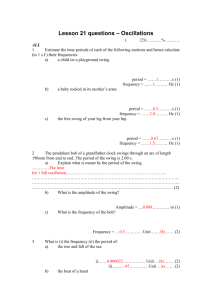

Introduc on Welcome to this Chapter 3 of the new mentorship. This is a comprehensive guide on trading, where we'll be diving deep into the world of Higher-Time Frame (HTF) Bias and Lower-Time Frame (LTF) execu on. This is my best a empt at breaking down these concepts into bite-sized, diges ble pieces. It might not be the best tutorial out there, but it is my best. In this tutorial, we'll be discussing the dynamic landscape of market movements, understanding the signi cance of tradi onal trading concepts and mastering the art of trading from level to level on the LTF. We'll also be exploring more advanced territories like Swing Failure Pa ern and Reclaim. We've worked hard to include gures and diagrams to illustrate these concepts, making it easier for you to grasp and apply them in your trading strategy. The only thing I ask from you, is that everything you learn here, you must prac se, trading SFPs and with this style is all about prac ce and experience. By the end of this guide, you'll have a solid understanding of how to ac vely trade the SFP and other HTF bias pa erns and be prepared to execute buy or sell trades when the price interacts with these levels in the future. You'll also be well-versed in the concept of con uence, which is when mul ple factors or indicators align together to provide a stronger and more reliable trading signal. tt fl ti ti tt fi ti ti tt ti tt tt tt ti fi ti ti ti tt tt tt tt References CryptoCred: h ps://twi er.com/cryptocred?s=21&t=8nZyDpFCmoVtSATYl3vdhg Tom Dante: h ps://twi er.com/trader_dante?s=21&t=8nZyDpFCmoVtSATYl3vdhg Will Hun ng: h ps://twi er.com/wmd4x?s=21&t=8nZyDpFCmoVtSATYl3vdhg Mindjacked: h ps://www.youtube.com/channel/UCt38QXfZx50WV4dCLqPczAQ/videos Trading With A Higher Time Frame Bias The traders who are the best of the best plan everything. You’ve heard the phrase “plan your trade and trade your plan” countless mes. In this sec on, we’ll understand what that means. Addi onally, we’ll understand how to make plans, and have a Higher-Time Frame (HTF) bias while execu ng trades on Lower-Time Frames (LTFs). Planning and reviewing your trades is what makes you a be er trader. Also, the only way to not be surprised by what the market does, especially when trading a very vola le asset class like crypto, is to be prepared for every single scenario. I am primarily a scalper. Some of my mentors had a very peculiar trait that I could never understand, they knew exactly which trades to leave running for extended targets and which ones to cut early. The reason they knew how to do this was because they always started with a top-down analysis before placing a trade. Basically, they had a weekly outlook, a daily outlook, a 4H outlook, an hourly outlook and nally a 15-minute outlook. The charts for all those meframes had already been scanned, marked and planned for before they got down to the minute or 5-minute me frame to actually execute their trades. Naturally, this gave them access to more data and more insights, to understand which trades to leave running. A simple example of the above is a ached below: fi ti ti tt ti ti ti tt ti ti Figure 1. 5-min TF Chart In this 5-minute TF chart, we see how the price is rejected from an hourly resistance zone. Then formed a 5-minute resistance zone in the process. The target for our hourly chart has not yet been reached (assuming one would have shorted the rst rejec on from that zone). Next the entry and target for the 5-minute chart has been met. But since we know that this chart would have a tendency to go lower than this level, we will only take par al pro ts here or move our stop loss up. In these scenarios, instead of a normal 2:1 risk: reward ra o, you have a much higher one and a higher hit rate. I call this trading style “HTF bias + LTF con rma on”. This means that we can have our stop loss for the trade based on the price ac on we see on the 5-minute chart but we will not exit at the target on the 5-minute chart, at least not completely. This is a trade I had taken personally, I exited half at the target mark and then let the rest of the trade run for more pro t. The reason I had more convic on in this trade to let it run even when I had made enough pro t was because the bias on the HTF was also down and the target for the HTF set-up was not yet reached. In this tutorial, you’ll learn what are the pa erns, behaviours and scenarios where I have a higher meframe bias and how to use it to your advantage to secure more pro t while execu ng on the LTF just like the above trade. Reasoning Behind This Style Of Trading: The trades that grow accounts are the ones with a daily bias. We will take swing trading examples to allow everyone to understand, but all of this trading is based on mostly price ac on so this can be done on any meframe. These are the ones that have the high R:R with a rela vely high hit rate because you've got a big daily Target and you've got your ght stop on the hourly, 15-minute or even 5-minute me frame. Type 1: Pinbar or reversal candles ti ti fi fi ti ti fi ti ti ti ti ti fi ft ti tt ti ti ti fi fi ti ti ti ti Even though many traders claim to