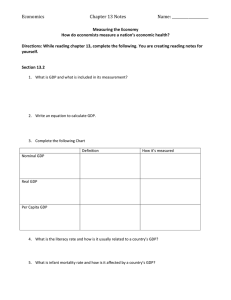

MEASURING A NATION'S INCOME Monday, March 7, 2022 9:39 AM Exercise 5 a. Year 1. GDP is the market value of all final goods • Value of Final good of firm A: $100 - $25 = $75.00 (because $25 is the revenue for intermediate good. GDP only includes final goods and $25 has been included in the cost of producing the final goods. Therefore, we have to minus $25 or you will calculate the number twice). • Value of final good of firm B = $130 → GDP = value of final good of firm A + value of final good of firm B = $130 + $75 = $205.00 2. GDP measures to things: the total income of everyone in the economy and the total expenditure of the output produced • GDP = total wage + total profit = ($20 +$30) + ($80 + $75) = $205.00 200 200 100 2017 400 400 100 2018 800 400 200 c. The economic well-being increase more in 2017 During the period of 2017-2018, there is no changes in real GDP (just the price) During the period of 2017-2017, real GDP increases by 100 reflecting a increase in economic well-being Exercise 6 Year Nominal GDP Real GDP GDP deflator 1 12 12 100 2 20 16 125 3 30 20 150 d. 25% e. 20 3. GDP = $100 + ($130-$25) = $205.00 I. Definition • GDP = Households + Firms + Government + Foreigners 1. The economy's income and expenditure • GDP measures two things at once: the total income of everyone in the economy and the total expenditure on the economy's output of goods and services. - Income = Expenditure (every spending of some buyers is the income for some sellers) → GDP includes the buyers and sellers transactional money. - GDP measures the flow of money (the circular-flow diagram) 2. The measurement of GDP • GDP is the market value of all the final goods and services produced within a country in a given period of time. a. "GDP is the market value" - Different kinds of products → a single measure of the economic activity - Using the market prices b. "of All" - Including all items produced in the economy and sold legally, excluding items produced and sold illegally. c. "Final" - Intermediate good is what devotes in the process of making the final goods → the factors of production. The value of intermediate goods has already included in the price of the final goods. Being sold in the market for re-sale or for production. - Final goods produced only for purchasing (the final products that are sold at stores for using) d. "Goods and services" - All transactions that money are included and paid e. "Produced" - GDP includes goods and services currently produced - It excludes the transactions happening in the past. f. "Within a country" - Products that are produced domestically, regardless of the nationality of the producer. (VD: Samsung products are produced in Vietnam) g. "In a given period of time" - GDP measures the value of production that takes place within a specific interval of time - Seasonal adjustments = The reports provided by the government to present the GDP statistics. MACROECONOMICS Page 1 Nominal GDP Real GDP GDP deflator 2016 g. "In a given period of time" - GDP measures the value of production that takes place within a specific interval of time - Seasonal adjustments = The reports provided by the government to present the GDP statistics. II. The components of GDP III. Real versus Nominal GDP 1. Definition • Real GDP: the production of goods and services valued at constant price (based on the price of any year = base year) - Calculating the GDP growth rate (how economy's overall production changes over time) - Not affected by the change in price → reflecting the changes in the amounts being produced. - The prices in the base year provide the basis for comparing quantities in different years. • Nominal GDP: the production of goods and services valued at current price 2. - The GDP deflator Reflecting only the prices of the goods and services The GDP deflator for the base year always equal 100 Measuring the current level of prices relative to the level of prices in the base year. + The quantities produced rise over time but prices remain the same → Nominal and Real GDP rise at the same rate → GDP deflator is constant + Nominal GDP rises but real GDP is constant → GDP deflator rises • Calculate the inflation rate using the GDP deflator IV. Is GDP a good measure of economic well-being - GDP measures our ability to obtain many of the inputs for worthwhile life - GDP is not a perfect measure of well-being + leisure: people spend more time on working → GDP rises However, they will spend less time on enjoying the goods and services produced (means the Consumption group that is included in GDP) → GDP decreases + The value of goods and services produced at home and voluntary activities + The quality of environment Government erases all environmental regulations → fims produce freely and GDP rises → the well-being falls The deterioration in the quality of air offsets he gains from greater production (production of agricultural, for instance) + The distribution of income Telling GDP per person on average of the total but does not tell the situation of each (the personal experiences) MACROECONOMICS Page 2 MEASURING