Cash and Cash Equivalents: Accounting Definitions & Classifications

advertisement

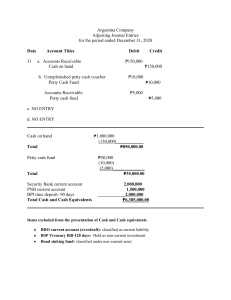

CASH AND CASH EQUIVALENTS "cash" simply means money. Money is the standard medium of exchange in business transactions. Money refers to the currency and coins which are in circulation and legal tender. However, in the accounting parlance, the term "cash" has a special and broader meaning and connotes more than money. As contemplated in accounting, cash includes money and any other negotiable instrument that is payable in money and acceptable by the bank for deposit and immediate credit. Accordingly, cash includes checks, bank drafts and money orders because these are acceptable by the bank for deposit or immediate encashment. Examples of cash equivalents are: ✓ Three-month BSP treasury bill ✓ Three-year BSP treasury bill purchased three months before date of maturity ✓ Three-month time deposit ✓ Three-month money market instrument or commercial paper Equity securities cannot qualify as cash equivalents because shares do not have a maturity date. However, preference shares with specified redemption date and acquired three months before redemption date can qualify as cash equivalents. Note that what is important is the date of purchase which should be three months or less before maturity. For example, when checks are received in full settlement of an account receivable, cash is immediately debited. Thus, a BSP treasury bill that was purchased one year ago cannot qualify as cash equivalent even if the remaining maturity is three months or less from the end of reporting period. But postdated checks received cannot be considered as cash yet because the postdated checks are unacceptable by the bank for deposit and immediate credit or outright encashment. Investment of excess cash The control and proper use of cash is an important aspect of cash management. Basically, the entity must maintain sufficient cash for use in current operations. Unrestricted cash There is no specific standard dealing with "cash". Any cash accumulated in excess of that needed for current operations should be invested even temporarily in some type of revenue earning investment. The only guidance is found in PAS 1, paragraph 66, which provides that an entity shall classify an asset as current when the asset is cash or a cash equivalent unless it is restricted to settle a liability for more than twelve months after the end of the reporting period. Accordingly, to be reported as "cash", an item must be unrestricted in use. This means that the cash must be readily available in the payment of current obligations and not be subject to any restrictions, contractual or otherwise. CASH ITEMS INCLUDED IN CASH a. Cash on hand includes undeposited cash collections and other cash items awaiting deposit such as customers' checks, cashier's or manager's checks, traveler's checks, bank drafts and money orders. b. Cash in bank includes demand deposit or checking account and saving deposit which are unrestricted as to withdrawal. c. Cash fund set aside for current purposes such as petty cash fund, payroll fund and dividend fund. CASH EQUIVALENTS PAS 7, paragraph 6, defines cash equivalents as shortterm and highly liquid investments that are readily convertible into cash and so near their maturity that they present insignificant risk of changes in value because of changes in interest rate. The standard further states that only highly liquid investments acquired three months before maturity can qualify as cash equivalents. Accordingly, excess cash may be invested in time deposits, money market instruments and treasury bills for the purpose of earning interest income. Classifications of investment of excess cash — Investments in time deposit, money market instruments and treasury bills should be properly classified. a. b. c. If the term is three months or less, such instruments are classified as cash equivalents and therefore included in the caption "cash and cash equivalents" If the term is more than three months but within one year, such investments are classified as shortterm financial assets or temporary investments and presented separately as current assets. If the term is more than one year, such investments are classified as noncurrent or longterm investments. ✓ However, such investments that become due within one year from the end of the reporting period are reclassified as current or temporary investments. MEASUREMENT OF CASH ❖ Cash is measured at face value. ❖ Cash in foreign currency is measured at the current exchange rate. ❖ If a bank or financial institution holding the funds of an entity is in bankruptcy or financial difficulty, cash should be written down to estimated realizable value if the amount recoverable is estimated to be lower than the face value. Financial statement presentation The caption cash and cash equivalents should be shown as the first line item under current assets. This caption includes all cash items, such as cash on hand, cash in bank, petty cash fund and cash equivalents which are unrestricted in use for current operations. However, the details comprising the cash and cash equivalents should be disclosed in the notes to financial statements. For example, an entity maintains two bank accounts: a. Cash in bank - First Bank, which is overdrawn by P10,000. b. Cash in bank - Second Bank, with a debit balance of P100,000. The net cash balance is P90,000. The proper statement classification of the two accounts is: Current asset: Cash in bank - Second Bank 100,000 Foreign currency Cash in foreign currency should be translated to Philippine pesos using the current exchange rate. Current liability: Bank overdraft - First Bank 10.000 Note that it is not necessary to adjust and open a bank overdraft account in the ledger. Deposits in foreign countries which are not subject to any foreign exchange restriction are included in "cash" In other words, the Cash in Bank - First Bank account is maintained in the ledger with a credit balance. Deposits in foreign bank which are subject to foreign exchange restriction should be classified separately among noncurrent assets and