Course Outline: CEE 109 – Engineering Economics

Course Coordinators:

Jerald M. Mutoc, REE

Jobenilita R. Cuñado

Email:

jeraldmutoc0517@gmail.com,

jobenilita_cunado@umindanao.edu.ph

Student Consultation:

By appointment

Mobile:

(+63)9306691873

(+63) 9360860118

Phone:

None

Effectivity Date:

June 2020

Mode of Delivery:

Blended (Online with face-to-face or virtual sessions)

Time Frame:

54 Hours

Student Workload:

Expected Self-Directed Learning

Requisites:

None

Credit:

3 Units

Attendance Requirements: A minimum of 95% attendance is required for all scheduled faceto-face virtual sessions

Course Policy

Areas of Concern

Overview

Contact Hours

Assessment Tasks

Assessment Schedule

Submissions

Details

This course instruction manual is designed for blended

learning – an approach where opportunities for virtual

interaction is combined with classroom-based instruction

delivery. The learning units are organized to be completed in

order as this module was designed to capitalize on prerequisite knowledge gained from preceding units.

This 3-unit course module is expected to be completed in 54

hours. A certain number of hours is scheduled for each

learning unit; however, a student has control over his/her

pace provided assessment activity requirements are

submitted as scheduled. Virtual and place-based learning

sessions, including assessments, comprise course contact

hours.

A combination of theory and practice-based assessments is

to be expected.

Periodical assessments are scheduled based on the school

calendar. Other assessment schedules will be posted as

deemed necessary.

All assessment tasks posted online via Learning Management

System are REQUIRED to be submitted as scheduled. A

Dishonesty Penalties

Return of Assessment

Results

Grading System

classwork will be created for submission purposes.

Classroom-based assessments are to be submitted within set

time limits.

Students are expected to work on individual assessments by

themselves.

Cheating incidences in any form are

DISCOURAGED, however, are beyond the control of the

course coordinator, especially that resources can be easily

sourced and shared online. As such, shared credits shall be

given to students who will submit identical works.

The use of other people’s work without acknowledging the

author shall be dealt with accordingly based on the

appropriate provisions in the student handbook.

The results of any assessment, if not readily available after

completion such as those of multiple-choice types, will be

returned within two weeks, at most, from the date of

submission.

Grades shall be computed based on the following:

Course Exercises (Quizzes, Assignments, Participation)

25%

Research

15%

First Major Assessment

10%

Second Major Assessment

10%

Third Major Assessment

10%

Final Assessment

30%

*Base 15 grading policy will be followed.

Mode of Communication

All communication shall be done on the virtual classroom via

streams, comment boxes or emails. Queries will only be

entertained during our class schedule or during special

meetings when one is scheduled.

Contact Details of the Dean Dr. Gina Fe G. Israel

Email:

Phone:

Contact Details of the Engr. Reena Ross E. Pusta

Program Head

Email:

Phone:

Students with Special Needs Students with special needs shall communicate to the course

coordinator the nature of his or her special needs. Depending

on the nature of the need, the course coordinator with the

approval of the program coordinator, may provide

alternative assessment tasks or extension of the deadline of

submission of assessment tasks. However, the alternative

assessment tasks should still be in the service of achieving the

desired course learning outcomes.

Course Information – View/Download the course syllabus in/from the LMS

CC’s Voice:

Hello! Welcome to CEE 109 – Engineering Economics. This course will expose you

to the fundamentals of engineering economics which you will find useful in

managing engineering projects.

CO

Engineering economics is a field that addresses the dynamic environment of

economics involving the evaluation of costs and benefits of proposed projects.

Engineers play an important role in investments, especially in making decisions

based on economic analysis and design considerations. One of the expected

outcomes of this course is for you to apply the various principles of engineering

economy to various engineering problems, engineering economy equations and

techniques to solve problems related to the economic aspect of engineering

projects. You will also be required to propose engineering projects based on

economic factors which necessitates the application of engineering economics

fundamentals.

Let us begin!

BIG PICTURE

Week 1 – 3: Unit Learning Outcomes (ULO)

At the end of the unit, you are expected to:

a. discuss the basic principles of engineering economy;

b. classify cost items based on the basic cost terminologies and concepts; and

c. apply the concept of interest in solving engineering problems.

Big Picture in Focus: ULOa. Discuss the basic principles of engineering economy.

Metalanguage

1. Deviation Analysis. It is the measure of the difference between an observed variable’s

value in a set and some other value which is often the mean of the set.

2. Risk. In financial terms, it is defined as the probability that an investment’s actual gains

are different from the expected returns.

3. Uncertainty. It refers to the unpredictability of an economy’s future outlook.

4. Capital. It refers to the money required in the production of goods or services.

5. Warranty Cost. It is the cost of repairing or replacing previously sold products during their

warranty periods.

6. First Cost. It is the sum of the initial expenditures involved in capitalizing a property or

building a project; includes items such as transportation, installation, preparation for

service, as well as other related costs.

7. Salvage Value. It is the estimated resale value of an asset at the end of its useful life.

8. Annual Operating Cost. It is a yearly expense associated with the maintenance and

administration of a business on a day-to-day basis.

9. Subcontract Cost. It is the cost associated with outsourcing part of the obligations and

tasks under a contract to another party.

10. Income. It is money (or some equivalent value) that an individual or business receives,

usually in exchange for providing a good or service or through investing capital.

11. Cash Flow. It is the net amount of cash and cash-equivalents being transferred into and

out of a business.

12. Time Value of Money. It is the concept that explains the change in the amount of money

over time for both owned and borrowed funds.

13. Tax. It is an involuntary fee imposed on individuals or corporations and enforced by a

government entity—whether local, regional or national—in order to finance government

activities.

14. Inflation. It is an economic term that refers to an environment of generally rising prices

of goods and services within a particular economy. As general prices rise, the purchasing

power of consumers decreases.

15. Rate of Return. It is the net gain or loss of an investment over a specified time period,

expressed as a percentage of the investment's initial cost.

Essential Language

INTRODUCTION

Engineering economy involves the systematic evaluation of the economic merits of

proposed solution to engineering problems. For a solution to be economically acceptable, it must

exhibit a positive balance between long-term benefits and long-term costs.

The need for engineering economy is primarily motivated by the work that engineers do

in performing analyses and synthesizing as the work on project of all sizes comes to a conclusion.

Engineers play a major role in investment by making decisions based on economic analysis and

design considerations. These decisions often reflect the engineer’s choice of how to best invest

funds by choosing the proper alternative out of a set of alternatives.

Principles of Engineering Economy

The development, study, and application of any discipline begin with a basic foundation.

In engineering economy, this foundation is the set of principles that provide a comprehensive

doctrine for developing methodologies.

The foundation of the discipline of Engineering Economy can be seen in terms of seven

principles. These seven principles are:

1. Develop the alternatives.

Alternates need to be developed from which the decision has to come from.

Brainstorming sessions have been found to be productive in coming up with these

alternatives.

2. Focus on the differences.

In this principle, deviation analysis is used. However, only the differences

among the expected future outcomes among the alternatives are considered relevant

in decision making.

3. Use a consistent viewpoint.

The viewpoint for the particular decision need to be first defined. The

perspective or viewpoint of the decision maker, which is often that of the owners of

the firm, would normally be used. It is then used consistently in the description,

analysis, and comparison of the alternatives.

4. Use a common unit of measure.

In measuring the economic consequences, a monetary unit is the common

measure. Other outcomes should be translated into monetary units in order to not

complicate the overall project analysis.

