Law on Sales: Regulatory Framework for Business Transactions

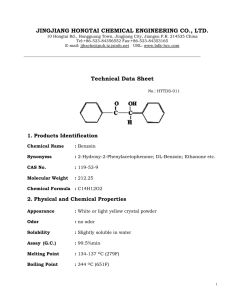

advertisement

REGULATORY FRAMEWORK FOR BUSINESS TRANSACTIONS Law on Sales 1. Contract of Sales is a contract whereby one of the contracting parties, known as the seller or vendor, obligates himself to transfer the ownership of and to deliver a determinate thing, and the other party, known as the buyer or vendee, obligates himself to pay therefore a price certain in money or its equivalent. 2. Contracting Parties in a Contract of Sale a. Seller or Vendor refers to the person who obligates himself to transfer the ownership of and to deliver a determinate thing. b. Buyer or Vendee refers to the person who obligates himself to pay therefore a price certain in money or its equivalent. 3. Essential elements of the contract of sale – These are elements necessary for validity and perfection of contract of sale. a. Subject matter which should be a determinate thing i. Requisites of subject matter of a contract of sale 1. It must be within the commerce of men. 2. It must be not contrary to law, morals, good customs, public order or public policy. 3. It must be determinate. 4. It must be owned by the vendor at the time of delivery. ii. Things that may become the subject matter of a contract of sale 1. Existing goods owned or possessed by the seller. 2. Goods to be manufactured, raised or acquired by the seller after the perfection of the contract of sale or “future goods” subject to the condition that it must materialize. If the future things do not materialize, the contract of sale will become inefficacious or void for absence of subject matter which is an essential element of contract of sale. 3. Goods whose acquisition by the seller depends upon the contingency which may or may not happen. 4. Things subject to resolutory condition which if happens, the contract of sale will be extinguished. 5. Hereditary rights 6. Undivided interest in co-owned property which will result to co-ownership on the part of buyer and seller. iii. Things not allowed to become the subject matter of a contract of sale making the contract null and void 1. 2. 3. 4. Those contrary to law, morals or public policy. Those outside the commerce of men. Future inheritance Vain hope iv. Distinctions between emptio rei speratae and emptio spei 1. Emptio rei speratae is the sale of future thing while emptio spei is a sale of hope or expectancy. 2. Sale of future harvest is emptio rei speratae while sale of lottery ticket No. 113 is emptio spei. 3. In emptio rei speratae the thing expected will definitely come into existence, but its quality or quantity unknown; while in emptio spei it is not certain that the thing will exist much less its quantity or quality. 4. Emptio rei speratae is subject to the condition that the thing should exist, so that if it does not, there will be no contract of sale by reason of the absence of an essential element of subject matter while emptio spei produces effects even though the thing does not come into existence because the subject matter is the hope itself. Regulatory Framework for Business Transactions Page 1 of 16 b. Price certain in money or its equivalent i. Requisites of price in a contract of sale 1. It must be certain. 2. It must be real 3. It must not be fictitious. ii. Instances when the price is certain 1. If the parties have agreed upon a definite amount for the sale. 2. If it be certain with reference to another thing certain. 3. If the determination of the price is left to the judgment of a specified person or persons. a. Remedies of the injured party if: i. The third person is unable or unwilling to fix the price. 1. The contract is inefficacious or null and void requiring declaration of nullity. ii. The third person acted in bad faith or by mistake. 1. The injured party may ask the court to fix the reasonable price. iii. The third person is prevented from fixing the price or terms by fault of the seller or the buyer. 1. The injured party may ask for damages. 4. If the price is fixed by the court which price may no longer be changed by the contracting parties. 5. If the price fixed is that which the thing sold would have on a definite day, or in a particular exchange or market, or when an amount is fixed above or below the price on such day, or in such exchange or market, provided said amount is certain. 6. If the price is fixed by one of the contracting parties and accepted by the other. iii. Effects of inadequacy of price in a contract of sale 1. It does not affect a contract of sale, except as it may indicate a defect in the consent which makes the contract voidable requiring annulment of contract. 2. It renders the contract one of donation if that is the real intention of parties. Thus, it will require reformation of instrument. iv. Effects of simulated price in a contract of sale 1. If the price is absolutely simulated, the contract of sale is null and void requiring declaration of nullity. 2. It the price is relatively simulated, the intent of the parties is hidden requiring reformation of instrument. c. Consent of the contracting parties on the determinate thing and the price certain in money i. Moment of perfection of contract of sale 1. At the moment there is a meeting of minds upon the thing which is the object of the contract and upon the price. Regulatory Framework for Business Transactions Page 2 of 16 ii. Moment of perfection of contract of sale by auction 1. When the auctioneer announces its perfection by the fall of the hammer or in any other manner. a. Rights of auctioneer and highest bidder before the perfection of contract of sale by auction i. Before perfection, any bidder may retract his bid. ii. Before perfection, the auctioneer may generally withdraw the goods from the sale unless the auction has been announced without reservation by auctioneer. b. Rights of auctioneer and highest bidder after the perfection of contract of sale by auction i. After perfection, the winning bidder cannot retract his bid. ii. After perfection, the auctioneer cannot withdraw the goods. c. Requisites before auctioneer may participate in bidding or auction i. The right to bid must have been reserved expressly by or on behalf of the seller. ii. The right to bid must not be prohibited by law or stipulation. iii. Notice must be given that the sale is subject to a right to bid by or on behalf of the seller. d. By bidders or puffers refer to persons employed by the seller to bid in his behalf, the purpose of which is to raise the price, but the said persons are not in themselves bound by their bids. The employment by the seller of by-bidders or puffers without notice to the other bidders may make the perfected contract of sale voidable because the consent of the highest bidder is vitiated by causal fraud. 