THE COST OF LIVING Tuesday, March 15, 2022 2:08 PM I. Definition • Basket of goods: - a fixed set of consumer products and services, the prices of which are used to measure a nation's rate of inflation. The basket's price and contents are evaluated on a regular basis. - The items in the basket are updated and changed periodically to keep up with current consumer habits in order to best represent the broader economy. - The products in the basket increases or decreases in price → the overall of the basket changes. CALCULATION CAUTIOUS ALERT!!! • Calculating the cost of the basket of goods in each year still have to based in the data of the base year (the basket of the base year is the fixed basket of goods) • CPI - Measuring the average change in prices over time that consumers pay for a basket of goods and services. - Changes in CPI are used to assess price changes associated with the cost of living. - Evaluating the consumers' purchasing power (the purchasing power of a country's unit of currency). Exercise 2 Year Price of cauliflower Qty of cauliflower Price of brocolli Qty of brocolli 2016 $200 100 heads $75 50 bunches $50 Price of carrots Qty of carrots 500 2017 $225 75 heads $120 80 bunches $100 500 It is all about calculating the amount of goods of services you can afford after the rise in price (is your standard of living the same? Worse-off? Better-off?) II. Calculate CPI 1. Fix the basket • Determine which prices are most important to the typical consumer (If consumer buy something with larger quantity then the price of that good should be given greater weight in measuring the cost of living). 2. Find the prices • Find the price of each good and services in the basket at each point in time. 3. Compute the basket's cost • Calculate the cost of the basket of goods and services at different times • Only the prices in calculation changes (quantity is fixed) → isolating the effects of price changes from the effects of any quantity changes that might be occurring at the same time 4. Choose the base year and compute the index • The index is always 100 in the base year 5. Compute the inflation - The core CPI: Calculate the CPI for all goods and services excluding food and energy (show substantial short-run volatility → reflects ongoing inflation trends) - PPI measures the cost of a basket of G&S bought by firms (firms eventually on their costs to consumers in the form of higher consumer prices → PPI are useful to predict changes in the CPI). Exercise 3 III. Problems in measuring the cost of living • Substitution bias - Substitution effect: decrease in sales for a product that can be attributed to consumers switching to cheaper alternatives when its price rises. - Prices do not change proportionately → Consumers buy more of the goods whose prices have risen less and fallen → Assuming the fixed basket of goods = ignoring the possibility of consumer substitution → overstates the increase in the cost of living (buyers buying substitutes → lower/constant cost of living but CPI calculates the fixed basket of goods = consumers buying the same qty as before → overrated) • Introduction of new goods - When a new good is introduced → consumers have more variety from which to choose → a dollar has increased in value (be able to greater variety) = maintain the current level of economic well-being - CPI is based on fixed basket of goods and services (fixed prices/qty) → does not increase in the value of the dollar (equivalent to a reduction in prices) - CPI includes the new product in the basket = changes in prices of the basket but does not includes the reduction in the cost of living with the initial introduction of the new product is never included → overstating the cost of living • Unmeasured quality change - Quality of goods deteriorate but the price remains the same = the value of a dollar falls (getting a good with lowered quality for the same amount of money) - Quality of goods rises but the price remains the same = the value of the a dollar rises (getting good with higher quality with the same amount of money) - Quality is hard to measure → SUBSTRACT FEW FOLLARS TO GET THE TRUE CPI IV. The GDP Deflator and the consumer index GDP deflator (Introduce the new products → same amount but higher standard of living → negative inflation According to CPI, we pay the same amount of money as before → inflation equals to 0 Introduction of new products → the reduction in purchasing the old products to buy the new products → lower in cost of living) The price of the product is higher than the years before in the flow with inflation. However, looking at the product in detail, there are innovations in services and functions → you are actually bettor off (higher standard of living) not worse off (lower standard of living) → CPI does not include that → inflation overstates (actually worthy) d. The information does affect the calculation of inflation: overstating the inflation rate - The introduction of new flavours → increase the purchasing power because right now with the same amount of money you can have earn more choices - CPI does include the new products