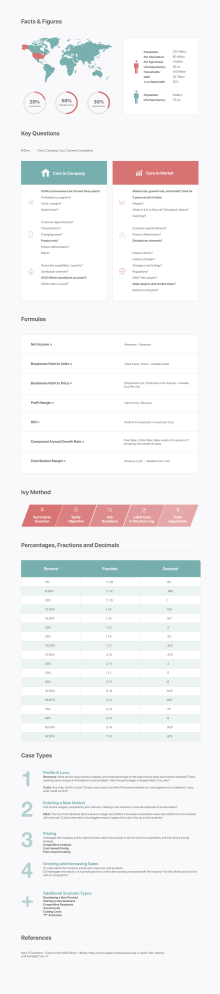

Facts & Figures 50% 20% Middle Income Low Income 30% Population: 320 Million Per Generation: 80 Million Per Age Group: 4 Million Life Expectancy: 80 yrs Households: 100 Million GDP: 20 Trillion % of World GDP: 25% Population: 8 Billion Life Expectancy: 70 yrs High Income Key Questions 5 C’s = Client, Company, Cost, Channels Competition Core to Market Core to Company Profits and revenues for the last three years? Market size, growth rate, and trends? (Ask for Profitability by segment? 3 years worth of data) Costs / margins? Margins? Market share? Where is it in its lifecycle? (Emerging? Mature? Declining?) Customer segmentations? Characteristics? Customer segmentation(s)? Changing needs? Product differentiation? Product mix? Distribution channels? Product differentiation? Brand? Industry drivers? Industry changes? Production capabilities / capacity? Changes in technology? Distribution channels? Regulations? WCS (What constitutes success?) M&A? New players? Which metric is used?” Major players and market share? Barriers to entry/exit? Formulas Net Income = Revenues - Expenses Breakeven Point in Units = Fixed Costs / (Price - Variable Costs) Breakeven Point in Price = (Total Fixed Cost / Production Unit Volume) + Variable Cost Per Unit Profit Margin = Net Income / Revenue ROI = Profit from Investment / Investment Cost Compound Annual Growth Rate = Final Value / Initial Value. Raise result to the power of 1 divided by the number of years Contribution Margin = Revenue / Unit - Variable Cost / Unit Ivy Method Summarize Question Verify Objective Ask Questions Label Case & Structure Arg. State Hypothesis Percentages, Fractions and Decimals Percent Fraction Decimal 5% 1 / 20 .05 8.33% 1 / 12 . 083 10% 1 / 10 .1 12.50% 1/8 .125 16.67% 1/6 .167 20% 1/5 .2 25% 1/4 .25 33.33% 1/3 .333 37.50% 3/8 .375 40% 2/5 .4 50% 1/2 .5 60% 3/5 .6 62.50% 5/8 .625 66.67% 2/3 .667 75% 3/4 .75 80% 4/5 .8 83.33% 5/6 .833 87.50% 7/8 .875 Case Types 1 2 3 4 + Profits & Loss: Revenues: What are the major revenue streams, and what percentage of the total revenue does each stream represent? Does anything seem unusual in the balance of percentages? Have the percentages changed lately? If so, why? Costs: Any major shifts in costs? Do any costs seem out of line?If we benchmarked our costs against our competitors’ costs, what would we find? Entering a New Market Can involve mergers, acquisitions, joint ventures, starting a new business, or the development of a new product. M&A: The two most important factors about a merger are whether it increases shareholder value and whether the two cultures will mesh well. Cultural mismatch is the biggest reason mergers fail or don’t live up to their potential. Pricing Investigate the company and its objective, learn about the product or service and the competition, and then pick a pricing strategy. Competitive Analysis Cost-based Pricing Price-based Costing Growing and Increasing Sales (1) Learn about the company and its size, resources, and products. (2) Investigate the industry: Is it growing and how is the client growing compared with the industry? Are the client’s prices in line with its competitors? Additional Scenario Types Developing a New Product Starting a New Business Competitive Response Turnarounds Cutting Costs “If” Scenarios References Marc P. Cosentino. “Case In Point 10th Edition.” iBooks. https://itunes.apple.com/us/book/case-in-point-10th-edition/ id1410410697?mt=11