4. Natural elements of the contract of sale – These are elements which are presumed to exist in a contract of sale unless validly waived by the contracting parties. a. b. c. d. Warranty against eviction Warranty against hidden defects Warranty against non-apparent and unregistered servitude or encumbrance Warranty for merchantability 5. Accidental elements in the contract of sale – These are elements which do not exist in a contract of sale unless provided by the contracting parties. a. b. c. d. Place of delivery and payment Time of delivery and payment Terms or conditions of payment Interest of the price 6. Characteristics of a contract of sale a. Principal – It can exist by itself without being dependent upon another contract. b. Consensual – It is perfected by mere consent upon the price certain and determinate thing except in case of sale of a piece of land by the agent in the name of the principal which is a formal or solemn contract which requires that the authority of the agent to sell the land must be in writing for the contract to be valid. c. Bilateral – The parties are bound by reciprocal obligations. d. Onerous – Valuable considerations are given by both parties to acquire rights. e. Commutative – The parties exchange almost equivalent values. f. Nominate – It has special name given to it by law. 7. Distinctions between contract of sale and dacion en pago a. In sale, there is no pre-existing credit, while in dacion en pago, there is pre-existing credit. b. A sale creates obligations while dacion en pago extinguishes obligations. c. In sale, there is greater freedom in fixing the price, while in dacion en pago, there is less freedom in fixing the price because of the amount of the pre-existing credit which the parties seek to extinguish. d. In sale, the cause or consideration is the price from the seller’s point of view, and the delivery of the object from the buyer’s view point, while in dacion en pago, the cause or consideration is the extinguishment of the obligation, from the debtor’s point of view and the delivery of the object given in place of the credit, from the creditor’s point of view. Note: Both contract of sale and dacion en pago are governed by Law on Sales. Regulatory Framework for Business Transactions Page 3 of 16 8. Distinctions between contract of sale and payment by cession a. In sale, there is no pre-existing credit while in payment by cession, there are pre-existing credits. b. A sale creates obligations while payment by cession extinguishes obligations. c. In sale, the cause or consideration is the price from the seller’s point of view, and the delivery of the object, from the buyer’s point of view while in payment by cession, the cause or consideration is the extinguishment of the obligation from the debtor’s point of view and the assignment of the things to be sold from the creditor’s point of view. d. In sale, there is greater freedom in fixing the price while in payment by cession there is less freedom in fixing the price because of the fixed amount of the pre-existing credits which the parties seek to extinguish. e. In sale, the buyer becomes the owner of the thing transferred upon delivery while in cession, the creditors do not become the owners of the property assigned to them but are merely given the right to sell such property and apply the proceeds to their claims. f. Contract of sale is governed by Law on Sales while payment by cession is governed by Financial Rehabilitation and Insolvency Act, a special law. 9. Distinctions between contract of sale and contract for a piece of work a. It is a contact of sale if it is for the delivery at a certain price of an article which the vendor in the ordinary course of business, manufactures or procures for the general market, whether the same is on hand or not while it is a contract for a piece of work if the goods are to be manufactured especially for the customer upon his special order and not for the general market. b. Contract of sale of movable property with a price of at least P500 or sale of immovable regardless of price is covered by Statute of Fraud while contract for a piece of work at a price of P500 is not covered by Statute of Fraud. 10. Distinctions between contract of sale and contract of barter a. In a contract of sale, the cause is cash while in a contract of barter, the cause is a noncash asset. b. Contract of sale of movable property with a price of at least P500 or sale of immovable regardless of price is covered by Statute of Fraud while contract of barter of movable with price of at least P500 or barter of immovable regardless of price is not covered by Statute of Fraud. 11. Rules for determining whether a contract is one of sale or barter if the cause is a combination of cash and noncash asset. a. Determine the manifest or evident intention of the parties. b. If the evident intention of the parties is not present, apply the following rules: i. The contract is one of barter if the value of the thing given as part of the consideration exceeds the monetary consideration. ii. The contract is one of sale if the monetary consideration is more than the value of the thing given as part of the consideration. iii. The contract is one of sale if the monetary consideration is equal to the value of the thing given as part of the consideration. 12. Distinctions between contract of sale and contract to sell a. In contract of sale, ownership passes to the buyer upon delivery while in contract to sell, the title to the goods does not pass to the buyer until some future time and oftentimes upon payment of the price. b. In contract of sale, the risk of loss or damage to the goods upon delivery is on the buyer, under the rule “res perit domino”, or the thing perished with the owner; while in contract to sell, the risk is borne by the seller after delivery based on the same principle that the thing perishes with the owner. c. In contract of sale, the non-payment of the price is a resolutory condition while in contract to sell, the payment in full of the price is a suspensive condition. Note: The rule on double sale applies only if both contracts are of sale but it is not applicable to contract to sell. Regulatory Framework for Business Transactions Page 4 of 16 13. Distinctions between contract of sale and agency to sell a. In sale, ownership passes to the buyer, while in agency to sell, ownership is retained by the principal. b. In sale, the buyer pays the seller, while in agency to sell, the buyer pays the agent and the latter transmits the money to the principal. c. In sale, the goods are delivered by the seller to the buyer while in agency to sell, it is delivered by the agent to the final consumer. 