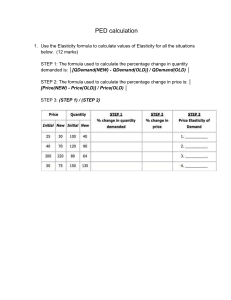

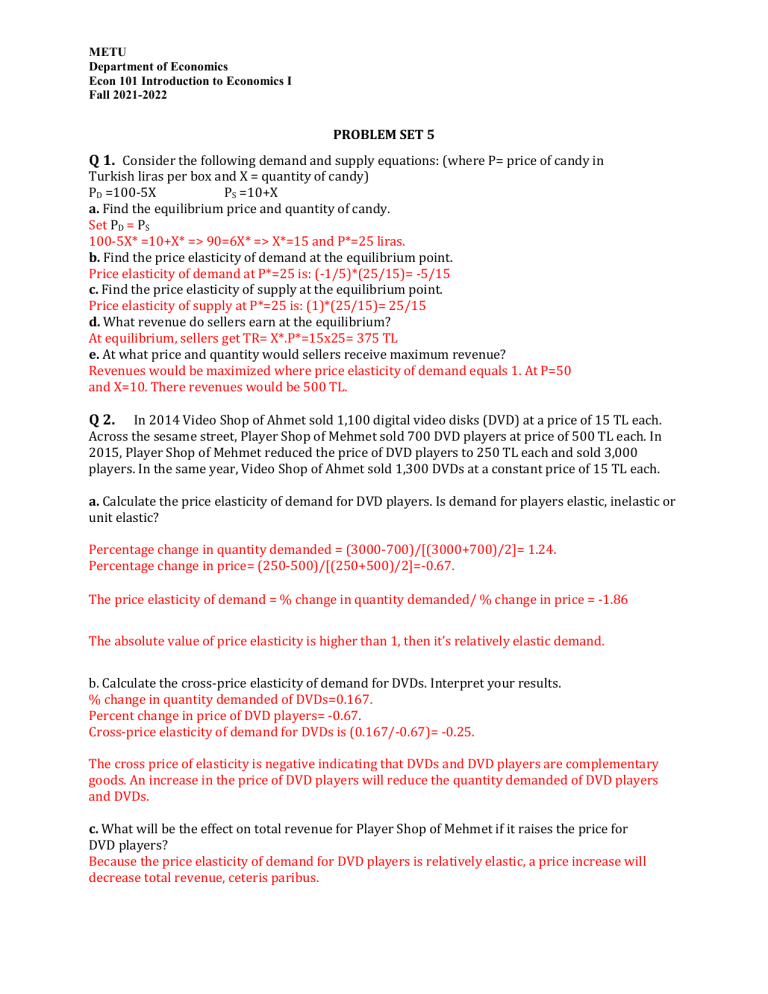

METU Department of Economics Econ 101 Introduction to Economics I Fall 2021-2022 PROBLEM SET 5 Q 1. Consider the following demand and supply equations: (where P= price of candy in Turkish liras per box and X = quantity of candy) PD =100-5X PS =10+X a. Find the equilibrium price and quantity of candy. Set PD = PS 100-5X* =10+X* => 90=6X* => X*=15 and P*=25 liras. b. Find the price elasticity of demand at the equilibrium point. Price elasticity of demand at P*=25 is: (-1/5)*(25/15)= -5/15 c. Find the price elasticity of supply at the equilibrium point. Price elasticity of supply at P*=25 is: (1)*(25/15)= 25/15 d. What revenue do sellers earn at the equilibrium? At equilibrium, sellers get TR= X*.P*=15x25= 375 TL e. At what price and quantity would sellers receive maximum revenue? Revenues would be maximized where price elasticity of demand equals 1. At P=50 and X=10. There revenues would be 500 TL. Q 2. In 2014 Video Shop of Ahmet sold 1,100 digital video disks (DVD) at a price of 15 TL each. Across the sesame street, Player Shop of Mehmet sold 700 DVD players at price of 500 TL each. In 2015, Player Shop of Mehmet reduced the price of DVD players to 250 TL each and sold 3,000 players. In the same year, Video Shop of Ahmet sold 1,300 DVDs at a constant price of 15 TL each. a. Calculate the price elasticity of demand for DVD players. Is demand for players elastic, inelastic or unit elastic? Percentage change in quantity demanded = (3000-700)/[(3000+700)/2]= 1.24. Percentage change in price= (250-500)/[(250+500)/2]=-0.67. The price elasticity of demand = % change in quantity demanded/ % change in price = -1.86 The absolute value of price elasticity is higher than 1, then it’s relatively elastic demand. b. Calculate the cross-price elasticity of demand for DVDs. Interpret your results. % change in quantity demanded of DVDs=0.167. Percent change in price of DVD players= -0.67. Cross-price elasticity of demand for DVDs is (0.167/-0.67)= -0.25. The cross price of elasticity is negative indicating that DVDs and DVD players are complementary goods. An increase in the price of DVD players will reduce the quantity demanded of DVD players and DVDs. c. What will be the effect on total revenue for Player Shop of Mehmet if it raises the price for DVD players? Because the price elasticity of demand for DVD players is relatively elastic, a price increase will decrease total revenue, ceteris paribus. Q 3. Consider the following demand and supply relationships in the market for golf balls where is the price of titanium, a metal used to make golf clubs, and R is the price of rubber. QD =90−2P −2T and QS =−9+5P −2.5R a) If R=2$ and T=10$, calculate the equilibrium price and quantity of golf balls. In equilibrium, 70 – 2P = –14 + 5P, which implies that P = 12 and Q = 46 b) At the equilibrium values, calculate the price elasticity of demand and the price elasticity of supply. Elasticity of Demand = -2*(12/46) = -0.52 and Elasticity of Supply = 5*(12/46) = 1.3 c) At the equilibrium values, calculate the cross-price elasticity of demand for golf balls with respect to the price of titanium. What does the sign of this elasticity tell you about whether golf balls and titanium are substitutes or complements? Eg,t = -2*(10/46) = -0.43 The negative sign indicates that titanium and golf balls are complements, i.e., when the price of titanium goes up the demand for golf balls decreases. Q 4. Suppose when the price of pizza is $4, the quantity demanded of pizza is 60 slices and the quantity demanded of cheese bread is 100 pieces. When the price of pizza is $2, the quantity demanded of pizza is 80 slices and the quantity demanded of cheese bread is 70 pieces. a) Calculate the price elasticity of demand for pizza. b) Is the demand for pizza elastic, inelastic or unit elastic? Absolute value of the price elasticity is less than 1, and therefore, the demand for pizza is price inelastic. c) Calculate the cross-price elasticity of cheese bread. 