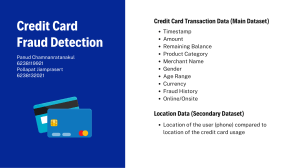

Credit Card Fraud Analysis Abstract With the extensive use of credit cards, fraud appears as a major issue in the credit card business. It is hard to have some figures on the impact of fraud, since companies and banks do not like to disclose the number of losses due to frauds. Credit card fraud detection is like being a financial detective, constantly on the lookout for suspicious activity. Millions of transactions whiz by daily, and your job is to identify the imposters. You analyse patterns, sniff out oddities like a bloodhound, and leverage clever algorithms to catch the bad guys. But it's no easy feat. Fraudsters evolve faster than fashion trends, and the sheer volume of data can be overwhelming. Yet, the stakes are high - protecting people's hard-earned money and keeping businesses safe from scams. So, we hone our skills, adapt to new tricks, and strive for accuracy, because every caught fraudster means one less victim and one step closer to a secure financial world. Some of the challenges of credit card fraud detection: I. II. III. The volume of data: There are billions of credit card transactions made every day, so it can be difficult to analyse all of the data in real time. The sophistication of fraudsters: Fraudsters are constantly developing new techniques to bypass security measures, so it is important to keep up with the latest trends. The need for accuracy: Fraud detection systems need to be accurate in order to avoid false positives, which can inconvenience legitimate cardholders. KEYWORDS Fraud Detection, Fraud Detection, Unusual Transactions, Data Analysis, Authentication, Secure Access, Identity Verification, Fraud Prevention, Fraud Prevention, Risk management, real-time monitoring, transaction monitoring, secure transactions, transaction monitoring, Transaction patterns, Credit Card Security, Cybersecurity, Cybersecurity Fraud Risk Score, Fraud Risk Score. INTRODUCTION Credit card fraud analysis helps protect digital financial ecosystems from the growing threat of unauthorized transactions. Focusing on anomaly detection and real-time tracking, this practice uses sophisticated analytics and advanced machine learning algorithms to detect unusual patterns and behaviours. Behaviour analysis and pattern recognition help to understand user behaviour and identify evolving fraud tactics. Machine learning and predictive modelling improve the ability to detect and prevent fraud. Authentication methods like multi-factor authentication (MFA) and biometric verification enhance transaction security. Collaboration and information sharing between financial institutions and stakeholders are essential to responding to emerging risks together. Challenges include: Countering sophisticated fraud techniques Minimizing false positives Tackling the global nature of fraud Adapting to emerging payments technologies Maintaining compliance with PCI DSS (Direct Payment System) and KYC (Know Your Customer) strengthens the security infrastructure and ensures continued effectiveness in the ever-changing landscape of electronic transactions. Key Objectives of Credit Card Fraud Analysis: I. Discovery of Peculiarities: Credit card extortion investigation points to distinguish anomalous designs and behaviours inside exchange information. By leveraging progressed analytics and machine learning calculations, investigators can distinguish deviations from commonplace investing or utilization designs, signalling potential false exercises. Real-time Observing: Opportune distinguishing proof of suspicious exchanges is significant in anticipating budgetary misfortunes. Real-time observing frameworks ceaselessly scrutinize exchanges, empowering fast reaction to abnormalities and potential extortion pointers. Behavioural Examination: Understanding client behaviour could be a essential viewpoint of credit card extortion investigation. By making profiles of ordinary investing habits, analysts can recognize deviations and inconsistencies which will demonstrate false exercises, such as startling exchanges or unordinary obtaining areas. Design Acknowledgment: Extortion examination includes the distinguishing proof of common extortion designs and strategies. Recognizing patterns in false exercises permits money related educate to remain ahead of rising dangers and adjust their security measures in like manner. Machine Learning and Prescient Modelling: Utilizing machine learning calculations and prescient modelling, credit card extortion investigation can persistently learn and adjust to unused extortion strategies. These innovations upgrade the capacity to foresee and anticipate extortion by recognizing advancing designs and patterns. Confirmation Upgrades: Credit card extortion examination expands to moving forward verification strategies. Multi-factor verification, biometric confirmation, and tokenization are among the strategies utilized to upgrade the security of electronic exchanges and ensure against unauthorized get to. Collaboration and Data Sharing: Collaboration between money related educate, law authorization offices, and industry partners is fundamental within the battle against credit card extortion. Data sharing stages and consortiums facilitate the dispersal of risk insights, empowering a collective reaction to rising dangers. Compliance with Directions: Credit card fraud examination is closely adjusted with administrative systems planned to protect monetary exchanges. Compliance with measures such as the Instalment Card Industry Information Security Standard (PCI DSS) and Know Your Client (KYC) controls strengthens the security foundation and diminishes vulnerabilities. LITERATURE REVIEW Credit card extortion postures a critical risk to both people and budgetary educate. This audit points to investigate the existing investigate scene in credit card extortion investigation, analysing different location approaches, challenges, and future headings. Data and Techniques: Information