14. Principles on sale of an undivided share of a specific mass of fungible goods though the seller purports to sell and the buyer purports to buy a definite number, weight or measure of the goods in the mass, and though the number, weight or measure of the goods in the mass is undetermined. I. II. If the quantity, number, weight or measure, of the mass is more than the quantity sold, the parties shall become co-owners of the mass. If the quantity of the mass is less than the quantity sold, the buyer becomes the owner of the whole mass, with the seller being bound to make good the deficiency from goods of the same kind and quality, unless a contrary intent appears. 15. Distinction between Bilateral promise to buy and sell and Unilateral promise to buy or sell a. Bilateral promise to buy and sell is as good as perfected contract of sale while unilateral promise to buy or sell accepted by the promissee is binding only if supported by option money. b. Policitacion refers to unilateral promise not accepted by the promisee, therefore, it does not produce any effect. 16. Distinctions between option money and earnest money or arras a. Option money is proof of perfection of contract of option while earnest money is proof of perfection of contract of sale. b. Option money is not part of the purchase price while earnest money is part of the purchase price. c. Option money is intended to reserve the property within the promised period while earnest money is intended as down payment on the contract of sale. 17. Moment of obtaining personal rights by the buyer over the fruits of the determine thing sold in a contract of sale a. From the moment of perfection of contract of sale 18. Effect of the complete loss of the object of the contract of sale before the perfection of the contract or at the moment of perfection of contract of sale a. The contract of sale is null and void for absence of essential element of subject matter. 19. Remedies of the buyer in case of the partial loss of the object of the contract of sale at the time of the perfection of the contract of sale I. II. Withdrawal from the contract or rescission. Demanding the remaining part and paying its proportionate price. 20. Party who shall bear the risk of the complete loss of the object of the contract of sale after perfection of contract of sale but before delivery of the subject matter a. Seller based on the concept of Res perit domino which means that the thing perishes with the owner b. Buyer on the basis of Provision of the Civil Code. 21. Effects of the complete loss of the object of the contract of sale after perfection of contract of sale and after delivery of the subject matter a. The buyer shall suffer the risk of loss. b. The buyer must pay the price. Regulatory Framework for Business Transactions Page 5 of 16 22. Contracts covered by Recto Law a. Installments sales of personal property b. Contracts purporting to be leases of personal property with option to buy, when the lessor has deprived the lessee of the possession or enjoyment of the thing 23. Remedies of vendor or lessor in Recto Law a. Sole remedy if the vendee or lessee fails to pay a single installment i. Exact fulfillment of the obligation with right to recovery for damages b. Alternative remedies if the vendee or lessee fails to pay two or more installments i. Exact fulfillment of the obligation with right to recovery for damages. ii. Cancel the sale should the vendee fails to pay two or more installments resulting to mutual restitution. However, the vendor may retain the installments already received if there is agreement to that effect provided such agreement is not unconscionable. iii. Foreclose the chattel mortgage on the thing sold, if one has been constituted without right to recover any deficiency. Any stipulation for recovery of deficiency is null and void. 24. Rights of the Buyer in Sale of residential property in installments governed by RA 6552 or Maceda Law a. Right to a grace period from the date the installment became due with no interest which can be exercised only once every five (5) years. i. For buyer who has paid at less than two years of installments, the minimum grace period is 60 days. ii. For buyer who has paid more than two years of installments, the grace period is 30 days for every year of installment paid. (One month per year of installment paid) b. Right to additional 30 days but with interest, after the expiration of the initial grace period, before the seller can cancel the contract by notarial act. c. Right to cash surrender value in case of cancellation by seller. i. For buyer who has paid less than two years of installments, he is not entitled to any cash surrender value. ii. For buyer who has paid two to five years of installments, he is entitled to 50% cash surrender value. iii. For buyer who has paid more than five years of installments, he entitled to an additional five per cent every year aside from the initial 50% but not to exceed ninety per cent of the total payments made. 25. Rights of Buyer of Subdivision or condominium unit under PD 957 also known as Subdivision and Condominium buyer's Protective Decree a. In case of noncompliance by the developer with the plan, the buyer may suspend payment of the price and ask for the cancellation of contract with corresponding demand for the return of the price he has paid. b. The developer shall pay the real property tax before transfer of ownership to buyer. c. The developer can only collect fees for registration of sale from the buyer. 26. Persons incapacitated to enter into a contract of sale a. Those suffering from absolute incapacity i. Minor ii. Insane iii. Demented iv. Deaf-mute who do not know how to write 1. If only one party is incapacitated, the contract of sale is voidable. 2. If both parties are incapacitated, the contract of sale is unenforceable. Regulatory Framework for Business Transactions Page 6 of 16 b. Those suffering from relative incapacity i. Husband and wife 1. As a general rule, the contract of sale between husband and wife is null and void. ii. Exceptional instances when husband and wife may validly sell to each other 1. If there is prenuptial or ante-nuptial agreement of complete separation of property 2. If there is judicial separation of property by reason of legal separation 27. Persons who are prohibited from acquiring by purchase, even at public or judicial auction, sales in legal redemption, compromises or renunciation a. The guardian, the property of the person or persons under his guardianship. b. Agents, the property whose administration or sale may have been entrusted to them, unless the consent of the principal has been given. c. Executors and administrators, the property of the estate under administration. d. Public officers and employees, the property of the