[Dermot McAleese] Economics For Business Competit(Bookos.org) (1)

advertisement

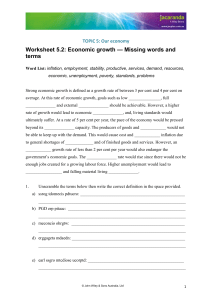

![[Dermot McAleese] Economics For Business Competit(Bookos.org) (1)](http://s2.studylib.net/store/data/027335701_1-7f52e23dfef133ce88ea7182d1e3a46d-768x994.png)