the restriction clearly indicated. Generally, overdrafts are not permitted in the Philippines. Cash fund for a certain purpose If the cash fund is set aside for use in current operations or for the payment of current obligation, it is a current asset. The cash fund is included as part of cash and cash equivalents. Examples of this fund are petty cash fund, payroll fund, travel fund, interest fund, dividend fund and tax fund. On the other hand, if the cash fund is set aside for noncurrent purpose or payment of noncurrent obligation, it is shown as long-term investment. Examples of this fund are sinking fund, preference share redemption fund, contingent fund, insurance fund and fund for acquisition or construction of property, plant and equipment. Classification of cash fund The classification of a cash fund as current or noncurrent should parallel the classification of the related liability. For example, a sinking fund that is set aside to pay a bond payable shall be classified as current asset when the bond payable is already due within one year after the end of reporting period. However, a cash fund set aside for the acquisition of a noncurrent asset should be classified as noncurrent regardless of the year of disbursement. Bank overdraft When the cash in bank account has a credit balance, it is said to be an overdraft. The credit balance in the cash in bank account results from the issuance of checks in excess of the deposits. A bank overdraft is classified as a current liability and should not be offset against other bank accounts with debit balances. Exception to the rule on overdraft ✓ When an entity maintains two or more accounts in one bank and one account results in an overdraft, such overdraft can be offset against the other bank account with a debit balance in order to show cash, net of bank overdraft or bank overdraft, net of other bank account. ✓ An overdraft can also be offset against the other bank account if the amount is not material. ✓ Under IFS, bank overdraft can be offset against other bank account when payable on demand and often fluctuates from positive to negative as an integral part of cash management. Compensating balance A compensating balance generally takes the form of minimum checking or demand deposit account balance that must be maintained in connection with a borrowing arrangement with a bank. For example, an entity borrows P5,000,000 from a bank and agrees to maintain a 10% or P500,000 minimum compensating balance in a demand deposit account. In effect, this arrangement results in the reduction of the amount borrowed because the compensating balance provides a source of fund to the bank as partial compensation for the loan extended. Classification of compensating balance If the deposit is not legally restricted as to withdrawal by the borrower because of an informal compensating balance agreement, the compensating balance is part of cash. If the deposit is legally restricted because of a formal compensating balance agreement, the compensating balance is classified separately as "cash held as compensating balance" under current assets if the related loan is short-term. If the related loan is long-term, the compensating balance is classified as noncurrent investment. Undelivered or unreleased check An undelivered or unreleased check is one that is merely drawn and recorded but not given to the payee before the end of reporting period. There is no payment when the check is pending delivery to the payee at the end of reporting period. The reason is that undelivered check is still subject to the entity's control and may thus be canceled anytime before delivery at the discretion of the entity. Accordingly, an adjusting entry is required to restore the cash balance and set up the liability. Cash XX Accounts payable or appropriate account XX In practice, the foregoing adjustment is sometimes ignored because the amount is not very substantial and there is no evidence of actual cancelation of the check in the subsequent period. Postdated check delivered A postdated check delivered is a check drawn, recorded and already given to the payee but it bears a date subsequent to the end of reporting period. The original entry recording a delivered postdated check shall also be reversed and therefore restored to the cash balance. Cash XX Accounts payable or appropriate account XX The reason is that there is no payment until the check can be presented to the bank for encashment or deposit. Stale check or check long outstanding A stale check is a check not encashed by the payee within a relatively long period of time. The question is how long a time must the check remain outstanding? The Negotiable Instruments Law provides that where the instrument is payable on demand, presentment must be made within a reasonable time after issue. In determining what is a reasonable time, consideration should be made regarding the nature of the instrument, the usage of trade or business, if any, with respect to such instrument and the facts of the particular case. Clearly, the law does not specify a definite period within which checks must be presented for encashment. Reference is made I to usage of trade or business practice. In banking practice, a check becomes stale if not encashed within six months from the time of issuance. Of course, this is a matter of entity policy. Thus, even after three months only, the entity may issue a stop payment order to the bank for the cancelation of a previously issued check. If the amount of stale check is immaterial, it is simply accounted for as miscellaneous income. Cash Miscellaneous income XX XX However, if the amount is material and liability is expected to continue, the cash is restored and the liability is again set up. Cash XX Accounts payable or appropriate account XX Accounting for cash shortage Where the cash count shows cash which is less than the balance per book, a cash shortage is to be recorded. Cash short or over Cash XX XX The cash short or over account is only a temporary or suspense account. When financial statements are prepared the same should be adjusted. Hence, if the cashier or cash custodian is held