State or GOCC under their administration. e. Justices, judges, prosecuting attorneys, clerks of court and other officers and employees connected with the administration of justice, the property and rights in litigation. Note: The contract of sale is null and void because it is contrary to law. 28. Obligations of the vendor or seller a. To transfer the ownership of the thing sold at the time the subject matter should be delivered. b. To deliver the determinate thing sold including the accessions and accessories in the condition in which they were upon the perfection of the contract. c. To warrant the thing sold against eviction, hidden defects and non-apparent and unregistered encumbrances. d. To take care of the thing sold with the diligence of a good father of a family unless the law or the stipulation of the parties requires another standard of care. 29. Obligation of the vendee or buyer a. To pay the price certain in money or its equivalent on the date agreed upon. 30. Delivery is a mode of acquiring ownership whereby the object of the contract is placed in the control and possession of the vendee. It is the act that transfers ownership from seller to buyer in a contract of sale. However, the contracting parties may agree that ownership will be transferred from the seller to the buyer by any other acts such as full payment of the price. 31. Types of Delivery a. Actual delivery b. Constructive delivery 32. Examples of constructive deliveries a. By legal formalities – When the same is made through a public document, the execution thereof shall be equivalent to the delivery of the thing sold. It applies to both movable and immovable property. b. Symbolic delivery (traditio simbolica or traditio clavium) – This is delivery that takes place by delivering the keys of the place or depository where the movable is stored or kept. c. Traditio longa manu – It is the delivery of a movable by mere consent or agreement of the parties if the thing cannot be transferred to the possession of the vendee at the time of sale. d. Traditio brevi manu – It is a delivery that takes place when the vendee is already in the possession of the thing sold even before the sale and thereafter continues in possession thereof in the concept of an owner. It applies to movables only. e. Traditio constitutum possessorium – It is a delivery that takes place when the vendor continues in possession of the thing sold after the sale but in another capacity such as that of a lessee or depositary. It applies to both movable and immovable property. f. Constructive deliveries of intangible assets or incorporeal rights i. By constructive traditio such as execution of public document. ii. By placing the titles of ownership in the possession of the vendee such as delivering the stock certificate covering the shares of stock sold. iii. Through the use by the vendee of his rights with consent of the vendor such as when the seller authorizes the buyer of shares of stock to vote during the stockholder’s meeting. Regulatory Framework for Business Transactions Page 7 of 16 33. Distinctions between Sale or return vs. Sale on trial or approval a. In sale or return, ownership is transferred to the buyer upon delivery while in sale on trial, delivery does not transfer ownership to the buyer but instead ownership is transferred to the buyer under any of the following instances: (a) when the buyer signifies his approval or acceptance of the goods; (b) when the buyer does an act adopting the transaction; or (c)when the buyer does not signify his approval or acceptance of the goods but retains the goods without giving notice of rejection within the time fixed in the contract or within reasonable time, and such time has expired. 34. Delivery to the common carrier (FOB Shipping Point) - The law presumes that the contract of sale is FOB Shipping Point which means that delivery to the carrier means delivery to the buyer. 35. As a general rule, a non-owner cannot transfer ownership to his buyer. However, these are the exceptional instances when the sale of a non-owner transfers ownership to the buyer: a. When the sale is made with authority or consent of the owner. b. When the owner is precluded by his conduct from denying the seller’s authority to sell. c. When the sale is made under the provisions of any factor’s acts, recording laws or any other provisions of law enabling the apparent owner to dispose of the goods as if he were the true owner thereof. d. When the sale is made under a statutory power of sale or under the order of court of competent jurisdiction. e. When the purchase is made in a merchant’s store, or in fairs, or markets. 36. Places wherein the things sold should be delivered a. Place stipulated in the contract. b. In case there is no stipulation, place fixed by usage or trade. c. In the absence of a and b, the seller’s place of business if he has one; if none, the seller’s place of residence. d. In the case of specific goods, the place where the goods are located at the time of perfection of contract of sale. 37. Time for delivery of the subject matter of a contract of sale a. At the time agreed upon. b. In the absence of time agreed upon, within reasonable time from the execution of the contract. 38. As a general rule, it is the obligation of the vendor to deliver the thing sold to the buyer after perfection of contract of sale. However, the following are the instances when a vendor is not bound to deliver the thing sold after perfection of contract of sale: a. If the vendee has not paid him the price. b. If no period for payment of the price has been fixed in the contract. c. If the vendee loses the right to make use of the period. 39. Unpaid seller is one who has not been paid or tendered the whole of the price or who has received a bill of exchange or other negotiable instruments as conditional payment and the condition under which it was received has been broken by reason of the dishonor of the instrument, the insolvency of the buyer, or otherwise. It includes an agent of the seller to whom the bill of lading has been indorsed, or a consignor or agent who has himself paid, or is directly responsible for the price, or any other person who is in the position of a seller 40. Rights of an unpaid seller a. Right to possessory lien on the goods or right to retain them while he is in possession of them i. Grounds for right of possessory lien 1. Where the goods have been sold without any stipulation as to credit. 2. Where the goods have been sold on credit, but the credit term has expired. 3. Where the buyer is insolvent. ii. Instances when right of possessory lien is no longer available to the unpaid seller 1. When the seller delivers the goods to a carrier or other bailee for the purpose of transmission to the buyer without reserving the ownership in the goods or the right to the possession thereof. 