2 d) Are these goods substitutes or complements? Cross­price elasticity of cheese bread is positive; these goods are substitutes for each other. Q 5. Suppose market demand for coffee-shop coffee (in millions of cups per year) is given by the equation QD= 18-(3/2)P, while coffee is supplied according to the market supply equation QS=3P. a) Solve for the equilibrium price and quantity, consumer surplus, and producer surplus. Graph your results. 3P= 18-(3/2)P => 9/2 P =18 P=4 Q=3P= 12 The equilibrium is at P= 4, Q=12 Consumer surplus is the area below the demand curve and above the equilibrium price, CS. To calculate the consumer surplus, recall that Area of a triangle = ½* base * height In this case CS = ½*12*8=48. Producer surplus is the area below the price and above the supply curve, PS. PS= ½*4*12= 24. b) Suppose government imposes an excise tax on coffee of 3 TL per coffee. Graph the changes in the equilibrium price and quantity (Hint: to see how the tax will shift the supply curve, solve for “the inverse supply curve”-price as a function of the quantity supplied. Then add 3 TL to the right hand side of the inverse supply curve, implying that price is 3 TL higher for every quantity of coffee sold. ) 3 In order to see why the supply curve shifts this way, recall that the supply curve gives the number of units the supplier is willing to supply at any given price. We can see that before the tax, the coffee shops were willing to supply 9 million cups of coffee at 3 TL a cup. If a tax of 3 TL per cup is levied, when the CONSUMER pays 6TL per cup, 3TL of that money goes to the government and 3 TL goes to suppliers. So since the producer is receiving 3 TL per cup, he should be willing to supply 9 million cups of coffee- the same as before the tax, when price was 3 TL. In other words, the producer is concerned with the price he will receive after the tax, which is 3 TL lower than what the consumer pays. So, if we have the price as a function of quantity (inverse supply curve): P=1/3 QS This tells us, for any quantity Q, what price the producer would need to get to make him willing to supply that quantity. If we have a 3 TL tax, this will mean that the producer will have to get 3 TL more than before to supply that quantity. So to get the new inverse supply curve: Pnew = P+3=1/3 QS+3 Pnew =1/3 QS+3 Or equivalently, QS=3P-9 To get the new equilibrium price and quantity: 3P-9=18-3/2 P 9/2 P =27 P=6 Q=3P-9 = 9 c. Show on a graph the new producer surplus and consumer surplus. Also show the tax revenue and the deadweight loss. How much revenue is the government getting from the tax? The consumer surplus is the area above the price paid and below the demand curve, CS. The producer surplus is the area between the net price received (market price the amount of the tax) and the original supply curve, PS. The deadweight loss is the triangle between the before-tax supply curve & the demand curve, between the new quantity and the old quantity. The tax revenue is just the amount of the tax multiplied by the quantity sold, 3TL*9 million =27 million TL. The new CS =0.5*6*9=27 4 The new PS=0.5*3*9=13.5 The DWL is 4.5, so … New CS + New PS + DWL+ Tax Revenue = Old CS + Old PS =72 d. Starting with the demand and supply functions given at the beginning of this question, assume that government gives a subsidy of 1,5 TL to producers. Graph the changes in the equilibrium price and quantity. After subsidy: QS’= QD then 3 (P’+3/2)= 18- (3/2)P’ At the new equilibrium: 18 – (3/2) P’ = 3P’+9/2 P’* = 3 and Q’* = 13,5 Consumers: Old eq. price - new eq. price = 4-3 = 1 Producers: Price received by producers after subsidy- Old eq. price = (3+3/2)-4 = 1/2=0.5 Who benefits more from the subsidy? Why? Illustrate the effect of the subsidy on the demand and supply curves. Since elasticity of supply is higher than elasticity of demand, consumers benefit more. Q 6. Given the following demand and supply equations: QD =60-3P QS =10+2P a. Calculate the equilibrium price and quantity levels. 60 – 3P = 10 + 2P P* = 10 and Q* = 30 b. Suppose now that government imposes a tax on producers, which amounts to $5 per unit of good. What will be the new equilibrium price and quantity? 