BBA – 1 Economics

Santosh Nair

March: 16 & 23 2024 | April 6, 2024

Assignment – April 11, 2024

R E G E N E S Y S ’ I N T E G R AT E D L E A D E R S H I P A N D M A N A G E M E N T

MODEL

2

D E V E L O P I N G R E G E N E S Y S G R A D U AT E AT T R I B U T E S

Getting a qualification is not enough, on its own, to prepare you to traverse the rapidly changing world of work, where industry 4.0 and

5.0 are rendering many professions obsolete. We will work with you throughout your studies to help you develop these critical attributes

to navigate the new world order, along with the skills and knowledge you need to excel in any environment:

3

T H E Q U I N T U P L E B O T TO M L I N E

While Regenesys’ Integrated Leadership and Management Model demonstrates the interconnected- ness of the individual with organisational layers and the

broader environment, the quintuple bottom line draws attention to the interrelationships between the actualisation of organisational purpose, and people, planet,

and prosperity, given the organisation’s ability to pivot

4

Facilitation Expectations

❖ Be open-minded

❖ Please raise the hand when you have to speak

❖ Listen carefully

❖ One conversation at a time

❖ Respect the opinions of others / if you disagree, do so politely

❖ Give constructive feedback

❖ Build on the ideas of others rather than destroying them

❖Take some risks and share new ideas

❖Have fun and enjoy the experience!

5

Key Areas Covered in This Course

COURSE OUTLINE

Introduction to Economics, Economic Systems and Modelling

PPF, Demand, Supply, Equilibrium and Elasticity

Saturday

16 - March

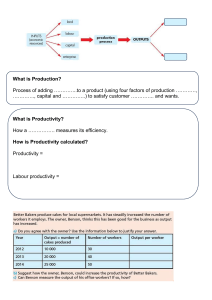

Production and Costs

Market Structures and Competition

Macroeconomic Indicators: GDP, Inflation, Fiscal & Monetary Policy

Saturday

23 - March

Saturday

6 - April

International Trade

6

Learning Outcomes

❖ Describe the nature and basic economic problem of South Africa’s economy

❖ Understand the task of economics and differentiate between microeconomics & macroeconomics

❖ Analyse the relationships between demand, supply and market equilibrium

❖ Show the relationships between production and cost

❖ Calculate and interpret various categories of price elasticity

❖ Describe perfect and imperfect competition in the economic environment

❖ Analyse the concept of the labour market

❖ Distinguish between fiscal, monetary and trade policy

❖ Measure economic performance

7

TAKE NOTE OF KEY POINTS ….!

❖ Slides with this mark is for knowledge;

Content NOT included in EXAMS…!

❖ Slide with this mark

Additional Learning | NOT covered in course / exam

❖ SG# 20 – This means: Study Guide & Page Number; You can

locate the content in this page!

8

Introduction

Activity – 10 Minutes

Aim: Acquaintance

Break-time is Democratized

Depends on Your Convenience

Time: Keep it short

Task: Please introduce yourself:

❖ Name

❖ Professional background (if willing to share)

❖ Keen area of interest in Economics

9

Your Take..? Please…

❖ Why do you … want to study Economics?

❖ Why should you – a law-student know

Economics?

❖ What is the big – deal?

10

Introduction to Economics &

Economic Problems

11

Introduction to Economics – Social Science

“Social science … studies choices that individuals, businesses,

governments and entire societies make while coping with scarcity

and incentives that influence and reconcile those choices.”

(Parkin, 2019:Pp 38)

Oikonomia: Greek term for Household management

❖ Reference text: Regenesys Study Guide

❖ Key textbook: Parkin, M. 2019, Economics, Global Edition, 13th ed., Harlow, United Kingdom: Pearson Education

12

Definition of Economics

❖ Microeconomics - study of choices that individuals and

businesses make, way these choices interact in

markets, and influence governments.

❖ Macroeconomics - study of performance of national

economy and global economy.

Macroeconomics deals with Aggregate Demand and Aggregate Supply; This stream was founded in the

aftermath of the Great Depression of 1930s by Lord John Maynard Keynes

13

Economic Problems

SG# 6

Scarcity

Choices

disincentives

Incentives – rewards / penalties determines our

choices

Traffic violation – penalty;

Bravery awards – saving lives

Limited by income, price, and time

14

Common Economic Terms

SG# 7

Economic Terms

Meaning / Explanation

Capital Goods

Goods not consumed but used in production of other goods

Examples: machinery, plant and equipment used in manufacturing and construction, of

buildings, residences, roads, dams etc.;

Capital goods do not yield direct consumer satisfaction, but permit more production and

satisfaction in future (Adapted from Mohr, 2015, p.7

Consumer Goods

Goods used or consumed by individuals or households (i.e., consumers) to satisfy wants

Examples: food, wine, clothing, shoes, furniture, household appliances etc.; (Adapted

from Mohr, 2015, p.7

Demand

Demand differs from wants, desires or needs; demand for good or service only if one has

financial ability to purchase; Demand should have purchasing power; (Adapted from

Mohr, 2015, p.4

15

Common Economic Terms

SG# 7

Economic Terms

Meaning / Explanation

Firms

A firm is an economic unit that employs factors of production and organises them to produce and

sell goods and services. (Adapted from Parkin, Powell, Matthews, 2017, p.44)

Households

People living under one roof considered households; do fundamental things vital to an economy

such as – Demand goods and services from product markets

Market

Markets: arrangement for buyers and sellers to access information and conduct business

Individuals and firms, pursuing self-interest, profited market-making – by buying or selling items

which they specialise; markets work only when property rights exist; (Adapted from Parkin,

Powell, Matthews, 2017, p.44)

Money

Any commodity or token generally accepted as means of payment; trade in markets can exchange

any item for any other item. Imagine complexity in barter; ‘invention’ of money makes exchange

much more efficient. (Adapted from Parkin, Powell, Matthews, 2017, p.44)

16

Common Economic Terms

Economic Terms

Meaning / Explanation

Needs

Needs are necessities, things essential for survival, food, water, shelter and clothing. Needs,

unlike wants, not unlimited; it is possible to calculate basic needs for a person / household to

survive. (Adapted from Mohr, 2015, p.4)

Services

Services: intangible things; medical, legal, financial services and services provided by public

servants. (Adapted from Mohr, 2015, p.7)

Wants

Wants human desires for goods and services; wants are unlimited – we all want everything. As

individuals or for society, always want or desire more or better goods and services. For

individuals, biological, spiritual, material, social wants; a group have collective wants, law and

order, justice and social security. (Adapted from Mohr, 2015, p.4)

SG# 8

17

Factors of Production

SG# 9

The Key 4 Ingredients in Economics of Production and Services

❖

Land – geographical area; can be bought or rented

❖

Labour – people who work in factories; only be rented

❖

Capital – physical, machinery, equipment; bought / rented

❖

Entrepreneurship: organisation of work under one common

goal; holding various parts together & make them work in unison

18

Everyone M ust Make Choices

Choices & Constraints

❖

Households – limited by income

❖

Businesses – profit seeking (mix of goods/ services)

❖

Governments – must choose how to spend taxes

19

RECALL …!

The 4 Factors of Production?

20

Microeconomics &

Macroeconomics

21

Dist inguish Between Micro and Macro

SG# 8

Microeconomics

❖ Deals with choices, individuals and businesses make;

❖ Interaction of choices in markets; influence governments policies;

❖ Focus - single economic variable: demand, supply, price, consumer;

❖ Include factors of production (labour, land, capital, entrepreneurship), from a

single owner to single user of these resources;

❖ Example: a business studying supply and demand for a specific product, production

capacity, and effects of regulation by government on this product.

22

Dist inguish Between Micro and Macro

SG# 8

Macroeconomics

❑ Study of performance of national, regional, and global economies and policy

tools used;

❑ Influences performance (e.g. taxation, public expenditure, subsidies, interest rate

changes, etc)

❑ Focus - entire economy (e.g. aggregate factors), aggregate output, savings

unemployment rate etc.;

❑ Include aggregate flows of income and expenditure between different economic

sectors.

❑ Example: effect of changes in interest rate or minimum wage levels on the

larger economy

23

Economists – M icr o and M acro Level

Common Economic Denominator – Interest Rate

A microeconomist will study, for example, the effects of low

interest rates on individual borrowers

A macroeconomist will study the effects of low interests rates on

national housing market or on unemployment rate

24

Economic Problems

❖

SG# 9

We are faced daily with finite resources and choices

(decisions) on how to make best use of them.