2. When the buyer or his agent lawfully obtains possession of the goods. 3. By waiver of the possessory lien. iii. Note: When the unpaid seller obtains judgment or decree for the price of the goods, he does not lose his possessory lien or his right to retain them while he is in possession of them. Regulatory Framework for Business Transactions Page 8 of 16 b. Right of stoppage in transit refers to the right of the unpaid seller to resume possession of the goods at any time while they are in transit, and he will them become entitled to the goods as he would have had if he had never parted with the possession. i. Ground for right of stoppage in transit 1. Where the buyer is insolvent. ii. Manners of exercising the right of stoppage in transit 1. By obtaining actual possession of the goods; or 2. By giving notice of his claim to the carrier or other bailee in whose possession the goods are iii. Effects of the exercise of right of stoppage in transit 1. The goods are no longer in transit. 2. The contract of carriage ceases and the carrier shall be liable as depositary or other bailee. 3. The carrier must deliver the goods to or according to the instructions of the seller. iv. Instances when goods are still in transit 1. From the time they are delivered to the carrier or other bailee for the purpose of transmission to the buyer, until the buyer or his agent, takes delivery of them from such carrier or other bailee. 2. If the goods are rejected by the buyer, and the carrier or other bailee continues in possession of them, even if the seller has refused to receive them back. v. Instances when goods are no longer in transit 1. If the buyer obtains delivery of the goods before arrival at the appointed destination. 2. If the carrier or other bailee acknowledges to the buyer or his agent, that he is holding the goods in his behalf, after arrival of the goods at their appointed destination. 3. If the carrier or other bailee wrongfully refuses to deliver the goods to buyer or his agent. c. Right of resale i. Grounds for right of resale 1. The goods are of perishable nature. 2. The seller has expressly reserved the right to resell the goods in case the buyer should make default. 3. The buyer has been in default for an unreasonable time. a. Note: It is not essential to the validity of resale that notice of an intention to resell the goods be given by the seller to the original buyer. But if the ground of sale is the buyer has been in default for an unreasonable time, then, giving notice of intention to original buyer becomes relevant to determine the unreasonableness of the default. ii. Place of Resale 1. Public sale; or 2. Private sale iii. Effects of Resale 1. The seller shall not be liable to the original buyer for the delivery of the goods. 2. The seller may recover damages from the original buyer for any loss occasioned by the breach of the contract of sale. 3. The new buyer acquires a good title against the original buyer. iv. Note: The unpaid seller is prohibited from participating as a bidder, directly or indirectly, in the public sale or private sale of the goods. Regulatory Framework for Business Transactions Page 9 of 16 d. Right to rescind the sale i. Grounds for right to rescind the sale 1. The seller has expressly reserved the right to rescind the sale in case the buyer should make default. 2. The buyer has been in default in the payment of the price for an unreasonable time. ii. Effects of rescission of sale 1. The seller shall not be liable to the buyer upon the contract of sale. 2. The seller may recover from the buyer damages for any loss occasioned by the breach of contract of sale. 3. The seller resumes ownership of the goods. 41. Remedies of buyer in sale of real estate with a statement of its area at the rate of a certain price per unit of measure or number if the vendor delivers the following area: a. Excess area i. Accept the whole area and pay for the contract rate; or ii. Accept the agreed area and reject the excess b. Lacking area i. Lacking of Less than 10% of Actual Area 1. Action quanti minoris or proportionate reduction of price; or 2. Action for cancellation but only if the lacking area of less than 10% of Actual Area is very important ii. Lacking of 10% or more of Actual Area 1. Action quanti minoris or proportionate reduction of price; or 2. Action for cancellation whether or not the lacking area of 10% or more of Actual Area is very important c. Poor quality i. Poor Quality of 10% or less of Actual Area 1. Action quanti minoris or proportionate reduction of price 2. Action for cancellation but only if the poor quality of not more than 10% of Actual Area is very important ii. Poor Quality of more than 10% of Actual Area 1. Action quanti minoris or proportionate reduction of price; or 2. Action for cancellation whether or not the poor quality of more than 10% of Actual Area is very important Note: Prescriptive period of the action – It shall be filed within 6 months from the date of delivery. 42. Rights of buyer and seller in sale real estate for a lump sum and not at the rate of a certain sum for a unit of measure or number a. In sale of real estate for a lump sum and not at the rate of a certain sum for a unit of measure or number, the vendor is bound to deliver all that it is included within the boundaries stated in the contract although there be greater or less area or number than that stated in the contract. b. The buyer has the obligation to pay the lump sum stipulated in the contract with no increase or decrease in the price although there be greater or less area or number than that stated in the contract unless the lacking or excess area is already unconscionable. 43. Preferred buyer in double sale of personal property a. Actual or constructive possessor in good faith b. Buyer with the oldest title 44. Preferred buyer in double sale of titled real property a. Registrant of the sale in good faith b. Actual or constructive possessor in good faith c. Buyer with the oldest title 45. Preferred buyer in double sale of untitled real property a. Buyer with the oldest title Regulatory Framework for Business Transactions Page 10 of 16 46. Natural elements or implied warranties in a contract of sale a. b. c. d. Warranty against eviction Warranty against hidden defects Warranty against undeclared charge or encumbrance or unregistered encumbrances/servitude Warranty for merchantability 47. Eviction refers to the deprivation of the vendee of the whole or a part of the thing sold by virtue of a final judgment based on a right prior to the sale or an act imputable to the vendor. 