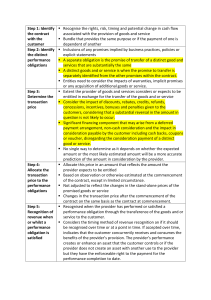

lOMoARcPSD|38286304 IFRS 15 - ACCA SBR notes SBR Easy Revision (Tribhuvan Vishwavidalaya) Scan to open on Studocu Studocu is not sponsored or endorsed by any college or university Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 IFRS 15: Revenue from Contract with Customer Objective: The objective of IFRS 15 is to establish the principles that an entity shall apply to report useful information to users of financial statements about the nature, amount, timing, and uncertainty of revenue and cash flows arising from a contract with a customer. IFRS 15 will have an impact on most suppliers of goods and services. Suppliers will need to reassess their revenue recognition policies and may need to revise them. The timing and amount of revenue recognised may not change for simple contracts but may well change for more complex arrangements (say involving several different types of goods and services or a combination of both). Scope: IFRS 15 Revenue from Contracts with Customers applies to all contracts with customers except for: leases within the scope of IAS 17 Leases; financial instruments and other contractual rights or obligations within the scope of IFRS 9 Financial Instruments, IFRS 10 Consolidated Financial Statements, IFRS 11 Joint Arrangements, IAS 27 Separate Financial Statements and IAS 28 Investments in Associates and Joint Ventures; insurance contracts within the scope of IFRS 4 Insurance Contracts; and nonmonetary exchanges between entities in the same line of business to facilitate sales to customers or potential customers. A contract with a customer may be partially within the scope of IFRS 15 and partially within the scope of another standard. In that scenario: • If other standards specify how to separate and/or initially measure one or more parts of the contract, then those separation and measurement requirements are applied first. The transaction price is then reduced by the amounts that are initially measured under other standards; • If no other standard provides guidance on how to separate and/or initially measure one or more parts of the contract, then IFRS 15 will be applied. Key definitions Contract Customer Income Transaction price Revenue An agreement between two or more parties that creates enforceable rights and obligations. A party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities in exchange for consideration. Increases in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in an increase in equity, other than those relating to contributions from equity participants. The amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer, excluding amounts collected on behalf of third parties. Income arising in the course of an entity’s ordinary activities. • 'Ordinary activities' means normal trading or operating activities. • 'Revenue' presented in the statement of profit or loss should not include items such as proceeds from the sale of non-current assets or sales tax. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 2. Revenue recognition A five step process: A contract to supply goods and services places a performance obligation (or a number of performance obligations) on the seller to deliver goods and services in accordance with the contract. Goods and services being sold are often described as “deliverables”. The core principle of IFRS 15 is that an entity will recognise revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. This core principle is delivered in a five-step model framework: (1) 'Identify the contract(s) with the customer (2) Identify the separate performance obligations within a contract (3) Determine the transaction price (4) Allocate the transaction price to the performance obligations in the contract (5) Recognise revenue when (or as) a performance obligation is satisfied.' Application of this guidance will depend on the facts and circumstances present in a contract with a customer and will require the exercise of judgment. Example: Summary of guidance: X Plc is a software developer. X Plc enters into a contract with a customer to transfer a software licence, perform an installation service and provide unspecified software updates and technical support for a two-year period. IFRS 15 provides guidance in the following areas: Step 1: Whether the contract is within the scope of IFRS 15 and what to do if IFRS 15 does not apply. Step 2: If IFRS 15 applies, whether the contract contains a single performance obligation or separate performance obligations (say for the licence, installation and updates). Step 3: How to identify the transaction price and whether this should be adjusted for time value of money. What to do if the consideration might vary depending on circumstance. Step 4: How the transaction price should be allocated to the separate performance obligations. Step 5: Whether the performance obligation is satisfied (and thus revenue recognised) over time or at a point in time. The application of IFRS 15 is straightforward for many contracts. However, IFRS 15 provides guidance for complex contracts where there are several deliverables. Note that revenue recognition and invoicing are two separate processes. Revenue recognised and amounts invoiced might be the same in many cases but are not the same in many others. Illustration 1 – The five steps: On 1 December 20X1, Wade receives an order from a customer for a computer as well as 12 months' of technical support. Wade delivers the computer (and transfers its legal title) to the customer on the same day. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 The customer paid $420 upfront. If sold individually, the selling price of the computer is $300 and the selling price of the technical support is $120. Required: Apply the 5 stages of revenue recognition, per IFRS 15, to determine how much revenue Wade should recognise in the year ended 31 December 20X1. Solution: Step 1 – Identify the contract: There is an agreement between Wade and its customer for the provision of goods and services. Step 2 – Identify the separate performance obligations within a contract: There are two performance obligations (promises) within the contract: • The supply of a computer • The supply of technical support. Step 3 – Determine the transaction price: The total transaction price is $420. Step 4 – Allocate the transaction price to the performance obligations in the contract: Based on standalone selling prices, $300 should be allocated to the sale of the computer and $120 should be allocated to the technical support. Step 5 – Recognise revenue when (or as) a performance obligation is satisfied: Control over the computer has been passed to the customer so the full revenue of $300 allocated to the supply of the computer should be recognised on 1 December 20X1. The technical support is provided over time, so the revenue allocated to this should be recognised over time. In the year ended 31 December 20X1, revenue of $10 (1/12 × $120) should be recognised from the provision of technical support. Step 1: Identify the contract: The first step in IFRS 15 is to identify the contract. A contract might be written, oral, or implied by a supplier’s customary business practices. There is no contract if each party has an enforceable right to terminate a wholly unperformed contract without compensating the other party. Combination of contracts: Two or more contracts entered into at or near the same time with the same customer (or related parties) must be combined and treated as a single contract if one or more of the following conditions are present: • The contracts are negotiated as a package with a single commercial objective; • The amount of consideration to be paid in one contract depends on the price or performance of the other contract; or • The goods or services promised in the contracts (or some goods or services promised in the contracts) are a single performance obligation. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Application criteria: A contract with a customer will be within the scope of IFRS 15 if all the following conditions are met: • The contract has been approved by the parties to the contract are committed to perform their respective obligations • Each party’s rights in relation to the goods or services to be transferred can be identified; • The payment terms for the goods or services to be transferred can be identified; • The contract has commercial substance (i.e. it is expected to change the risk, timing or amount of a supplier’s future cash flows); and • It is probable that the consideration to which the entity is entitled to in exchange for the goods or services will be collected. If a contract with a customer does not yet meet all of the above criteria, the entity will continue to reassess the contract going forward to determine whether it subsequently meets the above criteria. From that point, the entity will apply IFRS 15 to the contract. The standard provides detailed guidance on how to account for approved contract modifications. If certain conditions are met, a contract modification will be accounted for as a separate contract with the customer. If not, it will be accounted for by modifying the accounting for the current contract with the customer. Whether the latter type of modification is accounted for prospectively or retrospectively depends on whether the remaining goods or services to be delivered after the modification are distinct from those delivered prior to the modification. Further details on accounting for contract modifications can be found in the Standard. A good or service is not separately identifiable if: • Goods or service is not integrated with other goods or service in the contract. • Does not modify or customize another good or service in the contract. • Does not depend on other goods or services promised in the contract The contract: Aluna has a year end of 31 December 20X1. On 30 September 20X1, Aluna signed a contract with a customer to provide them with an asset on 31 December 20X1. Control over the asset passed to the customer on 31 December 20X1. The customer will pay $1m on 30 June 20X2. By 31 December 20X1, as a result of changes in the economic climate, Aluna did not believe it was probable that it would collect the consideration that it was entitled to. Therefore, the contract cannot be accounted for and no revenue should be recognised. Example: Application criteria X Plc is a real estate developer. X Plc enters into a contract with Mr. A for the sale of a limousine for $100,000. Mr. A intends to use the limousine to operate an executive transport service. Mr. A has no experience of executive transport and faces high levels of competition. