape, we acknowledge that each stands to gain valuable insights from our report. Embracing the concept that one size doesn't fit all, we've designed a framework for consuming the content in a way that optimizes both time and impact. The first part of our thesis provides a concise summary of innovative startup ideas rooted in the CBDC & blockchain ecosystem. For those who desire a deeper dive into these concepts, we expand upon them extensively in the second part. Based on your familiarity with the subject matter, we've tailored specific recommendations: 1. Fintech Natives: We recommend delving into the chapters ranging from 4 to 11 in Part 1. Upon completing these chapters, proceed to explore Part 2 in its entirety. This targeted approach will maximize your understanding of the fintech aspects within the CBDC and blockchain context. 2. Blockchain/Web3 Natives: If you are well-versed in blockchain or Web3 technologies, we suggest beginning with Chapters 1 to 3 and then proceeding to Chapters 8 to 11 in Part 1. Once done, immerse yourself in the comprehensive insights offered by Part 2. This tailored path ensures that you grasp the core foundations of blockchain while also covering the fintech angle. 3. Fintech & Blockchain Novices: For those who are relatively new to both fintech and blockchain, we recommend embarking on a complete journey. Engage with all the chapters within the thesis, as this holistic approach will furnish you with a solid grasp of the multifaceted landscape we explore. 4. Founders: If you're a founder seeking a well-rounded understanding, we encourage you to read all chapters of both Part 1 and Part 2. This comprehensive approach will equip you with insights that span from startup ideas to technology nuances, fostering a robust foundation for your entrepreneurial endeavours. If a particular idea sparks your interest, feel free to delve further into Part 2 for an indepth exploration. Happy reading! Future of Money by Subhendu & Ashish EXECUTIVE SUMMARY In this two-part thesis on Blockchain and the Future of Money, we embark on a comprehensive exploration of these topics, presenting a compelling case supported by data and analysis. Our research delves into the role of cryptocurrencies like Bitcoin, which is considered a store of value rather than the future of money itself. Additionally, we examine the efficacy of stablecoins in facilitating peer-to-peer (P2P) and smaller transactions, identifying their relevance within the financial ecosystem. Furthermore, we envision the future of money and payments, with Central Bank Digital Currencies (CBDCs) emerging as a pivotal element that is poised to replace physical cash in the coming decade. Backed by central banks and driven by blockchain technology, CBDCs promise enhanced efficiency, security, and financial inclusion, transforming domestic payment systems worldwide. As a key element in this transformative landscape, we delve into the potential of Distributed Ledger Technology (DLT) and blockchain. Our analysis demonstrates that blockchain technology, serving as the new digital equivalent of paper, holds the promise of revolutionizing various aspects of the monetary ecosystem. We explore how blockchain's establishing commercial banks as pioneers in the evolving financial landscape. Throughout our research, we back our arguments with data and analysis, painting a comprehensive picture of the decentralized nature that provides transparency, security, and immutability, making it a game-changer for financial transactions and recordkeeping. Moreover, our thesis highlights the crucial role of commercial banks in driving crossborder payments by leveraging deposit tokens, a cutting-edge solution introduced by major players like JPMorgan Chase (JPMC). These digital representations of fiat currency, powered by blockchain, enable faster and more efficient cross-border transactions, the transformative potential of blockchain and DLT in the future of money. By envisioning a financial ecosystem driven by CBDCs and deposit tokens, we underscore the significance of these technologies in fostering a more inclusive and efficient monetary system globally. As we explore the dynamic interplay between blockchain and the future of money, our thesis seeks to offer valuable insights into the trajectory of financial services and payment methods. We anticipate that our findings will inspire governments, businesses, and individuals to embrace blockchain technology as the catalyst for a more advanced and equitable monetary landscape. With meticulous research and thoughtful analysis, we aim to contribute to the ongoing dialogue on the future of money and its inevitable association with blockchain technology. Future of Money by Subhendu & Ashish CHAPTER 1 Introduction Money has played a critical role in facilitating value exchange among humans for centuries. As societies evolved and people settled into more permanent lifestyles, the need for a medium of exchange became apparent. This report aims to explore how digital innovations like blockchain and DLT (Distributed Ledger Technology) (wherever abbreviations are being used, give a full form the first time and in the annexure) will shape its future. The document covers a brief history of money, the emergence of cryptocurrencies such as Bitcoin, stablecoins, and altcoins, as well as the development and impact of CBDCs. We will examine the chronological evolution of these digital assets and their potential impact on the payment industry, providing insights into their market size, features, revenue streams, and competitive landscape. We aim to also elaborate on a few select areas that are likely to see significant impact due to the above developments and share our thoughts on why we would like to invest in opportunity sets around these verticals. Future of Money by Subhendu & Ashish CHAPTER 2 History of Money Money has been a fundamental aspect of human civilization for thousands of years. It serves as a means of communicating value, allowing us to express to each other how much we value a particular good or service, and to define the utility of an act or gesture. While bartering was the earliest form of exchange, it was often an inefficient process that relied on finding someone who wanted what you had to offer, and who had something that you wanted in return. This led to the invention of money, which allowed for more efficient exchanges. Money is so deeply ingrained in our nature as primates that even chimpanzees can be taught to exchange "money" (such as stones) for food, illustrating the universality of the concept. Throughout history money has taken various forms and factors as depicted below in exhibit. EVOLUTION OF MONEY DIGITAL CURRENCY ELECTRONIC MONEY CARDS PAPER MONEY METAL COINS GOLD BARTER Future of Money by Subhendu & Ashish The latest development in the evolution of money is the rise of cryptocurrencies, which use complex algorithms and decentralized networks to facilitate transactions without the need for traditional financial institutions. While