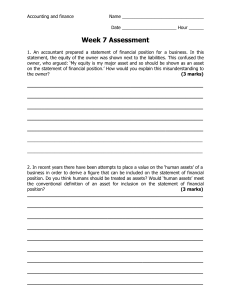

Spanish Accounting Chart & Consolidation Rules Pocket Guide

advertisement