5. Consider all relevant criteria.

The decision maker will normally select the alternative that will best serve the

long-term interests of the owners of the organization. In engineering economic

analysis, the primary criterion relates to the long-term financial interests of the

owners. This is based on the assumption that available capital will be allocated to

provide maximum monetary return to the owners. Often, though, there are other

organizational objectives you would like to achieve with your decision, and these

should be considered and given weight in the selection of an alternative.

6. Make risk and uncertainty explicit.

Risk and uncertainty are inherent in estimating the future outcomes of the

alternatives and should be recognized. The analysis of the alternatives involves

projecting or estimating the future consequences associated with each of them. The

magnitude and the impact of future outcomes of any course of action are uncertain.

The probability is high that today’s estimates of, for example, future cash receipts and

expenses will not be what eventually occurs. Thus, dealing with uncertainty is an

important aspect of engineering economic analysis.

7. Revisit your decisions.

A good decision-making process can result in a decision that has an

undesirable outcome. Other decisions, even though relatively successful, will have

results significantly different from the initial estimates of the consequences. Learning

from and adapting based on experience are essential and are indicators of a good

organization.

The Engineer’s Role in Decision Making

Decision is made routinely to choose one alternative over another in everyday life. Most

decisions involve money, called capital or capital fund, which is usually limited in amount. The

decision of where and how to invest this limited capital is motivated by a primary goal of adding

value as future, anticipated results of the selected alternative are realized.

People make decisions with the aid of computers, mathematics, concepts, and guidelines

in the decision-making process. Since most decisions affect what will be done, the time frame of

engineering economy is primarily the future.

Example 1:

An engineer is performing an analysis of warranty costs for drive train repairs within the

first year of ownership of luxury cars purchased in the United States. He found the average cost

(to the nearest peso) to be Php 28,490 per repair from data taken over a 5-year period.

Year

Average

Cost(Php/)Repair

2010

2011

2012

2013

2015

26,250

21,500

30,950

32,500

31,250

Table 1. Five-Year Average Cost per Repair Example

What range of repair costs should the engineer use to ensure that the analysis is sensitive

to changing warranty costs?

Solution:

At first glance the range should be approximately -30% to + 15% of the Php 28,490

average cost to include the low of Php 21,500 and high of Php 32,500. However, the last 3 years

of costs are higher and more consistent with an average of Php 31,566.67. The observed values

are approximately ±3% of this more recent average. If the analysis is to use the most recent data

and trends, a range of, say, ±5% of Php 31,566.67 is recommended. If, however, the analysis is to

be more inclusive of historical data and trends, a range of, say, ±25% or ±30% of Php 28,490 is

recommended.

WRITESHOP 1

Answer the following questions:

1. Why is the study of engineering economy important to the practicing engineer?

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

2. You have discussed with a coworker in the engineering department the importance

of explicitly defining the viewpoint (perspective) from which future outcomes of a

course of action being analyzed are to be developed. Explain what is meant by a

viewpoint or perspective.

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

Engineering Economy and the Design Process

An engineering economy study is accomplished using a structured procedure and

mathematical modeling techniques. The economic results are then used in a decision situation

that involves two or more alternatives and normally includes other engineering knowledge and

input.

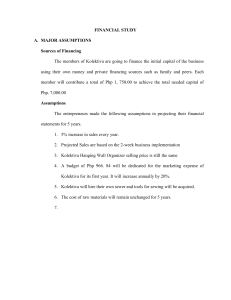

Figure 1. The Steps in an Engineering Economy Study

The engineering economic analysis procedure is as follows:

1. Problem recognition, definition, and evaluation.

A problem must be well understood and stated in an explicit form before the

project team proceeds with the rest of the analysis. Recognition of the problem is

2.

3.

4.

5.

normally stimulated by internal or external organizational needs or requirements. An

operating problem within a company (internal need) or a customer expectation about

a product or service (external requirement) are examples.

As an illustration, assume the problem is that a coal-fueled power plant must

be shut down by 2015 due to the production of excessive sulfur dioxide. The

objectives may be to generate the forecasted electricity needed for 2015 and beyond,

plus to not exceed all the projected emission allowances in these future years.

Development of the feasible alternatives.

Alternatives are stand-alone descriptions of viable solutions to problems that

can meet the objectives. Words, pictures, graphs, equipment and service descriptions,

simulations, etc. define each alternative. The best estimates for parameters are also

part of the alternative. Some parameters include equipment first cost, expected life,

salvage value (estimated trade-in, resale, or market value), and annual operating cost

(AOC), which can also be termed maintenance and operating (M&O) cost, and

subcontract cost for specific services. If changes in income (revenue) may occur, this

parameter must be estimated.

The two primary actions in this step are:

a. Searching for potential alternatives; and

b. Screening them to select a smaller group of feasible alternatives for

detailed analysis.

Development of the outcomes and cash flows for each alternative.

All viable alternatives at this stage is crucial. For example, if two alternatives

are described and analyzed, one will likely be selected and the implementation

initiated. If a third, more attractive method that was available is later recognized, a

wrong decision was made.

Also, all cash flows are estimated for each alternative. Since these are future

expenditures and revenues, the results of this step usually prove to be inaccurate

when the alternative is actually in place and operating. When cash flow estimates for

specific parameters are expected to vary significantly from a point estimate made

now, risk and sensitivity analyses (step 5) are needed to improve the chances of

selecting the best alternative. Sizable variation is usually expected in estimates of

revenues, AOC, salvage values, and subcontractor costs.

Selection of a criteria.

The criterion used to select an alternative in engineering economy for a

specific set of estimates is called a measure of worth. The measures of worth account

for the fact that money makes money over time. This is the concept of time value of

money.

Analysis and comparison of the alternatives.

In this step, techniques and computations involving cash flow estimates, time

value of money and a selected measure of worth are used. The result of the analysis

will be one or more numerical values – this can be in one of several terms, such as

money, an interest rate, number of years, or a probability.

Before an economic analysis technique is applied to the cash flows, some

decisions about what to include in the analysis must be made. Two important

possibilities are taxes and inflation as these will impact the costs of every alternative.

An after-tax analysis includes some additional estimates and methods compared to a

before-tax analysis. If taxes and inflation are expected to impact all alternatives

equally, they may be disregarded in the analysis. However, if the size of these

projected costs is important, taxes and inflation should be considered. Also, if the

impact of inflation over time is important to the decision, an additional set of

computations must be added to the analysis.

6. Selection of the preferred alternative.

The measure of worth is a primary basis for selecting the best economic

alternative. For example, if alternative A has a rate of return (ROR) of 15.2% per year

and alternative B will result in an ROR of 16.9% per year, B is better economically.

However, there can always be non-economic or intangible factors that must be

considered and they may alter the decision. Some of these non-economic factors

include:

Market pressures, such as need for an increased international presence

Availability of certain resources, e.g., skilled labor force, water, power, tax

incentives

Government laws that dictate safety, environmental, legal, or other

aspects

Corporate management’s or the board of director’s interest in a particular

alternative

Goodwill offered by an alternative toward a group: employees, union, etc.

7. Performance monitoring and post-evaluation results.

Performance monitoring helps in determining if a project is on track and when

changes may be needed. Monitoring and evaluation forms the basis for modification

of interventions and assessing the quality of activities being conducted.

A sound engineering economic analysis procedure incorporates the seven basic

principles. The seven-step procedure is also used to assist decision making within the engineering

design process.