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Mr. A pays a non-refundable deposit of $25k, and entered into a financing agreement for the remaining 75%. This is to be paid out of the proceeds of the new business venture. X Plc can repossess the limousine if Mr. A defaults but cannot seek further compensation. Analysis Have the parties approved the contract and are committed to perform their respective obligations? Can X Plc identify each party’s rights? Can X Plc identify the payment terms for the goods and services to be transferred? Does the contract have commercial substance? Is it probable the supplier will collect the consideration? It is not probable that X Plc will collect the consideration because: Yes Yes Yes Yes No (see below) (a) Mr A intends to repay the loan from income derived from a business which faces significant risks (high competition and Mr A’s limited experience); (b) Mr A lacks other income or assets that could be used to repay the loan; and (c) Mr A’s liability under the loan is limited because the loan is nonrecourse. Conclusion: The contract does not meet the IFRS 15 applicability criteria. Any consideration received in respect of a contract that does not meet the criteria is recognised as a liability. X Plc must recognise the $25,000 received as a liability until either there it becomes probable that the consideration will be received or until the revenue recognition criteria are met. This is where X Plc’s performance is complete and substantially all of the consideration in the arrangement has been collected and is non-refundable or the contract has been terminated and the consideration received is non-refundable. In each case the $25,000 would be recognised as revenue. Step 2: Identifying the separate performance obligations within a contract: At the inception of the contract, the entity should assess the goods or services that have been promised to the customer, and identify as a performance obligation or at the inception of a contract a supplier must determine whether the contract is for the sale of a single deliverable or several deliverables. This is important as revenue is recognised as these separate goods and services are delivered to the customer. Definition: A performance obligation is a promise in a contract with a customer to transfer to the customer either: • A good or service (or a bundle of goods or services) that is distinct; or • A series of distinct goods or services that are substantially the same and that have the same pattern of transfer to the customer. Distinct goods and services: At the inception of a contract the supplier must identify each promise to transfer distinct goods and services to the customer as performance obligations. A good or service is distinct if both of the following criteria are met: Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 • The customer can benefit from the good or service either on its own or together with other resources that are readily available to the customer; and • The supplier’s or entity’s promise to transfer the good or service is separately identifiable from other promises in the contract. A series of distinct goods or services is transferred to the customer in the same pattern if both of the following criteria are met: • Each distinct good or service in the series that the entity promises to transfer consecutively to the customer would be a performance obligation that is satisfied over time and • A single method of measuring progress would be used to measure the entity’s progress towards complete satisfaction of the performance obligation to transfer each distinct good or service in the series to the customer. Separately identifiable: In order to be identified as “distinct” goods or services must be separately identifiable. Promised goods or services that are not distinct are combined until a distinct bundle can be identified. This could mean that all of the goods or services promised in a contract might be accounted for as a single performance obligation. Factors for consideration as to whether a promise to transfer goods or services to the customer is not separately identifiable include, but are not limited to: • The entity does provide a significant service of integrating the goods or services with other goods or services promised in the contract; • The goods or services significantly modify or customize other goods or services promised in the contract; • The goods or services are highly interrelated or highly interdependent. Benefit from a good or service: A customer can benefit from a good or service if it could be used in some way to generate economic benefits. A supplier might regularly sell a good or service separately. This implies that a customer can benefit from such goods and services purchased together. A customer may be able to benefit from a good or service on its own, whereas for others the customer may be able to benefit from the good or service only in conjunction with other readily available resources. A readily available resource is a good or service that is sold separately or a resource that the customer has already obtained from the supplier. Example: Distinct goods and services: X Plc is a contractor which enters into a contract to build a bridge for a customer. X Plc is responsible for the overall management of the project. The project involves the provision of various goods and services including design, site preparation and construction of the bridge. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Analysis Can the customer benefit from the goods and services either on their own or together with other readily available resources? Yes X Plc or its competitors regularly sells many of these goods and services separately to other customers. Also, the customer could generate economic benefit from the individual goods and services by using, consuming, selling or holding those goods or services. Is X Plc’s promise to transfer individual goods and No services in the contract separately identifiable X Plc provides a significant service of integrating from other promises in the contract? the goods and services (the inputs) into the hospital (the combined output) for which the customer has contracted. (It is responsible for the overall management of the project). Conclusion: X Plc should account for all of the goods and services in the contract as a single performance obligation. If goods or services do not significantly modify other goods or service promised in the contract they would be separately identifiable. Example: Distinct goods and services: X Plc is a mobile phone company. X Plc sells mobile phone contracts under which a customer receives a handset and a contract under which the handset is connected to the network for a 24 month period. Monthly payments made by customers entitles them to send specified number of texts, a specified number of call minutes and a specified data download volume. Usage in excess of the specified amounts incurs an extra charge. X Plc sells the handset and network connection service separately and these are routinely available from other suppliers. Analysis Can the customer benefit from the goods and services either on their own or together with other readily available resources? Yes The customer can benefit from each of the goods and services either on their own or together with the other goods and services that are readily available. Is X Plc’s promise to transfer individual goods and services in the contract separately identifiable from other promises in the contract? Yes The handset and the network uses are separate outputs instead of inputs used to produce a combined output. Conclusion: X Plc should account for three separate performance obligations (the handset, the network service and network use above the specified minimum). Goods or services that are highly dependent on, or highly interrelated with, other goods or services in the contract are not separately identifiable. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Example: Distinct goods and services: X Plc is a mobile phone company. X Plc sells mobile phone contracts under which a customer receives a handset and a contract under which the handset is connected to the network for a 24 month period. Monthly payments made by customers entitles them to send specified number of texts, a specified number of call minutes and a specified data download volume. Usage in excess of the specified amounts incurs an extra charge. X Plc does not sell the handsets and network connections separately. Analysis Can the customer benefit from the goods and services either on their own or together with other readily available resources? Yes The customer can benefit from the handset and the network contract together but the ability to buy extra usage is a separate benefit. Is X Plc’s promise to transfer individual goods and No services in the contract separately identifiable The handset and the network uses are a single from other promises in the contract? input used to produce a combined output. The sale of extra minutes is a separate output. Conclusion: X Plc should account for two separate performance obligations (the handset and the network contract as a bundle and network use above the specified minimum). Step 3: Determining the transaction price: IFRS 15 defines the transaction price as the amount of consideration the entity expects to be entitled to in exchange for satisfying a performance obligation. The transaction price does not include the price collected for third parties for example sales tax or VAT. A supplier must consider the terms of the contract and its customary practices in determining the transaction price. The transaction price assumes transfers to the customer as promised in accordance with the existing contract and that the contract will not be cancelled, renewed or modified. The transaction price is affected by the nature, timing and amount of consideration promised by a customer. When determining the transaction price, the following must be considered: • The time value of money. • Variable consideration • Significant (Existence of) financing components • Non-cash consideration/ the fair value of any non-cash considerations. • Consideration payable to a customer: Consideration payable to the customer is treated as reduction in transaction price unless the payment is for good or services received from the customer. • Discounts Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Example: On 1 January 2015, Benzee sold car to a customer for $ 4000 with three years interest free credit. The customer took delivery of the car on 1 st January2015. The amount $4000 is payable to Benzee on 31st December2017. Benzee’s cost of capital is 8%. Required: Determine the transaction price for the sale of the furniture and calculate interest income to be recognized over three years. Solution: ($4000 x 1/1.08^3) =3175$ Interest income will be recognised as follows: 2015: $3175 x 8%= 254 2016: 3175+254 x 8%= 274 2017: ($3175+$254+$274) x8%= 297 • Variable consideration: Variable consideration can arise, for example, as a result of discounts, rebates, refunds, credits, price concessions, incentives, performance bonuses, penalties or other similar items. Variable consideration is also present if an entity’s right to consideration is contingent on the occurrence of a future event. If a contract includes variable consideration then an entity must estimate the amount it will be entitled to. Even when variable consideration can be estimated it is not necessarily included in the transaction price as there might be constraints on the estimate. IFRS 15 says that this estimate 'can only be included in the transaction price if it is highly probable that a significant reversal in the amount of cumulative revenue recognised will not occur when the uncertainty is resolved'. The standard deals with the uncertainty relating to variable consideration by limiting the amount of variable consideration that can be recognised. Specifically, variable consideration is only included in the transaction price if, and to the extent that, it is highly probable that its inclusion will not result in a significant revenue reversal in the future when the uncertainty has been subsequently resolved. However, a different, more restrictive approach is applied in respect of sales or usage-based royalty revenue arising from licences of intellectual property. Such revenue is recognised only when the underlying sales or usage occur. • Significant (Existence of) financing components: The agreed timing of payments in a contract might have the effect of the contract containing a significant financing component. If there is a financing component, then the consideration receivable needs to be discounted to present value using the rate at which the customer borrows money as per IFRS 9 with the objective of recognising revenue at an amount that reflects the cash price that a customer would have paid for the goods or services. Example is EMI. Journal entries Dr. Cash Cr. Interest Income Cr. Schedule Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Indications of a financing component IFRS 15 provides the following indications of a significant financing component: • The difference between the amount of promised consideration and the cash selling price of the promised goods or services • The length of time between the transfer of the promised goods or services to the customer and the payment date. No adjustment is necessary if the period between the transfer of and payment for, the promised good or service is expected to be one year or less. Discount rate: The discount rate used should be one that would be reflected in a separate financing transaction between the supplier and its customer at contract inception. It might be possible to identify the rate as that rate which discounts the nominal amount of the promised consideration to the price that the customer would pay in cash for the goods or services when (or as) they transfer to the customer. Presentation: The effects of financing (interest revenue or interest expense) must be presented separately from revenue from contracts with customers in the statement of comprehensive income. Example: Financing component: An enterprise sells a machine on 1 January 2015. The terms of sale are that the enterprise will receive $5 million on 31 December 2016 (2 years later). An appropriate discount rate is 6%. 1 January 2015 – Initial recognition Initial measurement of the consideration = $5m × 1 (1+0.06)2 = = $4,449,982 Debit Receivables: 4,449,982 Credit Revenue: 4,449,982 31 December 2015 Recognition of interest revenue: $4,449,982 @ 6% = 266,999 Debit Receivables: 266,999 Credit Revenue - interest: 266,999 Balance on the receivable Balance brought forward Interest revenue recognised in the period Carried forward $ 4,449,98 2 266,999 4,716,98 1 Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 31 December 2016 Recognition of interest revenue: $4,716,981 @ 6% = 283,019 Debit Receivables: 283,019 Credit Revenue - interest: 283,019 Balance on the receivable Balance brought forward Interest revenue recognised in the period Consideration received Carried forward $ 4,716,981 283,019 (5,000,000 ) - • Non-cash consideration: A customer might pay for goods and services using non-cash consideration (e.g. shares). Any non-cash consideration is measured at its fair value. If the fair value of non-cash consideration cannot be estimated reliably then the transaction is measured using the stand-alone selling price of the good or services promised to the customer. A customer might contribute goods or services (for example, materials, equipment or labour) to facilitate the fulfilment of a contract. Contributed goods or services must be accounted for as non-cash consideration if the supplier obtains control of those contributed goods or services. (Dr Asset/expense Cr Revenue). • Consideration payable to a customer: If consideration is paid to a customer in exchange for a distinct good or service, then it should be accounted for as a purchase transaction. Assuming that the consideration paid to a customer is not in exchange for a distinct good or service, an entity should account for it as a reduction of the transaction price. • Discounts: When the sum of the stand-alone selling prices of goods or services promised in a contract exceeds the promised consideration the customer is receiving a discount. The discount should be allocated entirely to one or more (but not all) performance obligations in the contract if all of the following criteria are met: 1. Each distinct good or service (or each bundle of distinct goods or services) in the contract is sold regularly on a stand-alone basis; 2. A bundle (or bundles) of some of those distinct goods or services are sold regularly at a discount to the stand-alone selling prices of the goods or services in each bundle; and 3. Such discounts are substantially the same as the discount in the contract. Example: Allocation of discount: X Plc sells three products at the following stand-alone selling prices: Stand-alone selling price $ Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Product A 100 Product B 140 Product C 110 X Plc sells one each of the products to Y Plc for $300 in total. Products B and C are sold regularly together for $200 (a discount of $50 on the combined standalone selling prices). The products are to be delivered at three different points in time. The delivery of each product is a separate performance obligation. X Plc regularly sells Products B and C together for $200 and Product A for $100. Therefore, the entire discount should be allocated to the promises to transfer Products B and C. The discount of $50 is allocated as follows: Stand-alone Allocated selling price Allocated discount transaction price $ ($) ($) Product A 100 100 Product B 140 (140 × 50/250) = 28 112 Product C 110 (110 × 50/250) = 22 88 350 300 Note that if the contract required delivery of B and C at the same time, X Plc could account for that delivery as a single performance obligation. The discount of $50 would then be allocated as follows: Stand-alone Allocated Allocated selling price discount transaction price $ ($) ($) Product A 100 100 Product B and C 140 50 200 340 300 In other cases, the discount is allocated proportionately to all performance obligations in the contract. Example: Allocation of discount: X Plc sells three products at the following stand-alone selling prices: Stand-alone selling price $ Product A 100 Product B 140 Product C 110 Products are not usually sold at a discount but X Plc agrees to sell one each of the products to Y Plc for $300 in total. The products are to be delivered at three different points in time. The delivery of each product is a separate performance obligation. There is no observable evidence about which performance obligation has attracted the discount. The discount of $50 is allocated on a proportionate basis as follows: Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Product A Product B Product C Stand-alone selling price $ 100 140 110 350 Allocated discount ($) (100 × 50/350) = 14.3 (140 × 50/350) = 20.0 (110 × 50/350) = 15.7 Allocated transaction price ($) 85.7 120.0 94.3 300.0 Step 4: Allocate the transaction price: Allocate the transaction price to the performance obligations in the contracts The objective is to allocate the transaction price to each performance obligation in an amount to which the supplier expects to be entitled for transferring the promised goods or services to the customer. Where a contract has multiple performance obligations, an entity will allocate the transaction price to the performance obligations in the contract by reference to their relative standalone selling prices. Standalone selling price is the price at which organisation would sell promised good or service separately to customer. The best evidence of the standalone selling price is the observable price of good or service when it is sold separately. The allocation is made at the start of the contract and there will be no adjustment need to be made for subsequent changes made in the stand alone selling price of the good or service. If a standalone selling price is not directly observable, the entity will need to estimate it. IFRS 15 suggests various methods that might be used, including: Adjusted market assessment approach Expected cost plus a margin approach Residual approach (only permissible in limited circumstances). Any