recognize pin bars and predict their outcomes, many incorrectly iden fy them. To clarify, a genuine bullish pin bar has a no ceably long wick compared to surrounding bars. This long wick is o en overlooked as traders mistakenly pick bars with any protruding wick. Addi onally, a bullish pin bar should have minimal or no upper wick. Remember these key features to iden fy and trade pin bars correctly. Figure 2. Pinbars Pinbars can look like any of the above images. The focus as always should be in the context of the price ac on and not in one isolated candle structure. There are three criterias I use for this type of daily or HTF bias: ti 1. It should be at the end of a trend or a swing. Figure 3. Bullish and Bearish Pinbar An arbitrary pinbar is usually not the best for a HTF bias. This is an age old pa ern and the only reason it s ll works today is because good traders use it in the correct context. Let’s understand how a pinbar is formed: We will take a real world example from an actual Bitcoin chart. tt ti Figure 4. Pinbar on Actual Bitcoin Chart Based on the above chart, we look at how we have a bullish pinbar at the very end of a down swing. A bullish pinbar on the higher meframe represents a scenario where the sellers tried to push the price further down but failed to do so and price moved up due to aggressive buyers stepping up or due to limit orders at the bo om of a trend. This is why it is important for this pa ern to appear at the end of a swing point, this ensures that our thesis of over excited sellers or late shorters get punished during the forma on of a bullish pinbar and vice versa for a bearish pinbar. Figure 5. Ideal Pinbar The above chart shows a zoomed in version of the pinbar in the earlier chart, gure Y. Figure Y was a daily chart while gure Z represents the hourly chart zoomed in on the pinbar of the same scenario. ti fi ti tt ti ti ti fi tt ft ti As is clear from the chart, the sellers force a breakdown on the lower meframes before a devia on and reclaim of that level takes place, this means that price is further moved up by shorts closing (which means a market buy) and more aggressive buyers stepping in. It is also important to note that since this takes place in a macro downtrend, most traders would feel more comfortable shor ng and hence would get trapped. It is also important to note that this is just an explana on for a how a pinbar is formed, we will not be trading this blindly, this is just an instrument to change our bias to bullish from bearish immediately a er a macro downtrend. The bo om wick for a bullish pinbar should be long with li le to no top wick. The top wick of a bearish pinbar should be long with li le to no bo om wick. Figure 6. Idealized Pin Bar This is an example of ideal pinbar forma ons. The key here is not to focus on the body of the candle but just the wick forma on. In fact, now that we know how and why pinbars are formed point 1 and Figure Z, you now have the tools to drop down to the lower meframes and see if the candle forma on has taken place in the discussed manner. ti fi tt tt tt tt ti ti ti ti ti tt Also important to men on here is no ma er how good the candle or the candle forma on looks for a high convic on trade, I always wait for LTF con rma on. Whatever we have discussed so far is only for HTF bias. We will also wait for an ideal pinbar to be formed as per our knowledge, rushing into trades or going against the discussed bias just because a non-ideal pinbar has been formed is not something I would advise. ti ti 2. 3. Con uence Although this is not something that the market will give you every me a pinbar appears as per our criteria, it is s ll important to con nue to look for con uence, be it price ac on or indicators. The reasoning behind this is that the pinbar is mostly a reversal pa ern as per our context and framework of trading. Trading reversals inherently has some risk and thus, you should always be looking for con uence. Figure 7. Idealized Pin Bar fi ti fl fl fi ti fl ti ti fl tt ti MACD divergence or RSI divergence is one of the rst thing that comes to mind when trading reversals. Many traders learn how to used these indicators when they rst start out and there is a bias that these don’t work, problem is that these don’t work in isola on. However, these are great con uence tools that every trader should keep in mind. How to trade with HTF pinbar bias? We will use all of the concepts used in chapter two about drawing accurate levels to our advantage here. Step 1. Iden fy your bias once the pa ern occurs. Figure 8. Iden fy your Bias Based on the above scenario, it is evident that market is showing signs of reversing to a bullish structure a er a bearish market structure break. Thus, we have now iden ed a bullish bias, now we draw our levels and iden fy trading zones on our execu on meframe, in this case our bias is based on the daily chart and our execu on will be on the hourly meframe. fi ti ti ti ti ti ti ti ti tt ti ft ti Step 2. Draw your levels and drop down to the execu on meframe. Figure 9. Draw your Levels Amongst other levels, one of the most important levels while trading bullish pinbars is the low of the candle