the future of cryptocurrency is uncertain, it represents a significant shift in the way we think about money and its role in our lives. Overall, money has played a vital role in human civilization, allowing for the efficient exchange of goods and services and facilitating economic growth. As technology continues to evolve, it is likely that money will continue to evolve with it, taking on new forms and functions as we find new ways to communicate value and exchange goods and services Money has long been seen as a sacred source of liquidity, serving as the lifeblood of economies around the world. While the concept of money is often associated with the private sector and capitalist markets, the reality is that it has always existed within the cocoons of the state, tied up in a complex web of regulations and guarantees. As the world of money continues to evolve, it is important to have a set of characteristics that can be used as a yardstick for assessing various forms of money and their impact on real-world financial transactions. Future of Money by Subhendu & Ashish Here are some of the features of money depicted in the table above that help us assess various forms of money that we are going to discuss in the subsequent chapters. The features are described in Annexure 1 in detail. This yardstick will enable us to evaluate the new disruptions that have happened in the forms of money. As humans settled extensively and initiated trade between different settlements or civilizations, money exchange or payments played a crucial role in the real economy. Money laid the foundation of modern trade and design of labor. The exhibit below depicts various use-cases of money. USE CASES OF MONEY Future of Money by Subhendu & Ashish CHAPTER 3 Payments gone Global Global payments have played a crucial role in shaping international trade and commerce, serving as the foundation for cross-border transactions. Despite the disruptions caused by external factors such as COVID-19, the cross-border payment ecosystem has demonstrated resilience and is steadily expanding. This sector is poised for substantial growth, with an average compound annual growth rate (CAGR) of 8.2% worldwide, led by the Asia-Pacific region. While there was a slight 5% dip in global payments revenue between 2019 and 2020, it has since rebounded. According to a study conducted by Mckinsey Global [1], the following 3-4 years will witness a remarkable surge in this industry as depicted in the exhibit below. GLOBAL PAYMENTS REVENUES INCREASED 11 PERCENT GLOBALLY IN 2021. The global cross border landscape is witnessing innovations that are putting immense pressure on the incumbents. According to a study by Capgemini by year 2026 new payment methods will take over which encompasses instant payments, emoney, mobile and digital wallets, DLT, QR code and account to account payments where the traditional methods are cards, etc. Future of Money by Subhendu & Ashish The cross-border payment revenues are concentrated in a business to business use case with more business globally adopting digital payment solutions. The exhibit below by Mckinsey Global shows how the landscape is across the 4 payment scenarios and their respective market sizes. CROSS-BORDER REVENUES REMAIN CONCENTRATED IN BUSINESS-TO-BUSINESS The current payment landscape shown below is quite exhaustive and has players who have evolved to capture a variety of use-cases as the market is quite competitive. This shows that the driving factor for innovation in the global payments market will be in the hands of customers, be it business or individuals: they are going to shape the direction of future services. Future of Money by Subhendu & Ashish MANY FIRMS HAVE EMERGED TO ADDRESS A VARIETY OF USE CASES IN CROSSBORDER PAYMENTS However, the exhaustive list of players depicted in the exhibit above by Mckinsey Global be it banks or tech firms/startups haven’t made cross-border payments easier, cheaper or faster. Another data from Oliver & Wyman in the figure below shows the high cost and slowness of global transactions and the size of global fees. Future of Money by Subhendu & Ashish CROSS-BORDER TRANSACTIONS: VOLUME, COST AND TIME The settlement time though depends on the kind of transaction. Credit card transactions have been instant, conventional bank transfer being the slowest and other kinds of payments remaining in between. The infographic below depicts the speed of cross border transactions and where the scope of innovation or room to disrupt lies. Future of Money by Subhendu & Ashish The overall challenges in cross-border payments are 7 fold and contribute to the leakages and impacts businesses globally, especially small & medium enterprises. 1. Fragmented data formats* 2. Compliance checks 3. Limited operating hours 4. Legacy technology: Banks’ usage of monolithic technologies, in-house servers and absence of API ecosystem 5. Higher Fees 6. Legal issues 7. Long duration for settlements – perverse incentive for banks to hold it in their balances and use the monies *Refer to Annexure 2 for in-depth understanding of truncated formats In the next section we would look into how the multi-intermediary process adds to the final cost of doing business in a global corridor. There is a high cost in processing a cross border transaction be it remittance or B2B payment and the process remains highly inefficient. A market analysis by Corpay [2] shows that the global premium charged to send payment across borders varies between 4% to a full quarter i.e. 25% with a global average of 3.39 %. The figure below shows the major buckets of cost that drive the premium and the second figure breaks it down into the contribution. Future of Money by Subhendu & Ashish The below figure shows the split of fees ranging from 4% - 25 % between various players. Payments Claims & treasury Operations operations Nostro - Vostro FX Costs Compliance Overhead Network Management Liquidity These inefficiencies drive the cost of doing business high and squeezing the margins, specially for SMBs. Moreover banks have underserved SMBs is a proven fact and more so the start ups, they want to move to challenger banks according to a survey by Capgemini. The SMBs would prefer players who can bundle core banking services and non-core banking services. Governments, financial regulators and Payment players (including Banks) need innovation to gather mindshare of the SMB ecosystem and look towards new technologies like DLT and blockchain technologies. In absence of a more sophisticated system that enables payments faster at lower costs in a trustworthy manner, financial inclusion and more balanced wealth distribution will remain as theoretical papers at symposiums and universities. And once in a while cryptos will keep raising its head with all its limitations which is not a healthy thing in today’s uncertain and ever changing world where the biggest casualties of crash in crypto values may not be common (wo)man but they will surely be the highest impacted. Future of Money by Subhendu & Ashish The tables below by Corpay show that small and micro transactions do pay high fees. AGGREGATE USD TO USD AGGREGATE USD TO FOREIGN Future of Money by Subhendu & Ashish The figure above shows the cost per international transaction. The number of intermediaries actually drive the cost and has ample room for innovation. A report by Mercator Advisory Group [3] highlights that in 2020, 43% of SMBs indicated they conducted international business as compared with 34% in 2019. In the next chapter we will explore what DLT, blockchain and demystify their real value. Future of Money by Subhendu & Ashish CHAPTER 4 DLT & Blockchain Blockchain has become quite a buzzword these days. With the advent of NFTs, BAYC & monkey jpegs blockchain technology has got its share of mainstream media. But blockchain or distributed ledger technology is far beyond the hype and has power to disrupt various aspects of our business and lives. The first use-case of blockchain was payments technology, a cry to revolt against the age-old financial organizations. Over the last decade blockchain has evolved from payments and impacting industries like supply chain, healthcare, creator economy and retail. A primer on blockchain technology We would simplify blockchain for the reader and take you through the nuts and bolts of this innovative technology. The idea of this chapter is to cut through the hype and discuss how blockchain has been impacting payments and the finance industry and what lies ahead. 31st October, 2008 is a historical day for all crypto and blockchain enthusiasts as Satoshi Nakamoto, who is often touted as the Father of Bitcoin published the white paper [4] on the cryptography mailing list at metzdowd.com describing a digital cryptocurrency, titled "Bitcoin: A Peer-to-Peer Electronic Cash System”. The white paper described a cryptocurrency called Bitcoin which took some time to gain popularity. Though Bitcoin is revolutionary, what had more immense potential was the underlying technology i.e. blockchain. Blockchain in simple terms is a distributed ledger or a database that requires a consensus between all the stakeholders to initiate a transaction/change in the ledger. Hence the name Distributed Ledger Technology or DLT. Future of Money by Subhendu & Ashish These transactions/changes/records are called blocks. These blocks are linked using cryptography. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. Blockchains have 6 major features which make them one of the most accurate databases ever created and that's why blockchain is a very secure and trustworthy way to keep track of important things, like money or information. The features are shown below in the exhibit FEATURES OF BLOCKCHAIN Future of Money by Subhendu & Ashish Blockchains are built on 3 fundamental technological components which make them quite unique and impart them with the potential to be a game changer in many industries and application. A Primer on Cryptocurrency An understanding of cryptocurrency is necessary to comprehend the real power of blockchain and DLT. Cryptocurrencies are digital assets whose ownership is recorded on a blockchain and can be moved across individuals. As mentioned earlier the block or an entry in a ledger is used to record the transaction and using the consensus mechanism the finality of settlement happens through the community of nodes. Hence cryptocurrencies are also completely decentralized, not controlled by any central or government authority. Each transaction takes immense computing power, hence the nodes are also awarded a portion of the transaction or gas fees in order for the network to operate independently of a controlling authority. Future of Money by Subhendu & Ashish Why do blockchains matter in payments? Before we delve into the intricacies of how blockchain is going to disrupt the payments industry let’s try to understand the ABCs of traditional payments workflow. The workflow below shows the process in a pictorial form “Blockchain kills intermediaries” It has the potential to disrupt the payments industry by eliminating the middlemen like banks, brokers and other intermediaries. This is because blockchain allows for direct, peer-to-peer transactions without the need for a central authority or intermediary to validate or process the transaction. Future of Money by Subhendu & Ashish The image below illustrates how a typical blockchain payment system works and a simple example of a user A trying to send money to user B. The money mentioned here is not the sovereign money but the network currency or the cryptocurrency native to that blockchain. Though these transactions come with a plethora of benefits listed in the value-wheel below, these technologies have become a double edged sword:1. Fewer intermediaries 2. Greater Safety 3. High Speed 4. Low cost 5. Anonymity Future of Money by Subhendu & Ashish The table below shows the speed to typical blockchain transactions across popular networks: Blockchain does solve some of the problems of the traditional payments system and naturally looks like a panacea for all problems corresponding to cross-border payments. However the technology hasn’t picked up the way it was projected a decade ago. New research indicates that the global payments transaction volume is small relative to global crypto payment volume. The figure below shows that remittance is the most matured use-case. Future of Money by Subhendu & Ashish The exhibit shows that on-chain remittances has been the most matured use-cases owing to the stablecoin development and infrastructure innovation lowering gas fees and increasing TPS across various blockchains. These remittances have been typically p2p using stablecoins. However, owing to regulatory uncertainty enterprises and businesses have not significantly adopted crypto transactions. In the next chapters we will discuss how crypto currencies evolved over the last 15 years since the inception and what are the drawbacks of this futuristic technology and the road ahead. Future of Money by Subhendu & Ashish CHAPTER 5 Bitcoin - The OG Bitcoin came into existence with a seminal paper on 31st October 2008 by Satoshi Nakamoto. The exhibit below depicts the important milestones in the history of Bitcoin. OCT 31 JAN 3 MAY 22 Satoshi has been speculated as a person or group of people who prophesied how digital currencies and payments would look like and why bitcoin is the answer to all of the issues with the current financial crisis. Post that bitcoin’s growth has been a roller coaster ride with the highest value being close to USD 65K. Post the peak bitcoin has been very unpredictable and nontrustworthy, the exhibit below by CoinmarketCap shows the price has been nothing but a roller coaster ride. Future of Money by Subhendu & Ashish The Bitcoin community or popularly known as bitcoin maximalist have positioned it as the the only cryptocurrency that truly matters and that all other cryptocurrencies and blockchain projects are inferior and unnecessary. However, bitcoin has failed to have the