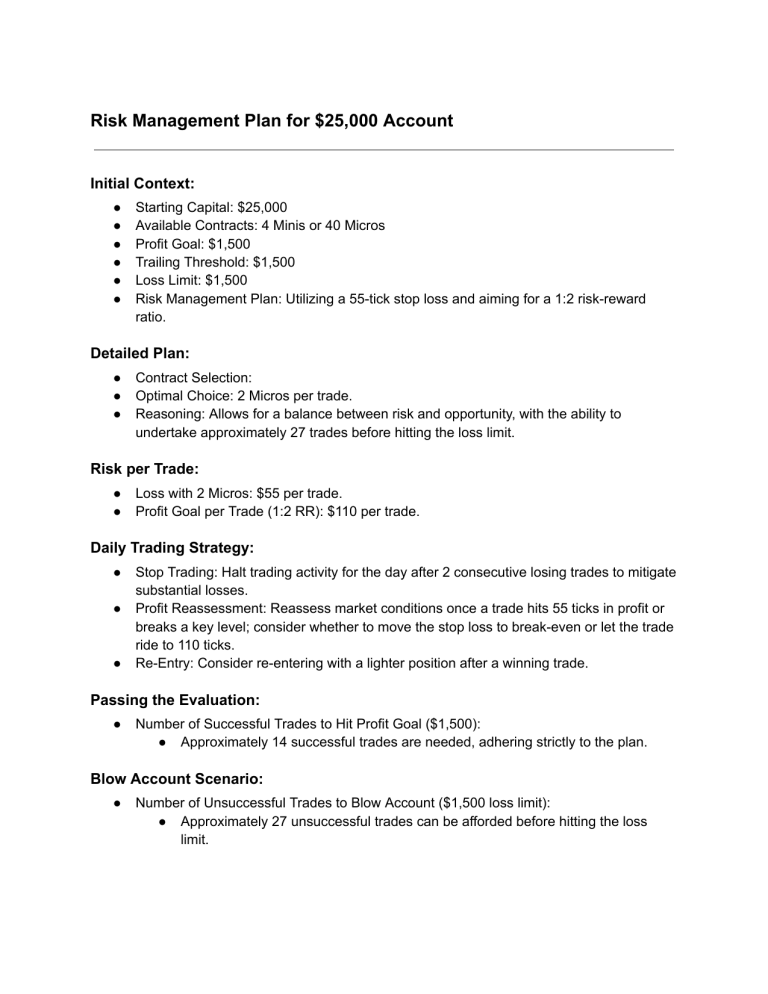

Risk Management Plan for $25,000 Account Initial Context: ● ● ● ● ● ● Starting Capital: $25,000 Available Contracts: 4 Minis or 40 Micros Profit Goal: $1,500 Trailing Threshold: $1,500 Loss Limit: $1,500 Risk Management Plan: Utilizing a 55-tick stop loss and aiming for a 1:2 risk-reward ratio. Detailed Plan: ● ● ● Contract Selection: Optimal Choice: 2 Micros per trade. Reasoning: Allows for a balance between risk and opportunity, with the ability to undertake approximately 27 trades before hitting the loss limit. Risk per Trade: ● ● Loss with 2 Micros: $55 per trade. Profit Goal per Trade (1:2 RR): $110 per trade. Daily Trading Strategy: ● ● ● Stop Trading: Halt trading activity for the day after 2 consecutive losing trades to mitigate substantial losses. Profit Reassessment: Reassess market conditions once a trade hits 55 ticks in profit or breaks a key level; consider whether to move the stop loss to break-even or let the trade ride to 110 ticks. Re-Entry: Consider re-entering with a lighter position after a winning trade. Passing the Evaluation: ● Number of Successful Trades to Hit Profit Goal ($1,500): ● Approximately 14 successful trades are needed, adhering strictly to the plan. Blow Account Scenario: ● Number of Unsuccessful Trades to Blow Account ($1,500 loss limit): ● Approximately 27 unsuccessful trades can be afforded before hitting the loss limit. Maintaining Discipline: ● ● Continuous Learning: Regularly review and learn from each trade. Emotional Discipline: Maintain composure, especially after a series of winning or losing trades, to avoid irrational decision-making. Additional Notes: ● ● ● Continuous Monitoring: Ensure adherence to the risk per trade and regularly review trade performance. Flexibility: Adapt the plan based on ongoing learning and changing market conditions. Success Factor: Regular monitoring, discipline, and adherence to risk management principles are crucial. Summary: By strategically trading 2 micros per setup and maintaining a disciplined approach, the trader can sustain approximately 27 losing trades before reaching the loss limit and needs around 14 successful trades to achieve the profit goal. This approach allows successfully passing the evaluation while staying within the corrected risk parameters. Regular monitoring, learning, and adaptability are paramount for maintaining and enhancing the efficacy of the trading strategy. Risk Management Plan for $50,000 Account Initial Context: ● ● ● ● ● ● Starting Capital: $50,000 Available Contracts: 10 Minis or 100 Micros Profit Goal: $3,000 Trailing Threshold: $2,500 Loss Limit: $2,500 Risk Management Plan: Based on a 55 tick stop loss, trading with a 1:1 or a 1:2 risk-reward ratio. Detailed Plan: Contract Selection: ● Optimal Choice: 4 Micros per trade. ● Reasoning: This choice allows for a reasonable amount of trades before hitting the loss limit, offering a balance between risk and opportunity. Risk per Trade: ● Loss with 4 Micros: ● ● 55 ticks×$0.50 per tick×4 micros=$110 per trade Profit Goal per Trade (1:2 RR): 110 ticks×$0.50 per tick×4 micros=$220 per trade Daily Trading Strategy: ● Stop Trading: After 2 consecutive losing trades, the trading activity is halted for the day to avoid substantial losses. ● Profit Reassessment: Once a trade hits 55 ticks in profit or breaks a key level, reassess the market conditions and decide whether to move the stop loss to break-even or to let the trade ride to 110 ticks. ● Re-Entry: After a winning trade, consider entering another trade with a lighter position. Passing the Evaluation: ● Number of Successful Trades to Hit Profit Goal $3,000l: $220 per trade≈13.6 trades ● ≈13.6 trades ● Optimal Strategy: Achieve approximately 14 successful trades with strict adherence to the plan to pass the evaluation. Blow Account Scenario: ● Number of Unsuccessful Trades to Blow