Engineering Economic Analysis Procedure

Step

1. Problem recognition, definition, and

evaluation.

Engineering Design Process

Activity

1. Problem/Need definition.

2. Problem/Need formulation and

evaluation.

2. Development of the feasible

alternatives.

3. Development of the cash flows for

each alternative.

4. Selection of a criterion (or criteria).

5. Analysis and comparison of the

alternatives.

6. Selection of the preferred alternative.

7. Performance monitoring and postevaluation results.

3. Synthesis of possible solutions

(alternatives).

4. Analysis, optimization, and

evaluation.

5. Specification of preferred alternative.

6. Communication.

Source: Middendorf, W.H., Design of Devices and Systems (New York: Marcel Dekker, Inc., 1986)

Table 2. The Engineering Economic Analysis Procedure vis-à-vis the Engineering Design Process

Example 1:

Bad news – you have just wrecked your car! An automobile wholesaler offers you Php 100,000

for the car “as is”. Also, your insurance company’s claims adjuster estimates that there is Php

100,000 in damages to your car. Because you have collision insurance with a Php 50,000

deductibility provision, the insurance company mails you a check for Php 50,000. The odometer

reading on your wrecked car is 58,000 miles.

You need another car immediately. What should you do?

Solution:

(a) Develop your alternatives (Principle 1):

1. Sell the wrecked car to the wholesaler and spend this money, the Php 50,000

insurance check, and all of your Php 350,000 life savings on a newer car. Total amount

paid out of savings is Php 350,000, and the car will have 28,000 miles.

2. Spend the Php 50,000 insurance check and Php 50,000 of savings to fix the car. Total

amount paid out of savings is Php 50,000, and the car will have 58,000 miles.

3. Spend the Php 50,000 insurance check and Php 50,000 of savings to fix the car, then

sell the car for Php 225,000. Spend the Php 225,000 plus Php 275,000 of additional

savings to buy the newer car. Total amount paid out of savings is Php 325,000, and

the car will have 28,000 miles.

4. Give the car to a lesser mechanic, who will repair it for Php 55,000 (Php 50,000

insurance and Php 5,000 of your savings) but will take an additional month of repair

time, and rent a car for that time at Php 20,000/month (paid out of savings). Total

amount paid out of savings is Php 25,000, and the car will have 58,000 miles.

5. Same as 4, but then sell the car for Php 225,000 and use this money plus Php 275,000

of additional savings to buy the newer car. Total amount paid out of savings is Php

300,000, and the car will have 28,000 miles.

ASSUMPTIONS

1. The less reliable repair shop in Alternatives 4 and 5 will not take longer than the

additional month to repair the car.

2. Each car will perform at the normal operating condition as it was originally intended

and to the same total mileage before being sold or salvaged.

3. Interest earned on money remaining in savings is negligible.

(b) Focus on the differences (Principle 2):

1. Alternative 1 varies from all others because the car is not to be repaired at all but

merely sold. This eliminates the benefit of the Php 25,000 increase in value of the car

when it is repaired then sold. Also, this alternative leaves no money in the bank.

2. Alternative 2 varies from Alternative 1 because it allows the old car to be repaired.

Alternative 2 differs from Alternatives 4 and 5 since it utilizes a more expensive (Php

25,000 more) and less risky repair facility. It also varies from Alternatives 3 and 5

because the car will be kept.

3. Alternative 3 gains an additional Php 25,000 by repairing the car and selling it to buy

the same car as in Alternative 1.

4. Alternative 4 uses the same idea as Alternative 2 but involves a less expensive repair

shop. This repair shop is more risky in the quality of its end product but will only cost

Php 55,000 in repairs and Php 20,000 in an additional month’s rental of a car.

5. Alternative 5 is the same as Alternative 4 but gains an additional Php 25,000 by selling

the repaired car and purchasing a newer car as in Alternatives 1 and 3.

(c) Use a consistent viewpoint (Principle 3):

The viewpoint taken here is that of the owner of the wrecked car.

(d) Use a common unit of measure (Principle 4):

The peso represents the value of the car to the owner. Hence, peso is used as the

consistent value against which everything is to be measured. This reduces all decisions to

a quantitative level, which can then be reviewed later with qualitative factors that may

carry their own peso value (e.g. how much is a reliable repair shop worth?).

(e) Consider all relevant criteria (Principle 5):

1. Alternative 1 is eliminated because Alternative 3 gains the same end result and would

also provide the car owner with Php 25,000 more cash. This is experienced with no

change in the risk to the owner. Car value = Php 500,000, savings = 0.

2. Alternative 2 is a good alternative to consider because it spends the least amount of

cash, leaving Php 300,000 in the bank. However, Alternative 2 provides the same end

result as Alternative 4 but costs Php 25,000 more to repair. Therefore, Alternative 2

is eliminated. Car value = Php 200,000, savings = Php 300,000.

3. Alternative 3 is eliminated because Alternative 5 also repairs the acr but at a lower

out-of-savings cost (Php 25,000 difference), and both Alternatives 3 and 5 have the

same end result of buying the newer car. Car value = Php 500,000, savings = Php

25,000.

4. Alternative 4 would be a good alternative because it saves Php 25,000 by using a

cheaper repair facility, provided that the risk of a poor repair job is judged to be small.

Car value = Php 200,000, savings = Php 325,000.

5. Alternative 5 is the alternative accepted because it repairs the car at a lower cost (Php

25,000 cheaper) but eliminates the risk of breakdown by selling it to someone else at

an additional Php 25,000 gain. Car value = Php 500,000, savings = Php 50,000.

(f) Make uncertainty explicit (Principle 6):

Among the uncertainties that can be found in this problem, the following are the most

relevant to the decision. If the original car is repaired and kept, there is a possibility that

it would have a higher frequency of breakdowns. If a cheaper repair facility is used, the

chance of a later breakdown is even greater. Also, the newer car purchased may be too

expensive, based on additional price paid (which is at least Php 300,000/30,000 miles =

Php 10 per mile). Finally, the newer car may also have been in an accident and could have

a worse repair history than the presently owned car.

(g) Revisit your decisions (Principle 7):

The newer car turned out after being “test driven” for 20,000 miles to be a real beauty.

Mileage was great, and no repairs were needed. The systematic process of identifying and

analyzing alternative solutions to this problem really paid off.

WRITESHOP 2

The Almost-Graduating Senior Problem. Consider this situation faced by a first-semester

senior in electrical engineering who is exhausted from extensive job interviewing and penniless

from excessive partying. Jose’s impulse is to accept immediately a highly attractive job offer to

work in his brother’s successful manufacturing company. He would then be able to relax for a

year or two, save some money, and then return to college to complete his senior year and

graduate. Jose is cautious about impulsive desire because it may lead to no college degree at all!

a. Develop at least two formulations for Jose’s problem.

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

b. Identify feasible solutions for each problem formulation in part (a). Be creative!

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

Big Picture in Focus: ULOb. Classify cost items based on the basic cost terminologies and

concepts.

Metalanguage

1. Cost. It is the monetary value of goods and services that producers and consumers

purchase.

2. Revenue. It is the income that a firm receives from the sale of goods or services to its

customers.

3. Depreciation. It is the measure of the decrease in monetary value of an asset over time

due to use, wear and tear or obsolescence.

Essential Knowledge

Cost Concepts for Decision Making

When conducting engineering economy studies and communicating results, it is

important to use consistent definitions for cost terms.