true properties of money as discussed in in chapter 2. The very volatile nature of bitcoin doesn’t make it suitable for a means of payment. The image below portrays the Bitcoin Volatility Index* and clearly shows how bitcoin is volatile. The addition of high gas fees, congestion and block size doesn’t make it a lucrative method of cross-border payments. *The Bitcoin Volatility Index (BVOL) is a measurement of the volatility of the price of Bitcoin over time. The BVOL is calculated by taking the standard deviation of Bitcoin's daily price changes over the previous 30-day period and multiplying it by the square root of 365 to estimate the annualised volatility. Future of Money by Subhendu & Ashish The example below show that Bitcoin hasn’t been fully embraced as a payments mechanism because of volatility and regulatory concerns. These examples solidify the case that Bitcoin will morph into a store of value and evolve as digital gold. A few months ago, El Salvador adopted Bitcoin, but ever since, a whopping 86 percent of merchants in the Central American nation have not processed a single bitcoin transaction. This was revealed in the First Business Survey 2022 report, carried out by the Chamber of Commerce and Industry of El Salvador (Camarasal) between January 15 and February 9, 2022. - the data shows bitcoin’s true utility is store of value. Future of Money by Subhendu & Ashish Despite its growing popularity, Bitcoin faced a number of challenges in its early years, including concerns about its use in illegal activities and the security of its underlying technology which are not completely unfounded areas of concerns. Today, Bitcoin is widely recognized as the first and most popular cryptocurrency, and it has paved the way for the development of many other digital currencies and blockchain-based applications. As of Feb 2022 based on a Coinmarket cap report there were 17000+ altcoins in circulation. Bitcoin educated the regulators about the power of blockchain and DLT, and regulators like central banks across the world have been hyperactive in embracing this disrupting technology to drive innovation in monetary and fiscal policies. Despite its ups and downs, Bitcoin remains an important and influential part of the cryptocurrency and blockchain ecosystem. Future of Money by Subhendu & Ashish CHAPTER 6 Evolution of stablecoins As discussed in the last chapter the high volatility index of Bitcoin created room for innovation and startups cropped up building the next generation of cryptocurrencies known as Stablecoins. As the name suggests Stablecoins are cryptocurrencies which are stable in nature owing to the pegging of the crypto assets to an asset like dollar, gold in the real world. Few platforms have achieved pegging through algorithms. They use these algorithms to manage the supply of the cryptocurrency and adjust the price based on supply and demand This pegging manages the volatility and price fluctuations and makes it lucrative for financial use cases like remittance, cross-border payments and more importantly, participation in Defi protocols. The first stablecoin, Tether (USDT), was launched in 2014, and was designed to be pegged to the value of the US dollar. Post that the stablecoin ecosystem has seen quite an innovation in the collateralization, algorithmic stable and hybrid models. Stablecoins have gained popularity as digital money and are being used for daily transactions like grocery shopping, online commerce, buying of digital assets without the risk of significant value fluctuations. Stablecoins over the years have picked up traction and been very popular. The TVL or total value locked in the stablecoin ecosystem is close to 130 billion USD with USDT being the market leader. Future of Money by Subhendu & Ashish Source: Defilama The data is as of May 5, 2023. The market capitalization was much higher at 165 billion USD 12 months back and dropped down due to few historical events These historical moments in the crypto market would highlight the pitfalls of crypto currencies and stablecoins. Luna crash happened during May 2022 when the algorithm failed to stabilize the ecosystems stablecoin UST. This led to a wipe out of close to USD 20 Billion from the stablecoin total market capitalization. The SVB crisis, considered the most significant financial crisis after 2008, had a profound impact on the crypto markets, particularly affecting Circle's popular stablecoin USDC. Unfortunately, USDC had invested USD 3.3 Billion in the declining SVB bank, leading to the depegging of the stablecoin. As a consequence, within 24 hours, billions were withdrawn from Circle's USDC stablecoin, resulting in a significant drop in market cap from $43.5 billion to $37 billion. The stablecoin's price also plummeted below $0.87. The stability of USDC, reliant on a 1:1 peg to the U.S. dollar, hinges on investor trust and demands equivalent backing with U.S. dollar assets.USDC has subsequently regained its peg and Circle has said it would transfer the reserves to BNY Mellon. Future of Money by Subhendu & Ashish These major events along with crises like Three Arrows Capital, FTX have led to doubt in the mind of crypto enthusiasts and have been a red flag for regulators given the impact on retail investors and larger implications of laundering, KYC and other perceived issues around Cryptocurrencies. The regulatory crackdown on stablecoins by governments around the world. In the wake of the UST collapse, regulators have become more concerned about the risks posed by stablecoins. This has led to increased scrutiny of stablecoin issuers and calls for stricter regulation and the broader crypto market downturn has led to the low trust in the future of stablecoins. Though stablecoin brings in the best of both worlds, stability of a fiat currency and speed of blockchain transactions, the very nature of outsourcing its stability to a real world asset or an algorithm doesn’t guarantee that these coins will be 100% secure. Future of Money by Subhendu & Ashish CHAPTER 7 Rise of Altcoins Bitcoin did pave a path for disruption in the cryptocurrency ecosystem and led to the rise of altcoins or alternative coins. The coins which are basically not Bitcoin got the alias as Altcoins. The altcoins served the same purpose that Bitcoin was serving but were cheaper to obtain. These altcoins used blockchain technology for the distributed ledger but varied in the kind of consensus algorithms they used. As mentioned bitcoin was the OG of crypto-currencies but had certain limitations like high gas price, limitation on transactions per second and price volatility. These coins were designed to overcome those limitations and customize it for different industries and use-cases Altcoins have served as utility tokens in web3 products, store of value, mechanism for payments or meme coins for banter. One of such coins of interest pertaining to our study here is XRP. XRP is the blockchain payments unicorn Ripple’s native currency which is used for quick liquidity. How does it work? When a