5 TL shift left in the supply curve implies that P=QS/2 – 5 + T (where T=5) Then, QSnew=2P At eqm, QSnew= QD 2P = 60 – 3P => P*new = 12; Q*new = 24 5 c. Find the price elasticity of demand between the new and old equilibrium prices. % Change in quantity demanded = (24 – 30) / ((30 + 24) / 2) = -6/ 27 % Change in price = (12 – 10) / ((10 + 12) / 2) = 2/11 Elasticity= % Change in quantity demanded / % Change in price = – 11/9. d. What is the tax revenue for the government and what percentage of it falls on the part of consumers? Tax revenue = 5*24 = 120 Total tax burden that falls on consumers = (12 – 10)*24 = 48 Total tax burden that falls on consumers in percentage terms = 48/120 = 40% From now on, consider that: QD = 60 – (0.5) P and QS = 10 + 2P e. Solve the parts (a), (b), (c) and (d) for these new demand and supply equations. a) 60-(0.5)P = 10+2P then P* = 20 ; Q* = 50 b) $5 shift left in the supply curve implies that QSnew = 2P 2P = 60 – (0.5)P then P*new = 24 ; Q*new = 48 c) Change in quantity demanded = (48 – 50) / ((48 + 50) / 2) = -2/ 49 Change in price = (24 – 20) / ((24 + 20) / 2) = 2/11 Elasticity= % Change in quantity demanded / % Change in price = – 11/49. d) Tax revenue = 5*48 = 240 Total tax burden that falls on consumers = (24 – 20)*48 = 192 in percentage terms, 80%. f. Comparing your results in parts (d) and (e), explain reasons for the change in total tax revenue of government and the change in the burden that falls on the consumers. Notice that equilibrium prices change exactly at the same amount in percentage terms in these two examples. However, in the second example, equilibrium quantity decreases less in percentage terms, since demand curve becomes less elastic now. For the changes in equilibrium prices, demand is elastic in the first example, but it is inelastic in the second example. Since consumers are less reactive to changes in prices in the second example, they bear much of the tax burden now. When demand becomes less elastic, the tax burden falls on consumers’ part increases, holding other things constant. PART B: MULTIPLE CHOICES Q.1 If a $100 drop in the price of a $10,000 car resulted in an increase in the quantity of cars purchased from 100 to 110 and a $100 drop in the price of a $1,000 vacation rental resulted in an increase in the quantity of weekly vacation homes rented from 100 to 110, the price elasticity of demand is: A) greater for the car. B) less for the car. C) the same for both the car and the vacation rental. D) not comparable. 6 Answer: A Q.2 Refer to the graph shown. Demand is inelastic on line segment: A) AB. B) BC. C) CD. D) The demand is not inelastic on any of these line segments. Answer: C Q.3 Which of the following statements is true about a downward-sloping demand curve that is a straight line? A) The slope and the elasticity are the same at all points. B) The slope remains the same, but elasticity rises as you move down the demand curve. C) The slope remains the same, but elasticity falls as you move down the demand curve. D) The slope and the elasticity fall as you move down the demand curve. Answer: C Q.4 Refer to the following graph. Elasticity is greatest at point: A) A. B) B. 7 C) C. D) It is the same everywhere along this supply curve. Answer: D Q.5 true? Refer to the following table to answer the question. Which of the following statements is Price of A Quantity Demanded of A Quantity Demanded of B Quantity Demanded of C $1.00 80 100 5 $1.50 60 98 10 $2.00 40 96 15 $2.50 20 94 20 $3.00 0 92 25 A) A and B are complements whereas A and C are substitutes. B) A and C are complements whereas A and B are substitutes. C) A and B are complements and A and C are complements. D) A and B are substitutes and A and C are substitutes. Answer: A Q.6 Elasticity of demand for bus services is 0.23 for the peak hours and 0.42 for off-peak hours. The same percentage increase in price would: A) lower revenues for both, but more for peak hours. B) raise revenues for both, but more for peak hours. C) raise revenue for peak hours but lower revenue for off-peak hours. D) lower revenue for peak hours but raise revenue for off-peak hours. Answer: B Q.7 Which of the following statements is true? A) In general, if a product has few substitutes it will have an elastic demand. B) The more time that passes the more inelastic the demand for a product becomes. C) The demand curve for a necessity is more elastic than the demand curve for a luxury. D) The more narrowly we define a market, the more elastic the demand for a product will be. Answer: D Q.8 Suppose Tinsel Town Videos lowers the price of its movie club membership by 10 percent and as a result, CineArts Videos experienced a 16 percent decline in its movie club membership. What is the value of the cross-price elasticity between the two movie club memberships? 