Fixed, Variable, and Incremental Costs

Fixed costs are those unaffected by changes in activity level over a feasible range of

operations for the capacity or capability available. Typical fixed costs include insurance and taxes

on facilities, general management and administrative salaries, license fees, and interest costs on

borrowed capital.

Variable costs are those associated with an operation that vary in total with the quantity

of output or other measures of activity level. If you were making an engineering economic

analysis of a proposed change to an existing operation, the variable costs would be the primary

part of the prospective differences between the present and changed operations as long as the

range of activities is not significantly changed. For example, the costs of material and labor used

in a product or service are variable costs – because they vary in total with the number of output

units – even though the costs per unit stays the same.

An incremental cost, or incremental revenue, is the additional cost, or revenue, that

results from increasing the output of a system by one (or more) units. Incremental cost is often

associated with “go/no go” decisions that involve a limited change in output or activity level.

Example 3:

A company considers increasing the number of goods that they produce. Their current

level of production and the added costs of producing additional units are listed below:

5,000 units cost Php 7.5M or Php 1,500 per unit.

7,000 units cost Php 8.75M or Php 1,250 per unit.

What is the incremental cost involved?

Solution:

The total incremental cost to produce the 2,000 additional units is given by:

Incremental Cost = Php 8.75 M – Php 7.5M = Php 1.25M

The incremental cost per unit is Php 1.25M/2,000 = Php 625.

The lower incremental cost per unit is due to certain costs, such as fixed costs remaining

constant. Although a portion of fixed costs can increase as production increases, usually, the cost

per unit declines since the company isn't buying additional equipment or fixed costs to produce

the added volume.

Recurring and Nonrecurring Costs

These two general terms are often used to describe various types of expenditures.

Recurring costs are those that are repetitive and occur when an organization produces

similar goods or services on a continuing basis. Variable costs are also recurring costs because

they repeat with each unit of output. But recurring costs are not limited to variable costs. For

example, office space rental – which is a fixed cost – is also a recurring cost.

Nonrecurring costs are those that are not repetitive, even though the total expenditure

may be cumulative over a relatively short period of time. Typically, nonrecurring costs involve

developing or establishing a capability or capacity to operate. For example, the purchase cost for

real estate upon which a plant will be built is a nonrecurring cost, as well as the cost of

constructing the plant itself.

Direct, Indirect, and Overhead Costs

These cost terms involve most of the previous cost elements.

Direct costs are those that can be reasonably measured and allocated to a specific output

or work activity. The labor and material costs directly associated with a product, service, or

construction activity are direct costs. For example, the materials needed to make a pair of scissors

would be a direct cost.

Indirect costs are those that are difficult to attribute or allocate to a specific output or

work activity. The term normally refers to types of costs that would involve too much effort to

allocate directly to a specific output. For example, the costs of common tools, general supplies,

and equipment maintenance in a plant are treated as indirect costs.

Overhead costs consist of plant operating costs that are not direct labor or direct material

costs. Examples of overhead include electricity, general repairs, property taxes, and supervision.

Administrative and selling expenses are usually added to direct costs and overhead costs to arrive

at a unit selling price for a product or service.

Standard Costs

Standard costs are representative costs per unit of output that are established in advance

of actual production or service delivery. They are developed from the direct labor hours,

materials, and support functions planned for the production or delivery process. For example, a

standard cost for manufacturing one unit of an automotive part such as a starter would be

developed as follows:

Standard Cost Element

Direct Labor

+

Direct Material

+

Factory Overhead Costs

Sources of Data for Standard Costs

Process routing sheets, standard times,

standard labor rates

Material quantities per unit, standard unit

material costs

Total factory overhead costs allocated based

on prime costs (direct labor plus direct

material costs)

= Standard Cost (per unit)

Table 3. Standard Cost and Sources

Standard costs play an important role in cost control and other management functions.

Some representative uses are the following:

1. Estimating future manufacturing or service delivery costs.

2. Measuring operating performance by comparing actual cost per unit with the

standard unit cost.

3. Preparing bids on products or services requested by customers.

4. Establishing the value of work-in-process and finished inventories.

Cash Cost versus Book Cost

A cost that involves payment of cash is called a cash cost (and results in a cash flow) to distinguish

it from one that does not involve a cash transaction and is reflected in the accounting system as

a noncash cost. This noncash cost is often referred to as a book cost. The most common example

of book cost is the depreciation charged for the use of assets such as plant and equipment.

Sunk Cost

A sunk cost is one that has occurred in the past and has no relevance to estimates of

future costs and revenues related to an alternative course of action.

Sunk costs result from past decisions and therefore are irrelevant in the analysis and

comparison of alternatives that affect the future which can be disregarded in an engineering

economic analysis.

The concept of sunk cost is illustrated in the following simple example. Suppose that John

Carlo finds a motorcycle he likes and pays Php 2,000 as a down payment, which will be applied

to the Php 65,000 purchase price but which must be forfeited if he decides not to take the cycle.

Over the weekend, John Carlo finds another motorcycle he considers equally desirable for a

purchase price of Php 61,500. For the purpose of deciding which motorcycle to purchase, the

Php 2,000 is a sunk cost and thus would not enter into the decision except that it lowers the

remaining cost of the first cycle. The decision then is between paying Php 63,000 (Php 65,000 –

Php 2,000) for the first motorcycle versus Php 61,500 for the second motorcycle.

Opportunity Cost

An opportunity cost is incurred because of the use of limited resources, such that the

opportunity to use those resources to monetary advantage in an alternative use is foregone.

Thus, it is the cost of the best rejected opportunity and is often hidden or implied.

Examples of opportunity costs:

A business owns its building. If the company moves, the building could be rented to

someone else. The opportunity cost of staying there is the amount of rent the company

would get.

David decides to quit working and got to school to get further training. The opportunity

cost of this decision is the lost wages for a year.

Jill decides to take the bus to work instead of driving. It takes her 60 minutes to get there

on the bus and driving would have been 40, so her opportunity cost is 20 minutes.

Life-Cycle Cost

Life-cycle cost refers to a summation of all costs, both recurring and nonrecurring, related

to a product, structure, system, or service during its life span. Life cycle begins with the

identification of the economic need or want (requirement) and ends with retirement and disposal

activities.

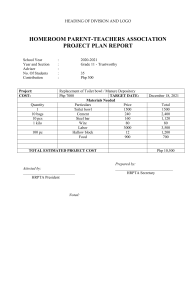

Figure 2. Phases of the Life Cycle and their Relative Costs

The cumulative committed life-cycle cost curve increases rapidly during the acquisition

phase. In general, approximately 80% of life-cycle costs are “locked in” at the end of this phase

by the decisions made during requirements analysis and preliminary detailed design. In contrast,

as reflected by the cumulative life-cycle cost curve, only about 20% of actual costs occur during

the acquisition phase, with about 805 being incurred during the operation phase.

Thus, one purpose of the life-cycle concept is to make explicit the interrelated effects of

costs over the total life span for a product. An objective of the design process is to minimize the

life-cycle cost – while meeting other performance requirements – by making the right tradeoffs

between prospective costs during the acquisition phase and those during the operation phase.

The cost elements of the life cycle that need to be considered will vary with the situation.

Several basic life-cycle cost categories include:

1. Investment Cost. It is the capital required for most of the activities in the acquisition

phase. Acquiring a specific equipment is an investment cost. This cost is also called a

capital investment.