48. Requisites in order that the seller’s warranty against eviction may be enforced a. b. c. d. There must be a final judgment depriving the vendee of the whole or part of the thing sold. The vendee must not appeal from the decision or judgment depriving him of the thing sold. The deprivation is based on a right prior to the sale or an act imputable to the vendor. The vendor must have been notified of the suit for eviction at the instance of the vendee. 49. Other Instances of Eviction which makes the seller liable for breach of warranty a. If the property is sold for non-payment of taxes due and not made known to the vendee before the sale. b. In case of judicial sales unless otherwise decreed in the judgment. 50. Two types of Buyer’s waiver of warranty against eviction a. Waiver Consciente is a type of waiver made by the buyer when he acted in good faith because he has no knowledge of risk of eviction. The seller is still liable for eviction. b. Waiver Intentionada is a type of waiver made by the buyer when acted in bad faith because he has knowledge of risk of eviction. The seller is no longer liable for eviction. 51. Status of Waiver of warranty against eviction a. Stipulation exempting a vendor from the obligation to answer for eviction is valid if he acted in good faith. b. Stipulation exempting a vendor from the obligation to answer for eviction is void if he acted in bad faith. 52. Liabilities of Vendor in case of Breach of Contract of Sale by reason of eviction a. Extent of Liability of Vendor who acted in bad faith i. Value of the thing at the time of eviction. ii. Income or fruits of the thing. iii. Cost of suit caused by eviction. iv. Expenses of the contract if the vendee has paid them. v. Damages, interests and ornamental expenses. b. Extent of Liability of Vendor acted in good faith i. Value of the thing at the time of eviction. ii. Income or fruits of the thing. iii. Cost of suit caused by eviction. iv. Expenses of the contract if the vendee has paid them. 53. Remedies of buyer for breach of warranty against hidden encumbrance or non-apparent servitude in contract of sale of immovable a. Within one year from the date of contract i. Action for damages; or ii. Action for rescission b. Within one year from the discovery of servitude after the lapse of the one year period from the date of contract i. Action for damages only Note: Prescriptive period – One year from the date of contract or discovery of servitude Regulatory Framework for Business Transactions Page 11 of 16 54. Other implied warranties of seller a. Where the buyer, expressly or by implication, makes known to the seller the particular purpose for which the goods are acquired, and it appears that the buyer relies on the seller's skill or judgment (whether he be the grower or manufacturer or not), there is an implied warranty that the goods shall be reasonably fit for such purpose. (warranty for particular purpose) b. Where the goods are brought by description from a seller who deals in goods of that description (whether he be the grower or manufacturer or not), there is an implied warranty that the goods shall be of merchantable quality. (warranty for merchantable quality) c. In the case of a contract of sale by sample, if the seller is a dealer in goods of that kind, there is an implied warranty that the goods shall be free from any defect rendering them unmerchantable which would not be apparent on reasonable examination of the sample. (warranty for merchantability) 55. Remedies of buyer in case of breach of warranty committed by the seller a. Accept or keep the goods and set up against the seller the breach of warranty by way of recoupment or diminution or extinction of the price. b. Accept or keep the goods and maintain an action against the seller for damages for breach of warranty. c. Refuse to accept the goods, and maintain an action against the seller for damages for breach of warranty. d. Rescind the sale and refuse to receive the goods or if the goods have already received, return them or offer to return them to the seller and recover the price of any part thereof which has been paid. 56. Requisites for enforcement of vendor’s liability against hidden defects a. The defect must exist at the time of sale. b. The defect must be hidden. c. The defect must render the thing unfit for the use for which it is intended or diminishes its fitness for such use to such an extent that had the vendee been aware thereof, he would not have acquired it or would have given a lower price for it. d. The action to enforce it must be made within the period provided by law. 57. Nature of Liability of Seller in sale of property with Hidden Defects a. The seller is liable for selling object with hidden defect regardless of the awareness of the presence of defect b. The seller is liable for selling object with hidden defect regardless of the reason of the loss of the thing sold. 58. Remedies of Buyer of Breach of Implied Warranties for Merchantability or Hidden Defect a. Accion redhibitoria is one of the two remedies of the vendee in case of breach of warranties against hidden defects, of merchantability, of merchantable quality or fitness for a particular purpose. It refers to the withdrawal from the contract or rescission. b. Accion quanti minoris is one of the two remedies of the vendee in case of breach of warranties against hidden defects, of merchantability, of merchantable quality or fitness for a particular purpose. It refers to demanding a proportionate reduction in the price. 59. Prescriptive period of action based on breach of warranty against hidden defect a. 6 months from the date of delivery 60. Extent of Liability of Seller in case of loss of thing sold with Hidden Defects a. The seller acted in bad faith and the cause of loss is the hidden defect i. Return the price, refund the expenses of the contract and pay damages b. The seller acted in good faith and the cause of loss is the hidden defect i. Return the price, refund the expenses of the contract and pay interests of the price c. The seller acted in bad faith and the cause of loss is the fault of buyer or fortuitous event i. Return the price paid less the value of the thing at the time of loss and to pay damages. d. The seller acted in good faith and the cause of loss is the fault of buyer or fortuitous event i. Return the price paid less the value of the thing at the time of loss 61. Status of Waiver of warranty against eviction a. Stipulation exempting a vendor from the obligation to answer for hidden defect is valid if he acted in good faith. b. Stipulation exempting a vendor from the obligation to answer for hidden defect is void if he acted in bad faith. Regulatory Framework for Business Transactions Page 12 of 16 62. Redhibitory defect refers to a defect in an animal and it is of such nature that expert knowledge, even after