Trading Session Analysis: Identifying POIs

advertisement

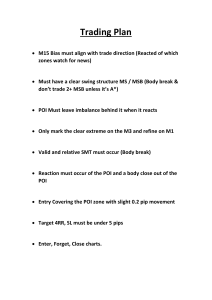

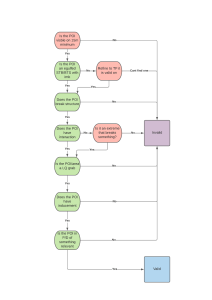

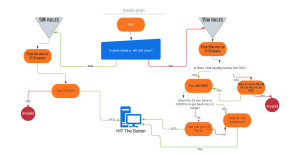

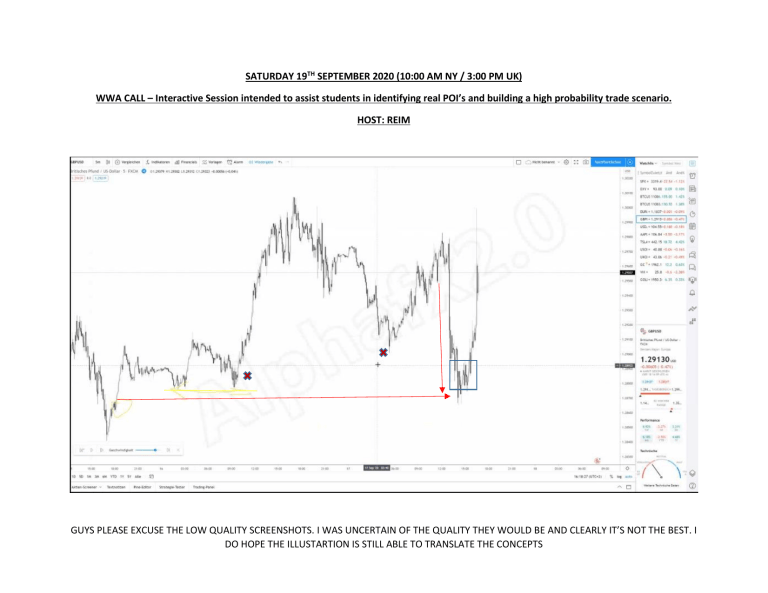

SATURDAY 19TH SEPTEMBER 2020 (10:00 AM NY / 3:00 PM UK) WWA CALL – Interactive Session intended to assist students in identifying real POI’s and building a high probability trade scenario. HOST: REIM GUYS PLEASE EXCUSE THE LOW QUALITY SCREENSHOTS. I WAS UNCERTAIN OF THE QUALITY THEY WOULD BE AND CLEARLY IT’S NOT THE BEST. I DO HOPE THE ILLUSTARTION IS STILL ABLE TO TRANSLATE THE CONCEPTS In the Screenshot above Reim dissects why the certain levels were not valid POI’s A) The one just above the Crosshair annotated by a red X B) The area just above the annotated yellow line annotated by a red X NUGGETS: If we await the inducement and look for the trade conditions where Liquidity is engineered (EQH or EQH) Liquidity is then grabbed via an aggressive run and mitigates into a previous IFC as show by Red arrow annotations, we can then begin seeking high probability setups within the blue box annotated. ENTRIES FROM TRADE SCENARIO ABOVE Entry 1 – Was Reim’s entry that he mentioned taking on an (additional concept) without BOS. Entry 2 – Was our WWA style entry with BOS and Mitigation of Imbalance + RFIC. EJ analysis Fake move annotated by the circle before the start of the trading week on Monday 14th September Generally we would like to trade away from this fake move. Fake POI annotated by Red Box as there was no Inducement This POI is also invalid as price action has a pool of liquidity resting just above annotated by the green horizontal line. See higher intraday time frame POI confirmation in screenshot below 1H Perspective showing Valid POI and EQH just below. Refined 1H POI down to the 5 Min illustrating liquidity grab, Imbalance fill and Mitigation into an RIFC There was deliberation on if a Limit should be set here But the follow up screenshots will show trade entry scenario from this area annotated by the star The Yellow horizontal line also annotates a reserved profit taking level R:R = 1:30 See entry opportunities below Building the narrative that price gives Reim boxed (purple) off the Asian range and showed his entry off Asian High (equal highs) inducement, holding his bearish bias and entering off fill of imbalance and mitigation of an RFIC Reim also shared a trade idea off a reaction to the 50% Asian Range which led to a retracement and opportunity for short re-entries. I did not get any screenshots of this. ONE NOTE I DID MAKE AS IMPORTANT IS – WHAT MAKES AN AREA IMPORTANT OR VALID? ALWAYS CONSIDER THE LAST INJECTION OF SELLS OR BUYS WHICH LED TO A VALID HH OR LL IN STRUCTIRE FORMATION. THIS WAS THE POINT WHICH REIM IDENTIFIED WOULD BE HIS PROFIT TAKING LEVEL. See Screenshot below for Reim’s example on using true structural points as POI’s Reim allowed us to discuss where we would likely place targets / TP’s annotated by the (cursor) green line The validation of this area came from the structural standpoint that this was failed supply (last injection of sells before new highs are made). There were certainly more nuggets but these were the ones I was able to capture. I do hope this helps our community as it’s a blessing to be a part of WWA.