but it only calculates the fixed basket of goods (the same quantity as before introducing the new flavour) and does not calculate the change in quantity of purchasing (the reduction in the cost of the old flavours because consumers will buy the new one to try the new taste) - The higher of dollars is neglected in the estmation of inflation (equivalent to the reduction in prices) Exercise 5 a. CPI Feature Reflects the price of goods and services produced domestically Reflects the price of goods and services consumed by consumers How various prices are weighted to yield a single number for the overall level of prices (các mức giá khác nhau quy về thành một mức) Comparing the price of currently produced goods and services to the price of the same good in the base year (changes automatically overtime) Comparing the price of fixed basket of goods and services to the price of the basket in the base year (ocassionally changes) Note: prices changing by varying amounts, the way we weight the various prices matters for the overall inflation rate → Not the same. Reasons: - The CPI only computes the fixed basket of goods - The GDP deflator has changes in goods and services automatically all the time V. Correcting Economic variables for the effects of inflation 1. Dollar figures from different times (comparing the value of dollars in the years) • Case study: regional differences in the cost of living The case of considering job offers - Factors effecting: + Price of goods (if the prices of goods are high, there will be salary inflation to catch up with the hike) + The transport of services (some regions offer high prices and others offer lower = consumers fly to cheaper and sellers fly to more expensive. However the transporting are costly → large price disparities can persist) → Choosing which place to work = salaries + cost of living (Housing especially) 2. Indexation • Indexation means adjusting a price, wage, or value based on the changes in another price or composite indicator of prices. (composite index: create a presentation of overall market or sector performance to conduct investment analyses, measure economic trends, and forecast market activity) (điều chỉnh giá, tiền lương hoặc giá trị khcs dựa trên những thay đổi của một mức giá khác hoặc chỉ số tổng hợp của giá cả) • Adjusting for the effects of inflation, cost of living or input prices over time, prices and costs in different economic geographic areas. • Escalate wages in inflationary environment (tưng lương trong môi trường lạm phát, nơi nếu không thương lượng việc tăng lương thường xuyên sẽ dẫn đến việc cắt giảm lương thực tế liên tục cho người lao động) • PURPOSE - Maintaining a stable real price of a good and servic relative to the purchasing power of a currency unit + A price of asset value is linked to a price level of a basket of goods. Price indexes are commonly published by government agencies → use in the indexation pf prices, wages, and transfer payments + Use this type of inflation → match an employee's salary increases to the inflation rate (mitigate the impact of inflation against a worker's standard of living) - Alleviating the negative effects inflation can have on recipients of transfer paymets and entitlements - Maintaining a stable relative price between goods or services https://www.investopedia.com/terms/i/indexation.asp 3. Real and nominal interest rates Real interest rate Nominal interest rate The interest rate as usually reported without a correction for the effects of inflation The interest rate corrected for the effects of inflation → how fast the purchasing power of your → How fast the number of dollars in your MACROECONOMICS Page 3 Exercise 7 a. 139.8 b. 159.1 c. d. Rise because to buy a dozen eggs take them less time of working than before. → how fast the purchasing power of your bank account rises over time → How fast the number of dollars in your bank account rises over time Reflecting the purchasing power value of the interest paid on an investment or loan and representing the rate of timepreference of borrower and lender Can be negative Cannot be negative REAL INTEREST RATE = NOMINAL INTEREST RATE - INFLATION RATE → Have to consider the effect of inflation on your purchasing power period after period → HIGHER THE RATE OF INFLATION, THE SMALLER THE INCREASE IN PURCHASING POWER → DEFLATION = PURCHASING POWER RISES BY MORE THAN THE RATE OF INTEREST MACROECONOMICS Page 4 Unemployment Sunday, March 20, 2022 2:12 PM I. Identifying unemployment 1. How is unemployment measured? Employed Unemployed Not in labor force Full-time students, - Employees, self- Who were not employed, employed, work as unpaid avalable for work and had tried retirees, homemakers worker in a family to find employement for the past member's business. 