a professional inspection has been made, is not sufficient to discover it. 63. Alternative remedies for redhibitory defect of an animal sold together with other animals not as a pair a. b. Accion redhibitoria or Cancellation of sale over the defective animal; or Accion quanti minoris or Proportional Reduction of Price over the defective animal 64. Remedy for redibitory defects of two animals sold together as a pair a. Accion redhibitoria or Cancellation of the contract of sale 65. Prescriptive period of action based on breach of warranty of animal with redhibitory defect a. 40 days from the date of delivery 66. Sale of animals without warranty for hidden defects a. Sale of animals at fairs b. Sale of animal at public auctions c. Sale of live stocks as condemned 67. Status of sale of animal suffering from contagious disease a. Null and void for being contrary to law and public policy 68. Requisites in order for the vendor to be liable in case the animal dies of disease a. The disease exists at the time of sale. b. The disease is the cause of death of the animal. c. The animal dies within 3 days from time of purchase. 69. Instances when the buyer’s deemed to have accepted the delivered goods a. When he intimates to the seller that he is accepting them. b. When he does an act in relation to the goods which is inconsistent with the ownership of the seller. c. When he retains the goods after the lapse of a reasonable time without intimating to the seller that he has rejected them. 70. As a general rule, the buyer may inspect the goods. However, the following are the exceptional instances when the buyer cannot examine the goods a. When there is an agreement to that effect. b. When there is stipulation that the goods shall not be delivered to the buyer until he has paid the price. c. When the goods are marked with the words collect on delivery. 71. Effects when the buyer refuses to accept delivery and the refusal is justified such as when the quantity is not complete or the goods being delivered are different from that stipulated a. Buyer has no duty to return goods to the seller unless otherwise agreed. b. The buyer shall not be obliged to pay the price. c. If the buyer constitutes himself as depositary of the goods, he shall be liable as such. 72. Effects when the buyer refuses to accept delivery and the refusal is unjustified a. Title to the goods passes to the buyer from the moment the goods are placed at his disposal. b. The buyer shall be obliged to pay the price. 73. The time and place of payment of the price of the contract of sale a. At the time and place stipulated b. At the time and place of delivery of the thing. Regulatory Framework for Business Transactions Page 13 of 16 74. Instances wherein the buyer shall pay interest for the period between the delivery of the thing and the payment of the price a. If there is stipulation for payment of interest and if the rate is not provided, it should be 12% before July 1,2013 and 6% afterwards. b. If the thing sold produces fruits or income. c. If the buyer is in default, from the time of judicial or extrajudicial demand for the payment of the purchase price. 75. Grounds for the suspension of the payment of the price by the vendee a. Disturbance in the vendee’s possession or ownership of the thing purchased. b. Reasonable grounds to fear such disturbance, by a vindicatory action or foreclosure of mortgage. c. Loss of the thing due to the fault of the vendor. 76. Instances wherein the right to suspend payment by the vendee is not available a. If the vendor gives security for the return of the price. b. If it has been stipulated that the vendee shall pay the price notwithstanding the existence of disturbance or danger. c. If the disturbance is a mere act of trespass. 77. Remedy of vendor to sue for immediate rescission of the contract of sale of immovable a. If there are reasonable grounds to fear the loss of the immovable property sold and its price. 78. Alternative remedies of vendor in case there is reasonable ground to fear the loss of the immovable property or its price a. Fulfillment of the contract with damages or b. Rescission of the contract with damages. 79. Effects if the buyer failed to pay the price of the contract of sales of immovable at maturity date a. The contract of sale is not automatically cancelled. b. The buyer may still pay the price provided notarial or judicial demand for rescission has not yet been made by the seller. 80. Grounds for immediate rescission of the sale of a movable at vendor’s option I. If at the time of the delivery of the thing, the vendee does not appear to receive the thing. II. If at the time of the delivery of the thing, the vendee having appeared, does not pay the price, unless a longer period is stipulated for its payment. 81. Remedies or Actions by the seller for breach of contract of sale of goods committed by buyer a. Assuming the goods have already been delivered, maintain an action for the price of the goods if the buyer wrongfully neglects or refuses to pay. b. Maintain an action for damages if the buyer wrongfully neglects or refuses to accept and pay for the goods. c. Rescind the contract if the buyer has repudiated the sale or manifested his inability to perform his obligation or has committed a breach of contract, where the goods have not been delivered to buyer. 82. Proper Action or remedy by the buyer if the seller has broken the contract to deliver specific or ascertained goods by not delivering the goods a. Bring an action for specific performance plus damages. b. Action for rescission plus damages. c. Action for damages. 83. Modes for extinguishment of contract of sale: a. No-Co-Me-Re-Pa-Lo-Pre-Re-Ful-An b. Cancellation of sale of personal property payable in installments c. Resale of the goods by the unpaid seller d. Rescission of the sale by the unpaid seller e. Rescission by the buyer in case of partial eviction f. Rescission by the buyer in case of breach of warranty against hidden defects g. Rescission by the buyer of sale of animals with redhibitory defects h. Rescission by the buyer of sale of land with non-apparent servitude or encumbrance i. Rescission by the buyer of sale of land with lacking area or area with poor quality j. By redemption, whether conventional redemption or legal redemption Regulatory Framework for Business Transactions Page 14 of 16 84. Types of Redemption in a Contract of Sale a. Conventional redemption is a type of redemption that occurs when the vendor reserved the right to repurchase the thing sold with the obligation to return to the vendee the price of the sale, expenses of the contract and necessary and useful expenses made on the thing sold and to comply with other stipulations which may have been agreed upon. i. Period for exercise of right of redemption in conventional redemption or pacto de retro sale of immovable property 1. If a period is not stated in the contract, it will be 4 years. 