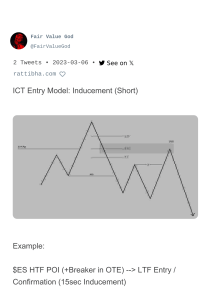

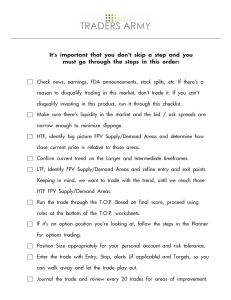

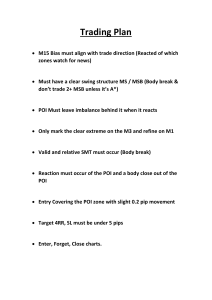

Phantom # Trading . Market Structure Bull Trend simple . Golden Rules Hit - . HH HH Hh - Always observe the HTF HL simple HH - The absolute basics on a Trend HL - The HTF overpowers the LTF Bear trend - , HH 's - BES - Top down TF analysis LH u - Pullbacks are a good way to LH LL enter LL Types ①Hign___ ②Hish ③*←.ei÷÷÷÷ - HL - Do not get lost in LTF noise LH BES IhrTf HL's DailyTF Break of LH on 1HR Structure - New daily impulsive leg of Structural Shifts Market Structure mapping = Body Market Structure break = Body ④ More LTF than There can sometimes be an initial break and these LTF structures They can be denoted as Liquidity Testers not an actual break the body would be the actual break. HTF Market Structure mapping = Wick Market Structure break = Body Always HTF ② These can only be used on HTF's as we want to use the full expansion to our advantage however on an LTF 5 mins or less it can be deemed as noise Market Structure mapping = Wicks Market Structure break = Wicks t Body Any TF ③ A lot of LL, HH Plays in this structure. This factors in all the methods and small details or play in Liquidity and this is also my proffered method. Use the Wick breaks as intent HL - Low - - - -B LL Always Mark the recent HH's and LL's also the LH's that break the HH's vice versa Phantom # Trading Orderblocks what is " " " "" orderblock S " "" ftp.poqboue y at a Particular Price, followed by a BOS - The block broke high Price returns to block Ks - You can trade counter trends when Price returns to a HTF POI. then You can refine the OB and look HH - for a higher RR entry. - OBT HL HL - The only way to become fluent would be to back test ①M HH y.fi#i*hEf-B0S1hrOB RTO HH LH LH Afro OBT here - OBT - OB's are valid after a BOS HH - - to also fill any inefficiencies Refiningordrl BOS - and . - 013T - - - - Price returns to gather more orders 5L thr - - Structures. . Level BOS Large impulsive move that break Orderblock Vin BOS where there are large orders being filled OBT SO order block ? - An order block is an area in a market FTYFpbebw Bullish an - When refining look for the candle Prior to the momentum that breaks the structure - Some order blocks would look weird however it comes down to Judgement which can only come from Practice Phantom FX Market Trading Inefficiency ÷¥÷÷÷÷÷ Bearish and Bullish Market imbalance FVG Market imbalance FVG How do I know - The concept of efficient PA Just shows that the buyers and sellers both had a fair chance at liquidity. - The concept of inefficient PA shows that there was pure power in one direction. Price comes back to these areas to fill any liquidity that was skipped. which Orderblock would work ? BOS -This imbalance already gave the Market enough power to push up so the OB below is of no use as aaaa market does not need to push higher. - You can use this to vent out imbalance order blocks. 501 level Bos Phantom FX Putting Marking the it all Trading together Range - Top down analysis, mark highs and identify Trends. ① weekly Dailyhigh ② Daily low high Look for potential POI'S, when done on all TF's look for breaks on a lower timeframe which may show intent to the up-side. weekly LOW imbalances 4hr ③ high 4h r low - Look for some signs of institutional play , / ④ such as quick movement filled with imbalances ' , " ' " ii Ihr Bos entry breaking structure leaving behind order blocks - when YOU have a 1HR or 4HR POI, go on a LTF and look for a BOS structure and enter off the LTF OB. 5min LTF TF BOS PIO - Visit the ICT charters for types of entries - Practice through back testing Phantom FX Trading Entry Types Risk Entry : ° Confirmation Entry V* Criteria: identify a POI on the HTF and use the LTF to refine it, then set a limit order on the refined OB Best Used: -when approaching trade aggressively. - when LTF block is within HTF block - when Pol and the trade idea Prevail Pros:. Provides entries that tap the POI and run - Provides high RR as is refined using an LTF block Cons: Minimal Confirmation of entry so the likely hood of being stopped out is increased. a trend Criteria: Identify a POI using the HTF (refine on LTF if you desire) when price taps into POI, drop down to LTF and Look for a Bos in desired direction and enter Pros: -Provides additional confirmation Prior to taking an entry - Provides high RR as POI is refined and executed on LTE off newly created order block Best used: -when POI is Large You can use this to decrease SL size - When Price is rapidly moving back into a POI - when taking a counter trend - when there are multiple POI's to consider. Cons: May miss trades that do not test the newly created OB on the LTF Phantom # Trading Wyckoff . Accumulation Markup Distribution Area EI BC BC SOS overbought Eu AR Demand greater than Demand Ma r wn rkdo ku p Ma Than supply sow ⇐ .. µµµ y .. Oversold EI Accumulation area Distribution Markup Sc In Periods of accumulation or distribution supply/demand and volume decrease Buying upthrust climax Accumulation W secondary test seconda r y # PS LPSY SOS Automatic Reaction PS LPSY SEEFF" sefgsntdary Climax Spring Distribution Test ( HOCH Type 1 Accumulation CHOCH iii. in . .. " ST LPS Type 1 Distribution Sc as SOW :÷. "÷ CHOCH "" CHOCH ST \ Affteoamcfitic ' ashes sellers Test Spring i÷¥ Type 2 Accumulation (No Spring) a " ST LPS STASSOW ( HOCH Sos :÷:"m CHEH CHEH LPSY SC EZ ' Supply greater " * a Type 2 Distribution (No UTAD)