Account $2,500 loss limit: ● $110 per trade≈22.7 trades ● Implication: You can approximately afford 22 unsuccessful trades before hitting the loss limit and blowing the account. Maintaining Discipline: ● Continuous Learning: Regularly review each trade, focusing on learning and enhancing the trading strategy. ● Emotional Discipline: Keep emotions in check, especially after a series of winning or losing trades, to avoid irrational decision-making. Additional Notes: ● Continuous Monitoring: Ensure adherence to the risk per trade and regularly review trade performance. ● Flexibility: Adapt the plan based on ongoing learning and changing market conditions. ● Success Factor: Regular monitoring, discipline, and adherence to risk management principles are crucial for the success of this revised plan. Summary: By strategically trading 4 micros per setup and maintaining a disciplined approach, the trader can sustain approximately 22 losing trades before blowing the account and needs around 14 successful trades to achieve the profit goal, hence successfully passing the evaluation while staying within the corrected risk parameters. Regular monitoring, learning, and adaptability are paramount for maintaining and enhancing the efficacy of the trading strategy. Risk Management Plan for $75,000 Account Initial Context: ● ● ● ● ● ● Starting Capital: $75,000 Available Contracts: 12 Minis or 120 Micros Profit Goal: $4,250 Trailing Threshold: $2,750 Loss Limit: $2,750 Risk Management Plan: Operating with a 55-tick stop loss and a focus on a 1:2 risk-reward ratio. Detailed Plan: ● Contract Selection: ● Optimal Choice: 5 Micros per trade. ● Reasoning: Allocating 5 Micros per trade allows for sufficient trades before hitting the loss limit, balancing risk and opportunity. Risk per Trade: ● ● Loss with 5 Micros: $137.5 per trade. Profit Goal per Trade (1:2 RR): $275 per trade. Daily Trading Strategy: ● ● ● Stop Trading: Cease trading activity for the day after 2 consecutive losing trades to control losses. Profit Reassessment: Once a trade gains 55 ticks in profit or breaks a key level, evaluate whether to move the stop loss to break-even or to let the trade ride to 110 ticks for a profit of $275. Re-Entry: After a winning trade, re-enter the market with a lighter position if conditions are favorable. Passing the Evaluation: ● Number of Successful Trades to Hit Profit Goal ($4,250): ● Approximately 16 successful trades are needed, strictly adhering to the plan. Blow Account Scenario: ● Number of Unsuccessful Trades to Blow Account ($2,750 loss limit): ● Approximately 20 unsuccessful trades can be afforded before hitting the loss limit. Maintaining Discipline: ● ● Continuous Learning: Regularly review and learn from each trade to enhance trading strategies. Emotional Discipline: Maintain composure, particularly after a series of winning or losing trades, to avoid irrational decision-making. Additional Notes: ● ● ● Continuous Monitoring: Regularly review trade performance and adherence to risk per trade. Flexibility: Adjust the plan based on ongoing learning and changing market conditions. Success Factor: Regular monitoring, discipline, and adherence to risk management principles are crucial for the success of this revised plan. Summary: By strategically trading 5 micros per setup and maintaining a disciplined approach, the trader can sustain approximately 20 losing trades before blowing the account and needs around 16 successful trades to achieve the profit goal, hence successfully passing the evaluation while staying within the corrected risk parameters. Regular monitoring, learning, and adaptability are paramount for maintaining and enhancing the efficacy of the trading strategy. Risk Management Plan for $100,000 Account Initial Context: ● Starting Capital: $100,000 ● Available Contracts: 14 Minis or 140 Micros ● Profit Goal: $6,000 ● Trailing Threshold: $3,000 ● Loss Limit: $3,000 Detailed Plan: Contract Selection: ● Optimal Choice: 6 Micros per trade. Risk per Trade: ● Loss with 6 Micros: $165 per trade. ● Profit Goal per Trade (1:2 RR): $330 per trade. Daily Trading Strategy: ● Stop Trading: After 2 consecutive losing trades, halt trading activity for the day. ● Re-Entry: After a winning trade, consider re-entering with a lighter position. Passing the Evaluation: ● Number of Successful Trades to Hit Profit Goal: ≈18 trades. Blow Account Scenario: ● Number of Unsuccessful Trades to Blow Account: ≈18 trades. Maintaining Discipline: ● Continuous Learning: Regularly review each trade and focus on learning. ● Emotional Discipline: Keep emotions in check and avoid irrational decision-making. Risk Management Plan for $150,000 Account Initial Context: ● Starting Capital: $150,000 ● Available Contracts: 17 Minis or 170 Micros ● Profit Goal: $9,000 ● Trailing Threshold: $5,000 ● Loss Limit: $5,000 Detailed Plan: Contract Selection: ● Optimal Choice: 1 Mini per trade. Risk per Trade: ● Loss with 1 Mini: $275 per trade. ● Profit Goal per Trade (1:2 RR): $550 per trade. Daily Trading Strategy: ● Stop Trading: After 2 consecutive losing trades, halt trading activity for the day. ● Re-Entry: After a winning trade, consider re-entering with a lighter position. Passing the Evaluation: ● Number of Successful Trades to Hit Profit Goal: ≈17 trades. Blow Account Scenario: ● Number of Unsuccessful Trades to Blow Account: ≈18 trades. Maintaining Discipline: ● Continuous Learning: Regularly review each trade and focus on learning. ● Emotional Discipline: Keep emotions in check and avoid irrational decision-making. Risk Management Plan for $250,000 Account Initial Context: ● Starting Capital: $250,000 ● Available Contracts: 27 Minis or 270 Micros ● Profit Goal: $15,000 ● Trailing Threshold: $6,500 ● Loss Limit: $6,500 Detailed Plan: Contract Selection: ● Optimal Choice: 1 Mini & 2 Micros per trade. Risk per Trade: ● Loss with 1 Mini & 2 Micros: $385 per trade. ● Profit Goal per Trade (1:2 RR): $770 per trade. Daily Trading Strategy: ● Stop Trading: After 2 consecutive losing trades, halt trading activity for the day. ● Re-Entry: After a winning trade, consider re-entering with a lighter position. Passing the Evaluation: ● Number of Successful Trades to Hit Profit Goal: ≈20 trades. Blow Account Scenario: ● Number of Unsuccessful Trades to Blow Account: ≈17 trades. Maintaining Discipline: ● Continuous Learning: Regularly review each trade and focus on learning. ● Emotional Discipline: Keep emotions in check and avoid irrational decision-making. Risk Management Plan for $300,000 Account Initial Context: ● Starting Capital: $300,000 ● Available Contracts: 35 Minis or 350 Micros ● Profit Goal: $20,000 ● Trailing Threshold: $7,500 ● Loss Limit: $7,500 Detailed Plan: Contract Selection: ● Optimal Choice: 1 Mini & 5 Micros per trade. Risk per Trade: ● Loss with 1 Mini & 5 Micros: $412.5 per trade. ● Profit Goal per Trade (1:2 RR): $825 per trade. Daily Trading Strategy: ● Stop Trading: After 2 consecutive losing trades, halt trading activity for the day. ● Re-Entry: After a winning trade, consider re-entering with a lighter position. Passing the Evaluation: ● Number of Successful Trades to Hit Profit Goal: ≈25 trades. Blow Account Scenario: ● Number of Unsuccessful Trades to Blow Account: ≈18 trades. Maintaining Discipline: ● Continuous Learning: Regularly review each trade and focus on learning. ● Emotional Discipline: Keep emotions in check and avoid irrational decision-making. Summary: These plans are structured to ensure the trader maintains a disciplined approach, allowing for a balanced opportunity to achieve the profit goals while adhering to the stipulated risk parameters. Regular monitoring, learning, and adaptability are key for maintaining and enhancing the efficacy of the trading strategies.