❖

Knowledge and skills required for economic analysis and

decision-making are fundamental prerequisites for individuals,

teams, organizations, institutions, societies, and governments.

25

What How and for Whom?

SG# 9

The Three Key Questions in Economics

Positive

Normative

❖

Economics create theories to answer question: “What is?” and “What ought to be?”

❖

Consider: every day, billions of people make economic choices that result in what,

how, and for whom goods and services are produced

❖

Choices people make are in interest of self and society

❖

Trade-offs – when one item is given away for another’s possession

❖

Opportunity costs – choosing an alternative by sacrificing a benefit

26

What How and for Whom?

SG# 9

The Three Key Questions in Economics

Economics attempts to answer:

•

What is? (Positive, realistic) higher wages higher GDP; empirically tested

•

What ought to be? (Normative, idealistic) higher wages good for labor; opinions /

subjective values matters

Choices based on:

•

What? to produce (goods and services; consumption – utility maximized)

•

How? to produce (factors of production; – cost minimized)

•

For Whom? to produce (distribution of income among factors of production and

income distribution among different individuals – purchasing power)

27

Other Guide to Choices ?

SG# 10

Interest: Self Vs. Society ?

Interest of self: buy a car/home for self; take care of

family;

Interest of society: building roads, electricity

networks, potable water connections, encouraging trade

– public goods

28

Trade - offs ?

Scarcity & Choices

❑ Scarcity and choices create trade-offs

❑ A trade-off is an exchange – giving up one thing to get something else

❑ Concept of trade-off is central to all economics

❑ Trade-offs consider self and social interest decisions (“big trade-off”)

29

Opportunity Costs

Benefits Sacrificed ?

An opportunity cost: benefit, profit, or value of something (e.g. time) that

must be given-up to acquire or achieve something else.

Factors of production (land, labour, capital, entrepreneurship) can be put to

alternative uses;

Every action, choice, or decision has an associated opportunity cost

30

RECALL …!

The 3 KEY Questions in Economics

Scarcity & Trade-off

Opportunity Cost and an Example

31

Economic Models

& Economist’s Role

32

Economic Modelling and Theories

SG# 18

Primer on Economic Models

Provide logical, abstract template to help organise analyst’s

thoughts about complex human behaviour (or interaction);

In ways that sheds some insight into a particular aspect of that

behaviour (or interaction)

Graphs, diagrams, or words (equations) represent model

33

Economic Modelling

Three Key Steps

❖ Observation and measurement

❖ Model building

❖ Testing of model and development of theory

Typical economic model would appear like this

𝑳𝒏𝑬𝑽𝑨𝑰𝑪𝒊𝒕 = 𝜶𝒊 + 𝜷𝟏 𝒙 𝑻𝒐𝒃𝑸𝒊𝒕 + 𝜷𝟐 𝒙 𝑳𝒏𝑴𝑽𝑨𝒊𝒕 + 𝜷𝟑 𝒙 𝑶𝑷𝑺𝑴𝒊𝒕 + 𝜷𝟒 𝒙 𝑨𝑻𝑶𝒊𝒕 + 𝝁𝒊𝒕

34

Development of Economic Theory

SG# 19 - 20

Three Key Steps – Explained (in Text)

35

Obstacles to Economic Models

SG# 20 - 21

Cause and effect and Ceteris paribus

• There are factor variables to consider – other things being equal

Fallacy of Composition

• Invalid conclusion of generalizing results

Post hoc Fallacy

• A false cause–and-effect relationship

Economic experiments not easy to

carry out; Economic behaviour have

simultaneous causes; Can’t be

certain of cause-and-effect

relationships

Technically: Partial equilibrium

(Pareto)

36

Task of an Economist

SG# 20

Three Key Task

❖ Devising methods and procedures for obtaining data

❖ Understanding and interpreting data

❖ Advising stakeholders on suitability of alternative courses of

action and allocation of scarce resources

37

RECALL …!

❖ 4 Economic Systems

❖ Economic Model

❖ Fallacy of Composition

❖ Post-hoc Fallacy

38

Graphs in Economics &

Production Possibility Frontier

PPF

39

Graphs in Economics

SG# 22 - 23

Y - axis

Axes:

Y coordinate (dependent)

X and Y coordinates

X coordinate (independent)

X - axis

Variables (Qty, Price etc.)

Scatter diagram

Correlation and causation

Patterns to look for: Direction of Variables Positive-same; Negative is opposite;

unrelated vars.; linear is straight-line;

Slope of a relationship: influence of one over another;

▪

Please refer to the Table 8 for detailed explanation on terms

Delta △. Slope is: △y/△x

40

Production Possibility Frontier (PPF)

SG# 23 - 25

• The Production Possibilities Frontier is a boundary between

those combinations of goods and services that can be produced

and those that cannot be;

• Shows limits to production of goods;

• Illustrates scarcity and alternating between choices;

• Involves opportunity cost to choices – makes curve bend

41

PPF for Pizzas and Cooldrinks

Key Parts of PPF:

Dilemma of Two – what combo?

Efficient Frontier – only on the blue-line

Constant Opportunity Cost implies that

resources can be substituted for alternative

purposes without any added cost. That makes

the opportunity cost = 1 and constant; if the

opportunity cost was not constant then in

increasing one product by a factor of 1 comes

at the expense of decreasing another by more

than 1 factor or vice versa

Beyond Realm – Unattainable or area beyond the blue-line;

Within Control – Attainable or area in the shade;

Presence of Opportunity Cost – Reason for the bend in the PPF –

curvature

Constant opportunity cost

makes PPF straight line

42

PPF – Points to Remember

SG# 24 - 25

Production efficiency achieved when goods and services produced at

lowest possible cost – outcome occurs at all points on PPF;

Points inside PPF, production is inefficient (resources are either unused or

misallocated or both).

Every choice on PPF involves trade-off (choices must be made).

Allocative efficiency is when goods/servicers produced at lowest

possible cost in quantities providing greatest possible benefit

Point out few critical aspects of PPF

43

Task 4 You – Next Session

Assume your brother’s company produces pizzas and cool drinks. Use

graph to determine:

❖ Draw a PPF Curve / Graph to explain:

❖ If it makes 3-million pizzas how many cool-drinks can it make?

❖ At14-million cool drinks how many pizzas can it make?

❖ What is the problem if company produces 2-million pizzas and 10million cool drinks?

44

PPF – Real- time Application

Textbook Ch-2 # 72

45

PPF – Real-time Application

Textbook

Ch-2 # 82

46

Economic Systems

47

Economic Systems

SG# 12 - 15

Traditional system:

Societies built on traditional beliefs, structure & customs;

Engage in agriculture based living and trading;

Limited inclination to progress or development;

Inuit; tribes of Amazon;

Command system (socialist or communist system):

System that runs on central planning, production and distribution;

No private ownership;

Prone to inefficiencies; govt. centricity

Former USSR, North Korea etc.;

48

Economic Systems

Market system:

Designed around free-market concept; Limited regulation;

Technologically advanced;

Social and other customs no hinderance to economic development; and liberal

US, Canada, UK; (US Post, National Railroad Passenger Corp. Amtrak is owned

by Federal Govt.; Canada Post; Great British Railways)

Mixed system:

Economic system with a balance between free-market;

Govt. intervention in limited manner and technologically progressive;

Social customs no hindrance to development; liberal;

Denmark, Finland, India, South Africa etc;

49

Economic system

Examining Advantage and Disadvantage

❖ System of production, distribution and consumption of goods and

services of an economy.