user sends a payment on the Ripple network, the payment is converted into XRP, transferred across the network, and then converted back into the recipient's local currency. This process is designed to be faster and more costeffective than traditional cross-border payment methods, which can involve multiple intermediaries, high fees, and long settlement times. Naturally Ripple platform looks like a great solution for cross-border payments based on the ease of transactions and cost but it hasn’t picked up the traction that it intended to. Ripple has processed nearly $30B worth of volume and 20M transactions since RippleNet was first launched. Though the numbers i.e the revenue, transaction volume, clientele, geographies of operation are impressive but when compared to the global scale of cross border payments happening annually, it’s miniscule. Future of Money by Subhendu & Ashish The reason some of the platforms like Ripple haven’t fulfilled their promise can be linked to regulatory challenges. The XRP crisis emerged in December 2020 when the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs, alleging the sale of XRP as an unregistered security. The lawsuit triggered significant regulatory scrutiny, causing major cryptocurrency exchanges to delist or suspend XRP trading. As a result, the value of XRP plummeted, and investors faced uncertainty over the future of the digital asset. The legal battle between Ripple Labs and the SEC has implications for the broader cryptocurrency industry and has raised questions about the regulatory status of other cryptocurrencies. As of July 2023, Ripple has achieved a partial victory in the SEC lawsuit; however, the SEC's appeal continues, leading to ongoing uncertainty in the crypto industry. The lack of clarity surrounding XRP's regulatory status still poses a dilemma for market participants. Despite this, the recent positive development has had a notable impact on XRP's price, with the token gaining 80% in just 15 days as depicted in the exhibit below The situation remains dynamic, and market sentiment may continue to be influenced by further legal outcomes and regulatory decisions. Future of Money by Subhendu & Ashish CHAPTER 8 Regulation - The necessary evil "If we want our regulators to do better, we have to embrace a simple idea: regulation isn't an obstacle to thriving free markets; it's a vital part of them." ~ James Surowiecki, Staff Writer, The New York Times It goes without saying that regulation has a big role to play and will have the final say when it comes to monetary and financial policy. Regulatory bodies are like airplanes, they give businesses and the general public a safe haven to fly. Though the counter argument could be that over-regulation could lead to curtailing innovation and ease of doing business. Cryptocurrency educated regulators on the power of DLT, hence the central banks across the globe are leapfrogging and building out their digital currency strategies. Blockchain’s initial success can be attributed to its anti-sovereignty set of beliefs. These set of principles did give a launchpad for early believers to rally the value of bitcoin and other crypto currencies. But we believe that regulation support and adoption is needed to take the blockchain industry to the next orbit. Regulatory bodies across the globe aren’t warm to the idea of cryptocurrency and have been working on building rules & frameworks to suppress the adoption among the general public. This ambiguity has dettered the adoption of crypto among business and enterprises. In fact a survey by Ripple and US Faster Payments Council [5] shows that 89% of the respondents mentioned regulations as the biggest hurdle for crypto adoption. This view is as extreme and naïve as it can get because it has been proven that the crypto system if not regulated in this complex world full of geopolitical tensions and vested interests can be equally harmful as beneficial as they seem to be. Future of Money by Subhendu & Ashish The survey also threw open that those in favor of crypto have not factored in any of the critical attributes for money to have for it to be eventually counted as currency. Future of Money by Subhendu & Ashish CHAPTER 9 State’s Comeback Central banks, among the world's top 10 economies from east to west, have a storied history spanning at least 150 years or more, signifying their enduring significance in shaping global economies. These banks' sole purpose was to bring financial stability to the state and control monetary flows. The first central bank Sveriges Riksbank i.e. The Central Bank of Sweden was established as a joint stock bank to lend government funds and act as a clearing house. For a long duration of time central banks have played the role of stabilizing the economy and controlling inflation. As discussed in earlier chapters, cryptocurrencies do have certain positive impacts on the payments and finance industry but they come with their own fair share of problems. The rise and usage of Bitcoin and stablecoins did prove the benefits of blockchain and DLT to the retail consumer and business alike. Despite cryptocurrencies existing for over a decade, widespread adoption has been limited, and interest from the mainstream ecosystem has been sporadic. This can be attributed to several factors, including regulatory uncertainties, high price volatility, security vulnerabilities, and the absence of robust consumer protection laws. These concerns have contributed to a cautious approach towards cryptocurrencies by many individuals and institutions and the merits of introducing a new form of money to their respective economies. We will explore these reasons and arguments in the upcoming sections. 114 countries, representing over 95 percent of global GDP, are exploring a CBDC. In May 2020, only 35 countries were considering a CBDC. A new high of 60 countries are in an advanced phase of exploration (development, pilot, or launch). The exhibit below shows a heatmap of countries currently working at CBDC and their stages of development. Future of Money by Subhendu & Ashish Central banks are working with BIS, IMF and other industry bodies to come up with CBDC which is just not a digital-native version of traditional notes and coins but goes beyond the current digital money which is commercial bank money. Interestingly, the rise of cryptocurrencies and their associated challenges has spurred central banks worldwide to explore and innovate in the realm of digital currencies. Countries like China, Singapore, and India are at the forefront of the Central Bank Digital Currency (CBDC) revolution. CBDCs offer a government-backed digital alternative to cryptocurrencies, aiming to address some of the drawbacks of traditional cryptocurrencies and create a more regulated and secure digital monetary system. The central banks also have reservations on the growing popularity of stablecoins and are concerned about their potential impact on the financial system and economy. The price volatility, breeding ground for illicit activities