before the pinbar was formed. Price always has a tendency to reach back to it during reversals. The candle closing of the pinbar has been marked on the chart with a ver cal line. ed, our bias is clear, it becomes a level to level trade. ti fi ti Once all the levels are iden Step 3. Entry And Risk Management. Figure 10. Entry and Risk Management tt The best play for the following setup is to ladder your entries and exits. This has been discussed in Chapter 1 in great detail. The best entry for a pinbar is the retest of the low of the candle before the pinbar, the second entry is the retest of a level above the pinbar that price reclaims, or retest of the top of the pinbar. In this case, we place buy orders at all of those levels and get a be er average entry as shown, stop is to be placed below the low of the pinbar and used on a closing basis. Bearish Example: Figure 10 ti ti ft tt In the a ached example, we again have a bearish scenario where price has rejected from the Monthly Open twice before the pinbar is formed. Price le a wick and hence moved past the monthly open where sellers stepped up and slammed the price back down, hence the bias is instantly bearish and then you have a bearish pinbar as shown. We also have good levels below us to look for targets so next, we drop down to the execu on meframe. Figure 11 Based on the above example, we marked our levels on the higher meframe (4-hour), and then we move down to the 15-minute meframe. In this example, we do not get another surge up for a be er entry but our bias remains short, so we wait for the retest of the 4H level below us to enter a posi on. Type 2: Bullish or Bearish Engul ng Candles ti ti tt fi ti tt What does the pa ern look like? Figure 12. Bearish Engul ng candle Figure 13. Bullish Engul ng candle ti fi fi ti fi tt fi fi fi ti fi tt Engul ng candles tend to signal a reversal of the current trend in the market. This speci c pa ern involves two candles with the la er candle ‘engul ng’ the en re body of the candle before it. The engul ng candle can be bullish or bearish depending on where it forms in rela on to the exis ng trend. The images above present the bullish and bearish engul ng candles. The large bullish candle shows that buyers are piling into the market aggressively and this provides the ini al bias for further upward momentum. This is again a reversal pa ern. So this is expected to occur at the end of a trend or at least short-term swing. And whenever I teach traders about engul ng bars they mostly start telling me they know all about it, but this is not to be traded as a two-candle pa ern to blindly long or short wherever it forms. Figure 14 In the above example, price reverses from a downturn a er a period of consolida on as indicated by the green circle. However, when price is already in an uptrend a er a market structure break to the upside, this is not the context for our HTF bias. This is indicated by the red circle. ti tt fi ti ft ft tt ti ti However, just iden fying such areas of interest and iden fying your HTF bias is not enough as you need an entry, a set target and proper risk management to consistently trade using these tools. How to trade with Engul ng candle as a HTF bias? Now we will look at trading examples: Step 1: Locate the Engul ng Candle At the Appropriate Trend Point Extreme Figure 15 The following chart illustrates how the engul ng candle formed at the end of a HTF downtrend. The wick on the second candle goes lower than the candle before it but the body “engulfs” the previous candle and closes above it. This shows strength in the market and that buyers are stepping up to defend the current level of support. Our current bias is hence Bullish. Next, we will drop down to the lower meframes and then look for levels and the LTF picture to execute a long. ti fi fi fi Step 2: Find the Entry Trigger On The Lower Time Frame. Figure16 In the above gure, there is a LTF zoomed in picture of the gure above. Contrary to popular belief, we do not enter as soon as the candle closes. The candle close on this meframe is shown by the ver cal black line. ti fi ti ti ti fi fi ti We now have a bullish bias but the hourly chart levels show us that we are right at resistance and rejec ng from the marked level. We will wait for a break above this level and a retest. Here, aggressive traders can enter on the retest with a limit order and others can wait for other forms of communica on but usually, if you have a HTF bias, then a LTF level retest, this should be enough con rma on to pivot long. Step 3: Execu on and Risk Management. Figure 17. Iden fy your Bias First and foremost order of business should be a stop placement. This should ideally be on a closing basis if price breaks down below the H1 level we are longing, so you are a emp ng to get out of the long posi on as close to your entry as possible. However, we have a “safety” stop or a hard stop loss below the last low before the break above the level. This is to ensure that we don’t lose more than we had planned in case a violent breakdown takes place. fi ti tt ti ti ti fi fi ti ti ti fi ti Next, we have a nal target at the Hourly level above. However, there