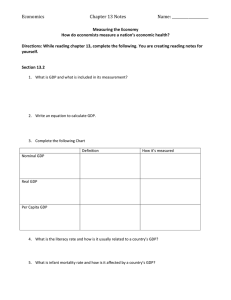

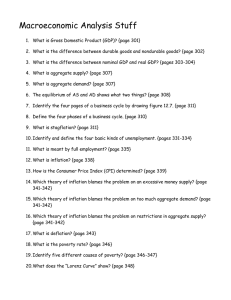

“Economics Final Syllabus Notes” Economic Introduction and Economic Problem: The word economy comes from the Greek word oikonomos, which means “one who manages a household.” Economic introduction refers to the initial phase of studying and understanding the principles and concepts of economics. It involves learning about the production, distribution, and consumption of goods and services, as well as the factors that influence economic behavior. The economic problem, also known as the fundamental economic problem, refers to the scarcity of resources in relation to unlimited human wants and needs. It arises from the fact that resources, such as land, labor, capital, and entrepreneurship, are limited, while people's desires and demands are infinite. This scarcity creates the need for individuals, businesses, and societies to make choices about how to allocate these limited resources efficiently and effectively to satisfy their needs and wants. Micro and Macro-economics: Microeconomics The study of how households and firms make decisions and how they interact in markets. Macroeconomics: The study of economy wide phenomena, including inflation, unemployment, and economic growth. Define public and private goods and their characteristics and also explain why market fails to provide the pubic goods and the free rider problem which emerge it. Public goods are non-excludable and non-rivalrous. Nonexcludability means that once a public good is provided, it is difficult to exclude anyone from benefiting from it. Non-rivalry means that one person's consumption of a public good does not diminish its availability for others. Examples of public goods include street lighting, national defense, and public parks. Private goods, on the other hand, are excludable and rivalrous. Excludability means that access to a private good can be restricted to those who pay for it. Rivalry means that the consumption of a private good by one person reduces its availability for others. Examples of private goods include food, clothing, and cars. The market often fails to provide public goods due to two main reasons: 1. Non-excludability: Since public goods are difficult to exclude people from using once they are provided, individuals have an incentive to "free ride" and enjoy the benefits without contributing to their provision. This leads to underinvestment in public goods as individuals expect others to pay for them. 2. Lack of profit motive: Public goods typically do not generate direct profits for private businesses because they cannot charge individual consumers for their usage. As a result, there is little incentive for private firms to invest in the production of public goods. The free rider problem arises when individuals benefit from a public good without contributing to its provision. This behavior is rational from an individual's perspective, as they can enjoy the benefits without incurring any costs. However, if everyone adopts this free riding behavior, the provision of public goods becomes inadequate, leading to a market failure. Explain the concept of aggregate demand and supply demand with their relevance and to economic fluctuations and further explain why aggregate demand curve is downward sloping and aggregate supply curve is upward sloping. Aggregate demand (AD) represents the total demand for goods and services in an economy at a given price level and within a specific time period. It is the sum of consumption, investment, government spending, and net exports (exports minus imports). AD shows the relationship between the overall price level and the quantity of goods and services demanded in the economy. Aggregate supply (AS) represents the total supply of goods and services that producers are willing and able to provide at different price levels. It shows the relationship between the overall price level and the quantity of goods and services supplied in the economy. The aggregate demand curve is downward sloping due to the wealth effect, interest rate effect, and international trade effect. 1. Wealth effect: As the overall price level decreases, the purchasing power of consumers increases. This leads to higher consumption spending, which increases aggregate demand. 2. Interest rate effect: A decrease in the overall price level reduces the demand for money, leading to lower interest rates. Lower interest rates stimulate investment and borrowing, which increases aggregate demand. 3. International trade effect: A decrease in the overall price level makes domestic goods relatively cheaper compared to foreign goods. This leads to an increase in net exports, as exports become more attractive and imports become relatively more expensive. This increase in net exports boosts aggregate demand. On the other hand, the aggregate supply curve is upward sloping due to the sticky wages, sticky prices, and resource availability. 1. Sticky wages: In the short run, wages are often fixed or slow to adjust. When the overall price level increases, firms' production costs rise, but wages remain constant. This leads to a decrease in firms' profits and a decrease in the quantity of goods and services supplied. 