8 A) -1.6 B) -0.625 C) 0.625 D) 1.6 Answer: D Q.9 In which case will the price change be the greatest (assuming the shifts described are the same size)? A) Demand is inelastic, and supply shifts to the left. B) Supply is perfectly elastic, and demand shifts to the left. C) Demand is elastic, and supply shifts to the left. D) Supply is elastic, and demand shifts to the left. Answer: A Q.10 Last year, Sefton purchased 60 pounds of potatoes to feed his family of five when his household income was $30,000. This year, his household income fell to $20,000 and Sefton purchased 80 pounds of potatoes. All else constant, Sefton's income elasticity of demand for potatoes is A) negative, so Sefton considers potatoes to be an inferior good. B) positive, so Sefton considers potatoes to be an inferior good. C) positive, so Sefton considers potatoes to be a normal good and a necessity. D) negative, so Sefton considers potatoes to be a normal good. Answer: A Q.11 The supply of Russian caviar from the Caspian Sea diminished after the collapse of Soviet communism. The price of caviar rose from $395 a pound to $595 a pound. Still, revenue from the sale of caviar rose 30 percent. You can conclude that: A) an elastic supply curve for caviar has shifted to the left. B) an inelastic supply curve for caviar has shifted to the left. C) the supply curve for caviar has shifted to the left along an inelastic demand curve. D) the supply curve for caviar has shifted to the left along an elastic demand curve. Answer: C Q.12 For people who live near a bus route, a subway station, or a commuter rail line, public transportation provides a substitute to driving their own cars. So, for these people, the cross-price elasticity of demand between gasoline and public transportation is A) positive. B) negative. 9 C) zero. D) infinity. Answer: A Q.13 If the minimum price that the Smith family would be willing to sell their house for is $185,000, but they in fact sell it for $210,000, they will receive: A) producer surplus in the amount of $210,000. B) producer surplus in the amount of $25,000. C) consumer surplus in the amount of $210,000. D) consumer surplus in the amount of $25,000. Answer: B Q.14 Paul goes to Sportsmart to buy a new tennis racquet. He is willing to pay $200 for a new racquet, but buys one on sale for $125. Paul's consumer surplus from the purchase is A) B) C) D) $325. $200. $125. $75. Answer: D Q.15 In an unregulated market equilibrium A) B) C) D) total consumer surplus equals total producer surplus. marginal benefit and marginal cost are maximized. consumers and producers benefit equally. the marginal benefit equals the marginal cost of the last unit sold. Answer: D Refer to the figure below for the next two questions. 10 Q.16 What area represents producer surplus at a price of P2? A) B) C) D) A+B B+D A+B+C A+B+C+D+E Answer: C Q.17 What area represents the increase in producer surplus when the market price rises from P1 to P2? A) B) C) D) B+D A+C+E C+E A+B Answer: D Refer to the figure below for the next four questions. Figure shows the demand and supply curves for the almond market. The government believes that the equilibrium price is too low and tries to help almond growers by setting a price floor at Pf. 11 Q.18 What area represents consumer surplus after the imposition of the price floor? A) B) C) D) A+B+E A+B A+B+E+F A Answer: D Q.19 What is the area that represents producer surplus after the imposition of the price floor? A) B) C) D) A+B+E B+E B+E+F B+C+D+E Answer: B Q.20 What area represents the portion of consumer surplus that has been transferred to producer surplus as a result of the price floor? A) B) C) D) B B+C B+E E Answer: A 12 Q.21 What area represents the deadweight loss after the imposition of the price floor? A) B) C) D) C+D+G F+G C+D C+D+F+G Answer: C Q.22 A per-unit tax will result in a deadweight loss unless the tax causes no change in: A) the price consumers pay. B) the price