sorts: Considers frequently analyse exchange information (sum, time, area, vendor), cardholder information (socioeconomics, investing propensities), and dealer information (industry, chance score). Extortion location strategies: Prevalent strategies incorporate rule-based frameworks, machine learning (irregularity location, classification, clustering), arrange investigation, behavioural profiling, and content investigation. Key Findings: Machine learning appears promising comes about: Considers report tall precision in extortion location utilizing differing calculations like Arbitrary Timberland, SVM, and Neural Systems. Significance of information pre-processing and include designing: Cleaning and enhancing information essentially moves forward calculation execution. Challenges stay: Imbalanced datasets, concept float (extortion strategies advance), and real-time location complexities posture challenges. Developing Patterns: Profound learning: Convolutional Neural Systems (CNNs) and Repetitive Neural Systems (RNNs) hold guarantee for analysing complex exchange designs. Graph-based approaches: Recognizing joins between false performing artists through arrange examination is picking up footing. Social media and behavioural information: Coordination extra information sources for moved forward client profiling and irregularity discovery. Future Headings: Reasonable AI: Understanding how models make choices is vital for building believe and relieving predisposition. Cross-institutional collaboration: Sharing information and experiences can improve framework viability and combat organized extortion. Versatile frameworks: Ceaselessly altering to advancing extortion strategies through real- time learning and upgrades. Credit card extortion investigation inquire about may be a energetic field, continually advancing with modern information sources, strategies, and challenges. Whereas machine learning appears guarantee, tending to information complexities and rising patterns will be pivotal in handling advanced extortion and guaranteeing money related security. Research & Methodology 1. The approach that this paper proposes uses the latest machine learning, and when looked at in detail on a larger scale, along with real-life elements, the full architecture diagram can be represented as follows: The above diagram is explained as: When a credit card transaction takes place, the details are sent to the credit card fraud detection system. This data includes things like the amount of the transaction, the location of the transaction, and the cardholder's billing information. The system then analyses the transaction data using a decision function. This function is made up of a set of rules or algorithms that are designed to identify fraudulent transactions. Some systems use machine learning (ML) algorithms to analyse the data. These algorithms are trained on historical data that includes both fraudulent and legitimate transactions. The ML engine can then identify patterns in the data that are associated with fraud. If the decision function determines that a transaction is fraudulent, the system will block the transaction and may also take other actions, such as notifying the cardholder or the bank. If the transaction is not fraudulent, it is authorized and the process is complete. 2. Machine learning We obtained our dataset from Kaggle, a data analysis website that provides datasets. Inside this dataset, there were twelve columns. These columns represented Account Number, Customer Age, Gender, Marital Status, Card Colour, Card Type, Domain, Amount, Outcome, and Customer City Address. In this dataset, the outcome column represents 0 and 1. Where 0 was used to represent a valid transaction and 1 was used to represent a fraudulent one. No of fraudulent transaction 14000 12000 10000 8000 Female 6000 Male 4000 2000 0 Female Male The above diagram shows the total number of males and females who have faced fraudulent transactions. From this graph, we get to know that the male count is 13015, i.e., the highest as compared to the female count. The line graph on the left appears to be a Receiver Operating Characteristic (ROC) curve. An ROC curve is a graphical plot that illustrates the diagnostic performance of a binary classification model (such as a machine learning model for fraud detection) as its discrimination threshold is varied. It plots the true positive rate (TPR) against the false positive rate (FPR) for different cut-off points. The specific ROC curve in the image shows good performance of the model. It starts at a point close to the origin (0,0), which is ideal, and then rises quickly and levels off at a high value for TPR, while FPR remains low. This means that the model is able to correctly identify a high proportion of positive cases (true positives) while keeping the number of negative cases incorrectly classified as positive (false positives) low. The flowchart on the right appears to depict the general process of evaluating a machine learning model. It starts with selecting the relevant columns from the dataset, followed by data pre-processing steps such as editing metadata, cleaning missing data, and splitting the data into training and testing sets. Next, the model is trained on the training data. This involves the model learning to identify patterns in the data that are associated with the target variable (e.g., fraudulent transactions in fraud detection). After training, the model is evaluated on the testing data. This involves using the model to make predictions on the testing data and then comparing those predictions to the actual values of the target variable. Finally, the evaluation results are analysed to assess the model’s performance. This typically involves calculating various metrics such as accuracy, precision, recall, and ROC AUC. The ROC AUC, which is likely represented by the area under the ROC curve in the image, is a measure of the model’s ability to correctly distinguish between positive and