is a par al take pro t opportunity at the red box in the gure. The reason is that we retest a part support level as resistance twice before forming a devia on above it. Since price went above it but failed to hold, we will take a par al pro t in these situa ons. It is easy to pick cherry picked examples that will show how these trades moved straight into target but as an educator, I would like to be open on how laddering entries and exits remains one of the most important techniques of risk management. This is why we are using real world examples and charts to illustrate our setups. SWING FAILURE PATTERN (SFP) The Swing Failure Pa ern is a popular concept in technical analysis, widely used by traders to iden fy poten al trend reversals or signi cant trading opportuni es in nancial markets. It involves recognizing speci c price ac on characteris cs that signal a failure of a prevailing trend, indica ng a possible shi in market sen ment. The Swing Failure Pa ern primarily focuses on swing highs and swing lows in a price chart. A swing high occurs when a price reaches a peak and is followed by a downward movement, while a swing low happens when a price reaches a trough and is followed by an upward movement. By analyzing the sequence of swing highs and lows, traders can iden fy the development of a Swing Failure Pa ern. IMAGE This pa ern can be found in various meframes, making it applicable for both short-term and long-term traders. It is most e ec ve in trending markets, especially when combined with other technical analysis tools like support and resistance levels, trendlines, and candles ck pa erns. You should approach the Swing Failure Pa ern with cau on and always implement proper risk management strategies. Like any technical analysis tool, it is not foolproof, and false signals may occur. However, when used in conjunc on with other con rma on indicators, it can provide valuable insights into poten al trend reversals, helping you make more informed decisions and enhance your overall trading strategies. How the Pa ern Forms The Swing Failure Pa ern forms based on the behaviour of swing highs and swing lows in a price chart. It involves a speci c sequence of price movements that signal a poten al trend reversal. Let's go through how the pa ern forms: tt tt ti ti fi ti ti ti fi ti ti fi tt ti ti ti fi ti ti ff tt ti fi fi tt tt tt tt ti tt tt ti ti ti ti ft Iden fying the Prevailing Trend: The rst step in recognizing the Swing Failure Pa ern is to iden fy the prevailing trend in the market. This could be an uptrend (higher highs and higher lows) or a downtrend (lower highs and lower lows). • ti ti • Figure 18. Iden fy your Bias • Forma on of Swing High and Swing Low: As the trend progresses, the market will form swing highs and swing lows. A swing high is a price peak that is higher than the preceding and succeeding peaks, while a swing low is a price trough that is lower than the preceding and succeeding troughs. • Figure 19 Failure of Swing High (Bearish Swing Failure Pa ern): a. In an uptrend, the market creates a new higher swing high. b. However, instead of con nuing the upward movement, the price reverses direc on and closes below the previous swing low. c. This failure to sustain the higher high and the subsequent close below the prior swing low forms the Bearish Swing Failure Pa ern, indica ng poten al weakness in the uptrend and a possible trend reversal. • Figure 20. Bearish Swing Failure Pa ern ti ti ti ti ti tt tt tt tt tt ti ti ti ti Failure of Swing Low (Bullish Swing Failure Pa ern): a. In a downtrend, the market establishes a new lower swing low. b. Instead of con nuing the downward movement, the price reverses direc on and closes above the previous swing high. c. This failure to con nue the downtrend and the subsequent close above the prior swing high forms the Bullish Swing Failure Pa ern, sugges ng poten al strength in the downtrend and a possible trend reversal. • • Con rma on Signals: While the Swing Failure Pa ern can be a powerful tool on its own, you should seek addi onal con rma on signals to increase the probability of a successful trade. Con rma on can be obtained from other technical indicators, such as moving averages, oscillators, or candles ck pa erns, as well as support and resistance levels. • Trading Opportuni es: Once the Swing Failure Pa ern is iden ed and con rmed, traders may consider implemen ng various trading strategies based on their risk tolerance and market analysis. This could include taking short posi ons in the case of a Bearish Swing Failure Pa ern or going long a er observing a Bullish Swing Failure Pa ern. • Risk Management: As with any trading strategy, risk management is crucial when trading based on the Swing Failure Pa ern. You should use appropriate stop-loss orders to limit poten al losses and posi on sizing techniques to manage risk e ec vely. fi ti ff fi ti ti tt tt ft tt ti ti tt fi ti ti ti tt ti fi ti ti ti fi tt Figure 21. Risk management Execu on: Not every sweep of a high/low is an SFP. Use the notes on liquidity. Ask yourself, where would a retail trader place stops or be baited to take a posi on. You need to understand how