producers receive after paying it. C) equilibrium quantity sold. D) either equilibrium price or equilibrium quantity. Answer: C Q.23 Refer to the graph shown. Assume that the market is initially in equilibrium at a price of $10 and a quantity of 500 units. If the government imposes a $4 per-unit tax on this product, producer surplus will fall from: A) 2,500 to 1,600. B) 5,000 to 3,200. C) 3,200 to 1,600. D) 5,000 to 2,500. Answer: A 13 Q.24 The figure below represents the market for pecans. Assume that this is an unregulated a competitive market. At a price of $9 A) the marginal cost of pecans is greater than the marginal benefit; therefore, output is inefficiently low. B) producers should lower the price to $3 in order to sell the quantity demanded of 4,000. C) the marginal benefit of pecans is greater than the marginal cost; therefore, output is inefficiently high. D) the marginal benefit of pecans is greater than the marginal cost; therefore, output is inefficiently low. Answer: D Q.25 Suppose the equilibrium price of organic almond butter is $10 a jar. At that price, quantity of almond butter demanded and supplied is 100,000. If a $6 tax per jar paid by suppliers increases the equilibrium price to $14 per jar and reduces the equilibrium quantity sold to 90,000: A) suppliers pay a greater portion of the tax because they are more price elastic. B) consumers pay a greater portion of the tax because they are less price elastic. C) suppliers pay a greater portion of the tax because the tax is levied on them. D) suppliers pay a greater portion of the tax because they are less price elastic. Answer: B Q.26 Assuming a binding price floor, the more elastic the supply and demand curves are, the: A) smaller the shortage a price floor will create. B) greater the shortage a price floor will create. C) smaller the surplus a price floor will create. D) greater the surplus a price floor will create. Answer: D Q.27 When the price of fresh fish increases 10%, quantity demanded decreases 5%. The price elasticity of demand for fresh fish is ___ and total revenue from fresh fish sales will ___. A) elastic; increase 14 B) elastic; decrease C) inelastic; decrease D) inelastic; increase Answer: D Q.28 The income elasticity of demand for education is 3.5. Thus, a 4% increase in income will A) B) C) D) decrease the quantity of education demanded by 3.5%. increase the quantity of education demanded by 14%. decrease the quantity of education demanded by 14%. increase the quantity of education demanded by 4%. Answer: B Q.29 The supply of product X is elastic if the price of X rises by: A) B) C) D) 5 percent and quantity supplied rises by 7 percent. 8 percent and quantity supplied rises by 8 percent. 10 percent and quantity supplied remains the same. 7 percent and quantity supplied rises by 5 percent. Answer: A PART C: TRUE/FALSE/UNCERTAIN 1) A price ceiling sets a minimum price for a good. FALSE 2) A price floor keeps the price of a good from falling too low. TRUE 3) If a price floor is set below the equilibrium price, the price floor will have no effect on the market. TRUE 4) Producer surplus is the difference between the lowest price a firm is willing to accept for a product and the price it actually receives for the product. TRUE 15 5) If the demand is inelastic, the absolute value of the price elasticity coefficient is greater than one. FALSE 6) Income elasticity of demand for a good is positive. UNCERTAIN, it depends on good being normal or inferior. 7) A perfectly inelastic demand curve is represented by a vertical line. TRUE 8) If the cross elasticity of demand for two goods is 1.0, then these two goods are substitutes. TRUE 9) Refer to the following graph. If price is currently at B and rises, total revenue will rise. FALSE 10) The total cost of taxation to consumers and producers generally exceeds the amount of tax revenue collected by government. TRUE 11) If a tax is legally required to be paid by sellers, sellers typically bear the full burden of the tax. FALSE 12) If the government's goal is to alter people's behavior through taxation, taxing goods with relatively elastic demand and supply would be most effective. 16 TRUE 13) Unlike excise taxes, price ceilings create no deadweight loss. FALSE 17