overall discount compared to the aggregate of standalone selling prices is allocated between performance obligations on a relative standalone selling price basis. In certain circumstances, it may be appropriate to allocate such a discount to some but not all of the performance obligations. Where consideration is paid in advance or in arrears, the entity will need to consider whether the contract includes a significant financing arrangement and, if so, adjust for the time value of money. A practical expedient is available where the interval between transfer of the promised goods or services and payment by the customer is expected to be less than 12 months. Example: Mayoo enter into contract with customer to transfer software license, perform installation and provide software update and technical support for five years in exchange for $240000. Mayoo has determined that each good or service is separate performance obligation. Mayoo sells the license, installation, updates and technical support separately, so each has a directly observable standalone selling price Software installation Installation service Software update $15000 0 $60000 $40000 Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Technical update $50000 $30000 0 Required: Allocate the $240,000 transaction price to the four performance obligations. Solution: Software solution 240000 x 150/300 = Installation service 240000 x 60/300= Software updates 240000x 40/300= Technical support 240000x 50/300= Total 120000 48000 32000 40000 240 Step 5: Recognise revenue: When a customer receives a good or a service it becomes an asset even if momentarily in the case of a service. An asset is transferred when (or as) the customer obtains control of that asset. An entity controls an asset if it can direct its use and obtain most of its remaining benefits. Control also includes the ability to prevent other entities from obtaining benefits from an asset. Control of an asset is defined as the ability to direct the use of and obtain substantially all of the remaining benefits from the asset. This includes the ability to prevent others from directing the use of and obtaining the benefits from the asset. The benefits related to the asset are the potential cash flows that may be obtained directly or indirectly. These include, but are not limited to: [IFRS 15:31-33] • using the asset to produce goods or provide services; • using the asset to enhance the value of other assets; • using the asset to settle liabilities or to reduce expenses; • selling or exchanging the asset; • pledging the asset to secure a loan; and • Holding the asset. Revenue is recognised when (or as) the entity satisfies a performance obligation by transferring a promised good or service to a customer. An entity must determine at contract inception whether it satisfies the performance obligation over time or satisfies the performance obligation at a point in time. A performance obligation might be satisfied (i.e. goods and services might be transferred): • Over time (in which case revenue would be recognised over time); or • At a point in time (in which case revenue is recognised at that point in time). Performance obligations satisfied over time: A performance obligation is satisfied over time if one of the following criteria is met: (a) 'The customer simultaneously receives and consumes the benefits provided by the entity's performance as the entity performs for example monthly payroll processing service. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 (b) The entity's performance creates or enhances an asset (for example, work in progress) that the customer controls as the asset is created or enhanced, or (c) The entity's performance does not create an asset with an alternative use to the entity and the entity has an enforceable right to payment for performance completed to date for example construction contract’ Revenue for performance obligation satisfied over time can only be recognised if the organisation can make reasonable estimate of progress. Revenue is recognised to the extent of the costs incurred if there is no reasonable estimate of progress, but organisation expects to cover its cost. If a performance obligation is satisfied over time, then revenue is recognised over time based on progress towards the satisfaction of that performance obligation. A single method of measuring progress should be used for each performance obligation and that method should be applied consistently to similar performance obligations and in similar circumstances. Progress must be remeasured at the end of each reporting period. In many circumstances simple time apportionment might be appropriate. Performance obligations satisfied at a point in time: If a performance obligation is not satisfied over time then it is satisfied at a point in time. The entity must determine the point in time at which a customer obtains control of a promised asset. IFRS 15 (para 38) provides the following indicators of the transfer of control: • 'The entity has a present right to payment for the asset • The customer has legal title to the asset • The entity has transferred physical and legal possession of the asset (exceptions for bill and hold, consignment sales and repurchase agreements); • The customer has the significant risks and rewards of ownership of the asset • The customer has accepted the asset'. Example: Revenue recognition: X Plc sells mobile phones and network contracts either together or separately at the following prices. Handse Contract Contract period Total network Total cost t ($per month) (months) contract ($) ($) ($) Separately 531 25 24 600 1,131 As a bundle nil 50 24 1,200 1,200 Revenue from selling a bundle (handset together with a network contract) would be recognised using the following steps. Step 3: Determine the transaction price: The transaction prices are $531 for the handset and $600 ($25 per month for 24 months) giving a total of $1,131 if sold separately. The transaction price is $1,200 for the handset and the contract sold as a bundle. Example (continued): Revenue recognition price (ignoring time value) Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Step 4: Allocate the transaction price: The transaction price is allocated in proportion to the stand-alone selling prices of distinct goods and services promised in the contract. Thus the revenue allocation is as follows: Handset ($1,200 × $531/$1,131) Network contract ($1,200 × $600/$1,131) $ 563.4 636.6 1,200.0 Step 5: Recognise revenue: The revenue for the handset is recognised when it is delivered at the start of the contract. There is no cash received at this point in time so a receivable is recognised to complete the revenue double entry. Dr Receivable: 563.4 Cr Revenue: 563.4 The revenue for the network contract is recognised over the life of the contract. The difference between the cash received each month and the amount recognised as revenue in the statement of profit or loss reduces the receivable to zero by the end of the 24 month contract period. Dr Cash: 50 Cr Revenue ($636.6 ÷ 24 months): 26.53 Cr Receivable: 23.47 Or over the life of the contract (as a proof) Dr Cash: 1,200 Cr Revenue ($636.6 ÷ 24 months): 636.6 Cr Receivable: 563.4 The above example does not take time value into account. The standalone selling prices used above are inconsistent with each other. The $531 for the hand set is payable up front but the $600 for the contract is payable by a series of monthly payments over a 24 month period. This example has been built using a discount rate of 1% per month. The 24 monthly payments should be discounted to arrive at a value for the standalone contract price that is comparable to that of the handset. Example (continued): Revenue recognition (taking time value into account) Separately Handse t ($) 531 Contract ($per month) 25 Annuity factor (24 months, 1% per month) 21.24 Total network contract ($) Total cost ($) 600 1,062 Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 The steps would then proceed as follows: Step 4: Allocate the transaction price: The transaction price is allocated in proportion to the stand-alone selling prices of distinct goods and services promised in the contract. Thus the revenue allocation is as follows: Handset ($1,062 × $531/$1,062) Network contract ($1,062 × $531/$1,062) $ 531 531 1,062 Step 5: Recognise revenue: The revenue for the handset is recognised when it is delivered at the start of the contract. Dr Receivable: 531 Cr Revenue: 531 The monthly payments of $50 comprise 2 amounts. $25 pays for the network contract and the balance (also $25) pays off the receivable. Over the life of the contract the receivable is reduced to zero after taking time value into account. The double entry at the end of the first month would be as follows: Dr. Cash: 50 CR. Revenue: 25 CR. Receivable: 25 And Dr. Receivable: 5.31 Cr. Revenue (interest): 5.31 Another way of thinking saying this is that the amount initially recognised for the hand set is the present value of the $25 per month that relates to it. A full amortisation table is shown below in order to illustrate this. Example (continued): Revenue recognition (taking time value into account) Amount receivable at the start Amount receivabl e at the end 511.31 1 531.00 Interest at 1% 5.31 2 511.31 5.11 (25.00) 491.42 3 491.42 4.91 (25.00) 471.34 4 471.34 4.71 (25.00) 451.05 5 451.05 4.51 (25.00) 430.56 Period Cash flow (25.00) Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 6 430.56 4.31 (25.00) 409.87 7 409.87 4.10 (25.00) 388.97 8 388.97 3.89 (25.00) 367.86 9 367.86 3.68 (25.00) 346.53 10 346.53 3.47 (25.00) 325.00 11 325.00 3.25 (25.00) 303.25 12 303.25 3.03 (25.00) 281.28 13 281.28 2.81 (25.00) 259.09 14 259.09 2.59 (25.00) 236.69 15 236.69 2.37 (25.00) 214.05 16 214.05 2.14 (25.00) 191.19 17 191.19 1.91 (25.00) 168.10 18 168.10 1.68 (25.00) 144.79 19 144.79 1.45 (25.00) 121.23 20 121.23 1.21 (25.00) 97.45 21 97.45 0.97 (25.00) 73.42 22 73.42 0.73 (25.00) 49.15 23 49.15 0.49 (25.00) 24.65 24 24.65 0.25 (25.00) -0.11 Methods of measuring progress towards satisfaction of a performance obligation include: • Output methods: % of completion: Output method recognise revenue on the basis of the value to the customer of goods or services transfers to date relative to the remaining goods and services promised. Example: Units produced or delivered, Milestone achieved, Appraisals of result achieved, Surveys of performance completed to date, Time elapsed. The value of the work certify is used to measure of the degree of completion so that revenue can be recognised in profit or loss. • Input methods: Costs incurred as a proportion of total expected costs: Cost incurred ÷ Total cost of production. Input method recognise revenue on the basis of the organisation’s efforts or inputs to the satisfaction of the performance obligation relative to the total expected output. Examples: Cost incurred, Resources consumed, Time elapsed, Labor hours worked Revenues can be recognised on straight line basis if inputs are used evenly throughout the performance period. