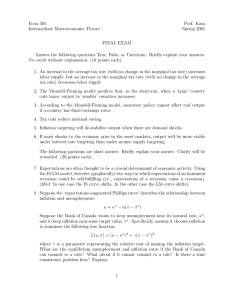

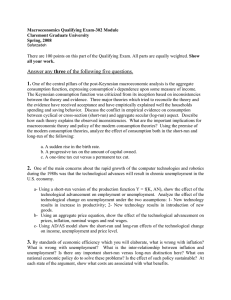

Book Reference: Jones – Chapter 9 Macroeconomic Theory Introduction to Short Run ECON2202 Spring 2024 9.1 Introduction In this chapter, we learn •how the gap between actual GDP and potential GDP measures the economy’s performance in the short run. •how costly fluctuations in economic activity can be. •that the rate of inflation tends to decline when the economy is in a recession. •a simple version of the short-run model that will help us understand these patterns. 9.2 The Long Run, the Short Run, and Shocks The long-run model is a guide to how the economy behaves on average. •Determines potential output and long-run inflation Potential output •Amount of production if all inputs were utilized at their long-run sustainable levels At any given time, the economy is unlikely to exactly equal the long-run average. The short-run model: •Determines current output and current inflation The Long Run, the Short Run, and Shocks In the short-run model •Assume the long run is given. •Potential output and the long-run inflation rate are exogenous. •Current output deviates from potential output because of economic shocks. •The current level of output and inflation are endogenous. Trends and Fluctuations Short-Run Fluctuation “Detrended output” or short-run output: •The difference in actual and potential output, expressed as a percentage of potential output: Economic Fluctuations and Short-Run Output Short-Run Output in the United States Fluctuations in U.S. GDP: •Difficult to see graphically over a long period of time •Have mostly been between + or –4% since 1950 The Great Depression: •Negative gap during the 1930s •Actual output was well below potential. Short Run A recession •begins when actual output falls below potential. •Short-run output becomes negative. •ends when short-run output starts to rise. •Short-run output becomes less negative. Typically, during a recession, •output is below potential for approximately 2 years. •Loss of about $3,000 per person •between 1.5 million and 3 million jobs are lost. U.S. Real GDP, Actual and Potential U.S. Economic Fluctuations Changes in U.S. Employment Case Study: The Great Depression 1930s worldwide calamity •25 percent of Americans were unemployed. •Industry production declined more than 60 percent. The beginning of modern macroeconomics Measuring Potential Output There is no directly observable measure of potential output in an economy. Ways to measure potential output: 1. “Detrend” the actual GDP data to extract a smooth trend 2. Use our long-run model (modifications of the Solow model) to compute the potential output implied by the theory The Inflation Rate What happens to inflation around recession is not obvious, but usually it declines Clicker Question 2 The short-run model determines a. potential output and current inflation. b. current output and long-run inflation. c. current output and current inflation. d. potential output and current output. Clicker Question 2 – Answer The short-run model determines a. potential output and current inflation. b. current output and long-run inflation. c. current output and current inflation. d. potential output and current output. 9.3 The Short-Run Model The short-run model is based on three premises: 1. The economy is constantly being hit by shocks. • Shocks: factors that cause fluctuations 2. Monetary and fiscal policies affect output. • Policymakers can neutralize shocks to the economy. 3. There is a dynamic trade-off between output and inflation. • Shown by the Phillips curve The Philips Curve: tradeoff between inflation and output The Phillips curve shows • a positive relationship between the change in inflation and short-run output. Therefore • a boom increases inflation. • a recession decreases inflation. Empirically, the slope is about 1⁄3. • If output exceeds potential by 3 percent, the inflation rate increases one percentage point. The Phillips Curve Measuring the Phillips Curve Clicker Question 9 If the economy is in a period of deflation, the Phillips curve implies that actual output is below potential output. a. true b. false Clicker Question 9 – Answer If the economy is in a period of deflation, the Phillips curve implies that actual output is below potential output. a. true b. false How the Short-Run Model Works Assume policymakers can select short-run output through monetary policy. Example: •1979: inflation was increasing due to oil prices. •Monetary policy raises interest rates (contractionary monetary policy). •What happens? •Recession! 9.4 Okun’s Law: Output and Unemployment Why do we use both increase in GDP or decrease in unemployment to talk about cycles? Because they are inversely related in the short run! Natural rate of unemployment: •The rate of unemployment that exists in the long run Cyclical unemployment: •Current unemployment minus the natural rate of unemployment Okun’s Law Cyclical unemployment Current rate of unemployment Natural rate of unemployment Short-run output Okun’s Law for the U.S. Economy 9.5 Filling in the Details The IS curve •Shows how an economy’s output in the short run depends negatively on the real interest rate The MP curve •Shows how monetary policy affects the real interest rate