2. Working Capital. It refers to the funds required for current assets that are needed for

the start-up and subsequent support of operation activities. For example, products

cannot be made or services delivered without having materials available in inventory.

Functions such as maintenance cannot be supported without spare parts, tools,

trained personnel, and other resources.

3. Operation and Maintenance Cost. It includes many of the recurring annual expense

items associated with the operation phase of the life cycle. The direct and indirect

costs of operation associated with the five primary resource areas – people, machines,

materials, energy, and information – are a major part of the costs in this category.

4. Disposal Cost. It includes nonrecurring costs of shutting down the operation and the

retirement and disposal of assets at the end of the life cycle. A classic example of a

disposal cost is that associated with cleaning up a site where a chemical processing

plant had been located.

WRITESHOP 3

1. A company in the process industry produces a chemical compound that is sold to

manufacturers for use in the production of certain plastic products. The plant that

produces the compound employs approximately 300 people. Develop a list of six different

cost elements that would be fixed and a similar list of six cost elements that would be

variable.

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

2. Refer to Problem (1) and your answer to it. Develop a table that shows the cost elements

you defined and classified as fixed and variable. Indicate which of these costs are also

recurring, nonrecurring, direct or indirect.

3. Classify each of the following cost items as mostly fixed or variable:

a. Raw materials

b. Direct labor

c. Depreciation

d. Supplies

e. Utilities

f. Property taxes

g. Administrative salaries

h. Payroll taxes

i. Insurance (building and equipment)

j. Clerical salaries

k. Sales commissions

l. Rent

m. Interest on borrowed money

Present Economy Studies

When the influence of time on money is not a significant consideration, cost analyses are

usually called present economy studies. Typical situations involving present economy studies are

as follows:

1. There is no initial investment of capital; only immediate operating costs and other

factors are involved. For example, assume that you are employed by Company A and

are making plans for a business trip. You can travel by commercial aircraft, which will

require 3 hours of travel time and the rental of the car at your destination. The

alternative is to travel by automobile, which will take 7 hours. Here, the basic

considerations are the immediate costs, the value of your time, and nonmonetary

factors (e.g. fatigue).

2. There is an initial investment of capital, but after this investment cost, the remaining

life-cycle cost is estimated to be the same, or directly proportional to the initial

investment. Thus, the alternative with the lowest investment cost will be the most

economical. Consider the construction of an interstate highway bridge overpass.

Whether a longitudinally reinforced concrete slab or a precast concrete design is used,

the maintenance and other life-cycle costs of the two designs are usually assumed to

be proportionally the same. However, if one or more steel design alternatives were

also being considered, a present economy study probably would not be appropriate.

Maintenance and other related costs would be expected to vary among the

alternatives, and the cost analysis should be based on the life cycle of the structure.

3. The differences in revenues and costs among the alternatives all occur within a limited

time period (1 year or less is a general guideline), or any future differences are

estimated to remain proportional to those in the first time period. This is often the

case when the decision is between alternative materials in manufacturing. For

example, if estimations show that using low-alloy/high-yield strength steel in

particular application gives better revenue and cost results than using low-carbon

steel, this relative advantage would be expected to remain in future time periods.

In engineering practice, situations that give rise to present economy studies are quite

common. Recognizing these situations often saves considerable analysis effort.

Big Picture in Focus: ULOc. Apply the concepts of interest in solving engineering problems.

Metalanguage

1. Interest. It is the price paid for the use of credit or money.

2. Profit. It is the financial benefit realized when revenue generated from a business activity

exceeds the expenses, costs, and taxes involved in sustaining the activity in question.

3. Interest Period. It is the length of the loan period.

4. Interest Rate. It is the amount a lender charges for the use of assets expressed as a

percentage of the principal.

5. Compounding. It is the process in which an asset's earnings, from either capital gains or

interest, are reinvested to generate additional earnings over time.

Essential Knowledge

MONEY-TIME RELATIONSHIPS AND EQUIVALENCE

The term capital refers to wealth in the form of money or property that can be used to

produce more wealth. Majority of engineering economic studies involve commitment of capital

for extended periods of time, so the effect of time must be considered. In this regard, it is

recognized that a peso today is worth more than a peso years from now because of the interest

(or profit) it can earn. Money, therefore, has a time value.

Capital in the form of money for the people, machines, materials, energy, and other things

needed in the operation of an organization may be classified into two basic categories. Equity

capital is that owned by individuals who have invested their money or property in a business

project or venture in the hope of receiving a profit. Debt capital, often called borrowed capital,

is obtained from lenders for investment. In return, the lenders receive interest from the

borrowers.

There are fundamental reasons why return to capital in the form of interest and profit is

an essential ingredient of engineering economic studies. First, interest and profit pay the

providers of capital for forgoing its use during the time the capital is being used. The fact that the

supplier can realize a return on capital acts as an incentive to accumulate capital by savings, thus

postponing immediate consumption in favor of creating wealth in the future. Second, interest

and profit are payments for the risk the investor takes in permitting another person, or an

organization, to use his or her capital.

Interest and the Time Value of Money

The terms interest, interest period, and interest rate are useful in calculating equivalent

sums of money for one interest period in the past and one period in the future.

However, for more than one interest period, the terms simple interest and compound

interest become important

Simple Interest

When the total interest earned or charged is linearly proportional to the initial amount of

the loan (principal), the interest rate, and the number of interest periods for which the principal

is committed, the interest and the interest rate are said to be simple.

Simple Interest (denoted as I) is defined as the interest on a loan or principal that is based

only on the original amount of the loan or principal. This is usually used for short-term loans

where the period of the loan is measured in days rather than years. Simple interest is not used

frequently in modern commercial practice. It can be calculated using the formula:

I = Pin

Equation 1

where:

P = principal/loan

I = interest

i = interest rate

n = period

The future amount of the principal may be calculated by adding the interest (I) to the

principal (P).

𝐹 = 𝑃 + 𝐼

𝐹 = 𝑃 + 𝑃𝑖𝑛

𝑭 = 𝑷(𝟏 + 𝒊𝒏)

Equation 2

There are two types of simple interest namely, ordinary simple interest and exact simple interest.

Ordinary simple interest is based on one banker’s year. A banker year is composed of 12 months

of 30 days each which is equivalent to a total of 360 days in a year. The value of n that is used in

Equations 1 and 2 may be calculated as

𝑑

𝑛 =

360

Exact simple interest is based on the exact number of days in a given year. A normal year

has 365 days while a leap year has 366 days. Unlike the ordinary simple interest where each

month has 30 days, in this type of simple interest, the number of days in a month is based on the

actual number of days each month contains following the Gregorian calendar. The value of n that

is used in Equations 1 and 2 may be calculated as

𝑑

𝑛 =

for ordinary year, and

365

𝑑

𝑛 =

for leap year

360

Example 1:

Problem: ECE Board April 2001

if Php 1,000 accumulates to Php 1,500 when invested at a simple interest for three

years, what is the rate of interest?

Given:

P = Php 1,000

F = Php 1,500

n=3

Required:

i=?

Solution:

F = P(1 + in)

1500 = 1000[1 + i(3)]

i = 0.1667

i = 16.67%

Answer

Example 2:

Problem: ECE Board November 1999

You loaned from a loan firm an amount of Php 100,000 with a rate of simple interest of

20% but the interest was deducted from the loan at the time the money was borrowed. If at the

end of one year, you have to pay the full amount of Php 100,000, what is the actual rate of

interest?