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Example: Samba Beauty center enters into a contract with a customer for unlimited Beautician services throughout the year for $5000the beauty center determine that as customer receive and consume the services throughout the year the contract performance obligation satisfies over time. So now revenue will be recognised$5000/12= $416.67 per month. Example: Cheeko building a residential apartments building, last year Cheeko entered into contract with a customer for specific unit which is under construction. Cheeko has determined that the contract is single performance obligation satisfied over time. Cheeko gathered following information related to the contract for the year: Cheeko Company year ended 31 December Cost to date: $1500 Future expected cost: $1000 Work certified to date: $1800 Expected sales value: $3200 Revenue taken in earlier periods: $1200 Cost incurred in earlier date: $950 Required: Calculate the figures to be included in statement of profit or loss related to revenue or cost for the year ended 31 December on both: 1. A sale basis (input method) 2. A cost basis (output method) Solution: Total expected profit Revenue Less: contract cost to date Less: Future expected cost Profit $ 3200 (1500 ) (1000 ) 700 Measure of progress towards completion Sale Basis: 1800/3200 = 56.25% Cost Basis: 1500/2500 = 60% Sale basis Revenue to date 3200x.56.25% = 1800 Revenue last year 1800 - 1200 = Cost of sales to date 2500x56.25% = 1406 600 Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Cost of sales last year 1406 - 950= Cost basis Revenue to date 3200x60% = 1920 Revenue last year 1920 – 1200 = Cost of sales to date 2500 x 60%= 1500 Cost of sales last year 1500 - 950= (456 ) 144 720 (550 ) 170 If progress cannot be reliably measured then revenue can only be recognised up to the recoverable costs incurred. Cost recognition: Cost is recognised in the same way proportion was applied to the revenue recognition. Except for the following: 1. Abnormal cost for example rectification process in the production of goods or providing services. It will be expensed in P&L simple and easy. 2. Input cost that are not proportionate to the construction process. If incurred cost is not proportionate to the progress in the satisfaction to the of the performance obligation that cost shall not be excluded in the when measuring progress of the contract. Such cost should be excluded from the measuring progress of the contract Contract costs: The incremental costs of obtaining a contract must be recognised as an asset if the entity expects to recover those costs such as sales commissions. However, those incremental costs are limited to the costs that the entity would not have incurred if the contract had not been successfully obtained (e.g. ‘success fees’ paid to agents). A practical expedient is available, allowing the incremental costs of obtaining a contract to be expensed if the associated amortisation period would be 12 months or less. IFRS 15 says that the following costs must be capitalised: • The costs of obtaining a contract. This must exclude costs that would have been incurred regardless of whether the contract was obtained or not (such as some legal fees, or the costs of travelling to a tender) Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 • The costs of fulfilling a contract if they do not fall within the scope of another standard (such as IAS 2 Inventories) and the entity expects them to be recovered and also recognised as an asset if they meet all of the following criteria: 1. The costs generate or enhance resources of the supplier that will be used in satisfying (or in continuing to satisfy) performance obligations in the future; and 2. Cost are expected to recovered 3. The costs relate directly to a contract or to an anticipated contract that the supplier can specifically identify; Amortisation: The asset recognised in respect of the costs to obtain or fulfil a contract is amortised on a systematic basis that is consistent with the pattern of transfer of the goods or services to which the asset relates. Costs that must be expensed when incurred include: 1. Cost of wasted material, labor and other resources 2. Costs that related to satisfied performance obligations 2. General and administrative costs Example: Incremental costs of obtaining a contract: X Plc wins a competitive bid to provide consulting services to a new customer. X Plc incurred the following costs to obtain the contract: $ 10,00 0 External legal fees for due diligence 15,00 0 Travel costs to deliver proposal 25,00 0 Total costs incurred 50,00 0 Analysis: The commission to sales employees is incremental to obtaining the contract and should be capitalised as a contract asset. Commissions to sales employees for winning the contract The external legal fees and the travelling cost are not incremental to obtaining the contract because they have been incurred regardless of whether X Plc obtained the contract or not. A supplier may recognise the incremental costs of obtaining a contract as an expense when incurred if the amortisation period of the asset that the entity otherwise would have recognised is one year or less. Example: Amortisation of contract costs: X Plc wins a 5 year contract to provide a service to a customer. The contract contains a single performance obligation satisfied over time. X Plc recognises revenue on a time basis Costs incurred by the end of year 1 and forecast future costs are as follows: $ Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Costs to date 10,00 0 Estimate of future costs 18,00 0 Total expected costs 28,00 0 Analysis: Costs must be recognised in the P&L on the same basis as that used to recognise revenue. X Plc recognises revenue on a time basis, therefore 1/5 of the total expected cost should be recognised = $5,600 per annum. Example: Amortisation of contract costs: X Plc wins a contract to build an asset for a customer. It is anticipated that the asset will take 2 years to complete The contract contains a single performance obligation. Progress to completion is measured on an output basis. At the end of year 1 the assets is 60% complete. Costs incurred by the end of year 1 and forecast future costs are as follows: $ 10,00 0 Estimate of future costs 18,00 0 Total expected costs 28,00 0 Analysis: Costs must be recognised in the P&L on the same basis as that used to recognise revenue. Costs to date Therefore 60% of the total expected cost should be recognised ($16,800) at the end of year 1. Example: CoCo enters into contract with a customer to transfer a computer software license, perform installation and provide software updates and technical support for three years in $300000. In order to fulfill the technical portion of the project, Coco purchases an additional work station for the technical support team. For $8000 and assigns one employee to be primarily responsible for providing customer a technical support. This employee also provide services to other customers. The employee is paid an annual salary of $ 30000 and is expected to spend 10% of his time supporting this customer. Req: Determine which cost should be recognised as an asset and which should be expensed. Answer: The work station cost should be recognised as an asset Under IAS 16 PPE. While employee cost will be recognised as an expense in P&L as employee is already working for Coco and not specific to contract also Coco have no control over employee. Example: Pepper enters into a contract with customer to transfer a computer software license, perform installation and provide software updates and technical support for three years for $240000. Pepper incurred the following cost: Legal fees Commission to sales employee Cost to deliver proposal $10000 $12000 $20000 Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Total $42000 Determine which cost should be recognised as an asset and which should be expensed. Answer: Assuming developer will recover the cost of legal fees and sales commission it would be recognised as an Asset. While the traveling cost will be expensed as it would have been incurred if contract was not obtained. Further useful implementation guidance in relation to applying IFRS 15: These topics include: Customer options for additional goods or services Customers’ unexercised rights Licensing Customer acceptance Disclosures of disaggregation of revenue These topics should be considered carefully when applying IFRS 15. Sale with a right to return: Some contracts result in the transfer of control of a product to a customer but also grant the customer the right to return the product for various reasons (such as dissatisfaction with the product) and receive any combination of the following: • A full or partial refund of any consideration paid; • A credit that can be applied against amounts owed, or that will be owed, to the supplier; and • Another product in exchange. All of the following must be recognised when a product is sold with a right of return: • Revenue for the transferred products in the amount of consideration to which the supplier expects to be entitled (i.e. revenue would not be recognised for the products expected to be returned); • A refund liability; and • An asset (and corresponding adjustment to cost of sales) for its right to recover products from customers on settling the refund liability. Royalties: Regardless of the above, revenue for a sales-based or usage-based royalties promised in exchange for a licence of intellectual property is recognised only when (or as) the later of the following events occurs: • The subsequent sale or usage occurs; and • The performance obligation to which some or all of the sales-based or usage based royalty has been allocated has been satisfied (or partially satisfied). Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Warranties: A supplier might provide a warranty in connection with the sale of goods or services. A warranty might provide an assurance that a product complies with agreed upon specifications. For example, new cars are supplied with a repair warranty under which the seller will carry out free repairs up to a given mileage. Other types of warranty might provide a customer with a service in addition to the assurance it complies with agreed upon specifications. A warranty that is a performance obligation is accounted for according to IFRS 15. This may require the allocation of the transaction price between the warranty and the underlying good or service. A warranty that is not a performance obligation might result in the recognition of a provision in accordance with IAS 37: Provisions, contingent liabilities and contingent assets. Warranties that are performance obligations (IFRS 15): Any warranty that provides a customer with a service in addition to the assurance that the product complies with agreed upon specifications. A warranty that the customer has the option to buy separately is a distinct service and is accounted for as a performance obligation. A contract with both an assurance-type warranty and a service-type warranty is accounted for as a single performance obligation if the two cannot reasonably be accounted for separately. The longer the warranty coverage period, the more likely it is that the promised warranty is a performance obligation because it is more likely to provide a service in addition to the assurance that the product complies with agreed-upon specifications. Not performance obligations (IAS 37): A warranty that a customer cannot purchase separately is not a performance obligation (unless it provides a service in addition to the assurance that the product complies with agreed-upon specifications). A warranty that is required by law is not a performance obligation. For example: • A legal requirement for a supplier to pay compensation if its products cause harm or damage is not a performance obligation. • A contractual promise to indemnify a customer for liabilities and damages arising from claims of patent, copyright, trademark or other infringement by the entity’s products is not a performance obligation. Principal versus agent considerations: An entity must decide the nature of each performance obligation or when organisation use another party to provide goods or services to a customer, the organisation need to determine whether it is acting as principal or agent. IFRS 15 (para B34) says this might be: • Principal: The organisation controls the good or service before it is transferred to customer and their revenue is gross consideration or 'to provide the specified goods or service itself Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 However, a supplier is not necessarily acting as a principal if it obtains legal title of a product just before legal title is transferred to a customer. A principal is responsible for satisfying a performance obligation. It may do this by itself or it may engage another party (for example, a subcontractor) to help do this. • Agent: The organisation arranges for another to provide good or services and their revenue is sales commission. If an entity is an agent, then revenue is recognised based on the fee or commission it is entitled to. An agent might sell goods for a principal and collect the cash from the sale. The agent then hands the cash to the principal after deducting an agency fee. Following are the indicators organisation is an agent and does not control the good or service before it is provided to customer include: • The organisation is not exposed to credit risk • The consideration is in the form of commission • The organisation does not have inventory risk • The organisation does not have the discretion in establishing for the other party‘s good or services • Another party is responsible for fulfilling the contract. Example: Agency: X plc distributes goods for Y plc under an agreement with the following terms: 1. X plc is given legal title to the goods by Y plc and sells them to the retailers. 2. Y plc sets the selling price and X plc is given a fixed margin on all sales. 3. Y plc retains all product liability and is responsible for any manufacturing defects. 4. X plc has the right to return inventory to Y plc without penalty. 5. X plc is not responsible for credit risk on sales made. Analysis: Y plc retains all significant risks and rewards of ownership of the goods transferred to X plc. In substance, X plc is acting as an agent for Y plc. Year ended 31 December 20X3 Y plc transferred legal title of goods which had cost $1,500,000 to X plc. X Plc is to sell these goods for Y Plc at a mark-up of 30%. X plc is entitled to a fee of 4% of the selling price of all goods sold. As at 31 December X plc had sold 80% of the goods and collected all cash due but had not yet remitted any cash to Y plc. X plc would recognise: Dr. Cash (80% × ($1,500,000 × 130%)): 1,560,000 Cr. Revenue (4% × $1,560,000): 62,400 Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Cr. Liability (balance = 96% × $1,560,000): 1,497,600 Y plc would recognise: Dr. Receivable: 1,497,600 Cr. Revenue: 1,497,600 Y plc would also recognise the unsold inventory of $300,000 (20% × %1,500,000) as part of its closing inventory. Non-refundable up-front fees: A supplier might charge a customer a non-refundable up-front fee. Such fees are common in health club membership contracts for example. If the fee relates to a good or service it is recognised in the usual way as the supplier satisfies the performance obligations under the contract. A fee might relate to an activity that the supplier needs to undertake at the start of the contract in order to fulfil the contract. In that case the activity does not result in the transfer of a promised good or service to the customer but is an advance payment for future goods or services. In that case the fee would be recognised as revenue as the future goods or services are provided. Example: Non-refundable up-front fee: X Ltd operates a health club. Club membership requires an up-front fee of $100 followed by a monthly membership fee of $50 paid at the end of each month. The same fees are required both for new joiners and existing members. Up-front fee ($) Monthly fee ($) Contract Total Total fee ($) period monthly (months) fees ($) 100 50 12 600 700 Analysis: The fee does not relate to a good or service provided at the start of the contract but rather to the delivery of a service over the life of the contract. The fee is part of the overall transaction price for 12 months of health club membership. It should be added to the monthly fee to arrive at the transaction price and this should be recognised on a monthly basis over 12 months in the amount of $58.33 ($700/12). Double entry (Credit entries in brackets) Cash ($) Start of the contract Each month: Cash receipt Release of the liability 100 Contract liability ($) (100.00) 50 8.33 Profit or loss (50.00) (8.33) 58.33 Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 and so on A supplier might grant the customer the option to renew a contract at the end of the initial contractual period. If the option provides the customer with a material right the revenue recognition period for the up-front fee would extend beyond the initial contractual period. Example: Non-refundable up-front fee: X Ltd operates a health club. Club membership requires an up-front fee of $100 followed by a monthly membership fee of $50 paid at the end of each month. Membership can be renewed at the end of each year for no further joining fee with members continuing to pay the original monthly fee without increase. X Ltd determines that members renew their membership once on average before leaving the club. Analysis: X Ltd is entering into two separate performance obligations at the start of the contract. These are the provision of monthly membership and the granting of a renewal option to members. Transaction price is normally allocated to each performance obligation with reference to relative standalone selling price. However, this contract gives a customer a material right to acquire future services similar to the original services in accordance with the terms in the original contract. X Ltd is allowed (as a practical alternative) to allocate the transaction price to the optional services by reference to those expected to be provided and the corresponding expected consideration. Up-front fee ($) Monthly fee ($) Contract Total Total fee ($) period monthly (months) fees ($) 100 500 12 1,200 1,300 The total fee should be recognised as revenue over the 24 months (in the monthly amount of $54.17 ($1,300/12)). A supplier might charge a non-refundable fee in part as compensation for costs incurred in setting up a contract. If those setup activities do not satisfy a performance obligation, they are disregarded when measuring the progress of the contract. Repurchase agreement: A contract in which entity sells an asset and also promises or has option to repurchase the asset. There are three types of repurchase agreement: 1. An organisation’s obligation to repurchase the asset at the customer request (put option). 2. An organisation’s right to repurchase the asset (call option). 3. An organisation’s obligation to purchase the asset (a forward). Forward or Call Option: When an organisation has an option or right to repurchase an asset, the customer does not obtain control of the asset and organisation account for the contract as either: • A lease if entity or must have to repurchase the asset lower than its selling price. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 • A financing agreement if organisation can or must have to repurchase asset equal to or higher than it original selling price. • If repurchase agreement is financing agreement then organisation will Continue to recognise asset. Recognise as interest expense, which increases the financial liability, equal to the difference between amount of consideration received from the customer and the amount of the consideration to be paid to the customer. Recognise financial liability for any consideration received from the customer. At the time of recognising the liability it will be: Cash Dr: xxx Financial liability Cr: xxx At the time of recognising interest expense it will be: Interest expense Dr: xxx Financial liability Cr: xxx At the time of derecognizing the liability it will be: Financial liability Dr: xxx Revenue Cr: xxx Put option: If any entity has the option to repurchase the asset at the customer’s request for less than the original price, the entity account for the contract as either: • A sale with the right of return if the customer does not have significant economic incentive to exercise the right. • A lease, if the customer has the significant economic incentive to exercise the right. If the repurchase right is equal to or greater than the original selling price, the organisation account for the contract as either: • A financing agreement if the re purchase price is more than the expected market value of the asset. • A sale with right of return, if the repurchase price is less than or equal to the expected market value of the asset and the customer does not have the significant economic incentive to exercise the right. Bill and hold arrangement: A contract in which organisation bills a customer for a product that has not yet delivered to a customer. • Revenue cannot be recognised in a bill and hold arrangement until control is transferred to organisation. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 • Generally, control is transferred to a customer when product is delivered to customer • In bill and hold arrangement, customer considered to obtain the control when all of the conditions will be met. • There must be strong reason for bill and hold arrangement for example customer asked to hold the product because of storage issue • The product has been separately identified as belonging to the customer • The product is currently ready for the transfer to the customer • The organisation cannot use the product or send it to another customer. Consignments: When an entity delivers it products to a dealer or distributor for sale to end customers, the entity needs to determine whether contract is a sale or consignment arrangement Sale: The dealer or distributor obtained the control of the product Recognise the revenue when the product is shipped or delivered to the dealer or distributor (depends on the terms and conditions of contract). Consignments: When the dealer or distributor does not obtained the control of the product. Recognise the revenue when the dealer or distributor sells the product to customer, or when dealer or distributor obtains the control of product. Following are the indicators of consignment arrangement: • The organisation controls the product until the specified event occurs, for example sale of product or specified period expires. • The organisation can require the return of the product or transfer the product to another party. • The dealer does not have the unconditional obligation to pay the entity for the product (though it might be required to pay the deposit). Refunds: If a product is sold with a right to return it then the consideration is variable. The entity must estimate the variable consideration and decide whether or not to include it in the transaction price. The refund liability should equal the consideration received (or receivable) that the entity does not expect to be entitled to. It must be updated at the end of each reporting period for changes in circumstances. Example: Variable consideration: X Plc sells 1,000 products to customers at a cost of $120 per product. Cash is received when control of a product transfers. X Plc allows customers to return any unused product within 60 days and receive a full refund. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 The cost of each product to X Plc is $90. X plc has considerable experience of selling this type of product. Based on this experience it estimates that 950 products will not be returned. Therefore X plc will not recognise the revenue on 50 products. X Plc will recognise the following on the inception of the contracts: Dr. Cash (1,000 × $120): 120,000 Cr. Revenue (950 × $120): 114,000 Cr. Refund liability (50 × $120): 6,000 In addition, X plc will recognise an asset of $4,500 (50 × $90) for its right to recover products on settling the refund liability. This is of the nature of an inventory adjustment. (Remember that the cost of 1,000 items ($90,000) would not be included in inventory after they are sold). Illustration: Refunds: Nardone enters into 50 contracts with customers. Each contract includes the sale of one product for $1,000. The cost to Nardone of each product is $400. Cash is received upfront and control of the product transfers on delivery. Customers can return the product within 30 days to receive a full refund. Nardone can sell the returned products at a profit. Nardone has significant experience in estimating returns for this product. It estimates that 48 products will not be returned. Required: How should the above transaction be accounted for? Solution: The fact that the customer can return the product means that the consideration is variable. Using an expected value method, the estimated variable consideration is $48,000 (48 products × $1,000). The variable consideration should be included in the transaction price because, based on Nardone’s experience, it is highly probable that a significant reversal in the cumulative amount of revenue recognised ($48,000) will not occur. Therefore, revenue of $48,000 and a refund liability of $2,000 ($1,000 × 2 products expected to be returned) should be recognised. Nardone will derecognise the inventory transferred to its customers. However, it should recognise an asset of $800 (2 products × $400), as well as a corresponding credit to cost of sales, for its right to recover products from customers on settling the refund liability. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Presentation on the statement of financial position: Contracts with customers will be presented in an entity’s statement of financial position as a contract liability, a contract asset, or a receivable, depending on the relationship between the entity’s performance and the customer’s payment. A contract liability is presented in the statement of financial position where a customer has paid an amount of consideration prior to the entity performing by transferring the related good or service to the customer. Or Contract liability: A contract might require payment in advance or allow the supplier a right to an amount of consideration that is unconditional (i.e. a receivable), before it transfers a good or service to the customer. In these cases, the supplier presents the contract as a contract liability when the payment is made or the payment is due (whichever is earlier). The contract liability is a supplier’s obligation to transfer goods or services to a customer for which it has received consideration (an amount of consideration is due) from the customer. Contract Asset: An organization right to receive consideration in exchange for the goods or services provided that means organization has complete the task before consideration received. Where the entity has performed by transferring a good or service to the customer and the customer has not yet paid the related consideration, a contract asset or a receivable is presented in the statement of financial position, depending on the nature of the entity’s right to consideration. A contract asset is recognised when the entity’s right to consideration is conditional on something other than the passage of time, for example future performance of the entity. A receivable is recognised when the entity’s right to consideration is unconditional except for the passage of time. A contract asset is reclassified as a receivable when the supplier’s right to consideration becomes unconditional. Contract assets and receivables shall be accounted for in accordance with IFRS 9. Any impairment relating to contracts with customers should be measured, presented and disclosed in accordance with IFRS 9. Any difference between the initial recognition of a receivable and the corresponding amount of revenue recognised should also be presented as an expense, for example, an impairment loss. Example: Contract assets: X Plc enters into a contract to construct a building for Y Plc for $1 million to be invoiced on completion. The contract is expected to take two years to complete. X Plc started work on the contract on the first day of its accounting period. At the end of year 1 X Plc assessed the contract to be 60% complete. The double entry to recognise revenue is as follows: Dr. Contract asset: 600,000 Cr. Revenue (60% of $1,000,000): 600,000 The $600,000 is not recognised as receivable because X Plc’s right to consideration will not become unconditional until it has the right to invoice for the amount. When this occurs the contract asset at that date would be reclassified as a receivable. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Example: On 1st April Mika entered into non-cancellable contract with Charlie for the sale of a machinery for $350,000. The machinery will be delivered to Charlie on 1 st June. The contract requires Charlie to make payment on 1stmay but Charlie makes the payment on 1 st June. Required: Prepare the journal entries make by the Mike to account for this contract. Solution: On 1st May Mika recognise a receivable as it has an non-cancellable right to consideration Receivable Dr: 350,000 Contract Liability Cr: $350,000 On 1st June Charlie make a payment, Mika recognise the cash collection: Cash Dr: $350000 Receivable Cr: 350000 On 1st July Mike will recognise the revenue when machinery is delivered to Mika Contract liability Dr: $350000 Revenue Cr: $350000 Example (Contract Asset and Receivable) On 1st April Mika enters into contract with Charlie for the sale of two machinery for $350000 each. The contract requires 1st machinery to be delivered on 1st May and payment of the first machinery is conditional on the delivery of second machinery. The second machinery is delivered on 1 st September. Required: Prepare the journal entries that would be require by Mika to account for this contract. Solution: On 1st May, Mika recognises a contract asset and revenue when it satisfied the performance obligation to deliver first machinery: Contract Asset Dr: $350000 Revenue Cr: $350000 A receivable is not recognised on 1st May as it has no unconditional right. On 1st September when it satisfies the condition receivable will is recognised: Receivable Dr: 700000 Contract asset Cr: 350000 Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Revenue Cr: 350000 Revenue disclosures: The disclosure objective stated in IFRS 15 is for an entity to disclose sufficient information to enable users of financial statements to understand the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. Therefore, an entity should disclose qualitative and quantitative information about all of the following: Its contracts with customers; The significant judgments, and changes in the judgments, made in applying the guidance to those contracts; and Any assets recognised from the costs to obtain or fulfil a contract with a customer. Entities will need to consider the level of detail necessary to satisfy the disclosure objective and how much emphasis to place on each of the requirements. An entity should aggregate or disaggregate disclosures to ensure that useful information is not obscured. In order to achieve the disclosure objective stated above, the Standard introduces a number of new disclosure requirements. Further detail about these specific requirements can be found at IFRS 15. Other aspects of IFRS 15 4.1 Contract modifications: A contract modification is any change in the scope and/or price of a contract approved by both parties (e.g. changes in design, quantity, timing or method of performance). This requirement interacts with the guidance on determining the transaction price. A contract modification might be treated in one of the following ways: • As a separate contract; or • As the termination of the existing contract and the creation of a new contract; or • As part of the existing contract. Contract modification as a separate contract: A contract modification might simply increase the scope of a contract to supply more distinct goods or services at a price that reflects stand-alone selling prices. Such a modification must be treated as a separate contract. Example: Contract modification results in new contract: X Plc enters into a contract to sell 100 units of a product to Y Plc for $14,000 ($140 per unit). X Plc transfers control of each unit at a point in time. X Plc transfers control of 55 units to Y Plc. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Contract modification: The contract is modified to require delivery of an additional 20 units to Y Plc at a price of $130 per unit which reflects the stand-alone selling price of the units at the time of the modification. The additional units are distinct. Analysis: The contract modification for the additional 20 products is, in effect, a new and separate contract that does not affect the accounting for the existing contract. X Plc recognises revenue of $140 per product for the 45 remaining products in the original contract and $130 per product for the 20 products in the new contract. A contract modification might not result in a new contract. This might be because the increase in the price of the contract due to the modification does not reflect the stand-alone selling prices for the new goods and services. If a contract modification does not result in a new contract the resultant treatment depends on whether the remaining goods or services to be supplied under the original contract are distinct or not. Termination of the existing contract and the creation of a new contract Sometimes a contract modification might not result in a new contract and the remaining goods or services to be supplied under the original contract are distinct from those transferred up to the date of the contract modification. In this case the original contract is terminated and a new contract created. The new contract is for the delivery of the remaining goods and services under the original contract together with those arising from the contract modification. The transaction price of the newly created contract is the sum of any amounts not yet recognised as revenue on the original contract and the consideration promised as part of the contract modification. Example: Contract modification results in termination of the original contract and creation of a new contract: X Plc enters into a contract to sell 100 units of a product to Y Plc for $14,000 ($140 per unit). X Plc transfers control of each unit at a point in time. X Plc transfers control of 55 units to Y Plc. Contract modification: The contract is modified to require delivery of an additional 20 units to Y Plc at a price of $100 per unit which does not reflect the stand-alone selling price of the units at the time of the modification. The reduced price is agreed to compensate Y plc for late delivery of the first 55 units transferred. Analysis: The contract modification for the additional 20 products is not at the stand alone selling price for such contracts. Therefore, this cannot be treated as a new separate contract. Goods remaining under the original contract are distinct. The original contract is terminated and the modification results in a new contract. The amount recognised as revenue for each of the remaining units is as follows: $ Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 Remaining revenue on original contract (45 units × $140) Revenue on new contract (20 units × $100) Number of units (45 units + 20 units) Price per unit 6,300 2,000 8,400 65 129.2 3 Modification treated as part of the existing contract: Sometimes a contract modification might not result in a new contract and the remaining goods or services to be supplied under the original contract are not distinct from those transferred up to the date of the contract modification. In this case the modification is treated as part of the existing contract because remaining goods or services form part of a single performance obligation that has been partially satisfied at the date of the contract modification. The effect that the contract modification has on the transaction price, and on the supplier’s measure of progress towards complete satisfaction of the performance obligation, is recognised as an adjustment to revenue (either as an increase in or a reduction of revenue) at the date of the contract modification (i.e. the adjustment to revenue is made on a cumulative catch-up basis). Example: Contract modification: X Plc enters into a contract to construct a building for Y Plc for $1 million. X Plc determines that the contract contains a single performance obligation satisfied over time. X Plc uses costs incurred as a percentage of total expected costs as a measure of progress towards complete satisfaction of the performance obligation. Transaction price: The following forecasts were made at the inception of the contract. $ 1,000,00 0 Total expected costs 700,000 End of year 1: X Plc has incurred costs to date of $420,000 which is 60% of the total expected costs ($700,000). The cumulative revenue and costs recognised for the first year are as follows: Transaction price Revenue (60% of 1,000,000) Cost of sales (60% of 700,000) Gross profit $ 600,000 (420,000 ) 180,000 Example (continued): Contract modification Year 2: The contract is modified, early in year 2, by changing the specification for the location of the stairwells. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 The customer agreed to pay an extra $250,000 for the modification resulting in a new total contract price of $1,250,000. The expected extra cost of the modification is $100,000 so that the total expected costs become $800,000. X Plc evaluates the modification and concludes that the remaining goods and services to be provided using the modified contract are not distinct from the goods and services transferred on or before the date of contract modification. Therefore, X Plc accounts for the contract modification as if it were part of the original contract. Accounting: X Plc measures progress at 52.5% ($420,000/$800,000). This requires a catch up adjustment at the date of the modification as follows. Revenue (52.5% of 1,250,000) Revenue recognised to date Catch-up adjustment This is recognised in year 2. $ 656,250 (600,000) 56,250 IFRS 15 and judgement: Management judgement is required throughout all five steps of revenue recognition. For example: • Contracts with customers do not need to be in writing but may arise through customary business practice. An entity must therefore ascertain whether it has a constructive obligation to deliver a good or service to a customer. • A contract can only be accounted for if it is probable that the entity will collect the consideration that it is entitled to. Whether benefits are probable is, ultimately, a judgement. • The entity must identify distinct performance obligations in a contract. However, past performance may give rise to expectations in a customer that goods or services not specified in the contract will be transferred. The identification of distinct performance obligations thus relies on management judgement about both contract terms, and the impact of the entity’s past behaviour on customer expectations. • Variable consideration should be included in the transaction price if it is highly probable that a significant reversal in the amount of cumulative revenue recognised to date will not occur. This may involve making judgements about whether performance related targets will be met. • The transaction price must be allocated to distinct performance obligations, based on observable, standalone selling prices. However, estimation techniques must be used if observable prices are not available. • If a performance obligation is satisfied over time, revenue is recognised based on progress towards the completion of the performance obligation. There are various ways to measure completion, using either input or output methods, and the entity must determine which one most faithfully represents the transaction. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com) lOMoARcPSD|38286304 • If a performance obligation is satisfied at a point in time, the entity must use judgement to ascertain the date at which control of the asset passes to the customer. These judgements increase the risk that the management of an entity could manipulate its profits. Adherence to the ACCA ethical code is, therefore, vital. Downloaded by Hashan Dasanayaka (hashandasanayaka21@gmail.com)