❖ Principles and techniques to solve economic problems of scarcity

through allocation of limited productive resources;

❖ Market economy

❖ Command economy

❖ Mixed economy

→ Comment on Open and

Closed economy

❖ Traditional economic system

50

Free Market economy

Freedom for Market

❖ Firms and households act in self-interest; determine how resources get

allocated, what goods get produced and who buys the goods;

❖ No government intervention in pure market economy (“laissez-faire”)

❖ No truly free market economy exists in world;

❖ Separation of government and market;

❖ Prevents government from becoming too powerful, keep their interests

aligned with markets;

51

Advantages - Disadvantages Free Market Economy

❖ Advantage – Free Market

Economy

❖ Efficiency in use of Factors of

Production

❖ Entrepreneurship encouraged

❖ More R&D, innovation and

❖ Only profitable goods/services;

❖ Healthy competition to produce

better products;

❖ Acceleration of technical

knowledge and processes;

❖ More engaged society

investments;

52

Advantages – Disadvantages: Free Market Economy

❖ Disadvantages – Free Market

Economy

❖ Firms do whatever is necessary to

make profit

inequality

❖ Greater social divide between rich

and poor

❖ Disproportionate political influence

❖ Distorted investment priorities

❖ Increase in corruption

❖ Increased exploitation of workers /

❖ Environmental degradation

consumers

❖ “Self-first” and “anything for money”

❖ Increased social and economic

53

Command Economy – Communist Countries

❖ Government is central feature of economy; often involved in everything from

planning to redistributing resources; modelled on central planning

❖ Core of communist philosophy;

❖ Stable supply of resources; prices, full employment hallmark feature;

❖ Government owns key industries like utilities, aviation, and railroad;

❖ Erstwhile USSR, North Korea best examples;

❖ No private ownership of factors of production;

54

Command economy

Advantages

❖ If executed correctly, government can mobilize resources on a

massive scale; Mobility can provide jobs for almost all of the

citizens;

❖ Government can focus on good of society rather an individual;

focus could lead to more efficient use of resource

55

Command economy

Disadvantages

❑ Hard for central planners to provide for everyone’s needs;

❑ Consumption rationed by Govt., cannot calculate demand; only sets

prices;

❑ A lack of innovation since there is no need to take any risk;

❑ Workers are also forced to pursue jobs in government;

56

Mixed Economy

Concept of mixed economy, is easily relatable to real world;

Demonstrates characteristics of both capitalism and socialism;

Allows level of private economic freedom in use of capital, but allows

governments interference in economic activities (legislate) to achieve

specific social aims;

Here in this economic system is efficiency

socialism;

<capitalism but efficiency

>

57

Mixed Economy

Three Key Points:

Most economies have twin-economic systems – both private & public work along;

Govt. use of resources; control private sector with taxes (promote social objectives);

Mixed economic systems: Private sector make profits; but ensures public good;

Companies nationalised if conduct is inappropriate;

Mixed economy: a blend of both Capitalism and Socialism; most cases market price

freedom exists; Sensitive sectors – prices managed;

Most countries are mixed economic system; example, India, S. Africa,

France etc., are mixed economies

58

Mixed economy

Advantages

❖ Less government intervention than command economy.

❖ Private businesses run efficiently, than government entity;

❖ Govt. use taxes to redistribute income, reduce inequality; run safetynet: healthcare or social security

❖ Govt. corrects market failures; break-up large monopolies

❖ Tax harmful products – cigarettes reduce negative externality of

consumption;

59

Mixed economy

Disadvantages

❖ Criticisms from both sides arguing sometimes too much

government intervention; sometimes there isn’t enough;

❖ Common problem is state run industries often subsidized by

government and run into large debts, they are uncompetitive;

60

Traditional economy

❖ Most traditional, ancient types of economies in world;

❖ These areas tend to be rural, second or third-world;

❖ Closely tied to the land, through farming;

❖ In this economic system, a surplus rare phenomenon;

❖ Vast portions of world still function under traditional economic system;

❖ Each member has specific and pronounced role – division of labour

❖ Societies close-knit, socially satisfied, but lack access to technology and

advanced medicine;

61

RECALL …!

MIXED Economy

COMMAND Economy

CAPITALIST Economy

TRADITIONAL Economy

62

Demand, Supply, Equilibrium And

Elasticities

63

Defining Market

•

SG# 38

Market - an arrangement, enables buyers and sellers to get

information and do business with each other;

•

Free market economies - work on assumption that market

forces, such as demand and supply, are best determinants of a

society’s or nation’s well-being and means to meet needs;

64

Understanding Movement in Market

Demand: societies looking for solutions;

Supply: source of solutions to societal problems

Market Equilibrium: point of agreement between

demand and supply on engagement and returns;

Elasticity: responsiveness of demand/supply to signals

65

Demand

SG# 39 - 42

Meaning & Law of Demand

•

Demand occurs when consumers want a product (or

service), can afford it, and plan to buy it.

•

Law of demand states that (if all other factors remain equal)

the higher the price of a good, the less people will demand that

good. Likewise, the lower the price of a good, the greater will

be the quantity demanded.

66

Demand Relationship

Change in Quantity Demanded

P1 (highest price) = Q1 (lowest demand)

P3 (lowest price) = Q3 (highest demand)

67

Demand Relationship

Change in Demand – Six Main Factors

❖

Price of related goods (substitutes and complements)

❖

Expected future prices

❖

Income levels

❖

Expected future income and credit

❖

Population

❖

Preferences

68

Laws of Demand

Laws of Demand – Factors Influencing Changes

The Law of Demand (1) | The quantity of Chomp bars demanded

Decreases if:

The price of a Chomp bar rises

Increases if:

The price of a Chomp bar falls

Changes in Demand (2) | The demand for Chomp bars

•

•

•

•

•

•

Decreases if:

The price of a substitute falls

•

The price of a complement rises

•

The expected future price of a Chomp bar falls

•

Income falls*

•

Expected future income falls or credit becomes harder to •

get*

The population decreases

•

*A Chomp bar is a normal good

Increases if:

The price of a substitute rises

The price of a complement falls

The expected future price of a Chomp bar rises

Income rises*

Expected future income rises or credit becomes easier to

get*

The population increases

69

The Demand Equation

The law of demand states that a decrease in price of a good or service results in an

increased demand of that good or service.

The demand equation is: 𝑸𝒅 = 𝒂 − 𝒃𝑷

Where:

Or

𝑷 = 𝒂 − 𝒃𝑸𝒅

Negative sign is due to inverse relation between quantity

demanded and price

𝑽𝒂𝒓𝒊𝒂𝒃𝒍𝒆

What it means

𝑷

Price

𝒂 and 𝒃

Positive Constants

𝑸𝒅

Quantity Demanded

70

The Demand Equation

The demand equation (Parkin, 2019:116) denotes three things:

1.

The price at which no one is willing to buy the good (where

𝑄 is zero).

2.

As the price falls, the quantity demanded increases.

3.

The constant (𝑏) tells us how fast the maximum price that

someone is willing to pay for good falls as quantity increases.

71

The Demand Equation

Demand Equation Denotes Three Things

𝑷 = 𝒂 − 𝒃𝑸𝒅

𝑸𝒅 = 𝒂 − 𝒃𝑷

72

Demand for Energy Bars

Real-time Example – Demand Schedule & Curve

Price

(rand per bar)

Quantity demanded

(thousands per week)

A

0.50

22

B

1.00

15

C

1.50

10

D

2.00

7

E

2.50

5

73

Demand for Energy Bars

Real-time Example – Demand Schedule & Curve

Original demand schedule

with original income

Price

(rand per

bar)

Quantity

demanded

(thousands

per week)

A

0.50

22

B

1.00

C

New demand schedule

with new higher income

Price

(rand per

bar)

Quantity

demanded

(thousands

per week)

A’

0.50

32

15

B’

1.00

25

1.50

10

C’

1.50

20

D

2.00

7

D’

2.00

17

E

2.50

5

E’

2.50

15

74

Supply

•

SG# 43 - 46

Organizations supply goods (or services) if they have

resources and technology to produce them, can profit from

producing them, and plan to produce and sell them;

•

The law of supply states that (ceteris paribus) higher the

price of a good, the greater quantity supplied, and lower

the price of good, the smaller quantity supplied;

75

Supply Curve

Supply Relationship

P1 (lowest price) = Q1 (lowest supply)

P3 (highest price) = Q3 (highest supply)

76

Supply Relationship

Six Main Factors for Change in Supply

❑

The prices of factors of production

❑

The prices of related goods and services produced

❑

Expected future prices

❑

The number of suppliers in the market

❑

Technological advances

❑

The state of nature

Supply of Energy Bars – Please refer

study guide

Check supply schedule & graph

Note what causes supply curve to

increase or decrease

77

Laws of Supply

Law of Supply – Factors Influencing Changes

The Law of Supply (1) | The quantity of Chomp bars supplied

Decreases if:

The price of a Chomp bar falls

Increases if:

The price of a Chomp bar rises

Changes in Supply (2) | The supply of Chomp bars

•

•

•

•

•

•

•

Decreases if:

The price of a factor of production used to produce

Chomp bars rises

The price of a substitute in production rises

The price of a complement in production falls

The expected future price of a Chomp bar rises

The number of suppliers of bars decreases

A technology change decreases Chomp bar production

A natural event decreases Chomp bar production

•

•

•

•

•

•

•

Increases if:

The price of a factor of production used to produce

Chomp bars falls

The price of a substitute in production falls

The price of a complement in production rises

The expected future price of a Chomp bar falls

The number of suppliers of bars increases

A technology change increases Chomp bar production

A natural event increases Chomp bar production

78

Notice

The concepts of demand and supply are fundamental to your

understanding of economics. Please ensure you complete the

recommended reading (Chapters 3 to 6 in Parkin, M. 2019,

Economics, Global Edition, 13th ed., Harlow, United Kingdom:

Pearson Education).

