Real Estate Project Financial Analysis: IRR & Cost Breakdown

advertisement

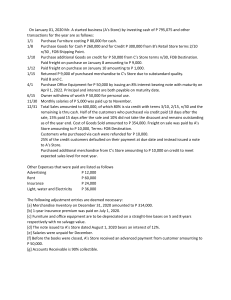

Findings Internal Rate of Return (IRR) is a financial metric used to evaluate the profitability of an investment by calculating the discount rate at which the net present value (NPV) of cash flows equals zero. In this context, an IRR of 14% means that the project is expected to generate returns equivalent to a 14% annual interest rate over its lifespan. A higher IRR indicates greater potential profitability. Land Price: This refers to the cost of acquiring the land for the project, totaling $35,600,000. It's a significant upfront expense and is crucial in determining the overall project cost and feasibility. Purchaser's Fees: These are expenses associated with purchasing the property, amounting to 5% of the land price, or $1,780,000. These fees typically include legal and administrative costs. Sales Fees: These are expenses incurred when selling the property upon completion of the project, amounting to 20% of the anticipated sales revenue, or $7,120,000. These fees cover marketing, real estate agent commissions, and other transaction costs. Contingency Allowance: This represents a reserve fund set aside to cover unexpected expenses during the project, amounting to 3.50% of the total project cost, or $1,246,000. It provides a buffer against cost overruns or unforeseen challenges. Leasing Cost: This is the expense associated with leasing the property, amounting to 40% of the total project cost, or $14,240,000. It covers expenses related to tenant improvements, marketing, and leasing commissions. Carparking: This refers to the cost of providing parking spaces for the development, amounting to 0.10% of the total project cost, or $35,600. It's a relatively minor expense but is essential for providing amenities to tenants or buyers. Revenues from Community: This represents income generated from community amenities or services associated with the project, amounting to 2% of the total project cost, or $712,000. It could include revenue from facilities like parks, recreation centers, or retail spaces. Ground Rents: These are income streams generated from leasing out land or property, amounting to 1% of the total project cost, or $356,000. It represents a recurring revenue stream for the project owner. External Works: These are expenses associated with infrastructure or improvements outside the main building structure, amounting to 2.50% of the total project cost, or $890,000. It includes costs for landscaping, roads, utilities, and site preparation. Professional Fees: These are fees paid to architects, engineers, consultants, and other professionals involved in the project, amounting to 5% of the total project cost, or $1,780,000. It covers design, planning, and project management services. Demolition: This refers to the cost of demolishing any existing structures on the site before commencing the new development, amounting to 1.50% of the total project cost, or $534,000. Base Build: This represents the cost of constructing the basic structure of the building, excluding any tenant-specific improvements, amounting to 2% of the total project cost, or $712,000. Programme: This refers to the cost associated with project management and scheduling, amounting to 4% of the total project cost, or $1,424,000. It covers expenses related to planning, coordination, and supervision. Revenue Inflation: This represents an anticipated increase in revenue over time due to inflation, amounting to 10% of the total project cost, or $3,560,000. It reflects the expectation that rental or sales income will rise to keep pace with inflation. Construction Inflation: This represents an anticipated increase in construction costs over time due to inflation, amounting to 15% of the total project cost, or $5,340,000. It accounts for the expected rise in material and labor expenses during the construction period. Conclusion The analysis of the project's financial components reveals several key insights. With an Internal Rate of Return (IRR) of 14%, the project demonstrates promising potential for generating attractive returns. However, significant expenses such as the high land price of $35,600,000 and substantial professional fees totaling $1,780,000 suggest a considerable upfront investment. Moreover, ongoing costs like leasing expenses, external works, and construction inflation highlight the need for prudent financial management throughout the project lifecycle. On the revenue side, income sources such as community revenues and ground rents offer opportunities for steady cash flow. Nevertheless, it's essential to navigate challenges such as purchaser's and sales fees, demolition costs, and revenue and construction inflation carefully. Overall, while the project shows promise, careful attention to cost control, revenue optimization, and risk mitigation will be vital to realizing its full potential and ensuring its longterm success.