and money laundering, and the unregulated sector of the crypto-currencies has encouraged most of the central banks to embrace a digital money roadmap. In the next section we will explore the differences between CBDC, commercial bank money and what are the salient features of this new form of money. Image Source: Atlantic Council Future of Money by Subhendu & Ashish Why CBDC? CBDC being built on DLT and blockchain come with the good parts of the crypto ecosystem which is programmability and interaction with smart contracts. Since CBDC will be issued by central banks they will also have the feature of sacred liquidity. Combined with these features CBDC becomes potent for greater financial inclusion, cross-border payments, vehicle for economic and social policy making usage of money customizable i.e basic necessities, specific locations or pre-defined time period. Overall the reasoning behind 90+ countries pursuing CBDC seems to be quite strong and a welcome strategy for governments, businesses and consumers worldwide. CBDC would be a new digital form of money issued by and hence a direct liability of the central bank. It will be designed as universally accessible (available in offline and online mode), hence will have all the 3 properties. The exhibit below shows the proposed form of money that CBDC will power. Future of Money by Subhendu & Ashish The World Economic Forum projects that 10% of world’s GDP will be tokenized by 2027 standing at USD 16 Trillion [6]. This trend will impact all forms of business, individuals and governments. A report by Crosstower and USISPF predicts that India’s tokenized GDP would be USD 1.1 Trillion [7]. Advantages of CBDC: Central banks globally are exploring use-cases and technology choices to implement this new form of money and there are strong reasons for such activity. The financial and economics research community has done deep research on the benefits of CBDC and the below mentioned ones are the highlights 1. Design of monetary policies with ease 2. Financial inclusion for unbanked/underbanked population 3. Real-time payments 4. Ride the digitization bandwagon 5. Combating financial crime 6. Better UX for consumers and businesses 7. Hygiene, less space and less overhead cost of printing & moving cash These major advantages along with features like finality of settlement, programmability, data transparency has encouraged central banks to build out their own CBDC implementation strategies which includes design choices, technological architecture, etc. “CBDC is the best stablecoin possible” A study by Ipsos MORI and OMFIF [8] shows that there is a huge trust on the central bank’s digital money endeavor than other players. The chart below shows that there is high net confidence in digital tender issued by central banks. Future of Money by Subhendu & Ashish Implementation Options IMF has broken down the CBDC architecture into two main categories: token based and account based. Future of Money by Subhendu & Ashish The token based ownership will work like cash or popular digital currencies where the ownership will be direct without the need of a commercial bank account and will be held in digital wallets issued by central banks in conjunction with private players. The UX will be very similar to current crypto wallets and there will be no intermediaries for transactions to happen. Account based ones will operate like traditional bank accounts needing a KYC before transactions. The UX will be similar to current commercial bank money though will still be more efficient as the finality of settlement will be much faster. Future of Money by Subhendu & Ashish Another categorization parameter is the type of user i.e. retail which will be widely open for general public and wholesale which would be restricted to financial institutions like commercial banks and clearing houses. A 2X2 matrix can be envisioned based on the above categorization parameters and use-cases of CBDC can be mapped. The existing technology stack used by commercial banks will not be useful for creating CBDCs. These digital assets will be created on private and permissioned blockchains and will be managed by the central banks. RBI is working towards the interoperability of the existing tech stack UPI with India’s CBDC e-Re to increase adoption. The retail CBDC whether token based or account based will gain more popularity as it will enable different forms of payment scenarios running from P2P(peer to peer) , P2M (peer to merchant), P2G (peer to government). The retail and token based use case will bring in a large user base of unbanked population into the digital currency revolution. Future of Money by Subhendu & Ashish Customer Persona Retail Wholesale Architecture Token Based Account Based Will be popular for unbanked population, low value transactions, promotes financial inclusion Geographies: Africa, India LatAm Will be popular in urban sections, gain transaction in P2P payments. Geographies: China, India* Will be less popular, no immediate use-case Will be popular for interbank settlements, cross-border payments Geographies: Global Based on the above features and benefits BIS has come with a money flower depicted in the previous page and below that aptly represents the feature set of each money and the benefits. Future of Money by Subhendu & Ashish Status Quo The global heatmap shows that close to 18 countries have their CBDC implementation in pilot stage which means their respective CBDC is in circulation and being used by a tiny cohort of consumers and merchants. China is quite ahead in the race of CBDC though some critics believe it hasn’t gained the pace that was expected. Future of Money by Subhendu & Ashish India has also started the pilot in Dec 2022 The users can do both P2P and P2M transactions. However there is an ongoing debate on why India needs CBDC when it has a robust UPI ecosystem. Let’s deep dive into the basic difference between UPI and CBDC and why India needs CBDC. The deep dive is a must for builders and innovators looking to disrupt this space. The PWC CBDC index based on BIS data depicted in the next page shows how the retail and wholesale CBDC projects are performing and their current status. Future of Money by Subhendu & Ashish Future of Money by Subhendu & Ashish In fact RBI Governor Shaktikanta Das recently clarified the differences between CBDC and UPI stating - “In CBDC, you will draw the digital currency and keep it in your wallet on your mobile. When you make a payment at a shop or to another individual, it will move from your wallet to their wallet. There is no routing or intermediation of the bank.” The table below shows the major differences between UPI and CBDC. Possible pitfalls of CBDC CBDC might look like a panacea for all problems associated with payments, financial inclusion and financial stability but it has its own fair share of pitfalls which we will discuss in this section. Future of Money by Subhendu & Ashish Financial experts fear that eventual popularity of CBDC might lead to reduction in