retail trades and go against that. Entry: On close of the candle that sweeps the high/low. nd 2 entry (op onal): Candle a er the sweep closes below/above the high/low as well. SL: Level of the wick of the ‘sweep’ candle. Place order or manual SL on a close above/below the wick. Target: 1) Last swing low/high 2) Range high/low ti ft ti ti Example 1: Example 2: The second entry might confuse you so let’s start with an already discussed example: The second entry is also valid even if you miss the ini al SFP. It provides higher convic on that sellers have no real strength and bids absorbed all orders pushing price below the low. Common Mistakes: Not every low/high has liquidity res ng below/above them. As such, SFPs will occur everywhere if you look hard enough. The trick is to prac ce as much as possible before implementa on. Ask yourself all the me, is the setup obvious or are you pushing it? Were there be stops res ng below this low? Were breakout traders baited in longing on price moving above this high? ti ti ti ti ti ti ti ti Here’s a couple of ps you can follow to increase accuracy when trading SFPs: Read the sec on on key highs again. Make sure you mark out the right highs. Also, dojis usually tt ti signal uncertainty in the market, it’s be er to steer clear of them when trading SFPs. Don’t rush your setups. Let Price develop and be as pa ent as possible. It’s alright to get one trade a week if you have a high success rate. Don’t have a twitchy trigger nger. You need to be calculated and execute at the right moment to be a trader. Use con uence: You can use volume, RSI divergences and moving averages for con uence to give you more convic on on the trade. The swing failure pa ern is a highly respected, logical and high frequency occurring pa ern. tt fl ti ti tt ti fi fl ti This works in each me frame and the edge lies on prac cing, observing and building an eye and experience on when to use it. Advanced SFP and Trade Management Once you see price ip the level as support, trade idea is already invalidated. There is no point in holding it ll stop. In this case, you get out for near Breakeven (BE). This is how you minimise the loss on your losing trades. Takeaway: Never panic and exit the moment price goes the opposite way. Make sure you understand when your trade idea is invalidated, get out the moment it is, not before, not a er. ft fl ti How to consider pulling orders (think of it as how to know if it is a true front run and your level worked)? Using the ATR If the ATR value exceeds the di erence between your order and the wick. It might be me to start considering cancelling your bids. Illustra on 2: Where to place your stops? ATR trick for placing stops when trading an SFP. Use this in addi on to the SFP tutorial. Link: h ps://t.me/EmperorbtcTA/493 In choppy Price Ac on, we some mes must wait for a sweep of a sweep (sort of like a 3 tap) and can't enter because we might just get wicked out and obviously can't have a manual stop because we can't posi on size accordingly. So we can use the ATR to have a safety stop. Se ngs need to be modi ed to 24 but just look at the ATR value of the "sweep" candle and then place your stop that much above the high/low. ti ti ti ff fi ti ti ti ti tti tt This way you can posi on size properly. If a candle closes above your SFP high, of course you close manually, but this is the op on to not get stopped out on that one extra sweep while also having xed invalida on. Illustra on 3: When to get out early, Evolving R concept. Novice traders are fearful when they’re in pro t (they want to bank pro t as soon as possible) and hopeful when they’re in the red (Unrealised loss makes them hope that the trade s ll works out). Again, psychology is very important for trade management, you want to do the inverse of novices. Consider this sample trade: In these scenarios, traders move their stops to entry and then sit on their hands hoping for 1 more R. The thinking is that it is a free trade now. ti ti ti fi ti fi fi ti ti Evolving R is a concept that explains that your Risk:Reward ra o is always changing when you’re in a posi on. Evolving R visualised for you. If you risked 2% on the trade, you’re up 6% and you’re now risking that 6% to make <2% more. This is when you place a market order and get out while booking great pro ts. When taking a trade, there’s a certain amount planning involved beyond just entry, target and stop loss. Evolving R concept doesn’t mean you get out of all your trades early the moment you’re in slight pro t. When the trade seems to be slowly reversing on you and the evolving R is less than 0.5, that’s when you START TO CONSIDER an early exit and securing pro ts. fi fi fi ti Illustra on for a plan when trading levels: Black: keep holding your trade Blue: Consider ge ng out or securing some pro t NOTE: When Price moves as illustrated in Black. You can choose to keep moving your stop up. Example: Move stop to slightly below a level once it is ipped. Things you should always keep in mind when taking a trade beyond, Entry, SL and TP are: 1) Trouble areas 2) Early Invalida on Areas fl fi fl tti ti 3) Trouble areas eliminated (levels ipped) to move stops.