4 weeks - Both full-time and part- Those waiting to be recalled to a time job from which the had been laid off - Temporily absent from work because of vacation, illness… • Labor force: the total number of workers • Unemployment rate: the % of labor force that are unemployed • Labor-force participation rate: the of the adult population participating in the labor force • Natural unemployment - The minimum unemployment rate resulting from real or voluntary economic forces - Representing the number of people unemployed due to the structure of labor force (structural and frictional) (replaced by tech or those lack of skills) - Persiting due to the flexibility of the labor market, which allows for workers to flow to and from companies (sector shifts - they leave their current job for better job option,…) → 100% full employment cannot be achieved til the labor market is inflexible (no one can quit theur job freely) → the normal rate of unemployment arount the unemployment fluctuaes. • Cyclical unemployment - The impact of economic recession or expansion on the total unemployment rate - Rising during recessions and fells during economic expansions and is a major focus of economic policy - One factor among many contribute to total unemployment - It is a result of businessess not having enough demand for labor to employ all those who are looking for work at that point within the business cycle. → The deviation of unemployment rate from its natural rate MACROECONOMICS Page 5 2. Does the unemployment rate measure what we want it to? - Discoraged workers: who are unemployed and have tried to find a job but ended up giving up because of unsuccessful search. → do not show on unemployment statistics - Some reported unemployed but actually not try to find a job (to join financial insurance for the unemployed or to avoid taxes) → USEFUL BUT IMPERFECT MEASURE OF JOBLESSNESS 3. How long are the unemployed without work? • Most spells of unemployment are short, but most unemployment observed at any given time in the long term. 4. • - Why are there alwas some people unemployed? Unemployment rate never falls zero even the market is doing well Wages balanc the quantity of labor supplied and the quantity of labor demanded. Reasons Frictional unmployment: the workers takes time to search for jobs that best suit them Structural unemployment: number of jobsin the labor market is insufficient to provide a job for everyone who wants one. + Minimum-wage laws + Unions + Efficiency wages II. Job search 1. Frictional unemployment is inevitable - The result of changes in the demand for laboramong different firms (some firms employ more workers and some firms lays off workers → the laid off workers find jobs from the employ position of others) - Changes in the composition of demand among industries or regions are call sectoral shifts → It takes time for workets to search for a job in the new sectors, sector shifts temporarily causes unemployment. → Workers in declining industries are outta work and searching for new jobs 2. Unemployment Insurance - Designed to offer workers partial protection against job loss (to the unemployed who were laid off because their previous employers no longer needed their skills) - Encouraging the unemployed stop looking or jobs → increasing job unemployment MACROECONOMICS Page 6 - Encouraging the unemployed stop looking or jobs → increasing job unemployment - There is still the good side of the policy: reducing the income uncertainty that workers face (giving them time to find the best-suited jobs → increase the working efficiency) III. Minimum-wage laws (support the sellers of labor) - Raising the quantity of labor supplied and reducing the quantity of labor demanded (higher wages → workers have more incentives to enter the market and gain more benefit while firms cannot endure the cost of labor or have no position left for hiring) → SURPLUS OF LABOR - Minimum-wage laws matter most for least skilled and least experienced members of the labor force → the unemployed waiting for jobs to open up (limited positions) (The skilled and experienced worker are not affected by this policy because they are already have stable positions and salaries) IV. Unions andcollective bargaining • A union is a worker association that bargains with emloyers over wages, benefits and working conditions. 1. The Economics of Unions • Collective bargaining: the process by which firms and unions agree on the terms of employment. • Strike: The organized withdrawal of labor froma firm by a union (refusing to work due to disagreement) • Union workers are paid higher than similar workers who do not belong to the unions Union raises the wage above the E level → the same effect as minimum-wage law (Workers who remain employed at higher wage = insiders of unions are better off while thoe who were employed and now unemployed = outsiders are worse off) • Unions raise wages in one part of the economy → the supply of labor increases in other of economy (because of the raising wage, firms in that one part of economy do not hire more workes → job searcher in that part of economy have to move from that part of economy to the part that positions are still available → reducing the wages in the industries that are not unionized because too much unemployed enter) → workers in unions reap the benefit of collective bargaining, while workers not in unions MACROECONOMICS Page 7 → workers in unions reap the benefit of collective bargaining, while workers not in unions bear some of the cost. • The role of unions in the economy depends in part on the laws that govern union organiztion and collective bargaining. → many laws are designed to encourage the formation of unions. 