Uploaded by

Barcelona, Czarina Joy N.

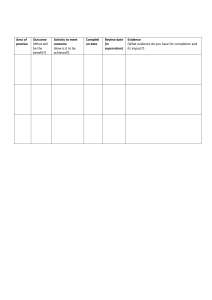

Local Gov Internal Control & Financial Reporting

advertisement

Local Government Internal Control System Numerous entities depend on the financial data provided and disseminated by local governments for various purposes, so the report that is provided needs to be of high quality monetary. If the financial figures included in the reports match the normative standards that are comprehensible, comparable, dependable, and relevant. In order to fulfill these quality requirements, local financial management, Government and the role that employees play in overseeing and executing fiscal disclosure. Consequently, employees in financial management need to possess good ability to use information technology to manage local government finances advancement. Nowadays the government is gradually moving away from the single-entry accounting system into double entry because single entry can’t provide comprehensive information and reflect the real performance. The accounting base applied changes from the cash basis to the accrual basis. The problem of applying the accounting basis is not just the technical problem of accounting, that is how to record transactions and present financial statements, but more important is how to determine accounting policy (accounting policy), accounting treatment for accounting, accounting choice, and design or analyze existing accounting systems. Policies for conducting such activities can’t be undertaken by persons (employees) who have no knowledge in accounting (Forum Lecturer on Public Sector Accounting, 2006). Therefore, needed competent human resources so as to produce quality financial statements and valuable information. The second thing that may affect the reliability and timeliness of government financial reporting is the utilization of information technology. Increasing volume of larger and more complex transactions must necessarily be followed by improved government financial management capabilities. To that end, the Government and the Regional Government are obliged to develop and utilize the progress of information technology to improve the ability to manage local finances, and to distribute Regional & Local Financial Information to public services. · The government's internal control system has a positive effect on the quality of the Regional Government Financial Reports Financial Supervision and Quality of Government Financial Reports Financial supervision is one of the factors that influence financial reporting to be more reliable. Good financial supervision will be useful to determine whether there has been a deviation and it is also useful to take remedial actions to ensure that resources in local government have been used effectively and efficiently as possible in this case reflected in reliable financial reporting. Financial oversight is also directed to obtain adequate confidence in the effectiveness and efficiency of the organization, reliability of financial reporting, and compliance with regulations. This module aims to identify the effects of financial accounting standards, HR capabilities, Internal Control Systems and Regional and Local, Financial Supervision on the quality of financial statements through internal control systems. Key takeaways: · I've learned that in order to effectively manage the progress of local government finances, financial management staff members must be proficient in the use of information technology this factor is an advantage in our generations since we grew up with the modernization, however it may also contains disadvantage since being digital and computer literate can be exploited for irregularities, In becoming a public servant it requires more than just acquired skills; it also requires character and discipline. · Internal controls are vital because they help safeguard an agency's assets, improve operational effectiveness, and keep stakeholders, especially the public trust and faith in the accuracy of financial data. As a citizen and a public administration student, it is one of our duty and responsibility to be aware of where our taxes should be spent wisely and this module is a bridge to value the importance of our rights, current laws, and the legal system. References: Muthaher, O. (2019, June 30). GOVERNMENT ACCOUNTING STANDARD, HUMAN CAPACITY, INTERNAL CONTROL SYSTEM AND FINANCIAL SUPERVISION AS A QUALITY ANALYSIS OF GOVERNMENT FINANCIAL STATEMENTS. Muthaher | Fokus Ekonomi : Jurnal Ilmiah https://ejournal.stiepena.ac.id/index.php/fe/article/view/190/203 Ekonomi.