bank deposits leading to a bank run [9]. The exhibit above shows few of the concerns that central banks have with CBDC which includes disintermediation of commercial banks and bank runs along with security and privacy being the major one. This early analysis has led to commercial banks embracing blockchain in an innovative way and creating value for their customers. Commercial banks have entered the fray and have launched Deposit Tokens. We are going to cover deposit tokens and what commercial banks’ play in the upcoming chapter. Future of Money by Subhendu & Ashish CHAPTER 10 Commercial banks enter the ring JP Morgan & Chase is the front runner in blockchain innovation and have devised strategies which look like an answer to the burgeoning CBDC craze. The 220 year old bank partnered with Oliver Wyman and launched Onyx. Commercial bank money could hold the keys to a safer tokenized economy. The German Banking Industry Committee has been working on the potential impact of Commercial Bank Money Tokens (CBMT) or Deposit tokens. Banks like Wells Fargo in the USA, DBS in Singapore are also working on pilots. How does it work ? A depository institution issues deposit tokens on a blockchain to indicate a deposit claim, which distinguishes them from stablecoins and CBDCs that are usually issued by private entities outside of the banking sector. This distinction in the issuer provides a significant benefit. Traditional banking infrastructure Future of Money by Subhendu & Ashish The exhibit above by Oliver & Wyman [10] shows how a simple deposit token workflow would look like. Since deposit tokens are essentially commercial bank money that has been transformed into a new technical format, they can be easily integrated into the banking ecosystem and subjected to the same regulatory and supervisory framework that currently applies to commercial bank Deposit tokens can mimic the current use-cases of commercial bank money which includes domestic and cross-border transactions, trading and settlement and cash collaterals. The token form catapults the commercial bank money to a new orbit with functionalities like programmability and instant and atomic settlement ( both payment vs payment & delivery vs payment) and interfacing with smart contracts. Commercial bank money has always been the majority part of the circulating money in the world economy, making up to 90%. The projections are that the CBMT or deposit tokens will also be widely used in the digital asset ecosystem and benefit the B2B use-cases most likely. In 2021, the major banking associations in Germany collaborated on a paper [11] regarding digital money, which presented various possibilities for deposit tokens or commercial bank money tokens (CBMT). These options include: 1. Each bank issuing standardized stablecoins that are supported by reserved funds ring-fenced at the ECB. 2. A joint stablecoin or synthetic CBDC that involves the creation of a special purpose vehicle (similar to Fnality). 3. Commercial bank money tokens or colored coins that represent bank deposits with interoperability. We will discuss in-depth opportunities that will be built using the core concept of CBMT or deposit tokens in our next chapter. Future of Money by Subhendu & Ashish CHAPTER 11 Our take Central banks and commercial banks around the world are recognizing the potential of blockchain and DLT and are actively developing their digital asset strategies. These digital assets are set to play a crucial role in the digital money and payments ecosystem. The future of digital currency lies in hybrid solutions that combine the best of both worlds. By leveraging the stability of central currencies and the speed of blockchain transactions, CBDCs have the potential to become an incredibly powerful tool in the digital payments landscape. We believe that in the near future, CBDCs will play a vital role in both domestic and international transactions. However, the challenge of achieving interoperability among various national currencies could limit their adoption on a large scale for global trade. Nonetheless, these challenges present opportunities for builders and entrepreneurs to develop innovative systems that facilitate the mass adoption of CBDCs. We see a bright future for deposit tokens (CBMT) in B2B and cross-border payment systems. This innovation is likely to materialize faster than CBDCs since it involves commercial banks without the need for central bank policy considerations, infrastructure, and public-private partnerships. Most central banks are focusing on domestic use-cases such as P2P, P2M, financial inclusion, and programmability in the initial stages of CBDC adoption. Therefore, commercial banks have a great opportunity to tap into the global payments and trade finance market by offering tokenized assets. However, they would require partnerships with protocols, platforms, and other entities to enable this new payments ecosystem for their clients. Future of Money by Subhendu & Ashish As a builder, you have a strong foundation of 10 ideas for the upcoming CBDC ecosystem and 4 ideas for the CMBT (Deposit Tokens) ecosystem depicted below. These ideas cover various categories such as consumer, businesses, financial institutions, and government, taking into account the current fiscal and regulatory policies. These concepts will evolve as CBDCs gain acceptance among consumers and businesses in the future. Idea Board for CBDC Ecosystem Future of Money by Subhendu & Ashish Idea Board for Deposit Token ( CMBT) Ecosystem Use these idea boards as a starting point for brainstorming and in-depth exploration, but don't be afraid to think outside the box and push the boundaries of innovation. The core features of CBDCs and blockchain, as discussed in previous chapters, should be your guiding principles to create impactful solutions. Additionally, the ideas are color-coded and accompanied by an impact barometer, indicating their potential influence on the CBDC and deposit tokens ecosystem. Consider factors such as the number of users, daily transactions, transaction volume, and the speed and efficiency of conducting business while evaluating these ideas. With this framework, you can build upon these 14 ideas and come up with new, bold, and innovative concepts that further enhance the CBDC and CMBT ecosystems. Embrace opportunities for disruption and transformation, always keeping in mind the foundational principles of CBDCs and blockchain technology to drive positive change and widespread adoption across all sectors of the economy. In the second part of this thesis we will delve into concepts that revolve around the CBDC and CBMT ecosystem. We'll explore their market sizes, unique features, potential revenue streams, as well as their competitors - both existing incumbents and new entrants. Future of Money by Subhendu & Ashish Acknowledgements Completing this thesis, exploring the fascinating junction of finance and technology, has been a collaborative endeavour that owes its success to the generosity, guidance, and contributions