2. Are unions good or bad for the economy? - A union may balance the firms' market power and protect the workers from being at themercy of the firms' owners. → right mix of job attributes → helping firms keep a happy and produtive workforce V. Efficiency wages • Efficiency wages: above-equilibrium wages paid by forms to increase worker prodctivity Wages above E → firms operate more efficiently → Increasing higher wages for higher productivity - Worker health Worker turnover Worker quality Worker effort MACROECONOMICS Page 8 Production and Growth Sunday, April 3, 2022 7:46 PM I. Productivity: Its role and Determinants 1. Why productivity is so important • Productivity: the quantity of goods and services produced from each unit of labor input - Productivity is the key determinant of living standards - The groeth of productivity is the key determinant of growth in standard of living → The larger the quantity of goods and services, the higher the living standard 2. How productivity is determined → by many factors a. Physical capital per worker • The stock of equipment and structures that are used to produce goods and services • Capital is an input into the production process that in the past was an output from a production process → Capital of a factor of production to produce all kinds of G&S, including more capital → Output and Input Example: a worker with more sophisticated and specialized tools can produce larger quantity of products that a worker with only basic tools b. • • - Human Capital per Worker The knowledge and skills that workers acquire via experiences, education and training Human capital is both an input and output Output: produced factor of production (from inputs: teachers, classes, books…) Input: nation's ability to produce c. • • • Natural resources The inputs in the production provided by nature Two forms: Renewable and Nonrenewable Differences in natural resources explains some of the differences in standards of living aroung the world Example: Kuwait rich because they happen to be on top of the largest pools of oil in the world The US → their land is suitable for agriculture • Unecessary for an economy to be highly productive d. Technological knowledge • Society's understanding of the best ways to produce goods and services (The ability to understand of the function , operation and application of current technology) • Many forms - One person uses it, everyone aware of it - Proprietary: only by the company that discovers it - Priorietary for a short-time (have the temporary right to produce exclusively (Human capital nói về khả năng produce của con người còn Tech knowledge nói về sự hiểu biết của con người về máy móc) II. Economic Growth and public policy 1. Saving and Investment • The more capital are produced → produce more goods and services → Raising future productivity = invest more in the production of capital (a capital if the factor of production of the other capital) MACROECONOMICS Page 9 factor of production of the other capital) • Trade-off: - For larger production of capital, the society have to decrease their consumption (devoting fewer resources to producing G&S for current consumption, consume less and save more current income) Example: Instead of invest money in building buildings for people to buy, the government will use the funds to produce more equipment and facilities to larger production of G&S. 2. Diminishing returns and catch-up effect a. Diminishing returns (Saving rate: forgoing some current consumption in favor of increasing the future consumption) • Raising the nation's saving rate = fewer resources needed to make consumption G&S → more resources to make capital goods to support larger production → capital stock increases and GDP grows → Temporary condition • Diminishing returns: the quantity of inputs increases = decrease in the production of extra output (Marginal output) → higher stock of capital → the benefits from additional capital become smaller over time = the growth slows down → INCREASING TH SAVING RATE CAN LEAD TO SUBSTANTIALLY HIGHER GROWTH FOR A PERIOD OF SEVERAL DECADES • The amount of capital of worker already high, additional capital investment has a relatively small effect on productivity (coordination problems) b. Catch-up effects • The property whereby countries that start off poor tend to grow more rapidly than countries that start off rich → small amount of investment in capital can raise the productivity substantially → POOR COUNTRIES TEND TO GROW FASTER RATE THAN RICH COUNTRIES 3. Investment from Abroad • Foreign direct investment (FDI): A capital investment that is ownd and operated by a MACROECONOMICS Page 10 • Foreign direct investment (FDI): A capital investment that is ownd and operated by a foreign entity • Foreign portfolio investment: An investment financed with foreign money but domestic by domestic residents Example: an American buy