2. Sticky prices: Similar to wages, prices of inputs or raw materials may be slow to adjust in the short run. When the overall price level increases, firms' costs increase, but they may not be able to immediately pass on these higher costs to consumers. This results in a decrease in the quantity of goods and services supplied. 3. Resource availability: In the long run, the availability of resources, such as labor and capital, is relatively fixed. As the overall price level increases, firms may not be able to increase their production capacity due to limited resources, leading to a less elastic supply curve. In summary, the aggregate demand curve is downward sloping due to the wealth effect, interest rate effect, and international trade effect, while the aggregate supply curve is upward sloping due to sticky wages, sticky prices, and resource availability. These concepts help explain how changes in price levels affect the overall demand and supply of goods and services in the economy, leading to economic fluctuations. Ten principle of economics: 1. People face trade-offs. 2. The cost of something is what you give up to get it. 3. Rational people think at the margin. 4. People respond to incentives. 5. Trade can make everyone better off. 6. Markets are usually a good way to organize economic activity. 7. Governments can sometimes improve market outcomes. 8. A country’s standard of living depends on its ability to produce goods and services. 9. Prices rise when the government prints too much money. 10. Society faces a short-run trade-off between inflation and unemployment. For further explanations see chapter 1 Consumer and producer Surplus, Price Floor and Price Ceiling and Market Equilibrium: Consumer Surplus: Consumer surplus is a concept in economics that measures the benefit or value that consumers receive when they are able to purchase a product or service at a price lower than what they are willing to pay. It represents the difference between the maximum price a consumer is willing to pay for a good or service and the actual price they pay. Producer Surplus: Producer surplus is the measure of the benefit or value that producers receive when they are able to sell a product or service at a price higher than their minimum acceptable price. It represents the difference between the price at which producers are willing to supply a good or service and the actual price they receive. Price Floor: A price floor is a government-imposed minimum price set above the equilibrium price in a market. It is designed to prevent prices from falling below a certain level, typically to protect producers or ensure a minimum income for certain goods or services. When a price floor is set above the equilibrium price, it can lead to a surplus of the product or service. Price Ceiling: A price ceiling is a government-imposed maximum price set below the equilibrium price in a market. It is usually implemented to make goods or services more affordable for consumers. When a price ceiling is set below the equilibrium price, it can lead to a shortage of the product or service. Market Equilibrium: Market equilibrium refers to the state of balance in a market where the quantity demanded by consumers equals the quantity supplied by producers. At equilibrium, there is no shortage or surplus, and the market clears without any upward or downward pressure on prices. The equilibrium price and quantity are determined by the intersection of the demand and supply curves in a market. Demand, Law of demand, Elasticity of demand, Shifts in demand curve and Supply, Law of supply, Elasticity of supply and Shifts in supply curve: Demand: In economics, demand refers to the quantity of a good or service that consumers are willing and able to purchase at a given price and within a specific time period. Law of Demand: The law of demand states that, all else being equal, there is an inverse relationship between the price of a good or service and the quantity demanded. In other words, as the price of a product increases, the quantity demanded decreases, and vice versa. Elasticity of Demand: Elasticity of demand measures the responsiveness of the quantity demanded to changes in price. It indicates how sensitive consumers are to price changes. If demand is elastic, a small change in price leads to a proportionately larger change in quantity demanded. If demand is inelastic, a change in price has a relatively smaller impact on quantity demanded. Shifts in Demand Curve: The demand curve represents the relationship between price and quantity demanded. A shift in the demand curve occurs when there is a change in factors other than price that influence the quantity demanded at each price level. These factors can include changes in consumer income, preferences, population, prices of related goods, and expectations. Supply: Supply refers to the quantity of a good or service that producers are willing and able to offer for sale at a given price and within a specific time period. Law of Supply: The law of supply states that, all else being equal, there is a direct relationship between the price of a good or service and the quantity supplied. In other