2. If a period less than 10 years is stated, follow the stated period. 3. If a period more than 10 years is stated, it will be 10 years because that is the maximum period. 4. If there is a pending case before the court to determine whether the contract is one pacto de retro sale or equitable mortgage, it will be 30 days from the decision of the court declaring it to be pacto de retro sale. ii. Rules in case of exercising conventional redemption in Pacto de retro sale 1. A co-owner of an undivided immovable which is essentially indivisible who sells his share with a right to repurchase to a third person who subsequently acquires the whole thereof, may be compelled by the latter to redeem the whole property, if the former wishes to make use of the right of redemption. 2. If several persons, jointly and in the same contract, should sell an undivided immovable with a right of repurchase, none of them may exercise this right for more than his respective share. 3. If the person who sold an immovable alone has left several heirs, each heir may redeem only the part which he may have acquired. 4. In cases of 1 and 2, the vendee may demand that the co-owners or co-heirs come to an agreement upon the repurchase of the whole thing, and if they fail to do so, the vendee cannot be compelled to consent to a partial redemption. 5. Each one of the co-owners of an undivided immovable who may have sold his share separately, may independently exercise the right of repurchase as regards his own share and the vendee cannot compel him to redeem the whole property. b. Legal Redemption is a type of redemption in a contract of sale that is available only in exceptional cases provided by law. It refers to the right of a third person to repurchase a real property sold by another person in exceptional cases provided by law. It is defined as the right to be subrogated upon the same terms and conditions stipulated in the contract, in the place of one who acquires a thing by purchase, or dation in payment, or by any other transaction whereby the ownership is transmitted by onerous title. i. Instances of Legal Redemption or Redemption by operation of Law 1. By a co-owner. A co-owner of a thing may exercise the right of redemption in case the shares of all the other co-owners or of any of them, are sold to a third person. All co-owners may exercise on the basis of their proportionate share. 2. By an adjoining rural lot owner. If a piece of rural land not exceeding one hectare is alienated to a person who is not landless, the adjoining rural owner shall have the right of legal redemption unless the grantee does not own any rural land. Order of Preference: a. Adjoining rural owner with smallest area b. Adjoining rural owner who first exercised the right 3. By adjoining urban lot owner. If a small piece of urban land which was bought for speculation has been resold, the owner of the adjoining land has a right of redemption at a reasonable price. a. The adjacent urban land owner whose intended use of the land in question appears best justified shall be preferred. Note: It is only the adjoining urban lot owner who has the right of legal preemption which is the right to be given the first opportunity before being offered to other person. Note: A co-owner has better right over adjoining rural or urban lot owner in the exercise of right of legal redemption. ii. Period for the exercise of right of legal redemption 1. 30 days from the notice given by the vendor or prospective vendor Regulatory Framework for Business Transactions Page 15 of 16 85. Instances wherein a contract of sale with a right to repurchase and other contract purporting to be an absolute sale shall be presumed to be an equitable mortgage thereby requiring reformation of instrument a. b. c. d. e. f. When the price of a sale with a right to repurchase is unusually inadequate. When the vendor remains in possession as lessee or otherwise When the period for the exercise of the right of repurchase is extended. When the purchaser retains for himself part of the purchase price. When the vendor binds himself to pay the real property taxes on the thing sold. When the real intention of the parties is that the transaction shall secure the payment of a debt or the performance of any other obligation. 86. Remedy of injured party in equitable mortgage a. Action for reformation of instrument 87. Assignment of credit is a contract whereby a person transfers his credit, right or action against a third person to another person for a consideration which is certain in money or its equivalent. It is perfected by mere consent. 88. Nature of Assignment of Credit a. It is a consensual contract perfected by mere consent. 89. Formality of Assignment of Credit to bind or to affect third persons a. For assignment of credit involving personal property, it must be in a public instrument. b. For assignment of credit involving real property, it must be recorded in the Registry of Property. 90. Warranties of the vendor in good faith or assignor in assignment of credits a. Existence of the credit at the time of sale b. Legality of the credit at the time of sale 91. Exceptional instances when the vendor or assignor of credit is liable for the insolvency of the debtor of the credit a. When the assignor expressly warrants the solvency of the debtor of the credit. i. Prescriptive period of warranty for solvency of debtor in assignment of credit 1. 1 year from the maturity date of credit or date of assignment whichever is later b. When the assignor acted in bad faith because the insolvency of the debtor of the credit is of public knowledge when he assigned the credit. 92. Difference between Assignment of Credit by Assignor and Negotiation of Negotiable Instruments by a General Indorser a. Assignment is applicable to non-negotiable promissory note while negotiation is applicable to negotiable promissory note. b. The transferee in assignment is called an assignee while the transferee in negotiation is called a holder. c. The transferor in assignment is called an assignor while the transferor in negotiation is called a general indorser if there is indorsement. d. The assignee in assignment is subject to personal defenses available to prior parties while the holder in due course in negotiation holds the instrument free from personal defenses available to prior parties. e. The assignor does not warrant the solvency of maker unless expressly stated while the general indorser guarantees the solvency of maker as long as notice of dishonor will be given to him. Regulatory Framework for Business Transactions Page 16 of 16