Failure to complete the recommended reading will compromise the

successful completion of your module.

79

Supply of Energy Bars

Real-time Example – Supply Schedule & Curve

Price

(rand per bar)

Quantity supplied

(thousands per week)

A

0.50

0

B

1.00

6

C

1.50

10

D

2.00

13

E

2.50

15

80

Equili brium – M ar ket Equili br i um

SG# 46 - 47

Market Equilibrium – When Demand Equals Supply

Equilibrium price is achieved when quantity demanded equals quantity

supplied and;

Likewise equilibrium quantity is the quantity bought and sold at the

equilibrium price

A market should move toward its equilibrium because:

• Price normalises buying and selling plans

• Price corrects when plans do not match

81

Equili brium in Market

A Case of Energy Bars (Chomp Bars)

At a price of R1.00 a bar, 15 million bars a week are demanded and 6 million are supplied, there is a

shortage of 9 million bars a week and the price rises;

If the price is R2.00 a bar, 7 million bars a week are demanded and 13 million are supplied, there is a

surplus of 6 million bars a week and the price fall;

If the price is R1.50 a bar, 10 million bars a week are demanded, and 10 million bars are supplied. There

is neither a shortage nor a surplus and the price does not change (equilibrium);

Price (Rand per

bar)

Qty Demand

0.50

1.00

1.50

2.00

2.50

22

15

10

7

5

Qty Supply

(million bars per week) (million bars per week)

0

6

10

13

15

Shortage (-) or

Surplus (+) (Million)

-22

-9

0

+6

+10

82

Equili brium – In Ener gy Bar s M ar ket

83

Equili brium – In Ener gy Bar s M ar ket

Follow example in your study

guide

Discuss on Consumer

Surplus & Producer Surplus

❖ Schedule

❖ Graph

S

Consumer Surplus

P1

Producer Surplus

D

84

Task 4 You

Activity for Home Study

Go to P.114 in Parkin, M. 2019, Economics: Global and Southern

African Perspectives, 13th Ed, Pearson Education UK;

Demand and Supply | Economics in News:

The Market for Orange Juice has Virtually Disappeared.

Read the article on Pg.#114 and,

Examine its Economic Analysis on Pg.#115

85

Elasticity – Concept

SG# 47 - 50

In economics, elasticity is the degree to which consumers (or producers)

change their demand (or change supply) in response to price changes.

Measure of elasticity varies depends on type of product (or service).

Relatively elastic (responsive)

Relatively inelastic (non-responsive)

86

Price Elasticity

Note, to calculate price elasticity of demand, we express change

in price as a percentage of average price and change in

quantity demanded as a percentage of average quantity

87

Price Elasticity of Demand

To calculate price elasticity of a good you need to know quantity

demanded of good at two different prices (when all other influences on

buying plans remain same).

ED = {(Q2 – Q1)/[(Q2 + Q1)/2]}/{(P2 - P1)/[(P2 + P1)]/2}

88

Price Elasticity of Demand

To calculate price elasticity of a good you need to know quantity

demanded of good at two different prices (when all other influences on

buying plans remain the same).

Price of a sandwich changes from $5 to $10 Quantity changes from 30 to 20

What is price elasticity of demand?

𝟐𝟎 −𝟑𝟎

𝟐𝟎+𝟑𝟎

𝟐

Elasticity of demand = 𝟏𝟎 −𝟓

𝟏𝟎+𝟓

𝟐

=

− 𝟏𝟎

𝟐𝟓

𝟓

𝟕.𝟓

=

𝟐

𝟓

𝟐

𝟑

−

=

−𝟐

𝟓

x

𝟑

𝟐

=

−𝟔

𝟏𝟎

= −𝟎. 𝟔

89

Elasticity of Demand

Here range of elasticity of demand is listed – these are various degrees of

elasticity – strength of response – based on the trigger: price;

Degrees are: Ed >1 | Ed <1 | Ed = 1

Value

Descriptive terms

Ed = 0

Perfectly inelastic demand

0 < Ed < 1

Inelastic or relatively inelastic demand

Ed = 1

Unitary elasticity, or unitarily elastic demand

1 < Ed < ∞

Elastic or relatively elastic demand

Ed = ∞

Perfectly elastic demand

90

Income & Cross Elasticity of Demand

Income elasticity of demand

Measures demand-response for a good when income changes of people, ceteris paribus.

Ratio of percentage change in demand to percentage change in income;

The cross-price elasticity of demand

Measures demand-response for one good to change in price of another good.

Percentage change in demand for A good in response to percentage change in price of B

good.

▪

Public Transport Example

▪

Refer to your Study Guide and complete the task questions that follow

91

Elasticity of Demand

Factors Influencing Elasticity of Demand

❖ Substitutes

❖ Closer the substitutes for a good or service, more elastic is the demand for it.

❖ Income spent of a product

❖ Greater the proportion of income spent on a good, more elastic (or less

inelastic) is the demand for it.

❖ The time elapsed since the price change

❖ Longer the time elapse since price change, more elastic is demand

92

Elasticity of Supply

Degrees of Supply Elasticity

93

Elasticity of Supply

Factors Affecting Price Elasticity of Supply

❖ Time Factor:

❖ Short Period – relatively less elastic (adjustments costly)

❖ Long Period – more elastic (blessed with time)

❖ Nature of Commodity:

❖ Perishable Goods – relatively less elastic (empty inventory quickly)

❖ Durable Goods – more elastic (inventory lasts longer)

❖ Production Technique:

❖ Complex Production Technique – supply remains inelastic (expensive to change)

❖ Simple Production Technique – supply is elastic (ease of change)

94

Elasticity of Supply – Factors Impact

Apply These Factors to Specific Industry

❖ Spare Production Capacity: If plenty spare capacity business can increase output without

increasing cost, supply remain elastic in response to change in demand

❖ Stocks of Finished Products & Components: If stocks of finished and inventory at high level

firm capable to respond to change in demand; supply remain elastic; perishable commodities

harder/expensive to store

❖ Ease of Factor Substitution / Mobility: If capital / labour are mobile, elasticity of supply high;

resources can be shifted to meet excess demand – relocating labour to different tasks;

❖ Time Period and Production Speed: Supply is price elasticity if firm is allowed longer time to

adjust its production levels;

95

End of Today’s Session

16 March 2024

96

Production & Cost

97

Relationship Between Production & Cost

SG# 50 - 53

Three Important Concepts

❑ Short and Long Run (Periods of time)

❑ Short-run: period of less than 1 year;

❑ Long-run: period greater than 1 year;

❑ Increasing and diminishing marginal returns

❑ Economies and diseconomies of scale

98

Short And Long Run

Profiting in Long-run

❖ Organisations make decisions with objective of achieving maximum

shareholder value;

❖ Employees of the firm are agents who are accountable to their

shareholders;

❖ Decisions relating to maximum attainable profit become critical;

❖ Particularly those that affect the long-run prospects of the firm.

99

Short Run

Time Frame

❑ Time frame where quantity of at least one factor of production is fixed;

❑For most firms, capital, land, and entrepreneurship are fixed;

❑Labour is variable factor of production;

❑ We call fixed factors of production “firm’s factory.”

❑ A restaurant might employ additional cooks due to seasonal demand

(short-run); but endure cost of Factors of Production that can’t be

changed;

100

Long Run

Time Frame

❖ A time frame in which quantities of all factors of production can be

varied.