responsible for the cash shortage, the adjustment should be: Due from cashier Cash short or over XX XX However, if reasonable efforts fail to disclose the cause of the shortage, the adjustment is Loss from cash shortage Cash short or over XX XX Accounting for cash overage Where the cash count shows cash which is more than the balance per book, a cash overage is to be recorded. Cash XX Cash short or over XX Note that whether it is a cash shortage or cash overage, the offsetting account is cash short or over account. Such account should be adjusted when statements are made. The cash overage is treated as miscellaneous income if there is no claim on the same. Cash short or over Miscellaneous income XX XX But where the cash overage is properly found to be the money of the cashier, the journal entry is: Cash short or over Payable to cashier XX XX Imprest system The imprest system is a system of control of cash which requires that all cash receipts should be deposited intact and all cash disbursements should be made by means of check. While internal control ideally requires that all payments should be made by means of check, this is sometimes impossible. There are occasions when the issuance of checks becomes impractical or inconvenient such as when small amounts are paid or things are hurriedly bought or customers are entertained. Consequently, in such instances, it may be more economical and convenient to pay in cash rather than issue checks. Petty cash fund The petty cash fund is money set aside to pay small expenses which cannot be paid conveniently by means of check. The reversal is made in order that the normal replenishment procedures may be followed by simply debiting expenses and crediting cash in bank without distinguishing whether the expenses pertain to the current period or prior period. e. Petty cash fund Cash in bank f. Accounting procedures a. A check is drawn to establish the fund. Petty cash fund Cash in bank b. XX XX A decrease in the fund is recorded normally. Cash in bank XX Petty cash fund There are two methods of handling the petty cash, namely: a. Imprest fund system b. Fluctuating fund system Imprest fund system The imprest fund system is the one usually followed in handling petty cash transactions. An increase in the fund is recorded normally. XX Illustration 2021 Nov. 10 The entity established an imprest fund of P10,000. XX Petty cash fund Cash in bank XX Payment of expenses out of the fund. 10,000 10,000 29 Replenished the fund. The petty cash items include the following: No formal journal entries are made. Currency and coin Supplies Telephone Postage The petty cashier generally requires a signed petty cash voucher for such payments and simply prepares memorandum entries in the petty cash journal. 2,000 5,000 1,800 1,200 Nov. 29 The journal entry to record the replenishment is: c. Replenishment of petty cash payments. Supplies Telephone Postage Cash in bank Whenever the petty cash fund runs low, a check is drawn to replenish the fund. The replenishment check is usually equal to the petty cash disbursements. It is at this time that the petty cash disbursements are recorded. Expenses Cash in bank XX XX It is to be pointed out that the petty cash disbursements should be replenished only by means of check and not from undeposited collections. d. At the end of the accounting period, it is necessary to adjust the unreplenished expenses in order to state the correct petty cash balance. Expenses XX Petty cash fund XX The adjustment is to be reversed at the beginning of the next accounting period. 5,000 1,800 1,200 8,000 Dec. 31 The fund was not replenished. An adjustment is necessary to record the unreplenished expenses. The fund is composed of the following: currency and coin P7,000, supplies P1,500, postage P500, miscellaneous expense P1,000. Supplies 1,500 Telephone 500 Postage 1,000 Cash in bank 3,000 2022 Jan. 1 The adjustment made on December 31, 2021 is reversed. Petty cash fund 3,000 Supplies Postage Miscellaneous expense 500 1,000 1,000 Feb. 1 The fund is replenished and increased to P15,000. The composition of the fund: Currency and coin 1,000 Supplies Postage Miscellaneous expense Total 4,500 3,000 1,500 10,000 Illustration Nov. 10 The entity established a petty cash fund of P10,000. Petty cash fund 10,000 Cash in bank 10,000 Journal entry Petty cash fund Supplies Postage Miscellaneous expense Cash in bank Nov. 11-28 Petty cash disbursements amounted to P8,000. 5,000 4,500 3,000 1,500 Expenses 8,000 Petty cash fund 14,000 8,000 Nov. 29 Issued a check for P10,000 to replenish the fund. Petty cash fund Cash in bank The total amount of the check drawn is P14,000 representing the petty cash disbursements of P9,000 and the fund increase of P5,000. 10,000 10,000 At this point, the petty cash balance per book is P12,000. Fluctuating fund system The system is called "fluctuating fund system" because the checks drawn to replenish the fund do not necessarily equal the petty cash disbursements. Dec. 1-30 Petty cash expenses amounted to P9,000. Expenses 9,000 Petty cash fund 9,000 31 Issued a check for P15,000 to replenish the fund. The replenishment checks are simply drawn upon the request of the petty cashier. Petty cash fund Cash in bank Moreover, petty cash disbursements are immediately recorded thus resulting in a fluctuating petty cash balance per book from time to time: At this point, the petty cash balance is P18,000. a. Establishment of the fund: Petty cash fund Cash in bank b. xx xx Payment of expenses out of the petty cash fund: Expenses xx Petty cash fund xx Under this system, the disbursements from the petty cash fund are immediately recorded in contradistinction with the imprest fund system where the disbursements are recorded upon the replenishment of the fund. c. Replenishment or increase of the fund: Petty cash fund Cash in bank xx xx The replenishment check may or may not be the same as the petty cash disbursements. d. At the end of the reporting period, no adjustment is necessary because the petty cash expenses are recorded outright. e. Decrease of the fund is reverted to the general cash. Cash in bank Petty cash fund xx xx 15,000 15,000