Given:

P = Php 100,000

n=1

Required:

i=?

Solution:

I = 0.20(100,000)

I = 20,000

Amount Received = 100,000 – 20,000

Amount Received = 80,000

I = Pin

20,000 = 80,000(i)(1)

i = 0.25

i = 25%

Answer

Example 3:

Problem: ECE Board November 1999

Mr. J. Reyes borrowed money from the bank. He received from the bank Php 1,842 and

promise to repay Php 2,000 at the end of 10 months. Determine the simple interest.

Given:

P = Php 1,842

F = Php 2,000

Required:

i=?

Solution:

𝑛=

10

12

F = P(1 + in)

2,000 = 1,842[1 + i(10/12)]

i = 0.1029

i = 10.29%

Answer

Example 4:

Problem:

On her recent birthday, April 22, 2019, Nicole was given by her mother a certain sum of

money as birthday present. She decided to invest the said amount on 20% exact simple interest.

If the account will mature on Christmas day at an amount of Php 10,000, how much did Nicole

receive from her mother on her birthday?

Given:

F = Php 10,000

i = 20%

Required:

P=?

Solution:

Solving for the total number of days the money was invested:

April 22 – 30

=8

May

= 31

June

= 30

July

= 31

August

= 31

September

= 30

October

= 31

November

= 30

December 1 – 25

= 25

247 days

F = P(1 + in)

10,000 = P[1 + (0.20)(247/365)]

P = Php 8,807.92

Answer

SOLVE IT!

Solve the following:

1. A deposit of Php 110,000 was made for 31 days. The net interest after deducting 20%

withholding tax is Php 890.36. Find the rate of return annually.

2. It is the practice of almost all banks in the Philippines that when they grant a loan, the

interest for one year is automatically deducted from the principal amount upon release

of money to the borrower. Let us therefore assume that you applied for a loan with a

bank and the Php 80,000 was approved at an interest rate of 14% of which Php 11,200

was deducted and you were given a check of Php 68,800. Since you have to pay the

amount of Php 80,000 one year after, what then will be the effective rate of interest?

3. If you borrow money from your friend with simple interest of 12%, find the present worth

of Php 20,000, which is due at the end of nine months.

4. Determine the exact simple interest on Php 5,000 invested for the period from January

15, 2016 to October 12, 2016, if the rate of interest is 18%.

Compound Interest

Compound interest is defined as the interest of loan or principal which is based not only

on the original amount of the loan or principal but the amount of loan or principal plus the

previous accumulated interest. This means that aside from the principal, the interest now earns

interest as well. Thus, the interest charges grow exponentially over a period of time.

Compound interest is frequently used in commercial practice than simple interest, more

especially if it is a longer period which spans for more than a year.

The future amount of the principal may be derived by the following tabulation:

Period

1

2

3

n

Principal

P

P(1 + i)

P(1 + i)2

Interest

Pi

P(1 + i)i

P(1 + i)2i

Total Amount

P + Pi = P(1 + i)

P(1 + i)(1 + i) = P(1 + i)2

P(1 + i)2(1 + i) = P(1 + i)3

P(1 + i)n

Table 4. Compound Interest

The tabulation above shows that the future amount (total amount) is just the value P(1 +

i) with an exponent which is numerically equal to the period.

It is also observed that compound interest is based on the principles of geometric

progression and using such method, the total amount after each period are as follows:

First term,

a1 = P(1 + i)

Second term, a2 = P(1 + i)2

Third term, a3 = P(1 + i)3 and so on.

Solving for the common ratio,

𝑟=

𝑟=

𝑎2

𝑎1

𝑃(1+𝑖)2

𝑃(1+𝑖)

𝑟 =1+𝑖

Using the formula for nth term of geometric progression:

an = a1rn-1

an = P(1 + i)(1 + i)n-1

an = P(1 + i)n

a. FUTURE AMOUNT, F:

𝑭 = 𝑷(𝟏 + 𝒊)𝒏

where:

P = principal

i = interest per period(in decimal)

n = number of interest periods

(1 + i)n = single payment compound amount factor

0

1

2

3

P

4

n

F

Cash Flow

Equation 3

b. PRESENT WORTH, P:

𝑭

𝑷=

Equation 4

(𝟏+𝒊)𝒏

where:

1

(1+𝑖)𝑛

0

= single payment present worth factor

1

2

P

3

Cash Flow

4

n

F

Continuous Compounding

The concept of continuous compounding is based on the assumption that cash payments

occur once per year but compounding is continuous throughout the year.

The basic equation for future worth of compound interest is

𝐹 = 𝑃(1 + 𝑖)𝑛 .

For m periods per year,

𝑁𝑅

𝐹 = 𝑃(1 + 𝑚 )𝑚𝑁 .

𝑚

Let x = 𝑁𝑅 ,

1

𝐹 = 𝑃(1 + 𝑥)𝑥(𝑁𝑅)(𝑁)

1

𝐹 = 𝑃[(1 + 𝑥)𝑥 ](𝑁𝑅)(𝑁) .

But,

1 𝑥

lim (1 + 𝑥) = 𝑒.

𝑥→∞

Therefore,

𝐹 = 𝑃𝑒 (𝑁𝑅)(𝑁)

where:

P = principal

𝑒 = 2.71828…

NR = nominal rate

N = number of years

(𝑁𝑅)(𝑁)

𝑒

= continuous compounding amount factor

The present worth of continuous compounding is

𝑃=

𝐹

𝑒 𝑁𝑅(𝑁)

Nominal and Effective Rates of Interest

Rate of interest is the cost of borrowing money. It also refers to the amount earned by a

unit principal per unit time.

There are two types of rates of interest, namely the nominal rate of interest and the

effective rate of interest.

Nominal rate of interest is defined as the basic annual rate of interest while effective rate

of interest is defined as the actual or the exact rate of interest earned on the principal during a

one-year period.

For example: A principal is invested at 5% compounded quarterly. In this statement, the

nominal rate is 5% while the effective rate is greater than 5% because of the compounding which

occurs four times a year. The following formula is used to determine the effective rate of interest:

𝐸𝑅 = [1 + 𝑖]𝑚 − 1

Equation 5

where:

m = number of interest period per year

i

= interest per period =

𝑁𝑅

𝑚

NR = nominal rate of interest

or,

𝐸𝑅 = [1 +

𝑁𝑅 𝑚

]

𝑚

−1

If the mode of compounding is annual, then i = NR.

Substituting the values of m and i:

𝐸𝑅 = [1 +

0.05 4

]

4

−1

𝐸𝑅 = 0.0509

𝐸𝑅 = 5.09%

Example 1:

Problem: ECE Board November 2000, ECE Board April 1999

The amount of Php 50,000 was deposited in the bank earning an interest of 7.5% per

annum. Determine the total amount at the end of 5 years if the principal and interest were not

withdrawn during the period.

0

1

2

3

50,000

0

Given:

4

5

F

P = Php 50,000

i = 7.5%

n=5

Required:

F=?

Solution:

F = P(1 + i)n

F = 50,000(1 + 0.075)5

F = Php 71,781.47

Answer

Example 2:

Problem: ME Board October 1999

If Php 5,000 shall accumulate for 10 years at 8% compounded quarterly, then what is the

compound interest at the end of 10 years?

Given:

P = Php 5,000

m = 4 (Note: there are 4 quarters in 1 year)

N = 10

i = 8%

Required:

I=?