❖ Long run is a period in which firm can change its factory;

❖ In long run restaurant might open second and third outlets; all

factors of production vary;

❖ There are minimal fixed costs and profit can be maximised

101

Behavior of Costs

TABLE: PRODUCTION SCHEDULE

Labour (workers

per day)

Output

(sweaters per

day)

Total Fixed

Costs

Total Variable

Costs

A

0

0

25

0

25

B

1

4

25

25

50

C

2

10

25

50

75

D

3

13

25

75

100

E

4

15

25

100

125

F

5

16

25

125

150

Total Cost

Dollars per day

102

Schedule of Aver age Cost and M ar ginal Cost

Labour

(workers

per day)

Output

(sweater

s per

day)

Total

Fixed

Costs

Total

Variable

Costs

Total

Cost

Marginal

Cost

(Calculated as

the 8.33 in

example earlier)

Dollars per day

Average

Fixed

Cost

Average

Variable

Cost

Average

Total

Cost

Dollars per sweater

A

0

0

25

0

25

0

-

-

-

B

1

4

25

25

50

6.25

6.25

6.25

12.50

C

2

10

25

50

75

4.17

2.50

5.00

7.50

D

3

13

25

75

100

8.33

1.92

5.77

7.69

E

4

15

25

100

125

12.5

1.67

6.67

8.33

F

5

16

25

125

150

25

1.56

7.81

9.38

Change of

Quantity

Change of Cost

Marginal Cost

0 to 4 =

Change - 4

Cost Added 25

25 / 4 = 6.25

4 to 10

Change - 6

Cost added 25

25/ / 6 = 4.17

10 to 13

Change -3

Cost added 25

25 / 3 = 8.33

13 to 15

Change -2

Cost added 25

25 / 2 = 12.5

15 to 16

Change - 1

Cost added 25

25 / 1 = 25

MR

103

Returns to Scale Concept

SG# 51 - 53

3 Laws of Returns to Scale

Laws of returns to scale a set of three interrelated laws:

❖ Law of increasing returns to scale – output increases by more

than proportional change in inputs;

❖ Law of constant returns to scale – output increases by same

proportional change as all inputs change; and

❖ Law of diminishing returns to scale – output increases by less

than proportional change in inputs.

104

Increasing and Diminishing Marginal Returns

Two Key Relationship Exist Between Production & Cost

•

Increasing and,

•

Diminishing marginal returns.

Marginal product of labour is increase in total product that results

from one-unit increase in quantity of labour employed, with all other

inputs remaining same.

A case of increasing, constant & diminishing

returns to scale

105

Returns to Scale: Restaurant Case

SG# 51

Restaurant employs one cook; kitchen has capacity for two cooks; restaurant decides to

add takeaway service to its offerings.

Takeaway orders increase; additional cooks added to complement. With two cooks,

marginal product rises; on employing third, fourth, and fifth cooks total product increases,

but marginal output declines (e.g. cooks are getting in each other’s way; insufficient

equipment; increasing waiting time, etc).

Cooks

Total product

Marginal Product

0

1

2

3

4

5

0

20

50 (20 + 30)

75 (50 + 25)

95 (75 + 20)

110 (95 + 15)

20

30

25

20

15

106

Example – Restaurant – Task 4 You

Follow example of a restaurant given in your Study Guide:

Cooks

Total product

Marginal product

As you saw with restaurant example, most production processes experience

increasing marginal returns initially, but “all production processes

eventually reach a point of diminishing marginal returns”

107

Law of Diminishing Marginal Returns

SG# 51

❖ When marginal product of an additional worker is less than marginal

product of previous worker.

❖ Diminishing marginal returns: more workers using same capital; working in

same space.

❖ More workers added, very less for additional workers to do productive job.

❖ Law of diminishing returns: applies only in short run; long run, firms

increase size, relocate to bigger premises, employ more capital/equipment

108

Economies and Diseconomies of Scale

SG# 52

Scale Economies

Economies of scale (or economies of large scale) are:

❑ Efficiencies achieved through size of production (e.g. costs are reduced over large

production volumes)

❑ Example – automobile, ICT and peripherals etc.;

Major reasons for presence of economies of scale include:

❑ Division of tasks (increased specialisation per unit)

❑ Skilled and experienced employees per unit (learning curve)

❑ Reduction in waste

109

Economies and Diseconomies of Scale

Diseconomies of Scale Exist Through

❑ Difficulties in control and supervision (monitoring productivity

and quality of output across thousands of employees imperfect

and expensive)

❑ Slow decision making due to excessive size of administration

❑ Low employee motivation (e.g. just a number; sense of

alienation);

110

Labour Market & Policies

111

Labor Market

SG# 55 - 64

Key Concepts | Difference Between Labor and Goods Market

Labor Market – Intermediary between Buyers and Sellers of Labor;

Labor deals with Human Beings and NOT inanimate objects (goods and services)

Labor – factor of production gets Wages in return

Labour Market

Goods Market

Link between potential sellers (households) and

potential purchasers (firms)

Physical presence is necessary

Link between sellers (firms) and potential purchasers

(households)

Physical presence not necessary

Labour services not transferable

Goods are fully transferable

Labour is always rented

Goods can be sold

Characterised by trade unions

These are absent from the goods market

Labour is heterogeneous

Goods can be homogeneous

Noneconomic considerations are important

Noneconomic considerations are not important

Remuneration is affected by a number of factors, e.g.

Prices of goods are determined by costs and demand

taxation, standard of living, etc.

112

Labor Market

SG# 56

❑ The macroeconomic view of the labour market difficult to capture; few data points

hints its health;

❑ Unemployment - during economic stress, demand for labour falls behind supply

drive unemployment up; high unemployment exacerbate economic stagnation;

❑ Cause Social upheaval - deprive large population opportunity to lead fulfilling lives

❑ All industries need labour - hospitality, construction, mining, telecommunications…

❑ A competitive labour market where firms demand and households supply (Parkin,

2016).

113

Labor Market

SG# 57

Labor Productivity Measures

❖ *Labour productivity measures hourly output of a country's economy

❖ Charts amount of “Real” GDP produced by an hour of labour

❖ Growth in labour productivity depends on three main factors:

▪ Saving and investment in physical capital,

▪ New technology, and

▪ Human capital

*Please read the in-section page on calculating labor productivity on Pg.# 57

114

Labor Market

SG# 57

Labor Productivity Measures

❑ Labour productivity directly linked to improved standards of living; signal higher

consumption;

❑ Labour productivity grows, more goods and services produced for same amount of

relative work; increase in output increases consumption of goods and services for a

reasonable price;

❑ Indicate short-term and cyclical changes in economy even turnaround; If output

increases but labour hours remains static, signals labour force is productive;

❑ Workers increase effort when unemployment rises to avoid losing jobs

115

Labor Market

Labor Productivity Policies

❖ Number of ways to improve productivity – capital investment, quality education and

technological progress;

❖ Investment in physical capital: Capital investments like infrastructure from

governments and the private sector help productivity and lower business costs;

❖ Quality of education and training: Opportunities to upgrade skills, offering affordable

education and training; help raise economy's productivity;

❖ Technological progress: Developing new technologies – hard-tech - computerisation

or robotics; soft-tech - modes of organising a business or pro-free market reforms and

policies enhance worker productivity;

116

Labor Market

Unemployment

❖ Unemployment when a person actively seeking employment unable to find work; cited

as measure of economic health; major life event with devastating impact; affects

unemployed, family and community;

❖ Unemployment rate: total unemployed people divided by total labour force;

❖ A key economic indicator; two categories of unemployment - voluntary and involuntary

unemployment;

❖ Voluntary – Person has left his job willingly

❖ Involuntary - Person has been fired or laid-off and must now seek new job

117

Labor Market

SG# 58

Unemployment Types

❖ Frictional unemployment: After a person leaves employment voluntary takes time to find another job; is

short-lived and least problematic for an economy; market processes of job search recruitment job-fitment

takes time;

❖ Cyclical unemployment: variation in unemployed workers over course of economic cycles; unemployment

rises during recession; declines during economic boom; various economic policy initiative by govts. to

tackle unemployment during recessionary economic trends;

❖ Structural unemployment: Technological change impacts labour market; changes, like automation of

manufacturing, workers displaced from jobs which are no longer needed;

❖ Institutional unemployment: due to permanent institutional factors, incentives in economy. Policies, like high

minimum wage, social benefits, restrictive occupational licensing; labour institutions, like unionisation

contribute to institutional unemployment;

118

Labor Market

SG# 58

Policies Dealing with Unemployment

❑ Govt. interested in labour market; creating jobs key macroeconomic objective with positive social effects. SA

has serious youth unemployment problem; lack of skills and experience impeding economy growth;

❑ Active labour market policies: Prevent unemployment; provide productive jobs; develop labour market

operations; enrich and improve labour demand-supply; at community level (households); make jobs more

appealing for young people;

❑ Passive labour market policies: regarded as generous - like unemployment-dole (e.g. unemployment

benefits and early retirement schemes); increasing wages often viewed as job destroyers; Unemployment

Insurance Fund (UIF) and proposed Basic Income Grant (BIG); may be to reduce unemployment in SA;

❑ Welfare State Vs. Enablers: Unemployment support by State is socialistic-welfare view (US, UK, EU SA

etc.); True capitalistic market make “employment enablers” no unemployment support (Singapore.)

