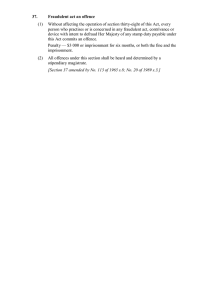

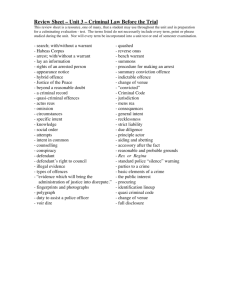

LW - Corporate Fraudulent and Criminal Behaviour Contents Fraudulent and Criminal Behaviour ............................................................................................ 2 INSIDER DEALING: .................................................................................................................... 2 Types of insiders: ..................................................................................................................... 3 MARKET ABUSE: ...................................................................................................................... 3 MONEY LAUNDERING: ............................................................................................................. 4 Corporate Fraudulent and Criminal Behaviour ........................................................................... 7 BRIBERY:................................................................................................................................... 7 FRAUDULENT AND WRONGFUL TRADING: ............................................................................. 8 1 Fraudulent and Criminal Behaviour INSIDER DEALING: Insider dealing - trading on the basis of price-sensitive information before the general public has access to that information. Insider dealing is a crime under Criminal Justice Act 1993 (part 5). Offenses of insider dealing (Criminal Justice Act 1993 , part 5, s.52): 1) Deal in price-affected securities on the basis of insider information; 2) Encourage another person to deal in price-affected securities in relation to insider information; 3) Disclose information to anyone other than in the proper performance of their employment, office or profession. Definitions by Criminal Justice Act 1993: a) Securities covered by legislation: shares and debentures (s.54); b) Dealing - acquiring or disposing of securities, whether as a principal or agent, or agreeing to acquire securities (s.55). c) Inside information (s.65): Relating to particular securities; Being specific or precise; Not having being made public; Being likely to have a significant effect on the price of the securities. 2 Types of insiders: Primary Those who get the insider information directly through either being a director, employee or shareholder of an issuer of securities or having access to information by virtue of employment, office or profession. Secondary Any other person who knew, or ought to have known, that the information in its possession was inside information. Summary: Fine not exceeding the statutory maximum and / or a maximum of 6 months imprisonment; 1) Indictment: Unlimited fine and / or maximum 7 years imprisonment. Defences: No person can be charged if they did not expect the dealing to result in any profit or the avoidance of any losses (s.53). MARKET ABUSE: Market abuse - any behaviour (action or inaction) anywhere in the world, directly or indirectly affecting investments traded on a UK market that is likely to be regarded by regular users of the market as falling below the standard reasonably expected of a person in that position. Should be at least one of the following types: 1) Information must not be generally available - insider dealing; 2) Information likely to give user false or misleading impression - misleading statements and practices; 3) Information distorts the market - rigging of the market. Indirect market abuse occurs if a person requires or encourages by action or inaction another to engage in behaviour that if done by the defendant would have amounted to direct market abuse. 3 Legislation: Financial Services and Markets Act 2000 (FSMA) part VIII gives the Financial Services Authority the power to impose civil penalties for market abuse. Previously, the UK relied on criminal sanctions : The common law crime of conspiracy to defraud to cover rigging of a market; The statutory offences of “misleading statements” and “market manipulation”, reenacted in FSMA as “misleading statements and practices”; Separate legislation making insider dealing a criminal offence. Criminal sanctions have remained. Financial Services Authority brings prosecution. MONEY LAUNDERING: Money laundering - process by which the proceeds of crime, either money or property, are converted into assets, which appear to have a legal rather than having an illegal origin. Phases of money laundering: I II III Placement Layering Integration Initial disposal of the proceeds of criminal activity into apparently legal business activity or property. Transfer of money from business to business or place to place in order to conceal its initial source. Result from previous procedures through which money takes on appearance of coming from a legal source. 