stock from a Mexico corp → use the proceeds from the stock sale to build a new factory → The investor take some of the income made by the receiver as profit • Investment from abroad does not have the same effect on all measures of economic prosperity - GDP measures domestically while GNP measures both at home and abroad → Foreign investment raises the incomeby less that raises the production (tăng cái productivity nhưng mà không tăng lương vì nó đã được chia cho investor) • Investment from abroad is one way for a country to grow → increase stock of capital, higher productivity and higher wages → learn from developed countries 4. • • • Education Opportunity cost: forgo the wags that students can earn from joining the labor workforce Producing the positive externalities: benefit society more than individuals Brain drain 5. Health and nutrition • Healthier workers = more productive → increasing productivity and raising living standards • The causal link between health and wealth runs in both directions • Unhealthy populations → poor country → unhealthy food → unhealthy population → poor 6. Property rights and political stability • Propety rights: the ability of people to exercise authority over the resources they own → the courts discourage theft and ensures buyers and sellers live up to their contracts • Political stability • Government confiscates the capital of some business → domestic residents have less incentive to save, invest and start new businesses → foreigners have less incentive to invest → A country with political stability will enjoy higher standard of living 6. Free trade • Inward-oriented policies : economic independence and self-reliance of developing countries (imposing high tariffs and restrictions) → making countries worse-off - Self-producing all capital goods - Cannot receive th state-of-art equipment from others • Obstacle: Geography - Countries with natural seaports find trade easier than countries without this resource 7. Research and development → task of government: encouraging researching of technological advance • Public good: a person discovers an idea → the idea enters the society's pool of knowledge → other people can use freely • Ways of encouraging: subsidy and patent system • Patent system: giving the inventor the exclusiveright to make the product for a specified number of years → private good → the inventors gain profit from their outcomes → have more incentive to produce MACROECONOMICS Page 11 8. Population growth • A large population means more workers to produce • A large population means more peoplr to consume → A large population need not mean a higher living standard → Both large and small nations are found at all levels of economic development MACROECONOMICS Page 12 The financial market Monday, April 4, 2022 9:59 AM I. Financial markets II. • • • • Stock markets Bond markets • Represeting ownership in a firm, a claim to the profits that the firm makes. • The sale of stock to raise money = equity finance • The owner of the stock is part of the owner of the corporation • If the company is profitable, the stockholders enjoy the benefits of these profits (bondholders get only the interest of bonds) • Corporation runs into financial difficulty, the bondholders are paid what they are due before stockholders receive anything at all → Stocks offer the holder higher risk and returns • Definition: It is a certificate of indebtness that specifies the obligations of the borrower to the holder of the bond • Identifying the time at which the loan will be repaid (the date of maturity) If selling the bonds before the date of matiurity, the bonds are sold at reduced price • Identifying the rate of interest that will paid periodically until the loan matures →The buyer gives Intel his money in exchange for this promise of interest and eventual repayment of the amount amount borrowed (principal) • A bond's term - the length of time until the bond matures - Bond never mature: perpetuity (only pay the interest) - The interest rate on a pond depends partly on its term - Long-term bonds are riskier than short-term bonds → to compensate the risk, long-term bonds payer higher interest • Credit risk - the probability that the borrower will fail to pay some of the interest or principal • Default - failure to pay - The probability of default is high → buyers demand for higher interest rate to compensate for the risk - Government bonds are safer = lower interest - Financially shaky corporations raise money by issueing junk bonds (very high interest rates) • Tax treatment - the way the tax laws treat the interest earned on the bond - The interest on most bonds is taxable income (owners have to pay a portion of his interest as income taxes • Government bonds = municipal bonds - Bond owners are not required to pay taxes Financial Intermediaries Definition: Financial institutions through which savers can indirectly provide funds to borrowers (banks, investment banks…) Reflecting the role of institutions standing between savers and borrows Helping create efficient markets and lower cost of doing business Providing leasing (contractional) or