119

Labor Market

Determinants of Labor Demand

❖ Businesses require labour and capital as inputs to production process;

❖ Demand for labour derived from demand for a firm's output; if economy grows demand

increase with it labour demand increase and vice versa; Labour market factors drive

supply-demand for labour;

❖ Employees will supply labour in exchange for wages;

❖ Closely linked with business cycle; for example, when economy stimulated, consumer

demand rises, output increases to meet demand; labour needed to meet output

increment

120

Labor Market

Determinants of Labor Supply

❖ The labour supply curve for any industry or occupation will be upward sloping. This is because, as wages

rise, other workers enter this industry attracted by the incentive of higher rewards;

❖ Real wages: Higher wages raise factor rewards; boost number of people willing and able to work;

❖ Overtime: earnings boost come via overtime payments, productivity-linked pay and stock options;

❖ Substitute occupations: real wages in competing jobs affect wages; earnings differential between

occupations; For example increased earnings for trained plumbers and electricians cause people to switch

jobs;

❖ Barriers to entry: Artificial limit to labour supply (eligibility criteria) restrict supply; forces higher pay levels –

case in point - legal services, medicine; strict ‘entry criteria’ applicable;

❖ Improving occupational labour mobility: more trained hands with key skills for particular occupation;

121

Labor Market

SG# 63 - 64

Determinants of Wages

Wage differentials exist when different workers earn different wages even if all wage markets are in equilibrium. These

wage differentials are permanent phenomena. Some of the determinants of wage differentials (Mohr and Fourie, 2020):

Job-related differences; Worker-related differences; Market structure-related differences; Discrimination-related

differences; and Productivity-related differences;

❑ A binding minimum wage is a minimum wage where the wage

is set above the equilibrium wage.

❑ A non-binding minimum wage is a minimum wage where the

wage is set below the equilibrium wage.

Binding minimum wage

120

120

Price of Labor (Wage)

Price of Labour (Wage)

Non-binding minimum wage

100

80

60

40

20

Deficit Labor

0

100

Surplus Labor

80

60

40

20

0

1

2

3

4

5

6

7

8

9

10

1

2

3

Units of labour (Quantity)

Quantity Demand of labour

Quantity supplied of labour

4

5

6

7

8

9

10

Units of labour (Quantity)

Minimum Wage

Quantity Demand of labour

Quantity supplied of labour

Minimum Wage

122

Market Structure and

Competition

123

Market Structure & Competition

SG# 27 - 30

Continuum of Market Structure – An Analysis

Monopoly /

Monopsony

Duopoly

Oligopoly

Monopolistic

Competition

Perfect

Competition

Perfect competition: (Ideal Condition)

Monopoly (imperfect competition)

• Many sellers and many buyers;

Oligopoly (imperfect competition)

• Identical goods / services

Monopolistic Competition

• No restrictions on entry into or exit from market

• Established firms have no advantage over new ones

• Sellers and buyers are prices takers

124

Monopoly

Greek Word – Meaning ‘One’

❖ Only one seller of a particular good; no competition; opportunity for exploitation

obvious.

❖ Monopolies exist for various reasons:

❖ Barriers to entry: entry might require large investment; (energy and transport sectors;)

❖ State intervention; (Eskom and Transnet in South Africa;)

❖ State award patent rights to certain companies (particular drug produced by pharmaceutical

company); and

❖ Control of certain key resource in certain niche market (exclusive ownership of raw materials)

SARB has a monopoly to print South African Rand

De Beers in Central Selling Organization (CSO)

South African Breweries (SAB) with very few small brewers

125

Oligopoly

Cartelization of Market

Oligopoly is indication of imperfect competition – a few players control market.

South African cellular phone industry originally consisted of Vodacom and MTN.

Today, other competitors include Cell C and Telkom.

In oligopoly market-entry difficult; high costs and significant barriers to entry;

Organisations in oligopoly have substantial pricing power and possible evidence of

collusion.

Cartels (collusion) usually prohibited by antitrust

laws (in SA prohibited by Competition Commission

SA)

Banking: First Bank, Standard Bank, Nedbank,

ABSA

Retail: Pick n Pay and Shoprite (Duopoly)

Energy: ESKOM and SASOL

126

Monopolistic Competition

Common in Market Place

❖ Here firms have many competitors; each firm sell a slightly different product;

❖ Many small businesses are of this kind;

❖ Common example, restaurant trade (excluding chain restaurants):

❖ Each restaurant is uniqueness; but all are competing for essentially same

customers (Economics online, 2015).

❖ Monopolistic competition is most common market structure you will encounter

Product / service Differentiator is the key to Monopolistic Competition

127

Perfect Competition

❖ Many firms sell identical products (or services) to many buyers;

❖ There are no restrictions on entry into or exit from market;

❖ Established firms have no advantage over new ones; and

❖ Sellers and buyers are well informed about prices.

❖ Farming, grocery retailing, plumbing, dry cleaning, etc., reflect conditions for perfect

competition; Perfect competitive market structures exist with difficulty in real world.

❖ Organisations in perfect competition are price takers.

❖ Firm cannot influence market price because its production insignificant part of total market;

❖ Closest to perfect competition in the Foreign Exchange Market in the world

128

Free Market Economy

SG# 29

All decisions are driven by pursuit of a single objective:

increasing shareholder value through maximisation of

economic profit.

Economic profit is equal to total revenue minus total cost, with

total cost measured as opportunity cost of production.

129

Firms Entry and Exit

New firms

enter a market

in which

existing firms

are making an

economic

profit

As new firms

enter a market,

the market

price falls and

the economic

profit of each

firm decreases

SG# 13

Firms exit a

market in

which they are

incurring an

economic loss

As firms leave

a market the

market price

rises and the

economic loss

incurred by the

remaining

firms

decreases

Entry and exit

stop when

firms make

zero economic

profit

Market structure determines fluidity in market - fluidity with which firms may enter / exit;

More FLEXIBLE its structure more dynamic the industry; (monopolistic)

More RIGID its structure less dynamic the industry (oligopoly, duopoly, monopoly)

130

RECALL …!

Perfect Competition

Oligopoly

Monopoly

Monopolistic Competition…

131

End of Microeconomic Concepts

Learning outcomes

❖ Understand the task of economics and distinctions between micro

and macroeconomics

❖ Analyze relationships between demand, supply and market

equilibrium

❖ Show relationships between production and cost

132

End of Unit Microeconomics

133

Macroeconomics

134

Schools of Economic Thought

135

Macroeconomic Schools of Thought

SG# 67 - 68

Developments in Macroeconomics

❖ Classical: Hold prices, wages, and rates flexible; markets always clear all goods and

services available for sale “invisible hand”; a metaphor for unseen forces moving free

market economy; individual self-interest and freedom of production as well as

consumption, best interest of society, as a whole, are fulfilled.

❖ Keynesian: largely founded on basis of works of John Maynard Keynes; focus on

aggregate demand as principal factor in unemployment and business cycle. termed

“laissez-faire” no government intervention in economy; makes a case for greater levels of

government intervention only in recession; government spending to offset fall in private

investment.

❖ Monetarists: The Monetarist school is largely credited to the works of Milton Friedman.

Monetarist economists believe that the role of government is to control inflation by

controlling the money supply.