negative cases. Overall, the image suggests that the machine learning model being evaluated is performing well. The ROC curve shows high accuracy and the flowchart outlines a comprehensive evaluation process. The X-axis is the recall, which is the fraction of actual positives that are correctly predicted. The Y-axis is the precision, which is the fraction of predicted positives that are actually positive. The blue line is the precision-recall curve. The green line is the baseline precision, which is the precision that would be achieved if the model simply predicted the most common class (in this case, that the loan will be repaid). It appears to be a precision-recall curve, which is a way of visualizing the performance of a binary classification model. In this case, the model is trying to predict whether or not a loan will be repaid. The curve shows the relationship between the precision and recall of the model at different threshold values. Precision is the fraction of predicted positives that are actually positive, while recall is the fraction of actual positives that are correctly predicted. The ideal point on the curve is in the upper left corner, where the model has both high precision and high recall. However, this is often not achievable, and there is typically a trade-off between precision and recall. In the image, the curve starts at a high precision and recall, but then drops off as the threshold increases. This means that the model is able to achieve high precision at the cost of recall. In other words, the model is able to correctly identify most of the loans that will be repaid, but it is also missing some of the loans that will be repaid. The specific threshold that is chosen will depend on the specific application. For example, if it is very important to avoid making bad loans, a higher threshold might be chosen, even if it means that some good loans are also missed. Conversely, if it is more important to approve all of the good loans, a lower threshold might be chosen, even if it means that some bad loans are also approved. Overall, the image shows that the model is performing well, but there is still room for improvement. It is important to consider the trade-off between precision and recall when choosing a threshold for this model. The model's accuracy is highest for the score bins with the lowest predicted scores (0.966 for score bins 0.500-0.600 and 0.600-0.700). This suggests that the model is good at identifying the most likely fraudulent transactions. The model's precision is also highest for the lower score bins, while the recall is highest for the higher score bins. This is a typical trade-off in binary classification tasks. Increasing the threshold to improve precision will typically decrease recall, and vice versa. The F1 score is highest for the score bin 0.600-0.700 (0.671), which suggests that the model achieves a good balance between precision and recall in this range. The cumulative AUC increases as the score threshold increases, reaching 0.957 for the last score bin. This indicates that the model has good overall performance in discriminating between fraudulent and non-fraudulent transactions. Overall, the table suggests that the machine learning model is performing well for credit card fraud detection. It is able to accurately identify a high proportion of fraudulent transactions while maintaining a reasonable level of precision and recall. Conclusion: Credit card fraud detection is a constant arms race against evolving criminal tactics. While no system is foolproof, advancements in technology and data analysis offer promising improvements: Machine learning and deep learning: These algorithms can identify complex patterns in transaction data, significantly improving fraud detection accuracy and adapting to novel attack methods. Real-time monitoring: Continuous analysis of transactions enables swift intervention, minimizing losses and inconvenience for legitimate users. Collaboration: Sharing data and intelligence across financial institutions and other stakeholders strengthens the overall defence against fraud. While technology plays a crucial role, it's important to remember the human element: Customer education: Raising awareness about fraud tactics and promoting responsible card usage empower individuals to contribute to their own security. Fraud investigation: Dedicated teams skilled in investigating fraudulent activity and tracking down perpetrators remain essential for deterring and prosecuting crime. Suggestions: Invest in advanced analytics: Implement machine learning and deep learning models alongside traditional rule-based systems for a more robust approach. Prioritize real-time monitoring: Continuous analysis allows for immediate action against suspicious transactions, minimizing losses. Foster collaboration: Share data and insights with other financial institutions and organizations to gain a broader view of fraud patterns and emerging threats. Educate customers: Promote awareness about fraud tactics and best practices for secure card usage through campaigns and informative materials. Maintain a skilled workforce: Invest in training and development for fraud investigators to effectively track down and apprehend criminals. Stay updated: Continuously monitor new fraud trends and adapt detection systems to stay ahead of evolving criminal techniques. By combining technological advancements with robust human support, the financial industry can significantly reduce the impact of credit card fraud and create a safer environment for consumers and businesses alike. Bibliography: https://www.researchgate.net/publication/3 36800562_Credit_Card_Fraud_Detection_us ing_Machine_Learning_and_Data_Science https://www.sciencedirect.com/science/arti cle/pii/S187705092030065X https://journalofbigdata.springeropen.com/a rticles/10.1186/s40537-022-00573-8 https://www.kaggle.com/ Group Members 1. Harshit Tatiparti – 2305490 2. Chhavi Mittial – 2304346 3. Siddharth Rathi - 2308045