factorng srevices, but do not accept public deposits (higher risk) Benefits: pooling risk, reducing cost, and providing economies of scale, among others 1. Banks • A primary job of banks: taking in deposits of savers and use these deposits to make loans to people who want to borrow (borrowers) → Banks pay depositers (savers) interest on their deposits and charge borrowers slightly higher interest on their loans (The difference will cover the banks' costs and returns some profit to the banks' owners → banks receive profit) • Facilitating purchases of goods and services by allowing people to write checks against their deposits and to access those deposits with debit cards (hỗ trợ mua sắm bằng cách yêu cầu saver gửi deposit và họ có thể tiêu bằng thẻ tín dụng) → medium of exchange = instrument or system used to facilitate the sale, purchase or trad eof goods between parties 2. a. • • - Mutual funds Definition: institution selling shares to the public (investors) and uses the proceeds to buy a portfolio of stocks and bonds (danh muc dau tu) Made up of a pool of money collected from many investors to invest in securities like stock, bonds and other assets Operated by money managers → allocating the fund's assets and attempt to produce capital gains or income for the fund's investors A mutual fund's portfolio is structured and maintained to match the investment objectives stated in its prospectus The primary advantage: allowing people with small amounts of money to diversify their holdings The value of mutual fund company depends on the performance of the securities it decides to buy People who have diverse portfolio of stocks and bonds face less risk because they only have small stake in each company MACROECONOMICS Page 13 b. How mutual funds work • A mutual fund is both an investment and actual company → A mutual fund investor is buying partial ownership of the muatual fund company and its assets • Investors earn a reaturn in three ways - Dividends on stocks and interest on bonds held in the fund's portfolio → Paid nearly all of the income the fund receives over the year to fund owners in the form of distribution → Choosing either to receive a check for distributions or reinvest the earnings and get more shares - The fund has the increase in price = the fund has capital gains (the increase value of capital assets) → Most funds pass these gains to the investors in distribution - Fund holdings (contents in portfolio) increase in price but are not sold to the fund manager → the fund's shares increase in price → selling your mutual fund shares for a profit III. Saving and Investment in the National Income accounts (295) 1. Identities • Nationak saving: The total income in the economy that remains after paying for consumption and government purchases • Private saving: the income that householdshave left after paying for taxes and consumption • Public saving: the tax revenue that the government has left after paying for its spending (the government receive tax and spend those amount of tax on gods and services) - Budget surplus: the government receive more money than it spends → - Budget deficit: the government spend more than the tax money it receives → →S=I 2. The emaning of saving and investment • Although S = I shows that saving = investment, this does not have to be true for every individual household or firm\ IV. 1. • - The makret for Loanable Funds The supply and demand for loanable funds The supply: coming from people who have extra in their income and want to save and lend out The lending can occur directly or indirectly → Saving is the supply of loanble funds • The demand - Coming from households and firms wishing to borrow to make investments MACROECONOMICS Page 14 - Coming from households and firms wishing to borrow to make investments → Investment if the demand • The price of a loan = Interest rate → Representing the amount that borrowers pay for loans and the amount lenders/savers receive for their saving • The E of lendings and borrowings - Interest rate lower than the E → S < D → lenders charge higher interest rate - Interest rate higher than E → S > D → lenders charge lower interest rate • The supply and demand for lonable funds depend on real interest rate → THE FINANCIAL MARKETS WORK MUCH LIKE THE MARKETS IN THE ECONOMY V. 1. • • • Measuring the time value of money The present value The amount of money today is worth more than the same amount in the future The amount of money today that would be needed, using prevailing interest rates, ti produce a given future amount of money Calculating the PV of a FV 2. • • • Future value The amount of money in the future that an amount of money today will yied, given prevailing interest rates Estimating how much an investment made today will be worth in the future Calculating future value → The higher the interest rate, the more you can depositing your money in a bank 3. Example • The PV of $200 million = → Calculating the PV of each years → the PV of the 20 years Screen clipping taken: 4/14/2022 1:36 PM MACROECONOMICS Page 15 Screen clipping taken: 4/14/2022 1:36 PM MACROECONOMICS Page 16