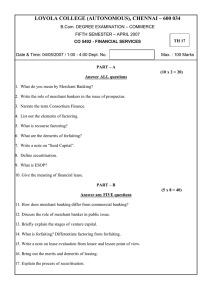

Financial Services Course Material: Concepts & Market in India

advertisement