4 History of legislation: 5 Proceeds of Crime Act 2002 seeks to control money laundering by creating three categories of criminal offences: Laundering: - Assisting of carrying out of laundering, contained in ss.327-329; - S.327: offence to conceal, Failure to report: - Failure to report suspicion, contained in ss.330-332; - S.330: offence if a person knows or suspects another disguise, convert, transfer or person is engaged in remove criminal property; laundering; - Concealing refers to - Relates to professionals in nature source, location, industry, for example disposition, movement of accountants; property; and - Maximum five years - Carries maximum 14 years and / or a fine. Tipping off: - Contained in s.333; - Offence to make a disclosure which is likely to prejudice an investigation under the act; - Maximum of five years and / or a fine. Money Laundering Regulations 2007 implemented the European Union Third Money Laundering Directive and applied to different business sectors (for example financial and credit business, accountants). Companies must have certain controls in place: a) Assessing the risk of your business being used by criminals to launder money; b) Checking the identity of your customers; c) Checking the identity of “beneficial owners” of corporate bodies and partnerships; d) Monitoring your customers’ business activities and reporting anything suspicious to the Serious Organised Crime Agency; e) Making sure you have the necessary management control systems in place; f) Keeping all documents that relate to financial transactions, the identity of your customers, risk assessment and management procedures and processes; g) Making sure that your employees are aware of the regulations and have had the necessary training. 6 Corporate Fraudulent and Criminal Behaviour BRIBERY: UK Bribery Act 2010 - key regulatory document. Section 7: Failure of commercial organisations to prevent bribery. Offence is committed irrespective of whether the acts or omissions which form part of the offence take place in the UK or elsewhere. Section 9 requires the Secretary of State to publish guidance containing procedures which commercial organisations can put in place to prevent bribery Maximum sentence for individual: 7-10 years of imprisonment. Maximum sentence for corporate body: unlimited fine. 7 Note: Companies operating in both jurisdictions must complywith both acts. Companies Act s.993 (1): If any business of a company is carried on with intent to defraud creditors of the company or creditors of any other person, or for any fraudulent purpose, every person who is knowingly a party to the carrying on of the business in that manner commits an offence. Fraud Act s.9 (2): This section applies to a business which is carried on: a) By a person who is outside the reach of section 993 Companies Act (offence of fraudulent trading); b) With intent to defraud creditors of any person or for any other fraudulent purpose. FRAUDULENT AND WRONGFUL TRADING: Fraudulent trading - carrying on a business with the intention of defrauding creditors or for any fraudulent purposes. The definition applies to company which is trading, has ceased trading or is in the process of being wound up. Wrongful trading according to Insolvency Act 1986 s.214: a) The company has gone into insolvent liquidation; b) At some time before the commencement of winding up of the company, that person knew or ought to have concluded that there was no reasonable prospect that the company would avoid going into insolvent liquidation; c) That person was a director of the company at that time. Wrongful trading refers to companies that continued to carry on their daily business trading insolvent, that is, unable to pay their debts as they fall due. Court will take into account in deciding whether or not the director knew or ought to know that the company is insolvent: The general knowledge, skill and experience that may reasonably be expected of a person carrying out the same functions as are carried out by that director in relation to the company; 8 The general knowledge, skill and experience that that director has. Company Directors Disqualification Act 1986 identifies three categories of conduct which may lead to disqualification of a person from management of companies: 1) General misconduct with companies: a) Indictable offence in connection with promotion, formation, management or liquidation of an company or with the receivership or management of a company’s property per section 2. Disqualification period: Summary conviction - maximum 5 years. Indictment maximum 15 years. b) Persistent breaches of companies legislation in relation to provisions which require any return, account or other document to be filed with, or notice of any matter to be given to, the Registrar of Companies. S.3 persistently in default that in five years person adjudged guilty on three or more defaults. Disqualification period: Maximum - 5 years. c) Fraud in winding up if person guilty of offence under 993 of Companies Act 2006 or otherwise found guilty by officer or liquidator. Disqualification period: Maximum - 15 years. 2) Insolvent companies and disqualification for unfitness: a) Disqualification of directors of companies which have become insolvent, who are found by the court to be unfit to be directors. Disqualification period: Minimum - 2 years. Maximum - 15 years. b) Disqualification after investigation of ac company under Companies Act 1985. Disqualification period: Maximum - 15 years. 9 3) Other cases for disqualification: a) Participation in fraudulent or wrongful trading under s.213 or s.214 Insolvency Act 1986; b) Undischarged bankrupts acting as directors per s.11 of the Company Directors Disqualification Act 1986; c) Failure to pay under a county court administration order per s.11 of the Company Directors Disqualification Act 1986. Anyone who acts in contraventionof a disqualification order is liable: To imprisonment for up to two years and/or a fine, on conviction or indictment; To imprisonment for up to six months and/or a fine not exceeding the statutory maximum, a summary conviction. 10