136

Macroeconomic Schools of Thought

Developments in Macroeconomics

❖ New Keynesian: attempts to add micro foundations to traditional Keynesian

economic theories. accept households firms operate on rational expectations;

maintains variety of market failures, including “sticky” prices and wages that is

resists change; prices seldom change despite changes in input cost or demand

patterns; on wages, workers tend to respond slowly to changes in performance of

company or economy.

❖ Neo-Classical: assumes people have rational expectations, strive maximise

utility; people act independently basis of all information they can attain.

137

Macroeconomic Schools of Thought

Developments in Macroeconomics

❖ New Classical: built on neoclassical school give importance to micro; models that

behaviour; assume agents maximise their utility have rational expectations; macro strives

to provide neoclassical micro foundations for its analysis; rivals new Keynesian school, uses

price stickiness and imperfect competition to generate macro models like Keynesian;

believe market clears at all times;

❖ Austrian: Older school, believes human behaviour is too idiosyncratic to model with

math; minimal government intervention best; contradicts Keynesian economics; has

useful theories on business cycle, implications of capital intensity, importance of time,

opportunity costs in determining consumption and value;

138

Economics of Aggregates

139

Economic Aggregates

SG# 69

Macroeconomics & Economic Identity

Macroeconomics - study of behaviour of aggregate economy; examines economy-wide phenomena change in unemployment, national income, growth rate, gross domestic product, inflation, and price levels.

Macroeconomic factors affect microeconomics and vice versa; Consider macroeconomic policies and

variables that could help to expand economy – say, whether we should:

▪ Increase government spending (G) and decrease taxes (T) (i.e. use fiscal policy);

▪ Decrease interest rates (i/r) and change money supply (monetary policy);

▪ Decrease import tariffs and protect specific industries (trade policy);

▪ Implement wage controls (labour policy); and

▪ Supply-side policies? Can we stimulate productivity through investment, and encourage profitability?

140

Circular Flow of Income & Expenditure

SG# 10 - 11

Scenario in an Economy

❖ Households that make consumption expenditures (C)

❖ Firms that make investments (I)

❖ Governments (G) buy Goods & Services, Taxes, Assistance

❖ The rest of the world that buys net exports (X – M)

❖ Firms that pay incomes to households (Y)

141

Circular Flow of Income & Expenditure

SG# 15

Economic Entities:

Households

Income

Expenses

Firms/Businesses

Govt.

Rest of World (Foreign Sector)

142

Circular Flow of Income & Expenditure

SG# 10 - 11

Economic Entities:

Households

Firms/Businesses

Govt.

Rest of World (Foreign Sector)

Centre: Financial Sector

143

Aggregate Income = Aggregate Expenditure

SG# 68 - 73

The Economic Identity

𝒀 = 𝑨𝑬

𝒀 = 𝑪 + 𝑰 + 𝑮 + (𝑿 − 𝑴)

Economic Identities

𝒀

𝑨𝑬

The Meaning

Income / Gross Domestic Product / Gross National Income

Aggregate Expenditure

𝑪

Consumption – Private and Public

𝑰

Investments – Private and Public

𝑮

Govt. Expenditure (Revenue expense, transfer of benefits)

(𝑿 − 𝑴)

Net Exports – Exports – Imports (Current Account Deficit)

144

Aggregate Income = Aggregate Expenditure

The Economic Identity – Two Factor Economy – Firms & Households

Firms rent Factors

of Production

Two Factor

Economy

Model

Factor

Market

Household

Firms

Firms Receives

Sales Income

Households

Receive Rent

Goods

Market

Households Pay for

Goods (Services)

𝒀 = 𝑨𝑬

𝒀 = 𝑪 + 𝑰 + 𝑮 + (𝑿 − 𝑴)

We will expand this

145

Aggregate Income = Aggregate Expenditure

SG# 71

The Economic Identity – Two Factor Economy – Firms & Households

𝒀 = 𝑨𝑬

This means income = expenditure

𝒀 = 𝑪 + 𝑰 + 𝑮 + (𝑿 − 𝑴)

This is a full GDP Identity

𝒀 = 𝑪 + 𝑰 + 𝑮 + (𝑿 − 𝑴)

This is GDP Identity for 2 Factor Economy

𝒀 = (𝑪 + 𝑰) + 𝑮 + (𝑿 − 𝑴)

+ 𝒄𝑰

𝑪=𝑪

Consumption = Autonomous consumption (subsistence) + Induced

consumption based on Income (travel, car, house, luxury purchases);

Therefore, it is MPC a factor of say, 0.5 or 0.3 etc;

𝒊 = 𝑰 Investment = Autonomous Investment (automatic)

𝑨 = 𝑪 + 𝑰 Expenditure = Consumption & Investment

+ 𝑰) 𝒐𝒓 (𝑪 + 𝑰)

𝒀 = 𝑨 = (𝑪

Equilibrium Condition is met with Income is Equal to Expenditure

∴𝒀= 𝑪+𝑰

+ 𝑐𝑌 + 𝑰

𝑌=𝑪

+ 𝑰

∴ 𝑌−𝑐𝑌= 𝑪

This is Keynesian

Marginal Propensity to

Consume

+ 𝑐𝑌) = MPC

(𝑪

+ 𝑰

∴ (1−𝑐)𝑌= 𝑪

∴ 𝑌0 =

𝟏

𝟏−𝒄

+ 𝑰)

(𝑪

146

Aggregate Income = Aggregate Expenditure

SG# 72

The Economic Identity – Three Factor Economy – Firms, Households & Govt.

Factor

Market

Firms rent Factors

of Production

Three

Factor

Economy

Model

Tax

Tax

Household

Govt.

Firms

Assistance

Assistance

Firms Receives

Sales Income

Households

Receive Rent

Goods

Market

Households Pay for

Goods (Services)

𝒀 = 𝑨𝑬

𝒀 = 𝑪 + 𝑰 + 𝑮 + (𝑿 − 𝑴)

We will expand this

147

Aggregate Income = Aggregate Expenditure

SG# 72

The Economic Identity – Three Factor Economy – Firms, Households & Govt.

𝒀 = 𝑨𝑬

This means income = expenditure

𝒀 = 𝑪 + 𝑰 + 𝑮 + (𝑿 − 𝑴)

This is a full GDP Identity

𝒀 = 𝑪 + 𝑰 + 𝑮 + (𝑿 − 𝑴)

This is GDP Identity for 3 Factor Economy

𝒀 = (𝑪 + 𝑰 + 𝑮)

+ 𝒄𝑰

𝑪=𝑪

Consumption = Autonomous consumption (subsistence) + Induced

consumption based on Income (travel, car, house, luxury purchases);

Therefore, it is MPC a factor of say, 0.5 or 0.3 etc. + Govt. Exp.

𝒊 = 𝑰 Investment = Autonomous Investment (automatic)

Expenditure = Consumption

𝑨 = 𝑪 + 𝑰 + 𝑮 & Investment + Govt. Exp.

)

𝒀 = (𝑪 + 𝑰 + 𝑮

Equilibrium Condition is met with Income is Equal to Expenditure

+ 𝑐𝑌)+ 𝑰 + 𝑮

)

∴ 𝒀 = (𝑪

+ 𝑐𝑌 + 𝑰 + 𝑮

𝑌=𝑪

+ 𝑰 + +𝑮

∴ 𝑌−𝑐𝑌= 𝑪

+ 𝑰 + +𝑮

∴ (1−𝑐)𝑌= 𝑪

∴ 𝑌0 =

𝟏

𝟏−𝒄

This is Keynesian

Marginal Propensity to

Consume

+ 𝑐𝑌) = MPC

(𝑪

+ 𝑰) + +𝑮

(𝑪

148

Economic Indicators

Analysis of Economic Performance & Predictions of Future Performance of Economies

❖ Unemployment rate, inflation rate, GDP, forex, etc.

❖ Characteristics:

❖

Pro-cyclic Indicators: Move in same direction of economy; GDP, Exports etc.

