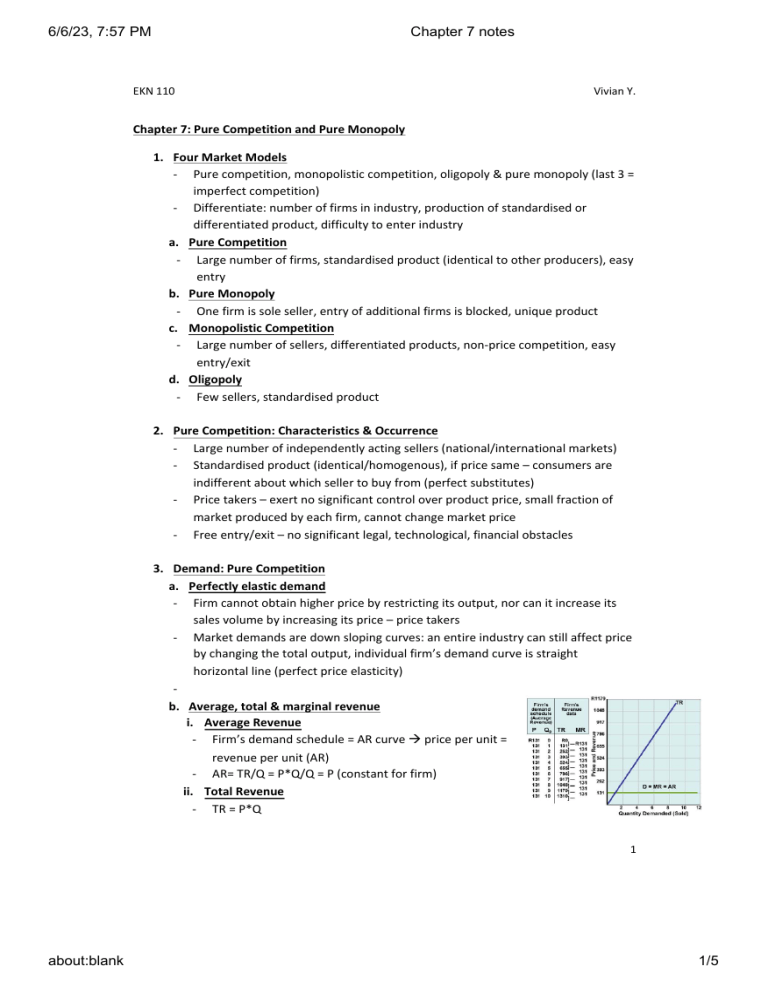

6/6/23, 7:57 PM Chapter 7 notes EKN 110 Vivian Y. Chapter 7: Pure Competition and Pure Monopoly 1. Four Market Models - Pure competition, monopolistic competition, oligopoly & pure monopoly (last 3 = imperfect competition) - Differentiate: number of firms in industry, production of standardised or differentiated product, difficulty to enter industry a. Pure Competition - Large number of firms, standardised product (identical to other producers), easy entry b. Pure Monopoly - One firm is sole seller, entry of additional firms is blocked, unique product c. Monopolistic Competition - Large number of sellers, differentiated products, non-price competition, easy entry/exit d. Oligopoly - Few sellers, standardised product 2. Pure Competition: Characteristics & Occurrence - Large number of independently acting sellers (national/international markets) - Standardised product (identical/homogenous), if price same – consumers are indifferent about which seller to buy from (perfect substitutes) - Price takers – exert no significant control over product price, small fraction of market produced by each firm, cannot change market price - Free entry/exit – no significant legal, technological, financial obstacles 3. Demand: Pure Competition a. Perfectly elastic demand - Firm cannot obtain higher price by restricting its output, nor can it increase its sales volume by increasing its price – price takers - Market demands are down sloping curves: an entire industry can still affect price by changing the total output, individual firm’s demand curve is straight horizontal line (perfect price elasticity) b. Average, total & marginal revenue i. Average Revenue - Firm’s demand schedule = AR curve à price per unit = revenue per unit (AR) - AR= TR/Q = P*Q/Q = P (constant for firm) ii. Total Revenue - TR = P*Q 1 about:blank 1/5 6/6/23, 7:57 PM Chapter 7 notes EKN 110 Vivian Y. - Increases by constant amount – straight line, slopes upward, constant iii. Marginal Revenue - Change in TR from selling 1 more unit of output - MR = ∆TR/∆Q = ∆(P*Q)/∆Q = P*∆Q/∆Q = P (constant) 4. Profit Maximisation in Short-run a. TR-TC approach - Firm is price taker à maximise economic profit by adjusting output à changes in amount of variable resources (fixed plant) - Profit/loss = TR – TC = P*Q – (TFC + TVC) à profit maximisation = total economic profit is at its maximum - Break-even point: output at which firm makes normal profit but not an economic profit, TR covers TC, any output between break-even points will produce economic profit - Maximum profit is where vertical distance between TR and TC curves is greatest b. MR-MC approach - Producing is preferable to shutting down – produce any output whose MR>MC = gain in revenue - If MC>MR – firm should not produce à adds more costs than revenue, profit would decline/ loss would increase - Initial stages of production – output is low, MR>MC (usually); later stages – output is high, rising MC>MR - Maximise profit/ minimise loss by producing output where MR = MC à firm should produce last complete unit of output where MR>MC (P=MC) i. Profit-Maximising case - Per unit profit = (Price – ATC)*Q à x total units of output = Profit - Firm is happy to accept lower profit per unit as it still adds to total profit ii. Loss-Minimising case - Very early stages of production MP is low, MC is high à firm would still produce because loss is less than firms total fixed costs, want to cover average variable costs iii. Shutdown case - Will not produce when AVC>P, smallest loss will be greater than fixed costs 5. Marginal Cost & Short-run Supply - Quantity supplied increases as price increases à economic profit is higher at higher prices 2 about:blank 2/5 6/6/23, 7:57 PM Chapter 7 notes EKN 110 Vivian Y. Price P1 < min. AVC à Qs = 0 Price P2 = min. AVC à Q2 units is supplied (MR2=MC) – just covers TVC, loss = fixed costs – indifferent to shutting down/supplying - Price P3 > min. AVC à Q3 units minimise short-run losses (MR=MC) - Price P4 à break even à supply Q4 = normal profit (no economic profit) TR =TC and MR = ATC - Price P5 = economic profit à Q5 6. Pure Monopoly - Single seller: single firm is sole producer (firm & industry are synonymous) - No close substitutes (product is unique) - the consumer who chooses not to buy the monopolized product must do without it - Price maker – firm controls total quantity supplied, controls price à change its product price by changing quantity supplied, downward-sloping product demand curve - Blocked entry – no immediate competitors à Economic, technological, legal or other type of barriers - Non-price competition – product is standardised/differentiated a. Examples - Govt.