words, as the price of a product increases, the quantity supplied also increases, and vice versa. Elasticity of Supply: Elasticity of supply measures the responsiveness of the quantity supplied to changes in price. It indicates how sensitive producers are to price changes. If supply is elastic, a small change in price leads to a proportionately larger change in quantity supplied. If supply is inelastic, a change in price has a relatively smaller impact on quantity supplied. Shifts in Supply Curve: The supply curve represents the relationship between price and quantity supplied. A shift in the supply curve occurs when there is a change in factors other than price that influence the quantity supplied at each price level. These factors can include changes in production costs, technology, input prices, government regulations, and expectations. GDP, Measures of GDP through product, Income and Expenditure Approach, GNP, NNP, NI, PI, DPI Gross Domestic Product (GDP) is a measure of the total value of all final goods and services produced within a country's borders during a specific time period, typically a year. It is used as an indicator of a country's economic performance. There are three main approaches to measuring GDP; 1. Product Approach: This approach calculates GDP by summing up the value of all final goods and services produced in an economy. It includes the value of goods and services at market prices. 2. Income Approach: This approach calculates GDP by summing up all the incomes earned by individuals and businesses in an economy. It includes wages, salaries, profits, rents, and interest. 3. Expenditure Approach: This approach calculates GDP by summing up all the expenditures made on final goods and services in an economy. It includes consumption, investment, government spending, and net exports (exports minus imports). Gross National Product (GNP) is a measure similar to GDP, but it includes the value of goods and services produced by a country's residents, both domestically and abroad. It takes into account the income earned by a country's citizens, regardless of their location. Net National Product (NNP) is derived from GNP by subtracting depreciation (the wear and tear on capital goods) from the total value of goods and services produced. It provides a measure of the net output of an economy after accounting for capital consumption. Personal Income (PI) is the total income received by individuals from all sources, including wages, salaries, rental income, dividends, and government transfers. Disposable Personal Income (DPI) is derived from personal income by subtracting personal taxes. It represents the income available to individuals for consumption and saving after taxes have been paid. In summary, GDP measures the total value of goods and services produced within a country, while GNP includes the value of production by a country's residents both domestically and abroad. NNP adjusts GNP for depreciation, PI measures total income received by individuals, and DPI represents income available for consumption and saving after taxes. Circular Flow of Income, Unemployment and its Types, Inflation and types and Measurement of CPI: The circular flow of income is a concept in economics that illustrates the flow of money and goods between different sectors of an economy. It shows how households, businesses, and the government interact through the exchange of income, goods, and services. In this model, households provide labor and other factors of production to businesses in exchange for income. They then use this income to purchase goods and services produced by businesses, completing the circular flow. Unemployment refers to the situation where individuals who are willing and able to work are unable to find employment. There are several types of unemployment; 1. Frictional unemployment: This type of unemployment occurs when individuals are in the process of transitioning between jobs or entering the workforce for the first time. 2. Structural unemployment: Structural unemployment arises from a mismatch between the skills and qualifications of workers and the available job opportunities. It can occur due to changes in technology, shifts in industries, or changes in the structure of the economy. 3. Cyclical unemployment: Cyclical unemployment is caused by fluctuations in the business cycle. During economic downturns or recessions, businesses may reduce their workforce, leading to higher unemployment rates. Inflation refers to the sustained increase in the general price level of goods and services in an economy over time. It erodes the purchasing power of money. There are different types of inflation: 1. Demand-pull inflation: Demand-pull inflation occurs when aggregate demand exceeds the available supply of goods and services, leading to an increase in prices. 2. Cost-push inflation: Cost-push inflation happens when the cost of production, such as wages or raw materials, increases, causing businesses to raise prices to maintain their profit margins. 