❖

Counter-cyclic Indicators: Move in opposite direction of economy; unemployment

❖

Leading Indicators: Change before economy changes: manufacturing, consumer

confidence

❖

Lagging Indicators: Do not change direction for a few months: consumer price inflation

and unemployment trends;

❖

Coincident Indicators: Move at the same pace/time as economy – GDP

149

End of Today’s Session

23 March 2024

150

Circular Flow of Income

& GDP & Calculation

151

SG# 10

Circular Flow of Income & Expenditure

Household

Firms

Income

Expenses

Government

Foreign

Sector

152

Gross Domestic Product

SG# 74

Key Economic Indicator

❖ GDP - primary indicator of health of country’s economy (due to

decreasing unemployment and increasing wages)

❖ Expenditure approach [C + I + G + (X – M)]

❖ Income approach (summing incomes firms pay households for

services of factors of production rented; e.g. wages for labour,

interest for capital, rent for land, and profit for entrepreneurship).

The modern-day GDP formula was systematically produced by Simon

Kuznets in his report to US Congress with the help of US Dept. of

Commerce, in 1934

153

Circular Flow of Income & Expenditure

Expenditure

Method

Expenditure

Method

Items

Symbol

USD

(2016)

Percentage

Personal

Consumption Exp.

C

12,758

68.7

Gross Private Dom.

Investment

I

3,036

16.3

Govt Expenditure

G

3,277

17.7

Net Exports (Export Import)

X–M

-502

-2.7

GDP Exp. Method

Y

18,569

100

of GDP

154

Circular Flow of Income & Expenditure

USD

(2016)

Percentage

of GDP

10,085

54.3

Net Interest

676

3.6

Rental Income

705

3.8

Corporate Profits

1,676

9.0

Proprietor’s Income

1418

7.7

Net Domestic Income at Factor

Cost

14,560

78.4

Indirect Taxes Less Subsidies

1,336

7.2

Net Domestic Income at Market

Place

15,896

85.6

Depreciation

2,910

15.7

GDP Income Approach

18,806

101.3

-237

-1.3

18,569

100

Items

Employee Compensation

Income

Method

Income

Method

Statistical Errors

GDP Expenditure Method

155

GDP of South Africa – 2010 - 2020

Trading Economics 2020

Population of South Africa – 59.4 Mn.

SG# 75

156

GDP of United Kingdom – 2010 - 2020

Trading Economics 2020

Population of United Kingdom – 67.3 Mn.

157

GDP of India – 2010 - 2020

Trading Economics 2020

Population of India – 1.38 Bn.

SG# 75

158

Measures of GDP

SG# 75 - 76

Inflation Matters

❖ Nominal GDP - measure of total quantity of goods & services economy

produces affected by changes in prices of those goods and services;

uses current market price to estimate GDP;

❖ Real GDP - measure of total quantity of goods & services economy

produces not affected by price changes of those goods and services.

❖

Economists use it to make real (actual) comparisons of the nation’s

change in outputs / GDP (also known as constant-price GDP and

inflation-corrected GDP)

159

GDP Base Year – 2018 – Task 4 You

Year

Price of a Lollipop

Quantity of

Lollipops

Price of a Pie

Quantity of Pies

2018

R4

10

R5

15

2019

R5

15

R6

10

2020

R6

20

R7

50

Year

Price * Quantity

Total

Price *

Quantity

Total

Nominal GDP for

year

2018

2019

2020

Year

Price * Quantity

Total

Price *

Quantity

Total

Real GDP for

year

2018

2019

160

2020

GDP – Gross Domestic Product

Key Economic Indicator – Nominal and Real

Year

Price of a hot

dog

Quantity of hot

dogs

Price of a

burger

Quantity of

burgers

2016

R1

100

R2

50

2017

R2

150

R3

100

2018

R3

200

R4

Price

Quantity

Year

Price

Quantity

150

Nominal GDP for

year

2016

(R1 x 100) = R100

(R2 x 50) = R100

R 200

2017

(R2 x 150) = R300

(R3 x 100) = R300

R 600

2018

(R3 x 200) = R600

(R4 x 150) = R600

R1 200

Nominal GDP considers current prices – price prevalent in the year

161

GDP – Gross Domestic Product

Key Economic Indicator – Nominal and Real

Year

Price of a hot

dog

Quantity of hot

dogs

Price of a

burger

Quantity of

burgers

2016

R1

100

R2

50

2017

R2

150

R3

100

2018

R3

200

R4

Price

Quantity

Year

Price

Quantity

150

Nominal GDP for

year

2016

(R1 x 100) = R100

(R2 x 50) = R100

R 200

2017

(R1 x 150) = R150

(R2 x 100) = R200

R 350

2018

(R1 x 200) = R200

(R2 x 150) = R300

R 500

Real GDP considers constant prices – price prevalent in the “base” year – here it is 2016

162

Gross Domestic Product

SG# 77

Estimation of GDP Deflator

𝑵𝒐𝒎𝒊𝒏𝒂𝒍 𝑮𝑫𝑷

❖ GDP Deflator =

𝑥

𝑹𝒆𝒂𝒍 𝑮𝑷𝑫

Year

2013

2014

2015

Calculation

(R200 / R200) x 100

(R600 / R350) x 100

(R1200 / R500) x 100

𝟏𝟎𝟎

GDP Deflator

100 (always 100)

171

240

163

Gross Domestic Product

SG# 77

Estimation of GDP Growth

𝑷𝒆𝒓𝒊𝒐𝒅 𝟐 − 𝑷𝒆𝒓𝒊𝒐𝒅 𝟏

𝑬𝒄𝒐𝒏𝒐𝒎𝒊𝒄 𝑮𝒓𝒐𝒘𝒕𝒉 =

𝒙 𝟏𝟎𝟎

𝑷𝒆𝒓𝒊𝒐𝒅 𝟏

Economic Growth:

𝑹 𝟏𝟐𝟕𝟐 𝑴𝒏 − 𝑹 𝟏𝟐𝟑𝟒 𝑴𝒏

𝑹 𝟏𝟐𝟑𝟒 𝑴𝒏

𝒙 𝟏𝟎𝟎

𝟑𝟖

𝒙 𝟏𝟎𝟎

𝟏𝟐𝟑𝟒

0.03079 𝒙 𝟏𝟎𝟎

Real Economic Growth:

3.079 %

Real GDP (approx. 3.1%)

164

Gross Domestic Product

SG# 77 - 78

Some Uses and Limitations

❖ Uses for GDP

❖ Standard of living over time

❖ Business cycles

❖ Limitations of Real GDP

❖ Different currencies

❖ Purchasing power parity

165

Limitations of Real GDP

Some Uses and Limitations

❖ Firstly, real GDP of one country must be converted into same

currency units as real GDP of other country (typically, USD is

used)

❖ Secondly, goods and services in both countries must be valued at

same prices, e.g. using purchasing power parity (PPP).

For PPP Refer: Economists Big Mac Index: realistic FX Rates

Big Mac in SA: R.33.50; in India: 245; in PPP terms INR/R = 7.31

Market FX Rate: INR / Rand = 5.25 (median)

166

Aggregate Demand-Supply

Short-run-Long-run

Equilibriums

167

Aggregate Demand

SG# 79 - 82

AD shows quantities of Real GDP buyers collectively buys at different price

levels

Is downward sloping but not for same reason as micro-demand curve

A downward sloping aggregate demand curve means when price level drops,

quantity of output demanded increases; national income increases;

Aggregate Demand shifts

Determinants of Aggregate

Demand

❖

❖

❖

❖

❖

Consumer wealth

Household indebtedness

Taxes

Consumer expectations

Real interest rates

❖ Real interest rate & Expectations of

Returns

Effect of Net Exports on Aggregate

Demand

❖ Foreign incomes and Exchange rate

(depreciation)

168

Aggregate Supply

In long run economy uses all factors of production efficiently,

∴ Long run AS is a vertical line at potential GDP.

Potential output – highest level of Real GDP sustainable over long term.

Determinants of Aggregate Supply

Factors other than price level shifts supply curve

❖ Prices of factors of production:

Price of labour, capital, land changes

AS Curve shifts left

❖ Exchange rate:

Value of the Rand decreases, this

increases the cost of importing

foreign factors of production;

❖ Technology:

Increase in technology shifts AS curve

shift right;

❖ Business taxes can

Affect output decisions of firms

curve shift

AS

169

Short - run Equili brium

Short run-in macroeconomic analysis, market economic condition

changes, prices (& wages) fail to adjust quickly to maintain equilibrium;

Failure of equilibrium cause long periods of shortage / surplus; economy

fails to achieve natural employment and potential output.

Occurs when Real GDP demand is equal to GDP supply.

SRAS

Price level

SRAD