of many. I extend my heartfelt appreciation to those who have been instrumental in this journey: First and foremost, my sincere gratitude to Ashish Fafadia for his perceptive feedback and invaluable suggestions, which significantly elevated the calibre of this work. Your expertise has been illuminating and instrumental in shaping the final content. I am thankful to Karthik Reddy for providing the platform that allowed these ideas to take flight and gain momentum. To Udayan Pandey, Parvez Mulla, Jatin Madhra, and Joseph Sebastian from the Blume Fintech Team, my profound appreciation for enriching the content with your contributions, adding depth and perspective to the fintech and blockchain landscape. Rohit Kaul and Disha Sharma from Blume’s Corporate Team deserve a special mention for their innovative insights into the marketing campaigns surrounding this thesis, which added a dynamic dimension to the project. A special note of thanks goes to the entire Blume Team. Your unwavering support has been pivotal in allocating the necessary time and resources required to bring this project to fruition. I also want to express my gratitude to Santosh Panda, Bimlesh Gundurao, and Pranav Agarwal, who generously shared insights and experiences during interviews, enriching the thesis content. Lastly, I am indebted to my friends and colleagues whose encouragement, support, and occasional distractions turned this journey into an engaging and memorable experience. To all the individuals acknowledged here, as well as those who contributed in various ways, I offer my heartfelt thanks. Your collective contributions have indelibly shaped and enriched this work. Warm regards, Subhendu Panigrahi Future of Money by Subhendu & Ashish Annexure Annexure 1 1. Liquidity by a central authority or sacred liquidity: Centralised control over liquidity to ensure stability and accessibility. 2. Sacred liquidity:High importance placed on maintaining fluidity in financial systems. 3. Secure finality of settlement: Assurance of secure and irreversible transaction completion. 4. Inflationary/Deflationary: Referring to the impact on the value of money due to changes in its supply. 5. Anti-fraud: Measures in place to prevent and detect fraudulent activities. 6. Trust: The reliance on the integrity and authenticity of financial systems. 7. Limited supply: A capped quantity of a currency, as seen with cryptocurrencies like Bitcoin. 8. Fungibility: The property of money or assets being interchangeable without distinction. 9. Form/Source/Technology: Varied forms of money, their origins, and the technological basis for transactions. 10. Volatility: The extent of price fluctuations in a currency or asset. 11. Anonymity: Concealing the identities of transaction participants. 12. Programmability: The ability to encode specific functions and conditions into financial transactions. Annexure 2 What does Fragmented and truncated data format mean? In cross-border payments, concise and structured messages are exchanged between financial institutions using specific formats like ISO 15022 or ISO 20022. However, the challenge arises from the multitude of formats available, with each institution favoring its legacy systems, causing delays and inefficiencies during message conversion. Additionally, banks use internal messaging systems that require external messages to be converted into their preferred formats, resulting in further processing delays. Future of Money by Subhendu & Ashish Annexure 3 The 6 major features of blockchain are listed below: Decentralization: Blockchain is designed to be a decentralized system, meaning that there is no central authority or intermediary controlling the network. Instead, transactions are verified and recorded by a distributed network of computers, known as nodes. Immutability: Once a block of transactions is added to the blockchain, it cannot be altered or deleted. This makes the blockchain an immutable ledger, which ensures that transactions are secure and tamper-proof. Transparency: Blockchain is a transparent technology, meaning that anyone can view the entire transaction history of the blockchain. This creates a high level of accountability and trust among network participants. This is the feature of a public blockchain or permissionless blockchain.. However permissioned blockchain or private blockchains have picked up interest in a lot of enterprise use cases including payments and financial services. Security: Blockchain uses advanced cryptographic techniques to secure transactions and protect against fraudulent activities such as double-spending or hacking. This makes the blockchain a very secure way to store and transfer digital assets. Smart contracts: Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into code. They allow for automated and decentralized execution of contracts, reducing the need for intermediaries and increasing efficiency. Interoperability: Blockchains can be designed to work together, allowing for the exchange of assets and information across different networks. This creates a more connected and seamless digital ecosystem. Future of Money by Subhendu & Ashish DISCLAIMER The content presented in this thesis represents the perspectives of the Blume Fintech team regarding the future of money and the role of blockchain. It is intended to provide educational and informative insights and should not be interpreted as financial advice. All market data, prices, and graphs included in this thesis are based on information available up until July 31st, 2023. References to third-party sources, products, services, or organizations in this report are solely for informational purposes and do not indicate endorsement or affiliation. The accuracy and reliability of information from external sources are beyond the control of the author(s). The author(s) retain the right to modify the content, format, and structure of this book/report without prior notification. By choosing to read and utilize this book/report, you acknowledge your understanding of and consent to the terms outlined in this disclaimer. Should you disagree with these terms, kindly refrain from using or depending on the information offered in this book/report. The author(s) assume no responsibility for any liability, loss, or risk resulting directly or indirectly from the utilization or application of the information presented herein. Future of Money by Subhendu & Ashish REFERENCES 1] The 2022 McKinsey Global Payments Report 2] Currency Conversion and Global Trade’s Hidden Costs 3] 2020 Small Business Payments Insights: SMB Attitudes and Banking- Charting a New Course 4] Bitcoin: A Peer-to-Peer Electronic Cash System 5] Transforming the Way Money Moves 6] Towards a tokenized world 7] India’s $1 Trillion Digital Asset Opportunity 8] Digital Currencies: A Question of Trust 9] Central bank digital currencies: financial stability implications 10] Deposit Tokens emerging as a foundation for Stable Digital Money 11] Digitization of Bank Deposits Future of Money by Subhendu & Ashish