3. Built-in inflation: Built-in inflation is a result of expectations of future inflation. It occurs when workers and businesses anticipate higher prices and adjust wages and prices accordingly, leading to a self-perpetuating cycle of inflation. The Consumer Price Index (CPI) is a commonly used measure of inflation. It measures changes in the average price level of a basket of goods and services consumed by households. The CPI is calculated by comparing the current prices of the basket of goods to a base period. It provides a way to track and compare changes in the cost of living over time. Characteristics of Perfect Competition and Monopoly, GDP and its Components and GDP Deflator: Characteristics of Perfect Competition: 1. Large number of buyers and sellers: In perfect competition, there are numerous buyers and sellers in the market, none of whom have significant market power. 2. Homogeneous products: The goods or services offered by firms in perfect competition are identical or very similar, with no differentiation. 3. Free entry and exit: Firms can freely enter or exit the market without any barriers, ensuring that there is no artificial restriction on competition. 4. Perfect information: Buyers and sellers have complete knowledge about prices, quality, and other relevant factors in the market. 5. Price takers: Individual firms in perfect competition have no control over the market price and must accept the prevailing price determined by market forces. Characteristics of Monopoly: 1. Single seller: In a monopoly, there is only one seller or producer in the market, giving them significant control over the market. 2. Unique product: The monopolist offers a product or service that has no close substitutes, giving them a monopoly power. 3. High barriers to entry: Monopolies often have barriers to entry, such as patents, exclusive access to resources, or high start-up costs, which prevent or limit competition. 4. Price maker: The monopolist has the power to set prices based on their own discretion, as they face no competition. 5. Imperfect information: Monopolies may have an information advantage over buyers, as they control the market and can manipulate information to their advantage. Gross Domestic Product (GDP) and its Components: Gross Domestic Product (GDP) is a measure of the total value of all final goods and services produced within a country's borders during a specific period, usually a year. It is composed of four main components; 1. Consumption (C): This includes the spending by households on goods and services, such as food, clothing, and healthcare. 2. Investment (I): Investment refers to spending on capital goods, such as machinery, equipment, and construction, by businesses and households. 3. Government Spending (G): This component includes the expenditure by the government on public goods and services, such as infrastructure, defense, and education. 4. Net Exports (NX): Net exports represent the difference between a country's exports and imports. If exports exceed imports, it is a positive contribution to GDP, while if imports exceed exports, it is a negative contribution. GDP Deflator: The GDP deflator is a measure of the overall price level in an economy. It is calculated by dividing nominal GDP (measured at current prices) by real GDP (measured at constant prices) and multiplying by 100. The GDP deflator reflects the average price change of all goods and services produced in an economy over time. It is used to adjust nominal GDP for inflation and obtain real GDP, which allows for a more accurate comparison of economic output across different time periods. Characteristics of Monopolistic Competition and Oligopoly: Monopolistic competition and oligopoly are two types of market structures that exist between perfect competition and monopoly. Here are the characteristics of each: Monopolistic Competition: 1. Many Sellers: There are numerous firms operating in the market, each offering slightly differentiated products. 2. Product Differentiation: Firms engage in product differentiation through branding, marketing, or other means to make their products appear unique. 3. Easy Entry and Exit: Firms can enter or exit the market relatively easily, leading to low barriers to entry. 4. Non-Price Competition: Firms compete based on factors other than price, such as product quality, advertising, customer service, or design. 5. Limited Control over Price: Each firm has some control over the price of its product due to product differentiation, but the market is still influenced by overall supply and demand. Oligopoly: 1. Few Sellers: There are only a few dominant firms in the market, often referred to as oligopolists. 2. Interdependence: The actions and decisions of one firm directly impact the others, leading to strategic behavior and mutual interdependence. 3. Barriers to Entry: Oligopolies typically have high barriers to entry, making it difficult for new firms to enter the market. 4. Product Differentiation: Firms may differentiate their products, but it is not as pronounced as in monopolistic competition. 5. Price Rigidity: Oligopolistic firms often engage in price rigidity, where they avoid frequent price changes to maintain stability in the market. 6. Collusion and Competition: Oligopolistic may engage in collusion to fix prices or limit competition, but competition among them still exists.