-regulated public utilities – ESKOM, SA Postal Services - Near-monopolies (firm has bulk of sales in specific market)– SAB, De Beers diamonds b. Monopoly Demand i. Assumptions - Patents, economies of scale or resource ownership secure the monopolist’s status - No governmental regulation - Firm is a single-price monopolist (no price discrimination) - Demand curve = market demand curve (pure monopolist = industry) – down-sloping, quantity demanded increases as price decreases ii. MR is less than Price - Increase sales by charging lower price à MR is less than Price (AR) – each additional unit sold increases total revenue by its price à TR increases at a diminishing rate - MR curve is below demand curve à MR< Price - MR is +ve while TR is increasing. When TR reaches max. – MR=0. When TR is diminishing – MR is –ve - - about:blank iii. Monopolist is price maker The monopolist will never choose a price-quantity combination where price reductions cause TR to decrease (MR<0). Chooses prices in elastic region – decrease in price = increase in TR 3/5 6/6/23, 7:57 PM Chapter 7 notes EKN 110 - - MR=MC rule – maximise profit must produce up to output where MR =MC - No supply curve, no unique relationship between P & Qs iv. Economic effects of Monopoly - Price, output & efficiency: monopolist if profitable when selling smaller output at higher prices – no productive or allocative efficiency – P > min. ATC– triangle abc = efficiency loss (P>MC; P> min. ATC) à sum of consumer surplus & producer surplus is not maximised 7. Regulated Monopoly a. Natural monopolies - Subject to price regulation, deregulate parts of industries where competition seems possible b. Socially Optimal Price: P=MC - Price that achieves allocative efficiency c. Fair-return price: P=ATC - Price where normal profit is obtained d. Dilemma of regulation - When price is set to achieve allocative efficiency – might suffer losses (would need subsidies to survive) Monopolistic competition o Characteristics § Large number of sellers • Not as many as in pure competition • • Small market shares: small % of total market à limited control over market price No collusion Independent action: no interdependence, each firm can determine own pricing policy – unnoticeable effect on competitors Differentiated Products • Product attributes (features, materials, design), service, location (accessibility & proximity), brand names & packaging (enhance appeal), some control over price (due to differentiation) Easy Entry & Exit • Competitors are typically small firms • Economies of scale are few • § § § • Capital requirements are low • Small financial barriers from differentiation Advertising • Make consumers aware of product differentiation • Non-price competition 4 about:blank 4/5 6/6/23, 7:57 PM Chapter 7 notes EKN 110 - Vivian Y. Oligopoly o Characteristics § Few large producers • Few huge firms dominate local market § Homogenous/ differentiated product • Many industrial products are standardised products • Many consumer goods are differentiated à non-price competition (advertising) § Control over price but mutual interdependence • Firms are price makers • needs to consider how its rivals will react to any change in its price, output, product characteristics or advertising Strategic behavior: self-interested behaviour that takes into account the reaction of others • Mutual interdependence: each firm’s profit depends not entirely on its own price and sales strategies but also on those of the other firms Entry barriers • same as in monopoly • § • • • • § economies of scale high costs to enter large expenditure for capital (plant & equipment) ownership & control of raw materials • pre-emptive & retaliatory pricing & advertising strategies Mergers • Some oligopolies were created through the growth of the dominant firms in an industry but others through mergers • Mergers increase the market shareà greater economies of scale • “Desire for monopoly power”: the larger the firm has greater control over market supply and price of the product 5 about:blank 5/5