Solution:

F = P(1 + i)n

F = 5,000(1 +

0.08 4(10)

)

4

F = Php 11,040.20

I=F–P

I = 11,040.20 – 5,000

I = Php 6,040.20

Answer

Example 3:

Problem: CE Board May 1998

Compute the equivalent rate of 6% compounded semi-annually to a rate compounded

quarterly.

Given:

i = 6%

Quarterly: m = 4

Semi-annually: m = 2

Required:

i =? when m = 4

Solution:

ERquarterly = ERsemi-annually

𝑖

(1 + 4)4 − 1 = (1 +

i = 0.0596

i = 5.96%

0.06 2

2

) −1

Answer

Example 4:

Problem: ME Board April 1998

Php 1,500 was deposited in a bank account 20 years ago. Today, it is worth Php 3,000.

Interest is paid semi-annually. Determine the interest rate paid on this account.

Given:

P = Php 1,500

F = Php 3,000

N = 20

Required:

NR = ?

Solution:

0

1,500

F = P(1 +

𝑁𝑅 mN

)

𝑚

1

2

3

………

20

3,000

3,000 = 1,500(1 +

NR = 0.035

NR = 3.5%

𝑁𝑅 2(20)

)

2

Answer

Example 4:

Problem: ME Board October 1997

When will an amount be tripled with an interest of 11.56%?

Given:

i = 11.56%

Required:

n= ?, when P becomes F=3P

Solution:

F = P(1 = i)n

3P = P(1 + 0.1156)n

3 = 1.1156n

Take log on both sides:

log 3 = n log 1.1156

log 3

n = log 1.1156

n = 10.04 years

Answer

Example 5:

Problem: ME Board October 1997

A nominal interest of 3% compounded continuously is given on the account. What is the

accumulated amount of P 10,000 after 10 years?

Given:

NR = 3%

P = Php 10,000

N = 10

Required:

F=?

Solution:

F = Pe(NR)N

F = 10,000(0.03)(10)

F = Php 13,498.59

Answer

Example 6:

Problem: ME Board April 1996

A firm borrows Php 2,000 for 6 years at 8%. At the end of 6 years, it renews the loan for

the amount due plus Php 2,000 more for 2 years at 8%. What is the lump sum due?

Given:

P = Php 2,000

i = 8%

n=8

Required:

Plump sum due = ?

Solution:

0

1

2

3

………

6

2,000

2,000

F2

F1

Solving for F1:

F = P(1 + i)n

F1 = 2,000(1 + 0.08)8

F1 = 3,701.86

Solving for F2:

F2 = 2,000(1 + 0.08)2

F2 = 2,332.80

Total Future Worth = F1 + F2

Total Future Worth = 6,034.66

Solving for the present worth of the total future worth:

𝑃=

𝑃=

𝐹

(1+𝑖)𝑛

6,034.66

(1+0.08)8

P = Php 3,260.34

Answer

SOLVE IT!

Solve the following:

1. What is the effective rate corresponding to 18% compounded daily? Take 1 year is equal

to 360 days.

2. Which of these gives the lowest effective rate of interest?

a. 12.35% compounded annually

b. 11.90% compounded semi-annually

c. 12.20% compounded quarterly

d. 11.60% compounded monthly

3. How many years will Php 100,000 earn a compound interest of Php 50,000 if the interest

rate is 9% compounded quarterly?

4. Mandarin Bank advertises 9.5% account that yields 9.84% annually. Find how often the

interest is compounded.

5. Alexander Michael owes Php 25,000 due in one year and Php 75,000 due in four years.

He agrees to pay Php 50,000 today and the balance in two years. How much must he pay

at the end of two years if money is worth 5% compounded semi-annually?

The Concept of Equivalence

Alternative should be compared as far as possible when they produce similar results,

serve the same purpose, or accomplish the same function, though this is not always possible in

some types of economy studies.

How can alternatives for providing the same service or accomplishing the same function

be compared when interest is involved over extended periods of time? Thus, we should consider

the comparison of alternative options, or proposals, by reducing them to an equivalent basis that

is dependent on (1) the interest rate, (2) the amounts of money involved, (3) the timing of

monetary receipts and/or expenses, and (4) the manner in which the interest, or profit, on

invested capital is paid and the initial capital recovered.

To better understand the mechanics of interest and to expand on the notion of economic

equivalence, consider a situation in which we borrow Php 8,000 and agree to repay it in four

years at an interest rate of 10% per year. There are many plans by which the principal of this loan

and the interest on it can be repaid. For simplicity, we have selected four plans to demonstrate

the idea of economic equivalence. Here equivalence means that all four plans are equally

desirable to the borrower. In each that interest rate is 10% per year and the original amount

borrowed is Php 8,000; thus, differences among the plans rest with items (3) and (4) above. The

four plans are shown in Table 5.

(1)

(2)

(3) = 10% x (2) (4) = (2) + (3)

(5)

Amount Owed

Interest

Total Money

at Beginning

Accrued for

Owed at

Principal

Year

of Year

Year

End of Year

Payment

Plan 1: At End of Each Year Pay Php 2,000 Principal Plus Interest Due

(6) = (3) + (5)

Total

End-of-Year

Payment (Cash Flow)

1

2

3

4

Php 2,800

2,600

2,400

2,200

Php 10,000

(total amount repaid)

Php 8,000

6,000

4,000

2,000

20,000 Php-yr

Php 800

600

400

200

Php 2,000

(total interest)

Php 8,800

6,600

4,400

2,200

Php 2,000

2,000

2,000

2,000

Php 8,000

Plan 2: Pay Interest Due at End of Each Year and Principal at End of Four Years

1

2

3

4

Php 8,000

8,000

8,000

8,000

32,000 Php-yr

Php 800

800

800

800

Php 3,200

(total Interest)

Php 8,800

8,800

8,800

8,800

Php

0

0

0

8,000

Php 8,000

Php

800

800

800

8,800

Php 11,200

(total amount repaid)

Php 1,724

1,896

2,086

2,294

Php 8,000

Php

Plan 3: Pay in Four Equal End-of-Year Payments

1

2

3

4

Php 8,000

6,276

4,380

2,294

20,960 Php-yr

Php

800

628

438

230

Php 2,096

(total interest)

Php 8,800

6,904

4,818

2,524

2,524

2,524

2,524

2,524

Php 10,096

(total amount repaid)

Plan 4: Pay Principal and Interest in One Payment at End of Four Years

1

2

3

4

Php 8,000

8,800

9,680

10,648

Php 37,130 Php-yr

Php

800

880

968

1,065

Php 3,713

(total interest)

Php 8,800

9,680

10,648

11,713

Php

0

0

0

8,000

Php 8,000

Php

0

0

0

11,713

Php 11,713

(total amount repaid)

Table 5. Four Plans for Repayment of Php 8,000 in Four Years with Interest at 10% Per Year

In Plan 1, Php 2,000 of the loan principal is repaid at the end of each years one through

four. As a result, the interest we repay at the end of a particular year is affected by how much

we syill owe on the loan at the beginning of that year. Our end-of-year payment is just the sum

of Php 2,000 and interest computed on the beginning-of-year amount owed.

Plan 2 indicates that none of the loan principal is repaid until the end of the fourth year.

Our interest cost each year is Php 800, and it is repaid at the end of years one through four.

Because interest does not accumulate in either Plan 1 or Plan 2, compounding of interest is not

present. Notice that Php 3,200 in interest paid in Plan 2, whereas only Php 2,000 is paid in Plan

1. We had the use of the Php 8,000 principal for four years in Plan 2 but, on average, had the use

of much less than Php 8,000 in Plan 1.

Plan 3 requires that we repay equal end-of-year amounts of Php 2,524 each. Observe that

the four end-of-year payments in Plan 3 completely repay the Php 8,000 loan principal with

interest at 10% per year.

Finally, Plan 4 shows that no interest and no principal are repaid for the first three years

of the loan period. Then at the end of the fourth year, the original loan principal plus the

accumulated interest for four years is repaid in a single lump-sum amount of Php 11,712.80

(rounded in the table). Plan 4 involves compound interest. The total amount of interest repaid in

Plan 4 is highest of all the plans considered. Not only was the principal repayment in Plan 4

deferred until the end of year four, but we also deferred all interest payment until that time.

Going back to the notion of economic equivalence, if interest rates remain constant at

10% for the plans shown in Table 5, all four plans are equivalent. This assumes that one can freely

borrow and lend at the 10% rate. Hence, we would be indifferent about whether the principal is

repaid early in the loan’s life (e.g. Plans 1 and 3) or repaid at the end of year four (e.g. Plans 2 and

4). Economic equivalence is established, in general, when we are indifferent between a future

payment, or series of future payments, and a present sum of money.

When total peso-years are calculated for each plan and divided into total interest paid

over the four years (the sum of column 3), the ratio is found to be constant:

Plan

1

2

3

4

Area Under Curve

(Peso-Years)

(Sum of Column 2 in

Table 5)

Php 20,000

32,000

20,960

37,130

Total

Interest Paid

(Sum of Column 3 in

Table 5)

Php 2,000

3,200

2,096

3,713

Ratio of

Total Interest

to Peso-Years

0.10

0.10

0.10

0.10

Table 6. Total interest to Peso-Years Ratio for All Four Plans

Because the ratio is constant at 0.10 for all plans, we can deduce that all repayment

methods considered in Table 5 are equivalent, even though each involves a different total endof-year payment in column 6. Dissimilar peso-years of borrowing, by itself does not necessarily

mean that different loan repayment plans are or are not equivalent. In summary, equivalence is

established when total interest paid, divided by peso-years of borrowing, is a constant ratio

among financing plans.

Notation and Cash Flow Diagram/Tables

The following notation is utilized in formulas for compound interest calculations:

i =

N =

P =

F

=

A =

effective interest rate per interest period

number of compounding periods

present sum of money; the equivalent value of one of more cash flows at a

reference point in time called the present

future sum of money; the equivalent value of one or more cash flows at a

reference point in time called the future

end-of-period cash flows (or equivalent end-of-period values) in a uniform series

continuing for a specified number of periods, starting at the end of the first period

and continuing through the last period

Cash flows are important in engineering economy because they form the basis for

evaluating alternatives. The use of cash flow (time) diagrams and/or tables is strongly

recommended for situations in which the analyst needs to clarify or visualize what is involved

when flows of money occur at various times. In addition, viewpoint (Principle 3) is an essential

feature of cash flow diagrams.

The difference between total cash inflows (receipts) and cash outflows (expenditures) for

a specified period of time is the net cash flow for the period.

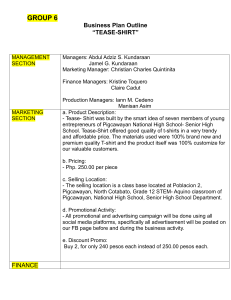

Figure 3 shows a cash flow diagram for Plan 4 of Table 5, and Figure 4 depicts the net cash

flow of Plan 3. These two figures also illustrate the definition of the preceding symbols and their

placement on a cash flow diagram. Notice that all cash flows have been placed at the end of the

year to correspond with the convention used in Table 5. In addition, a viewpoint has been

specified.

Figure 3. Cash Flow Diagram for Plan 4 of Table 5

Figure 4. Cash Flow Diagram for Plan 3 of Table 5

The cash flow diagram employs several conventions:

1. The horizontal line is a time scale, with progression of time moving from left to right.

The period (e.g. year, quarter, month) labels can be applied to intervals of time rather

than to points on the time scale.

2. The arrows signify cash flows and are placed at the end of the period. If a distinction

needs to be made, downward arrows represent expenses (negative cash flows or cash

outflows) and upward arrows represent receipts (positive cash flows or cash inflows).

3. The cash flow diagram is dependent on the point of view. For example, the situations

shown in Figures 3 and 4 were based on cash flow as seen by the lender. If directions

of all arrows have been reversed, the problem would have been diagrammed from

the borrower’s point of view.

QUIZ 1

Before evaluating the economic merits of a proposed investment, the XYZ Corporation

insists that its engineers develop a cash flow diagram of the proposal. An investment of Php

10,000 can be made that will produce uniform annual revenue of Php 5,310 for five years and

then have a market value of Php 2,000 at the end of year five. Annual expenses will be Php 3,000

at the end of each year for operating and maintaining the project. Draw a cash flow diagram for

the five-year life of the project. Use the corporation’s viewpoint.

Key Points

Engineering economy involves the systematic evaluation of the economic

merits of proposed solution to engineering problems.

The foundation of the discipline of Engineering Economy can be seen in terms

of seven principles which include (1) develop the alternatives, (2) focus on

the differences, (3) use a consistent viewpoint, (4) use a common unit of

measure, (5) consider all relevant criteria, (6) make risk and uncertainty

explicit, and (7) revisit your decisions.

The engineering economic analysis procedure involves seven steps: (1)

problem recognition, definition, and evaluation, (2) development of the

feasible alternatives, (3) development of the outcomes and cash flows for

each alternative, (4) selection of a criteria, (5) analysis and comparison of the

alternatives, (6) selection of the preferred alternative, and (7) performance

monitoring and post-evaluation results.

Fixed costs are those unaffected by changes in activity level over a feasible

range of operations for the capacity or capability available.

Variable costs are those associated with an operation that vary in total with

the quantity of output or other measures of activity level.

An incremental cost, or incremental revenue, is the additional cost, or

revenue, that results from increasing the output of a system by one (or more)

units.

Recurring costs are those that are repetitive and occur when an organization

produces similar goods or services on a continuing basis.

Nonrecurring costs are those that are not repetitive, even though the total

expenditure may be cumulative over a relatively short period of time.

Direct costs are those that can be reasonably measured and allocated to a

specific output or work activity.

Indirect costs are those that are difficult to attribute or allocate to a specific

output or work activity.

Overhead costs consist of plant operating costs that are not direct labor or

direct material costs.

Standard costs are representative costs per unit of output that are

established in advance of actual production or service delivery.

A cost that involves payment of cash is called a cash cost.

A book cost is one that does not involve a cash transaction and is reflected in

the accounting system as a noncash cost.

A sunk cost is one that has occurred in the past and has no relevance to

estimates of future costs and revenues related to an alternative course of

action.

An opportunity cost is incurred because of the use of limited resources, such

that the opportunity to use those resources to monetary advantage in an

alternative use is foregone.

Life-cycle cost refers to a summation of all costs, both recurring and

nonrecurring, related to a product, structure, system, or service during its life

span.

When the influence of time on money is not a significant consideration, cost

analyses are usually called present economy studies.

The term capital refers to wealth in the form of money or property that can

be used to produce more wealth.

Equity capital is that owned by individuals who have invested their money or

property in a business project or venture in the hope of receiving a profit.

Debt capital, often called borrowed capital, is obtained from lenders for